Gambaran keseluruhan

Strategi ini adalah sistem perdagangan komprehensif yang menggabungkan tahap Fibonacci retracement, persimpangan rata-rata bergerak dan penilaian trend momentum. Ia menghasilkan isyarat perdagangan dengan persimpangan rata-rata bergerak cepat dan rata-rata bergerak perlahan, sambil menggunakan tahap Fibonacci retracement sebagai titik rujukan harga penting, dan menggabungkan penilaian trend untuk mengoptimumkan masa perdagangan.

Prinsip Strategi

Logik teras strategi adalah berdasarkan elemen utama berikut:

- Sistem persilangan purata bergerak menggunakan purata bergerak sederhana pada hari ke-9 dan ke-21 (SMA) sebagai petunjuk isyarat

- Tahap pengunduran Fibonacci yang dikira dalam 100 kitaran ((23.6%, 38.2%, 50%, 61.8%) digunakan untuk analisis struktur pasaran

- Mencari trend pasaran dengan harga dan kedudukan garis rata-rata pantas

- Isyarat untuk membina gudang dipicu oleh garis rata-rata perlahan di atas garis rata-rata cepat ((buat lebih) atau di bawah garis rata-rata perlahan ((buat kosong)

- Sistem ini secara automatik menetapkan peratusan stop loss dan tahap hentian berdasarkan harga masuk

Kelebihan Strategik

- Analisis pelbagai dimensi: menggabungkan tiga elemen yang paling dikenali dalam analisis teknikal: trend, momentum, dan tahap harga

- Pengurusan risiko yang sempurna: menggunakan kadar hentian kerugian yang ditetapkan untuk melindungi keselamatan dana

- Tingkat visualisasi yang tinggi: semua tahap harga dan isyarat perdagangan utama dipaparkan dengan jelas pada carta

- Kebolehsuaian: boleh disesuaikan dengan parameter untuk menyesuaikan diri dengan keadaan pasaran yang berbeza

- Peraturan operasi jelas: keadaan penjanaan isyarat jelas, mengelakkan penilaian subjektif

Risiko Strategik

- Sistem Linear Bergerak boleh menghasilkan isyarat palsu dalam pasaran yang bergolak

- Tetapan stop loss peratusan tetap mungkin tidak sesuai untuk semua keadaan pasaran

- Dalam pasaran yang sangat tidak menentu, harga boleh menembusi titik henti dengan cepat

- Kesan tahap Fibonacci mungkin berubah mengikut perubahan keadaan pasaran

- Penghakiman trend mungkin terlewat pada titik peralihan pasaran

Arah pengoptimuman strategi

- Memperkenalkan penunjuk kadar turun naik untuk menyesuaikan kadar hentian hentian secara dinamik

- Menambah analisis jumlah transaksi untuk mengesahkan isyarat transaksi

- Pertimbangkan pengesahan pada tempoh masa yang berbeza untuk meningkatkan kebolehpercayaan isyarat

- Menerima syarat penyaringan persekitaran pasaran, berdagang di bawah keadaan pasaran yang sesuai

- Membangunkan sistem pengoptimuman parameter yang bersesuaian

ringkaskan

Ini adalah strategi perdagangan komprehensif yang menggabungkan beberapa alat analisis teknikal klasik. Dengan menggabungkan garis purata bergerak, pengunduran Fibonacci dan analisis trend, strategi ini dapat menangkap peluang perdagangan yang berpotensi di pasaran.

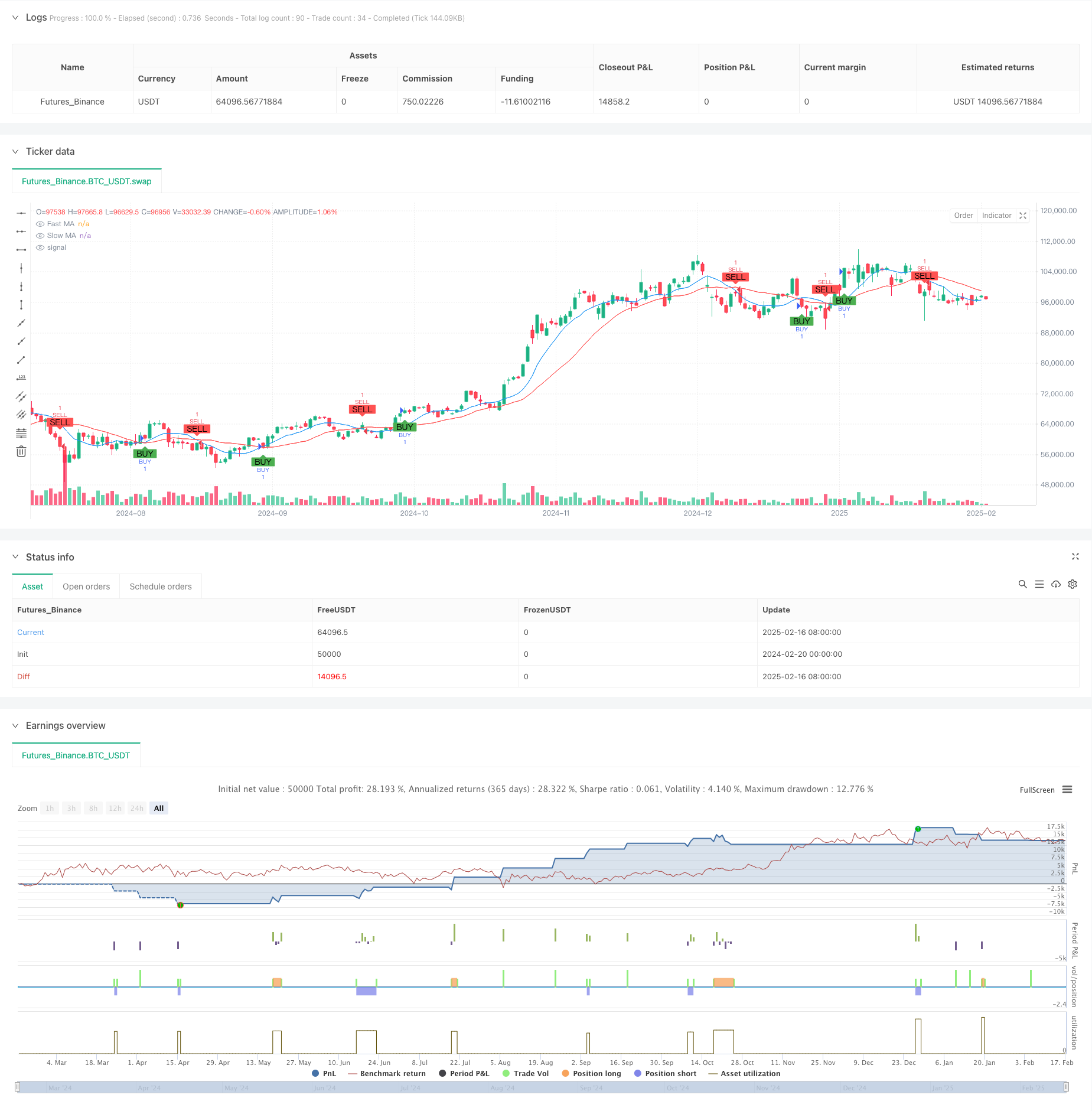

/*backtest

start: 2024-02-20 00:00:00

end: 2025-02-17 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Buy/Sell Strategy with TP, SL, Fibonacci Levels, and Trend", overlay=true)

// Input for stop loss and take profit percentages

stopLossPercentage = input.int(2, title="Stop Loss (%)") // Stop loss percentage

takeProfitPercentage = input.int(4, title="Take Profit (%)") // Take profit percentage

// Example of a moving average crossover strategy

fastLength = input.int(9, title="Fast MA Length")

slowLength = input.int(21, title="Slow MA Length")

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Entry conditions (Buy when fast MA crosses above slow MA, Sell when fast MA crosses below slow MA)

longCondition = ta.crossover(fastMA, slowMA)

shortCondition = ta.crossunder(fastMA, slowMA)

// Plot moving averages for visual reference

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Fibonacci Retracement Levels

lookback = input.int(100, title="Lookback Period for Fibonacci Levels")

highLevel = ta.highest(high, lookback)

lowLevel = ta.lowest(low, lookback)

fib236 = lowLevel + (highLevel - lowLevel) * 0.236

fib382 = lowLevel + (highLevel - lowLevel) * 0.382

fib50 = lowLevel + (highLevel - lowLevel) * 0.5

fib618 = lowLevel + (highLevel - lowLevel) * 0.618

// Display Fibonacci levels as text on the chart near price panel (left of candle)

label.new(bar_index, fib236, text="Fib 23.6%: " + str.tostring(fib236, "#.##"), style=label.style_label_left, color=color.purple, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

label.new(bar_index, fib382, text="Fib 38.2%: " + str.tostring(fib382, "#.##"), style=label.style_label_left, color=color.blue, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

label.new(bar_index, fib50, text="Fib 50%: " + str.tostring(fib50, "#.##"), style=label.style_label_left, color=color.green, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

label.new(bar_index, fib618, text="Fib 61.8%: " + str.tostring(fib618, "#.##"), style=label.style_label_left, color=color.red, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

// Trend condition: Price uptrend or downtrend

trendCondition = close > fastMA ? "Uptrending" : close < fastMA ? "Downtrending" : "Neutral"

// Remove previous trend label and add new trend label

var label trendLabel = na

if (not na(trendLabel))

label.delete(trendLabel)

// Create a new trend label based on the current trend

trendLabel := label.new(bar_index, close, text="Trend: " + trendCondition, style=label.style_label_left, color=color.blue, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

// Buy and Sell orders with Stop Loss and Take Profit

if (longCondition)

// Set the Stop Loss and Take Profit levels based on entry price

stopLossLevel = close * (1 - stopLossPercentage / 100)

takeProfitLevel = close * (1 + takeProfitPercentage / 100)

// Enter long position with stop loss and take profit levels

strategy.entry("BUY", strategy.long)

strategy.exit("Sell", "BUY", stop=stopLossLevel, limit=takeProfitLevel)

// Display TP, SL, and Entry price labels on the chart near price panel (left of candle)

label.new(bar_index, takeProfitLevel, text="TP\n" + str.tostring(takeProfitLevel, "#.##"), style=label.style_label_left, color=color.green, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

label.new(bar_index, stopLossLevel, text="SL\n" + str.tostring(stopLossLevel, "#.##"), style=label.style_label_left, color=color.red, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

label.new(bar_index, close, text="BUY\n" + str.tostring(close, "#.##"), style=label.style_label_left, color=color.blue, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

if (shortCondition)

// Set the Stop Loss and Take Profit levels based on entry price

stopLossLevel = close * (1 + stopLossPercentage / 100)

takeProfitLevel = close * (1 - takeProfitPercentage / 100)

// Enter short position with stop loss and take profit levels

strategy.entry("SELL", strategy.short)

strategy.exit("Cover", "SELL", stop=stopLossLevel, limit=takeProfitLevel)

// Display TP, SL, and Entry price labels on the chart near price panel (left of candle)

label.new(bar_index, takeProfitLevel, text="TP\n" + str.tostring(takeProfitLevel, "#.##"), style=label.style_label_left, color=color.green, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

label.new(bar_index, stopLossLevel, text="SL\n" + str.tostring(stopLossLevel, "#.##"), style=label.style_label_left, color=color.red, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

label.new(bar_index, close, text="SELL\n" + str.tostring(close, "#.##"), style=label.style_label_left, color=color.orange, textcolor=color.white, size=size.small, xloc=xloc.bar_index, yloc=yloc.price)

// Plot Buy/Sell labels on chart

plotshape(series=longCondition, title="BUY Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="SELL Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")