[trans]

Gambaran keseluruhan

Strategi dagangan pivot pelbagai dimensi dengan sistem Fibonacci dinamik adalah strategi perdagangan berdasarkan analisis teknikal, yang menggunakan banyak petunjuk seperti pivot intraday, jarak pusat (CPR), tahap pengunduran Fibonacci, purata berat perbelanjaan (VWAP) dan purata bergerak untuk mengenal pasti peluang membeli dan menjual yang berpotensi. Strategi ini sesuai untuk pedagang intraday, terutama untuk perdagangan garis pendek pada carta K 3 minit. Strategi ini berpusat pada menentukan sama ada garis K bersentuhan dengan kedudukan sokongan dan rintangan utama dalam keadaan tertentu, dan seterusnya mencetuskan isyarat perdagangan.

Strategi ini menggunakan sistem titik-titik pivot yang mengira harga tinggi, rendah dan harga tutup setiap hari, menggabungkan purata purata bertimbangan perdagangan (VWAP) dan VWAP bergerak (MVWAP) sebagai rujukan rintangan sokongan dinamik. Pada masa yang sama, ia membina sistem keputusan perdagangan yang komprehensif melalui petunjuk teknikal seperti indeks relatif lemah (RSI), purata bergerak sederhana (SMA) dan purata bergerak indeks (EMA).

Strategi pertama mengenal pasti garis K hijau ((naik) dan merah ((turun) yang memenuhi syarat, dan kemudian menilai sama ada garis K tersebut menyentuh tahap harga kritikal, seperti titik pivot, titik sokongan, titik rintangan atau VWAP. Apabila garis K merah menyentuh tahap harga kritikal, ia akan mencetuskan isyarat beli ((CE); apabila garis K hijau menyentuh tahap harga kritikal, ia akan mencetuskan isyarat jual ((PE)).

Prinsip Strategi

Prinsip strategi ini adalah berdasarkan pada tingkah laku pasaran yang berputar di sekitar pergerakan sokongan dan rintangan yang penting. Keputusan perdagangan dibuat dengan menggabungkan bentuk garis K, jumlah transaksi dan indikator momentum.

Mekanisme pengenalan K:

- Garis K Hijau ((Meningkat): harga penutupan lebih tinggi daripada harga bukaan, entiti garis K sekurang-kurangnya 17 mata, harga bukaan lebih rendah daripada titik rendah ditambah 0.382 kali K, harga penutupan lebih tinggi daripada titik rendah ditambah 0.682 kali K.

- Garis K merah ((turun): harga penutupan lebih rendah daripada harga pembukaan, entiti Garis K setinggi sekurang-kurangnya 17 mata.

Sistem pengiraan titik pusat:

- Titik pusat hari (PP): (Harga tertinggi + harga terendah hari + harga penutupan hari) / 3

- R1, R2, R3 dan R4

- Sokongan: S1, S2, S3, S4

- Bahagian tengah ((CPR): terdiri daripada CPR bawah dan CPR atas, memberikan kawasan harga di mana pasaran mungkin disusun

Referensi dinamik harga:

- VWAP ((harga purata bertimbangan kuantiti urus niaga): mencerminkan tahap harga purata selepas faktor kuantiti urus niaga

- MVWAP (Moving Weighted Average Price): purata bergerak untuk VWAP, yang memberikan rujukan harga yang lebih lancar

Sistem penunjuk bantuan:

- RSI: digunakan untuk mengukur keadaan pasaran yang terlalu banyak dibeli dan dijual

- SMA ((50 kitaran) dan EMA ((20 kitaran): menyediakan rujukan arah trend harga

- Analisis jumlah transaksi: menilai trend jumlah transaksi melalui garis purata jumlah transaksi 20 kitaran

Sinyal dagangan dihasilkan:

- Apabila garis K merah yang memenuhi syarat menyentuh mana-mana titik pivot, kedudukan sokongan, kedudukan rintangan atau VWAP / MVWAP, menghasilkan isyarat beli ((CE)

- Apabila garis K hijau yang memenuhi syarat menyentuh mana-mana titik pivot, sokongan, rintangan atau VWAP / MVWAP, menghasilkan isyarat jual ((PE)

Idea teras strategi adalah untuk menangkap potensi pembalikan harga berhampiran tahap sokongan dan rintangan utama, menapisnya melalui bentuk garis K tertentu dan pelbagai petunjuk teknikal, dan meningkatkan keberkesanan isyarat. Garis K yang menyentuh titik-titik pusat sering mewakili peningkatan kemungkinan pasaran akan ragu-ragu atau berbalik di tahap harga utama ini.

Kelebihan Strategik

Dengan mengkaji kod strategi ini secara mendalam, kita dapat menyimpulkan kelebihan yang ketara berikut:

Mekanisme pengesahan pelbagai dimensi: Menggabungkan pelbagai petunjuk teknikal (Pivot Point, VWAP, Moving Average, RSI) untuk mengesahkan isyarat perdagangan, mengurangkan risiko isyarat palsu.

Kebolehan beradaptasiSistem titik teras harian dikemas kini setiap hari, membolehkan strategi menyesuaikan diri dengan keadaan pasaran dan kadar turun naik yang berbeza.

Pengiktirafan garis K yang tepat: Meningkatkan kualiti isyarat dengan menyaring peluang perdagangan yang berpotensi melalui syarat bentuk K-Line yang ketat dan tahap Fibonacci.

Tetapan paparan fleksibelStrategi: mempunyai fungsi penyesuaian pandangan, hanya pada jangka masa yang sesuai (graf harian 15 minit atau kurang) untuk memaparkan titik-titik pusat, mengurangkan kerumitan grafik.

Kelebihan pemikiran terbalikStrategi: Cari peluang membeli apabila K merah menyentuh kedudukan penting, cari peluang menjual apabila K hijau menyentuh kedudukan penting, memanfaatkan kemungkinan pasaran dalam keadaan overbought dan oversold jangka pendek.

Sistem harga bertaraf: mengandungi pelbagai lapisan sokongan dan rintangan ((S1-S4 dan R1-R4), menyediakan harga rujukan yang kaya, sesuai dengan keadaan pasaran yang berbeza-beza.

Penggabungan pusat (CPR):CPR menyediakan pengenalan kawasan pencatatan yang berpotensi pada hari itu, yang mempunyai nilai rujukan penting dalam perdagangan dalam hari.

Bantuan visual: Dengan banyak tanda dan bentuk yang ditunjukkan, garis K yang memenuhi syarat dan keadaan yang menyentuh harga kritikal dapat diiktiraf secara intuitif di carta, memudahkan peniaga untuk mengenal pasti dengan cepat.

Pengesahan pesananGabungan analisis kuantiti urus niaga, menilai penyertaan pasaran melalui purata kuantiti urus niaga, meningkatkan kebolehpercayaan isyarat.

Untuk dagangan dalam sehariStrategi ini direka khas untuk jangka masa yang singkat (terutamanya carta 3 minit) dan sesuai untuk pedagang dalam hari yang menggunakan turun naik pasaran untuk perdagangan yang kerap.

Kelebihan di atas menjadikan strategi ini sebagai sistem dagangan dalam sehari yang komprehensif, kuat dan beradaptasi, yang sangat sesuai untuk pelabur yang mempunyai pengetahuan tentang analisis teknikal dan ingin berdagang berdasarkan tingkah laku harga dan tahap harga kritikal.

Risiko Strategik

Walaupun strategi ini mempunyai banyak kelebihan, ia juga mempunyai beberapa risiko yang perlu diperhatikan oleh peniaga:

Isyarat terlalu berisikoOleh kerana strategi ini melibatkan banyak titik pusat ((PP, R1-R4, S1-S4) dan petunjuk lain, ia mungkin menghasilkan terlalu banyak isyarat dalam pasaran yang bergolak, yang menyebabkan kekerapan perdagangan dan peningkatan yuran.

- Penyelesaian: Anda boleh mempertimbangkan untuk menambah syarat penapisan tambahan, seperti sekatan masa dagangan atau syarat pengesahan trend.

Perangkap perdagangan terbalikStrategi berdasarkan logik terbalik ((Garis K merah menyentuh kedudukan penting untuk membeli, Garis K hijau menyentuh kedudukan penting untuk menjual), yang boleh menyebabkan kerugian berturut-turut dalam pasaran yang kuat.

- Penyelesaian: Untuk menilai trend pasaran keseluruhan sebelum menggunakan strategi, penapis trend boleh ditambah untuk mengelakkan perdagangan berlawanan semasa trend yang kuat.

Kepekaan ParameterKesan strategi sangat bergantung kepada parameter pengenalan K-line (jika K-line lebih tinggi daripada 17 titik) dan seting kitaran purata bergerak, yang mungkin memerlukan parameter yang berbeza dalam keadaan pasaran yang berbeza.

- Penyelesaian: Uji ulang untuk pelbagai jenis dan keadaan pasaran, set parameter yang optimum.

Kekurangan mekanisme kawalan kerugian: Tidak ada strategi stop loss yang ditetapkan dengan jelas dalam kod, yang boleh menyebabkan kerugian tunggal yang terlalu besar.

- Penyelesaiannya: melaksanakan strategi henti rugi yang jelas, seperti henti rugi dinamik berdasarkan ATR atau henti rugi dengan nombor tetap.

Kekurangan strategi dalam sehariSebagai strategi harian yang memberi tumpuan kepada carta 3 minit, tidak sesuai untuk memegang jangka panjang dan kehilangan peluang untuk trend jangka panjang.

- Penyelesaian: Pertimbangkan strategi ini sebagai sebahagian daripada sistem dagangan dan gunakan strategi jangka menengah dan jangka panjang.

Batasan titik pusatDalam pasaran yang berdekatan, harga mungkin sering menyentuh beberapa titik pusat, menghasilkan isyarat kekecohan.

- Penyelesaian: Dalam pasaran yang disusun, anda boleh mempertimbangkan untuk menutup strategi sementara atau menambah syarat pengesahan isyarat.

Kurangnya penyesuaian berat bagi jumlah transaksiWalaupun VWAP digunakan, strategi ini tidak menyesuaikan berat isyarat secara dinamik mengikut saiz jumlah transaksi.

- Penyelesaian: Tambah syarat penurunan nilai bagi memastikan perdagangan dilakukan dengan penyertaan pasaran yang mencukupi.

Kebergantungan masa: Hari pivot berdasarkan data hari sebelumnya, mungkin tidak stabil pada permulaan hari perdagangan baru kerana kekurangan data yang mencukupi pada hari itu.

- Penyelesaian: Pertimbangkan untuk mengaktifkan semula strategi 30 hingga 60 minit sebelum hari perdagangan untuk mendapatkan maklumat pasaran yang mencukupi.

Cabaran untuk melaksanakan automasiStrategi melibatkan penilaian pelbagai syarat, dan mungkin mengalami kelewatan atau ketidaksempurnaan semasa pelaksanaan automasi sebenar.

- Penyelesaian: Mengoptimumkan sistem pelaksanaan, memastikan kelewatan yang rendah, atau pertimbangkan kaedah semi-otomatik yang digabungkan dengan pengesahan manual.

Mengesan risiko bias: Logik pengiktirafan K-baris hijau / merah dalam kod mungkin tidak sesuai dalam pengesanan semula dengan persekitaran cakera.

- Penyelesaian: Uji simulasi yang ketat untuk memastikan strategi masih berkesan dalam persekitaran perdagangan sebenar.

Mengenali dan menguruskan risiko ini adalah penting untuk berjaya menggunakan strategi ini, dan peniaga harus membuat penyesuaian yang sesuai mengikut toleransi risiko dan tabiat perdagangan mereka.

Arah pengoptimuman strategi

Berdasarkan analisis yang mendalam mengenai kod, berikut adalah arah utama di mana strategi ini boleh dioptimumkan:

Parameter pengenalan garisan K dinamik:

- Strategi semasa menggunakan nilai tetap (seperti ketinggian K sekurang-kurangnya 17 mata) untuk mengenal pasti K-garis yang berkesan, yang boleh diubah menjadi parameter dinamik berdasarkan ATR (rentang turun naik rata-rata sebenar), menjadikan strategi lebih sesuai untuk persekitaran kadar turun naik yang berbeza.

- Alasan pengoptimuman: Parameter tetap mempunyai kesan yang berbeza-beza dalam persekitaran kadar turun naik yang berbeza, dan parameter dinamik dapat meningkatkan kebolehpasaran strategi.

Sistem penapis trend:

- Menambah jangka masa yang lebih tinggi (seperti 15 minit atau 30 minit) untuk menilai trend, melakukan perdagangan atau menyesuaikan berat isyarat hanya ke arah trend utama.

- Alasan untuk mengoptimumkan: mengelakkan dagangan berlawanan yang kerap dalam trend yang kuat, meningkatkan kadar kemenangan dan kadar kerugian.

Sistem penilaian kualiti isyarat:

- Menetapkan sistem penilaian komprehensif untuk setiap isyarat perdagangan, mempertimbangkan pelbagai faktor seperti: K-baris kekuatan, kepentingan titik-titik pusat yang disentuh, nilai RSI, kecacatan jumlah dagangan, dan sebagainya.

- Alasan pengoptimuman: Tidak semua isyarat berkualiti sama, sistem penilaian boleh menapis isyarat berkualiti rendah, meningkatkan kecekapan perdagangan.

Pengurusan kewangan bersepadu:

- Menyesuaikan saiz kedudukan mengikut kekuatan isyarat dan keadaan pasaran yang dinamik, meningkatkan kedudukan dalam peluang kebarangkalian yang tinggi, mengurangkan risiko dalam keadaan kebarangkalian yang rendah.

- Alasan pengoptimuman: Pengurusan wang yang berkesan adalah penting untuk keuntungan jangka panjang dan dapat meningkatkan prestasi strategi secara signifikan.

Pengesahan pelbagai kerangka masa:

- Memeriksa kesesuaian syarat untuk pelbagai bingkai masa sebelum menghasilkan isyarat, seperti perdagangan apabila isyarat pada carta 3 minit dan 15 minit adalah sama.

- Alasan pengoptimuman: Pengesahan bingkai masa yang lebih banyak dapat mengurangkan kebarangkalian isyarat yang salah dan meningkatkan ketepatan perdagangan.

Kerosakan dan mekanisme penangguhan:

- Menerapkan sistem henti rugi pintar, seperti henti rugi dinamik berdasarkan kadar turun naik atau henti rugi kedudukan struktur penting, sambil menetapkan sasaran henti rugi automatik.

- Alasan pengoptimuman: Pengurusan risiko yang baik adalah penting untuk mengelakkan penarikan balik yang besar dan melindungi keuntungan.

Penapis masa transaksi:

- Mengenali masa perdagangan yang cekap dan tidak cekap, mengelakkan masa yang kurang turun naik atau huru-hara di pasaran (seperti waktu makan tengah hari atau sebelum dan selepas pasaran dibuka).

- Alasan pengoptimuman: Perlakuan pasaran berbeza pada masa yang berbeza, dan perdagangan pilihan dapat meningkatkan kecekapan keseluruhan.

Parameter penunjuk penyesuaian:

- Mengubah parameter penunjuk teknikal yang tetap (seperti 14 kitaran RSI, 20 kitaran EMA) menjadi parameter yang disesuaikan secara automatik berdasarkan keadaan pasaran.

- Alasan pengoptimuman: Apabila keadaan pasaran berubah, parameter penunjuk optimum juga harus disesuaikan dengan baik, meningkatkan kepekaan penunjuk.

Klasifikasi persekitaran pasaran:

- Algoritma tambahan secara automatik mengenal pasti keadaan pasaran semasa ((kecenderungan, pengiraan, turun naik, dan lain-lain) dan menetapkan parameter yang berbeza untuk aplikasi persekitaran yang berbeza.

- Alasan pengoptimuman: Satu parameter yang ditetapkan sukar untuk melakukan yang terbaik dalam semua keadaan pasaran, dan penyesuaian adaptasi persekitaran dapat meningkatkan kestabilan strategi secara signifikan.

Pembelajaran Mesin:

- Mengambil kira kebarangkalian kejayaan isyarat ramalan model pembelajaran mesin yang bersepadu, menyaring dan mengutamakan isyarat perdagangan berdasarkan pengenalan corak sejarah.

- Rujukan pengoptimuman: Pembelajaran mesin dapat menemui corak rumit yang sukar dikenali oleh manusia, meningkatkan tahap kecerdasan strategi.

Dengan melaksanakan arah pengoptimuman di atas, strategi ini dapat meningkatkan daya serap, ketepatan dan keuntungan jangka panjang dengan ketara, dengan mengekalkan kelebihan asalnya, dan dapat mengatasi pelbagai cabaran keadaan pasaran dengan lebih baik.

ringkaskan

Strategi dagangan pivot multi-dimensi dengan sistem indikator Fibonacci dinamik adalah sistem strategi dagangan harian yang komprehensif, kuat dan terstruktur. Ia menggabungkan alat analisis teknikal tradisional (pivot, Fibonacci retracement, moving average) dengan indikator dinamik moden (V, WAP, CPR), yang memberikan pedagang kerangka perdagangan harian yang berpotensi melalui penyaringan syarat K-line yang ketat dan pengesahan pelbagai indikator.

Kelebihan utama strategi ini adalah liputan menyeluruhnya terhadap tahap harga kritikal dan tangkapan sensitif terhadap titik-titik perubahan yang berpotensi. Dengan menetapkan syarat pengenalan K-line yang ketat, strategi ini dapat menyaring banyak bunyi pasaran yang tidak masuk akal dan memberi tumpuan kepada peluang perdagangan yang berkemungkinan tinggi.

Walau bagaimanapun, strategi ini juga mempunyai beberapa batasan, seperti kemungkinan terlalu banyak isyarat, risiko perdagangan terbalik, dan cabaran pengoptimuman parameter. Untuk mengatasi masalah ini, kami telah mengemukakan beberapa arah pengoptimuman, termasuk penyesuaian parameter dinamik, pengesahan jangka masa berbilang, pengurusan dana pintar, dan penyesuaian keadaan pasaran.

Perlu diperhatikan bahawa strategi perdagangan apa pun bukanlah alat untuk “menjana wang”, perdagangan yang berjaya memerlukan kesabaran, disiplin dan pembelajaran berterusan peniaga selain bergantung pada strategi itu sendiri. Untuk strategi ini, peniaga disarankan untuk terlebih dahulu menguji sepenuhnya dalam persekitaran simulasi, membiasakan diri dengan ciri-ciri persembahannya dalam keadaan pasaran yang berbeza, secara beransur-ansur menyesuaikan parameter untuk menyesuaikan dengan jenis perdagangan tertentu dan gaya peribadi, dan akhirnya membentuk sistem perdagangan yang diperibadikan dan menguntungkan secara lestari.

Melalui amalan, maklum balas dan pengoptimuman yang berterusan, strategi perdagangan multi-dimensi dan sistem Fibonacci yang dinamik dapat menjadi senjata yang kuat dalam alatan pedagang dalam hari, menyediakan kerangka analisis teknikal yang boleh dipercayai untuk memahami turun naik pasaran dalam hari.

Overview

The Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators is a technical analysis-based trading strategy that utilizes daily pivot points, Central Pivot Range (CPR), Fibonacci retracement levels, Volume Weighted Average Price (VWAP), and moving averages to identify potential buying and selling opportunities. This strategy is particularly suitable for intraday traders, especially those focusing on 3-minute chart timeframes. The core of the strategy is determining whether candles meeting specific conditions touch key support and resistance levels, thereby triggering trading signals.

The strategy employs a pivot point system calculated from daily high, low, and close prices, combined with Volume Weighted Average Price (VWAP) and Moving VWAP (MVWAP) as dynamic support and resistance references. It also incorporates technical indicators such as the Relative Strength Index (RSI), Simple Moving Average (SMA), and Exponential Moving Average (EMA) to create a comprehensive trading decision system.

The strategy first identifies qualifying green (bullish) and red (bearish) candles, then determines if these candles touch key price levels such as pivot points, support levels, resistance levels, or VWAP. When a red candle touches a key price level, it triggers a buy signal (CE); when a green candle touches a key price level, it triggers a sell signal (PE). This contrarian approach reflects the core concept of seeking potential reversal points at key price levels.

Strategy Principles

The principles of this strategy are built on market behavior where prices fluctuate around key support and resistance levels, combined with candle patterns, volume, and momentum indicators for trading decisions. The specific principles are analyzed as follows:

Candle Identification Mechanism:

- Green Candle (Bullish): Close higher than open, candle body height at least 17 points, open lower than low plus 0.382 times candle range, close higher than low plus 0.682 times candle range.

- Red Candle (Bearish): Close lower than open, candle body height at least 17 points.

Pivot Point Calculation System:

- Daily Pivot Point (PP): (Daily High + Daily Low + Daily Close) / 3

- Resistance Levels: R1, R2, R3, R4

- Support Levels: S1, S2, S3, S4

- Central Pivot Range (CPR): Comprised of bottom CPR and top CPR, providing a price region where the market may consolidate

Dynamic Price References:

- VWAP (Volume Weighted Average Price): Reflects the average price level considering volume factors

- MVWAP (Moving Volume Weighted Average Price): Moving average of VWAP, providing a smoother price reference

Auxiliary Indicator System:

- RSI: Used to measure market overbought/oversold conditions

- SMA (50-period) and EMA (20-period): Provide price trend direction references

- Volume Analysis: Assesses volume trends through 20-period volume moving average

Trade Signal Generation:

- When qualifying red candles touch any pivot point, support level, resistance level, or VWAP/MVWAP, a buy signal (CE) is generated

- When qualifying green candles touch any pivot point, support level, resistance level, or VWAP/MVWAP, a sell signal (PE) is generated

The core idea of the strategy is to capture potential reversals near key support and resistance levels, filtered through specific candle patterns and multiple technical indicators to enhance signal validity. Candles touching pivot points often represent increased possibility of market hesitation or reversal at these key price levels.

Strategy Advantages

Deep analysis of the strategy code reveals the following significant advantages:

Multi-dimensional Verification Mechanism: Combines multiple technical indicators (pivot points, VWAP, moving averages, RSI) to validate trading signals, reducing false signal risk.

Dynamic Market Adaptation: Daily pivot point system updates daily, allowing the strategy to adapt to different market environments and volatilities.

Precise Candle Identification: Screens potential trading opportunities through strict candle pattern conditions and Fibonacci levels, improving signal quality.

Flexible Display Settings: The strategy features view adaptation functionality, only displaying pivot points in appropriate timeframes (intraday charts below 15 minutes), reducing chart clutter.

Contrarian Thinking Advantage: The strategy looks for buying opportunities when red candles touch key levels and selling opportunities when green candles touch key levels, leveraging potential short-term overbought/oversold market conditions.

Complete Price Level Hierarchy: Includes multiple layers of support and resistance (S1-S4 and R1-R4), providing rich reference prices suitable for market environments with different volatility ranges.

Integrated Central Pivot Range (CPR): CPR provides identification of potential consolidation areas for the day, which has important reference value in intraday trading.

Visual Assistance: Through rich markers and shapes, qualifying candles and instances of touching key price levels are intuitively marked on the chart, enabling traders to quickly identify them.

Volume Confirmation: Incorporates volume analysis, assessing market participation through volume moving averages, enhancing signal reliability.

Suitable for Intraday Trading: The strategy is specially designed for short timeframes (particularly 3-minute charts), suitable for intraday traders looking to capitalize on market fluctuations through frequent trading.

These advantages make this strategy a strong, adaptive intraday trading system, particularly suitable for investors with a good understanding of technical analysis who wish to trade based on price action and key price levels.

Strategy Risks

Despite its many advantages, the strategy also presents several potential risks that traders should carefully address:

Excessive Signal Risk: Due to the strategy involving multiple pivot points (PP, R1-R4, S1-S4) and other indicators, it may generate too many signals in volatile markets, leading to frequent trading and increased fees.

- Solution: Consider adding additional filtering conditions, such as trading session limitations or trend confirmation conditions.

Contrarian Trading Trap: The strategy is based on contrarian logic (buy when red candles touch key levels, sell when green candles touch key levels), which may lead to consecutive losses in strong trending markets.

- Solution: Assess the overall market trend before using the strategy, and add trend filters to avoid counter-trend trading in strong trends.

Parameter Sensitivity: Strategy effectiveness is highly dependent on candle identification parameters (e.g., candle height must exceed 17 points) and moving average period settings, which may require different parameters in different market environments.

- Solution: Backtest different instruments and market conditions to optimize parameter settings.

Lack of Stop-Loss Mechanism: No explicit stop-loss strategy is set in the code, which may lead to excessive single-trade losses.

- Solution: Implement clear stop-loss strategies, such as ATR-based dynamic stop-losses or fixed-point stop-losses.

Intraday Strategy Limitations: As a strategy focusing on 3-minute charts, it is not suitable for medium to long-term holdings, potentially missing opportunities in longer-term trends.

- Solution: View this strategy as part of a trading system, used in conjunction with medium and long-term strategies.

Pivot Point Limitations: In range-bound markets, prices may frequently touch multiple pivot points, generating confusing signals.

- Solution: Consider temporarily disabling the strategy or adding signal confirmation conditions in consolidating markets.

Lack of Volume Weight Adjustment: Although VWAP is used, the strategy does not dynamically adjust signal weights based on volume size.

- Solution: Add volume threshold conditions to ensure trading occurs with sufficient market participation.

Time Dependency: Daily pivot points are based on previous day’s data, and may perform unstably at the beginning of a new trading day due to insufficient current day data.

- Solution: Consider enabling the strategy 30-60 minutes after the trading day begins to gather sufficient market information.

Automation Implementation Challenges: The strategy involves multiple condition judgments, and may face delays or untimely execution during actual automated execution.

- Solution: Optimize execution systems to ensure low latency, or consider semi-automated methods combined with manual confirmation.

Backtest Bias Risk: The green/red candle identification logic in the code may perform inconsistently between backtesting and live trading environments.

- Solution: Conduct rigorous live simulation testing to ensure the strategy remains effective in actual trading environments.

Recognizing and managing these risks is crucial for successfully applying this strategy. Traders should make appropriate adjustments based on their risk tolerance and trading habits.

Strategy Optimization Directions

Based on deep analysis of the code, the following are key directions for optimizing this strategy:

Dynamic Candle Identification Parameters:

- The current strategy uses fixed values (such as candle height of at least 17 points) to identify effective candles. This could be changed to dynamic parameters based on ATR (Average True Range) to better adapt to different volatility environments.

- Optimization rationale: Fixed parameters perform differently in various volatility environments; dynamic parameters can improve strategy adaptability.

Trend Filtering System:

- Add trend determination from higher timeframes (such as 15-minute or 30-minute) to only execute trades in the direction of the main trend or adjust signal weights.

- Optimization rationale: Avoid frequent counter-trend trading in strong trends, improving win rate and risk-reward ratio.

Signal Quality Scoring Mechanism:

- Establish a comprehensive scoring system for each trading signal, considering multiple factors such as candle strength, importance of the pivot point touched, RSI value, volume anomalies, etc.

- Optimization rationale: Not all signals are of equal quality; a scoring system can filter out low-quality signals and improve trading efficiency.

Capital Management Integration:

- Dynamically adjust position size based on signal strength and market conditions, increasing positions on high-probability opportunities and reducing risk exposure in low-probability situations.

- Optimization rationale: Effective capital management is crucial for long-term profitability and can significantly improve strategy performance.

Multiple Timeframe Confirmation:

- Check condition consistency across multiple timeframes before generating signals, for example, trading only when 3-minute and 15-minute chart signals align.

- Optimization rationale: Multiple timeframe confirmation can reduce the probability of false signals and improve trading precision.

Stop-Loss and Take-Profit Mechanisms:

- Implement smart stop-loss systems, such as volatility-based dynamic stop-losses or key structural position stop-losses, while setting automatic take-profit targets.

- Optimization rationale: Sound risk management is crucial for avoiding significant drawdowns and protecting profits.

Trading Time Filters:

- Identify efficient and inefficient trading sessions, avoiding periods of low market volatility or chaotic periods (such as lunch hours or before and after market open and close).

- Optimization rationale: Market behavior characteristics differ across various sessions; selective trading can improve overall efficiency.

Adaptive Indicator Parameters:

- Change fixed technical indicator parameters (such as 14-period RSI, 20-period EMA) to parameters that automatically adjust based on market state.

- Optimization rationale: When market conditions change, optimal indicator parameters should also adjust accordingly, improving indicator sensitivity.

Market Environment Classification:

- Add algorithms to automatically identify the current market environment (trending, consolidating, high volatility, etc.) and apply different parameter settings for different environments.

- Optimization rationale: Single parameter settings are difficult to perform optimally in all market environments; environment-adaptive adjustments can significantly enhance strategy stability.

Machine Learning Enhancement:

- Consider integrating machine learning models to predict signal success probability, filtering and prioritizing trading signals based on historical pattern recognition.

- Optimization rationale: Machine learning can discover complex patterns difficult for humans to identify, raising the strategy’s intelligence level.

By implementing these optimization directions, the strategy can significantly improve adaptability, accuracy, and long-term profitability while maintaining its original advantages, better addressing challenges across various market conditions.

Summary

The Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators is a comprehensive, well-structured intraday trading strategy system. It cleverly combines traditional technical analysis tools (pivot points, Fibonacci retracements, moving averages) with modern dynamic indicators (VWAP, CPR). Through strict candle condition screening and multiple indicator confirmation, it provides traders with a promising intraday trading framework.

The core advantage of this strategy lies in its comprehensive coverage of key price levels and sensitive capture of potential reversal points. By setting strict candle identification conditions, the strategy can filter out a large amount of meaningless market noise and focus on high-probability trading opportunities. At the same time, the use of volume and momentum indicators further enhances signal reliability.

However, the strategy also has some limitations, such as potentially excessive signals, contrarian trading risks, and parameter optimization challenges. To address these issues, we’ve proposed several optimization directions, including dynamic parameter adjustment, multiple timeframe confirmation, intelligent capital management, and market environment adaptation. These optimizations can help traders adjust the strategy according to their own needs and market characteristics, improving overall trading effectiveness.

It’s worth noting that no trading strategy is a “magic bullet.” Successful trading depends not only on the strategy itself but also on the trader’s patience, discipline, and continuous learning. For this strategy, it’s recommended that traders first thoroughly test it in a simulated environment, familiarize themselves with its performance characteristics under different market conditions, gradually adjust parameters to adapt to specific trading instruments and personal styles, and ultimately form a personalized, sustainably profitable trading system.

Through continuous practice, feedback, and optimization, the Multi-Dimensional Pivot Point Trading System with Dynamic Fibonacci Indicators can become a powerful weapon in an intraday trader’s toolbox, providing a reliable technical analysis framework for capturing short-term market opportunities.

The strategy’s integration of traditional pivot points with modern technical tools creates a balanced approach that respects market structure while remaining responsive to intraday price movements. By focusing on key price interactions at critical levels, traders can develop a deeper understanding of market psychology and potentially improve their trading performance.

Ultimately, successful implementation will require thoughtful customization, rigorous testing, and disciplined execution. When properly applied as part of a comprehensive trading plan that includes sound risk management principles, this strategy offers a systematic method for navigating the complexities of intraday markets with greater confidence and precision.

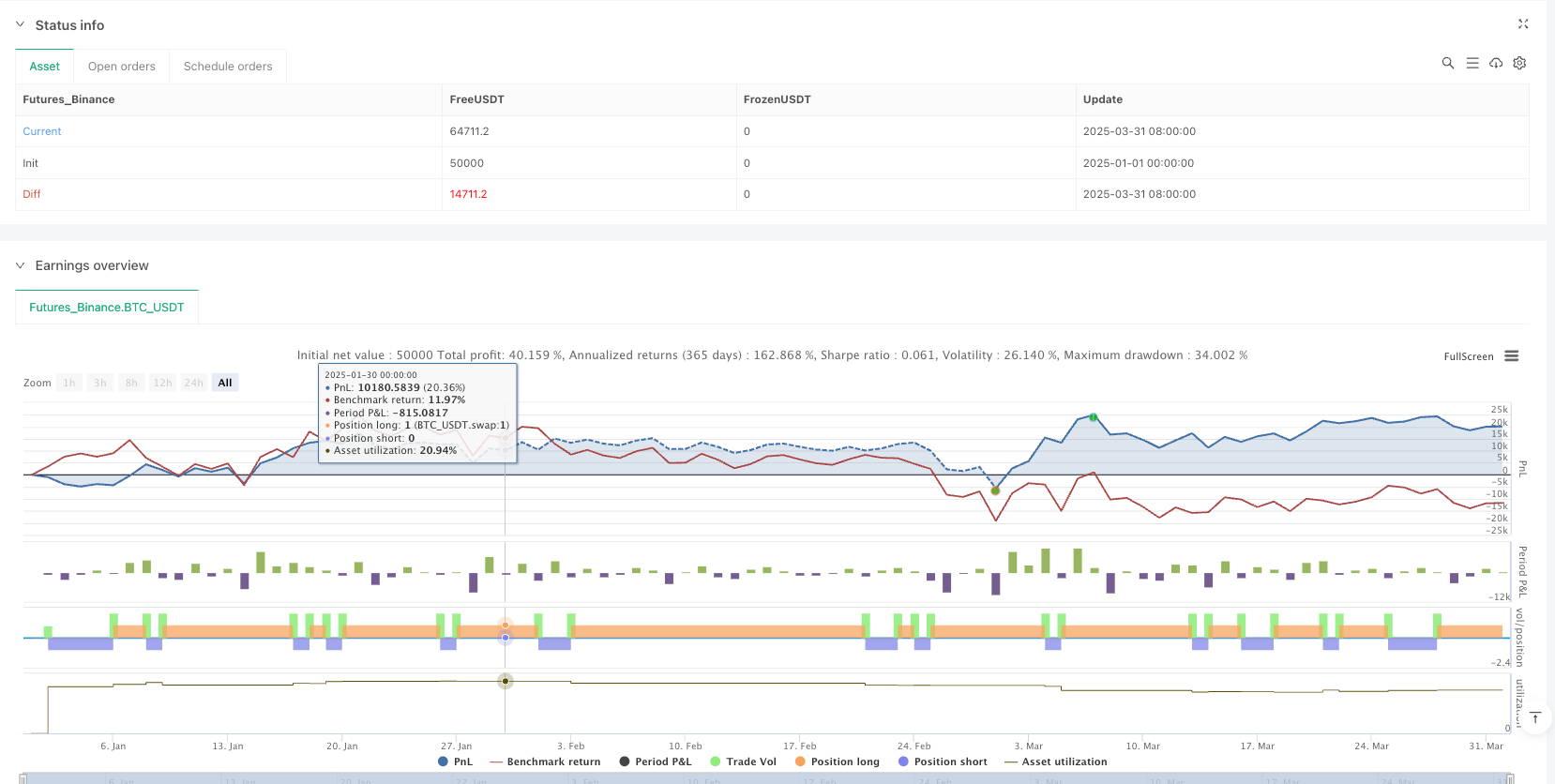

/*backtest

start: 2025-01-01 00:00:00

end: 2025-04-01 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pivot Point CE/PE Strategy", overlay=true)

// Identify 3-minute candles (Assuming the script is applied to a 3-minute chart)

// Calculate candle range

candleRange = high - low

// Conditions for a qualifying green candle

greenCandle = (close > open) and (candleRange >= 17) and (open < (low + 0.382 * candleRange)) and (close > (low + 0.682 * candleRange))

// Conditions for a qualifying red candle

redCandle = (close < open) and (candleRange >= 17)

// Fibonacci levels for qualifying green and red candles

green_fib_0_382 = greenCandle ? high - 0.382 * candleRange : na

green_fib_0_618 = greenCandle ? high - 0.618 * candleRange : na

red_fib_0_382 = redCandle ? low + 0.382 * candleRange : na

red_fib_0_682 = redCandle ? low + 0.682 * candleRange : na

// Daily Pivot Point Calculation

[daily_high, daily_low, daily_close] = request.security(syminfo.tickerid, "D", [high, low, close])

daily_pivot = (daily_high + daily_low + daily_close) / 3

daily_r1 = daily_pivot + (daily_pivot - daily_low)

daily_s1 = daily_pivot - (daily_high - daily_pivot)

daily_r2 = daily_pivot + (daily_high - daily_low)

daily_s2 = daily_pivot - (daily_high - daily_low)

daily_r3 = daily_high + 2 * (daily_pivot - daily_low)

daily_s3 = daily_low - 2 * (daily_high - daily_pivot)

daily_r4 = daily_high + 3 * (daily_pivot - daily_low)

daily_s4 = daily_low - 3 * (daily_high - daily_pivot)

// Updated CPR Calculation

bottom_cpr = (daily_high + daily_low) / 2

top_cpr = (daily_pivot - bottom_cpr) + daily_pivot

// VWAP and MVWAP Calculation

vwap = ta.vwap(close)

mvwap_length = input.int(20, title="MVWAP Length")

mvwap = ta.sma(vwap, mvwap_length)

// Volume Analysis

volume_ma = ta.sma(volume, 20)

plot(volume, color=color.gray, title="Volume")

plot(volume_ma, color=color.orange, title="Volume MA")

// RSI Calculation

rsi_length = input.int(14, title="RSI Length")

rsi = ta.rsi(close, rsi_length)

plot(rsi, color=color.blue, title="RSI")

// SMA and EMA Calculation

sma_length = input.int(50, title="SMA Length")

ema_length = input.int(20, title="EMA Length")

sma = ta.sma(close, sma_length)

ema = ta.ema(close, ema_length)

plot(sma, color=color.red, title="SMA")

plot(ema, color=color.green, title="EMA")

// Dynamic Visibility Condition Based on Chart Scale

show_pivot = (timeframe.isintraday and timeframe.multiplier <= 15)

// Display daily pivot points

plot(show_pivot ? daily_pivot : na, color=color.blue, title="Daily Pivot", style=plot.style_stepline)

plot(show_pivot ? daily_r1 : na, color=color.red, title="Daily R1", style=plot.style_stepline)

plot(show_pivot ? daily_r2 : na, color=color.red, title="Daily R2", style=plot.style_stepline)

plot(show_pivot ? daily_r3 : na, color=color.red, title="Daily R3", style=plot.style_stepline)

plot(show_pivot ? daily_r4 : na, color=color.red, title="Daily R4", style=plot.style_stepline)

plot(show_pivot ? daily_s1 : na, color=color.green, title="Daily S1", style=plot.style_stepline)

plot(show_pivot ? daily_s2 : na, color=color.green, title="Daily S2", style=plot.style_stepline)

plot(show_pivot ? daily_s3 : na, color=color.green, title="Daily S3", style=plot.style_stepline)

plot(show_pivot ? daily_s4 : na, color=color.green, title="Daily S4", style=plot.style_stepline)

// Display Central Pivot Range (CPR)

plot(show_pivot ? top_cpr : na, color=color.purple, title="Top CPR", style=plot.style_stepline)

plot(show_pivot ? bottom_cpr : na, color=color.orange, title="Bottom CPR", style=plot.style_stepline)

plot(vwap, color=color.fuchsia, title="VWAP")

plot(mvwap, color=color.teal, title="MVWAP")

// Mark qualifying candles

plotshape(greenCandle, title="Green Candle", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(redCandle, title="Red Candle", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Detect Green Candle Touching Pivot Points

greenTouchPivot = greenCandle and ((open <= daily_pivot and high >= daily_pivot) or

(open <= daily_r1 and high >= daily_r1) or

(open <= daily_r2 and high >= daily_r2) or

(open <= daily_r3 and high >= daily_r3) or

(open <= daily_r4 and high >= daily_r4) or

(open <= daily_s1 and high >= daily_s1) or

(open <= daily_s2 and high >= daily_s2) or

(open <= daily_s3 and high >= daily_s3) or

(open <= daily_s4 and high >= daily_s4) or (open <= vwap and high >= vwap) or (open <= mvwap and high >= mvwap))

// Detect Red Candle Touching Pivot Points

redTouchPivot = redCandle and ((low <= daily_pivot and open >= daily_pivot) or

(low <= daily_r1 and open >= daily_r1) or

(low <= daily_r2 and open >= daily_r2) or

(low <= daily_r3 and open >= daily_r3) or

(low <= daily_r4 and open >= daily_r4) or

(low <= daily_s1 and open >= daily_s1) or

(low <= daily_s2 and open >= daily_s2) or

(low <= daily_s3 and open >= daily_s3) or

(low <= daily_s4 and open >= daily_s4) or ((open >= vwap and low <= vwap) or (open >= mvwap and low <= mvwap)))

// Mark Green Candle Touching Pivot

plotshape(greenTouchPivot, title="Green Touch Pivot", location=location.abovebar, color=color.green, style=shape.triangleup, text="GTouch")

// Mark Red Candle Touching Pivot

plotshape(redTouchPivot, title="Red Touch Pivot", location=location.belowbar, color=color.red, style=shape.triangledown, text="RTouch")

// CE Entry Below Red Touch Pivot

if (redTouchPivot)

strategy.entry("CE", strategy.long)

// PE Entry Above Green Touch Pivot

if (greenTouchPivot)

strategy.entry("PE", strategy.short)