Gambaran keseluruhan

Strategi ini adalah sistem perdagangan automatik yang menggabungkan pengesanan trend pelbagai kitaran dan pengurusan risiko. Ia mengiktiraf peluang perdagangan terutamanya melalui purata bergerak indeks ((EMA) dalam dua tempoh masa 5 minit dan 1 minit, sambil menggunakan persentasen perhentian dan keuntungan yang tetap untuk mengawal risiko.

Prinsip Strategi

Logik utama strategi ini adalah berdasarkan kepada dua tempoh masa:

- Menggunakan EMA 200 kitaran 5 minit sebagai penapis trend utama, hanya boleh melakukan lebih banyak apabila harga berada di atas garis purata ini, dan hanya boleh melakukan lebih sedikit apabila berada di bawah garis purata.

- Pada kitaran 1 minit, gunakan 20 kitaran EMA sebagai pemicu masuk. Apabila harga melintasi garis rata-rata ke atas, ia akan mencetuskan isyarat ganda, dan apabila ia melintasi ke bawah, ia akan mencetuskan isyarat kosong.

- Pengurusan risiko menggunakan kaedah perkadaran tetap, dengan stop loss setiap perdagangan ditetapkan pada 0.5% dari harga masuk, dan sasaran keuntungan ditetapkan dua kali ganda dari jarak stop loss, membentuk nisbah keuntungan risiko 1: 2.

Kelebihan Strategik

- Analisis pelbagai kitaran memberikan penilaian trend yang lebih dipercayai, mengurangkan risiko tercetus palsu.

- Menggunakan kaedah pengurusan risiko peratusan tetap, menjadikan pengurusan dana lebih teratur dan sistematik.

- Setinggan risiko / keuntungan 1: 2, walaupun peluang kemenangan hanya 40%, ia boleh menghasilkan keuntungan.

- Logik strategi mudah difahami dan dilaksanakan.

- Tanda isyarat dagangan visual memudahkan pengesahan semula.

Risiko Strategik

- Pasaran yang bergolak dengan cepat boleh menyebabkan isyarat palsu yang kerap berlaku.

- Dalam tempoh turun naik yang rendah, penghentian 0.5% mungkin terlalu ketat.

- Bergantung pada persimpangan linear, terdapat kemungkinan ketinggalan.

- Perdagangan frekuensi tinggi mungkin membawa kos transaksi yang lebih tinggi.

- Ia mungkin lebih besar apabila pasaran berbalik dengan cepat.

Arah pengoptimuman strategi

- Memperkenalkan indikator kadar turun naik untuk menyesuaikan jarak henti secara dinamik.

- Tambah isyarat pengesahan jumlah penumpang untuk meningkatkan kualiti kemasukan.

- Anda boleh mempertimbangkan untuk memasukkan penunjuk kekuatan trend seperti ADX untuk menapis trend lemah.

- Tambah indikator getaran seperti RSI untuk menapis isyarat di pasaran setapak.

- Tetapan nisbah risiko / keuntungan yang dibangunkan mengikut dinamik ciri-ciri pasaran yang berbeza.

ringkaskan

Ini adalah strategi pengesanan trend yang tersusun dengan jelas dan logik. Dengan menggabungkan analisis pelbagai kitaran dan pengurusan risiko yang ketat, strategi ini dapat menangkap tren pasaran dengan berkesan sambil melindungi dana. Walaupun terdapat beberapa ruang untuk pengoptimuman, kerangka asas strategi ini adalah kukuh dan sesuai untuk penambahbaikan dan penyesuaian lebih lanjut sebagai strategi asas.

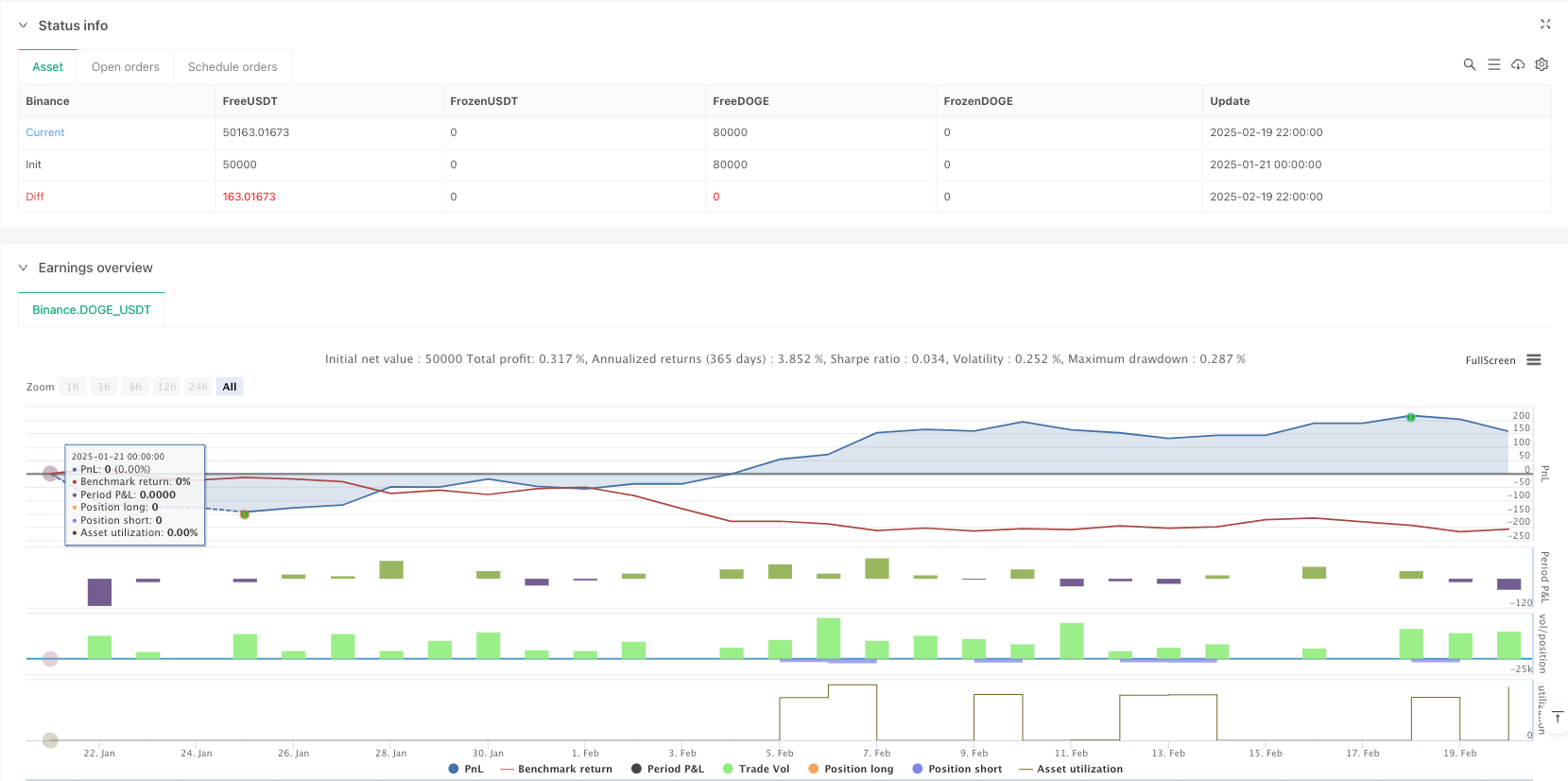

/*backtest

start: 2025-01-21 00:00:00

end: 2025-02-20 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("Scalping Strategy: 1-min Entries with 5-min 200 EMA Filter", overlay=true, initial_capital=10000, currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=5, calc_on_every_tick=true)

// --- Higher Timeframe Trend Filter ---

// Get the 200-period EMA on a 5-minute timeframe

ema200_5 = request.security(syminfo.tickerid, "5", ta.ema(close, 200), lookahead=barmerge.lookahead_on)

plot(ema200_5, color=color.purple, title="5-min 200 EMA")

// --- Local (1-Minute) Indicators ---

// On a 1-minute chart, calculate a 20-period EMA for entry triggers

ema20_1 = ta.ema(close, 20)

plot(ema20_1, color=color.yellow, title="1-min 20 EMA")

// --- Entry Conditions ---

// For long entries:

// - The overall trend is bullish: current close > 5-min 200 EMA

// - The 1-min candle closes and crosses above its 20 EMA

longCondition = (close > ema200_5) and ta.crossover(close, ema20_1)

// For short entries:

// - Overall bearish trend: current close < 5-min 200 EMA

// - 1-min candle crosses below its 20 EMA

shortCondition = (close < ema200_5) and ta.crossunder(close, ema20_1)

// --- Risk Management Settings ---

// For scalping, use a tight stop loss. Here we set risk at 0.5% of the entry price.

var float riskPerc = 0.005 // 0.5% risk per trade

// Declare global variables for stop loss and take profit so they can be used outside the if-blocks

var float longStop = na

var float longTP = na

var float shortStop = na

var float shortTP = na

// --- Trade Execution ---

if (longCondition)

entryPrice = close

// Stop loss for long: 0.5% below entry

longStop := entryPrice * (1 - riskPerc)

// Take profit: twice the risk distance (1:2 risk-reward)

longTP := entryPrice + 2 * (entryPrice - longStop)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", stop=longStop, limit=longTP)

if (shortCondition)

entryPrice = close

// Stop loss for short: 0.5% above entry

shortStop := entryPrice * (1 + riskPerc)

// Take profit: twice the risk distance

shortTP := entryPrice - 2 * (shortStop - entryPrice)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", stop=shortStop, limit=shortTP)

// --- Visual Debug Markers ---

// Plot a green triangle below bars when a long signal is generated

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.tiny)

// Plot a red triangle above bars when a short signal is generated

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.tiny)