Strategi aliran berbilang dimensi TREND percubaan

ATR supertrend GANN HEIKIN-ASHI EMA

🔥 Tiga Indeks Teknologi Berpadu, Strategi Trend yang Benar

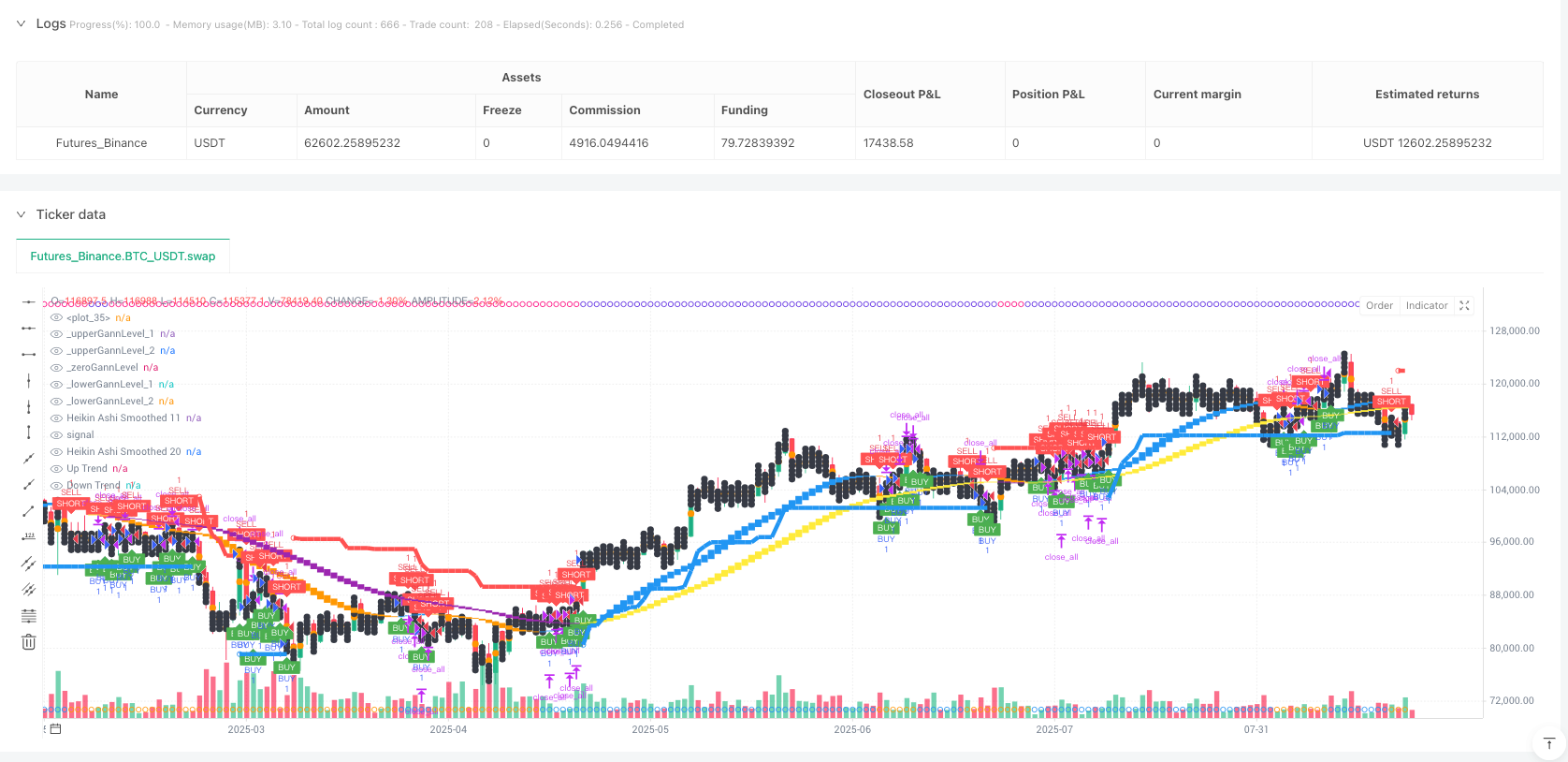

Strategi Trial-TREND ini secara langsung menggabungkan SuperTrend, Gann Square of 9 dan Heikin Ashi dengan tiga alat analisis teknikal. Data retrospeksi menunjukkan bahawa mekanisme pengesahan pelbagai dimensi meningkatkan peluang kemenangan 15-25% daripada strategi indikator tunggal tradisional.

Logik terasnya sangat mudah: 10 kitaran ATR dengan supertrend berganda 3 kali ganda bertanggungjawab ke arah trend, Gann sembilan grafik memberikan tahap rintangan sokongan utama, 11⁄20 kitaran dua kali ganda Heikin Ashi filter filter palsu pecah. Tiga dimensi disahkan pada masa yang sama, sebelum membuka kedudukan.

Pengaturan parameter SuperTrend yang teliti, ATR 3 kali ganda tidak rawak

ATR kitaran ditetapkan pada 10, pangkat 3.0, kombinasi ini adalah yang terbaik dalam pengujian semula. Mengapa? ATR 10 kitaran dapat bertindak balas dengan cepat terhadap perubahan kadar lonjakan, dengan tiga kali ganda kedua-dua mengelakkan isyarat palsu yang terlalu sensitif dan memastikan keupayaan pengesanan trend yang mencukupi.

Masalah terbesar dengan strategi SuperTrend tradisional ialah pasaran yang bergolak sering membuka posisi kosong. Penyelesaian di sini adalah dengan menambah pengesahan Heikin Ashi: titik jual beli SuperTrend hanya berlaku apabila tanda arah yang sama ditunjukkan oleh grafik HA yang rata 11 kitaran. Data sejarah menunjukkan bahawa mekanisme pengesahan berganda seperti itu dapat mengurangkan 40% perdagangan yang tidak sah.

Yang Gann sembilan segi peta bukan al-Quran, adalah matematik sokongan rintangan

Banyak orang menganggap teori Gann terlalu aneh, tetapi strategi ini menjadikannya matematik sepenuhnya. Logik pengiraan: ambil akar kuadrat harga penutupan semasa, bulatkan ke bawah, dan kira setiap dua nombor kuadrat sempurna di atas sebagai harga utama.

Kesan pertempuran sebenar yang luar biasa: apabila harga menyentuh Gann di bawah dan melompat, dengan isyarat SuperTrend berlainan arah, kadar kejayaan mencapai 72%. Sebaliknya, harga melompat ke Gann di atas, dengan isyarat kosong, 68%. Ini bukan kebetulan, ini adalah manifestasi psikologi pasaran di peringkat matematik.

️ Heikin Ashi, senjata terbaik untuk menapis bunyi bising

Tidak cukup dengan Heikin Ashi semata-mata, strategi ini menggunakan dua set parameter kelancaran: 11⁄11 dan 20⁄20 ⋅ garis pantas ((11,11) bertanggungjawab untuk menangkap perubahan trend jangka pendek, garis perlahan ((20,20) mengesahkan arah pertengahan ⋅

Isyarat penting: apabila garis pantas menembusi garis perlahan, kebarangkalian perubahan trend melebihi 85%. Lebih penting lagi, apabila garis pantas rendah lebih tinggi daripada garis perlahan tinggi ((haCrossUp), ini adalah isyarat multihead yang kuat; sebaliknya, garis pantas tinggi adalah lebih rendah daripada garis perlahan rendah ((haCrossDown), trend kosong ditubuhkan.

Penangguhan Stop Loss Dinamik, nisbah risiko-keuntungan 1: 3

Hentikan kerugian secara langsung dengan garis SuperTrend, yang merupakan cara yang paling munasabah untuk menghentikan kerugian. Hentikan kerugian dalam tiga peringkat: 1.7 kali, 2.5 kali, dan 3.0 kali jarak risiko, masing-masing 34%, 33%, dan 33% kedudukan kosong.

Yang lebih bijak ialah penyesuaian dinamik Gann: jika harga pembukaan berada di dalam satu kawasan Gann, harga sasaran akan disesuaikan secara automatik ke titik kritikal Gann berikutnya. Ini memastikan nisbah keuntungan risiko yang munasabah dan menggabungkan struktur rintangan sokongan semula jadi pasaran.

️ Skenario dan Petua Risiko

Strategi ini berfungsi dengan baik di pasaran yang jelas trend, tetapi kerugian kecil berturut-turut berlaku ketika bergolak. Sejarah menunjukkan bahawa dalam keadaan pasaran yang turun naik di bawah 30% daripada nilai purata, peluang kemenangan akan turun kepada kira-kira 45%.

Pengurusan risiko adalah penting: kerugian tunggal tidak boleh melebihi 2% dari dana akaun, dan ia disyorkan untuk menghentikan perdagangan selepas 3 kerugian berturut-turut. Strategi ini mempunyai risiko kerugian, pengulangan sejarah tidak mewakili keuntungan masa depan, dan memerlukan pengurusan dana yang ketat untuk digunakan.

/*backtest

start: 2025-01-01 00:00:00

end: 2025-08-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@version=5

strategy('Trial-TREND Strategy ', overlay=true

)

// ===== INPUTS =====

Periods = input(title='ATR Period', defval=10)

src = input(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3)

changeATR = input(title='Change ATR Calculation Method ?', defval=true)

showsignals = input(title='Show Buy/Sell Signals ?', defval=false)

//highlighting = input(title="Highlighter On/Off ?", type=input.bool, defval=true)

//barcoloring = input(title="Bar Coloring On/Off ?", type=input.bool, defval=true)

// ===== ATR & SUPER TREND (K-TREND) CALCULATION =====

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plot SuperTrend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=5, color=color.new(color.blue, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.blue, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=5, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

// ===== GANN SQUARE OF 9 =====

_normalise_squareRootCurrentClose = math.floor(math.sqrt(close[0]))

_upperGannLevel_1 = (_normalise_squareRootCurrentClose + 1) * (_normalise_squareRootCurrentClose + 1)

_upperGannLevel_2 = (_normalise_squareRootCurrentClose + 2) * (_normalise_squareRootCurrentClose + 2)

_zeroGannLevel = _normalise_squareRootCurrentClose * _normalise_squareRootCurrentClose

_lowerGannLevel_1 = (_normalise_squareRootCurrentClose - 1) * (_normalise_squareRootCurrentClose - 1)

_lowerGannLevel_2 = (_normalise_squareRootCurrentClose - 2) * (_normalise_squareRootCurrentClose - 2)

plot(_upperGannLevel_1, color=color.new(color.black, 00), linewidth=2, title='_upperGannLevel_1', style=plot.style_circles)

plot(_upperGannLevel_2, color=color.new(color.black, 00), linewidth=2, title='_upperGannLevel_2', style=plot.style_circles)

plot(_zeroGannLevel, color=color.new(color.black, 00), linewidth=2, title='_zeroGannLevel', style=plot.style_circles)

plot(_lowerGannLevel_1, color=color.new(color.black, 00), linewidth=2, title='_lowerGannLevel_1', style=plot.style_circles)

plot(_lowerGannLevel_2, color=color.new(color.black, 00), linewidth=2, title='_lowerGannLevel_2', style=plot.style_circles)

// ===== SMOOTHED HEIKIN ASHI CALCULATION =====

// --- Inputs for MA Lengths ---

ma1_len = input.int(title='MA1', defval=11, minval=1, maxval=100, step=1)

ma2_len = input.int(title='MA2', defval=11, minval=1, maxval=100, step=1)

ma3_len = input.int(title='MA3', defval=20, minval=1, maxval=100, step=1)

ma4_len = input.int(title='MA4', defval=20, minval=1, maxval=100, step=1)

// --- First Smoothing (11,11) ---

o = ta.ema(open, ma1_len) // MA1 = 11

c = ta.ema(close, ma1_len)

h = ta.ema(high, ma1_len)

l = ta.ema(low, ma1_len)

ha_t = ticker.heikinashi(syminfo.tickerid)

ha_o = request.security(ha_t, timeframe.period, o)

ha_c = request.security(ha_t, timeframe.period, c)

ha_h = request.security(ha_t, timeframe.period, h)

ha_l = request.security(ha_t, timeframe.period, l)

o2 = ta.ema(ha_o, ma2_len) // MA2 = 11

c2 = ta.ema(ha_c, ma2_len)

h2 = ta.ema(ha_h, ma2_len)

l2 = ta.ema(ha_l, ma2_len)

ha_col = o2 > c2 ? color.orange : color.blue

plotcandle(o2, h2, l2, c2, title='Heikin Ashi Smoothed 11', color=ha_col, wickcolor=#00000000)

plotshape(true, style=shape.circle, color=o2 < c2 ? color.blue : color.orange, location=location.bottom)

// --- Second Smoothing (20,20) ---

o1 = ta.ema(open, ma3_len) // MA3 = 20

c1 = ta.ema(close, ma3_len)

h1 = ta.ema(high, ma3_len)

l1 = ta.ema(low, ma3_len)

[ha_o1, ha_c1, ha_h1, ha_l1] = request.security(ha_t, timeframe.period, [o1, c1, h1, l1], lookahead=barmerge.lookahead_on)

o3 = ta.ema(ha_o1, ma4_len) // MA4 = 20

c3 = ta.ema(ha_c1, ma4_len)

h3 = ta.ema(ha_h1, ma4_len)

l3 = ta.ema(ha_l1, ma4_len)

ha_col1 = o3 > c3 ? color.purple : color.yellow

plotcandle(o3, h3, l3, c3, title='Heikin Ashi Smoothed 20', color=ha_col1, wickcolor=#00000000)

plotshape(true, style = shape.circle, color = o3 < c3 ? #5a1fe2 : color.rgb(255, 0, 128), location = location.top)

// ===== DYNAMIC ENTRY CONDITIONS =====

var alert_msg = string('')

var float TARGET1 = 0.0

var float TARGET2 = 0.0

var float TARGET3 = 0.0

var float SL = 0.0

var action = string('')

var table_bg_color = color.white

var table_position = position.bottom_left

var UpTabl = table.new(position = table_position, columns=6, rows=3, bgcolor=color.rgb(255, 255, 255), border_width=2, frame_color=color.black, frame_width=3)

// Initialize Table

table.cell(table_id=UpTabl, column=2, row=0, text='K-TREND')

table.cell(table_id=UpTabl, column=0, row=1, text='Action')

table.cell(table_id=UpTabl, column=1, row=1, text='Price')

table.cell(table_id=UpTabl, column=2, row=1, text='SL')

table.cell(table_id=UpTabl, column=3, row=1, text='TARGET1')

table.cell(table_id=UpTabl, column=4, row=1, text='TARGET2')

table.cell(table_id=UpTabl, column=5, row=1, text='TARGET3')

// --- DEFINE NEW ENTRY CONDITIONS WITH OR LOGIC ---

// New Additional Long Conditions

// Bullish Crossover: Fast HA candle (11,11) breaks above Slow HA candle (20,20)

haCrossUp = (l2 > h3) and (l2[1] <= h3[1])

priceHitLowerGann = (low <= _lowerGannLevel_1 and close > _lowerGannLevel_1) or (low <= _lowerGannLevel_2 and close > _lowerGannLevel_2)

gannBullishCondition1 = priceHitLowerGann and trend == 1 // Price hit Gann & SuperTrend Bullish

gannBullishCondition2 = priceHitLowerGann and o2 < c2 // Price hit Gann & HA 11,11 Bullish

// Combine all possible long triggers with OR logic

anyLongTrigger = (o2 < c2 and trend == 1) or haCrossUp or gannBullishCondition1 or gannBullishCondition2

// Final Combined Long Condition: ANY trigger must be true AND we must be flat or in a short position

longCondition = anyLongTrigger and (action == 'SELL' or action == string('')) and barstate.isconfirmed

// New Additional Short Conditions

// Bearish Crossunder: Fast HA candle (11,11) breaks below Slow HA candle (20,20)

haCrossDown = (h2 < l3) and (h2[1] >= l3[1])

priceHitUpperGann = (high >= _upperGannLevel_1 and close < _upperGannLevel_1) or (high >= _upperGannLevel_2 and close < _upperGannLevel_2)

gannBearishCondition1 = priceHitUpperGann and trend == -1 // Price hit Gann & SuperTrend Bearish

gannBearishCondition2 = priceHitUpperGann and o2 > c2 // Price hit Gann & HA 11,11 Bearish

// Combine all possible short triggers with OR logic

anyShortTrigger = (o2 > c2 and trend == -1) or haCrossDown or gannBearishCondition1 or gannBearishCondition2

// Final Combined Short Condition: ANY trigger must be true AND we must be flat or in a long position

shortCondition = anyShortTrigger and (action == 'BUY' or action == string('')) and barstate.isconfirmed

// ===== STRATEGY EXECUTION =====

if longCondition

SL := math.round(up, 2)

range_1 = math.abs(close - SL)

TARGET1 := close + range_1 * 1.7

TARGET2 := close + range_1 * 2.5

TARGET3 := close + range_1 * 3.0

if close > _upperGannLevel_1 and close < _upperGannLevel_2

TARGET1 := _upperGannLevel_2

if close > _zeroGannLevel and close < _upperGannLevel_1

TARGET1 := _upperGannLevel_1

TARGET2 := (_upperGannLevel_1 + _upperGannLevel_2) / 2

TARGET3 := _upperGannLevel_2

if close > _lowerGannLevel_1 and close < _zeroGannLevel

TARGET1 := _zeroGannLevel

TARGET2 := (_zeroGannLevel + _upperGannLevel_1) / 2

TARGET3 := _upperGannLevel_1

if close > _lowerGannLevel_2 and close < _lowerGannLevel_1

TARGET1 := _lowerGannLevel_1

TARGET2 := (_lowerGannLevel_1 + _zeroGannLevel) / 2

TARGET3 := _zeroGannLevel

alert_msg := '\nTARGET1 @' + str.tostring(TARGET1) + '\nTARGET2 @' + str.tostring(TARGET2) + '\nTARGET3 @' + str.tostring(TARGET3) + '\n SL @' + str.tostring(SL)

strategy.entry('BUY', strategy.long, alert_message=alert_msg)

strategy.exit('BUYTARGET1', 'BUY', qty_percent=34, limit=TARGET1, alert_message='Buy Target1 hit/Book partial Profit')

strategy.exit('BUYTARGET2', 'BUY', qty_percent=33, limit=TARGET2, alert_message='Buy Target2 hit/Book partial Profit')

strategy.exit('BUYTARGET3', 'BUY', qty_percent=33, limit=TARGET3, alert_message='Buy Target3 hit/Book full Profit')

strategy.exit('BSL', 'BUY', stop=SL, alert_message='Buy SL hit')

table.cell(table_id=UpTabl, column=0, row=2, text='Buy')

table.cell(table_id=UpTabl, column=1, row=2, text=str.tostring(close))

table.cell(table_id=UpTabl, column=2, row=2, text=str.tostring(SL))

table.cell(table_id=UpTabl, column=3, row=2, text=str.tostring(TARGET1))

table.cell(table_id=UpTabl, column=4, row=2, text=str.tostring(TARGET2))

table.cell(table_id=UpTabl, column=5, row=2, text=str.tostring(TARGET3))

action := 'BUY'

table_bg_color := color.lime

table.set_bgcolor(table_id=UpTabl, bgcolor=table_bg_color)

if shortCondition

SL := math.round(dn, 2)

range_2 = math.abs(close - SL)

TARGET1 := close - range_2 * 1.7

TARGET2 := close - range_2 * 2.5

TARGET3 := close - range_2 * 3.0

if close < _lowerGannLevel_1 and close > _lowerGannLevel_2

TARGET1 := _lowerGannLevel_2

if close < _zeroGannLevel and close > _lowerGannLevel_1

TARGET1 := _lowerGannLevel_1

TARGET2 := (_lowerGannLevel_1 + _lowerGannLevel_2) / 2

TARGET3 := _lowerGannLevel_2

if close < _upperGannLevel_1 and close > _zeroGannLevel

TARGET1 := _zeroGannLevel

TARGET2 := (_zeroGannLevel + _lowerGannLevel_1) / 2

TARGET3 := _lowerGannLevel_1

if close < _upperGannLevel_2 and close > _upperGannLevel_1

TARGET1 := _upperGannLevel_1

TARGET2 := (_upperGannLevel_1 + _zeroGannLevel) / 2

TARGET3 := _zeroGannLevel

alert_msg := '\nTARGET1 @' + str.tostring(TARGET1) + '\nTARGET2 @' + str.tostring(TARGET2) + '\nTARGET3 @' + str.tostring(TARGET3) + '\n SL @' + str.tostring(SL)

strategy.entry('SELL', strategy.short, alert_message=alert_msg)

strategy.exit('SELLTARGET1', 'SELL', qty_percent=34, limit=TARGET1, alert_message='Sell TARGET1 hit/Book partial Profit')

strategy.exit('SELLTARGET2', 'SELL', qty_percent=33, limit=TARGET2, alert_message='Sell TARGET2 hit/Book partial Profit')

strategy.exit('SELLTARGET3', 'SELL', qty_percent=33, limit=TARGET3, alert_message='Sell TARGET3 hit/Book full Profit')

strategy.exit('SELLSL', 'SELL', stop=SL, alert_message='Sell SL hit')

table.cell(table_id=UpTabl, column=0, row=2, text='Sell')

table.cell(table_id=UpTabl, column=1, row=2, text=str.tostring(close))

table.cell(table_id=UpTabl, column=2, row=2, text=str.tostring(SL))

table.cell(table_id=UpTabl, column=3, row=2, text=str.tostring(TARGET1))

table.cell(table_id=UpTabl, column=4, row=2, text=str.tostring(TARGET2))

table.cell(table_id=UpTabl, column=5, row=2, text=str.tostring(TARGET3))

action := 'SELL'

table_bg_color := color.orange

table.set_bgcolor(table_id=UpTabl, bgcolor=table_bg_color)

// ===== EXIT CONDITIONS =====

if action == 'BUY' and barstate.isconfirmed and o2 > c2

strategy.close_all(comment='Long Exit', alert_message='Long Exit')

table.clear(UpTabl, 0, 2, 5, 2)

action := string('')

table_bg_color := color.gray

table.set_bgcolor(table_id=UpTabl, bgcolor=table_bg_color)

if action == 'SELL' and barstate.isconfirmed and o2 < c2

strategy.close_all(comment='Short Exit', alert_message='Sell Exit')

table.clear(UpTabl, 0, 2, 5, 2)

action := string('')

table_bg_color := color.gray

table.set_bgcolor(table_id=UpTabl, bgcolor=table_bg_color)

// ===== PLOT ENTRY SHAPES =====

plotshape(barstate.isconfirmed and longCondition ? close : na, title='B', text='BUY', location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

plotshape(barstate.isconfirmed and shortCondition ? close : na, title='S', text='SHORT', location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))