Gambaran keseluruhan

Strategi ini ialah sistem perdagangan inovatif yang menggabungkan urutan Fibonacci dan Bollinger Bands. Ia membentuk sistem pertimbangan julat turun naik harga yang unik dengan menggantikan gandaan sisihan piawai Bollinger Bands tradisional dengan nisbah Fibonacci (1.618, 2.618, 4.236). Strategi ini merangkumi fungsi pengurusan transaksi yang lengkap, termasuk tetapan henti untung dan henti rugi serta penapisan tetingkap masa transaksi, menjadikannya sangat praktikal dan fleksibel.

Prinsip Strategi

Logik teras strategi adalah berdasarkan interaksi antara harga dan Fibonacci Bollinger Bands. Mula-mula, hitung purata pergerakan mudah (SMA) harga sebagai landasan tengah, dan kemudian gunakan ATR didarab dengan nisbah Fibonacci berbeza untuk membentuk trek atas dan bawah. Apabila harga menembusi jalur Fibonacci yang dipilih oleh pengguna, sistem akan menjana isyarat dagangan. Khususnya, isyarat panjang dicetuskan apabila harga terendah lebih rendah daripada jalur beli sasaran dan harga tertinggi lebih tinggi daripada jalur; isyarat pendek dicetuskan apabila harga terendah lebih rendah daripada jalur jualan sasaran dan harga tertinggi lebih tinggi daripada band.

Kelebihan Strategik

- Kebolehsuaian yang kukuh: Laraskan lebar jalur secara dinamik melalui ATR untuk menjadikan strategi menyesuaikan diri dengan persekitaran pasaran yang berbeza dengan lebih baik

- Fleksibiliti tinggi: Pengguna boleh memilih jalur Fibonacci yang berbeza sebagai isyarat dagangan mengikut gaya dagangan mereka

- Pengurusan risiko yang sempurna: fungsi henti untung, henti rugi dan penapisan masa terbina dalam untuk mengawal risiko dengan berkesan

- Intuisi Visual: Jalur ketelusan yang berbeza dipaparkan untuk membantu pedagang memahami struktur pasaran

- Logik pengiraan yang jelas: Gunakan kombinasi penunjuk teknikal klasik, mudah difahami dan diselenggara

Risiko Strategik

- Risiko pecahan palsu: Harga mungkin jatuh semula serta-merta selepas pecahan, menghasilkan isyarat palsu

- Kepekaan parameter: Pilihan nisbah Fibonacci yang berbeza boleh menjejaskan prestasi strategi dengan ketara

- Kebergantungan masa: Jika anda mendayakan tingkap masa dagangan, anda mungkin terlepas peluang perdagangan yang penting

- Pergantungan persekitaran pasaran: mungkin menjana terlalu banyak isyarat dagangan dalam pasaran yang tidak menentu

Arah pengoptimuman strategi

- Mekanisme pengesahan isyarat: Adalah disyorkan untuk menambah penunjuk volum atau momentum sebagai pengesahan terobosan

- Pengoptimuman parameter dinamik: Nisbah Fibonacci boleh dilaraskan secara automatik berdasarkan turun naik pasaran

- Penapisan persekitaran pasaran: Tambahkan fungsi pertimbangan arah aliran dan gunakan parameter yang berbeza dalam persekitaran pasaran yang berbeza

- Sistem pemberat isyarat: Wujudkan analisis rangka masa berbilang untuk meningkatkan kebolehpercayaan isyarat

- Pengoptimuman pengurusan kedudukan: laraskan saiz kedudukan secara dinamik berdasarkan turun naik pasaran dan kekuatan isyarat

ringkaskan

Ini ialah strategi yang menggabungkan alat analisis teknikal klasik secara inovatif dan mengoptimumkan strategi Bollinger Band tradisional melalui jujukan Fibonacci. Kelebihan utamanya terletak pada kebolehsuaian dan fleksibilitinya, tetapi apabila menggunakannya, perhatian harus diberikan kepada pemadanan antara pemilihan parameter dan persekitaran pasaran. Masih banyak ruang untuk penambahbaikan dalam strategi ini dengan menambah penunjuk pengesahan tambahan dan mengoptimumkan mekanisme penjanaan isyarat.

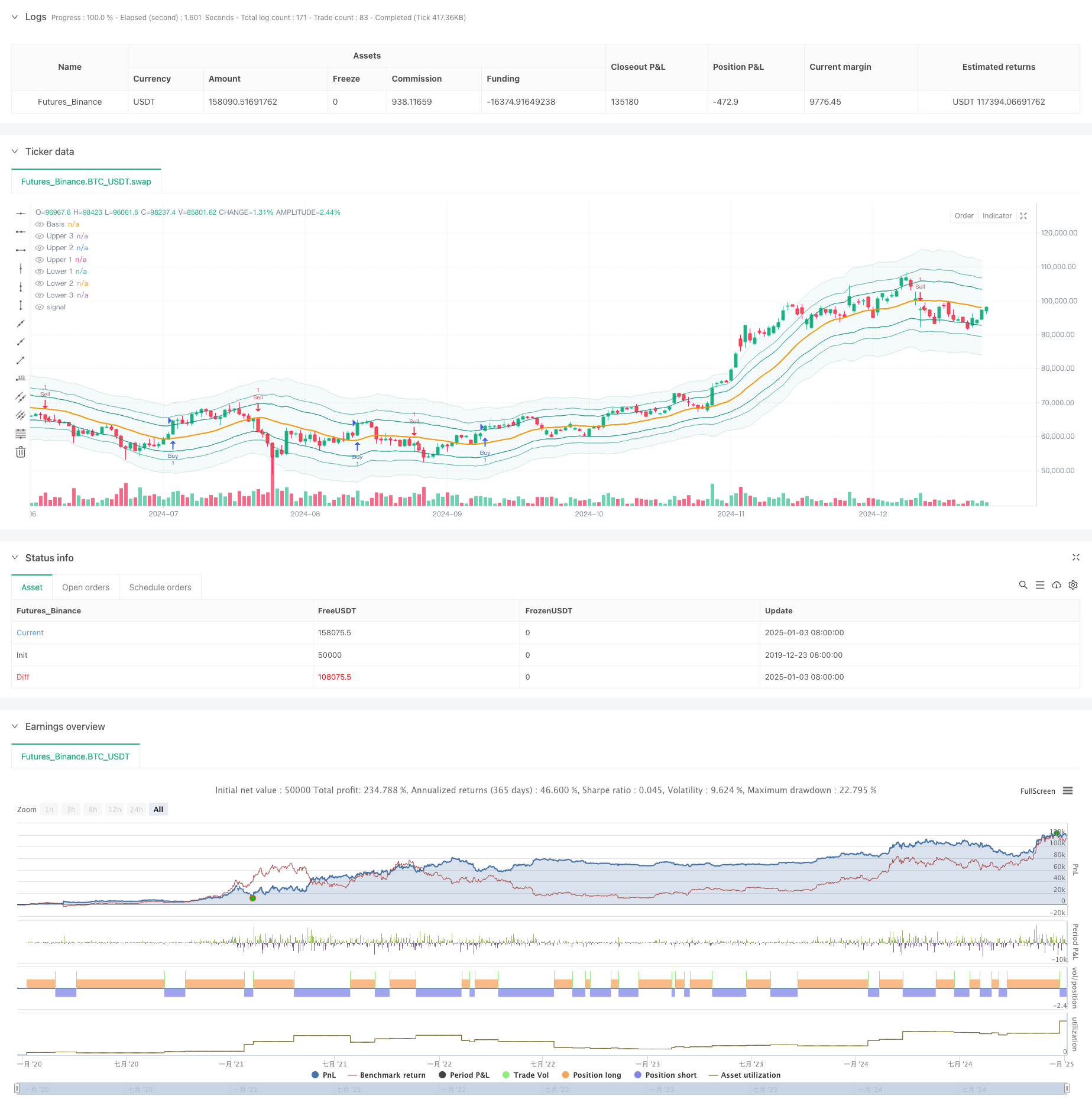

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// © sapphire_edge

// # ========================================================================= #

// #

// # _____ __ _ ______ __

// # / ___/____ _____ ____ / /_ (_)_______ / ____/___/ /___ ____

// # \__ \/ __ `/ __ \/ __ \/ __ \/ / ___/ _ \ / __/ / __ / __ `/ _ \

// # ___/ / /_/ / /_/ / /_/ / / / / / / / __/ / /___/ /_/ / /_/ / __/

// # /____/\__,_/ .___/ .___/_/ /_/_/_/ \___/ /_____/\__,_/\__, /\___/

// # /_/ /_/ /____/

// #

// # ========================================================================= #

strategy(shorttitle="⟡Sapphire⟡ FiboBands Strategy", title="[Sapphire] Fibonacci Bollinger Bands Strategy", initial_capital= 50000, currency= currency.USD,default_qty_value = 1,commission_type= strategy.commission.cash_per_contract,overlay= true )

// # ========================================================================= #

// # // Settings Menu //

// # ========================================================================= #

// -------------------- Main Settings -------------------- //

groupFiboBands = "FiboBands"

length = input.int(20, minval = 1, title = 'Length', group=groupFiboBands)

src = input(close, title = 'Source', group=groupFiboBands)

offset = input.int(0, 'Offset', minval = -500, maxval = 500, group=groupFiboBands)

fibo1 = input(defval = 1.618, title = 'Fibonacci Ratio 1', group=groupFiboBands)

fibo2 = input(defval = 2.618, title = 'Fibonacci Ratio 2', group=groupFiboBands)

fibo3 = input(defval = 4.236, title = 'Fibonacci Ratio 3', group=groupFiboBands)

fiboBuy = input.string(options = ['Fibo 1', 'Fibo 2', 'Fibo 3'], defval = 'Fibo 1', title = 'Fibonacci Buy', group=groupFiboBands)

fiboSell = input.string(options = ['Fibo 1', 'Fibo 2', 'Fibo 3'], defval = 'Fibo 1', title = 'Fibonacci Sell', group=groupFiboBands)

showSignals = input.bool(true, title="Show Signals", group=groupFiboBands)

signalOffset = input.int(5, title="Signal Vertical Offset", group=groupFiboBands)

// -------------------- Trade Management Inputs -------------------- //

groupTradeManagement = "Trade Management"

useProfitPerc = input.bool(false, title="Enable Profit Target", group=groupTradeManagement)

takeProfitPerc = input.float(1.0, title="Take Profit (%)", step=0.1, group=groupTradeManagement)

useStopLossPerc = input.bool(false, title="Enable Stop Loss", group=groupTradeManagement)

stopLossPerc = input.float(1.0, title="Stop Loss (%)", step=0.1, group=groupTradeManagement)

// -------------------- Time Filter Inputs -------------------- //

groupTimeOfDayFilter = "Time of Day Filter"

useTimeFilter1 = input.bool(false, title="Enable Time Filter 1", group=groupTimeOfDayFilter)

startHour1 = input.int(0, title="Start Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

startMinute1 = input.int(0, title="Start Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

endHour1 = input.int(23, title="End Hour (24-hour format)", minval=0, maxval=23, group=groupTimeOfDayFilter)

endMinute1 = input.int(45, title="End Minute", minval=0, maxval=59, group=groupTimeOfDayFilter)

closeAtEndTimeWindow = input.bool(false, title="Close Trades at End of Time Window", group=groupTimeOfDayFilter)

// -------------------- Trading Window -------------------- //

isWithinTradingWindow(startHour, startMinute, endHour, endMinute) =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

startInMinutes = startHour * 60 + startMinute

endInMinutes = endHour * 60 + endMinute

timeInMinutes >= startInMinutes and timeInMinutes <= endInMinutes

timeCondition = (useTimeFilter1 ? isWithinTradingWindow(startHour1, startMinute1, endHour1, endMinute1) : true)

// Check if the current bar is the last one within the specified time window

isEndOfTimeWindow() =>

nyTime = timestamp("America/New_York", year, month, dayofmonth, hour, minute)

nyHour = hour(nyTime)

nyMinute = minute(nyTime)

timeInMinutes = nyHour * 60 + nyMinute

endInMinutes = endHour1 * 60 + endMinute1

timeInMinutes == endInMinutes

// Logic to close trades if the time window ends

if timeCondition and closeAtEndTimeWindow and isEndOfTimeWindow()

strategy.close_all(comment="Closing trades at end of time window")

// # ========================================================================= #

// # // Calculations //

// # ========================================================================= #

sma = ta.sma(src, length)

atr = ta.atr(length)

ratio1 = atr * fibo1

ratio2 = atr * fibo2

ratio3 = atr * fibo3

upper3 = sma + ratio3

upper2 = sma + ratio2

upper1 = sma + ratio1

lower1 = sma - ratio1

lower2 = sma - ratio2

lower3 = sma - ratio3

// # ========================================================================= #

// # // Signal Logic //

// # ========================================================================= #

// -------------------- Entry Logic -------------------- //

targetBuy = fiboBuy == 'Fibo 1' ? upper1 : fiboBuy == 'Fibo 2' ? upper2 : upper3

buy = low < targetBuy and high > targetBuy

// -------------------- User-Defined Exit Logic -------------------- //

targetSell = fiboSell == 'Fibo 1' ? lower1 : fiboSell == 'Fibo 2' ? lower2 : lower3

sell = low < targetSell and high > targetSell

// # ========================================================================= #

// # // Strategy Management //

// # ========================================================================= #

// -------------------- Trade Execution Flags -------------------- //

var bool buyExecuted = false

var bool sellExecuted = false

float labelOffset = ta.atr(14) * signalOffset

// -------------------- Buy Logic -------------------- //

if buy and timeCondition

if useProfitPerc or useStopLossPerc

strategy.entry("Buy", strategy.long, stop=(useStopLossPerc ? close * (1 - stopLossPerc / 100) : na), limit=(useProfitPerc ? close * (1 + takeProfitPerc / 100) : na))

else

strategy.entry("Buy", strategy.long)

if showSignals and not buyExecuted

buyExecuted := true

sellExecuted := false

label.new(bar_index, high - labelOffset, "◭", style=label.style_label_up, color = color.rgb(119, 0, 255, 20), textcolor=color.white)

// -------------------- Sell Logic -------------------- //

if sell and timeCondition

if useProfitPerc or useStopLossPerc

strategy.entry("Sell", strategy.short, stop=(useStopLossPerc ? close * (1 + stopLossPerc / 100) : na), limit=(useProfitPerc ? close * (1 - takeProfitPerc / 100) : na))

else

strategy.entry("Sell", strategy.short)

if showSignals and not sellExecuted

sellExecuted := true

buyExecuted := false

label.new(bar_index, low + labelOffset, "⧩", style=label.style_label_down, color = color.rgb(255, 85, 0, 20), textcolor=color.white)

// # ========================================================================= #

// # // Plots and Charts //

// # ========================================================================= #

plot(sma, style = plot.style_line, title = 'Basis', color = color.new(color.orange, 0), linewidth = 2, offset = offset)

upp3 = plot(upper3, title = 'Upper 3', color = color.new(color.teal, 90), offset = offset)

upp2 = plot(upper2, title = 'Upper 2', color = color.new(color.teal, 60), offset = offset)

upp1 = plot(upper1, title = 'Upper 1', color = color.new(color.teal, 30), offset = offset)

low1 = plot(lower1, title = 'Lower 1', color = color.new(color.teal, 30), offset = offset)

low2 = plot(lower2, title = 'Lower 2', color = color.new(color.teal, 60), offset = offset)

low3 = plot(lower3, title = 'Lower 3', color = color.new(color.teal, 90), offset = offset)

fill(upp3, low3, title = 'Background', color = color.new(color.teal, 95))