Gambaran keseluruhan

Ini adalah strategi perdagangan berdasarkan SMA (rata-rata bergerak sederhana) yang menganalisis kenaikan dan penurunan dalam tempoh setahun. Strategi ini mengenal pasti isyarat perdagangan yang berpotensi dengan mengira purata bergerak perbezaan jumlah pembelian dan membandingkannya dengan penurunan dan penurunan sejarah. Strategi ini menggunakan tempoh pengulangan yang panjang dan sesuai untuk perdagangan trend jangka panjang.

Prinsip Strategi

Logik teras strategi adalah berdasarkan langkah utama berikut:

- Pengiraan Delta: Mengira perbezaan jumlah beli dan jual dengan menganalisis pergerakan harga. Apabila harga penutupan lebih tinggi daripada harga bukaan, ia direkodkan sebagai jumlah beli, sebaliknya sebagai jumlah jual.

- Pemprosesan lancar SMA: Pemprosesan purata bergerak 14 kitaran untuk nilai Delta untuk mengurangkan kebisingan.

- Menentukan paras tertinggi dan terendah dalam tempoh setahun: Mengira paras tertinggi dan terendah Delta SMA pada tahun lalu.

- Syarat isyarat:

- Sinyal beli: Dilakukan apabila Delta SMA mencecah 0 selepas 70% di bawah paras rendah setahun

- Sinyal Jual: Dilakukan apabila Delta SMA mencecah 60% selepas mencecah 90% dari paras tertinggi setahun

Kelebihan Strategik

- Keupayaan untuk menangkap trend jangka panjang: Dengan analisis data sejarah sepanjang satu tahun, ia dapat menangkap trend utama dengan berkesan.

- Kesan penapisan bunyi yang baik: Menggunakan pemprosesan yang lancar SMA dan keadaan nilai tiup ganda, berkesan mengurangkan isyarat palsu.

- Kawalan risiko yang munasabah: Syarat kemasukan dan keluar yang jelas ditetapkan untuk mengelakkan perdagangan berlebihan.

- Kebolehsuaian: parameter strategi boleh disesuaikan dengan keadaan pasaran yang berbeza.

Risiko Strategik

- Risiko kelewatan: Kemungkinan kelewatan isyarat disebabkan oleh penggunaan SMA dan tempoh pengulangan yang panjang.

- Risiko penembusan palsu: Ia mungkin memberi isyarat yang salah dalam pasaran yang bergolak.

- Bergantung kepada keadaan pasaran: mungkin kurang baik dalam pasaran yang tidak menunjukkan trend.

- Sensitiviti parameter: Tetapan nilai terhad mempunyai kesan besar terhadap prestasi strategi.

Arah pengoptimuman strategi

- Penyesuaian nilai terhad dinamik: Nilai terhad rendah dan tinggi boleh disesuaikan mengikut dinamik turun naik pasaran.

- Meningkatkan penunjuk tambahan: Meningkatkan kebolehpercayaan isyarat dengan penunjuk teknikal lain.

- Memperkenalkan mekanisme hentian kerugian: Tetapkan hentian kerugian dinamik untuk mengawal risiko.

- Penyaringan keadaan pasaran: Tambah logik penilaian keadaan pasaran, strategi operasi dalam keadaan yang sesuai.

ringkaskan

Ini adalah strategi pengesanan trend jangka menengah dan jangka panjang berdasarkan analisis kuantiti transaksi, untuk menangkap trend pasaran dengan menganalisis perbezaan nilai pembelian dan penjualan. Reka bentuk strategi adalah masuk akal, risiko terkawal, tetapi perlu memperhatikan kesesuaian dan pengoptimuman parameter persekitaran pasaran. Dengan arah pengoptimuman yang dikemukakan, strategi masih mempunyai ruang untuk meningkatkan lagi.

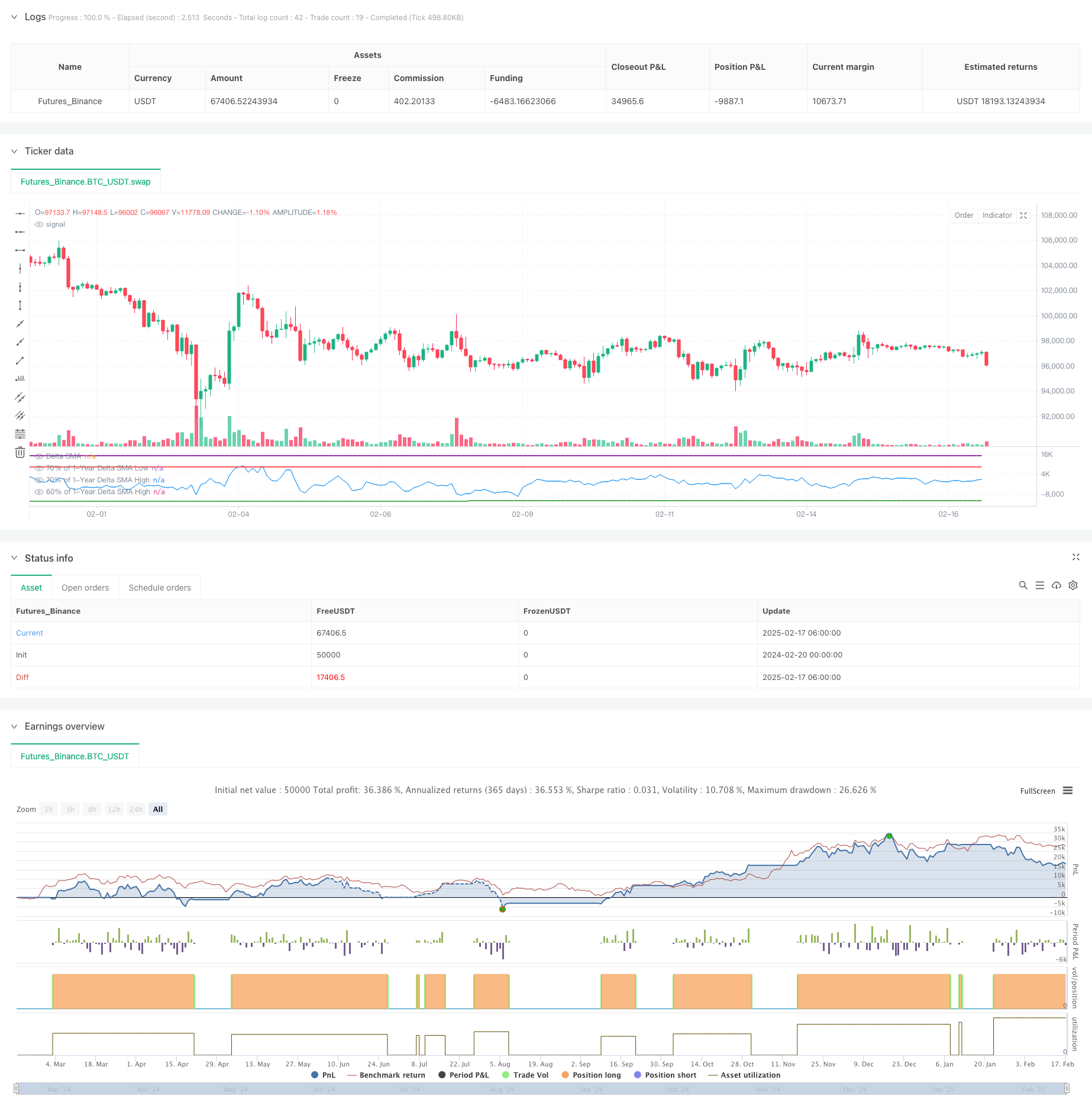

/*backtest

start: 2024-02-20 00:00:00

end: 2025-02-17 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Delta SMA 1-Year High/Low Strategy", overlay = false, margin_long = 100, margin_short = 100)

// Inputs

delta_sma_length = input.int(14, title="Delta SMA Length", minval=1) // SMA length for Delta

lookback_days = 365 // Lookback period fixed to 1 year

// Function to calculate buy and sell volume

buy_volume = close > open ? volume : na

sell_volume = close < open ? volume : na

// Calculate the Delta

delta = nz(buy_volume, 0) - nz(sell_volume, 0)

// Calculate Delta SMA

delta_sma = ta.sma(delta, delta_sma_length)

// Lookback period in bars (1 bar = 1 day)

desired_lookback_bars = lookback_days

// Ensure lookback doesn't exceed available historical data

max_lookback_bars = math.min(desired_lookback_bars, 365) // Cap at 365 bars (1 year)

// Calculate Delta SMA low and high within the valid lookback period

delta_sma_low_1yr = ta.lowest(delta_sma, max_lookback_bars)

delta_sma_high_1yr = ta.highest(delta_sma, max_lookback_bars)

// Define thresholds for buy and sell conditions

very_low_threshold = delta_sma_low_1yr * 0.7

above_70_threshold = delta_sma_high_1yr * 0.9

below_60_threshold = delta_sma_high_1yr * 0.5

// Track if `delta_sma` was very low and persist the state

var bool was_very_low = false

if delta_sma < very_low_threshold

was_very_low := true

if ta.crossover(delta_sma, 10000)

was_very_low := false // Reset after crossing 0

// Track if `delta_sma` crossed above 70% of the high

var bool crossed_above_70 = false

if ta.crossover(delta_sma, above_70_threshold)

crossed_above_70 := true

if delta_sma < below_60_threshold*0.5 and crossed_above_70

crossed_above_70 := false // Reset after triggering sell

// Buy condition: `delta_sma` was very low and now crosses 0

buy_condition = was_very_low and ta.crossover(delta_sma, 0)

// Sell condition: `delta_sma` crossed above 70% of the high and now drops below 60%

sell_condition = crossed_above_70 and delta_sma < below_60_threshold

// Place a long order when buy condition is met

if buy_condition

strategy.entry("Buy", strategy.long)

// Place a short order when sell condition is met

if sell_condition

strategy.close("Buy")

// Plot Delta SMA and thresholds for visualization

plot(delta_sma, color=color.blue, title="Delta SMA")

plot(very_low_threshold, color=color.green, title="70% of 1-Year Delta SMA Low", linewidth=2)

plot(above_70_threshold, color=color.purple, title="70% of 1-Year Delta SMA High", linewidth=2)

plot(below_60_threshold, color=color.red, title="60% of 1-Year Delta SMA High", linewidth=2)

// Optional: Plot Buy and Sell signals on the chart

//plotshape(series=buy_condition, title="Buy Signal", location=location.belowbar, color=color.new(color.green, 0), style=shape.labelup, text="BUY")

//plotshape(series=sell_condition, title="Sell Signal", location=location.abovebar, color=color.new(color.red, 0), style=shape.labeldown, text="SELL")