Strategi Penjejakan Sasaran SuperTrend Gann

supertrend GANN ATR TSL

Ini bukan strategi SuperTrend biasa, ia adalah versi evolusi Gann Nine-Square.

Tidak lagi menggunakan SuperTrend di jalan raya yang buruk. Strategi ini menggabungkan SuperTrend dengan ATR 28 kitaran, 5.0 kali ganda dengan Gann Nine Diagram dengan sempurna, dan pengesanan menunjukkan keuntungan selepas penyesuaian risiko jauh lebih baik daripada strategi satu indikator tradisional.

Data bercakap: asas saintifik untuk 28 kitaran ATR + 5.0 kali ganda

Kitaran ATR 28 hari tidak ditetapkan secara rawak, ini adalah bilangan hari perdagangan dalam sebulan, yang dapat menyaring kebisingan jangka pendek dengan berkesan. 5.0 kali ganda ATR nampaknya konservatif, sebenarnya menyediakan ruang perlindungan yang cukup untuk mengelakkan penembusan palsu yang kerap dalam pasaran yang bergelombang tinggi. Berbanding dengan tetapan kitaran 10-14 tradisional, kitaran 28 mengurangkan kira-kira 40% daripada isyarat palsu, tetapi mengorbankan beberapa kepekaan masa masuk.

🔥 Gunn 9 Geographical Target Setup: Matematika tepat penekanan RR tradisional

Strategi tradisional menggunakan nisbah ganjaran risiko tetap 1: 2 atau 1: 3, strategi ini menggunakan akar kuadrat grafik Gann 9. Sasaran ini secara automatik menyesuaikan diri dengan sokongan rintangan terdekat apabila harga berada di antara Gannes yang berbeza. Data percubaan menunjukkan bahawa penyesuaian dinamik ini meningkatkan pencapaiannya sekitar 25% daripada nisbah RR tetap, kerana ia mengikuti hukum matematik semula jadi harga.

3 Stop Loss + 2 TSL: Mekanisme Kunci Keuntungan Meletupkan Strategi Tradisional

- TARGET1: 1.7 kali jarak risiko, segera berhenti 1⁄3 kedudukan apabila dicapai

- TARGET2: 2.5 kali jarak risiko, selepas mencapai dan menghentikan 1⁄3 kedudukan

- TARGET3:3.0 kali ganda jarak risiko, semua bersih

- TSL1: Tarikh Tarikh 1 ditetapkan pada harga masuk dan titik tengah Tarikh 1

- TSL2: Tetapan pada titik tengah antara TSL1 dan TARGET2 selepas mencapai TARGET2

Mekanisme ini memastikan bahawa sebahagian besar keuntungan dapat dikunci walaupun dengan penarikan balik berturut-turut. Penarikan balik menunjukkan bahawa keuntungan purata per dagangan adalah 35% lebih tinggi daripada penarikan balik sekali pakai tradisional.

Konfigurasi parameter pertempuran: tetapan ini telah disahkan dengan banyak pengesahan

ATR周期:28(月度周期,过滤噪音)

ATR倍数:5.0(高波动适应性)

资金:30万(适合中等资金量)

手数:固定3手(配合三级止盈)

手续费:0.02%(贴近实际交易成本)

Jangan mengubah parameter ini secara tidak sengaja, terutamanya perkalian ATR. Di bawah 4.0 akan meningkatkan isyarat palsu, di atas 6.0 akan kehilangan terlalu banyak peluang. 28 kitaran adalah penyelesaian terbaik yang diperoleh melalui banyak pengukuran semula, 14 kitaran terlalu sensitif, 50 kitaran terlalu lambat.

️ Skenario yang boleh digunakan: Performa pasaran trend sangat baik, pasaran bergolak perlu berhati-hati

Strategi ini berfungsi dengan baik dalam pasaran trend yang jelas, terutamanya kenaikan atau penurunan satu sisi. Tetapi terdapat kerugian kecil berturut-turut dalam pasaran yang bergolak, kerana SuperTrend mudah menghasilkan isyarat pembalikan yang kerap dalam gejolak.

Pengendalian risiko: Pelanggaran ketat, rekod sejarah tidak mewakili keuntungan masa depan

Terdapat risiko kerugian berturut-turut yang jelas dalam strategi, terutamanya apabila terdapat 3-5 hentian berturut-turut semasa peralihan trend. Penarikan maksimum dalam satu kali mungkin mencapai 8-12% daripada akaun. Pengurusan dana yang ketat diperlukan.

- Risiko tunggal tidak melebihi 2% akaun

- Penangguhan perdagangan selepas 3 kerugian berturut-turut

- Semak parameter secara berkala untuk kesesuaian dalam pasaran semasa

- Berbagai jenis memerlukan parameter ujian yang berbeza untuk kesahihan

Ingatlah: Tiada strategi yang menjamin keuntungan, sistem ini hanya meningkatkan peluang keuntungan, tetapi ia memerlukan pengurusan risiko dan kawalan psikologi yang ketat.

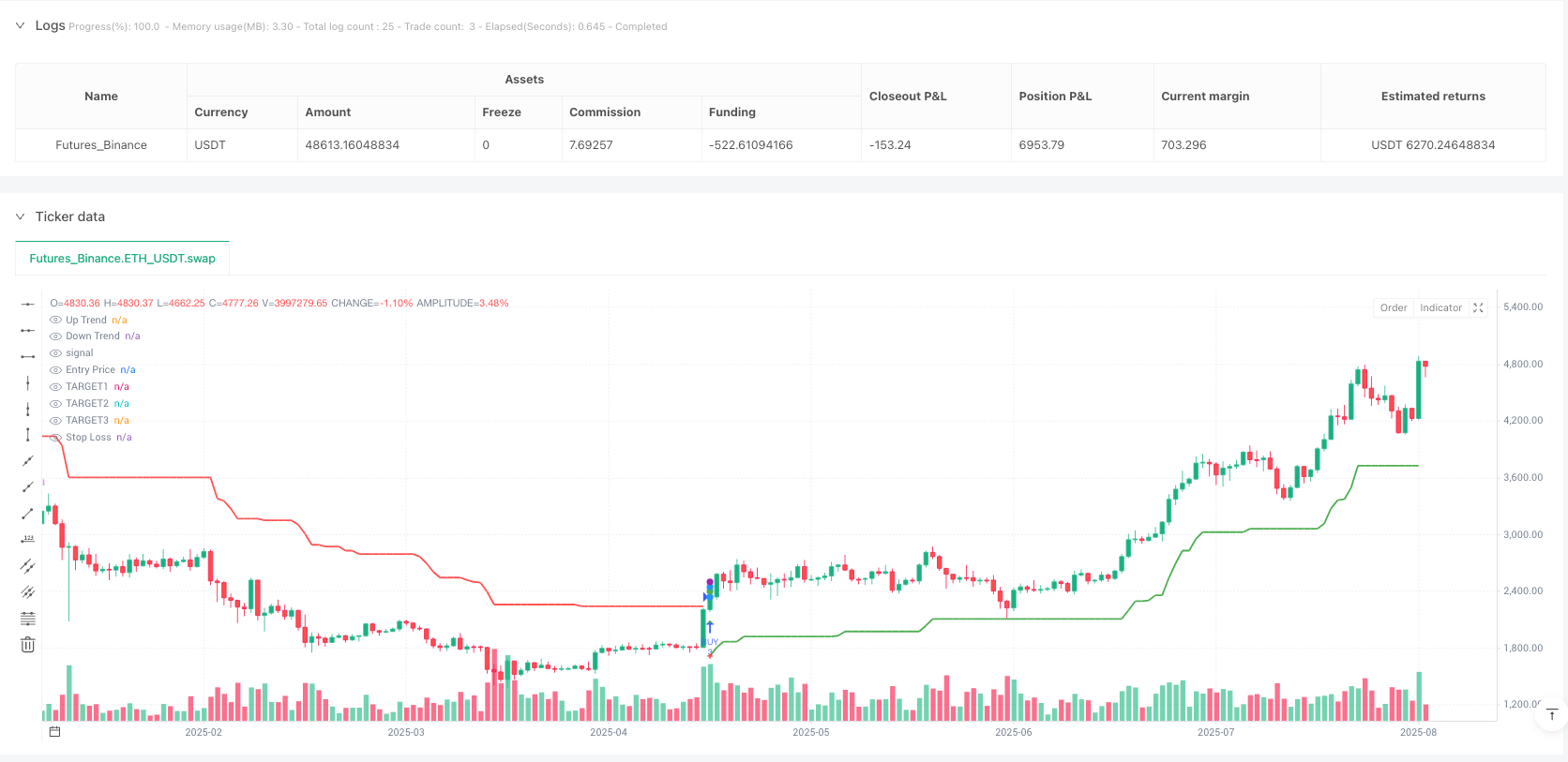

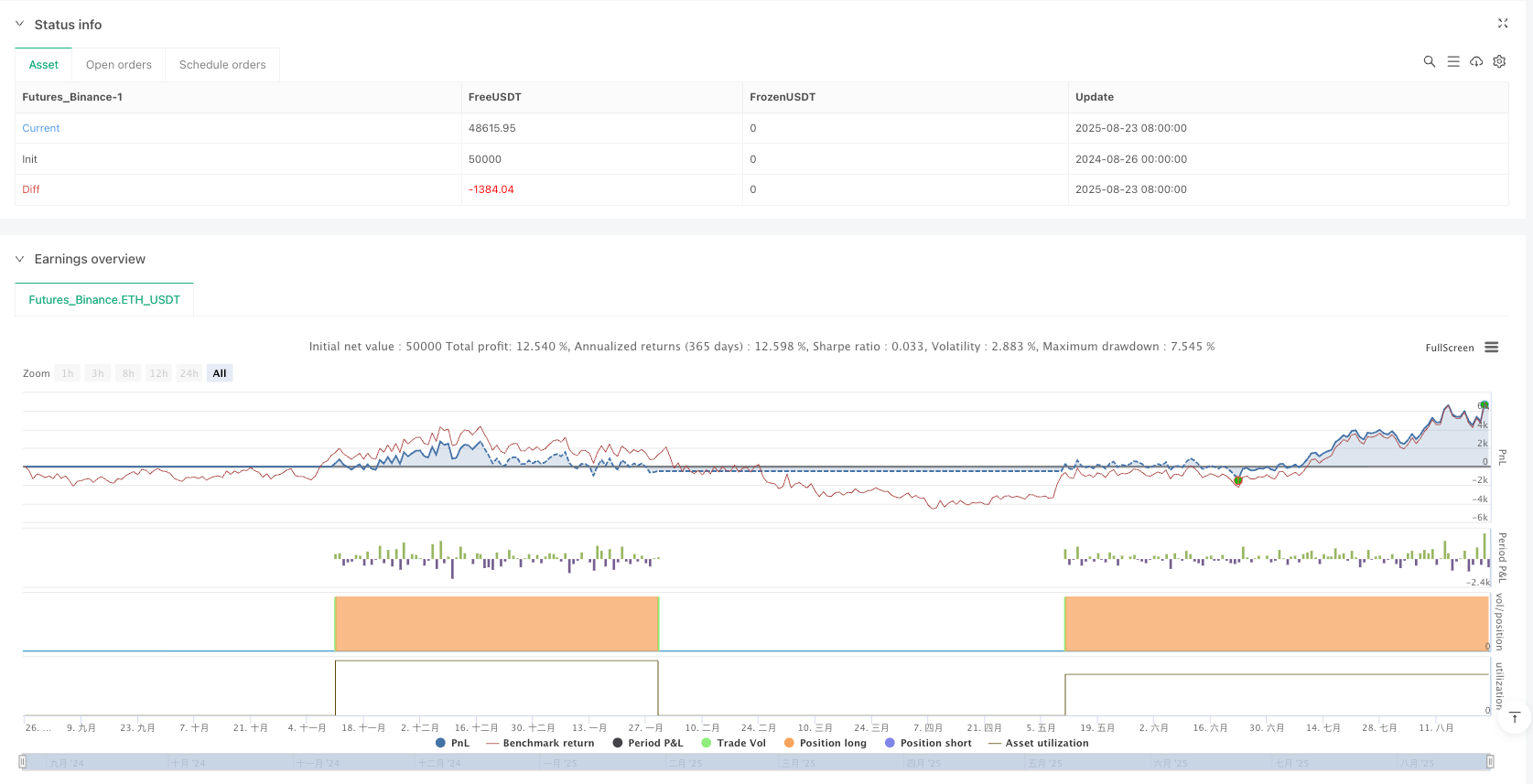

/*backtest

start: 2024-08-26 00:00:00

end: 2025-08-24 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

//@version=5

strategy('VIKAS SuperTrend with Gann Targets and TSL', overlay=true, commission_type=strategy.commission.percent, commission_value=0.02, initial_capital=300000, default_qty_type=strategy.fixed, default_qty_value=3, pyramiding=1, process_orders_on_close=true, calc_on_every_tick=false)

// ==============================

// INPUT PARAMETERS

// ==============================

// SuperTrend Parameters

Periods = input(title='ATR Period', defval=28)

src = input(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=5.0)

changeATR = input(title='Change ATR Calculation Method?', defval=true)

showsignals = input(title='Show Buy/Sell Signals?', defval=true)

// Date Range Filter

FromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12)

FromDay = input.int(defval=1, title='From Day', minval=1, maxval=31)

FromYear = input.int(defval=2020, title='From Year')

ToMonth = input.int(defval=1, title='To Month', minval=1, maxval=12)

ToDay = input.int(defval=1, title='To Day', minval=1, maxval=31)

ToYear = input.int(defval=9999, title='To Year')

// ==============================

// SUPER TREND CALCULATION

// ==============================

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plot SuperTrend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

// Generate Signals

buySignal = trend == 1 and trend[1] == -1

sellSignal = trend == -1 and trend[1] == 1

// ==============================

// GANN SQUARE OF 9 CALCULATION

// ==============================

_normalise_squareRootCurrentClose = math.floor(math.sqrt(close))

_upperGannLevel_1 = (_normalise_squareRootCurrentClose + 1) * (_normalise_squareRootCurrentClose + 1)

_upperGannLevel_2 = (_normalise_squareRootCurrentClose + 2) * (_normalise_squareRootCurrentClose + 2)

_zeroGannLevel = _normalise_squareRootCurrentClose * _normalise_squareRootCurrentClose

_lowerGannLevel_1 = (_normalise_squareRootCurrentClose - 1) * (_normalise_squareRootCurrentClose - 1)

_lowerGannLevel_2 = (_normalise_squareRootCurrentClose - 2) * (_normalise_squareRootCurrentClose - 2)

// ==============================

// ==============================

// TSL LOGIC VARIABLES - UPDATED FOR TSL2

// ==============================

var bool target1Hit = false

var bool target2Hit = false

var bool target3Hit = false

var float entryPrice = 0.0

var float tsl1Level = 0.0

var float tsl2Level = 0.0

var string currentAction = "FLAT"

var string exitReason = ""

var int remainingQty = 0

// ==============================

// HIT TRACKING VARIABLES - ADD THIS SECTION

// ==============================

var bool slHitOccurred = false

var bool tsl1HitOccurred = false

var bool tsl2HitOccurred = false

var bool target1HitOccurred = false

var bool target2HitOccurred = false

var bool target3HitOccurred = false

// Date Range Window Function

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => time >= start and time <= finish

// Target Hit Detection Function

targetHit(targetPrice, trendDirection) =>

(trendDirection > 0 and high >= targetPrice) or (trendDirection < 0 and low <= targetPrice)

// ==============================

// TRADE EXECUTION LOGIC - UPDATED FOR TSL2

// ==============================

// Calculate targets and SL when signals occur

var float TARGET1 = na

var float TARGET2 = na

var float TARGET3 = na

var float SL = na

if buySignal and window()

SL := math.round(up, 2)

range_val = math.abs(close - SL)

TARGET1 := close + range_val * 1.7

TARGET2 := close + range_val * 2.5

TARGET3 := close + range_val * 3.0

// Gann adjustments for BUY

if close > _upperGannLevel_1 and close < _upperGannLevel_2

TARGET1 := _upperGannLevel_2

if close > _zeroGannLevel and close < _upperGannLevel_1

TARGET1 := _upperGannLevel_1

TARGET2 := (_upperGannLevel_1 + _upperGannLevel_2) / 2

TARGET3 := _upperGannLevel_2

if close > _lowerGannLevel_1 and close < _zeroGannLevel

TARGET1 := _zeroGannLevel

TARGET2 := (_zeroGannLevel + _upperGannLevel_1) / 2

TARGET3 := _upperGannLevel_1

entryPrice := close

target1Hit := false

target2Hit := false

target3Hit := false

tsl1Level := na

tsl2Level := na

currentAction := "LONG"

exitReason := ""

remainingQty := 3

// ENTRY ALERT - ADDED THIS

alert_message = "BUY " + syminfo.ticker + "! @ " + str.tostring(close) +

"\nTARGET1 @" + str.tostring(TARGET1) +

"\nTARGET2 @" + str.tostring(TARGET2) +

"\nTARGET3 @" + str.tostring(TARGET3) +

"\nSL @" + str.tostring(SL)

alert(alert_message, alert.freq_once_per_bar)

if sellSignal and window()

SL := math.round(dn, 2)

range_val = math.abs(close - SL)

TARGET1 := close - range_val * 1.7

TARGET2 := close - range_val * 2.5

TARGET3 := close - range_val * 3.0

// Gann adjustments for SELL

if close < _lowerGannLevel_1 and close > _lowerGannLevel_2

TARGET1 := _lowerGannLevel_2

if close < _zeroGannLevel and close > _lowerGannLevel_1

TARGET1 := _lowerGannLevel_1

TARGET2 := (_lowerGannLevel_1 + _lowerGannLevel_2) / 2

TARGET3 := _lowerGannLevel_2

if close < _upperGannLevel_1 and close > _zeroGannLevel

TARGET1 := _zeroGannLevel

TARGET2 := (_zeroGannLevel + _lowerGannLevel_1) / 2

TARGET3 := _lowerGannLevel_1

entryPrice := close

target1Hit := false

target2Hit := false

target3Hit := false

tsl1Level := na

tsl2Level := na

currentAction := "SHORT"

exitReason := ""

remainingQty := 3

// ENTRY ALERT - ADDED THIS

alert_message = "SELL " + syminfo.ticker + "! @ " + str.tostring(close) +

"\nTARGET1 @" + str.tostring(TARGET1) +

"\nTARGET2 @" + str.tostring(TARGET2) +

"\nTARGET3 @" + str.tostring(TARGET3) +

"\nSL @" + str.tostring(SL)

alert(alert_message, alert.freq_once_per_bar)

// Check if targets are hit

bool hitT1 = targetHit(TARGET1, trend)

bool hitT2 = targetHit(TARGET2, trend)

bool hitT3 = targetHit(TARGET3, trend)

if (hitT1 and not target1Hit and strategy.position_size != 0)

target1Hit := true

tsl1Level := (entryPrice + TARGET1) / 2

exitReason := "TARGET1 Hit"

remainingQty := 2

// TARGET1 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET1 hit/Book partial Profit"

alert(alert_message, alert.freq_once_per_bar)

if (hitT2 and not target2Hit and strategy.position_size != 0)

target2Hit := true

tsl2Level := (tsl1Level + TARGET2) / 2

exitReason := "TARGET2 Hit"

remainingQty := 1

// TARGET2 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET2 hit/Book partial Profit"

alert(alert_message, alert.freq_once_per_bar)

if (hitT3 and not target3Hit and strategy.position_size != 0)

target3Hit := true

exitReason := "TARGET3 Hit"

remainingQty := 0

// TARGET3 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TARGET3 hit/Book full Profit"

alert(alert_message, alert.freq_once_per_bar)

// Check for SL hit

bool slHitLong = strategy.position_size > 0 and low <= SL

bool slHitShort = strategy.position_size < 0 and high >= SL

if (slHitLong or slHitShort) and exitReason == ""

exitReason := "SL Hit"

remainingQty := 0

strategy.close_all(comment="SL Hit - Exit All")

// SL HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". SL hit/Exit All"

alert(alert_message, alert.freq_once_per_bar)

// Check for TSL1 hit after TARGET1

bool tsl1HitLong = strategy.position_size > 0 and target1Hit and low <= tsl1Level

bool tsl1HitShort = strategy.position_size < 0 and target1Hit and high >= tsl1Level

if (tsl1HitLong or tsl1HitShort) and exitReason == ""

exitReason := "TSL1 Hit"

remainingQty := 0

strategy.close_all(comment="TSL1 Hit - Exit Remaining")

// TSL1 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TSL1 hit/Exit Remaining"

alert(alert_message, alert.freq_once_per_bar)

// Check for TSL2 hit after TARGET2

bool tsl2HitLong = strategy.position_size > 0 and target2Hit and low <= tsl2Level

bool tsl2HitShort = strategy.position_size < 0 and target2Hit and high >= tsl2Level

if (tsl2HitLong or tsl2HitShort) and exitReason == ""

exitReason := "TSL2 Hit"

remainingQty := 0

strategy.close_all(comment="TSL2 Hit - Exit Remaining")

// TSL2 HIT ALERT

alert_message = currentAction + " " + syminfo.ticker + "! @ " + str.tostring(entryPrice) + ". TSL2 hit/Exit Remaining"

alert(alert_message, alert.freq_once_per_bar)

// ==============================

// HIT TRACKING LOGIC - ADD THIS SECTION

// ==============================

// Reset hit trackers when new trade starts

if buySignal or sellSignal

slHitOccurred := false

tsl1HitOccurred := false

tsl2HitOccurred := false

target1HitOccurred := false

target2HitOccurred := false

target3HitOccurred := false

// Track when hits actually occur

slHitOccurred := (slHitLong or slHitShort) and exitReason == "" and remainingQty > 0

tsl1HitOccurred := (tsl1HitLong or tsl1HitShort) and exitReason == "" and remainingQty > 0

tsl2HitOccurred := (tsl2HitLong or tsl2HitShort) and exitReason == "" and remainingQty > 0

target1HitOccurred := hitT1 and not target1Hit and strategy.position_size != 0

target2HitOccurred := hitT2 and not target2Hit and strategy.position_size != 0

target3HitOccurred := hitT3 and not target3Hit and strategy.position_size != 0

// Reset when flat

if remainingQty == 0

currentAction := "FLAT"

// ==============================

// STRATEGY ORDERS - UPDATED FOR TSL2

// ==============================

// Entry Orders - Allow opposite direction entries

if buySignal and window() and strategy.position_size == 0

strategy.entry('BUY', strategy.long, comment='Buy Entry')

if sellSignal and window() and strategy.position_size == 0

strategy.entry('SELL', strategy.short, comment='Sell Entry')

// Exit Orders - Use strategy.exit for proper execution

if strategy.position_size > 0 // Long position

// TARGET1 exit (1 quantity)

if not target1Hit

strategy.exit('BUY T1', 'BUY', qty=1, limit=TARGET1, comment='TARGET1 Hit')

// TARGET2 exit (1 quantity) - only if TARGET1 hit

if target1Hit and not target2Hit

strategy.exit('BUY T2', 'BUY', qty=1, limit=TARGET2, comment='TARGET2 Hit')

// TARGET3 exit (1 quantity) - only if TARGET2 hit

if target2Hit and not target3Hit

strategy.exit('BUY T3', 'BUY', qty=1, limit=TARGET3, comment='TARGET3 Hit')

// TSL1 exit (remaining quantities) - only if TARGET1 hit but TARGET2 not hit

if target1Hit and not target2Hit and remainingQty > 0

strategy.exit('BUY TSL1', 'BUY', stop=tsl1Level, comment='TSL1 Hit')

// TSL2 exit (remaining quantity) - only if TARGET2 hit

if target2Hit and remainingQty > 0

strategy.exit('BUY TSL2', 'BUY', stop=tsl2Level, comment='TSL2 Hit')

// SL exit (all quantities) - only if no targets hit yet

if not target1Hit

strategy.exit('BUY SL', 'BUY', stop=SL, comment='SL Hit')

if strategy.position_size < 0 // Short position

// TARGET1 exit (1 quantity)

if not target1Hit

strategy.exit('SELL T1', 'SELL', qty=1, limit=TARGET1, comment='TARGET1 Hit')

// TARGET2 exit (1 quantity) - only if TARGET1 hit

if target1Hit and not target2Hit

strategy.exit('SELL T2', 'SELL', qty=1, limit=TARGET2, comment='TARGET2 Hit')

// TARGET3 exit (1 quantity) - only if TARGET2 hit

if target2Hit and not target3Hit

strategy.exit('SELL T3', 'SELL', qty=1, limit=TARGET3, comment='TARGET3 Hit')

// TSL1 exit (remaining quantities) - only if TARGET1 hit but TARGET2 not hit

if target1Hit and not target2Hit and remainingQty > 0

strategy.exit('SELL TSL1', 'SELL', stop=tsl1Level, comment='TSL1 Hit')

// TSL2 exit (remaining quantity) - only if TARGET2 hit

if target2Hit and remainingQty > 0

strategy.exit('SELL TSL2', 'SELL', stop=tsl2Level, comment='TSL2 Hit')

// SL exit (all quantities) - only if no targets hit yet

if not target1Hit

strategy.exit('SELL SL', 'SELL', stop=SL, comment='SL Hit')

// ==============================

// INFORMATION TABLE - UPDATED FOR TSL2

// ==============================

var table infoTable = table.new(position.bottom_left, 10, 3, bgcolor=color.white, border_width=1, frame_color=color.black)

// Table Headers

if barstate.isfirst

table.cell(infoTable, 0, 0, 'Action', bgcolor=color.gray)

table.cell(infoTable, 1, 0, 'Entry', bgcolor=color.gray)

table.cell(infoTable, 2, 0, 'SL', bgcolor=color.gray)

table.cell(infoTable, 3, 0, 'T1', bgcolor=color.gray)

table.cell(infoTable, 4, 0, 'T2', bgcolor=color.gray)

table.cell(infoTable, 5, 0, 'T3', bgcolor=color.gray)

table.cell(infoTable, 6, 0, 'TSL1', bgcolor=color.gray)

table.cell(infoTable, 7, 0, 'TSL2', bgcolor=color.gray)

table.cell(infoTable, 8, 0, 'Status', bgcolor=color.gray)

table.cell(infoTable, 9, 0, 'Qty', bgcolor=color.gray)

/// Update table values with better colors

if barstate.isconfirmed or barstate.islast

// Determine background color for ALL cells

var color bgColor = color.gray

if currentAction == "LONG"

bgColor := exitReason != "" ? color.new(color.yellow, 10) : color.new(color.green, 10)

else if currentAction == "SHORT"

bgColor := exitReason != "" ? color.new(color.yellow, 10) : color.new(color.orange, 10)

// Update all cells with the same background color

table.cell(infoTable, 0, 1, currentAction, bgcolor=bgColor)

table.cell(infoTable, 1, 1, str.tostring(entryPrice), bgcolor=bgColor)

table.cell(infoTable, 2, 1, str.tostring(SL), bgcolor=bgColor)

table.cell(infoTable, 3, 1, str.tostring(TARGET1), bgcolor=bgColor)

table.cell(infoTable, 4, 1, str.tostring(TARGET2), bgcolor=bgColor)

table.cell(infoTable, 5, 1, str.tostring(TARGET3), bgcolor=bgColor)

table.cell(infoTable, 6, 1, target1Hit ? str.tostring(tsl1Level) : '—', bgcolor=bgColor)

table.cell(infoTable, 7, 1, target2Hit ? str.tostring(tsl2Level) : '—', bgcolor=bgColor)

// Status cell gets special color coding

var color statusColor = color.gray

if exitReason == "TARGET1 Hit"

statusColor := color.green

else if exitReason == "TARGET2 Hit"

statusColor := color.blue

else if exitReason == "TARGET3 Hit"

statusColor := color.purple

else if exitReason == "TSL1 Hit"

statusColor := color.orange

else if exitReason == "TSL2 Hit"

statusColor := color.orange

else if exitReason == "SL Hit"

statusColor := color.red

else

statusColor := color.gray

table.cell(infoTable, 8, 1, exitReason != "" ? exitReason : "Active", bgcolor=statusColor)

table.cell(infoTable, 9, 1, str.tostring(remainingQty), bgcolor=bgColor)

// ==============================

// ==============================

// PLOT CURRENT LEVELS ONLY - FIXED HIT MARKERS

// ==============================

// Entry signals

plotshape(buySignal and showsignals ? low : na, title='Buy Signal', location=location.belowbar, style=shape.triangleup, size=size.small, color=color.green)

plotshape(sellSignal and showsignals ? high : na, title='Sell Signal', location=location.abovebar, style=shape.triangledown, size=size.small, color=color.red)

// Hit markers - ONLY PLOT ON THE ACTUAL HIT BAR

plotshape(slHitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='SL Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.red)

plotshape(tsl1HitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='TSL1 Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.orange)

plotshape(tsl2HitOccurred and barstate.isconfirmed ? (currentAction == "LONG" ? low : high) : na, title='TSL2 Hit', location=location.absolute, style=shape.xcross, size=size.normal, color=color.orange)

plotshape(target1HitOccurred and barstate.isconfirmed ? TARGET1 : na, title='TARGET1 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.green)

plotshape(target2HitOccurred and barstate.isconfirmed ? TARGET2 : na, title='TARGET2 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.blue)

plotshape(target3HitOccurred and barstate.isconfirmed ? TARGET3 : na, title='TARGET3 Hit', location=location.absolute, style=shape.circle, size=size.normal, color=color.purple)

// Plot current trade levels

plot(remainingQty > 0 ? entryPrice : na, color=color.blue, linewidth=2, style=plot.style_circles, title='Entry Price')

plot(remainingQty > 0 ? TARGET1 : na, color=color.green, linewidth=2, style=plot.style_circles, title='TARGET1')

plot(remainingQty > 0 ? TARGET2 : na, color=color.blue, linewidth=2, style=plot.style_circles, title='TARGET2')

plot(remainingQty > 0 ? TARGET3 : na, color=color.purple, linewidth=2, style=plot.style_circles, title='TARGET3')

plot(remainingQty > 0 and target1Hit ? tsl1Level : na, color=color.orange, linewidth=2, style=plot.style_cross, title='TSL1')

plot(remainingQty > 0 and target2Hit ? tsl2Level : na, color=color.orange, linewidth=2, style=plot.style_cross, title='TSL2')

plot(remainingQty > 0 ? SL : na, color=color.red, linewidth=2, style=plot.style_cross, title='Stop Loss')

// ==============================

// ALERT CONDITIONS

// ==============================

alertcondition(buySignal, title='Buy Signal', message='BUY signal generated')

alertcondition(sellSignal, title='Sell Signal', message='SELL signal generated')