Gambaran keseluruhan

Ini adalah strategi perdagangan penyesuaian diri berdasarkan RSI dan CCI. Strategi ini membina sistem perdagangan yang lengkap dengan memantau keadaan persilangan RSI dan CCI dalam tempoh masa yang berbeza, digabungkan dengan trend EMA rata-rata. Strategi ini mempunyai ciri-ciri penyesuaian diri yang kuat, kestabilan isyarat, dan lain-lain, yang dapat menangkap peluang overbought dan oversold pasaran dengan berkesan.

Prinsip Strategi

Logik utama strategi ini merangkumi:

- Tempoh masa menyesuaikan diri: menyesuaikan parameter RSI dan CCI secara dinamik mengikut tempoh masa yang berbeza (dari 1 minit hingga 4 jam).

- Pengesahan Dual Indicator: menggunakan gabungan RSI (indicator yang agak kuat) dan CCI (indicator yang bergerak ke hadapan) untuk menapis isyarat perdagangan. Isyarat perdagangan dihasilkan apabila RSI dan CCI memenuhi syarat tertentu pada masa yang sama.

- Pemeriksaan kesinambungan isyarat: memastikan kestabilan isyarat dengan menetapkan jangka masa minimum.

- Hentian Hentian Dinamis: titik hentian hentian yang ditetapkan secara dinamik berdasarkan tahap RSI dan CCI semasa masuk.

- Pengesahan trend: menggunakan EMA 200 kitaran sebagai rujukan trend.

Kelebihan Strategik

- Adaptif: Strategi dapat menyesuaikan parameter secara automatik mengikut kitaran masa yang berbeza.

- Kebolehpercayaan isyarat yang tinggi: Kebolehpercayaan isyarat yang meningkat dengan ketara melalui pengesahan silang indikator teknologi ganda.

- Pengendalian risiko yang sempurna: Menggunakan mekanisme hentian hentian dinamik, yang dapat mengawal risiko dengan berkesan.

- Peraturan operasi jelas: syarat kemasukan dan keluar jelas, memudahkan operasi praktikal.

- Skala yang baik: kerangka dasar fleksibel, syarat penapisan baru boleh ditambah mengikut keperluan.

Risiko Strategik

- Sensitiviti parameter: Parameter optimum mungkin berbeza dalam keadaan pasaran yang berbeza.

- Risiko bergolak: Isyarat palsu mungkin muncul semasa pasaran bergolak.

- Kesan Slip Point: Perdagangan frekuensi tinggi mungkin menghadapi kesan Slip Point.

- Penangguhan isyarat: mekanisme pengesahan berganda mungkin menyebabkan sedikit kelewatan masa masuk.

- Kepercayaan kepada keadaan pasaran: Performa dalam pasaran trend kuat mungkin lebih baik daripada pasaran goyah.

Arah pengoptimuman strategi

- Penyesuaian parameter: mekanisme pengoptimuman parameter penyesuaian boleh diperkenalkan, menyesuaikan parameter mengikut keadaan pasaran yang dinamik.

- Pengiktirafan persekitaran pasaran: Tambah modul pengiktirafan persekitaran pasaran untuk menggunakan strategi perdagangan yang berbeza dalam keadaan pasaran yang berbeza.

- Penyesuaian kadar lonjakan: memperkenalkan penunjuk kadar lonjakan, menyesuaikan parameter stop-loss mengikut saiz kadar lonjakan.

- Penapisan isyarat: Tambah lebih banyak petunjuk teknikal dan pengenalan bentuk untuk menapis isyarat palsu.

- Pengurusan risiko: Memperbaiki skim pengurusan wang, meningkatkan tempoh memegang dan kawalan kedudukan.

ringkaskan

Strategi ini membina sistem perdagangan yang mantap dengan menggabungkan kelebihan RSI dan CCI. Sifat penyesuaian diri strategi dan mekanisme kawalan risiko yang baik menjadikannya mempunyai kepraktisan yang baik. Dengan pengoptimuman dan penyempurnaan yang berterusan, strategi ini dijangka dapat mencapai prestasi yang lebih baik dalam perdagangan sebenar.

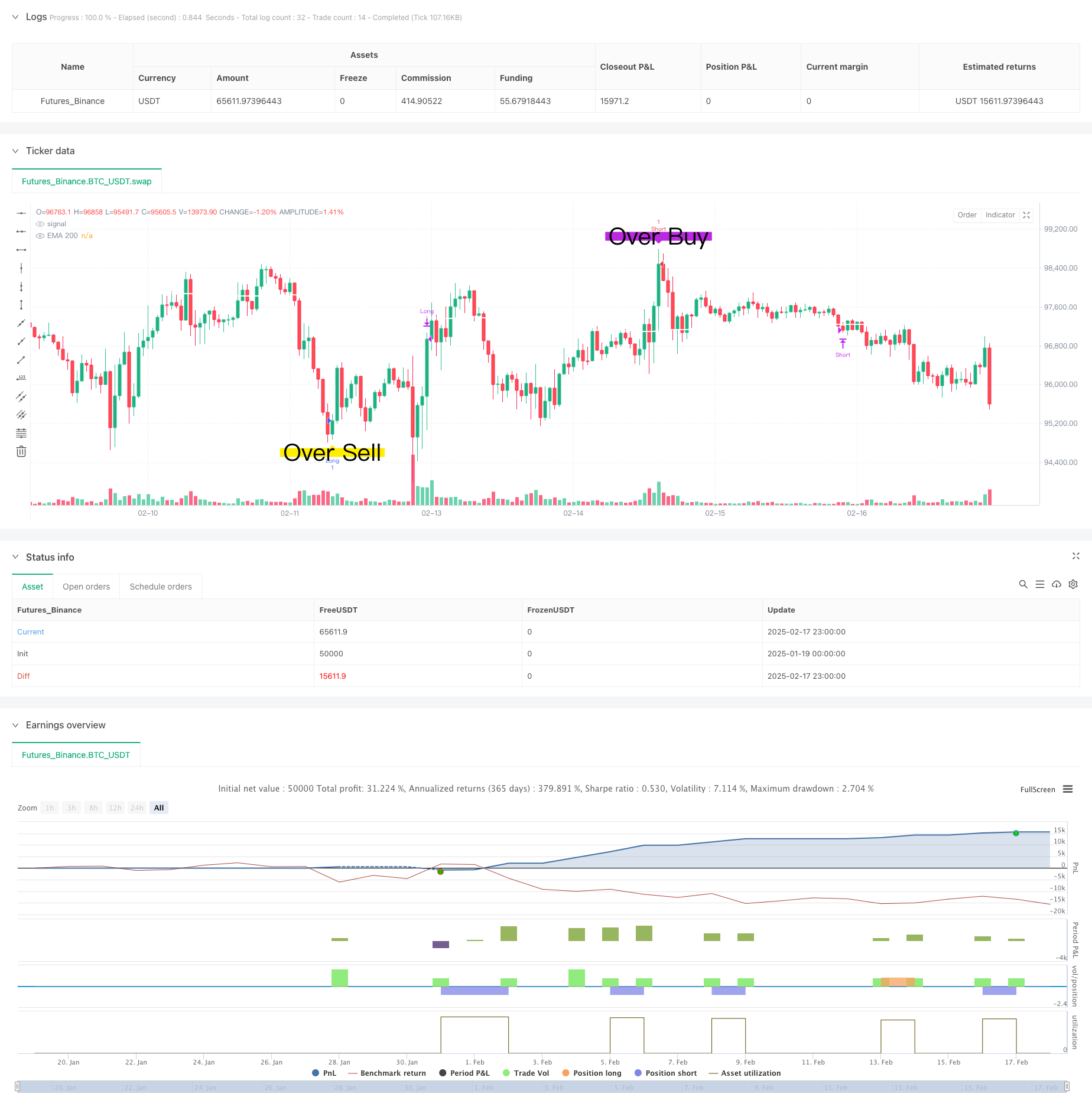

/*backtest

start: 2025-01-19 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("RSI & CCI Strategy with Alerts", overlay=true)

// Detect current chart timeframe

tf = timeframe.period

// Define settings for different timeframes

rsiLength = tf == "1" ? 30 : tf == "5" ? 30 : tf == "15" ? 30 : tf == "30" ? 30 : 30 // Default

cciLength = tf == "1" ? 15 : tf == "5" ? 20 : tf == "15" ? 20 : tf == "30" ? 20 : 20 // Default

cciBuyThreshold = tf == "1" ? -100 : tf == "5" ? -100 : tf == "15" ? -100 : tf == "30" ? -100 : -100

cciSellThreshold = tf == "1" ? 100 : tf == "5" ? 100 : tf == "15" ? 100 : tf == "30" ? 100 : 100 // Default

stayTimeFrames = tf == "1" ? 1 : tf == "5" ? 1 : tf == "15" ? 1 : tf == "30" ? 1 : tf == "240" ? 1 : 2 // Default

stayTimeFramesOver =tf == "1" ? 1 : tf == "5" ? 2 : tf == "15" ? 2 : tf == "30" ? 3 : 2 // Default

// Calculate RSI & CCI

rsi = ta.rsi(close, rsiLength)

rsiOver = ta.rsi(close, 14)

cci = ta.cci(close, cciLength)

// EMA 50

ema200 = ta.ema(close, 200)

plot(ema200, color=color.rgb(255, 255, 255), linewidth=2, title="EMA 200")

// CCI candle threshold tracking

var int cciEntryTimeLong = na

var int cciEntryTimeShort = na

// Store entry time when CCI enters the zone

if (cci < cciBuyThreshold)

if na(cciEntryTimeLong)

cciEntryTimeLong := bar_index

else

cciEntryTimeLong := na

if (cci > cciSellThreshold)

if na(cciEntryTimeShort)

cciEntryTimeShort := bar_index

else

cciEntryTimeShort := na

// Confirming CCI has stayed in the threshold for required bars

cciStayedBelowNeg100 = not na(cciEntryTimeLong) and (bar_index - cciEntryTimeLong >= stayTimeFrames) and rsi >= 53

cciStayedAbove100 = not na(cciEntryTimeShort) and (bar_index - cciEntryTimeShort >= stayTimeFrames) and rsi <= 47

// CCI & RSI candle threshold tracking for Buy Over and Sell Over signals

var int buyOverEntryTime = na

var int sellOverEntryTime = na

// Track entry time when RSI and CCI conditions are met

if (rsiOver <= 31 and cci <= -120)

if na(buyOverEntryTime)

buyOverEntryTime := bar_index

else

buyOverEntryTime := na

if (rsiOver >= 69 and cci >= 120)

if na(sellOverEntryTime)

sellOverEntryTime := bar_index

else

sellOverEntryTime := na

// Confirm that conditions are met for the required stayTimeFrames

buyOverCondition = not na(buyOverEntryTime) and (bar_index - buyOverEntryTime >= stayTimeFramesOver)

sellOverCondition = not na(sellOverEntryTime) and (bar_index - sellOverEntryTime <= stayTimeFramesOver)

//Buy and sell for over bought or sell

conditionOverBuy = buyOverCondition

conditionOverSell = sellOverCondition

// Buy and sell conditions

buyCondition = cciStayedBelowNeg100

sellCondition = cciStayedAbove100

// // Track open positions

var bool isLongOpen = false

var bool isShortOpen = false

// // Strategy logic for backtesting

// if (buyCondition and not isLongOpen)

// strategy.entry("Long", strategy.long)

// isLongOpen := true

// isShortOpen := false

// if (sellCondition and not isShortOpen)

// strategy.entry("Short", strategy.short)

// isShortOpen := true

// isLongOpen := false

// // Close positions based on EMA 50

// if (isLongOpen and exitLongCondition)

// strategy.close("Long")

// isLongOpen := false

// if (isShortOpen and exitShortCondition)

// strategy.close("Short")

// isShortOpen := false

// Track RSI at position entry

var float entryRSILong = na

var float entryRSIShort = na

// Track CCI at position entry

var float entryCCILong = na

var float entryCCIShort = na

if (buyOverCondition and not isLongOpen)

strategy.entry("Long", strategy.long)

entryRSILong := rsi // Store RSI at entry

entryCCILong := cci

isLongOpen := true

isShortOpen := false

if (sellOverCondition and not isShortOpen)

strategy.entry("Short", strategy.short)

entryRSIShort := rsi // Store RSI at entry

entryCCIShort := cci // Stpre CCI at entry

isShortOpen := true

isLongOpen := false

exitLongRSICondition = isLongOpen and not na(entryRSILong) and rsi >= (entryRSILong + 12) or rsi <= (entryRSILong -8)

exitShortRSICondition = isShortOpen and not na(entryRSIShort) and rsi <= (entryRSIShort - 12) or rsi >= (entryRSIShort +8)

exitLongCCICondition = isLongOpen and not na(entryCCILong) and cci <= (entryCCILong -100)

exitShortCCICondition = isShortOpen and not na(entryCCIShort) and cci >= (entryCCIShort +100)

// Close positions based on EMA 50 or RSI change

if (isLongOpen and (exitLongRSICondition) or (exitLongCCICondition))

strategy.close("Long")

isLongOpen := false

entryRSILong := na

entryCCILong := na

isLongOpen := false

if (isShortOpen and (exitShortRSICondition) or (exitShortCCICondition))

strategy.close("Short")

isShortOpen := false

entryRSIShort := na

entryCCIShort := na

isShortOpen := false

// Plot buy and sell signals

plotshape(buyCondition, style=shape.labelup, location=location.belowbar, color=color.green, size=size.large, title="Buy Signal", text="BUY")

plotshape(sellCondition, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.large, title="Sell Signal", text="SELL")

//Plot buy and sell OverBought

plotshape(conditionOverBuy, style=shape.labelup, location=location.belowbar, color=color.rgb(255, 238, 0), size=size.large, title="OverBuy Signal", text="Over Sell")

plotshape(conditionOverSell, style=shape.labeldown, location=location.abovebar, color=color.rgb(186, 40, 223), size=size.large, title="OverSell Signal", text="Over Buy")

// Alerts

alertcondition(buyCondition, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sellCondition, title="Sell Alert", message="Sell Signal Triggered")