Gambaran keseluruhan

Strategi perdagangan pergerakan struktur pasaran adalah kaedah perdagangan maju yang berdasarkan pada perubahan struktur pasaran, tangkapan kecairan dan pergerakan trend. Strategi ini menyediakan kerangka keputusan perdagangan yang sistematik kepada peniaga dengan menganalisis ciri-ciri utama perubahan harga, mengenal pasti peluang untuk membalikkan dan melanjutkan trend yang berpotensi.

Prinsip Strategi

Strategi ini adalah berdasarkan kepada empat petanda utama:

- CHOCH (Change of Character): Mengesan perubahan arah pasaran yang berpotensi dengan mengenal pasti titik-titik perubahan trend harga.

- Break of Structure, BOS: mengesahkan momentum dan arah trend yang pecah.

- Inducements, IDM: menangkap perangkap kecairan dan pergerakan wang di pasaran.

- Sweeps: mengenal pasti penembusan palsu dan peluang untuk merebut kecairan.

Strategi menggunakan indikator analisis teknikal yang komprehensif, termasuk purata rentang pergerakan sebenar (ATR), indeks kekuatan relatif (RSI) dan jumlah transaksi, untuk membina sistem keputusan perdagangan berbilang dimensi.

Kelebihan Strategik

- Pengurusan risiko sistematik: Mengendalikan risiko perdagangan tunggal dengan berkesan dengan mengira stop loss dan hentian ATR.

- Keadaan penapisan berbilang: gabungan CHoCH, BOS, RSI dan jumlah pertukaran, meningkatkan ketepatan isyarat.

- Pengurusan kedudukan dinamik: menggunakan peratusan hak dan kepentingan untuk menetapkan kedudukan perdagangan, mengoptimumkan kecekapan penggunaan dana.

- Mekanisme kemasukan dan keluar yang fleksibel: strategi perdagangan boleh disesuaikan dengan dinamik struktur pasaran.

Risiko Strategik

- Risiko terobosan palsu: Indeks struktur pasaran mungkin memberi isyarat yang salah.

- Sensitiviti parameter: Tetapan parameter strategi mempunyai kesan ketara terhadap prestasi.

- Jumlah transaksi dan risiko kecairan: mungkin kurang baik dalam pasaran yang kurang kecairan.

- Kawalan penarikan balik: Mungkin menghadapi penarikan balik yang lebih besar dalam pasaran yang terus berkembang.

Arah pengoptimuman strategi

- Memperkenalkan algoritma pembelajaran mesin: Optimumkan pilihan parameter dan pengenalan isyarat.

- Menambah analisis pelbagai kerangka masa: meningkatkan kebolehpercayaan isyarat.

- Membangunkan modul pengurusan risiko dinamik: menyesuaikan kedudukan mengikut turun naik pasaran.

- Mengintegrasikan lebih banyak petunjuk teknikal: seperti MACD, Brinband dan sebagainya, meningkatkan penapisan isyarat.

ringkaskan

Strategi perdagangan berayun struktur pasaran adalah kaedah perdagangan kuantitatif yang maju yang menyediakan pedagang dengan kerangka keputusan perdagangan yang kuat melalui analisis struktur pasaran yang sistematik. Dengan pengoptimuman dan pengurusan risiko yang berterusan, strategi ini berpotensi untuk mendapatkan prestasi perdagangan yang stabil dalam pelbagai persekitaran pasaran.

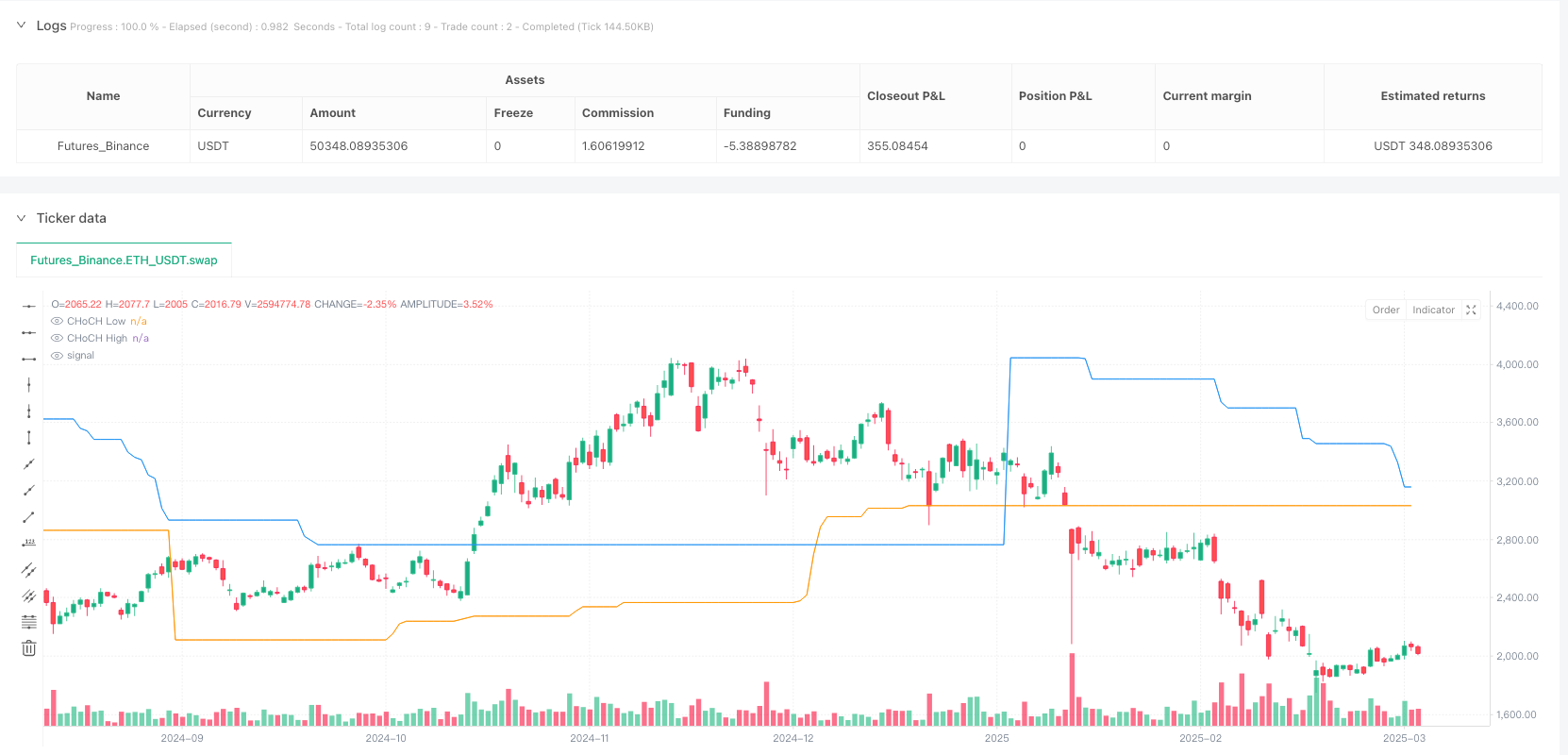

/*backtest

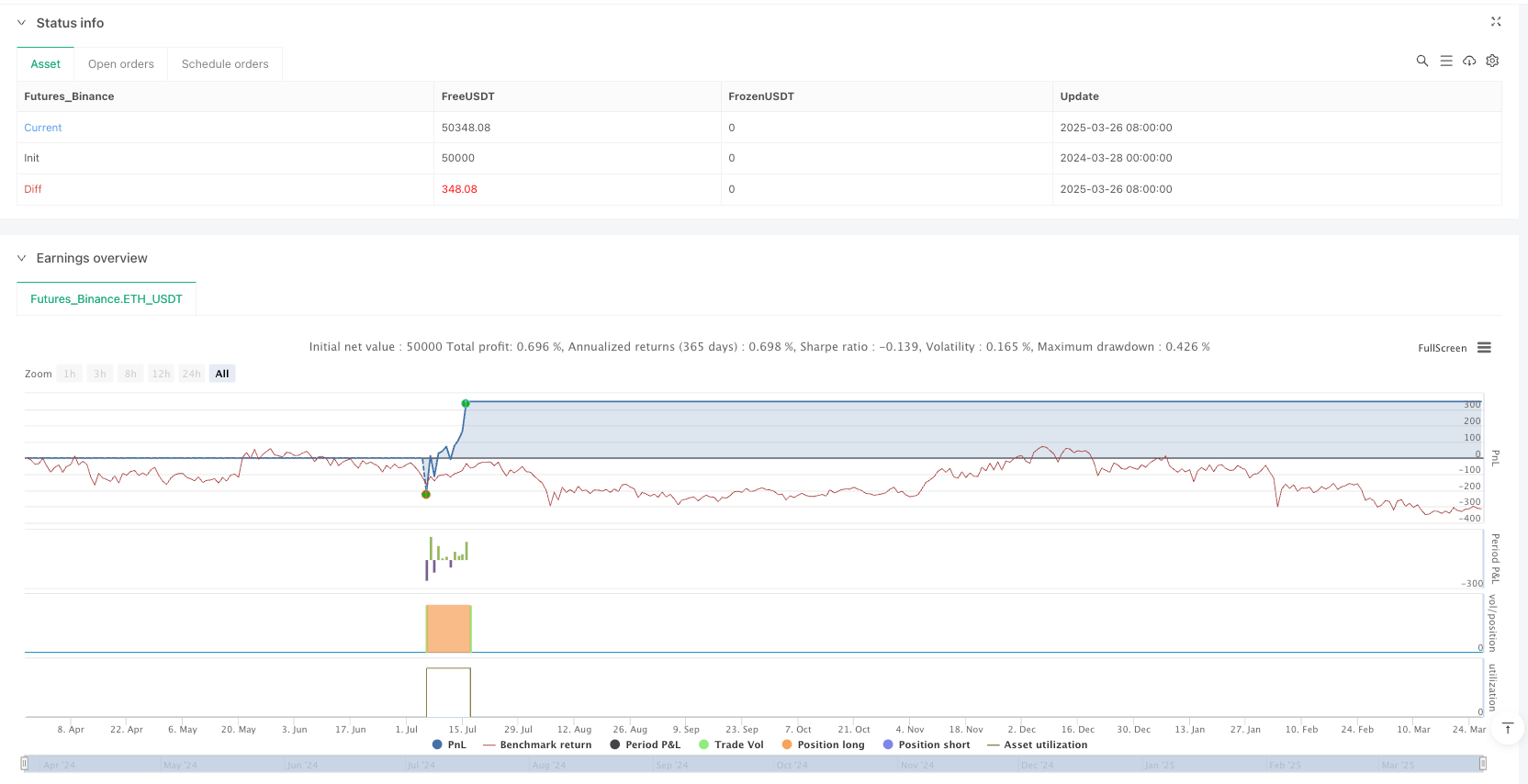

start: 2024-03-28 00:00:00

end: 2025-03-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Market Structure Swing Trading", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=5)

// === Input Parameters ===

len = input(50, "CHoCH Detection Period")

shortLen = input(3, "IDM Detection Period")

atrMultiplierSL = input(2.0, "ATR Multiplier for Stop Loss")

atrMultiplierTP = input(3.0, "ATR Multiplier for Take Profit")

rsiPeriod = input(14, "RSI Period")

rsiOverbought = input(70, "RSI Overbought Level")

rsiOversold = input(30, "RSI Oversold Level")

volThreshold = input(1.2, "Volume Multiplier Threshold")

// === ATR Calculation for SL & TP ===

atr = ta.atr(14)

stopLossLong = close - (atr * atrMultiplierSL)

takeProfitLong = close + (atr * atrMultiplierTP)

stopLossShort = close + (atr * atrMultiplierSL)

takeProfitShort = close - (atr * atrMultiplierTP)

// === RSI Filter ===

rsi = ta.rsi(close, rsiPeriod)

longConditionRSI = rsi < rsiOversold

shortConditionRSI = rsi > rsiOverbought

// === Volume Filter ===

volThresholdValue = ta.sma(volume, 20) * volThreshold

highVolume = volume > volThresholdValue

// === Market Structure Functions ===

swings(len) =>

var int topx = na

var int btmx = na

upper = ta.highest(len)

lower = ta.lowest(len)

top = high[len] > upper ? high[len] : na

btm = low[len] < lower ? low[len] : na

topx := top ? bar_index[len] : topx

btmx := btm ? bar_index[len] : btmx

[top, topx, btm, btmx]

[top, topx, btm, btmx] = swings(len)

// === CHoCH Detection ===

var float topy = na

var float btmy = na

var os = 0

var top_crossed = false

var btm_crossed = false

if top

topy := top

top_crossed := false

if btm

btmy := btm

btm_crossed := false

if close > topy and not top_crossed

os := 1

top_crossed := true

if close < btmy and not btm_crossed

os := 0

btm_crossed := true

// === Break of Structure (BOS) ===

var float max = na

var float min = na

var int max_x1 = na

var int min_x1 = na

if os != os[1]

max := high

min := low

max_x1 := bar_index

min_x1 := bar_index

bullishBOS = close > max and os == 1

bearishBOS = close < min and os == 0

// === Trade Conditions with Filters ===

longEntry = bullishBOS and longConditionRSI and highVolume

shortEntry = bearishBOS and shortConditionRSI and highVolume

// === Execute Trades ===

if longEntry

strategy.entry("Long", strategy.long)

strategy.exit("Long TP/SL", from_entry="Long", stop=stopLossLong, limit=takeProfitLong)

if shortEntry

strategy.entry("Short", strategy.short)

strategy.exit("Short TP/SL", from_entry="Short", stop=stopLossShort, limit=takeProfitShort)

// === Plotting Market Structure ===

plotshape(series=longEntry, location=location.belowbar, color=color.green, style=shape.labelup, title="BUY")

plotshape(series=shortEntry, location=location.abovebar, color=color.red, style=shape.labeldown, title="SELL")

plot(topy, color=color.blue, title="CHoCH High")

plot(btmy, color=color.orange, title="CHoCH Low")