Gambaran keseluruhan

Strategi ini ialah sistem perdagangan lanjutan berdasarkan tahap sokongan dan rintangan yang digabungkan dengan saluran aliran dinamik dan ciri pengurusan risiko. Strategi ini mengenal pasti tahap sokongan dan rintangan utama dengan menganalisis titik turun naik harga tertinggi dan terendah dalam tempoh tinjauan semula tertentu, dan menggunakan parameter lebar saluran untuk membina julat dagangan dinamik, memberikan pedagang gambaran yang jelas tentang struktur pasaran dan isyarat dagangan yang tepat.

Prinsip Strategi

Logik teras strategi merangkumi elemen utama berikut:

- Tahap sokongan dan rintangan dikira berdasarkan harga terendah dan tertinggi sepanjang tempoh lihat balik yang ditentukan pengguna

- Tetapkan lebar saluran dinamik melalui parameter peratusan untuk membina saluran atas dan bawah berdasarkan tahap sokongan dan rintangan

- Isyarat beli dicetuskan apabila harga menghampiri tahap sokongan (dalam 1% daripada tahap sokongan)

- Sistem secara automatik mengira tahap henti rugi dan ambil untung berdasarkan peratusan yang ditetapkan oleh pengguna

- Dagangan hanya dilaksanakan dalam jangka masa ujian belakang yang ditentukan

- Kira dan paparkan nisbah risiko-pulangan dalam masa nyata untuk membantu pedagang menilai potensi manfaat dan risiko setiap transaksi

Kelebihan Strategik

- Kebolehsuaian yang kukuh: tahap sokongan dan rintangan akan diselaraskan secara dinamik dengan perubahan pasaran untuk menyesuaikan diri dengan persekitaran pasaran yang berbeza

- Pengurusan risiko yang lebih baik: pengiraan bersepadu dan visualisasi stop loss, ambil untung dan nisbah pulangan risiko

- Isyarat dagangan yang jelas: Sediakan isyarat kemasukan yang jelas untuk mengurangkan kesan pertimbangan subjektif

- Visualisasi yang sangat baik: Tahap harga yang berbeza dipaparkan secara intuitif melalui garisan dan label warna yang berbeza

- Parameter fleksibel dan boleh laras: Benarkan pengguna melaraskan pelbagai parameter mengikut gaya dagangan peribadi dan ciri pasaran

Risiko Strategik

- Risiko turun naik pasaran: Terlalu banyak isyarat dagangan mungkin dicetuskan dalam pasaran yang sangat tidak menentu

- Risiko pecahan palsu: Apabila harga hampir kepada tahap sokongan, pecahan palsu mungkin berlaku, mengakibatkan isyarat palsu

- Kepekaan parameter: Tetapan tempoh lihat balik dan lebar saluran mempunyai kesan yang lebih besar pada prestasi strategi

- Sekatan perdagangan sehala: Strategi semasa hanya menyokong perdagangan panjang, yang mungkin terlepas peluang pintasan

- Kebergantungan masa: Prestasi strategi dihadkan kepada julat masa ujian belakang yang ditentukan

Arah pengoptimuman strategi

- Tambah penapis arah aliran: perkenalkan purata bergerak atau penunjuk momentum untuk menapis isyarat arah aliran balas

- Tingkatkan arah dagangan: tambah logik dagangan jualan singkat untuk menambah baik kekomprehan strategi

- Mengoptimumkan penjanaan isyarat: Mengesahkan kesahihan pecahan harga dengan penunjuk volum

- Tetapan henti rugi dinamik: laraskan jarak henti rugi secara dinamik berdasarkan ATR atau turun naik

- Pengurusan kedudukan yang dipertingkatkan: laraskan saiz kedudukan secara dinamik berdasarkan nisbah pulangan risiko dan turun naik pasaran

ringkaskan

Strategi ini menggabungkan konsep utama dalam analisis teknikal - tahap sokongan dan rintangan serta saluran aliran - untuk membina sistem perdagangan dengan logik yang ketat dan risiko yang boleh dikawal. Kelebihan strategi terletak pada kebolehsuaian dan pengurusan risiko yang kukuh, tetapi peniaga masih perlu berhati-hati melaraskan parameter mengikut keadaan pasaran dan toleransi risiko peribadi. Melalui arahan pengoptimuman yang dicadangkan, strategi boleh dipertingkatkan lagi dan dibangunkan menjadi sistem perdagangan yang lebih komprehensif dan mantap.

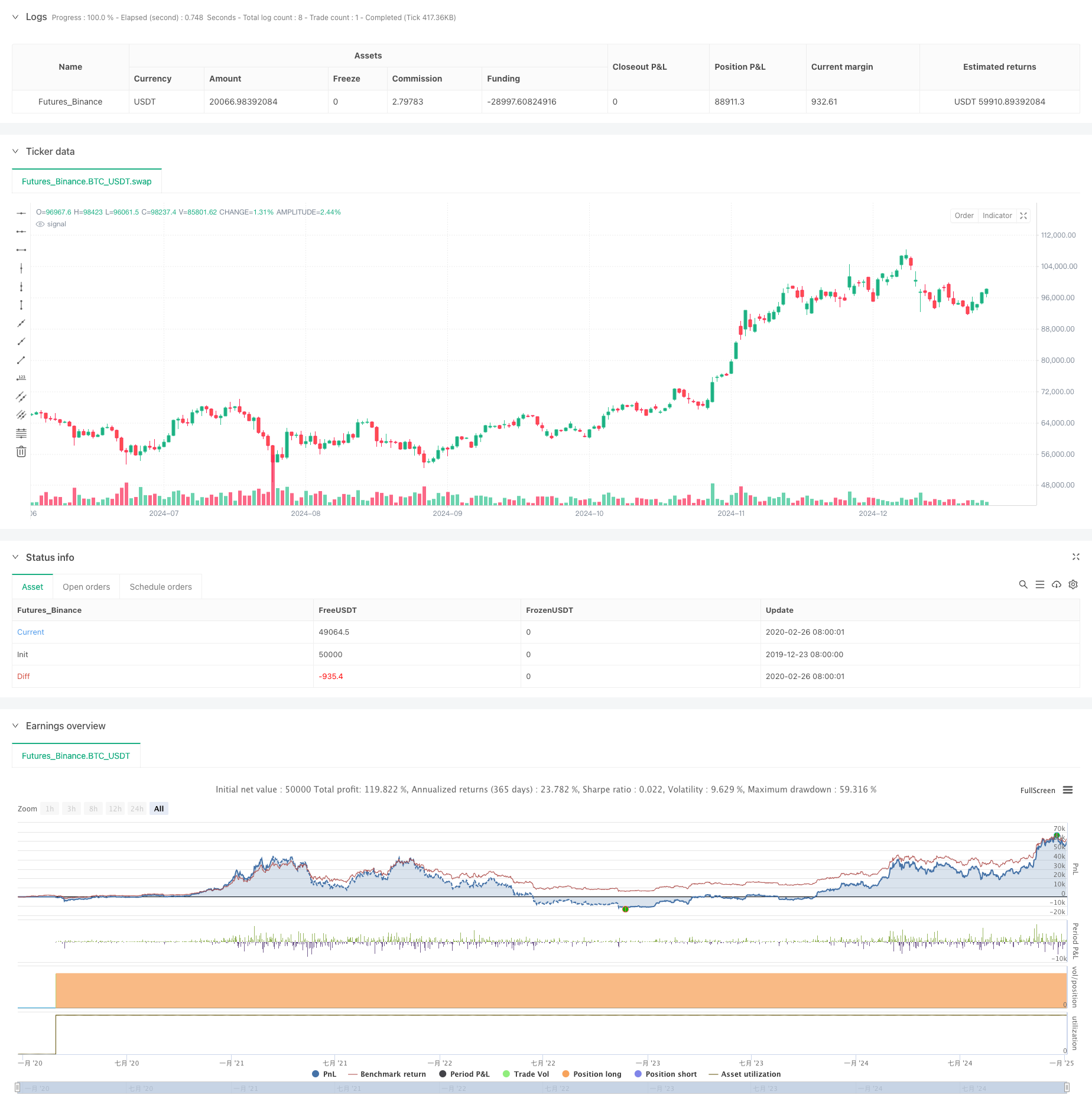

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Support and Resistance with Trend Lines and Channels", overlay=true)

// Inputs

lookback = input.int(20, title="Lookback Period for Support/Resistance", minval=1)

channelWidth = input.float(0.01, title="Channel Width (%)", minval=0.001) / 100

startDate = input(timestamp("2023-01-01 00:00"), title="Backtesting Start Date")

endDate = input(timestamp("2023-12-31 23:59"), title="Backtesting End Date")

// Check if the current bar is within the testing range

inTestingRange = true

// Support and Resistance Levels

supportLevel = ta.lowest(low, lookback) // Swing low (support)

resistanceLevel = ta.highest(high, lookback) // Swing high (resistance)

// Trend Lines and Channels

var line supportLine = na

var line resistanceLine = na

var line upperChannelLine = na

var line lowerChannelLine = na

// Calculate channel levels

upperChannel = resistanceLevel * (1 + channelWidth) // Upper edge of channel

lowerChannel = supportLevel * (1 - channelWidth) // Lower edge of channel

// Create or update the support trend line

// if na(supportLine)

// supportLine := line.new(bar_index, supportLevel, bar_index + 1, supportLevel, color=color.green, width=2, extend=extend.right)

// else

// line.set_y1(supportLine, supportLevel)

// line.set_y2(supportLine, supportLevel)

// // Create or update the resistance trend line

// if na(resistanceLine)

// resistanceLine := line.new(bar_index, resistanceLevel, bar_index + 1, resistanceLevel, color=color.red, width=2, extend=extend.right)

// else

// line.set_y1(resistanceLine, resistanceLevel)

// line.set_y2(resistanceLine, resistanceLevel)

// // Create or update the upper channel line

// if na(upperChannelLine)

// upperChannelLine := line.new(bar_index, upperChannel, bar_index + 1, upperChannel, color=color.blue, width=1, style=line.style_dashed, extend=extend.right)

// else

// line.set_y1(upperChannelLine, upperChannel)

// line.set_y2(upperChannelLine, upperChannel)

// // Create or update the lower channel line

// if na(lowerChannelLine)

// lowerChannelLine := line.new(bar_index, lowerChannel, bar_index + 1, lowerChannel, color=color.purple, width=1, style=line.style_dashed, extend=extend.right)

// else

// line.set_y1(lowerChannelLine, lowerChannel)

// line.set_y2(lowerChannelLine, lowerChannel)

// Buy Condition: When price is near support level

buyCondition = close <= supportLevel * 1.01 and inTestingRange

if buyCondition

strategy.entry("Buy", strategy.long)

// Stop Loss and Take Profit

stopLossPercentage = input.float(1.5, title="Stop Loss Percentage", minval=0.0) / 100

takeProfitPercentage = input.float(3.0, title="Take Profit Percentage", minval=0.0) / 100

var float longStopLoss = na

var float longTakeProfit = na

if strategy.position_size > 0

longStopLoss := strategy.position_avg_price * (1 - stopLossPercentage)

longTakeProfit := strategy.position_avg_price * (1 + takeProfitPercentage)

strategy.exit("Exit Buy", "Buy", stop=longStopLoss, limit=longTakeProfit)

// Visualize Entry, Stop Loss, and Take Profit Levels

var float entryPrice = na

if buyCondition

entryPrice := close

if not na(entryPrice)

label.new(bar_index, entryPrice, text="Entry: " + str.tostring(entryPrice, "#.##"), style=label.style_label_up, color=color.green, textcolor=color.white)

if strategy.position_size > 0

line.new(bar_index, longStopLoss, bar_index + 1, longStopLoss, color=color.red, width=1, extend=extend.right)

line.new(bar_index, longTakeProfit, bar_index + 1, longTakeProfit, color=color.blue, width=1, extend=extend.right)

// Risk-to-Reward Ratio (Optional)

if not na(entryPrice) and not na(longStopLoss) and not na(longTakeProfit)

riskToReward = (longTakeProfit - entryPrice) / (entryPrice - longStopLoss)

label.new(bar_index, entryPrice, text="R:R " + str.tostring(riskToReward, "#.##"), style=label.style_label_up, color=color.yellow, textcolor=color.black, size=size.small)