Gambaran keseluruhan

Strategi ini adalah sistem perdagangan bertingkat berdasarkan analisis keletihan pasaran, yang mengenal pasti masa-masa penting di mana pasaran mungkin bertukar melalui analisis mendalam mengenai dinamik harga. Strategi ini menggabungkan mekanisme pengurusan risiko yang dinamik, termasuk pelbagai dimensi seperti pengurusan dana, pengoptimuman stop loss, dan kawalan penarikan balik, untuk membentuk kerangka keputusan perdagangan yang lengkap.

Prinsip Strategi

Pusat strategi ini adalah untuk menilai tahap keletihan pasaran dengan memantau pergerakan harga yang berterusan.

- Menentukan arah trend dengan membandingkan harga penutupan semasa dengan harga penutupan sebelumnya pada 4 K

- Tiga tahap intensiti isyarat yang berbeza telah ditetapkan (9/12/14)

- Apabila harga terus bergerak ke arah yang sama, sistem akan mengumpulkan jumlah isyarat.

- Apabila tahap intensiti isyarat yang ditetapkan telah dicapai, sistem akan memberikan isyarat dagangan yang sesuai.

- Sistem pengurusan kedudukan yang mengintegrasikan mekanisme stop loss dinamik berasaskan ATR dan nisbah pulangan risiko

Kelebihan Strategik

- Sistem isyarat bertingkat menyediakan tahap yang berbeza untuk mengenal pasti peluang perdagangan

- Menjaga keselamatan wang melalui pengurusan wang dan mekanisme kawalan risiko

- Dengan menggunakan ATR, anda dapat menyesuaikan diri dengan lebih baik dengan turun naik pasaran

- Memperkenalkan mekanisme tracking stop loss untuk lebih mengunci keuntungan

- Perlindungan penarikan balik maksimum untuk mengelakkan kerugian yang berlebihan

- Sistem ini mempunyai keluasan yang baik dan ruang untuk pengoptimuman parameter

Risiko Strategik

- Mungkin memberi isyarat yang salah dalam pasaran yang bergolak

- Had isyarat tetap mungkin tidak sesuai untuk semua keadaan pasaran

- Kemunduran mungkin lebih besar dalam keadaan berbalik pantas

- Perlu lebih banyak pengoptimuman parameter

- Sistem pengurusan wang boleh mengehadkan ruang untuk keuntungan dalam beberapa kes

Arah pengoptimuman strategi

- Memperkenalkan mekanisme penapisan kadar turun naik pasaran untuk menyesuaikan had isyarat dalam persekitaran turun naik yang berbeza

- Tingkatkan dimensi analisis volum dan tingkatkan kebolehpercayaan isyarat

- Membangunkan sistem pengoptimuman parameter yang bersesuaian

- Menambah Indeks Analisis Keadaan Pasar

- Mengoptimumkan sistem pengurusan wang dan menjadikannya lebih fleksibel

ringkaskan

Strategi ini menyediakan kerangka perdagangan yang sistematik kepada peniaga melalui analisis keletihan bertingkat dan sistem pengurusan risiko yang baik. Walaupun terdapat beberapa tempat yang perlu dioptimumkan, konsep reka bentuk keseluruhan utuh dan mempunyai nilai aplikasi praktikal.

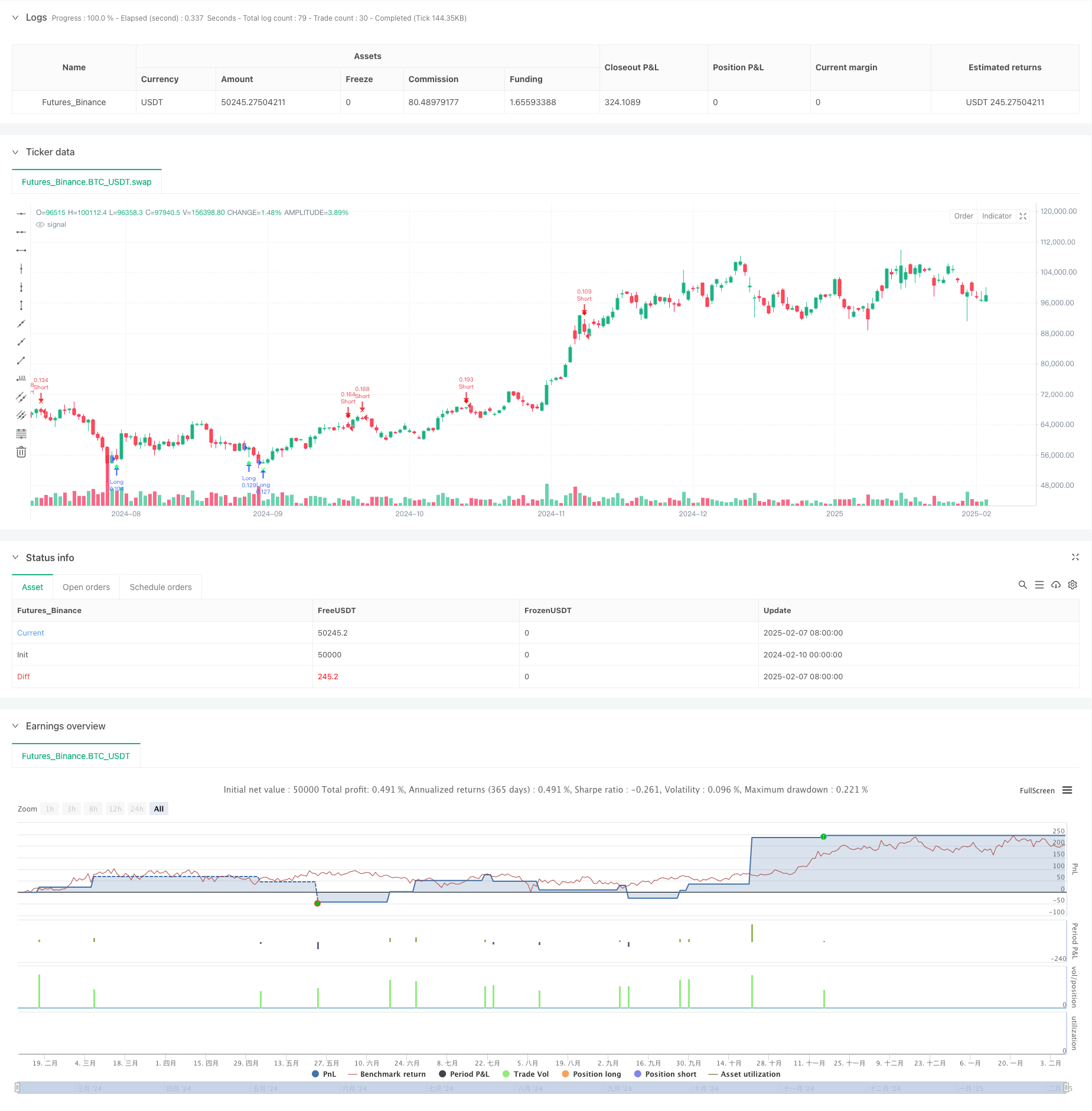

/*backtest

start: 2024-02-10 00:00:00

end: 2025-02-08 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy(title="Improved Exhaustion Signal with Risk Management and Drawdown Control", shorttitle="Exhaustion Signal", overlay=true)

// ———————————————— INPUT SETTINGS ————————————————

showLevel1 = input.bool(true, 'Show Level 1 Signals')

showLevel2 = input.bool(true, 'Show Level 2 Signals')

showLevel3 = input.bool(true, 'Show Level 3 Signals')

// Thresholds for signal strength levels

level1 = 9

level2 = 12

level3 = 14

// Risk management inputs

riskPercentage = input.float(1.0, title="Risk Percentage per Trade", minval=0.1, maxval=5.0) // Risk per trade in percentage

riskRewardRatio = input.float(2.0, title="Risk-to-Reward Ratio", minval=1.0, maxval=5.0) // Reward-to-risk ratio

trailingStop = input.bool(true, title="Enable Trailing Stop") // Enable/Disable trailing stop

trailingStopDistance = input.int(50, title="Trailing Stop Distance (in points)", minval=1) // Distance for trailing stop

// Drawdown protection settings

maxDrawdown = input.float(10.0, title="Max Drawdown Percentage", minval=0.1, maxval=50.0) // Max allowable drawdown before stopping trading

// ———————————————— GLOBAL VARIABLES ————————————————

var int cycle = 0

var int bullishSignals = 0

var int bearishSignals = 0

var float equityHigh = na // Initialize as undefined

// Track equity drawdown

if (na(equityHigh) or strategy.equity > equityHigh)

equityHigh := strategy.equity

drawdownPercent = 100 * (equityHigh - strategy.equity) / equityHigh

// Stop trading if drawdown exceeds the limit

if drawdownPercent >= maxDrawdown

strategy.close_all()

// ———————————————— FUNCTION: RESET & IMMEDIATE RECHECK USING AN ARRAY RETURN ————————————————

f_resetAndRecheck(_bullish, _bearish, _cycle, _close, _close4) =>

newBullish = _bullish

newBearish = _bearish

newCycle = _cycle

// Reset cycle if necessary based on price action

newBullish := 0

newBearish := 0

newCycle := 0

if _close < _close4

newBullish := 1

newCycle := newBullish

else if _close > _close4

newBearish := 1

newCycle := newBearish

resultArray = array.new_int(3, 0)

array.set(resultArray, 0, newBullish)

array.set(resultArray, 1, newBearish)

array.set(resultArray, 2, newCycle)

resultArray

// ———————————————— EXHAUSTION LOGIC ————————————————

if cycle < 9

// Bullish cycle: close < close[4]

if close < close[4]

bullishSignals += 1

bearishSignals := 0

cycle := bullishSignals

// Bearish cycle: close > close[4]

else if close > close[4]

bearishSignals += 1

bullishSignals := 0

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

// ——— BULLISH checks ———

if bullishSignals > 0

if bullishSignals < (level3 - 1)

if close < close[3]

bullishSignals += 1

bearishSignals := 0

cycle := bullishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else if bullishSignals == (level3 - 1)

if close < close[2]

bullishSignals := level3

cycle := bullishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

// ——— BEARISH checks ———

else if bearishSignals > 0

if bearishSignals < (level3 - 1)

if close > close[3]

bearishSignals += 1

bullishSignals := 0

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else if bearishSignals == (level3 - 1)

if close > close[2]

bearishSignals := level3

cycle := bearishSignals

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

else

newVals = f_resetAndRecheck(bullishSignals, bearishSignals, cycle, close, close[4])

bullishSignals := array.get(newVals, 0)

bearishSignals := array.get(newVals, 1)

cycle := array.get(newVals, 2)

// ———————————————— SIGNAL FLAGS ————————————————

bullishLevel1 = showLevel1 and (bullishSignals == level1)

bearishLevel1 = showLevel1 and (bearishSignals == level1)

bullishLevel2 = showLevel2 and (bullishSignals == level2)

bearishLevel2 = showLevel2 and (bearishSignals == level2)

bullishLevel3 = showLevel3 and (bullishSignals == level3)

bearishLevel3 = showLevel3 and (bearishSignals == level3)

// ———————————————— PLOT SIGNALS ————————————————

plotshape(bullishLevel1, style=shape.diamond, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 1 Bullish Signal")

plotshape(bearishLevel1, style=shape.diamond, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 1 Bearish Signal")

plotshape(bullishLevel2, style=shape.xcross, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 2 Bullish Signal")

plotshape(bearishLevel2, style=shape.xcross, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 2 Bearish Signal")

plotshape(bullishLevel3, style=shape.flag, color=color.new(#30ff85, 0), textcolor=color.white, size=size.tiny, location=location.belowbar, title="Level 3 Bullish Signal")

plotshape(bearishLevel3, style=shape.flag, color=color.new(#ff1200, 0), textcolor=color.white, size=size.tiny, location=location.abovebar, title="Level 3 Bearish Signal")

// ———————————————— RESET AFTER LEVEL 3 ————————————————

if bullishSignals == level3 or bearishSignals == level3

bullishSignals := 0

bearishSignals := 0

cycle := 0

// ———————————————— BACKTEST LOGIC ————————————————

// Set up basic long and short entry conditions based on signal levels

longCondition = bullishLevel1 or bullishLevel2 or bullishLevel3

shortCondition = bearishLevel1 or bearishLevel2 or bearishLevel3

// Calculate position size based on risk percentage

equity = strategy.equity

riskAmount = equity * riskPercentage / 100

atr = ta.atr(14)

stopLossLevel = atr * 1.5 // Using ATR for dynamic stop-loss

positionSize = riskAmount / stopLossLevel

// Initialize strategy logic

if longCondition

strategy.entry("Long", strategy.long, qty=positionSize)

if shortCondition

strategy.entry("Short", strategy.short, qty=positionSize)

// ———————————————— CONCRETE STOP LOSS AND TAKE PROFIT ————————————————

stopLoss = stopLossLevel

takeProfit = stopLoss * riskRewardRatio

// Apply stop loss and take profit to the strategy based on concrete price levels

strategy.exit("Exit Long", from_entry="Long", stop=close - stopLoss, limit=close + takeProfit)

strategy.exit("Exit Short", from_entry="Short", stop=close + stopLoss, limit=close - takeProfit)

// ———————————————— TRAILING STOP ————————————————

if trailingStop

strategy.exit("Exit Long Trailing", from_entry="Long", trail_price=close - trailingStopDistance, trail_offset=trailingStopDistance)

strategy.exit("Exit Short Trailing", from_entry="Short", trail_price=close + trailingStopDistance, trail_offset=trailingStopDistance)