Gambaran keseluruhan

Strategi ini adalah kaedah perdagangan kuantitatif yang menggunakan pelbagai petunjuk teknikal yang komprehensif, yang bertujuan untuk menangkap trend pasaran dengan tepat dan perdagangan yang terkawal risiko dengan menggabungkan petunjuk seperti purata bergerak indeks (EMA), indeks kekuatan relatif (RSI), julat pergerakan sebenar rata-rata (ATR), harga purata bertimbangan kuantiti (VWAP) dan super trend (Supertrend).

Prinsip Strategi

Prinsip-prinsip utama strategi ini adalah berdasarkan kepada kerja sama antara pelbagai indikator teknikal:

- Menggunakan purata bergerak indeks 50 dan 200 hari (EMA) untuk menentukan arah trend dan kemungkinan titik perubahan trend

- Memastikan pergerakan trend dan mengelakkan kenaikan atau penurunan yang berlebihan melalui indeks RSI yang agak kuat

- Hentian dinamik dan jarak hentian digunakan untuk mengira purata jangkauan riak sebenar (ATR)

- Tahap sokongan dan tekanan yang mengesahkan pergerakan harga yang digabungkan dengan harga purata bertimbangan purata ((VWAP))

- Menggunakan petunjuk Supertrend untuk mengesahkan arah trend dan isyarat perdagangan

Kelebihan Strategik

- Synergy multi-indikator: meningkatkan keakuratan dan kebolehpercayaan isyarat dengan mengintegrasikan pelbagai petunjuk teknikal

- Pengurusan risiko: Stop loss ATR dinamik dan nisbah pulangan risiko tetap, mengawal risiko perdagangan tunggal dengan berkesan

- Fleksibiliti: menyesuaikan parameter mengikut perubahan pasaran dan menyesuaikan diri dengan keadaan pasaran yang berbeza

- Penapisan isyarat: Menapis isyarat ketidakpastian melalui indikator seperti RSI dan VWAP untuk mengurangkan perdagangan yang salah

- Real-time: menghasilkan isyarat dan amaran perdagangan dalam masa nyata untuk memudahkan peniaga bertindak balas dengan cepat terhadap perubahan pasaran

Risiko Strategik

- Sensitiviti parameter: tetapan parameter penunjuk yang tidak betul boleh menyebabkan isyarat perdagangan yang kerap atau isyarat yang hilang

- Kejadian pasaran yang tidak dijangka: tidak dapat mengelakkan kejadian Black Swan dan turun naik pasaran yang kuat

- Risiko over-fit: perlu untuk mengkaji semula dan mengesahkan parameter strategi

- Kos urus niaga: Perdagangan yang kerap boleh meningkatkan yuran dan kos slip

- Ketidakpuasan penunjuk: Pada tahap pasaran tertentu, beberapa penunjuk teknikal mungkin kehilangan keberkesanan ramalan

Arah pengoptimuman strategi

- Memperkenalkan algoritma pembelajaran mesin: menyesuaikan parameter penunjuk secara dinamik menggunakan teknologi AI

- Menambah lebih banyak syarat penapisan: pengenalan penunjuk tambahan seperti kadar turun naik dan jumlah dagangan

- Membangunkan modul analisis pelbagai kitaran: mengesahkan isyarat perdagangan pada skala masa yang berbeza

- Pengendalian risiko yang lebih baik: memperkenalkan strategi pengurusan kedudukan dan pengurusan dana yang lebih kompleks

- Meningkatkan parameter penyesuaian diri: menyesuaikan strategi hentian dan hentian secara automatik mengikut turun naik pasaran

ringkaskan

Ini adalah strategi perdagangan kuantitatif berdasarkan indikator teknologi pelbagai dimensi, yang bertujuan untuk menangkap trend pasaran dan mengawal risiko perdagangan melalui kombinasi indikator yang sistematik dan pengurusan risiko yang ketat. Strategi ini berpusat pada sinergi indikator dan pengoptimuman parameter dinamik, yang menyediakan kaedah yang fleksibel dan agak stabil untuk perdagangan kuantitatif.

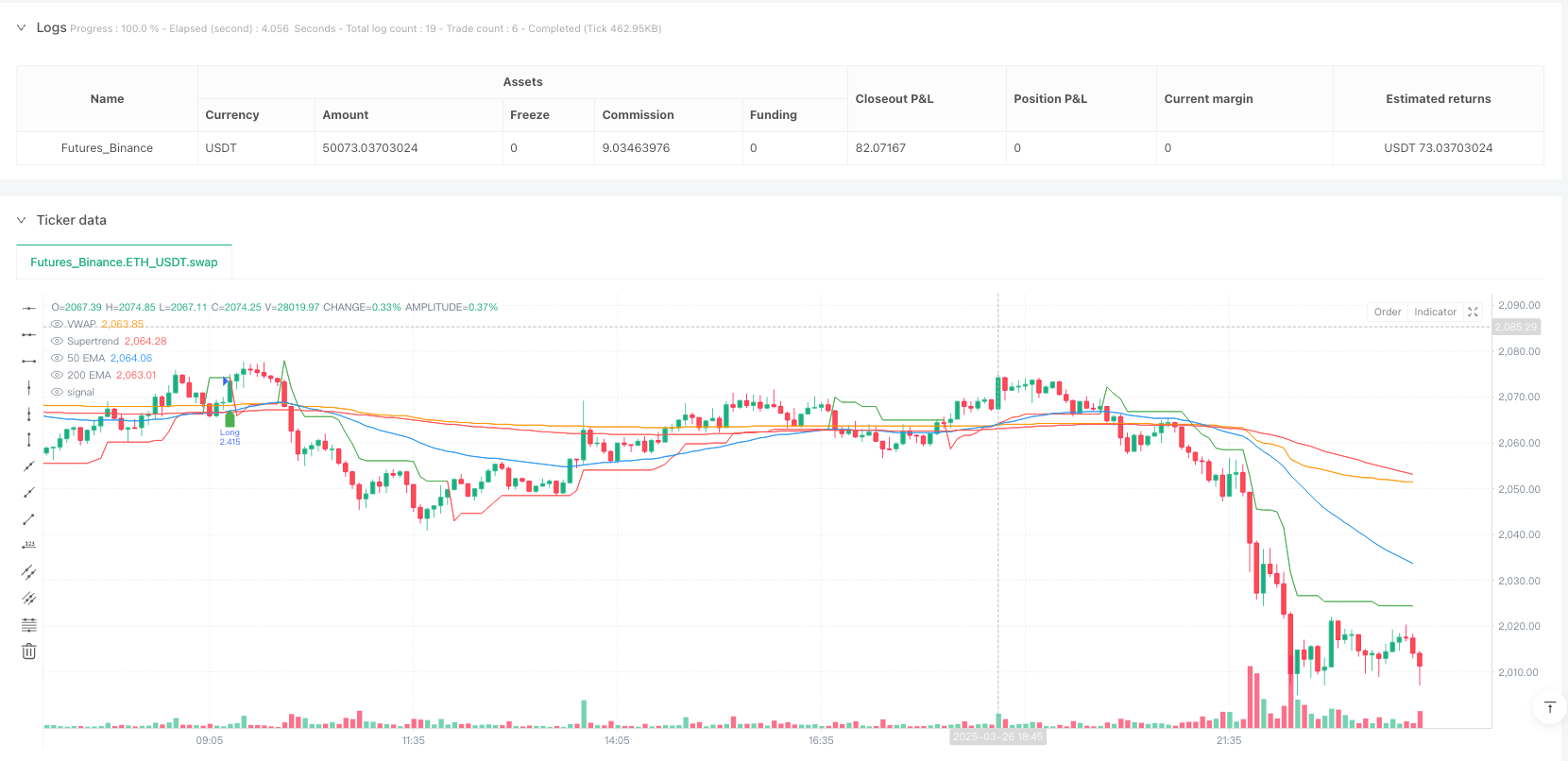

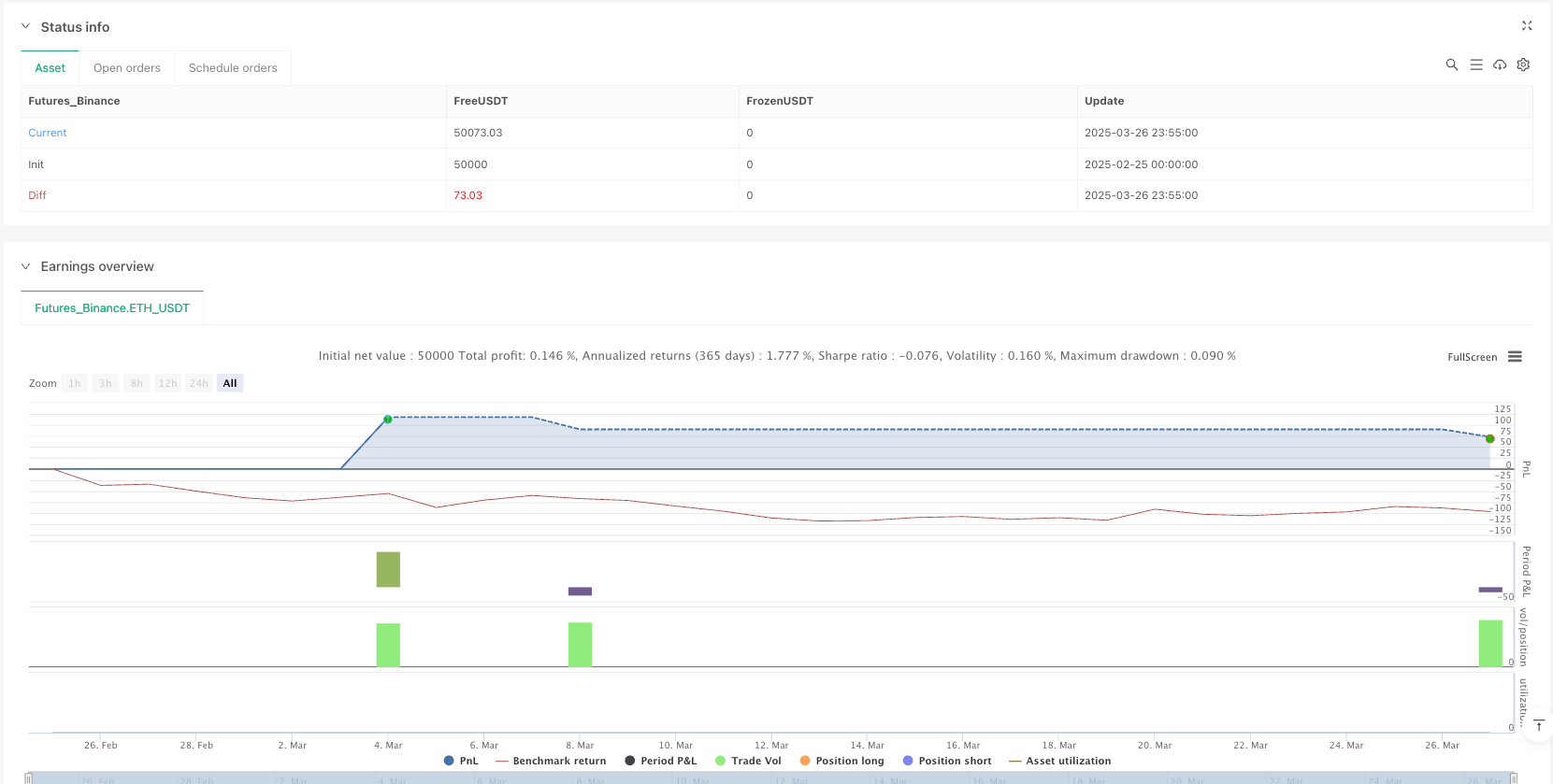

/*backtest

start: 2025-02-25 00:00:00

end: 2025-03-27 00:00:00

period: 5m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Advanced BTC/USDT Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// ==== INPUT PARAMETERS ====

emaShortLength = input.int(50, title="Short EMA Length")

emaLongLength = input.int(200, title="Long EMA Length")

rsiLength = input.int(14, title="RSI Length")

atrLength = input.int(14, title="ATR Length")

supertrendFactor = input.float(2.0, title="Supertrend Factor")

supertrendATRLength = input.int(10, title="Supertrend ATR Length")

riskRewardRatio = input.float(2.0, title="Risk-Reward Ratio")

// ==== TECHNICAL INDICATORS ====

// Exponential Moving Averages (EMA)

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// Relative Strength Index (RSI)

rsi = ta.rsi(close, rsiLength)

// Supertrend Indicator

[supertrend, supertrendDirection] = ta.supertrend(supertrendFactor, supertrendATRLength)

// Average True Range (ATR) for Stop Loss Calculation

atr = ta.atr(atrLength)

stopLossDistance = atr * 1.5 // ATR-based stop-loss

takeProfitDistance = stopLossDistance * riskRewardRatio

// Volume Weighted Average Price (VWAP)

vwap = ta.vwap(close)

// ==== ENTRY CONDITIONS ====

// Long Entry: Golden Cross + RSI Confirmation + VWAP Support + Supertrend Uptrend

longCondition = ta.crossover(emaShort, emaLong) and rsi > 40 and rsi < 65 and close > vwap and supertrendDirection == 1

// Short Entry: Death Cross + RSI Confirmation + VWAP Resistance + Supertrend Downtrend

shortCondition = ta.crossunder(emaShort, emaLong) and rsi > 60 and rsi < 80 and close < vwap and supertrendDirection == -1

// ==== EXIT CONDITIONS ====

// Stop-Loss and Take-Profit Levels for Long Positions

longStopLoss = close - stopLossDistance

longTakeProfit = close + takeProfitDistance

// Stop-Loss and Take-Profit Levels for Short Positions

shortStopLoss = close + stopLossDistance

shortTakeProfit = close - takeProfitDistance

// ==== TRADE EXECUTION ====

// Open Long Trade

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

// Open Short Trade

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

// ==== ALERT SYSTEM (OPTIONAL) ====

// Send real-time alerts for buy/sell signals

alertcondition(longCondition, title="BUY Alert 🚀", message="BTC Buy Signal! 📈")

alertcondition(shortCondition, title="SELL Alert 🔻", message="BTC Sell Signal! 📉")

// ==== PLOTTING ====

// Plot Moving Averages

plot(emaShort, color=color.blue, title="50 EMA")

plot(emaLong, color=color.red, title="200 EMA")

// Plot Supertrend

plot(supertrend, color=supertrendDirection == 1 ? color.green : color.red, title="Supertrend")

// Plot VWAP

plot(vwap, color=color.orange, title="VWAP")

// Plot Buy/Sell Signals

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")