Jadi, apa yang anda lakukan dengan taktik ini?

Anda tahu? Kebanyakan peniaga mempunyai masalah: apabila mereka melihat isyarat yang tidak baik, mereka akan lari!😱 Tetapi strategi ini berlawanan arah, ia memberitahu anda: “Jangan tergesa-gesa, tunggu dan lihat!”

Strategi ini akan menunggu 3 garis K (boleh disesuaikan) untuk melihat apakah anda benar-benar ingin “berpisah” atau hanya ekspresi emosi.

Logik utama: Jangan buat keputusan dengan tergesa-gesa

Syarat kemasukan:

- Menemui corak penembusan tinggi rendah

- Pengesahan K-Line ((Kedudukan harga tutup betul)

- Sistem penilaian pelbagai dimensi: RSI dinamik + pengesahan jumlah transaksi + analisis kadar turun naik

- Minimum skor 3.0 untuk masuk (maksimum 5.0)

Fokus!Sistem penarafan di sini adalah sangat bijak, dan ia mengambil kira:

- K kekuatan garis (peratusan entiti)

- Adakah jumlah transaksi meningkat?

- RSI dalam julat yang munasabah

- Tahap kadar turun naik semasa

Kebijaksanaan Yang Diperlukan Untuk Menunda Perlawanan

Strategi tradisional: Lihat isyarat kekalahan→ Beraksi segera Strategi ini: melihat isyarat kegagalan→ menunggu 3 garis K→ mengesahkan semula→ masuk akal

Mengapa penangguhan?

- Mengelakkan perangkap penembusan palsu: Pasaran sering ‘bermain mati’, kelewatan boleh menyaring bunyi bising

- Mengurangkan kadar transaksiPengurangan kos saman:

- Meningkatkan Kadar KemenanganBerikan lebih masa kepada trend:

️ Pengurusan risiko: Jangan mudah berputus asa

Walaupun ia adalah “buddhisme”, ia adalah sangat terkawal risiko:

- Hentikan Kerugian1.5 kali ATR (boleh disesuaikan)

- Penangguhan2.5 kali ATR (boleh disesuaikan)

- Masa transaksiBerdagang hanya semasa berdagang saham:

- Penutupan dan penutupanTidak pernah bermalam

Reka Bentuk Visual: Permulaan

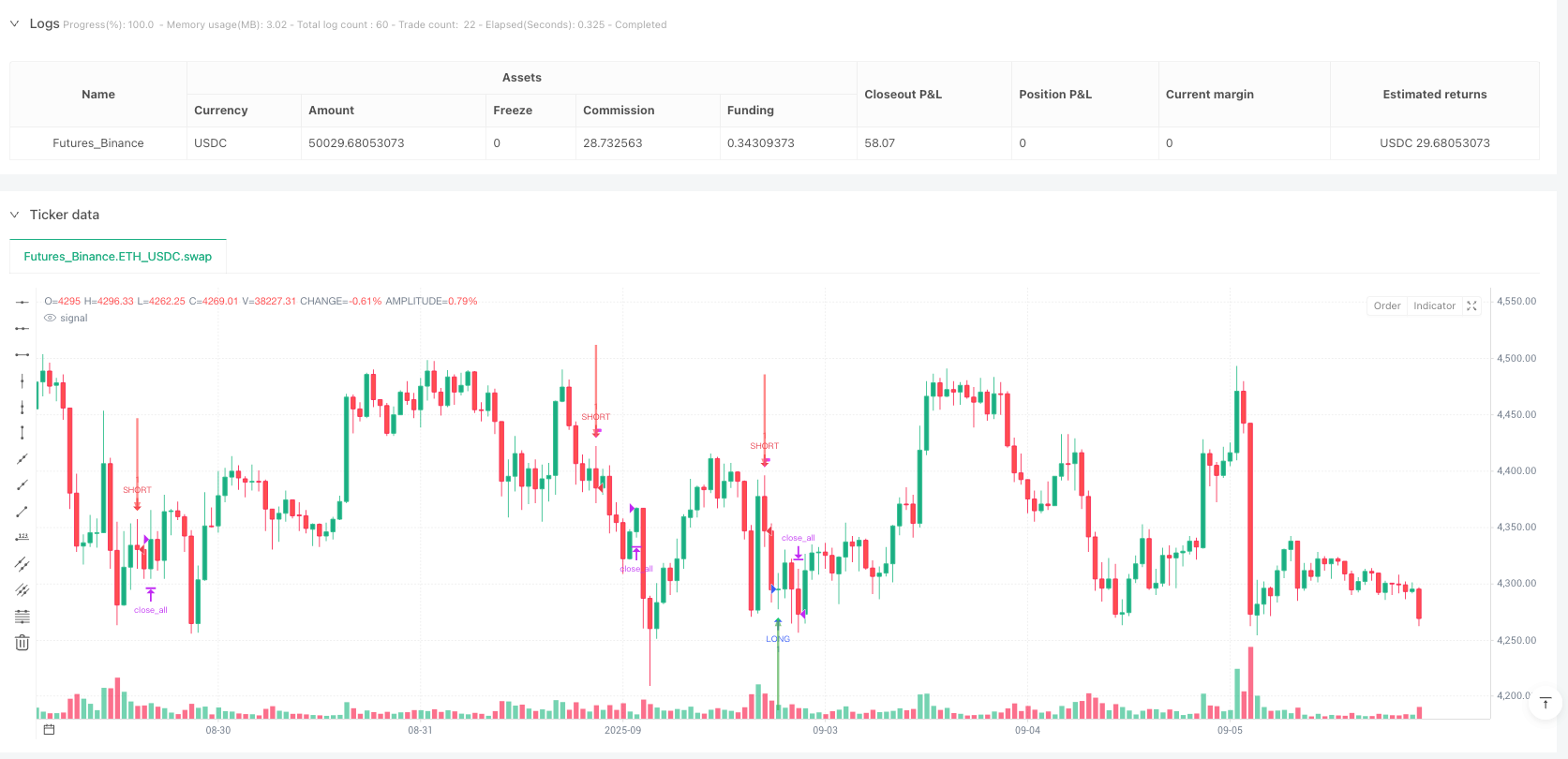

- Segitiga Hijau: Biasa buat banyak isyarat

- 🔴 Segitiga merah: isyarat kosong biasa

- Tanda bendera: isyarat berkualiti tinggi ((nilai ≥4.5)

- Orange X: Isyarat Kegagalan Awal (Di Abaikan)

- 🔴 Red X: Isyarat kegagalan yang ditangguhkan ((perbuatan keluar)

Panduan untuk mengelakkan lubangJangan panik apabila terdapat warna oren X, ini adalah “peringatan palsu” yang sengaja diabaikan oleh taktik!

Skenario yang sesuai

Strategi ini amat sesuai untuk:

- Terbalik di tengah-tengah pergolakan

- Seorang peniaga yang tidak mahu dianiaya kerana sering mengalami kerugian

- Pelabur yang ingin meningkatkan kualiti isyarat

- Peminat Dagangan Dalam Hari

Ingat: Kesabaran adalah senjata terbesar seorang peniaga, dan kadang-kadang “tunggu dan pergi” lebih bijak daripada “bergerak segera”!

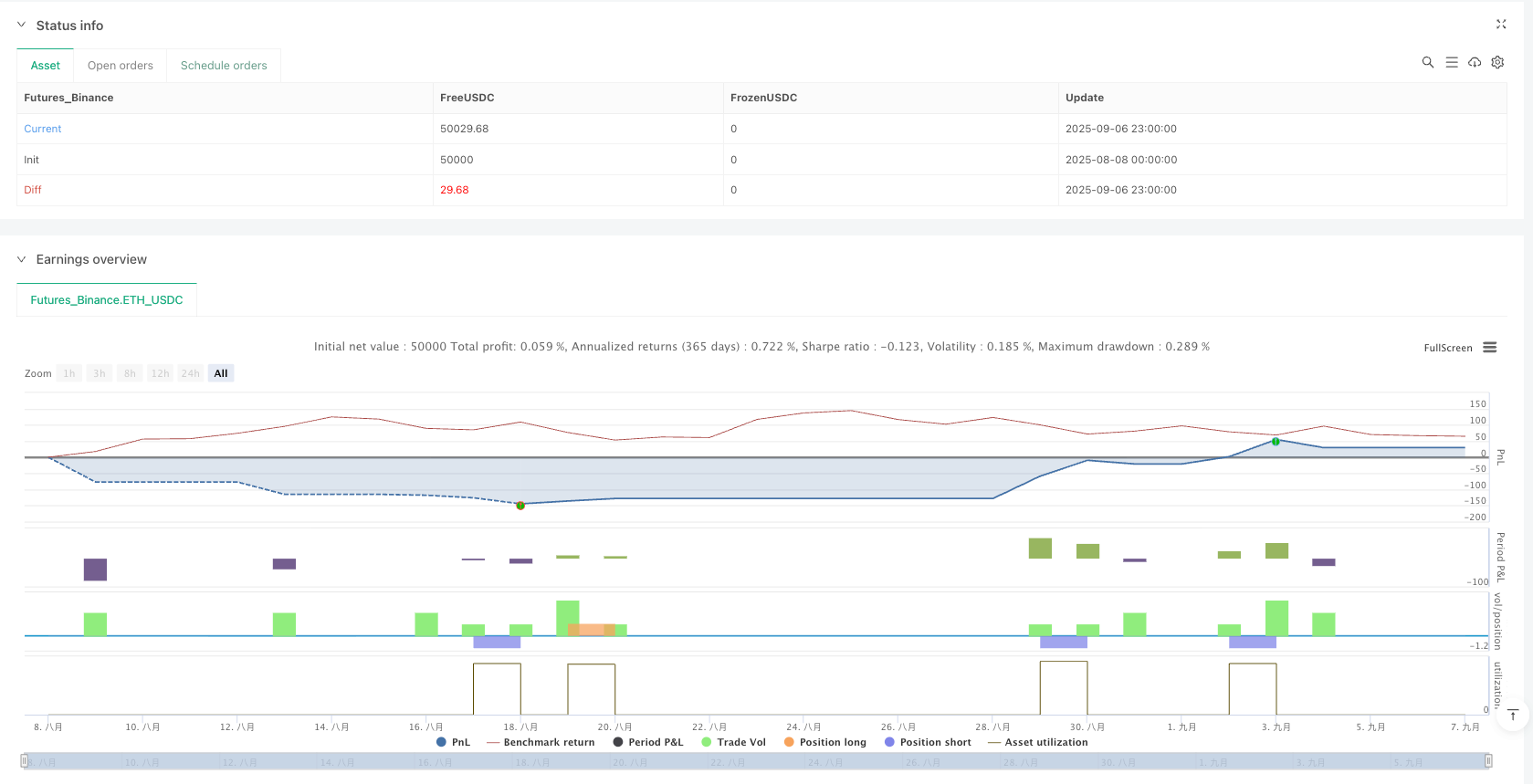

/*backtest

start: 2025-08-08 00:00:00

end: 2025-09-07 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDC"}]

*/

//@version=6

strategy("Delayed X Exit Strategy - Final Version", overlay=true)

// === INPUTS ===

// Strategy Settings

delayBars = input.int(3, "Delay X Exit (bars after entry)", minval=1, maxval=10, group="Exit Strategy")

showScores = input.bool(true, "Show Signal Scores", group="Display")

minScore = input.float(3.0, "Minimum Score to Trade", minval=1.0, maxval=5.0, step=0.1, group="Strategy")

volumePeriod = input.int(20, "Volume Average Period", group="Strategy")

// Risk Management

stopATRMult = input.float(1.5, "Stop Loss ATR Multiplier", minval=0.5, maxval=3.0, step=0.1, group="Risk Management")

targetATRMult = input.float(2.5, "Take Profit ATR Multiplier", minval=1.0, maxval=5.0, step=0.1, group="Risk Management")

// Time Filters - US Market Hours Only

startHour = input.int(9, "Start Trading Hour", minval=0, maxval=23, group="Time Filter")

endHour = input.int(16, "End Trading Hour", minval=0, maxval=23, group="Time Filter")

startMinute = input.int(30, "Start Trading Minute", minval=0, maxval=59, group="Time Filter")

// === TIME FILTER - MARKET HOURS ONLY ===

currentHour = hour(time, "America/New_York")

currentMinute = minute(time, "America/New_York")

marketOpen = (currentHour == startHour and currentMinute >= startMinute) or (currentHour > startHour and currentHour < endHour)

inTradingHours = marketOpen

// --- Original Pattern Detection ---

lowPoint = ta.lowest(low, 3)

prevLowPoint = ta.lowest(low[3], 3)

isHigherLow = low == lowPoint and low > prevLowPoint

bullConfirm = isHigherLow and close > open

highPoint = ta.highest(high, 3)

prevHighPoint = ta.highest(high[3], 3)

isLowerHigh = high == highPoint and high < prevHighPoint

bearConfirm = isLowerHigh and close < open

// --- Pattern Failures (X signals) ---

failHigherLow = isHigherLow[1] and low < low[1]

failLowerHigh = isLowerHigh[1] and high > high[1]

// Track entry information for delayed exit logic

var int entryBar = na

var string entryDirection = na

var float entryPrice = na

// === ENHANCED SCORING SYSTEM ===

rsi = ta.rsi(close, 14)

atr = ta.atr(14)

avgVolume = ta.sma(volume, volumePeriod)

// Scoring components (optimized for delayed exits)

bullCandleStrength = bullConfirm ? (close > open and (close - open) / (high - low) > 0.6 ? 1 : 0.5) : 0

bearCandleStrength = bearConfirm ? (close < open and (open - close) / (high - low) > 0.6 ? 1 : 0.5) : 0

volumeConfirm = volume > avgVolume * 1.2 ? 1 : (volume > avgVolume ? 0.5 : 0)

bullMomentum = bullConfirm ? (rsi > 25 and rsi < 65 ? 1 : (rsi < 75 ? 0.5 : 0)) : 0

bearMomentum = bearConfirm ? (rsi > 35 and rsi < 75 ? 1 : (rsi > 25 ? 0.5 : 0)) : 0

currentRange = high - low

volatilityScore = currentRange > atr * 0.7 ? 1 : 0.5

// Pattern quality (more lenient for delayed exits)

recentBullSignals = ta.barssince(bullConfirm)

recentBearSignals = ta.barssince(bearConfirm)

bullPatternQuality = bullConfirm ? (na(recentBearSignals) or recentBearSignals > 2 ? 1 : 0.5) : 0

bearPatternQuality = bearConfirm ? (na(recentBullSignals) or recentBullSignals > 2 ? 1 : 0.5) : 0

// Calculate total scores

bullScore = bullConfirm ? bullCandleStrength + volumeConfirm + bullMomentum + volatilityScore + bullPatternQuality : 0

bearScore = bearConfirm ? bearCandleStrength + volumeConfirm + bearMomentum + volatilityScore + bearPatternQuality : 0

// === TRADE SIGNALS ===

longSignal = bullConfirm and bullScore >= minScore and inTradingHours

shortSignal = bearConfirm and bearScore >= minScore and inTradingHours

// === STRATEGY ENTRIES ===

if longSignal and strategy.position_size == 0

strategy.entry("LONG", strategy.long, qty=1)

entryBar := bar_index

entryDirection := "LONG"

entryPrice := close

if shortSignal and strategy.position_size == 0

strategy.entry("SHORT", strategy.short, qty=1)

entryBar := bar_index

entryDirection := "SHORT"

entryPrice := close

// === DELAYED EXIT LOGIC ===

// Only consider X exits if they occur delayBars+ after entry

shouldExitOnDelayedFailure = false

barsAfterEntry = na(entryBar) ? 0 : bar_index - entryBar

if strategy.position_size != 0 and not na(entryBar) and barsAfterEntry >= delayBars

// Check for pattern failure that matches our position direction

if strategy.position_size > 0 and failHigherLow

shouldExitOnDelayedFailure := true

if strategy.position_size < 0 and failLowerHigh

shouldExitOnDelayedFailure := true

// Execute delayed failure exits

if shouldExitOnDelayedFailure

if strategy.position_size > 0

strategy.close("LONG", comment="Delayed X Exit")

if strategy.position_size < 0

strategy.close("SHORT", comment="Delayed X Exit")

entryBar := na

entryDirection := na

entryPrice := na

// === STANDARD STOP/TARGET EXITS ===

// Only use stop/target if we haven't exited on delayed failure

if strategy.position_size > 0 and not shouldExitOnDelayedFailure // Long position

stopLevel = strategy.position_avg_price - (atr * stopATRMult)

targetLevel = strategy.position_avg_price + (atr * targetATRMult)

strategy.exit("LONG_EXIT", "LONG", stop=stopLevel, limit=targetLevel)

if strategy.position_size < 0 and not shouldExitOnDelayedFailure // Short position

stopLevel = strategy.position_avg_price + (atr * stopATRMult)

targetLevel = strategy.position_avg_price - (atr * targetATRMult)

strategy.exit("SHORT_EXIT", "SHORT", stop=stopLevel, limit=targetLevel)

// Reset entry tracking when position closes

if strategy.position_size == 0 and not na(entryBar)

entryBar := na

entryDirection := na

entryPrice := na

// End of day exit

if not inTradingHours and strategy.position_size != 0

strategy.close_all(comment="EOD")

entryBar := na

entryDirection := na

entryPrice := na

// === VISUAL ELEMENTS ===

// Main entry signals

plotshape(longSignal, "Long Entry", shape.triangleup, location.belowbar,

color=color.new(color.lime, 0), size=size.normal)

plotshape(shortSignal, "Short Entry", shape.triangledown, location.abovebar,

color=color.new(color.red, 0), size=size.normal)

// Premium signals (score >= 4.5)

premiumLong = longSignal and bullScore >= 4.5

premiumShort = shortSignal and bearScore >= 4.5

plotshape(premiumLong, "Premium Long", shape.flag, location.belowbar,

color=color.new(color.aqua, 0), size=size.large)

plotshape(premiumShort, "Premium Short", shape.flag, location.abovebar,

color=color.new(color.fuchsia, 0), size=size.large)

// Pattern failures - Orange for early (ignored), Red for delayed (actionable)

earlyFailure = (failHigherLow or failLowerHigh) and not na(entryBar) and barsAfterEntry < delayBars

actionableFailure = (failHigherLow or failLowerHigh) and not na(entryBar) and barsAfterEntry >= delayBars

plotshape(earlyFailure, "Early X (Ignored)", shape.xcross, location.abovebar,

color=color.new(color.orange, 0), size=size.small)

plotshape(actionableFailure, "Delayed X (Exit)", shape.xcross, location.abovebar,

color=color.new(color.red, 0), size=size.normal)

// Entry confirmation arrows

plotarrow(longSignal ? 1 : shortSignal ? -1 : 0,

colorup=color.new(color.green, 30), colordown=color.new(color.red, 30))

// === ENHANCED POSITION VISUALIZATION ===

var line stopLine = na

var line targetLine = na

var label positionLabel = na

var label delayLabel = na

if strategy.position_size != 0

// Draw position lines and labels

if strategy.position_size > 0 // Long position

stopPrice = strategy.position_avg_price - (atr * stopATRMult)

targetPrice = strategy.position_avg_price + (atr * targetATRMult)

// Show delay status

delayText = barsAfterEntry < delayBars ?

"X Ignored (" + str.tostring(barsAfterEntry) + "/" + str.tostring(delayBars) + ")" :

"X Active (" + str.tostring(barsAfterEntry) + " bars)"

delayLabel := label.new(bar_index, high + (atr * 2), delayText,

color=barsAfterEntry < delayBars ? color.orange : color.red,

textcolor=color.white, size=size.small)

if strategy.position_size < 0 // Short position

stopPrice = strategy.position_avg_price + (atr * stopATRMult)

targetPrice = strategy.position_avg_price - (atr * targetATRMult)

// Show delay status

delayText = barsAfterEntry < delayBars ?

"X Ignored (" + str.tostring(barsAfterEntry) + "/" + str.tostring(delayBars) + ")" :

"X Active (" + str.tostring(barsAfterEntry) + " bars)"

delayLabel := label.new(bar_index, low - (atr * 2), delayText,

color=barsAfterEntry < delayBars ? color.orange : color.red,

textcolor=color.white, size=size.small)

// === ALERTS ===

alertcondition(longSignal, title="Long Entry", message="LONG Entry Signal Triggered")

alertcondition(shortSignal, title="Short Entry", message="SHORT Entry Signal Triggered")

alertcondition(shouldExitOnDelayedFailure, title="Delayed X Exit", message="Pattern Failure Exit - Delayed Strategy")

alertcondition(premiumLong, title="Premium Long", message="PREMIUM LONG Signal - High Probability Setup")

alertcondition(premiumShort, title="Premium Short", message="PREMIUM SHORT Signal - High Probability Setup")