Gambaran keseluruhan

Strategi ini ialah sistem perdagangan analisis teknikal berbilang dimensi yang menggabungkan penunjuk momentum (RSI, MACD), penunjuk arah aliran (EMA), petunjuk turun naik (Bollinger Bands, ATR) dan penunjuk struktur harga (Kolaborasi terkoordinasi pelbagai dimensi). isyarat untuk menangkap peluang pasaran. Reka bentuk strategi adalah berdasarkan tempoh masa 15 minit dan menggunakan henti rugi dinamik ATR dan ambil untung, dengan keupayaan kawalan risiko yang kukuh.

Prinsip Strategi

Logik teras strategi merangkumi dimensi berikut:

- Pengesahan arah aliran: Gunakan silang EMA 9⁄21 untuk menentukan arah aliran

- Pengesahan momentum: Gabungkan RSI terlebih jual dan terlebih beli (55⁄45) dan histogram MACD untuk mengesahkan momentum

- Rujukan turun naik: turun naik harga diukur oleh Bollinger Bands (20 tempoh, 2 sisihan piawai)

- Sokongan dan rintangan: Tahap Fibonacci 0.382⁄0.618⁄0.786 dikira menggunakan tahap tinggi dan rendah 100 tempoh

- Pengurusan Risiko: 1.5x stop loss dan 3x take profit berdasarkan ATR 14-tempoh

Urus niaga hanya dibuat selepas isyarat berbilang dimensi dicetuskan secara kolaboratif, yang meningkatkan ketepatan urus niaga.

Kelebihan Strategik

- Pengesahan silang isyarat berbilang dimensi dengan ketara mengurangkan isyarat palsu

- Henti rugi dan ambil untung ATR dinamik, menyesuaikan diri dengan persekitaran pasaran yang berbeza

- Digabungkan dengan penunjuk teknikal klasik, mudah difahami dan diselenggara

- Pemilihan masa kemasukan yang tepat untuk meningkatkan kadar kemenangan

- Nisbah risiko-pulangan ialah 1:2, yang memenuhi piawaian perdagangan profesional

- Sesuai untuk persekitaran pasaran yang tidak menentu

Risiko Strategik

- Pengoptimuman parameter boleh menyebabkan pemasangan berlebihan

- Keadaan isyarat berbilang mungkin terlepas beberapa keadaan pasaran

- Berbilang stop loss tetap mungkin gagal dalam keadaan pasaran yang melampau

- Keperluan tinggi untuk sumber pengkomputeran

- Kos urus niaga boleh menjejaskan prestasi strategi

Arah pengoptimuman strategi

- Memperkenalkan faktor volum untuk mengesahkan kekuatan isyarat

- Laraskan ambang RSI secara dinamik agar sesuai dengan pasaran yang berbeza

- Penapis kekuatan trend ditambah

- Optimumkan henti rugi dan ambil untung berganda

- Tambahkan penapis masa untuk mengelakkan turun naik pasaran

- Pertimbangkan untuk memperkenalkan pembelajaran mesin untuk mengoptimumkan parameter secara dinamik

ringkaskan

Strategi ini membina sistem perdagangan yang teguh melalui kerjasama terkoordinasi penunjuk teknikal pelbagai dimensi. Kelebihan terasnya terletak pada pengesahan silang isyarat dan kawalan risiko dinamik, tetapi perhatian juga harus diberikan kepada isu pengoptimuman parameter dan kebolehsuaian kepada persekitaran pasaran. Arah pengoptimuman seterusnya akan tertumpu terutamanya pada pelarasan parameter dinamik dan peningkatan kualiti isyarat.

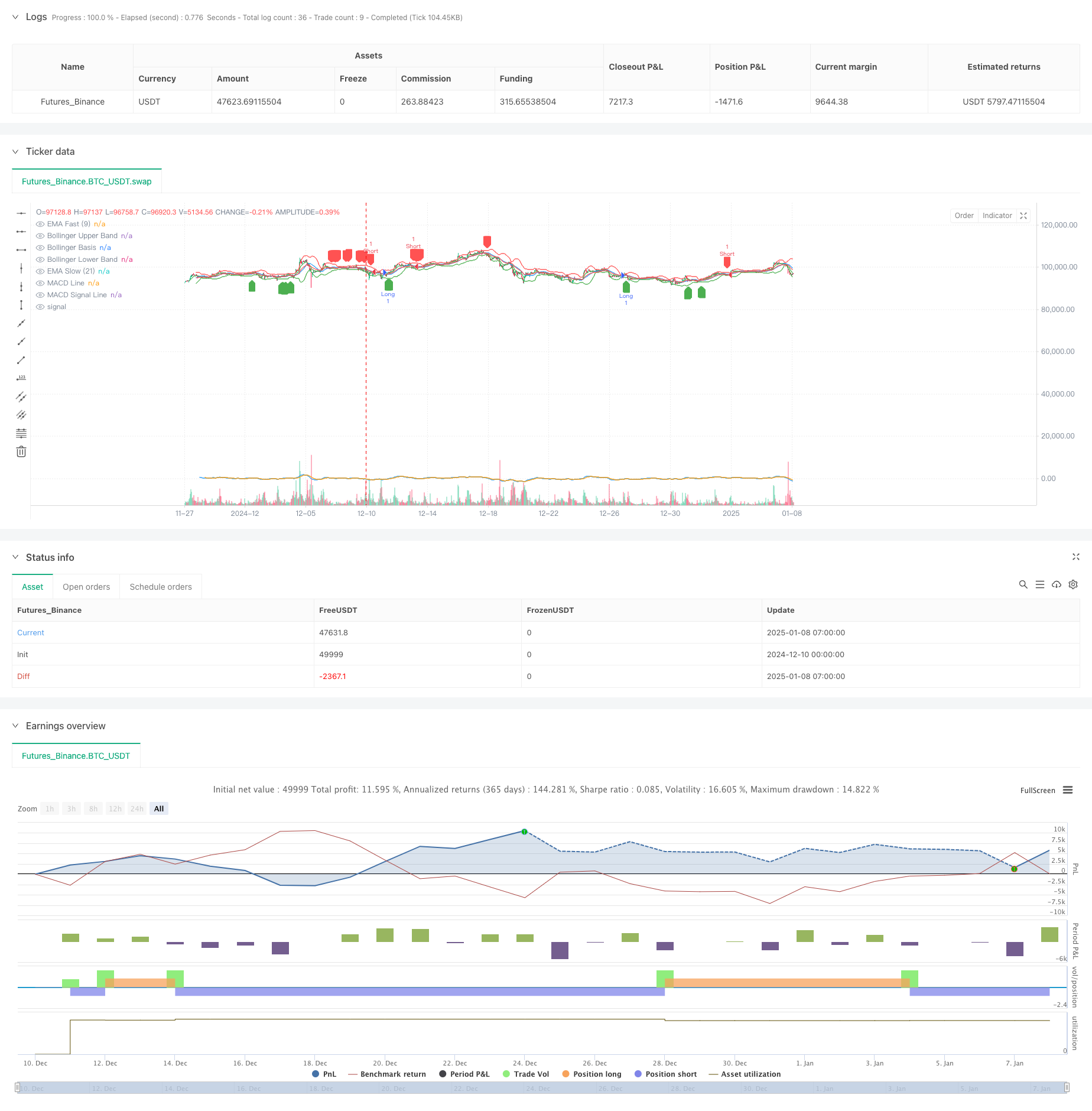

/*backtest

start: 2024-12-10 00:00:00

end: 2025-01-08 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Optimized Advanced Strategy", overlay=true)

// Bollinger Bandı

length = input(20, title="Bollinger Band Length")

src = close

mult = input.float(2.0, title="Bollinger Band Multiplier")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// RSI

rsi = ta.rsi(close, 14)

// MACD

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// EMA

emaFast = ta.ema(close, 9)

emaSlow = ta.ema(close, 21)

// ATR

atr = ta.atr(14)

// Fibonacci Seviyeleri

lookback = input(100, title="Fibonacci Lookback Period")

highPrice = ta.highest(high, lookback)

lowPrice = ta.lowest(low, lookback)

fiboLevel618 = lowPrice + (highPrice - lowPrice) * 0.618

fiboLevel382 = lowPrice + (highPrice - lowPrice) * 0.382

fiboLevel786 = lowPrice + (highPrice - lowPrice) * 0.786

// Kullanıcı Ayarlı Stop-Loss ve Take-Profit

stopLossATR = atr * 1.5

takeProfitATR = atr * 3

// İşlem Koşulları

longCondition = (rsi < 55) and (macdLine > signalLine) and (emaFast > emaSlow) and (close >= fiboLevel382 and close <= fiboLevel618)

shortCondition = (rsi > 45) and (macdLine < signalLine) and (emaFast < emaSlow) and (close >= fiboLevel618 and close <= fiboLevel786)

// İşlem Girişleri

if (longCondition)

strategy.entry("Long", strategy.long, stop=close - stopLossATR, limit=close + takeProfitATR, comment="LONG SIGNAL")

if (shortCondition)

strategy.entry("Short", strategy.short, stop=close + stopLossATR, limit=close - takeProfitATR, comment="SHORT SIGNAL")

// Bollinger Bandını Çizdir

plot(upper, color=color.red, title="Bollinger Upper Band")

plot(basis, color=color.blue, title="Bollinger Basis")

plot(lower, color=color.green, title="Bollinger Lower Band")

// Fibonacci Seviyelerini Çizdir

// line.new(x1=bar_index[1], y1=fiboLevel382, x2=bar_index, y2=fiboLevel382, color=color.blue, width=1, style=line.style_dotted)

// line.new(x1=bar_index[1], y1=fiboLevel618, x2=bar_index, y2=fiboLevel618, color=color.orange, width=1, style=line.style_dotted)

// line.new(x1=bar_index[1], y1=fiboLevel786, x2=bar_index, y2=fiboLevel786, color=color.purple, width=1, style=line.style_dotted)

// Göstergeleri Görselleştir

plot(macdLine, color=color.blue, title="MACD Line")

plot(signalLine, color=color.orange, title="MACD Signal Line")

plot(emaFast, color=color.green, title="EMA Fast (9)")

plot(emaSlow, color=color.red, title="EMA Slow (21)")

// İşlem İşaretleri

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="Long Entry")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Short Entry")