Gambaran keseluruhan

Ini adalah strategi perdagangan inovatif yang menggabungkan analisis zon kecairan dan dinamik struktur pasaran dalaman untuk mengenal pasti titik masuk yang berkemungkinan tinggi. Strategi ini menyediakan pedagang dengan cara yang fleksibel dan tepat untuk memasuki pasaran dengan mengesan interaksi harga dengan tahap pasaran utama dan menggunakan pertukaran pasaran dalaman untuk mencetuskan perdagangan.

Prinsip Strategi

Logik teras strategi ini adalah berdasarkan dua komponen utama: pengenalan kawasan kecairan dan penukaran pasaran dalaman. Kawasan kecairan ditentukan secara dinamik dengan menganalisis ketinggian dan ketinggian tempatan, manakala penukaran pasaran dalaman adalah berdasarkan perubahan arah pasaran berdasarkan harga yang menembusi tahap bullish atau bearish sebelumnya.

Strategi ini mempunyai ciri-ciri utama:

- Logik peralihan pasaran dalaman: tidak bergantung pada bentuk carta tradisional, tetapi berdasarkan harga untuk mencapai tahap kritikal

- Pengesanan kawasan kecairan: mengenal pasti kawasan kecairan utama secara dinamik untuk mengelakkan perdagangan dalam keadaan pasaran yang lemah

- Fleksibiliti mod: menawarkan tiga mod perdagangan “Both”, “Bullish Only” dan “Bearish Only”

- Pengurusan risiko: tahap berhenti dan henti yang boleh disesuaikan

- Kawalan Julat Waktu: Kawalan Julat Waktu yang tepat

Kelebihan Strategik

- Kebolehan beradaptasi dinamik: strategi untuk bertindak balas dengan cepat terhadap perubahan struktur pasaran

- Pendaftaran tepat: meningkatkan ketepatan pendaftaran dengan menggabungkan zon kecairan dan pertukaran pasaran dalaman

- Risiko terkawal: mekanisme terbina dalam untuk menghentikan dan menghentikan kerosakan

- Fleksibiliti: pilihan mod dagangan mengikut keadaan pasaran yang berbeza

- Analisis pelbagai dimensi: mengambil kira tingkah laku harga, kecairan dan struktur pasaran

Risiko Strategik

- Keadaan pasaran yang tidak menentu boleh menyebabkan penangguhan tercetus.

- Dalam pasaran yang bergolak, isyarat yang kerap boleh meningkatkan kos dagangan

- Tetapan parameter yang tidak betul boleh menjejaskan prestasi strategi

- Hasil pengesanan mungkin berbeza dengan cakera keras

Arah pengoptimuman strategi

- Memperkenalkan algoritma pembelajaran mesin untuk pengoptimuman penyesuaian parameter

- Menambah lebih banyak syarat penapisan, seperti jumlah transaksi, indikator kadar turun naik

- Membangunkan mekanisme pengesahan pelbagai kerangka masa

- Mengoptimumkan algoritma hentian dan hentian, mempertimbangkan perubahan dinamik kadar turun naik pasaran

ringkaskan

Ini adalah strategi perdagangan inovatif yang menggabungkan analisis kecairan dan dinamik struktur pasaran. Ia menyediakan pedagang dengan alat perdagangan yang kuat melalui logik pertukaran pasaran dalaman yang fleksibel dan pengesanan kawasan kecairan yang tepat.

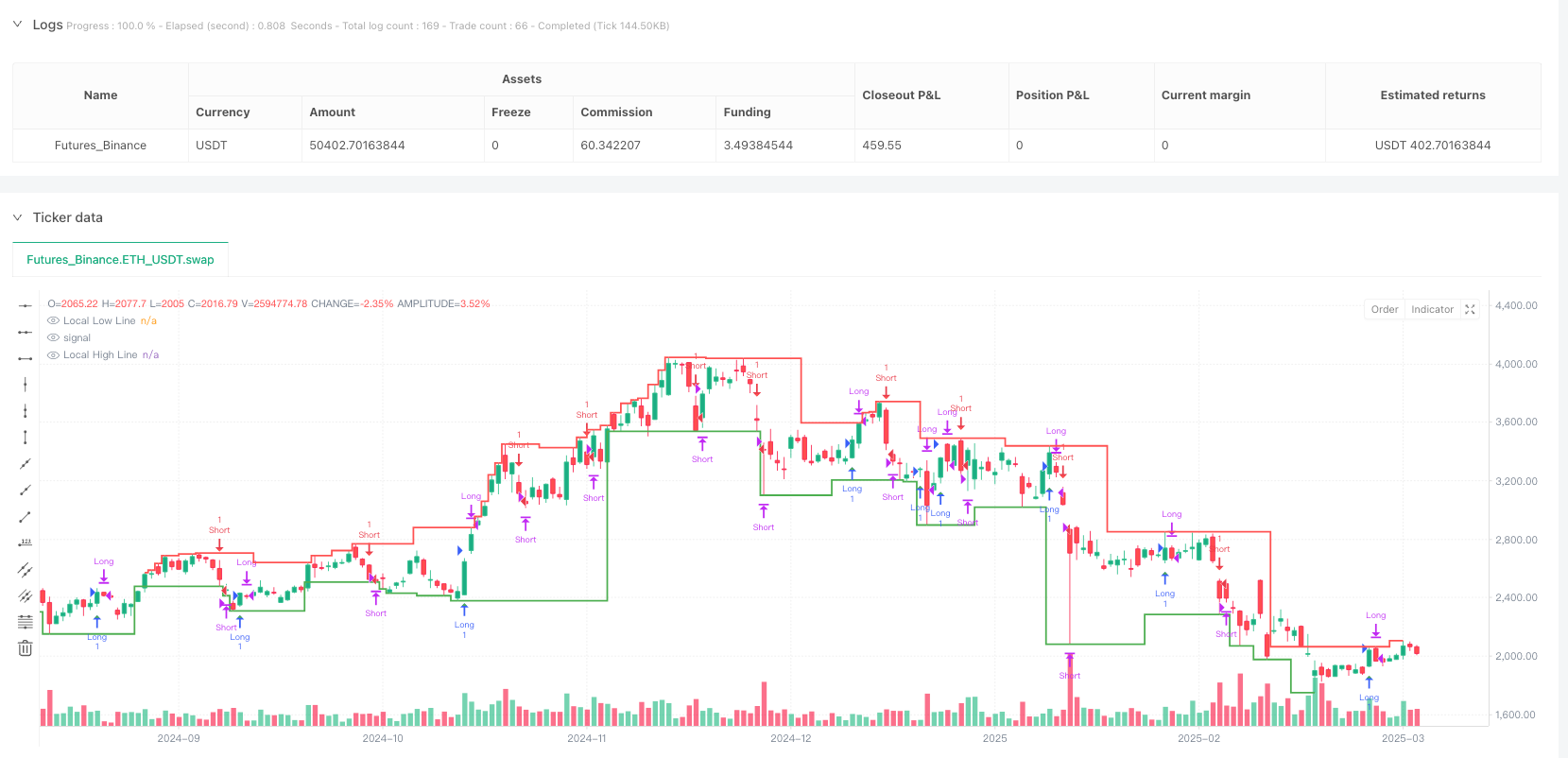

/*backtest

start: 2024-03-28 00:00:00

end: 2025-03-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Liquidity + Internal Market Shift Strategy", overlay=true)

// ======== Mode Selection ========

mode = input.string("Both", title="Mode", options=["Both", "Bullish Only", "Bearish Only"])

// ======== Stop-Loss and Take-Profit Input (in pips) ========

enableTakeProfit = input.bool(true, title="Enable Custom Take Profit") // Option to enable/disable take profit

stopLossPips = input.int(10, title="Stop Loss (in pips)", minval=1) // Stop loss in pips

takeProfitPips = input.int(20, title="Take Profit (in pips)", minval=1) // Take profit in pips

// ======== Internal Shift Logic ========

// Fixed number of consecutive candles to track (set to 1)

consecutiveBullishCount = 1

consecutiveBearishCount = 1

// Function to check for bullish and bearish candles

isBullish = close > open

isBearish = close < open

// Variables to track consecutive candles and mark lowest/highest

var int bullishCount = 0

var int bearishCount = 0

var float lowestBullishPrice = na

var float highestBearishPrice = na

var float previousBullishPrice = na // For the previous bullish lowest price

var float previousBearishPrice = na // For the previous bearish highest price

// Variables to track last internal shift type (1 = Bullish, -1 = Bearish, 0 = None)

var int lastInternalShift = 0

// Counting consecutive bullish and bearish candles

if isBullish

bullishCount := bullishCount + 1

bearishCount := 0

if bullishCount == 1 or low < lowestBullishPrice

lowestBullishPrice := low

else if isBearish

bearishCount := bearishCount + 1

bullishCount := 0

if bearishCount == 1 or high > highestBearishPrice

highestBearishPrice := high

else

bullishCount := 0

bearishCount := 0

lowestBullishPrice := na

highestBearishPrice := na

// Internal shift conditions

internalShiftBearish = close < previousBullishPrice and close < lowestBullishPrice

internalShiftBullish = close > previousBearishPrice and close > highestBearishPrice

// Condition to alternate internal shifts

allowInternalShiftBearish = internalShiftBearish and lastInternalShift != -1

allowInternalShiftBullish = internalShiftBullish and lastInternalShift != 1

// Tracking shifts

if bullishCount >= consecutiveBullishCount

previousBullishPrice := lowestBullishPrice

if bearishCount >= consecutiveBearishCount

previousBearishPrice := highestBearishPrice

// ======== Liquidity Seal-Off Points Logic ========

upperLiquidityLookback = input.int(10, title="Lookback Period for Upper Liquidity Line")

lowerLiquidityLookback = input.int(10, title="Lookback Period for Lower Liquidity Line")

isLocalHigh = high == ta.highest(high, upperLiquidityLookback)

isLocalLow = low == ta.lowest(low, lowerLiquidityLookback)

var bool touchedLowerLiquidityLine = false

var bool touchedUpperLiquidityLine = false

if (low <= ta.lowest(low, lowerLiquidityLookback))

touchedLowerLiquidityLine := true

if (high >= ta.highest(high, upperLiquidityLookback))

touchedUpperLiquidityLine := true

var bool lockedBullish = false

var bool lockedBearish = false

var int barSinceLiquidityTouch = na

// ======== Combined Signals ========

bullishSignal = allowInternalShiftBullish and touchedLowerLiquidityLine and not lockedBullish

bearishSignal = allowInternalShiftBearish and touchedUpperLiquidityLine and not lockedBearish

if bullishSignal

lockedBullish := true

touchedLowerLiquidityLine := false

barSinceLiquidityTouch := 0

if bearishSignal

lockedBearish := true

touchedUpperLiquidityLine := false

barSinceLiquidityTouch := 0

if not na(barSinceLiquidityTouch)

barSinceLiquidityTouch := barSinceLiquidityTouch + 1

if barSinceLiquidityTouch >= 3

lockedBullish := false

lockedBearish := false

if touchedLowerLiquidityLine

lockedBullish := false

if touchedUpperLiquidityLine

lockedBearish := false

// ======== Plot Combined Signals ========

plotshape(bullishSignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny, title="Bullish Signal")

plotshape(bearishSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny, title="Bearish Signal")

plot(isLocalHigh ? high : na, color=color.red, linewidth=2, style=plot.style_stepline, title="Local High Line")

plot(isLocalLow ? low : na, color=color.green, linewidth=2, style=plot.style_stepline, title="Local Low Line")

// ======== Track Entry and Opposing Signals ========

var float entryPrice = na

var int entryTime = na

var string positionSide = ""

// ======== Strategy Execution (Mode Logic) ========

if (mode == "Both")

// Short Entry Logic (Bearish Signal)

if (bearishSignal and na(entryPrice))

strategy.entry("Short", strategy.short)

entryPrice := close

entryTime := time

positionSide := "short"

// Long Entry Logic (Bullish Signal)

if (bullishSignal and na(entryPrice))

strategy.entry("Long", strategy.long)

entryPrice := close

entryTime := time

positionSide := "long"

// Exit Logic: Close on Opposing Signal (after the current signal is triggered)

if (positionSide == "short" and bullishSignal )

strategy.close("Short")

entryPrice := na

positionSide := ""

if (positionSide == "long" and bearishSignal)

strategy.close("Long")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceLong = entryPrice - stopLossPips * syminfo.mintick

takeProfitPriceLong = entryPrice + takeProfitPips * syminfo.mintick

stopLossPriceShort = entryPrice + stopLossPips * syminfo.mintick

takeProfitPriceShort = entryPrice - takeProfitPips * syminfo.mintick

// Long Stop-Loss and Take-Profit Conditions

if (positionSide == "long" and close <= stopLossPriceLong)

strategy.close("Long", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "long" and enableTakeProfit and close >= takeProfitPriceLong)

strategy.close("Long", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

// Short Stop-Loss and Take-Profit Conditions

if (positionSide == "short" and close >= stopLossPriceShort)

strategy.close("Short", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "short" and enableTakeProfit and close <= takeProfitPriceShort)

strategy.close("Short", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

if (mode == "Bullish Only")

if (bullishSignal and na(entryPrice))

strategy.entry("Long", strategy.long)

entryPrice := close

entryTime := time

positionSide := "long"

if (positionSide == "long" and bearishSignal)

strategy.close("Long")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceLong = entryPrice - stopLossPips * syminfo.mintick

takeProfitPriceLong = entryPrice + takeProfitPips * syminfo.mintick

if (positionSide == "long" and close <= stopLossPriceLong)

strategy.close("Long", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "long" and enableTakeProfit and close >= takeProfitPriceLong)

strategy.close("Long", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""

if (mode == "Bearish Only")

if (bearishSignal and na(entryPrice))

strategy.entry("Short", strategy.short)

entryPrice := close

entryTime := time

positionSide := "short"

if (positionSide == "short" and bullishSignal)

strategy.close("Short")

entryPrice := na

positionSide := ""

// Stop-Loss and Take-Profit Logic (in pips)

stopLossPriceShort = entryPrice + stopLossPips * syminfo.mintick

takeProfitPriceShort = entryPrice - takeProfitPips * syminfo.mintick

if (positionSide == "short" and close >= stopLossPriceShort)

strategy.close("Short", comment="Stop Loss Triggered")

entryPrice := na

positionSide := ""

if (positionSide == "short" and enableTakeProfit and close <= takeProfitPriceShort)

strategy.close("Short", comment="Take Profit Triggered")

entryPrice := na

positionSide := ""