Gambaran Keseluruhan Strategi

Breakout Opening Range (ATR) Tracking Stop Loss Strategy adalah sistem perdagangan kuantitatif yang menggabungkan Breakout Opening Range (Opening Range Breakout) dengan analisis pasaran pintar (Smart Money Concepts). Strategi ini memberi tumpuan kepada menangkap peluang Breakout dalam Julat Harga yang terbentuk 5 minit selepas pembukaan pasaran saham AS (09:30-09:35 EST), dan menggabungkan pelbagai syarat penapisan untuk memastikan kualiti isyarat perdagangan.

Prinsip Strategi

Logik teras strategi penembusan ATR untuk menjejaki hentian terhad berdasarkan kepentingan julat harga awal selepas pembukaan pasaran. Strategi ini pertama-tama menangkap dan merekodkan harga tertinggi dan terendah pada tetingkap masa tertentu (09:30-09:35 EST) untuk membentuk “Julat Pembukaan”. Kemudian, sistem memantau harga untuk tindakan penembusan dalam julat ini, menggabungkan mekanisme penting berikut untuk memastikan kualiti perdagangan:

Pengiktirafan dan pengesahan penembusan dalam kawasan terbukaSistem ini merekodkan harga tertinggi dan terendah dalam tetingkap masa yang ditetapkan, kemudian memantau penembusan. Penembusan mesti disahkan melalui mekanisme penapisan berganda:

- Saringan peratusan garisan bayangan: Pastikan garisan atas / bawah garisan penembusan tidak melebihi peratusan yang ditetapkan dari entiti garisan, untuk mengelakkan penembusan palsu.

- Penapisan jarak penembusan: Pastikan harga penembusan yang munasabah, tidak terlalu kecil (mengelakkan penembusan kecil), dan tidak terlalu besar (mengelakkan perpanjangan berlebihan).

Mekanisme kemasukanStrategi ini menyokong dua jenis kemasukan:

- Kemasukan segera: Kemasukan langsung pada harga penutupan pada carta yang sama yang mengesahkan penembusan yang berkesan.

- Kembalikan masuk: menunggu harga kembali ke kedudukan peratusan yang ditetapkan entiti penembusan dan masuk semula, biasanya boleh diset pada kedudukan pemulihan 50%.

Tetapan Stop LossSistem ini menyediakan dua jenis penangguhan:

- Hentikan Kerosakan Penembusan: Tetapkan Hentikan Kerosakan di luar titik teratas Kerosakan Penembusan.

- Hentikan Jarak Arah: Hentikan Hentikan di luar sempadan arah dalam Jarak Terbuka untuk memberi ruang lebih besar untuk harga.

Pengurusan RisikoSistem menggunakan penggandaan ganjaran risiko (Risk:Reward Multiplier) untuk mengira kedudukan berhenti secara automatik, mewujudkan pengurusan risiko yang dinamik. Sebagai contoh, menetapkan nisbah ganjaran risiko 2: 1 bermakna potensi keuntungan adalah dua kali ganda daripada potensi kerugian.

ATR mengesan kerugian: Apabila keuntungan mencapai nisbah risiko-balas yang ditetapkan, sistem boleh mengaktifkan tracking stop loss berdasarkan ATR, mengunci sebahagian daripada keuntungan sambil membenarkan trend berterusan.

Perdagangan peluang keduaSistem ini secara automatik mencari peluang terobosan yang terbalik dalam tempoh perdagangan terbuka, untuk mewujudkan kemungkinan perdagangan dua hala pada hari itu.

Kelebihan Strategik

Fokus pada peluang dagangan berkualitiDengan menggunakan mekanisme pengesahan berganda (penyaringan garis bayangan, penyaringan jarak), strategi ini dapat mengurangkan jumlah transaksi palsu dan meningkatkan kadar kemenangan.

Mekanisme kemasukan yang fleksibel: Mendukung kemasukan segera atau penarikan balik, menyesuaikan diri dengan gaya perdagangan dan keadaan pasaran yang berbeza. Masukan segera sesuai dengan trend yang kuat, sementara kemasukan balik dapat memperoleh harga kemasukan yang lebih baik.

Pengurusan risiko penyesuaianPengaturan Hentian Dinamis Berasaskan Risiko-Pengembalian-Nombor-Risiko memastikan setiap dagangan mempunyai ciri-ciri risiko yang konsisten, mewujudkan pengurusan dana yang standard.

Memaksimumkan keuntunganATR menjejaki fungsi stop loss sambil melindungi keuntungan yang telah dicapai, membolehkan pergerakan yang kuat berterusan dan mengelakkan penarikan awal.

Visibiliti tinggiSistem ini menyediakan fungsi bantuan visual yang komprehensif, termasuk penanda jarak, penanda pengesahan penembusan, petunjuk status perdagangan, penanda masuk / henti / berhenti, dan lain-lain, untuk meningkatkan intuisi keputusan perdagangan.

Reka bentuk yang tidak berat sebelahPengambilan sepenuhnya strategi:

barstate.isconfirmedMemastikan semua keputusan berdasarkan data harga yang disahkan, mengelakkan bias ramalan, dan sesuai dengan keadaan perdagangan sebenar.Mekanisme peluang keduaDengan mengaktifkan fungsi perdagangan peluang kedua, strategi dapat menyesuaikan diri dengan cepat dengan perubahan pasaran, menangkap peluang terbalik, dan meningkatkan kecekapan penggunaan dana.

Pengurusan sesi yang lebih baikFungsi penutupan sesi automatik yang terbina dalam memastikan tidak menyimpan dagangan semalaman, mengurangkan risiko bermalam.

Risiko Strategik

Risiko pergerakan dalam tempoh pembentukanDalam tempoh pembentukan antara 09:30-09:35, pasaran mungkin mengalami turun naik yang luar biasa, yang menyebabkan antara terlalu lebar atau terlalu sempit. Antara yang terlalu lebar boleh menyebabkan kerugian yang terlalu besar, dan antara yang terlalu sempit boleh mencetuskan pecah palsu yang kerap. PenyelesaianAnda boleh mempertimbangkan untuk menambah ukuran penapis untuk tempoh terbuka, untuk mengecualikan tempoh yang tidak biasa; atau menyesuaikan penapis tarikh dagangan untuk mengelakkan hari-hari tertentu yang mempunyai turun naik yang tinggi (seperti hari pengumuman data ekonomi penting).

Risiko penarikan balik selepas penembusan: Pasaran mungkin akan berpatah balik selepas penembusan yang berkesan, menyebabkan pasaran terus bergerak ke arah yang sama selepas penangguhan telah dicetuskan. PenyelesaianPertimbangkan untuk menggunakan tetapan henti rugi yang lebih longgar, seperti henti rugi pada jarak yang sama; atau menyesuaikan mekanisme kemasukan untuk memutar balik kemasukan untuk mendapatkan harga kemasukan yang lebih baik dan pendedahan risiko yang lebih kecil.

Kualiti isyarat bergantung kepada tetapan penapisPencerobohan: Penapis garis bayangan yang disahkan dan parameter penapis jarak mempunyai kesan yang ketara terhadap kualiti isyarat, parameter yang tidak betul mungkin menapis peluang perdagangan yang baik atau menerima terlalu banyak isyarat berkualiti rendah. PenyelesaianMengoptimumkan parameter penapis dengan mengkaji semula sejarah untuk mencari tetapan terbaik untuk pasaran dan varieti tertentu. Pertimbangkan untuk menggunakan parameter penyesuaian dan menyesuaikan standard penapisan mengikut dinamik turun naik pasaran.

Sensitiviti parameter hentiTetapan parameter ATR yang mengesan kerugian terlampau ketat boleh menyebabkan penarikan diri terlalu awal dalam penyesuaian kecil, manakala tetapan yang terlalu longgar boleh menyebabkan terlalu banyak pulangan keuntungan. Penyelesaian: Sesuaikan kitaran ATR dan penggandaan berdasarkan ciri-ciri turun naik sejarah varieti sasaran; pertimbangkan untuk melaksanakan strategi seting seting, beberapa kedudukan menggunakan stop loss tetap, dan beberapa kedudukan menggunakan stop loss pengesanan.

Had frekuensi daganganStrategi: Perdagangan maksimum dua kali sehari (perdagangan awal dan perdagangan peluang kedua) mungkin tidak dapat memanfaatkan sepenuhnya semua peluang dalam sehari. PenyelesaianPertimbangan strategi pengembangan untuk memantau jarak harga penting pada waktu lain dalam hari; atau strategi gabungan untuk menambah sumber isyarat dagangan yang digabungkan dengan petunjuk teknikal lain.

Arah pengoptimuman strategi

Siklus masa lapangStrategi semasa menggunakan selang terbuka 5 minit yang tetap, boleh mempertimbangkan panjang selang penyesuaian mengikut dinamik turun naik pasaran. Dalam pasaran turun naik yang rendah, selang boleh dipersingkat menjadi 3 minit, dan dalam pasaran turun naik yang tinggi, ia boleh dilanjutkan menjadi 10 minit, lebih baik untuk menyesuaikan diri dengan keadaan pasaran yang berbeza.

Pengesahan kuantiti gabunganMenambah syarat penapisan jumlah transaksi dalam mekanisme pengesahan penembusan, yang memerlukan jumlah transaksi pada saat penembusan secara ketara lebih tinggi daripada jumlah transaksi rata-rata dalam beberapa kitaran sebelumnya, meningkatkan keberkesanan penembusan. Ini dapat dicapai dengan mengira nisbah jumlah transaksi penembusan dengan nilai purata jumlah transaksi N kitaran sebelumnya.

Analisis pelbagai kerangka masa: Memperkenalkan penapis arah trend pada bingkai masa yang lebih tinggi, masuk hanya apabila arah trend garis matahari atau garis jam selaras dengan arah penembusan, meningkatkan peluang kemenangan perdagangan. Trend bingkai masa yang lebih tinggi boleh ditentukan dengan simpangan purata bergerak sederhana atau penunjuk trend yang lebih tinggi.

Pengurusan wang yang optimum: melaksanakan mekanisme penyesuaian saiz kedudukan yang dinamik, menyesuaikan jumlah kontrak secara automatik berdasarkan turun naik sejarah, saiz akaun semasa dan prestasi terkini, untuk mengawal risiko yang lebih halus. Sebagai contoh, meningkatkan kedudukan secara beransur-ansur selepas keuntungan berturut-turut dan mengurangkan kedudukan selepas kerugian berturut-turut.

Model pembelajaran mesin bersepaduModel pembelajaran mesin diperkenalkan untuk menilai kualiti penembusan, mengenal pasti model penembusan yang paling mungkin berjaya melalui model latihan data sejarah. Ciri-ciri boleh merangkumi saiz ruang terbuka, turun naik pasaran, pergerakan harga pada hari perdagangan sebelumnya, dan lain-lain.

Peningkatan Logik Perniagaan Peluang KeduaMengoptimumkan keadaan pemicu perdagangan peluang kedua, bukan hanya berdasarkan kegagalan perdagangan awal, tetapi juga mempertimbangkan perubahan struktur pasaran dan penunjuk momentum baru, untuk meningkatkan kadar kejayaan perdagangan kedua.

Parameter varieti peribadiPerkembangan set parameter yang dioptimumkan untuk pelbagai jenis perdagangan, dengan mengambil kira sifat turun naik dan tingkah laku harga yang unik untuk setiap jenis. Sebagai contoh, jenis yang lebih turun naik mungkin memerlukan tetapan penapis yang lebih longgar dan nisbah ganjaran risiko yang lebih konservatif.

Menyatakan sentimen pasaranMemperkenalkan indeks VIX atau penunjuk sentimen pasaran lain, menyesuaikan parameter strategi atau melarang perdagangan sementara semasa sentimen pasaran yang melampau, mengelakkan keadaan ketidakpastian yang tinggi.

ringkaskan

Breakout ATR Tracking Stop Loss Strategy adalah sistem perdagangan kuantitatif yang tersusun dengan baik yang menggabungkan penembusan dalam tempoh pembukaan, mekanisme penapisan pintar, pilihan masuk yang fleksibel, dan fungsi pengurusan risiko yang canggih. Strategi ini sangat sesuai untuk perdagangan dalam sehari di pasaran saham dan niaga hadapan AS, yang menghasilkan keuntungan dengan menangkap penembusan arah selepas pembukaan.

Nilai teras strategi ini adalah mekanisme pengesahan bertingkat dan sistem pengurusan risiko, yang secara signifikan mengurangkan perdagangan palsu melalui penapis garis bayangan dan jarak, sambil menggunakan perkalian ganjaran risiko dan pengesanan henti kerugian ATR untuk memastikan pendedahan risiko dan perlindungan keuntungan yang konsisten. Fungsi perdagangan peluang kedua menambah fleksibiliti dan peluang keuntungan tambahan kepada strategi.

Walaupun strategi ini mempunyai banyak kelebihan, pengguna perlu mengambil perhatian terhadap kepentingan pengoptimuman parameter, yang mungkin memerlukan penyesuaian khusus untuk pasaran dan varieti yang berbeza untuk mencapai kesan terbaik. Pada masa yang sama, peniaga disarankan untuk menggunakan strategi ini sebagai sebahagian daripada sistem perdagangan yang lengkap, digabungkan dengan analisis pasaran yang lebih luas dan prinsip pengurusan risiko.

Strategi ini mempunyai potensi untuk meningkatkan kestabilan dan keuntungan lebih lanjut dan menjadi alat yang kuat dalam kotak alat peniaga profesional dengan melaksanakan arah pengoptimuman yang disyorkan, terutamanya parameter yang sesuai, analisis jangka masa yang banyak dan sistem pengurusan wang yang dipertingkatkan.

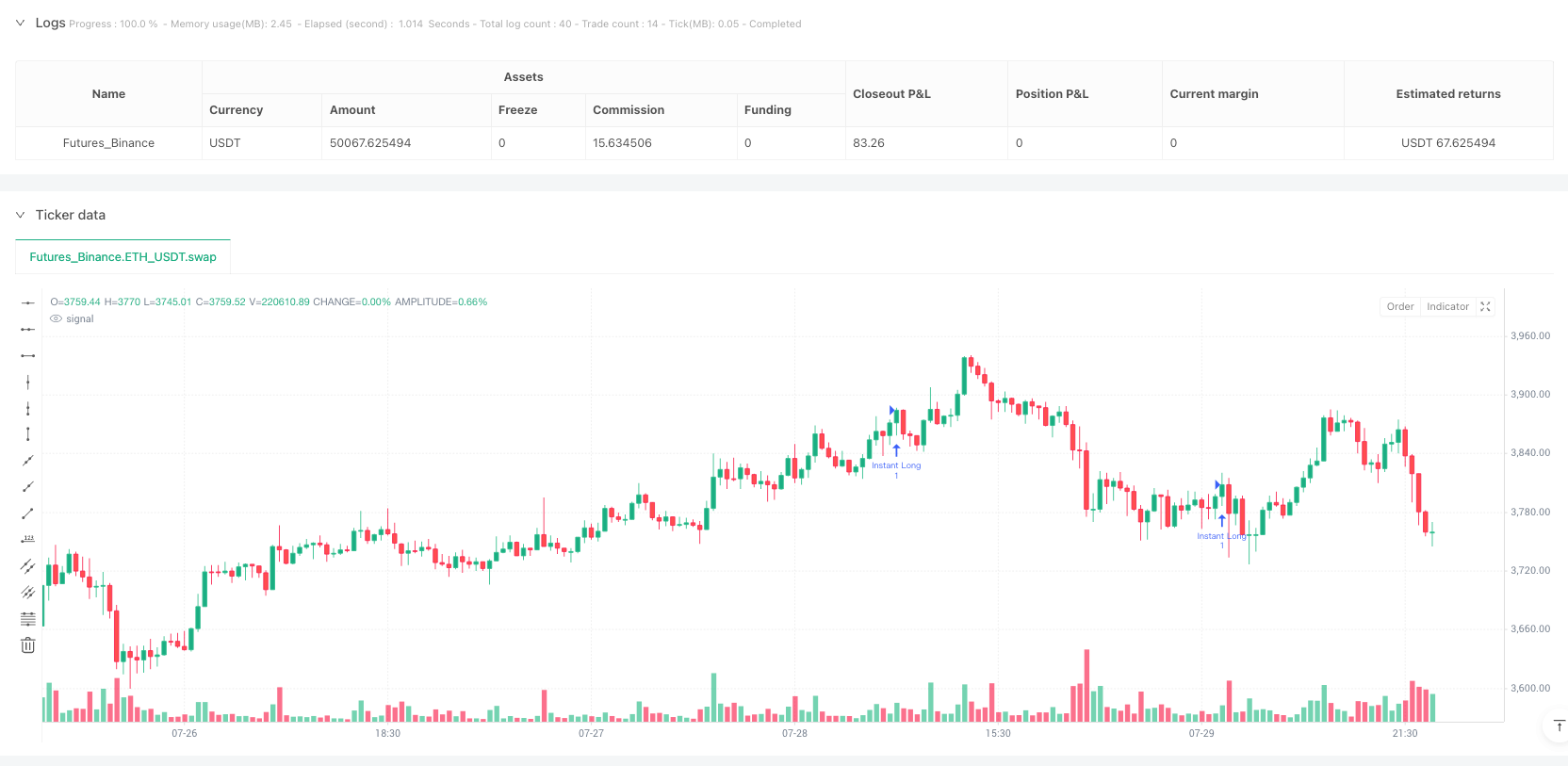

/*backtest

start: 2025-07-18 00:00:00

end: 2025-07-30 00:00:00

period: 30m

basePeriod: 30m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Casper SMC 5min ORB - Roboquant AI", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1, max_bars_back=500, calc_on_order_fills=true, calc_on_every_tick=false, initial_capital=50000, currency=currency.USD)

// === STRATEGY SETTINGS ===

// Risk Management

contracts = input.int(1, "Contracts", minval=1, group="Risk Management")

risk_multiplier = input.float(2.0, "Risk:Reward Multiplier", minval=0.5, maxval=10.0, group="Risk Management")

sl_points = input.int(2, "Stop Loss Points Below/Above Breakout Candle", minval=1, group="Risk Management")

// Entry Settings

entry_type = input.string("Instant", "Entry Type", options=["Retracement", "Instant"], group="Entry Settings")

retracement_percent = input.float(50.0, "Retracement % of Breakout Candle Body", minval=10.0, maxval=90.0, group="Entry Settings")

// Stop Loss Settings

sl_type = input.string("Opposite Range", "Stop Loss Type", options=["Breakout Candle", "Opposite Range"], group="Stop Loss Settings")

// Second Chance Trade Settings

enable_second_chance = input.bool(false, "Enable Second Chance Trade", group="Second Chance Trade")

second_chance_info = input.string("If initial SL is hit, allow opposite breakout trade", "Info: Second Chance Logic", group="Second Chance Trade")

// Breakout Filter Settings

use_wick_filter = input.bool(false, "Use Wick Filter", group="Breakout Filter")

max_wick_percent = input.float(50.0, "Max Wick % of Candle Body", minval=10.0, maxval=200.0, group="Breakout Filter")

// Breakout Distance Filters

use_breakout_distance_filter = input.bool(true, "Use Breakout Distance Filter", group="Breakout Distance Filter")

min_breakout_multiplier = input.float(0.1, "Min Breakout Distance (OR Size * X)", minval=0.0, maxval=3.0, group="Breakout Distance Filter")

max_breakout_multiplier = input.float(1.6, "Max Breakout Distance (OR Size * X)", minval=0.5, maxval=5.0, group="Breakout Distance Filter")

// Trailing Stop Loss Settings

use_trailing_sl = input.bool(false, "Use Trailing Stop Loss", group="Trailing Stop Loss")

profit_r_multiplier = input.float(1.0, "Start Trailing After X R Profit", minval=0.5, maxval=5.0, group="Trailing Stop Loss")

atr_length = input.int(14, "ATR Length", minval=1, maxval=50, group="Trailing Stop Loss")

atr_multiplier = input.float(1.0, "ATR Multiplier for Trailing", minval=0.5, maxval=5.0, group="Trailing Stop Loss")

// Session Management

or_start_hour = input.int(9, "Opening Range Start Hour", minval=0, maxval=23, group="Session Management")

or_start_minute = input.int(30, "Opening Range Start Minute", minval=0, maxval=59, group="Session Management")

or_end_minute = input.int(35, "Opening Range End Minute", minval=0, maxval=59, group="Session Management")

session_timezone = input.string("America/New_York", "Session Timezone", group="Session Management")

force_session_close = input.bool(true, "Force Close at Session End", group="Session Management")

session_end_hour = input.int(16, "Session End Hour", minval=0, maxval=23, group="Session Management")

session_end_minute = input.int(0, "Session End Minute", minval=0, maxval=59, group="Session Management")

// Day of Week Trading Filters

trade_monday = input.bool(true, "Trade on Monday", group="Day of Week Filters")

trade_tuesday = input.bool(true, "Trade on Tuesday", group="Day of Week Filters")

trade_wednesday = input.bool(true, "Trade on Wednesday", group="Day of Week Filters")

trade_thursday = input.bool(true, "Trade on Thursday", group="Day of Week Filters")

trade_friday = input.bool(true, "Trade on Friday", group="Day of Week Filters")

// Visual Settings

high_line_color = input.color(color.green, title="Opening Range High Line Color", group="Visual Settings")

low_line_color = input.color(color.red, title="Opening Range Low Line Color", group="Visual Settings")

// Label Control Settings

show_trading_disabled_labels = input.bool(false, "Show Trading Disabled Labels", group="Label Controls")

show_breakout_validation_labels = input.bool(true, "Show Breakout Validation Labels", group="Label Controls")

show_second_chance_labels = input.bool(false, "Show Second Chance Labels", group="Label Controls")

show_trade_status_labels = input.bool(false, "Show Trade Status Labels", group="Label Controls")

show_entry_labels = input.bool(false, "Show Entry Labels", group="Label Controls")

show_sl_tp_labels = input.bool(false, "Show Stop Loss / Take Profit Labels", group="Label Controls")

// === VARIABLES ===

// ATR for trailing stop loss

atr = ta.atr(atr_length)

// === NYSE OPENING RANGE LOGIC ===

// FIXED: Using configurable hour/minute inputs with timezone

current_time = time(timeframe.period, "0000-2400:23456", session_timezone)

current_hour = hour(current_time, session_timezone)

current_minute = minute(current_time, session_timezone)

is_opening_range = current_hour == or_start_hour and current_minute >= or_start_minute and current_minute <= or_end_minute

// Check if we're at the start of a new trading day - FIXED: More reliable detection

is_new_day = ta.change(time("1D"))

// ADDED: Check if trading is allowed on current day of week (using session timezone)

current_day = dayofweek(current_time, session_timezone)

is_trading_day_allowed = (current_day == dayofweek.monday and trade_monday) or (current_day == dayofweek.tuesday and trade_tuesday) or (current_day == dayofweek.wednesday and trade_wednesday) or (current_day == dayofweek.thursday and trade_thursday) or (current_day == dayofweek.friday and trade_friday)

// Variables to store opening range high and low for current day

var float or_high = na

var float or_low = na

var bool lines_drawn = false

var bool breakout_occurred = false

var float breakout_candle_high = na

var float breakout_candle_low = na

var float breakout_price = na

var string breakout_direction = na

var int or_start_bar = na // ADDED: Store the bar index when opening range starts

// ADDED: Second chance trade variables

var bool first_trade_sl_hit = false

var string first_trade_direction = na

var bool second_chance_available = false

var bool second_trade_taken = false

var bool daily_trades_complete = false // ADDED: Prevent more than 2 trades per day

// Reset variables at the start of each trading day

if is_new_day

or_high := na

or_low := na

lines_drawn := false

breakout_occurred := false

breakout_candle_high := na

breakout_candle_low := na

breakout_price := na

breakout_direction := na

or_start_bar := na // ADDED: Reset opening range start bar

// ADDED: Reset second chance variables

first_trade_sl_hit := false

first_trade_direction := na

second_chance_available := false

second_trade_taken := false

daily_trades_complete := false // ADDED: Reset trade limit

// Capture opening range data during 09:30-09:35 EST

if is_opening_range

if na(or_high) or na(or_low)

or_high := high

or_low := low

or_start_bar := bar_index // ADDED: Store the bar index when opening range starts

else

or_high := math.max(or_high, high)

or_low := math.min(or_low, low)

// Draw lines when we're past the opening range and haven't drawn yet

if not is_opening_range and not na(or_high) and not na(or_low) and not na(or_start_bar) and not lines_drawn

// FIXED: Lines start from the actual opening range start time and extend forward

start_x = or_start_bar

end_x = bar_index + 50 // Extend lines forward for visibility

lines_drawn := true

// ADDED: Show visual indicator if trading is disabled for current day

if not is_trading_day_allowed and show_trading_disabled_labels

day_name = current_day == dayofweek.monday ? "Monday" :

current_day == dayofweek.tuesday ? "Tuesday" :

current_day == dayofweek.wednesday ? "Wednesday" :

current_day == dayofweek.thursday ? "Thursday" :

current_day == dayofweek.friday ? "Friday" : "Weekend"

label.new(x=bar_index, y=(or_high + or_low) / 2, text="Trading Disabled\n" + day_name, color=color.gray, textcolor=color.white, style=label.style_label_center, size=size.normal)

// Check for breakouts after opening range is complete (only first breakout of the day)

// FIXED: Added barstate.isconfirmed to avoid lookahead bias

if barstate.isconfirmed and not is_opening_range and not na(or_high) and not na(or_low) and lines_drawn and not breakout_occurred and not daily_trades_complete and is_trading_day_allowed

// Calculate candle body and wick percentages

candle_body = math.abs(close - open)

top_wick = high - math.max(open, close)

bottom_wick = math.min(open, close) - low

top_wick_percent = candle_body > 0 ? (top_wick / candle_body) * 100 : 0

bottom_wick_percent = candle_body > 0 ? (bottom_wick / candle_body) * 100 : 0

// ADDED: Calculate opening range size for distance filters

or_size = or_high - or_low

// Check for first breakout above opening range high

if close > or_high

// FIXED: Mark breakout as occurred FIRST (this is THE breakout candle)

breakout_occurred := true

breakout_candle_high := high

breakout_candle_low := low

breakout_price := close

breakout_direction := "long"

// ADDED: Validate this specific breakout candle against distance filter

breakout_distance_valid = true

if use_breakout_distance_filter

min_breakout_level = or_high + (or_size * min_breakout_multiplier)

max_breakout_level = or_high + (or_size * max_breakout_multiplier)

breakout_distance_valid := close >= min_breakout_level and close <= max_breakout_level

// Apply wick filter for long breakouts

wick_filter_valid = not use_wick_filter or top_wick_percent <= max_wick_percent

// Show appropriate label based on validation results

if show_breakout_validation_labels

if wick_filter_valid and breakout_distance_valid

label.new(x=bar_index, y=high, text="VALID", color=high_line_color, textcolor=color.white, style=label.style_label_down, size=size.tiny)

else

label.new(x=bar_index, y=high, text="INVALID", color=color.gray, textcolor=color.white, style=label.style_label_down, size=size.tiny)

// Mark breakout as invalid so no trade will be placed (regardless of label setting)

if not (wick_filter_valid and breakout_distance_valid)

breakout_direction := "invalid"

// Check for first breakout below opening range low

else if close < or_low

// FIXED: Mark breakout as occurred FIRST (this is THE breakout candle)

breakout_occurred := true

breakout_candle_high := high

breakout_candle_low := low

breakout_price := close

breakout_direction := "short"

// ADDED: Validate this specific breakout candle against distance filter

breakout_distance_valid = true

if use_breakout_distance_filter

min_breakout_level = or_low - (or_size * min_breakout_multiplier)

max_breakout_level = or_low - (or_size * max_breakout_multiplier)

breakout_distance_valid := close <= min_breakout_level and close >= max_breakout_level

// Apply wick filter for short breakouts

wick_filter_valid = not use_wick_filter or bottom_wick_percent <= max_wick_percent

// Show appropriate label based on validation results

if show_breakout_validation_labels

if wick_filter_valid and breakout_distance_valid

label.new(x=bar_index, y=low, text="VALID", color=low_line_color, textcolor=color.white, style=label.style_label_up, size=size.tiny)

else

label.new(x=bar_index, y=low, text="INVALID", color=color.gray, textcolor=color.white, style=label.style_label_up, size=size.tiny)

// Mark breakout as invalid so no trade will be placed (regardless of label setting)

if not (wick_filter_valid and breakout_distance_valid)

breakout_direction := "invalid"

// ADDED: Check for second chance breakout (opposite direction after initial SL hit)

// FIXED: Added barstate.isconfirmed to avoid lookahead bias

if barstate.isconfirmed and not is_opening_range and not na(or_high) and not na(or_low) and lines_drawn and second_chance_available and not second_trade_taken and not daily_trades_complete and is_trading_day_allowed

// Calculate candle body and wick percentages

candle_body = math.abs(close - open)

top_wick = high - math.max(open, close)

bottom_wick = math.min(open, close) - low

top_wick_percent = candle_body > 0 ? (top_wick / candle_body) * 100 : 0

bottom_wick_percent = candle_body > 0 ? (bottom_wick / candle_body) * 100 : 0

// ADDED: Calculate opening range size for distance filters

or_size = or_high - or_low

// If first trade was LONG and failed, look for SHORT breakout

if first_trade_direction == "long" and close < or_low

// FIXED: Mark second chance breakout as taken FIRST

second_trade_taken := true

second_chance_available := false

breakout_candle_high := high

breakout_candle_low := low

breakout_price := close

breakout_direction := "short"

// ADDED: Validate this specific breakout candle against distance filter

breakout_distance_valid = true

if use_breakout_distance_filter

min_breakout_level = or_low - (or_size * min_breakout_multiplier)

max_breakout_level = or_low - (or_size * max_breakout_multiplier)

breakout_distance_valid := close <= min_breakout_level and close >= max_breakout_level

// Apply wick filter for short breakouts

wick_filter_valid = not use_wick_filter or bottom_wick_percent <= max_wick_percent

// Show appropriate label based on validation results

if show_second_chance_labels

if wick_filter_valid and breakout_distance_valid

label.new(x=bar_index, y=low, text="2nd Chance\nOR Low Break\nVALID", color=color.orange, textcolor=color.white, style=label.style_label_up, size=size.tiny)

else

label.new(x=bar_index, y=low, text="2nd Chance\nOR Low Break\nINVALID", color=color.gray, textcolor=color.white, style=label.style_label_up, size=size.tiny)

// Mark breakout as invalid so no trade will be placed (regardless of label setting)

if not (wick_filter_valid and breakout_distance_valid)

breakout_direction := "invalid"

// If first trade was SHORT and failed, look for LONG breakout

else if first_trade_direction == "short" and close > or_high

// FIXED: Mark second chance breakout as taken FIRST

second_trade_taken := true

second_chance_available := false

breakout_candle_high := high

breakout_candle_low := low

breakout_price := close

breakout_direction := "long"

// ADDED: Validate this specific breakout candle against distance filter

breakout_distance_valid = true

if use_breakout_distance_filter

min_breakout_level = or_high + (or_size * min_breakout_multiplier)

max_breakout_level = or_high + (or_size * max_breakout_multiplier)

breakout_distance_valid := close >= min_breakout_level and close <= max_breakout_level

// Apply wick filter for long breakouts

wick_filter_valid = not use_wick_filter or top_wick_percent <= max_wick_percent

// Show appropriate label based on validation results

if show_second_chance_labels

if wick_filter_valid and breakout_distance_valid

label.new(x=bar_index, y=high, text="2nd Chance\nOR High Break\nVALID", color=color.orange, textcolor=color.white, style=label.style_label_down, size=size.tiny)

else

label.new(x=bar_index, y=high, text="2nd Chance\nOR High Break\nINVALID", color=color.gray, textcolor=color.white, style=label.style_label_down, size=size.tiny)

// Mark breakout as invalid so no trade will be placed (regardless of label setting)

if not (wick_filter_valid and breakout_distance_valid)

breakout_direction := "invalid"

// === STRATEGY LOGIC ===

// Check if we have a breakout and place retracement entry orders

var bool entry_placed = false

var bool second_entry_placed = false // ADDED: Track second trade entry separately

var float entry_price = na

var float stop_loss = na

var float take_profit = na

var float trailing_stop = na

var bool trailing_active = false

var float initial_risk = na

var bool trailing_started = false

var string current_entry_id = na // FIXED: Track which entry ID we're using

// Arrays to store historical trade boxes

var array<box> historical_trade_boxes = array.new<box>()

var array<box> historical_sl_boxes = array.new<box>()

var array<box> historical_tp_boxes = array.new<box>()

// Variables to track current active trade boxes for extending to exit

var box current_profit_box = na

var box current_sl_box = na

// ADDED: General position close detection for extending boxes - Handle timing issues

if barstate.isconfirmed and strategy.position_size == 0 and strategy.position_size[1] != 0

// Extend trade visualization boxes to exact exit point when any position closes

if not na(current_profit_box)

// Ensure minimum 8 bars width or extend to current bar, whichever is longer

box_left = box.get_left(current_profit_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_profit_box, final_right)

current_profit_box := na // Clear reference after extending

if not na(current_sl_box)

// Ensure minimum 8 bars width or extend to current bar, whichever is longer

box_left = box.get_left(current_sl_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_sl_box, final_right)

current_sl_box := na // Clear reference after extending

// ADDED: Backup safety check - extend boxes if position is closed but boxes still active

if not na(current_profit_box) and strategy.position_size == 0

box_left = box.get_left(current_profit_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_profit_box, final_right)

current_profit_box := na

if not na(current_sl_box) and strategy.position_size == 0

box_left = box.get_left(current_sl_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_sl_box, final_right)

current_sl_box := na

// Reset entry flag on new day

if is_new_day

entry_placed := false

second_entry_placed := false // ADDED: Reset second entry flag

entry_price := na

stop_loss := na

take_profit := na

trailing_stop := na

trailing_active := false

initial_risk := na

trailing_started := false

current_entry_id := na // FIXED: Reset entry ID

current_profit_box := na // ADDED: Reset current trade boxes

current_sl_box := na

// SIMPLIFIED: Detect when position closes to enable second chance (FIXED for lookahead bias)

if barstate.isconfirmed and strategy.position_size == 0 and strategy.position_size[1] != 0 and entry_placed and not first_trade_sl_hit

// A position just closed and we had an active trade

if enable_second_chance and not second_trade_taken

// Simplified logic - if position closed, enable second chance

first_trade_sl_hit := true

first_trade_direction := breakout_direction

second_chance_available := true

// Reset variables for potential second trade

entry_price := na

trailing_stop := na

trailing_active := false

initial_risk := na

trailing_started := false

current_entry_id := na

// Add visual marker

if show_trade_status_labels

label.new(x=bar_index, y=close, text="Trade Closed\nSecond Chance Available", color=color.yellow, textcolor=color.black, style=label.style_label_down, size=size.tiny)

else

// Second chance not enabled or already taken - mark day complete

daily_trades_complete := true

// ADDED: Handle case where first breakout was invalid (no trade placed)

if breakout_occurred and breakout_direction == "invalid" and enable_second_chance and not first_trade_sl_hit

// First breakout was invalid, enable second chance immediately

first_trade_sl_hit := true

// Determine what direction the invalid breakout was

first_trade_direction := breakout_price > or_high ? "long" : "short"

second_chance_available := true

if show_trade_status_labels

label.new(x=bar_index + 1, y=(or_high + or_low) / 2, text="First Breakout Invalid\nSecond Chance Available", color=color.yellow, textcolor=color.black, style=label.style_label_center, size=size.tiny)

// REMOVED: Complex historical box cleanup to avoid lookahead bias

// Historical boxes will be cleaned up automatically by Pine Script's runtime

// Place entry orders after breakout - FIXED: Add barstate.isconfirmed for consistency

if barstate.isconfirmed and not daily_trades_complete and is_trading_day_allowed and ((breakout_occurred and not entry_placed and not na(breakout_candle_high) and breakout_direction != "invalid") or (second_trade_taken and not second_entry_placed and not na(breakout_candle_high) and breakout_direction != "invalid"))

// For long breakout

if breakout_direction == "long"

// Calculate stop loss based on selected method

if sl_type == "Breakout Candle"

stop_loss := breakout_candle_low - (sl_points * syminfo.mintick)

else

// Use opposite side of opening range (below opening range low)

stop_loss := or_low - (sl_points * syminfo.mintick)

if entry_type == "Retracement"

// Calculate retracement entry price (x% of breakout candle body)

breakout_candle_body = breakout_candle_high - breakout_candle_low

retracement_amount = breakout_candle_body * (retracement_percent / 100)

entry_price := breakout_candle_high - retracement_amount

// FIXED: Store the entry ID we're using (differentiate first vs second chance)

current_entry_id := second_trade_taken ? "Long Retracement 2nd" : "Long Retracement"

// Place buy limit order at retracement level

strategy.entry(current_entry_id, strategy.long, limit=entry_price, qty=contracts)

// Add visual markers

if show_entry_labels

entry_label_text = second_trade_taken ? "BUY LIMIT (2nd)\n" + str.tostring(entry_price, "#.##") : "BUY LIMIT\n" + str.tostring(entry_price, "#.##")

label.new(x=bar_index, y=entry_price, text=entry_label_text, color=color.green, textcolor=color.white, style=label.style_label_up, size=size.tiny)

else

// Immediate entry at breakout candle close

entry_price := breakout_price

// FIXED: Store the entry ID we're using (differentiate first vs second chance)

current_entry_id := second_trade_taken ? "Instant Long 2nd" : "Instant Long"

// Place buy market order

strategy.entry(current_entry_id, strategy.long, qty=contracts)

// Add visual markers

if show_entry_labels

entry_label_text = second_trade_taken ? "BUY MARKET (2nd)\n" + str.tostring(entry_price, "#.##") : "BUY MARKET\n" + str.tostring(entry_price, "#.##")

label.new(x=bar_index, y=entry_price, text=entry_label_text, color=color.green, textcolor=color.white, style=label.style_label_up, size=size.tiny)

// Calculate take profit based on risk:reward

risk_size = entry_price - stop_loss

take_profit := entry_price + (risk_size * risk_multiplier)

// FIXED: Set exit orders with proper entry ID and always include initial stop loss

if use_trailing_sl

// Initialize trailing stop and calculate initial risk

trailing_stop := stop_loss

trailing_active := true

initial_risk := math.abs(entry_price - stop_loss)

trailing_started := false

// FIXED: Always set initial stop loss, even with trailing enabled

exit_id = second_trade_taken ? "Long Exit 2nd" : "Long Exit"

strategy.exit(exit_id, current_entry_id, stop=stop_loss, limit=take_profit)

else

// FIXED: Use stored entry ID

exit_id = second_trade_taken ? "Long Exit 2nd" : "Long Exit"

strategy.exit(exit_id, current_entry_id, stop=stop_loss, limit=take_profit)

// Create trade visualization boxes (TradingView style) - FIXED: Minimum 8 bars width

// Blue profit zone box (from entry to take profit)

// Store trade boxes for historical display - FIXED: Remove time usage

array.push(historical_trade_boxes, current_profit_box)

array.push(historical_sl_boxes, current_sl_box)

array.push(historical_tp_boxes, na) // No TP box for long trades

// Add stop loss and take profit markers

if show_sl_tp_labels

label.new(x=bar_index, y=stop_loss, text="SL\n" + str.tostring(stop_loss, "#.##"), color=color.red, textcolor=color.white, style=label.style_label_down, size=size.tiny)

label.new(x=bar_index, y=take_profit, text="TP\n" + str.tostring(take_profit, "#.##"), color=color.blue, textcolor=color.white, style=label.style_label_down, size=size.tiny)

// ADDED: Set the appropriate entry flag based on which trade this is

if second_trade_taken

second_entry_placed := true

daily_trades_complete := true

else

entry_placed := true

// For short breakout

else if breakout_direction == "short"

// Calculate stop loss based on selected method

if sl_type == "Breakout Candle"

stop_loss := breakout_candle_high + (sl_points * syminfo.mintick)

else

// Use opposite side of opening range (above opening range high)

stop_loss := or_high + (sl_points * syminfo.mintick)

if entry_type == "Retracement"

// Calculate retracement entry price (x% of breakout candle body)

breakout_candle_body = breakout_candle_high - breakout_candle_low

retracement_amount = breakout_candle_body * (retracement_percent / 100)

entry_price := breakout_candle_low + retracement_amount

// FIXED: Store the entry ID we're using (differentiate first vs second chance)

current_entry_id := second_trade_taken ? "Short Retracement 2nd" : "Short Retracement"

// Place sell limit order at retracement level

strategy.entry(current_entry_id, strategy.short, limit=entry_price, qty=contracts)

// Add visual markers

if show_entry_labels

entry_label_text = second_trade_taken ? "SELL LIMIT (2nd)\n" + str.tostring(entry_price, "#.##") : "SELL LIMIT\n" + str.tostring(entry_price, "#.##")

label.new(x=bar_index, y=entry_price, text=entry_label_text, color=color.red, textcolor=color.white, style=label.style_label_down, size=size.tiny)

else

// Immediate entry at breakout candle close

entry_price := breakout_price

// FIXED: Store the entry ID we're using (differentiate first vs second chance)

current_entry_id := second_trade_taken ? "Instant 2nd" : "Instant Short"

// Place sell market order

strategy.entry(current_entry_id, strategy.short, qty=contracts)

// Add visual markers

if show_entry_labels

entry_label_text = second_trade_taken ? "SELL MARKET (2nd)\n" + str.tostring(entry_price, "#.##") : "SELL MARKET\n" + str.tostring(entry_price, "#.##")

label.new(x=bar_index, y=entry_price, text=entry_label_text, color=color.red, textcolor=color.white, style=label.style_label_down, size=size.tiny)

// Calculate take profit based on risk:reward

risk_size = stop_loss - entry_price

take_profit := entry_price - (risk_size * risk_multiplier)

// FIXED: Set exit orders with proper entry ID and always include initial stop loss

if use_trailing_sl

// Initialize trailing stop and calculate initial risk

trailing_stop := stop_loss

trailing_active := true

initial_risk := math.abs(entry_price - stop_loss)

trailing_started := false

// FIXED: Always set initial stop loss, even with trailing enabled

exit_id = second_trade_taken ? "Short Exit 2nd" : "Short Exit"

strategy.exit(exit_id, current_entry_id, stop=stop_loss, limit=take_profit)

else

// FIXED: Use stored entry ID

exit_id = second_trade_taken ? "Short Exit 2nd" : "Short Exit"

strategy.exit(exit_id, current_entry_id, stop=stop_loss, limit=take_profit)

// Create trade visualization boxes (TradingView style) - FIXED: Minimum 8 bars width

// Store trade boxes for historical display - FIXED: Remove time usage

array.push(historical_trade_boxes, current_profit_box)

array.push(historical_sl_boxes, current_sl_box)

array.push(historical_tp_boxes, na) // No TP box for short trades

// Add stop loss and take profit markers

if show_sl_tp_labels

label.new(x=bar_index, y=stop_loss, text="SL\n" + str.tostring(stop_loss, "#.##"), color=color.red, textcolor=color.white, style=label.style_label_up, size=size.tiny)

label.new(x=bar_index, y=take_profit, text="TP\n" + str.tostring(take_profit, "#.##"), color=color.blue, textcolor=color.white, style=label.style_label_up, size=size.tiny)

// ADDED: Set the appropriate entry flag based on which trade this is

if second_trade_taken

second_entry_placed := true

daily_trades_complete := true

else

entry_placed := true

// === TRAILING STOP LOGIC ===

// FIXED: Proper trailing stop loss management

if use_trailing_sl and trailing_active and strategy.position_size != 0 and not na(current_entry_id)

if strategy.position_size > 0 // Long position

// Calculate current unrealized profit in points

current_profit = close - entry_price

profit_r = current_profit / initial_risk

// Check if we should start trailing (after X R profit)

if not trailing_started and profit_r >= profit_r_multiplier

trailing_started := true

// Start trailing from a level that's better than the initial stop

trailing_stop := math.max(trailing_stop, close - (atr * atr_multiplier))

// Update trailing stop if trailing has started

if trailing_started

// Calculate new trailing stop using ATR

potential_new_stop = close - (atr * atr_multiplier)

// Only move stop loss up (never down) and ensure it's better than initial SL

if potential_new_stop > trailing_stop and potential_new_stop > stop_loss

trailing_stop := potential_new_stop

// Update the exit order with new trailing stop

exit_id = second_trade_taken ? "Long Exit 2nd" : "Long Exit"

strategy.exit(exit_id, current_entry_id, stop=trailing_stop, limit=take_profit)

else if strategy.position_size < 0 // Short position

// Calculate current unrealized profit in points

current_profit = entry_price - close

profit_r = current_profit / initial_risk

// Check if we should start trailing (after X R profit)

if not trailing_started and profit_r >= profit_r_multiplier

trailing_started := true

// Start trailing from a level that's better than the initial stop

trailing_stop := math.min(trailing_stop, close + (atr * atr_multiplier))

// Update trailing stop if trailing has started

if trailing_started

// Calculate new trailing stop using ATR

potential_new_stop = close + (atr * atr_multiplier)

// Only move stop loss down (never up) and ensure it's better than initial SL

if potential_new_stop < trailing_stop and potential_new_stop < stop_loss

trailing_stop := potential_new_stop

// Update the exit order with new trailing stop

exit_id = second_trade_taken ? "Short Exit 2nd" : "Short Exit"

strategy.exit(exit_id, current_entry_id, stop=trailing_stop, limit=take_profit)

// === SESSION END CLOSE ===

// Force close all positions at configured session end time (optional)

// FIXED: Using configurable hour/minute with timezone

if force_session_close and current_hour == session_end_hour and current_minute == session_end_minute

// ADDED: Extend boxes immediately before session close to prevent timing issues

if not na(current_profit_box)

// Ensure minimum 8 bars width or extend to current bar, whichever is longer

box_left = box.get_left(current_profit_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_profit_box, final_right)

current_profit_box := na // Clear reference after extending

if not na(current_sl_box)

// Ensure minimum 8 bars width or extend to current bar, whichever is longer

box_left = box.get_left(current_sl_box)

min_right = box_left + 8

final_right = math.max(min_right, bar_index)

box.set_right(current_sl_box, final_right)

current_sl_box := na // Clear reference after extending

strategy.close_all(comment="Session End Close")

// === ALERTS ===

alert_once_long = (strategy.position_size > 0) and (strategy.position_size[1] == 0)

alert_once_short = (strategy.position_size < 0) and (strategy.position_size[1] == 0)

alertcondition(alert_once_long, title="Long Entry (Once)", message="Long Entry Signal")

alertcondition(alert_once_short, title="Short Entry (Once)", message="Short Entry Signal")