2

fokus pada

331

Pengikut

Gambaran keseluruhan

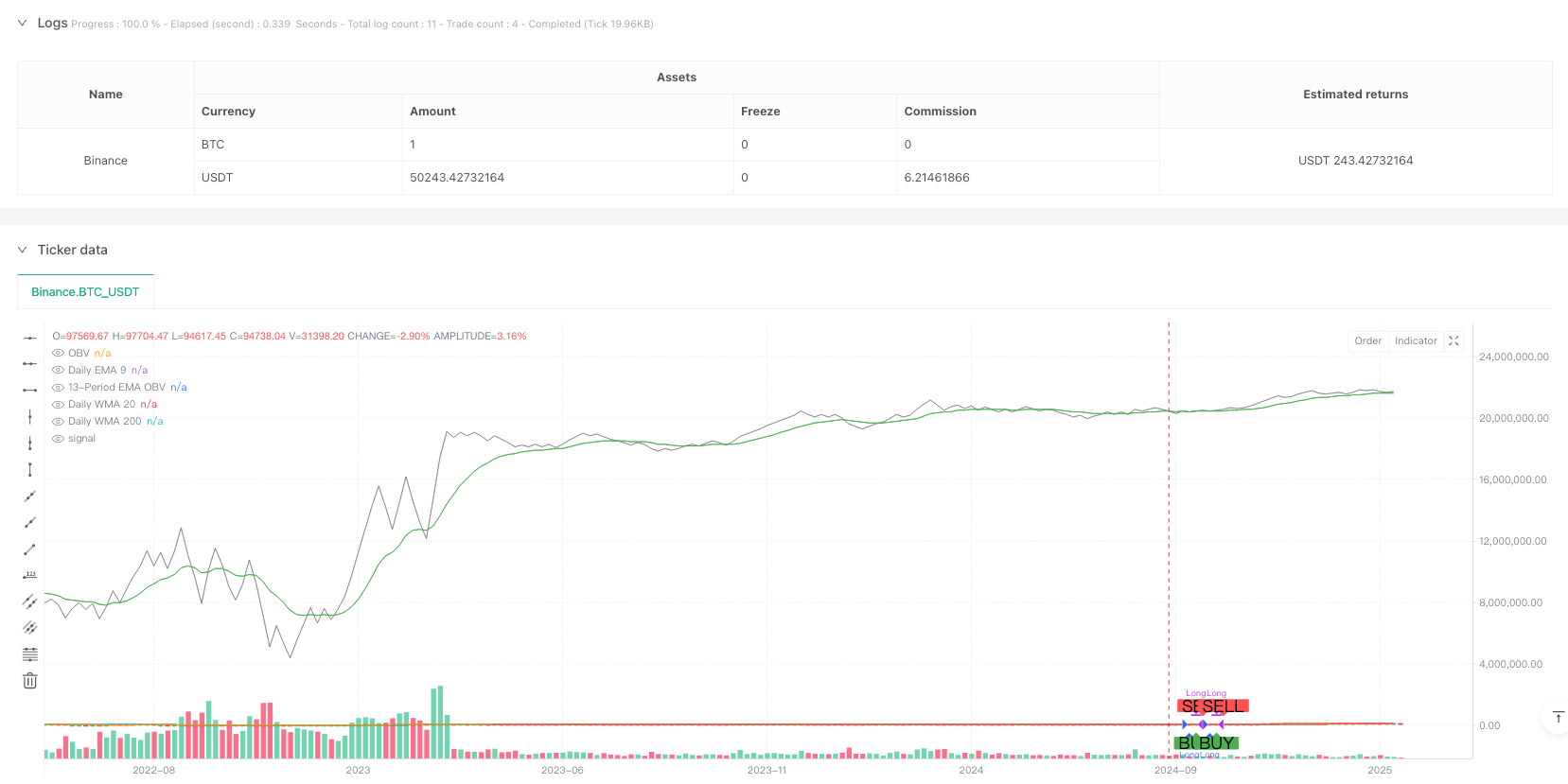

Strategi ini adalah sistem pengesanan trend yang menggabungkan purata bergerak berkala dan analisis kuantiti transaksi. Strategi ini mengesahkan trend keseluruhan melalui tiga garis rata EMA9, WMA20 dan WMA200 dalam kitaran sunset, sambil memperkenalkan indikator OBV ((On Balance Volume) dan EMA untuk mengesahkan jumlah transaksi, untuk mencapai perdagangan yang lebih stabil.

Prinsip Strategi

Strategi ini berfungsi berdasarkan dua syarat utama:

- Pengesahan trend - Mengesahkan arah trend dengan menilai sama ada tiga garis harian (EMA9, WMA20, WMA200) berada dalam keadaan naik. Apabila tiga garis rata-rata condong ke atas, menunjukkan bahawa setiap tempoh masa menunjukkan trend berbilang kepala.

- Pengesahan kuantiti transaksi - Analisis kuantiti transaksi menggunakan indikator OBV dan EMA 13 kitaran. Apabila EMA OBV berada di atas OBV, menunjukkan kenaikan harga sokongan kuantiti transaksi, mengesahkan kesahihan trend. Strategi hanya akan menghasilkan isyarat ganda jika kedua-dua syarat ini dipenuhi secara serentak. Strategi akan keluar dengan rata jika salah satu syarat tidak dipenuhi.

Kelebihan Strategik

- Analisis pelbagai bingkai masa - mengurangkan risiko penembusan palsu dengan mempertimbangkan trend jangka pendek (EMA9), jangka menengah (WMA20) dan jangka panjang (WMA200) secara menyeluruh.

- Sokongan jumlah pesanan - memperkenalkan analisis indikator OBV untuk memastikan pergerakan harga mendapat sokongan jumlah pesanan.

- Kawalan risiko yang sempurna - Mengambil kira peratusan pengurusan kedudukan dan bayaran, lebih sesuai dengan persekitaran perdagangan sebenar.

- Sokongan visual - Membantu peniaga memahami masa masuk dan keluar dengan tanda grafik yang jelas.

Risiko Strategik

- Penundaan pembalikan trend - Mungkin reaksi lambat pada permulaan pembalikan trend kerana penggunaan pengesahan garis rata-rata berbilang.

- Pasaran goyah tidak boleh digunakan - dalam fasa penyusunan bertaburan, penembusan palsu yang kerap boleh menyebabkan terlalu banyak perdagangan.

- Pertimbangan kos modal - bayaran 0.1% boleh menjejaskan keuntungan secara ketara dalam perdagangan frekuensi tinggi.

Arah pengoptimuman strategi

- Memperkenalkan penunjuk turun naik - penambahan penunjuk turun naik seperti ATR boleh dipertimbangkan untuk menyesuaikan kedudukan secara dinamik dalam keadaan pasaran yang berbeza.

- Peningkatan mekanisme henti rugi - disyorkan untuk menambah fungsi henti rugi untuk lebih melindungi keuntungan.

- Penapis keadaan pasaran - penambahan indikator penilaian keadaan pasaran untuk mengurangkan frekuensi perdagangan atau menghentikan perdagangan di pasaran yang bergolak.

- Pilihan parameter pengoptimuman - Pertimbangkan untuk mengoptimumkan kitaran purata dan parameter OBV untuk pelbagai pasaran dan varieti.

ringkaskan

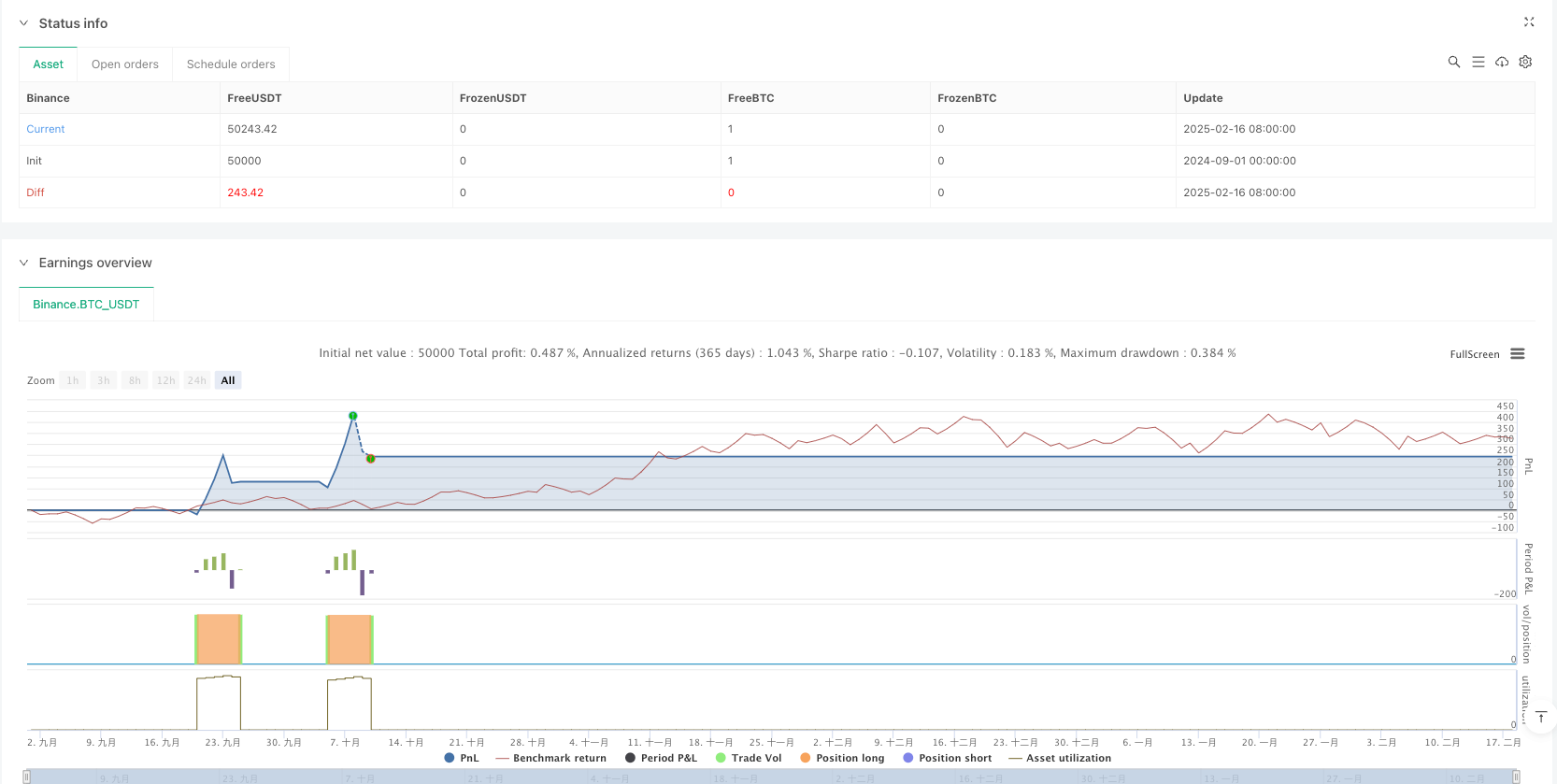

Strategi ini, dengan menggabungkan analisis trend pelbagai kitaran dan pengesahan kuantiti transaksi, membina sistem pengesanan trend yang agak lengkap. Logik strategi jelas, kawalan risiko masuk akal, tetapi masih ada ruang untuk pengoptimuman.

Kod sumber strategi

/*backtest

start: 2024-09-01 00:00:00

end: 2025-02-18 08:00:00

period: 5d

basePeriod: 5d

exchanges: [{"eid":"Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Strategy: Daily MAs + OBV", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, commission_type=strategy.commission.percent, commission_value=0.1)

//=== Daily Moving Averages Calculation =========================

// Get daily timeframe values using request.security.

dailyEMA9 = request.security(syminfo.tickerid, "D", ta.ema(close, 9))

dailyWMA20 = request.security(syminfo.tickerid, "D", ta.wma(close, 20))

dailyWMA200 = request.security(syminfo.tickerid, "D", ta.wma(close, 200))

// Check if each moving average is trending upward (current > previous).

ema9_up = dailyEMA9 > nz(dailyEMA9[1])

wma20_up = dailyWMA20 > nz(dailyWMA20[1])

wma200_up = dailyWMA200 > nz(dailyWMA200[1])

trend_condition = ema9_up and wma20_up and wma200_up

//=== OBV and its 13-period EMA Calculation ================================

// Calculate OBV manually using a cumulative sum.

obv_val = ta.cum(close > close[1] ? volume : (close < close[1] ? -volume : 0))

// 13-period EMA of the OBV.

ema13_obv = ta.ema(obv_val, 13)

// Condition: 13-period EMA of OBV must be above the OBV value.

obv_condition = ema13_obv > obv_val

//=== Entry Condition ===================================================

// Both trend and OBV conditions must be met.

buy_condition = trend_condition and obv_condition

//=== Entry and Exit Orders =============================================

// Enter a long position when the buy condition is met and no position is open.

if buy_condition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

// Exit the position when the condition is no longer met.

if not buy_condition and strategy.position_size > 0

strategy.close("Long")

//=== Explicit Entry and Exit Markers ====================================

// Determine the exact bar where entry and exit occur.

entry_signal = (strategy.position_size > 0 and (strategy.position_size[1] <= 0))

exit_signal = (strategy.position_size == 0 and (strategy.position_size[1] > 0))

plotshape(entry_signal, title="Entry Signal", location=location.belowbar, style=shape.labelup, text="BUY", color=color.new(color.green, 0), size=size.normal)

plotshape(exit_signal, title="Exit Signal", location=location.abovebar, style=shape.labeldown, text="SELL", color=color.new(color.red, 0), size=size.normal)

//=== Plots for Visualization ===============================================

// Plot daily moving averages.

plot(dailyEMA9, color=color.blue, title="Daily EMA 9")

plot(dailyWMA20, color=color.orange, title="Daily WMA 20")

plot(dailyWMA200, color=color.red, title="Daily WMA 200")

// Plot OBV and its 13-period EMA using color.new() to specify transparency.

plot(obv_val, color=color.new(color.gray, 30), title="OBV")

plot(ema13_obv, color=color.new(color.green, 0), title="13-Period EMA OBV")