2

fokus pada

366

Pengikut

Gambaran keseluruhan

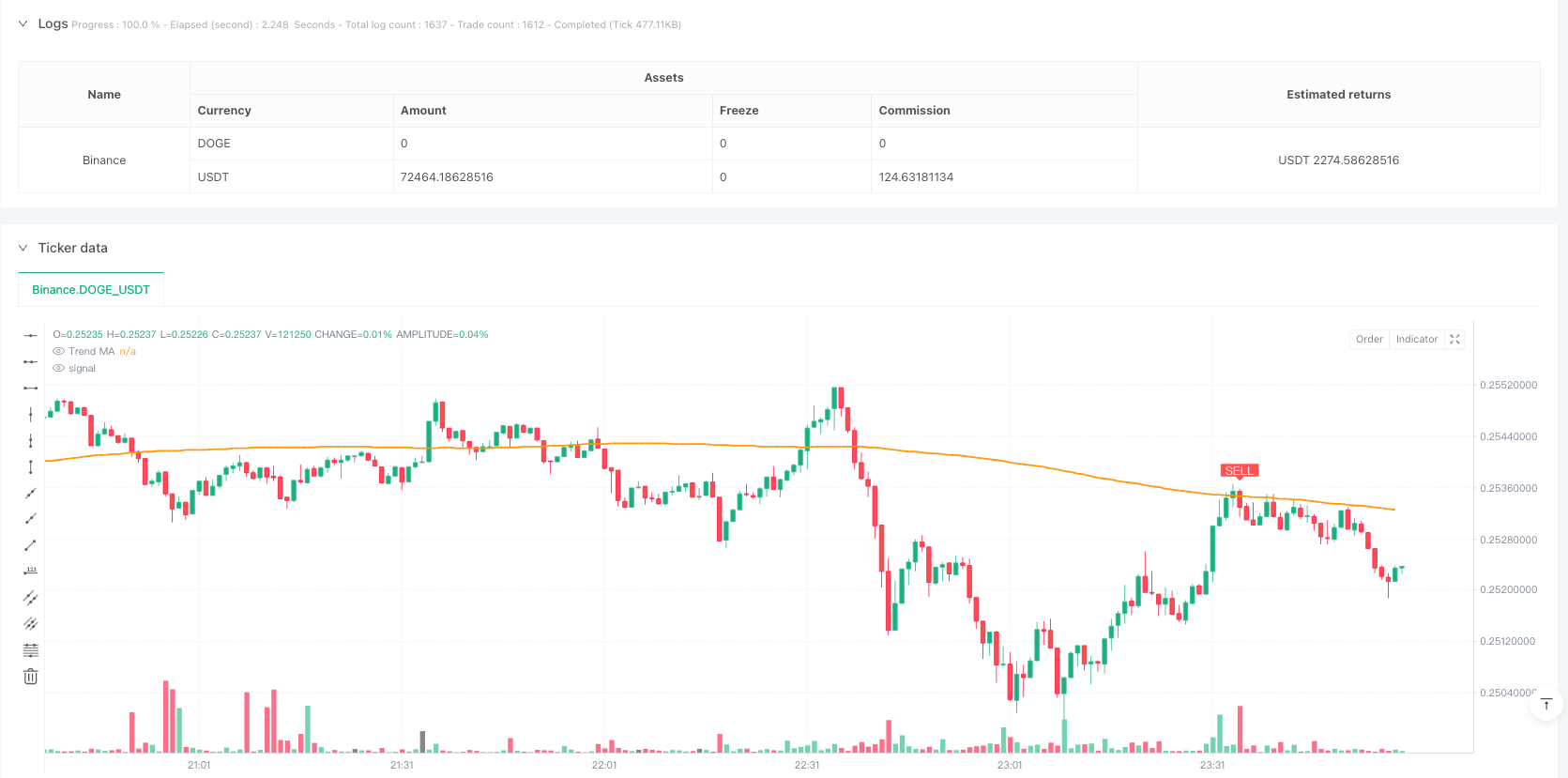

Strategi ini adalah sistem perdagangan penapis ganda yang menggabungkan RSI (indikator yang agak kuat) dan garis rata-rata trend. Strategi ini berdagang di peringkat garis matahari dengan menggabungkan isyarat RSI yang terlalu banyak dan terlalu banyak dengan garis rata-rata trend jangka panjang.

Prinsip Strategi

Strategi ini berdasarkan kepada komponen teras berikut:

- RSI digunakan untuk mengenal pasti kawasan overbought dan oversold, dengan parameter lalai 14 kitaran

- Tahap overbuy ditetapkan pada 70, dan tahap oversell ditetapkan pada 30.

- Purata bergerak sederhana 200 kitaran sebagai penapis trend

- Syarat pembelian: RSI melangkau dari kawasan oversold dan harga berada di atas garis purata

- Syarat jual: RSI melangkaui ke bawah dari kawasan overbought dan harga berada di bawah garis purata Strategi melakukan perdagangan secara automatik pada setiap isyarat yang muncul, dan fungsi peringatan boleh dikonfigurasi.

Kelebihan Strategik

- Mekanisme pengesahan dua kali meningkatkan kebolehpercayaan transaksi dengan ketara

- Mengurangkan risiko isyarat palsu dengan menggabungkan trend dan momentum

- Sistem pelaksanaan transaksi automatik sepenuhnya

- Tetapan parameter yang fleksibel membolehkan pengoptimuman dasar

- Fungsi peringatan masa nyata yang bersepadu untuk memudahkan operasi

- Antara muka visual untuk memaparkan isyarat perdagangan dengan jelas

- Menyokong fungsi pengesanan semula untuk pengesahan strategi

Risiko Strategik

- Pasaran yang bergolak mungkin menghasilkan isyarat dagangan yang kerap

- Kemungkinan titik balik trend terlewat

- Tetapan parameter yang tidak betul boleh menjejaskan prestasi strategi

- Kemunculan pasaran yang melampau boleh menyebabkan penarikan balik yang lebih besar Ia disyorkan untuk menguruskan risiko dengan:

- Tetapkan kedudukan henti rugi yang munasabah

- Menyesuaikan saiz kedudukan dengan betul

- Sentiasa mengoptimumkan parameter strategi

- Kaedah penilaian tambahan dalam kombinasi dengan penunjuk teknikal lain

Arah pengoptimuman strategi

- Menambah penapis turun naik untuk menyesuaikan piawaian dagangan semasa turun naik yang tinggi

- Memperkenalkan mekanisme parameter penyesuaian diri, menyesuaikan parameter secara dinamik mengikut keadaan pasaran

- Tambah mekanisme pengesahan volum untuk meningkatkan kebolehpercayaan isyarat

- Membangunkan mekanisme keluar yang lebih kompleks, mengoptimumkan masa tamat keuntungan

- Mengintegrasikan analisis kitaran masa berbilang untuk memberikan pandangan pasaran yang lebih menyeluruh

ringkaskan

Strategi ini membina sistem perdagangan yang stabil dengan menggabungkan RSI dan trend line. Strategi ini direka dengan munasabah, peraturan operasi yang jelas, dan kepraktisan yang baik. Dengan pengurusan risiko yang munasabah dan pengoptimuman berterusan, strategi ini dijangka memperoleh keuntungan yang stabil dalam perdagangan sebenar.

Kod sumber strategi

/*backtest

start: 2025-02-13 00:00:00

end: 2025-02-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=5

strategy("Leading Indicator Strategy – Daily Signals", overlay=true,

pyramiding=1, initial_capital=100000,

default_qty_type=strategy.percent_of_equity, default_qty_value=100)

/// **Inputs for Customization**

rsiLength = input.int(14, minval=1, title="RSI Period")

oversold = input.float(30.0, minval=1, maxval=50, title="Oversold Level")

overbought = input.float(70.0, minval=50, maxval=100, title="Overbought Level")

maLength = input.int(200, minval=1, title="Trend MA Period")

useTrendFilter = input.bool(true, title="Use Trend Filter (MA)",

tooltip="Require price above MA for buys and below MA for sells")

/// **Indicator Calculations**

rsiValue = ta.rsi(close, rsiLength) // RSI calculation

trendMA = ta.sma(close, maLength) // Long-term moving average

/// **Signal Conditions** (RSI crosses with optional trend filter)

buySignal = ta.crossover(rsiValue, oversold) // RSI crosses above oversold level

sellSignal = ta.crossunder(rsiValue, overbought) // RSI crosses below overbought level

bullCond = buySignal and (not useTrendFilter or close > trendMA) // final Buy condition

bearCond = sellSignal and (not useTrendFilter or close < trendMA) // final Sell condition

/// **Trade Execution** (entries and exits with alerts)

if bullCond

strategy.close("Short", alert_message="Buy Signal – Closing Short") // close short position if open

strategy.entry("Long", strategy.long, alert_message="Buy Signal – Enter Long") // go long

if bearCond

strategy.close("Long", alert_message="Sell Signal – Closing Long") // close long position if open

strategy.entry("Short", strategy.short, alert_message="Sell Signal – Enter Short") // go short

/// **Plotting** (MA and signal markers for clarity)

plot(trendMA, color=color.orange, linewidth=2, title="Trend MA")

plotshape(bullCond, title="Buy Signal", style=shape.labelup, location=location.belowbar,

color=color.green, text="BUY", textcolor=color.white)

plotshape(bearCond, title="Sell Signal", style=shape.labeldown, location=location.abovebar,

color=color.red, text="SELL", textcolor=color.white)

// (Optional) Plot RSI in a separate pane for reference:

// plot(rsiValue, title="RSI", color=color.blue)

// hline(oversold, title="Oversold", color=color.gray, linestyle=hline.style_dotted)

// hline(overbought, title="Overbought", color=color.gray, linestyle=hline.style_dotted)