Gambaran keseluruhan

Strategi ini adalah sistem perdagangan komprehensif berdasarkan pelbagai petunjuk teknikal yang menggabungkan indikator momentum, indikator trend dan indikator kadar turun naik untuk menangkap peluang turun naik jangka pendek di pasaran. Strategi ini mengenal pasti peluang perdagangan melalui isyarat silang MACD, pengesahan trend EMA, penyaringan kekuatan RSI overbought dan oversold dan trend ADX, dan menggunakan stop loss dinamik berasaskan ATR untuk menguruskan risiko.

Prinsip Strategi

Logik teras strategi adalah berdasarkan komponen utama berikut:

- Penunjuk MACD digunakan untuk menangkap perubahan momentum, untuk menentukan masa masuk dengan persilangan garis cepat dan lambat

- 200 EMA kitaran digunakan untuk mengesahkan arah trend keseluruhan, harga terletak di atas garis purata dianggap sebagai trend multihead, sebaliknya sebagai trend overhead

- RSI digunakan untuk mengesahkan pergerakan harga, RSI> 50 menyokong melakukan lebih banyak, RSI <50 menyokong melakukan lebih sedikit

- Indeks ADX digunakan untuk menyaring trend lemah dan hanya dipertimbangkan untuk masuk apabila ADX lebih besar daripada set terowong

- Indikator ATR digunakan untuk mengira kedudukan berhenti dan berhenti secara dinamik, menyesuaikan diri dengan turun naik pasaran

Kelebihan Strategik

- Memperbaiki kebolehpercayaan isyarat melalui cross-validasi pelbagai indikator

- Sistem pengurusan risiko dinamik yang secara automatik menyesuaikan stop loss mengikut turun naik pasaran

- Adaptif, parameter boleh disesuaikan dengan keadaan pasaran yang berbeza

- Mekanisme pengesahan trend yang lengkap untuk mengurangkan risiko penembusan palsu

- Logik masuk dan keluar yang sistematik, mengurangkan penilaian subjektif

Risiko Strategik

- Penunjuk berbilang boleh menyebabkan ketinggalan isyarat

- Tempoh masa yang singkat terdedah kepada bunyi pasaran

- Pengoptimuman parameter boleh menyebabkan pemasangan berlebihan

- Perdagangan frekuensi tinggi mungkin membawa kos transaksi yang lebih tinggi

- Ia boleh mencetuskan kerugian yang kerap apabila pasaran berubah-ubah.

Arah pengoptimuman strategi

- Memperkenalkan penunjuk volum sebagai pengesahan tambahan

- Mengoptimumkan ADX Threshold dan meningkatkan kecekapan penapisan trend

- Tambah penapis masa untuk mengelakkan masa-masa kurang kebolehpasaran

- Membangunkan sistem parameter adaptasi untuk meningkatkan kestabilan strategi

- Menambah penapis kadar turun naik pasaran untuk keadaan pasaran yang berbeza

ringkaskan

Strategi ini membina sistem perdagangan yang lengkap dengan menggunakan pelbagai petunjuk teknikal secara bersepadu. Walaupun terdapat beberapa ketinggalan dan cabaran pengoptimuman parameter, dengan pengurusan risiko yang munasabah dan pengoptimuman berterusan, strategi ini menunjukkan kesesuaian dan kebolehpercayaan yang baik.

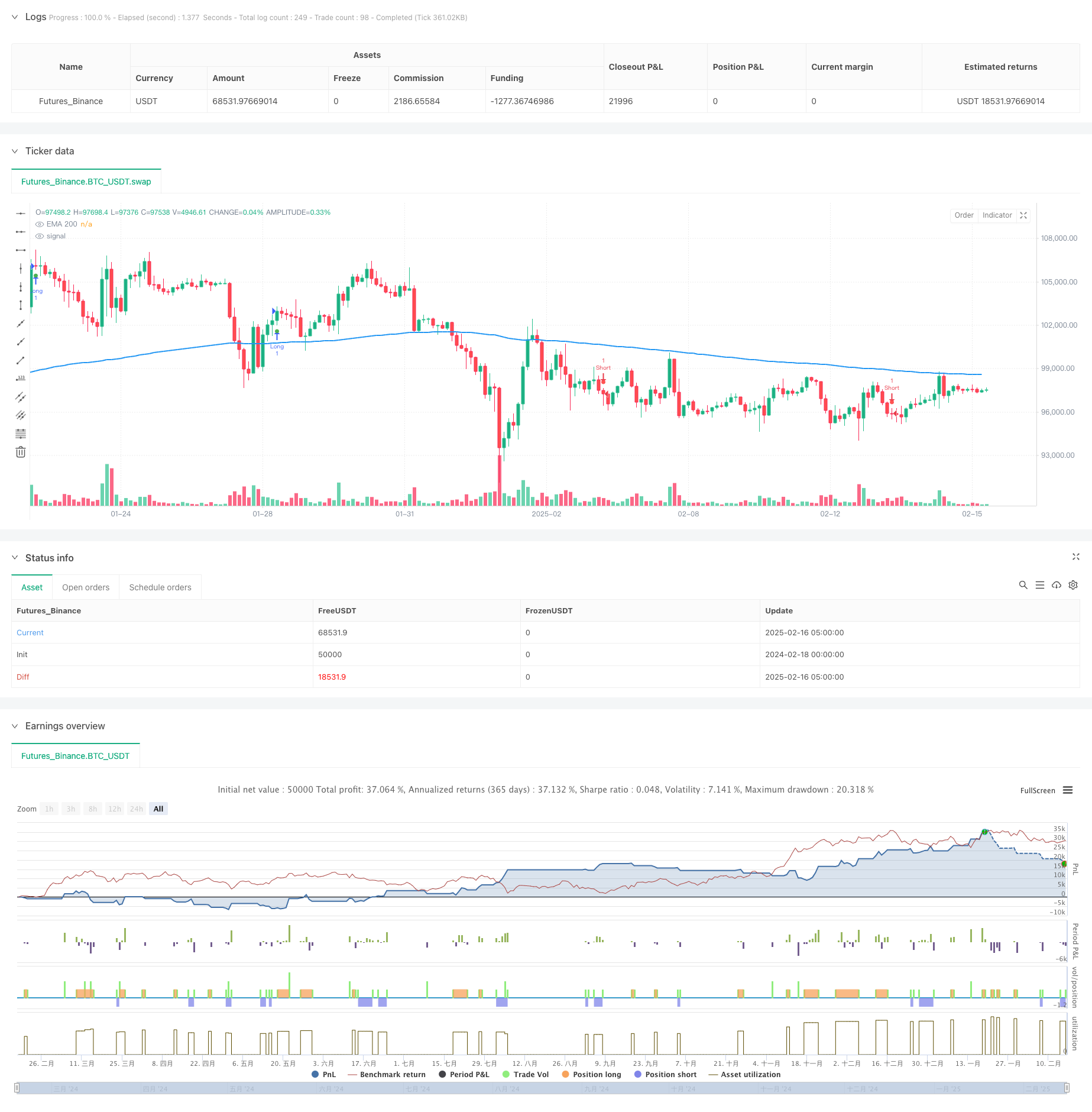

/*backtest

start: 2024-02-18 00:00:00

end: 2025-02-16 08:00:00

period: 3h

basePeriod: 3h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Impulse Wave Strategy", overlay=true)

// === INPUT PARAMETERS ===

fast_length = input(12, title="MACD Fast Length")

slow_length = input(26, title="MACD Slow Length")

signal_smoothing = input(9, title="MACD Signal Smoothing")

ema_length = input(200, title="EMA Length")

rsi_length = input(14, title="RSI Length")

adx_length = input(14, title="ADX Length")

adx_smoothing = input(14, title="ADX Smoothing")

atr_length = input(14, title="ATR Length")

risk_reward_ratio = input(2, title="Risk-Reward Ratio")

adx_threshold = input(20, title="ADX Threshold")

// === INDICATORS ===

[macdLine, signalLine, _] = ta.macd(close, fast_length, slow_length, signal_smoothing)

ema = ta.ema(close, ema_length)

rsi = ta.rsi(close, rsi_length)

[dmiPlus, dmiMinus, adx] = ta.dmi(adx_length, adx_smoothing)

// === ENTRY CONDITIONS ===

bullishTrend = ta.crossover(macdLine, signalLine) and close > ema and adx > adx_threshold and rsi > 50

bearishTrend = ta.crossunder(macdLine, signalLine) and close < ema and adx > adx_threshold and rsi < 50

// === STOP-LOSS & TAKE-PROFIT CALCULATION ===

longStopLoss = close - ta.atr(atr_length) * 1.5

longTakeProfit = close + (ta.atr(atr_length) * 1.5 * risk_reward_ratio)

shortStopLoss = close + ta.atr(atr_length) * 1.5

shortTakeProfit = close - (ta.atr(atr_length) * 1.5 * risk_reward_ratio)

// === STRATEGY EXECUTION ===

// Enter Long

if bullishTrend

strategy.entry("Long", strategy.long)

strategy.exit("TakeProfitLong", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

// Enter Short

if bearishTrend

strategy.entry("Short", strategy.short)

strategy.exit("TakeProfitShort", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

// === PLOTTING ===

plot(ema, title="EMA 200", color=color.blue, linewidth=2)

plotshape(series=bullishTrend, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(series=bearishTrend, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// === ALERTS ===

alertcondition(bullishTrend, title="Bullish Entry", message="Buy Signal Triggered!")

alertcondition(bearishTrend, title="Bearish Entry", message="Sell Signal Triggered!")

// === DEBUGGING LOG ===

label.new(bar_index, high, "ADX: " + str.tostring(adx), color=color.white, textcolor=color.black)

label.new(bar_index, low, "MACD Cross: " + str.tostring(macdLine), color=color.white, textcolor=color.black)