Gambaran keseluruhan

Strategi ini adalah kaedah perdagangan jangka masa yang inovatif yang menggabungkan konsep wang pintar, purata bergerak indeks (EMA) dan analisis trend jangka masa untuk menangkap peluang perdagangan dengan mengenal pasti kawasan tekanan sokongan yang tepat dan isyarat pasaran yang dinamik.

Prinsip Strategi

Pusat strategi ini berdasarkan kepada indikator teknikal dan analisis utama seperti berikut:

- Pengesahan trend pelbagai bingkai masa: menilai trend menggunakan purata bergerak sederhana ((SMA) pada bingkai masa 5 minit dan 15 minit pada masa yang sama.

- Pengenalan zon tekanan sokongan: Garis tekanan sokongan dinamik dikira melalui harga tertinggi dan terendah 50 kitaran.

- Analisis zon bekalan dan permintaan: menilai harga minimum dan tertinggi dalam 20 kitaran sebagai zon kritikal bekalan dan permintaan.

- Konsep Kewangan Cerdas (SMC) Capture Liquidity: Kenali Perangkap Kecairan Pasaran dan Titik-Titik Penembusan

- Penjanaan isyarat dagangan: gabungan antara EMA laju dan perlahan, arah trend, kawasan tekanan sokongan dan penapis kadar turun naik.

Kelebihan Strategik

- Analisis pasaran berbilang dimensi: mengambil kira trend pelbagai kerangka masa secara menyeluruh, meningkatkan ketepatan isyarat.

- Pengurusan risiko dinamik: titik berhenti dan kerugian yang tetap ((100 titik), mengawal risiko perdagangan tunggal dengan berkesan.

- Aplikasi konsep wang pintar: mengenal pasti masa masuk yang lebih tepat melalui penangkapan kecairan dan penembusan kawasan.

- Penapisan kadar turun naik: mengelakkan perdagangan dalam pasaran yang bergelombang tinggi, mengurangkan risiko perdagangan yang tidak rasional.

- Penjanaan isyarat dagangan yang fleksibel: trend, momentum dan struktur pasaran dipertimbangkan secara menyeluruh.

Risiko Strategik

- Batasan untuk menghentikan pegangan tetap: Pengurusan risiko yang optimum mungkin tidak sesuai dalam keadaan pasaran yang berbeza.

- Batasan pelbagai syarat: Syarat penjanaan isyarat yang rumit boleh menyebabkan peluang perdagangan berkurangan.

- Had bingkai masa: hanya menggunakan 5 minit dan 15 minit mungkin terlepas trend yang lebih besar.

- Ketinggalan penunjuk teknikal: EMA dan SMA sebagai penunjuk ketinggalan mungkin melambatkan isyarat.

Arah pengoptimuman strategi

- Penangguhan brek dinamik: memperkenalkan mekanisme penangguhan brek beradaptasi berdasarkan kadar turun naik atau kawasan tekanan sokongan.

- Tambah kerangka masa: memperkenalkan lebih banyak kerangka masa (seperti 1 jam, 4 jam) untuk pengesahan trend.

- Pengoptimuman pembelajaran mesin: menyesuaikan parameter masuk dan keluar secara dinamik menggunakan algoritma pembelajaran mesin.

- Penyesuaian volatility: membangunkan algoritma penapisan kadar turun naik yang lebih halus.

- Sistem penilaian risiko: memperkenalkan penilaian risiko komprehensif, menyesuaikan saiz kedudukan secara dinamik.

ringkaskan

Strategi ini menyediakan pedagang dengan kaedah perdagangan yang sistematis dan teratur dengan mengintegrasikan analisis jangka masa berbilang, konsep dana pintar dan mekanisme penjanaan isyarat canggih. Walaupun terdapat beberapa risiko yang berpotensi, analisis berbilang dimensi dan pengurusan risiko dinamiknya memberikan kelebihan yang ketara kepada pedagang. Pengoptimuman masa depan akan meningkatkan lagi penyesuaian strategi dan potensi keuntungan.

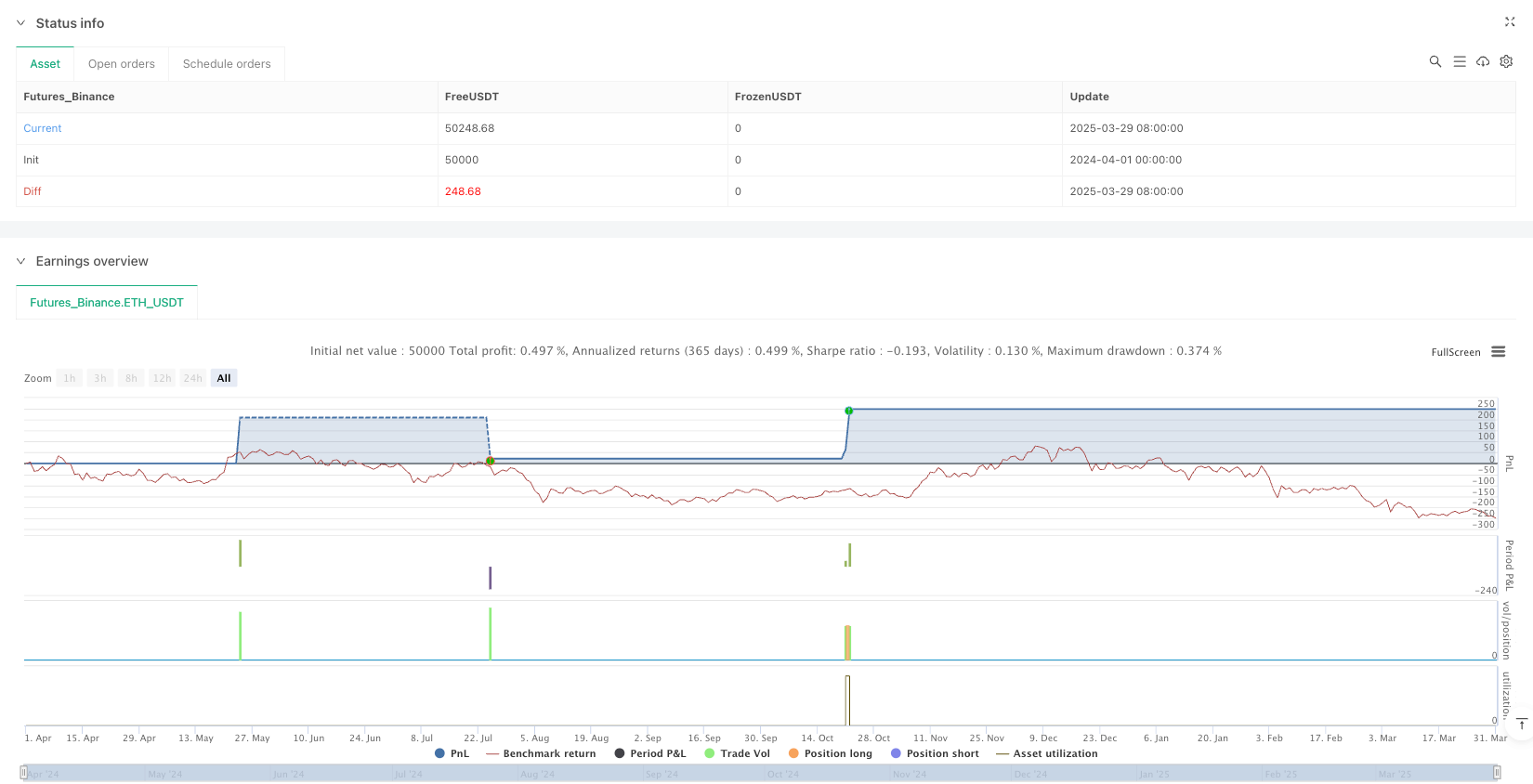

/*backtest

start: 2024-04-01 00:00:00

end: 2025-03-31 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maechelang

//@version=6

strategy("Optimized Trading Strategy v6", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Timeframe Confirmation (M5 & M15) ===

m5_trend = request.security(syminfo.tickerid, "5", ta.sma(close, 50))

m15_trend = request.security(syminfo.tickerid, "15", ta.sma(close, 50))

// === Support & Resistance (Swing High & Low) ===

swingHigh = ta.highest(high, 50)

swingLow = ta.lowest(low, 50)

plot(swingHigh, "Resistance", color=color.blue, linewidth=2, style=plot.style_stepline)

plot(swingLow, "Support", color=color.red, linewidth=2, style=plot.style_stepline)

// === Supply & Demand Zones ===

demand_zone = ta.lowest(low, 20)

supply_zone = ta.highest(high, 20)

bgcolor(close > demand_zone ? color.new(color.green, 85) : na)

bgcolor(close < supply_zone ? color.new(color.red, 85) : na)

// === Smart Money Concepts (SMC) - Liquidity Grab & Breaker Block ===

liqGrab = (ta.highest(high, 10) < ta.highest(high, 50)) and (ta.lowest(low, 10) > ta.lowest(low, 50))

breakerBlock = ta.crossover(close, ta.sma(close, 50)) or ta.crossunder(close, ta.sma(close, 50))

// === News Filter (Hindari Volatilitas Tinggi) ===

newsVolatility = ta.tr(true) > ta.sma(ta.tr(true), 20) * 1.5

// === Buy & Sell Signals (EMA + SMC + Multi-Timeframe) ===

emaFast = ta.ema(close, 9)

emaSlow = ta.ema(close, 21)

buySignal = ta.crossover(emaFast, emaSlow) and close > swingLow and not breakerBlock and close > m5_trend and close > m15_trend and not newsVolatility

sellSignal = ta.crossunder(emaFast, emaSlow) and close < swingHigh and not breakerBlock and close < m5_trend and close < m15_trend and not newsVolatility

// === TP & SL Fixed 100 Pips ===

pip = syminfo.mintick * 100

buyTP = close + 100 * pip

buySL = close - 100 * pip

sellTP = close - 100 * pip

sellSL = close + 100 * pip

// === Entry & Exit Orders ===

if buySignal

strategy.entry("BUY NOW", strategy.long)

strategy.exit("EXIT BUY", from_entry="BUY NOW", limit=buyTP, stop=buySL)

label.new(bar_index, low, "BUY NOW\nEntry: " + str.tostring(close, "#.##") + "\nTP: " + str.tostring(buyTP, "#.##") + "\nSL: " + str.tostring(buySL, "#.##"), color=color.blue, textcolor=color.white, size=size.small)

if sellSignal

strategy.entry("SELL NOW", strategy.short)

strategy.exit("EXIT SELL", from_entry="SELL NOW", limit=sellTP, stop=sellSL)

label.new(bar_index, high, "SELL NOW\nEntry: " + str.tostring(close, "#.##") + "\nTP: " + str.tostring(sellTP, "#.##") + "\nSL: " + str.tostring(sellSL, "#.##"), color=color.red, textcolor=color.white, size=size.small)