Mekanisme penapisan enam kali, bukan satu set penunjuk teknikal biasa

Lihatlah ribuan strategi, kebanyakannya adalah kombinasi sederhana dari satu indikator. Strategi ini secara langsung mengintegrasikan syarat penapisan enam dimensi ADX, DI, CCI, RSI, ATR, lalu lintas. Bukan untuk bermain-main, tetapi untuk menyelesaikan masalah isyarat palsu dari satu indikator. Data retrospeksi menunjukkan bahawa kualiti isyarat meningkat dengan ketara selepas penapisan berulang, tetapi kosnya adalah penurunan frekuensi isyarat sekitar 40%.

ADX + DI: Pengesahan dua hala kekuatan dan arah

Strategi tradisional melihat kekuatan trend atau arah trend, jarang ada yang menggabungkan ADX dan DI secara sistematik. Reka bentuk di sini adalah bijak: DI + / DI- silang menentukan arah, ADX threshold ((default25) penapis trend lemah.

CCI berpasangan dengan purata bergerak

Panjang CCI ditetapkan pada 20 kitaran, dengan 14 kitaran purata bergerak. Kombinasi parameter ini dioptimumkan untuk mencari titik keseimbangan antara kepekaan dan kestabilan. Mendukung 5 jenis purata bergerak, tetapi SMA dan EMA paling stabil dalam pertempuran sebenar.

RSI Permukaan Penapis: Elakkan Terlalu Beli dan Terlalu Jual

Penapis RSI ditetapkan pada sempadan 30⁄70, bukan untuk menyalin, tetapi untuk mengelakkan penembusan palsu dalam keadaan yang melampau. Perancangan ini membantu strategi mengelakkan banyak isyarat palsu pasaran goyah, terutama pada peringkat penyusunan melintang.

ATR dan jumlah transaksi: insurans ganda terhadap aktiviti pasaran

Penapisan ATR memastikan pasaran mempunyai turun naik yang mencukupi, dengan had lalai 1.0 ≠. Penapisan jumlah transaksi memerlukan 1.5 kali ganda daripada purata transaksi semasa melebihi 20 kitaran ≠. Kedua-dua syarat ini bekerjasama, menapis banyak peluang perdagangan berkualiti rendah ≠.

Tiga Mekanisme Keluar: Fleksibiliti dalam Berbeza-beza Persekitaran Pasaran

Moving Average Entry, ADX Change Stop, Performance Stop 3 mekanisme boleh digunakan secara berasingan atau dalam kombinasi. Moving Average Entry sesuai untuk pasaran trend, dan ADX Change Stop adalah insurans terakhir.

Fungsi Reverse Trading: Mencari Peluang Dari Kerugian

Fungsi Countertrade membolehkan membuka kedudukan terbalik sebaik sahaja kedudukan kosong. Ini bukan perjudian, tetapi berdasarkan logik pembalikan penunjuk teknikal. Tetapi perhatikan bahawa fungsi ini boleh menyebabkan kerugian berturut-turut di pasaran yang sedang tren dan disyorkan hanya digunakan di pasaran yang bergolak atau akhir trend.

Petua risiko dan senario penggunaan

Strategi ini berfungsi dengan baik di pasaran yang jelas dalam trend, tetapi isyarat jarang berlaku ketika bergolak di lateral. Walaupun penapisan berganda meningkatkan kualiti isyarat, ia juga meningkatkan risiko kehilangan peluang.

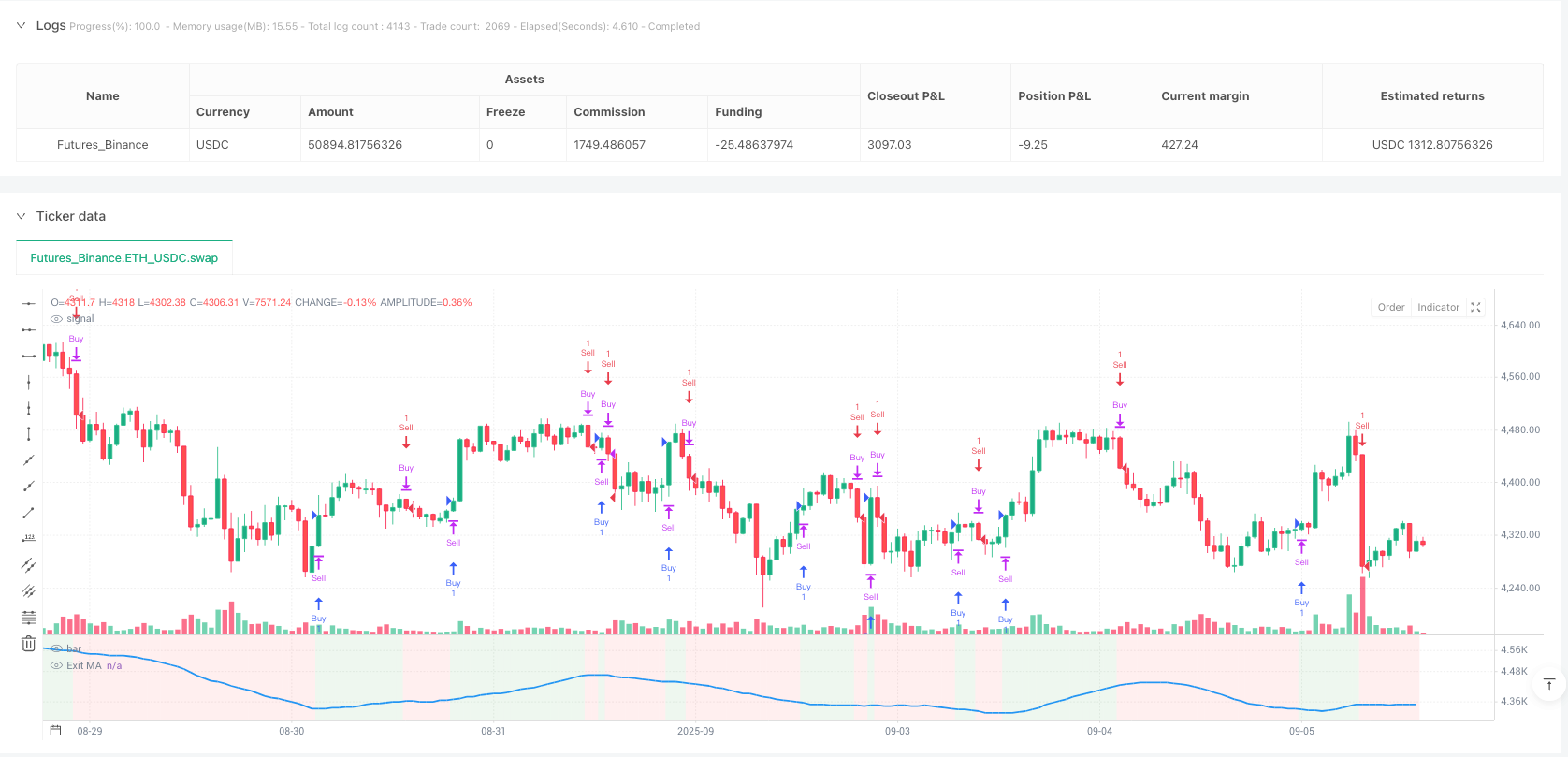

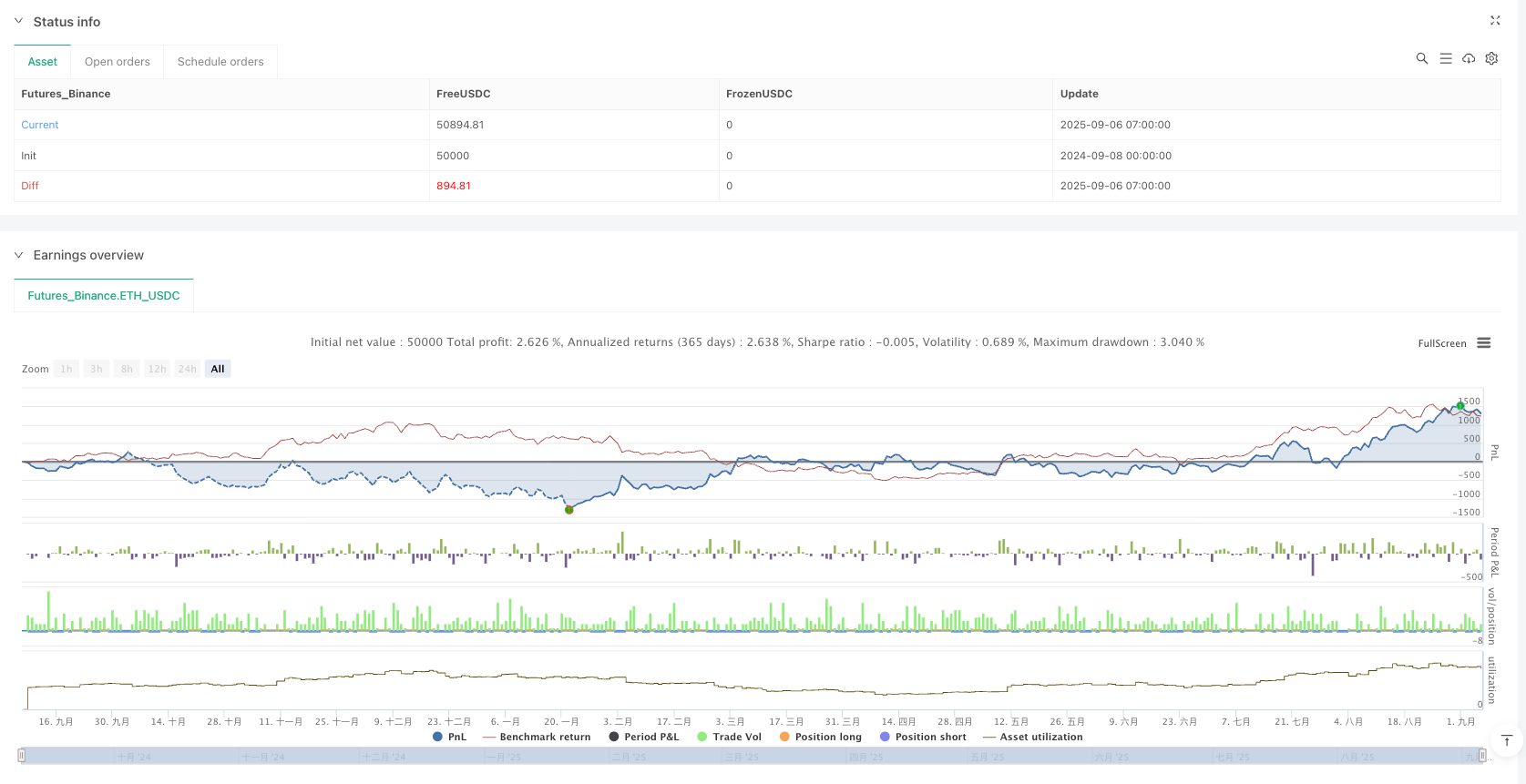

/*backtest

start: 2024-09-08 00:00:00

end: 2025-09-06 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDC"}]

*/

//@version=6

strategy("Optimized ADX DI CCI Strategy", shorttitle="ADXCCI Opt")

// Input Groups

group_indicators = "Indicator Settings"

indicator_timeframe = input.timeframe("", "Indicator Timeframe", options=["", "1", "5", "15", "30", "60", "240", "D", "W"], group=group_indicators, tooltip="Empty uses chart timeframe")

group_adx = "ADX & DI Settings"

adx_di_len = input.int(30, "DI Length", minval=1, group=group_adx)

adx_smooth_len = input.int(14, "ADX Smoothing Length", minval=1, group=group_adx)

use_adx_filter = input.bool(false, "Use ADX Filter", group=group_adx)

adx_threshold = input.int(25, "ADX Threshold", minval=0, group=group_adx)

group_cci = "CCI Settings"

cci_length = input.int(20, "CCI Length", minval=1, group=group_cci)

cci_src = input.source(hlc3, "CCI Source", group=group_cci)

ma_type = input.string("SMA", "CCI MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group=group_cci)

ma_length = input.int(14, "CCI MA Length", minval=1, group=group_cci)

group_rsi = "RSI Filter Settings"

use_rsi_filter = input.bool(false, "Use RSI Filter", group=group_rsi)

rsi_length = input.int(14, "RSI Length", minval=1, group=group_rsi)

rsi_lower_limit = input.int(30, "RSI Lower Limit", minval=0, maxval=100, group=group_rsi)

rsi_upper_limit = input.int(70, "RSI Upper Limit", minval=0, maxval=100, group=group_rsi)

group_atr = "ATR Filter Settings"

use_atr_filter = input.bool(false, "Use ATR Filter", group=group_atr, tooltip="If enabled, requires ATR to exceed threshold for signals")

atr_length = input.int(14, "ATR Length", minval=1, group=group_atr)

atr_threshold = input.float(1.0, "ATR Threshold", minval=0.0, step=0.1, group=group_atr, tooltip="Minimum ATR value for valid signals")

group_volume = "Volume Filter Settings"

use_volume_filter = input.bool(false, "Use Volume Filter", group=group_volume, tooltip="If enabled, requires volume to exceed threshold for signals")

volume_length = input.int(20, "Volume MA Length", minval=1, group=group_volume, tooltip="Period for volume moving average")

volume_threshold_multiplier = input.float(1.5, "Volume Threshold Multiplier", minval=0.1, step=0.1, group=group_volume, tooltip="Volume must exceed MA by this factor")

group_signal = "Signal Settings"

cross_window = input.int(0, "Cross Window (Bars)", minval=0, maxval=5, group=group_signal, tooltip="0 means exact same bar, higher allows recent crosses")

allow_long = input.bool(true, "Allow Long Trades", group=group_signal, tooltip="Only allows new Long trades, closing open trades still possible")

allow_short = input.bool(true, "Allow Short Trades", group=group_signal, tooltip="Only allows new Short trades, closing open trades still possible")

buy_di_cross = input.bool(true, "Require DI+/DI- Cross for Buy", group=group_signal, tooltip="If unchecked, DI+ > DI- is enough")

buy_cci_cross = input.bool(true, "Require CCI Cross for Buy", group=group_signal, tooltip="If unchecked, CCI > MA is enough")

sell_di_cross = input.bool(true, "Require DI+/DI- Cross for Sell", group=group_signal, tooltip="If unchecked, DI+ < DI- is enough")

sell_cci_cross = input.bool(true, "Require CCI Cross for Sell", group=group_signal, tooltip="If unchecked, CCI < MA is enough")

countertrade = input.bool(true, "Countertrade", group=group_signal, tooltip="If checked, open opposite trade after closing one")

color_background = input.bool(true, "Color Background for Open Trades", group=group_signal, tooltip="Green for Long, Red for Short")

group_exit = "Exit Settings"

use_ma_exit = input.bool(true, "Use MA Cross for Exit", group=group_exit)

ma_exit_length = input.int(20, "MA Length for Exit", minval=1, group=group_exit)

ma_exit_type = input.string("SMA", "MA Type for Exit", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group=group_exit)

use_adx_stop = input.bool(false, "Use ADX Change Stop-Loss", group=group_exit)

adx_change_percent = input.float(5.0, "ADX % Change for Stop-Loss", minval=0.0, step=0.1, group=group_exit, tooltip="Close trade if ADX changes by this % vs previous bar")

use_perf_stop = input.bool(false, "Use Performance Stop-Loss", group=group_exit, tooltip="Close trade if performance reaches this % loss")

perf_stop_percent = input.float(-10.0, "Performance Stop-Loss (%)", minval=-100.0, maxval=0.0, step=0.1, group=group_exit, tooltip="Negative % value for loss threshold")

// Trade Statistics Variables

var bool in_long = false

var bool in_short = false

var bool can_trade = strategy.equity > 0

var float initial_capital = strategy.initial_capital

var string open_trade_status = "No Open Trade"

var float long_trades = 0

var float short_trades = 0

var float long_wins = 0

var float short_wins = 0

var float entry_price = 0

// Calculations with Timeframe

[di_plus, di_minus, adx] = request.security(syminfo.tickerid, indicator_timeframe, ta.dmi(adx_di_len, adx_smooth_len))

cci = request.security(syminfo.tickerid, indicator_timeframe, ta.cci(cci_src, cci_length))

rsi = request.security(syminfo.tickerid, indicator_timeframe, ta.rsi(close, rsi_length))

atr = request.security(syminfo.tickerid, indicator_timeframe, ta.atr(atr_length))

volume_ma = request.security(syminfo.tickerid, indicator_timeframe, ta.sma(volume, volume_length))

ma_func(source, length, type, tf) =>

switch type

"SMA" => request.security(syminfo.tickerid, tf, ta.sma(source, length))

"EMA" => request.security(syminfo.tickerid, tf, ta.ema(source, length))

"SMMA (RMA)" => request.security(syminfo.tickerid, tf, ta.rma(source, length))

"WMA" => request.security(syminfo.tickerid, tf, ta.wma(source, length))

"VWMA" => request.security(syminfo.tickerid, tf, ta.vwma(source, length))

cci_ma = ma_func(cci, ma_length, ma_type, indicator_timeframe)

ma_exit = ma_func(close, ma_exit_length, ma_exit_type, indicator_timeframe)

// Plot MA if enabled (Global Scope)

plot(use_ma_exit ? ma_exit : na, "Exit MA", color=color.blue, linewidth=2)

// ADX Change Calculation

adx_change = ta.change(adx)

adx_prev = nz(adx[1], adx)

adx_percent_change = adx_prev != 0 ? math.abs(adx_change / adx_prev * 100) : 0

adx_stop_condition = use_adx_stop and adx_percent_change >= adx_change_percent

// Performance Stop-Loss Calculation

bool perf_stop_condition = false

if in_long and use_perf_stop

perf_stop_condition := (close - entry_price) / entry_price * 100 <= perf_stop_percent

if in_short and use_perf_stop

perf_stop_condition := (entry_price - close) / entry_price * 100 <= perf_stop_percent

// ATR Filter

atr_filter = not use_atr_filter or atr >= atr_threshold

// Volume Filter

volume_filter = not use_volume_filter or volume >= volume_ma * volume_threshold_multiplier

// Cross Detection

buy_cross_di = ta.crossover(di_plus, di_minus)

sell_cross_di = ta.crossover(di_minus, di_plus)

buy_cross_cci = ta.crossover(cci, cci_ma)

sell_cross_cci = ta.crossunder(cci, cci_ma)

long_exit_ma = ta.crossunder(close, ma_exit)

short_exit_ma = ta.crossover(close, ma_exit)

// Recent Cross Checks

buy_di_recent = ta.barssince(buy_cross_di) <= cross_window

sell_di_recent = ta.barssince(sell_cross_di) <= cross_window

buy_cci_recent = ta.barssince(buy_cross_cci) <= cross_window

sell_cci_recent = ta.barssince(sell_cross_cci) <= cross_window

// Signal Conditions

adx_filter = not use_adx_filter or adx > adx_threshold

rsi_buy_filter = not use_rsi_filter or rsi < rsi_lower_limit

rsi_sell_filter = not use_rsi_filter or rsi > rsi_upper_limit

buy_di_condition = buy_di_cross ? buy_di_recent : di_plus > di_minus

buy_cci_condition = buy_cci_cross ? buy_cci_recent : cci > cci_ma

sell_di_condition = sell_di_cross ? sell_di_recent : di_plus < di_minus

sell_cci_condition = sell_cci_cross ? sell_cci_recent : cci < cci_ma

buy_signal = buy_di_condition and buy_cci_condition and adx_filter and rsi_buy_filter and atr_filter and volume_filter

sell_signal = sell_di_condition and sell_cci_condition and adx_filter and rsi_sell_filter and atr_filter and volume_filter

// Alarms

alertcondition(buy_signal, title="Buy Signal Alert", message="ADXCCI Strategy: Buy Signal Triggered")

alertcondition(sell_signal, title="Sell Signal Alert", message="ADXCCI Strategy: Sell Signal Triggered")

// Strategy Entries and Labels

float chart_bottom = ta.lowest(low, 100)

if buy_signal and not in_long and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

if sell_signal and not in_short and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

// Reverse Exits (only if MA exit, ADX stop, and Perf stop are not used)

if not use_ma_exit and not adx_stop_condition and not perf_stop_condition

if sell_signal and in_long

strategy.close("Buy")

label.new(bar_index, chart_bottom, "↓", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close > entry_price

long_wins := long_wins + 1

in_long := false

if countertrade and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

if buy_signal and in_short

strategy.close("Sell")

label.new(bar_index, chart_bottom, "↑", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close < entry_price

short_wins := short_wins + 1

in_short := false

if countertrade and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

// MA Exit

if use_ma_exit

if in_long and long_exit_ma

strategy.close("Buy")

label.new(bar_index, chart_bottom, "↓", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close > entry_price

long_wins := long_wins + 1

in_long := false

if countertrade and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

if in_short and short_exit_ma

strategy.close("Sell")

label.new(bar_index, chart_bottom, "↑", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close < entry_price

short_wins := short_wins + 1

in_short := false

if countertrade and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

// ADX Stop-Loss

if adx_stop_condition

if in_long

strategy.close("Buy")

label.new(bar_index, chart_bottom, "↓", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close > entry_price

long_wins := long_wins + 1

in_long := false

if countertrade and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

if in_short

strategy.close("Sell")

label.new(bar_index, chart_bottom, "↑", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close < entry_price

short_wins := short_wins + 1

in_short := false

if countertrade and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

// Performance Stop-Loss

if perf_stop_condition

if in_long

strategy.close("Buy")

label.new(bar_index, chart_bottom, "↓", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close > entry_price

long_wins := long_wins + 1

in_long := false

if countertrade and allow_short and can_trade

strategy.entry("Sell", strategy.short)

label.new(bar_index, chart_bottom, "↓", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "SELL", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_short := true

in_long := false

short_trades := short_trades + 1

entry_price := close

if in_short

strategy.close("Sell")

label.new(bar_index, chart_bottom, "↑", color=color.red, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

if close < entry_price

short_wins := short_wins + 1

in_short := false

if countertrade and allow_long and can_trade

strategy.entry("Buy", strategy.long)

label.new(bar_index, chart_bottom, "↑", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.normal, yloc=yloc.price)

label.new(bar_index, chart_bottom, "BUY", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.large, yloc=yloc.price)

in_long := true

in_short := false

long_trades := long_trades + 1

entry_price := close

// Warn if Equity is Negative

if not can_trade and (buy_signal or sell_signal)

label.new(bar_index, close, "No Equity", color=color.yellow, style=label.style_label_center, textcolor=color.black, size=size.tiny)

// Background Coloring (Global Scope)

bgcolor(color_background ? (in_long ? color.new(color.green, 90) : in_short ? color.new(color.red, 90) : na) : na)