Gambaran keseluruhan

Strategi ini ialah sistem mengikut arah aliran berdasarkan berbilang purata pergerakan terlicin, yang menggunakan pelicinan tiga kali ganda untuk menapis bunyi pasaran sambil menggabungkan penunjuk momentum RSI, penunjuk turun naik ATR dan penapis arah aliran EMA 200 tempoh untuk mengesahkan isyarat dagangan. Strategi ini menggunakan tempoh masa 1 jam, iaitu rangka masa yang mengimbangi kekerapan dagangan dan kebolehpercayaan arah aliran secara berkesan sambil memadankan gelagat dagangan institusi.

Prinsip Strategi

Teras strategi adalah untuk membina garis arah aliran utama dengan melicinkan harga tiga kali dan menggunakan garis isyarat tempoh yang lebih pendek untuk melintasinya untuk menjana isyarat dagangan. Isyarat dagangan hanya akan dilaksanakan jika syarat berikut dipenuhi pada masa yang sama:

- Hubungan antara kedudukan harga dan 200EMA mengesahkan arah aliran utama

- Kedudukan penunjuk RSI mengesahkan momentum

- Penunjuk ATR mengesahkan turun naik yang mencukupi

- Persilangan garis isyarat dan purata pergerakan terlicin tiga kali ganda mengesahkan titik masuk tertentu Stop loss menggunakan stop loss dinamik berdasarkan ATR, dan take profit ditetapkan pada 2 kali ATR untuk memastikan nisbah risiko-pulangan yang baik.

Kelebihan Strategik

- Pelicinan tiga kali dengan ketara mengurangkan isyarat palsu dan meningkatkan kebolehpercayaan pertimbangan arah aliran

- Mekanisme pengesahan berbilang memastikan hala tuju transaksi adalah konsisten dengan arah aliran utama

- Tetapan henti rugi dan ambil untung dinamik untuk menyesuaikan diri dengan turun naik pasaran yang berbeza

- Strategi ini berjalan pada kitaran 1 jam, yang boleh mengelakkan kejutan dengan berkesan dalam kitaran masa yang lebih rendah.

- Ciri tanpa lukis semula memastikan kebolehpercayaan keputusan ujian belakang

Risiko Strategik

- Dalam pasaran sisi, kerugian kecil yang berterusan mungkin berlaku

- Mekanisme pengesahan berbilang boleh menyebabkan peluang dagangan terlepas

- Kelewatan isyarat boleh menjejaskan pengoptimuman titik masuk

- Kemeruapan yang mencukupi diperlukan untuk menjana isyarat yang sah

- Henti rugi dinamik mungkin tidak cukup tepat pada masanya dalam keadaan pasaran yang melampau

Arah pengoptimuman strategi

- Anda boleh menambah penunjuk volum sebagai pengesahan tambahan

- Pertimbangkan untuk memperkenalkan mekanisme pengoptimuman parameter penyesuaian

- Boleh meningkatkan pertimbangan kuantitatif kekuatan aliran

- Optimumkan berbilang tetapan stop loss dan take profit

- Pertimbangkan untuk menambah pengayun untuk mengoptimumkan prestasi pasaran sisi

ringkaskan

Ini adalah strategi mengikut arah aliran dengan struktur lengkap dan logik yang ketat. Melalui pelbagai proses pelicinan dan pelbagai mekanisme pengesahan, kebolehpercayaan isyarat dagangan dipertingkatkan dengan berkesan. Mekanisme pengurusan risiko yang dinamik menjadikannya sangat mudah disesuaikan. Walaupun terdapat ketinggalan tertentu, masih terdapat banyak ruang untuk penambahbaikan dalam strategi melalui pengoptimuman parameter dan menambah penunjuk tambahan.

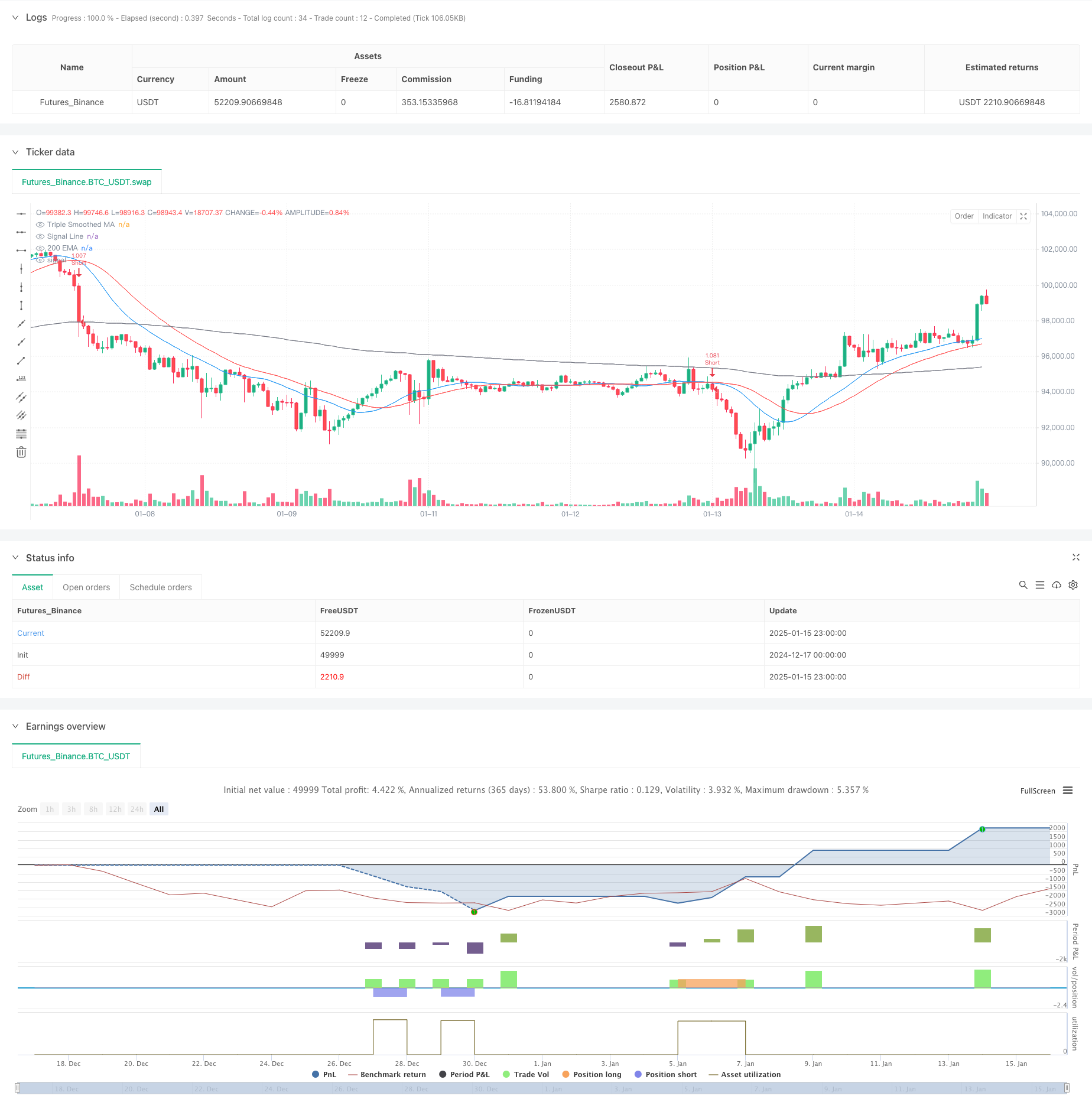

/*backtest

start: 2024-12-17 00:00:00

end: 2025-01-16 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=6

strategy("Optimized Triple Smoothed MA Crossover Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// === Input Settings ===

slength = input.int(7, "Main Smoothing Length", group="Moving Average Settings")

siglen = input.int(12, "Signal Length", group="Moving Average Settings")

src = input.source(close, "Data Source", group="Moving Average Settings")

mat = input.string("EMA", "Triple Smoothed MA Type", ["EMA", "SMA", "RMA", "WMA"], group="Moving Average Settings")

mat1 = input.string("EMA", "Signal Type", ["EMA", "SMA", "RMA", "WMA"], group="Moving Average Settings")

// === Trend Confirmation (Higher Timeframe Filter) ===

useTrendFilter = input.bool(true, "Enable Trend Filter (200 EMA)", group="Trend Confirmation")

trendMA = ta.ema(close, 200)

// === Momentum Filter (RSI Confirmation) ===

useRSIFilter = input.bool(true, "Enable RSI Confirmation", group="Momentum Confirmation")

rsi = ta.rsi(close, 14)

rsiThreshold = input.int(50, "RSI Threshold", group="Momentum Confirmation")

// === Volatility Filter (ATR) ===

useATRFilter = input.bool(true, "Enable ATR Filter", group="Volatility Filtering")

atr = ta.atr(14)

atrMa = ta.sma(atr, 14)

// === Risk Management (ATR-Based Stop Loss) ===

useAdaptiveSL = input.bool(true, "Use ATR-Based Stop Loss", group="Risk Management")

atrMultiplier = input.float(1.5, "ATR Multiplier for SL", minval=0.5, maxval=5, group="Risk Management")

takeProfitMultiplier = input.float(2, "Take Profit Multiplier", group="Risk Management")

// === Moving Average Function ===

ma(source, length, MAtype) =>

switch MAtype

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"RMA" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

// === Triple Smoothed Calculation ===

tripleSmoothedMA = ma(ma(ma(src, slength, mat), slength, mat), slength, mat)

signalLine = ma(tripleSmoothedMA, siglen, mat1)

// === Crossovers (Entry Signals) ===

bullishCrossover = ta.crossunder(signalLine, tripleSmoothedMA)

bearishCrossover = ta.crossover(signalLine, tripleSmoothedMA)

// === Additional Confirmation Conditions ===

trendLongCondition = not useTrendFilter or (close > trendMA) // Only long if price is above 200 EMA

trendShortCondition = not useTrendFilter or (close < trendMA) // Only short if price is below 200 EMA

rsiLongCondition = not useRSIFilter or (rsi > rsiThreshold) // RSI above 50 for longs

rsiShortCondition = not useRSIFilter or (rsi < rsiThreshold) // RSI below 50 for shorts

atrCondition = not useATRFilter or (atr > atrMa) // ATR must be above its MA for volatility confirmation

// === Final Trade Entry Conditions ===

longCondition = bullishCrossover and trendLongCondition and rsiLongCondition and atrCondition

shortCondition = bearishCrossover and trendShortCondition and rsiShortCondition and atrCondition

// === ATR-Based Stop Loss & Take Profit ===

longSL = close - (atr * atrMultiplier)

longTP = close + (atr * takeProfitMultiplier)

shortSL = close + (atr * atrMultiplier)

shortTP = close - (atr * takeProfitMultiplier)

// === Strategy Execution ===

if longCondition

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=longSL, limit=longTP)

if shortCondition

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=shortSL, limit=shortTP)

// === Plots ===

plot(tripleSmoothedMA, title="Triple Smoothed MA", color=color.blue)

plot(signalLine, title="Signal Line", color=color.red)

plot(trendMA, title="200 EMA", color=color.gray)

// === Alerts ===

alertcondition(longCondition, title="Bullish Signal", message="Triple Smoothed MA Bullish Crossover Confirmed")

alertcondition(shortCondition, title="Bearish Signal", message="Triple Smoothed MA Bearish Crossover Confirmed")