Gambaran keseluruhan

Ini adalah strategi perdagangan trend-following dan deviasi berdasarkan pelbagai petunjuk teknikal. Strategi ini menggunakan gabungan Bollinger Bands, RSI, Stochastic, dan MFI untuk menangkap peluang overbought dan oversold di pasaran dan meningkatkan kebolehpercayaan isyarat perdagangan melalui pengesahan silang pelbagai petunjuk.

Prinsip Strategi

Strategi ini menggunakan mekanisme penapisan berlapis untuk mengesahkan isyarat dagangan:

- Menggunakan Brin Band ((20,2) sebagai rujukan untuk rantaian turun naik harga, dan mencetuskan pilihan pra-sinyal beli apabila harga menembusi Brin Band.

- RSI ((3)) ditetapkan sebagai rantaian overbought dan oversold ((85,15), yang disahkan sebagai oversold apabila RSI melangkaui 15 ke atas.

- Indikator rawak ((10,3) diset kepada ((85,15), dan lebih lanjut mengesahkan oversold apabila garis K naik ke atas 15 .

- Pergerakan EMA 10 kitaran MFI digunakan untuk mengesahkan aliran dana, trend menaik menyokong pembelian. Syarat beli perlu dipenuhi pada masa yang sama: harga menembusi tren bawah Brin, RSI menembusi oversold, penunjuk rawak menembusi oversold dan MFI trend ke atas. Syarat jual adalah sebaliknya: harga menembusi Brin, RSI menembusi overbought, dan penunjuk rawak menembusi overbought.

Kelebihan Strategik

- Penyelidikan silang pelbagai petunjuk teknikal, mengurangkan isyarat palsu secara ketara.

- Gabungan antara trend dan dinamika, ia boleh menangkap trend dan memberi amaran perubahan.

- Penggunaan RSI pantas ((3 kitaran) meningkatkan kecekapan masa masuk.

- Pengesahan aliran dana melalui MFI, meningkatkan kebolehpercayaan transaksi.

- Menggunakan pita Brin sebagai rujukan turun naik untuk menyesuaikan diri dengan keadaan pasaran yang berbeza.

Risiko Strategik

- Berbilang penunjuk boleh menyebabkan isyarat ketinggalan dan terlepas peluang kemasukan terbaik.

- Ia mungkin berlaku dalam pasaran yang bergolak.

- RSI pantas mungkin lebih sensitif terhadap bunyi.

- Jumlah sampel yang lebih besar diperlukan untuk mengesahkan kestabilan strategi. Langkah-langkah kawalan risiko berikut disyorkan:

- Tetapkan Stop Loss Stop

- Mengendalikan skala transaksi tunggal

- Penyesuaian parameter dalam keadaan pasaran yang berbeza

- Menapis transaksi dengan lebih banyak ciri pasaran

Arah pengoptimuman strategi

- Parameter penyesuaian dinamik:

- Parameter Brin-band yang disesuaikan dengan turun naik pasaran

- Pengaturan kitaran RSI dan penunjuk rawak berdasarkan kitaran pasaran

- Tambahkan penapis persekitaran pasaran:

- Tambah Indeks Kekuatan Trend

- Pertimbangkan perubahan jumlah trafik

- Meningkatkan pengurusan risiko:

- Mencapai Hentikan Kerosakan Dinamik

- Peningkatan had tempoh pegangan

- Pengoptimuman Isyarat:

- Tambah syarat pengesahan trend

- Mengoptimumkan berat indeks

ringkaskan

Strategi ini membina sistem perdagangan yang agak lengkap dengan kerjasama berkolaborasi antara pelbagai petunjuk. Kelebihan utama strategi ini adalah meningkatkan kebolehpercayaan isyarat dengan cross-validasi pelbagai jenis petunjuk, sambil mempertimbangkan pelbagai ciri pasaran seperti trend, momentum dan aliran dana. Walaupun terdapat risiko ketinggalan, strategi ini mempunyai potensi aplikasi yang baik dengan pengoptimuman parameter yang munasabah dan langkah-langkah pengurusan risiko.

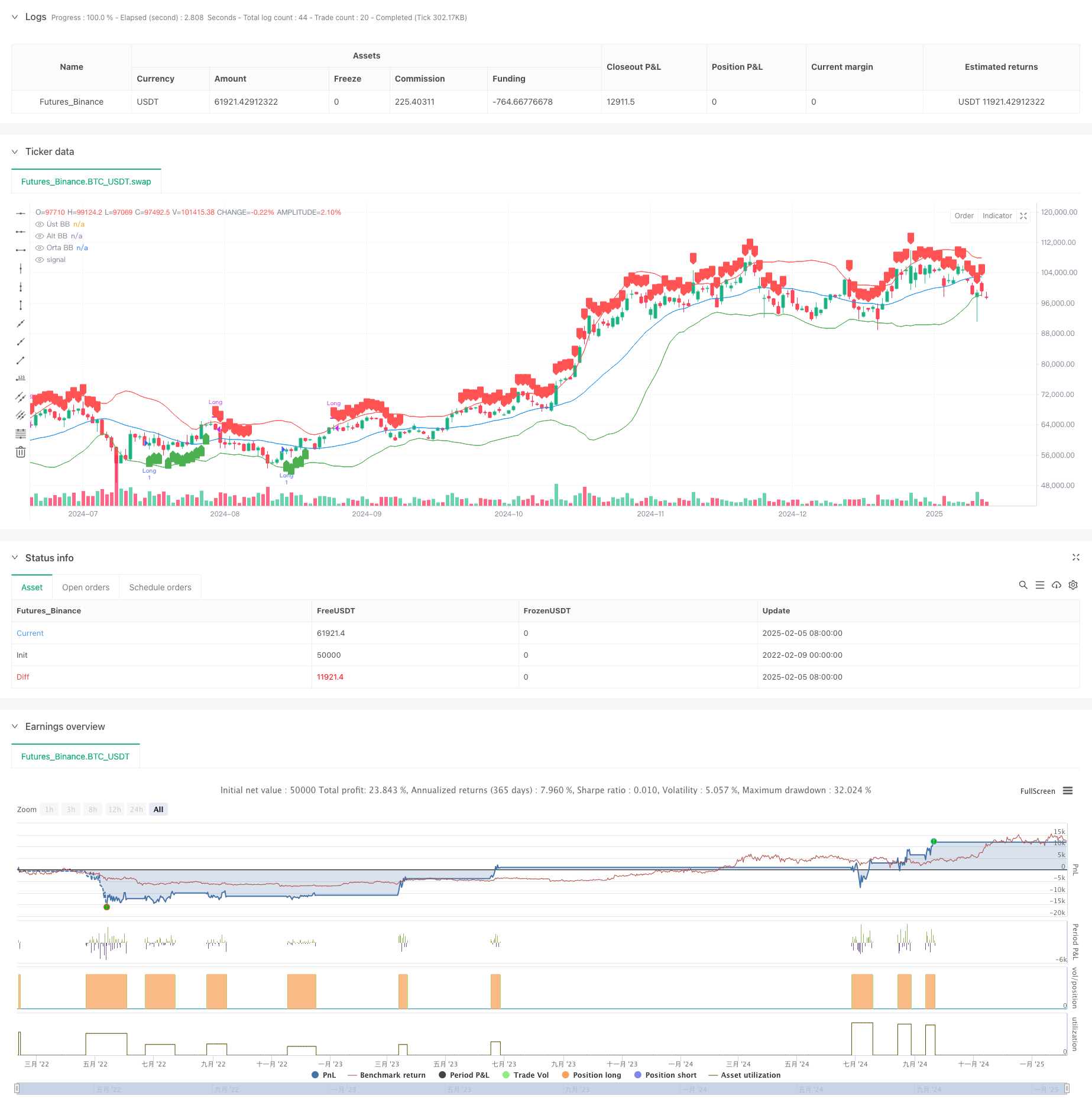

/*backtest

start: 2022-02-09 00:00:00

end: 2025-02-06 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ahmetkaratas4238

//@version=5

strategy("İzmir Stratejisi", overlay=true)

// **Bollinger Bantları Hesaplamaları**

bbLength = 20

bbMult = 2.0

basis = ta.sma(close, bbLength)

dev = bbMult * ta.stdev(close, bbLength)

upperBand = basis + dev

lowerBand = basis - dev

// **RSI (3,85,15) Hesaplaması**

rsiLength = 3

rsiUpper = 85

rsiLower = 15

rsi = ta.rsi(close, rsiLength)

// **Stochastic (10,3,85,15) Hesaplaması**

stochLength = 10

smoothK = 3

smoothD = 3

stochUpper = 85

stochLower = 15

k = ta.sma(ta.stoch(close, high, low, stochLength), smoothK)

d = ta.sma(k, smoothD)

// **Money Flow Index (MFI) Hesaplaması**

mfiLength = 14

mfi = ta.mfi(close, mfiLength) // Hata düzeltildi: Artık yalnızca periyot alıyor

mfiTrendUp = ta.ema(mfi, 10) > ta.ema(mfi[1], 10) // MFI yükseliş trendi

mfiTrendDown = ta.ema(mfi, 10) < ta.ema(mfi[1], 10) // MFI düşüş trendi

// **ALIM ŞARTLARI**

var bbBreakdown=false

var rsiBreakout=false

var stochBreakout=false

bbBreakdown := ta.crossunder(close,lowerBand)?true:bbBreakdown // Fiyat BB altına sarktı mı?

rsiBreakout := ta.crossover(rsi, rsiLower)?true:rsiBreakout // RSI 15 seviyesini yukarı kırdı mı?

stochBreakout := ta.crossover(k, stochLower)?true:stochBreakout // Stochastic alt bandı yukarı kırdı mı?

buyCondition = bbBreakdown and rsiBreakout and stochBreakout and mfiTrendUp

// **SATIM ŞARTLARI**

var bbBreakup=false

var rsiBreakdown=false

var stochBreakdown=false

bbBreakup := ta.crossunder(close, upperBand)?true:bbBreakup // Fiyat BB üst bandından aşağı kırdı mı?

rsiBreakdown := ta.crossunder(rsi, rsiUpper)?true:rsiBreakdown // RSI 85 seviyesini aşağı kırdı mı?

stochBreakdown := ta.crossunder(k, stochUpper)?true:stochBreakdown // Stochastic üst bandı aşağı kırdı mı?

sellCondition = bbBreakup and rsiBreakdown// and stochBreakdown and mfiTrendDown

if ta.crossunder(close,lowerBand)

bbBreakup:=false

if ta.crossover(rsi, rsiLower)

rsiBreakdown:=false

if ta.crossover(k, stochLower)

stochBreakdown:=false

if ta.crossunder(close, upperBand)

bbBreakdown:=false

if ta.crossunder(rsi, rsiUpper)

rsiBreakout:=false

if ta.crossunder(k, stochUpper)

stochBreakout:=false

// **Alım İşlemi Aç**

if buyCondition

strategy.entry("Long", strategy.long)

// **Satım İşlemi Yap (Pozisyon Kapat)**

if sellCondition

strategy.close("Long")

// **Bollinger Bantlarını Göster**

plot(upperBand, title="Üst BB", color=color.red)

plot(lowerBand, title="Alt BB", color=color.green)

plot(basis, title="Orta BB", color=color.blue)

// **Alım ve Satım Sinyallerini İşaretle**

plotshape(series=buyCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="AL")

plotshape(series=sellCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="SAT")