Gambaran keseluruhan

Ini adalah strategi penunjuk kejutan KDJ beradaptasi pelbagai kerangka masa yang inovatif yang bertujuan untuk memberikan isyarat perdagangan yang lebih tepat dan fleksibel dengan menyesuaikan parameter penunjuk secara dinamik dan menganalisis trend pasaran di pelbagai kerangka masa. Strategi ini menggabungkan pengiraan panjang yang berasaskan volatiliti, pengagihan berat badan di pelbagai kerangka masa, dan penilaian trend yang beradaptasi, yang menyediakan pedagang dengan alat analisis yang kompleks dan kuat.

Prinsip Strategi

Prinsip-prinsip utama strategi ini merangkumi teknik-teknik utama berikut:

- Analisis pelbagai kerangka masa: menggunakan tiga kerangka masa serentak 1 minit, 5 minit dan 15 minit

- Pengiraan panjang ayunan yang beradaptasi: parameter penyesuaian indikator berdasarkan kadar turun naik pasaran yang dinamik

- Pembahagian berat dinamik: pembahagian faktor berat yang berbeza untuk bingkai masa yang berbeza

- Mekanisme penilaian trend: menentukan arah trend pasaran dengan mengira purata smooth AvgTotal

- Penjanaan isyarat pintar: menggabungkan isyarat utama dan isyarat yang dijangkakan untuk meningkatkan ketepatan isyarat

Kelebihan Strategik

- Fleksibiliti yang tinggi: kerangka masa dan konfigurasi berat yang boleh disesuaikan

- Kebolehan beradaptasi dinamik: menyesuaikan parameter penunjuk mengikut turun naik pasaran

- Analisis pelbagai dimensi: mengintegrasikan maklumat dari pelbagai kerangka masa

- Isyarat kelewatan rendah: mengandungi isyarat utama dan isyarat yang diharapkan

- Penapis trend terbina dalam: mengurangkan isyarat salah dalam keadaan pasaran yang tidak baik

Risiko Strategik

- Risiko parameter yang terlalu sesuai

- Kerangka masa berbilang boleh menambah kerumitan isyarat

- Kebolehpercayaan isyarat mungkin menurun dalam keadaan pasaran yang melampau

- Isyarat pengesahan penunjuk diperlukan

Arah pengoptimuman strategi

- Kemasukan algoritma pembelajaran mesin untuk menyesuaikan berat secara dinamik

- Menambah syarat penapisan tambahan

- Optimumkan mekanisme penangguhan

- Membangunkan kesesuaian antara spesies

ringkaskan

Kerangka masa berbilang ini menyesuaikan diri dengan strategi penunjuk indikator goyah KDJ dengan reka bentuk inovatif, memberikan pedagang alat analisis pasaran yang fleksibel, dinamik dan pelbagai dimensi, dengan kelebihan teknologi yang ketara dan ruang untuk peningkatan prestasi yang berpotensi.

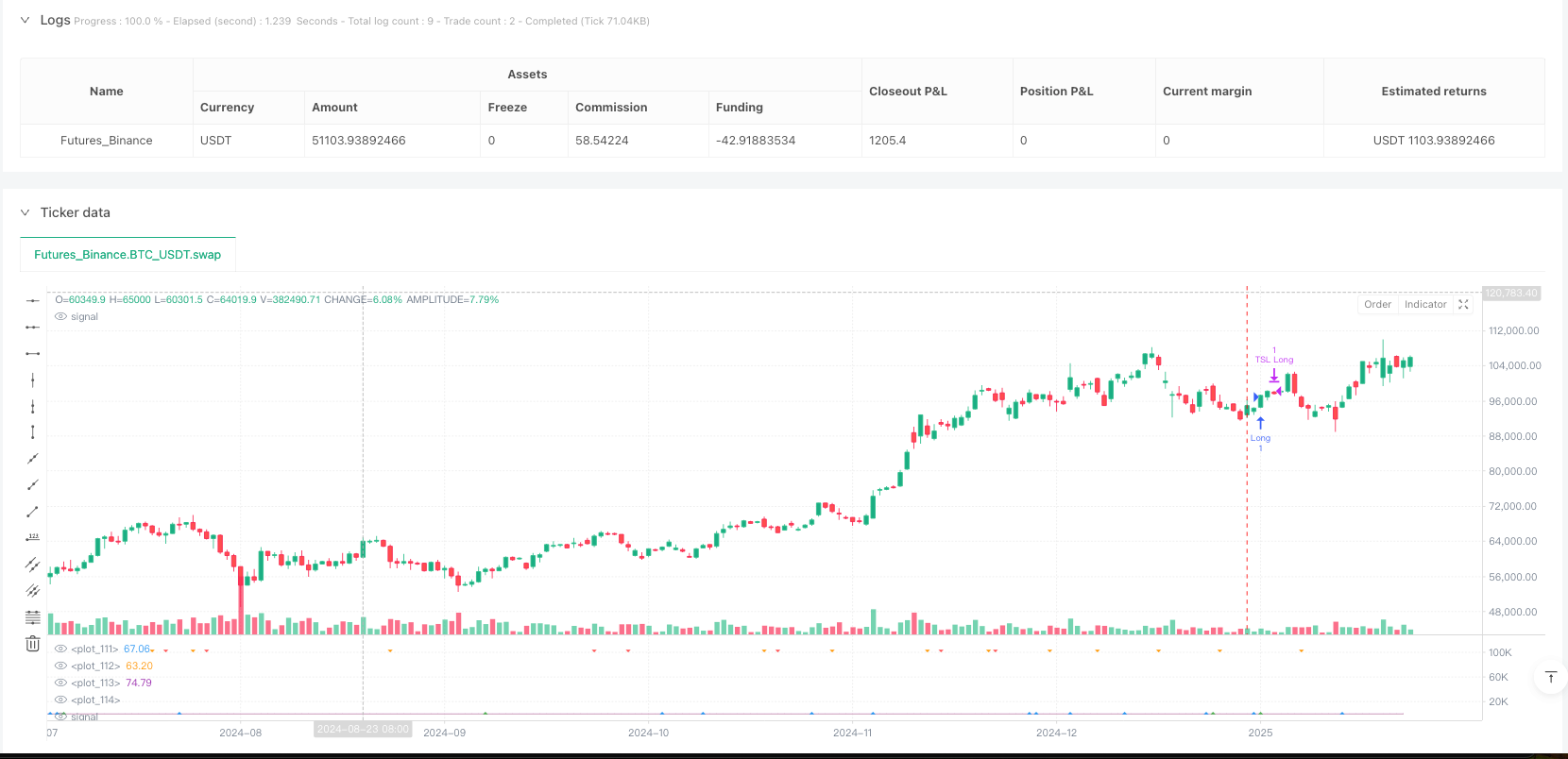

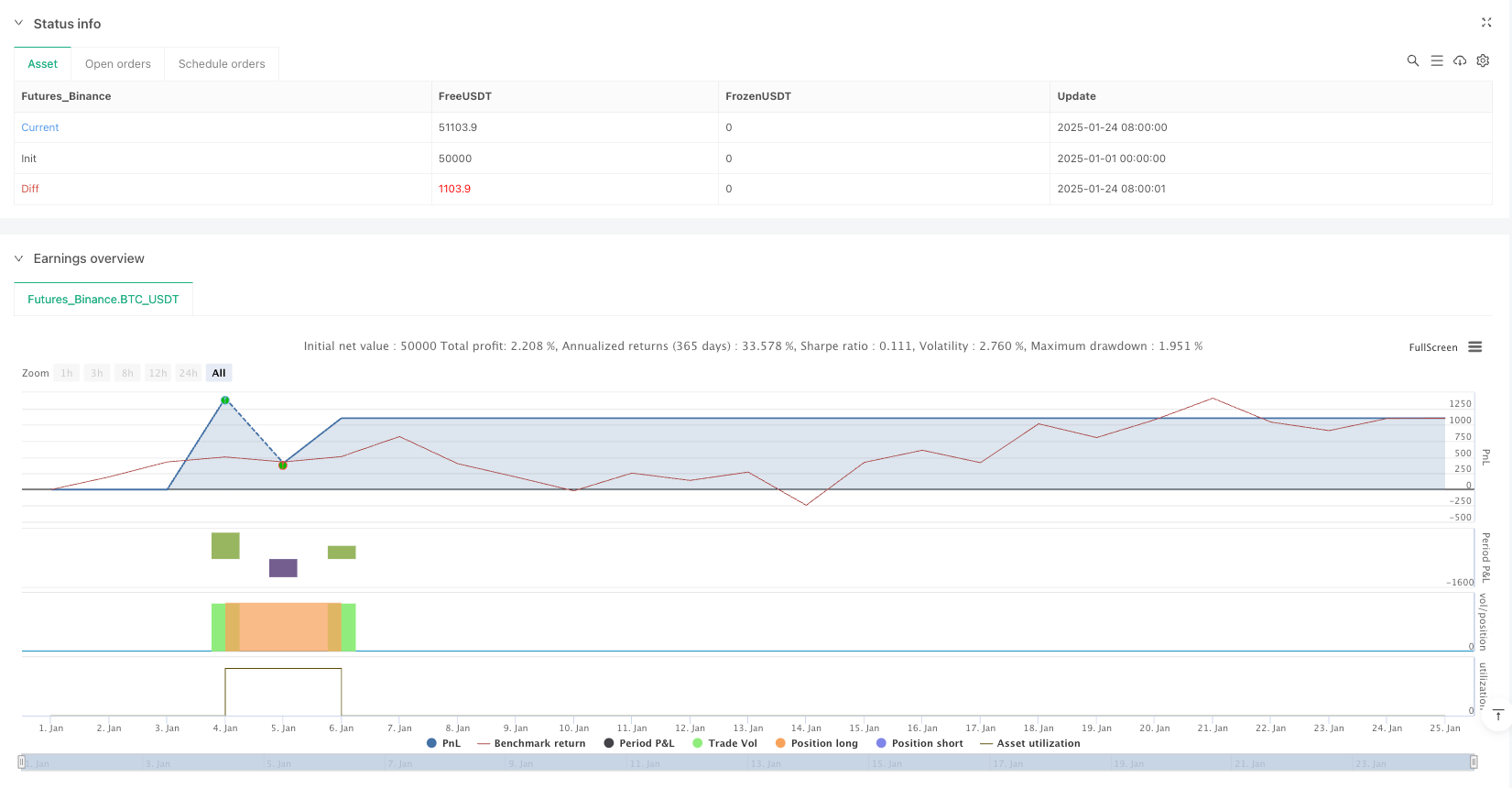

/*backtest

start: 2025-01-01 00:00:00

end: 2025-01-25 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ is subject to the Mozilla Public License 2.0 (https://mozilla.org/MPL/2.0/)

// © Lausekopf

//@version=5

strategy("Adaptive KDJ (MTF)", overlay=false)

// Dropdown for the swing length calculation method

method = input.int(1, title="Calculation Method", options=[1, 2, 3], tooltip="1: Volatility Based\n2: Inverse Volatility\n3: Fixed Length")

// Fixed length for method 3

fixedLength = input.int(9, title="Fixed KDJ Length", minval=3, maxval=15)

// Timeframes

tf1 = input.timeframe("1", title="Timeframe 1")

tf2 = input.timeframe("5", title="Timeframe 2")

tf3 = input.timeframe("15", title="Timeframe 3")

// Timeframe weighting

weightOption = input.int(1, title="Timeframe Weighting", options=[1, 2, 3, 4, 5])

weightTF1 = weightOption == 1 ? 0.5 : weightOption == 2 ? 0.4 : weightOption == 3 ? 0.33 : weightOption == 4 ? 0.2 : 0.1

weightTF2 = 0.33

weightTF3 = 1.0 - (weightTF1 + weightTF2)

// EMA smoothing length

smoothingLength = input.int(5, title="EMA Smoothing Length", minval=1, maxval=50)

// Trend calculation period

trendLength = input.int(40, title="Trend Calculation Period", minval=5, maxval=50)

// KDJ function

f_kdj(len, srcHigh, srcLow, srcClose) =>

roundedLen = int(math.round(len))

high_max = ta.highest(srcHigh, roundedLen)

low_min = ta.lowest(srcLow, roundedLen)

rsv = 100 * (srcClose - low_min) / (high_max - low_min)

k = ta.sma(rsv, 3)

d = ta.sma(k, 3)

j = 3 * k - 2 * d

[k, d, j]

// Swing length function

f_swingLength(tf) =>

atrLen = 14

volatility = request.security(syminfo.tickerid, tf, ta.atr(atrLen) / close)

var float length = na

if method == 1

length := volatility > 0.03 ? 3 : volatility > 0.002 ? 14 : 15

if method == 2

length := 18

if method == 3

length := fixedLength

length

// Calculate swing lengths for each timeframe

swingLength1 = f_swingLength(tf1)

swingLength2 = f_swingLength(tf2)

swingLength3 = f_swingLength(tf3)

// Calculate KDJ values

[k1, d1, j1] = f_kdj(swingLength1, request.security(syminfo.tickerid, tf1, high), request.security(syminfo.tickerid, tf1, low), request.security(syminfo.tickerid, tf1, close))

[k2, d2, j2] = f_kdj(swingLength2, request.security(syminfo.tickerid, tf2, high), request.security(syminfo.tickerid, tf2, low), request.security(syminfo.tickerid, tf2, close))

[k3, d3, j3] = f_kdj(swingLength3, request.security(syminfo.tickerid, tf3, high), request.security(syminfo.tickerid, tf3, low), request.security(syminfo.tickerid, tf3, close))

// Weighted averages

avgK = (k1 * weightTF1 + k2 * weightTF2 + k3 * weightTF3)

avgD = (d1 * weightTF1 + d2 * weightTF2 + d3 * weightTF3)

avgJ = (j1 * weightTF1 + j2 * weightTF2 + j3 * weightTF3)

smoothAvgK = ta.ema(avgK, smoothingLength)

smoothAvgD = ta.ema(avgD, smoothingLength)

smoothAvgJ = ta.ema(avgJ, smoothingLength)

smoothAvgTotal = ta.ema((avgK + avgD + avgJ) / 3, smoothingLength)

// Trend determination

trendAvg = ta.sma(smoothAvgTotal, trendLength)

isUptrend = trendAvg > 60

isDowntrend = trendAvg < 40

// Dynamic signal thresholds

buyLevel = isUptrend ? 40 : isDowntrend ? 15 : 25

sellLevel = isUptrend ? 85 : isDowntrend ? 60 : 75

// Buy/Sell signals

buySignal = smoothAvgJ < buyLevel and ta.crossover(smoothAvgK, smoothAvgD)

sellSignal = smoothAvgJ > sellLevel and ta.crossunder(smoothAvgK, smoothAvgD)

// Anticipated signals

anticipateBuy = (smoothAvgK - smoothAvgK[1]) > 0 and (smoothAvgD - smoothAvgD[1]) < 0 and math.abs(smoothAvgK - smoothAvgD) < 5

anticipateSell = (smoothAvgK - smoothAvgK[1]) < 0 and (smoothAvgD - smoothAvgD[1]) > 0 and math.abs(smoothAvgK - smoothAvgD) < 5

// Entry conditions

longEntryCondition = (buySignal or anticipateBuy) and smoothAvgTotal < 22

shortEntryCondition = (sellSignal or anticipateSell) and smoothAvgTotal > 78

// Entry orders

strategy.entry("Long", strategy.long, when=longEntryCondition)

strategy.entry("Short", strategy.short, when=shortEntryCondition)

// Trailing Stop-Loss

atrMultiplierTSL = 2.5

atrValueTSL = ta.atr(12) * atrMultiplierTSL

strategy.exit("TSL Long", from_entry="Long", trail_points=atrValueTSL / syminfo.mintick, stop=open * 0.9972)

strategy.exit("TSL Short", from_entry="Short", trail_points=atrValueTSL / syminfo.mintick, stop=open * 1.0028)

// Plot signals

plotshape(series=buySignal, location=location.bottom, style=shape.triangleup, color=color.green, size=size.small)

plotshape(series=sellSignal, location=location.top, style=shape.triangledown, color=color.red, size=size.small)

plotshape(series=anticipateBuy, location=location.bottom, style=shape.triangleup, color=color.blue, size=size.tiny, offset=-1)

plotshape(series=anticipateSell, location=location.top, style=shape.triangledown, color=color.orange, size=size.tiny, offset=-1)

// Plot KDJ lines

plot(smoothAvgK, color=color.blue, linewidth=1)

plot(smoothAvgD, color=color.orange, linewidth=1)

plot(smoothAvgJ, color=color.purple, linewidth=1)

plot(smoothAvgTotal, color=color.white, linewidth=1)

// Alert for impending signals

alertcondition(anticipateBuy or anticipateSell, title='Impending KDJ Crossover', message='Possible KDJ crossover detected!')

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Lausekopf