Jadi, apa yang anda lakukan dengan taktik ini?

Tidak seperti strategi satu arah yang tetap, ia boleh bertukar arah mengikut keadaan pasaran. Bayangkan jika anda mempunyai pemandu lama yang boleh memandu dan berbalik, dan dapat mengikuti pergerakan pasaran ke arah mana pun!

Kumpulan Indeks Teknologi Inti

Strategi ini menggunakan gabungan lima petanda yang sangat kuat:

- Kembali ke KernelIa adalah seperti navigasi GPS yang menunjukkan arah trend harga.

- VWAP: Jumlah transaksi dengan harga purata yang bertimbangan, memberitahu anda di mana ‘uang besar’

- CVD berpunca daripada ketidakseimbangan“Saya tidak tahu apa-apa tentang apa yang berlaku di Malaysia, saya tidak tahu apa yang berlaku di Malaysia.

- Indeks RSI yang agak lemahMencegah terjatuh dari kedudukan yang melampau

- Julat turun naik sebenar ATR“Dynamic adjustment to stop loss, adapt to market fluctuation” (Dinamik penyesuaian to stop loss untuk menyesuaikan diri dengan turun naik pasaran)

Mekanisme pengesahan pelbagai

Di sinilah panduan untuk mengelakkan terowong! bahagian yang paling bijak dalam taktik ini adalah “multi-verifikasi”, seperti membeli rumah dengan melihat kawasan, jenis rumah, dan harga, ia meminta:

- Pergerakan trend ((Kernel + VWAP double confirmation)

- Perpaduan kuantiti (sama ada peningkatan atau peningkatan berterusan)

- K-Line Form Transition (≥60% entiti, mengelakkan perangkap bintang salib)

- Pembatasan Jendela Masa: Berdagang pada 9:15-15:15 sahaja, mengelakkan kekacauan pembukaan dan penutupan.

️ Pengurusan Risiko Pintar

Strategi untuk mengawal risiko ini adalah seperti buku teks!

- Dinamika Hentikan KerugianTerdapat tiga mod untuk dipilih: ATR, Fixed Score, Swing High Low

- PenghantaranTarget 1: Menghapuskan 50 peratus kedudukan dan membiarkan keuntungan berlari

- Tracking Stop Loss: Stop loss akan dipindahkan secara automatik selepas keuntungan, dan keuntungan akan dikunci

- Had harian“Saya tidak tahu apa-apa tentang apa yang berlaku di Malaysia, tetapi saya tidak tahu apa yang berlaku di Malaysia.

- Pengurusan wangPerdagangan: Riska terkawal dalam 1%

Cadangan untuk kegunaan dalam peperangan

Jika anda ingin menggunakan strategi ini, ingat beberapa perkara:

- Kitaran terbaikGraf 5 minit adalah yang terbaik kerana ia dapat menangkap pergerakan jangka pendek dan tidak terlalu kerap

- Varieti yang boleh digunakanIa direka khas untuk indeks bank, tetapi indeks lain juga boleh dirujuk.

- Masa urus niagaWaktu di India: 9:15-15:15, mengelakkan bunyi bunyi dua tali K di hadapan cakera.

- Kawalan KedudukanCadangan: 25 - 75 kontrak untuk setiap tangan, maksimum 200 tangan

Yang paling menarik dari strategi ini ialah “bertabrakan dan berpatah balik”, pasaran lembu boleh melakukan lebih banyak, pasaran beruang boleh kosong, dan pasaran bergolak tidak takut! Seperti pisau tentera Switzerland, ia boleh menangani apa sahaja.

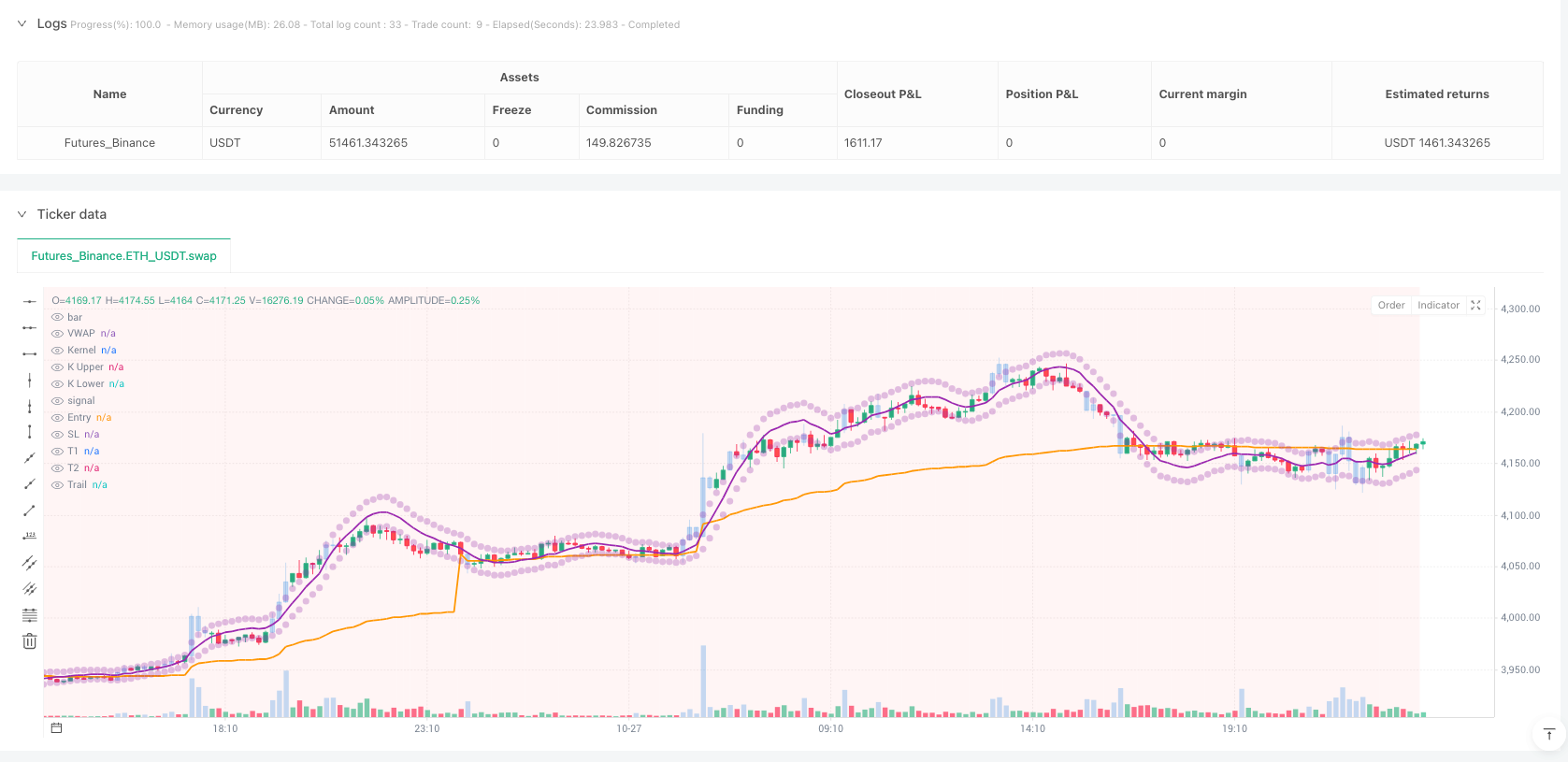

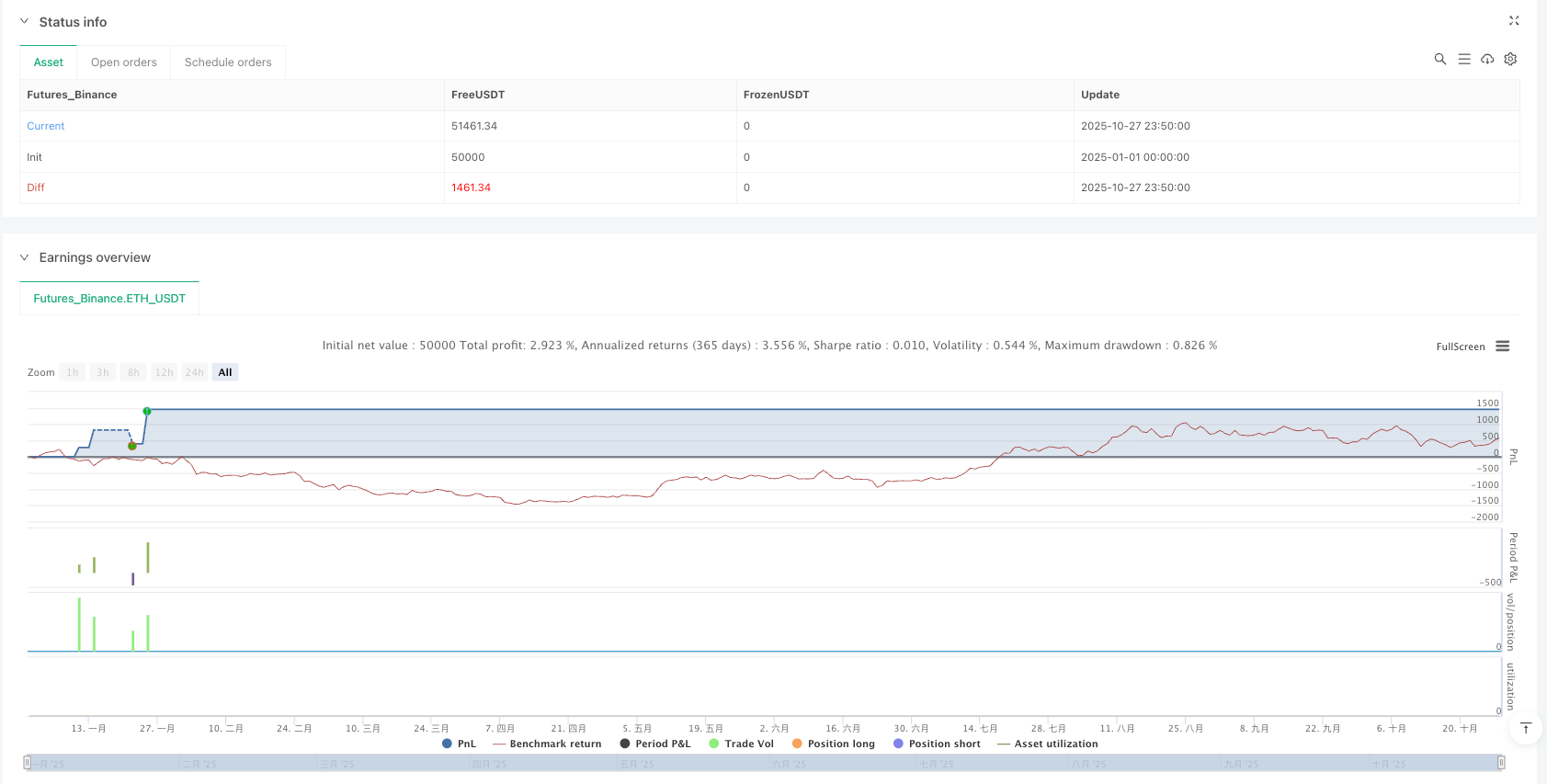

/*backtest

start: 2025-01-01 00:00:00

end: 2025-10-28 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("BankNifty LONG & SHORT Multi-Confluence",

shorttitle="BN Long-Short",

overlay=true)

// ═══════════════════════════════════════════════════════════

// 📊 STRATEGY INFO

// ═══════════════════════════════════════════════════════════

// Timeframe: 5-MINUTE CHART (Recommended)

// Direction: LONG & SHORT (Both directions)

// Asset: BankNifty Futures

// Style: Intraday Momentum Trading

// ═══════════════════════════════════════════════════════════

// ═══════════════════════════════════════════════════════════

// ⚙️ INPUT PARAMETERS

// ═══════════════════════════════════════════════════════════

// Trading Direction

tradingDirection = input.string("Both", "Trading Direction",

options=["Long Only", "Short Only", "Both"], group="🎯 Strategy Type")

// Trading Hours (IST)

startHour = input.int(9, "Start Hour", minval=0, maxval=23, group="⏰ Trading Session")

startMinute = input.int(15, "Start Minute", minval=0, maxval=59, group="⏰ Trading Session")

endHour = input.int(15, "End Hour", minval=0, maxval=23, group="⏰ Trading Session")

endMinute = input.int(15, "End Minute", minval=0, maxval=59, group="⏰ Trading Session")

avoidFirstCandles = input.int(2, "Skip First N Candles", minval=0, maxval=10, group="⏰ Trading Session")

// Position Sizing

lotSize = input.int(25, "Lot Size", minval=15, maxval=75, group="💰 Position Management")

maxContracts = input.int(75, "Max Contracts", minval=25, maxval=200, step=25, group="💰 Position Management")

riskPercent = input.float(1.0, "Risk % Per Trade", minval=0.5, maxval=3.0, step=0.1, group="💰 Position Management")

// Kernel Regression

kernelLength = input.int(20, "Kernel Length", minval=10, maxval=50, group="📈 Indicators")

// VWAP

vwapSource = input.string("Session", "VWAP Type", options=["Session", "Rolling"], group="📈 Indicators")

vwapRollingLength = input.int(20, "Rolling VWAP Length", minval=10, maxval=100, group="📈 Indicators")

// Volume

volumeLength = input.int(20, "Volume MA Length", minval=10, maxval=50, group="📊 Volume")

volumeMultiplier = input.float(1.5, "Volume Spike", minval=1.1, maxval=3.0, step=0.1, group="📊 Volume")

// CVD

useCVD = input.bool(true, "Use CVD Filter", group="📊 Volume")

cvdLength = input.int(10, "CVD Smoothing", minval=5, maxval=30, group="📊 Volume")

// RSI

useRSI = input.bool(true, "Use RSI Filter", group="🎯 Filters")

rsiLength = input.int(14, "RSI Length", minval=7, maxval=30, group="🎯 Filters")

rsiOverbought = input.int(70, "RSI Overbought", minval=60, maxval=85, group="🎯 Filters")

rsiOversold = input.int(30, "RSI Oversold", minval=15, maxval=40, group="🎯 Filters")

// Price Action

candleBodyPercent = input.float(0.6, "Min Body %", minval=0.4, maxval=0.9, step=0.05, group="🎯 Filters")

minCandlePoints = input.float(20.0, "Min Candle Size", minval=10.0, maxval=100.0, step=5.0, group="🎯 Filters")

// Stop Loss

stopLossType = input.string("ATR", "Stop Loss Type", options=["Fixed", "ATR", "Swing"], group="🛡️ Exits")

atrLength = input.int(14, "ATR Length", minval=7, maxval=30, group="🛡️ Exits")

atrMultiplier = input.float(1.5, "ATR Multiplier", minval=0.5, maxval=3.0, step=0.1, group="🛡️ Exits")

fixedStopLoss = input.float(50.0, "Fixed SL (points)", minval=20.0, maxval=200.0, step=10.0, group="🛡️ Exits")

swingLookback = input.int(10, "Swing Lookback", minval=5, maxval=30, group="🛡️ Exits")

// Targets

rrTarget1 = input.float(1.5, "Target 1 R:R", minval=0.5, maxval=3.0, step=0.1, group="🛡️ Exits")

rrTarget2 = input.float(2.5, "Target 2 R:R", minval=1.0, maxval=5.0, step=0.5, group="🛡️ Exits")

partialExitPercent = input.int(50, "Partial Exit %", minval=25, maxval=75, step=5, group="🛡️ Exits")

// Trailing

useTrailing = input.bool(true, "Trailing Stop", group="🛡️ Exits")

trailActivationRR = input.float(1.2, "Activate at R:R", minval=0.5, maxval=2.0, step=0.1, group="🛡️ Exits")

trailStopRR = input.float(0.8, "Trail Stop R:R", minval=0.3, maxval=1.5, step=0.1, group="🛡️ Exits")

// Risk Management

maxTradesPerDay = input.int(5, "Max Trades/Day", minval=1, maxval=20, group="🚨 Risk")

maxConsecutiveLosses = input.int(2, "Stop After Losses", minval=1, maxval=5, group="🚨 Risk")

dailyLossLimit = input.float(2.5, "Daily Loss %", minval=1.0, maxval=10.0, step=0.5, group="🚨 Risk")

dailyProfitTarget = input.float(5.0, "Daily Target %", minval=2.0, maxval=20.0, step=0.5, group="🚨 Risk")

// ═══════════════════════════════════════════════════════════

// 📊 INDICATORS

// ═══════════════════════════════════════════════════════════

// Kernel Regression

kernel = ta.linreg(close, kernelLength, 0)

kernelSlope = kernel - kernel[1]

// VWAP

vwapValue = vwapSource == "Session" ? ta.vwap(close) : ta.sma(hlc3, vwapRollingLength)

vwapSlope = vwapValue - vwapValue[1]

// Volume

volumeMA = ta.sma(volume, volumeLength)

highVolume = volume > volumeMA * volumeMultiplier

volumeIncreasing = volume > volume[1] and volume[1] > volume[2]

// CVD

buyVolume = close > open ? volume : 0

sellVolume = close < open ? volume : 0

volumeDelta = buyVolume - sellVolume

cvd = ta.cum(volumeDelta)

cvdMA = ta.sma(cvd, cvdLength)

// RSI

rsi = ta.rsi(close, rsiLength)

// ATR

atr = ta.atr(atrLength)

// Price Action

candleRange = high - low

candleBody = math.abs(close - open)

bodyPercent = candleRange > 0 ? candleBody / candleRange : 0

// Swing High/Low

swingHigh = ta.highest(high, swingLookback)

swingLow = ta.lowest(low, swingLookback)

// ═══════════════════════════════════════════════════════════

// ⏰ TIME MANAGEMENT

// ═══════════════════════════════════════════════════════════

currentMinutes = hour * 60 + minute

startMinutes = startHour * 60 + startMinute

endMinutes = endHour * 60 + endMinute

tradingTime = currentMinutes >= startMinutes and currentMinutes <= endMinutes

var int barsToday = 0

newDay = ta.change(dayofweek)

if newDay

barsToday := 0

if tradingTime

barsToday += 1

skipInitialBars = barsToday <= avoidFirstCandles

forceExitTime = currentMinutes >= (endMinutes - 5)

// ═══════════════════════════════════════════════════════════

// 💼 POSITION TRACKING

// ═══════════════════════════════════════════════════════════

var int todayTrades = 0

var int consecutiveLosses = 0

var float todayPnL = 0.0

var float entryPrice = na

var int entryBar = 0

var float stopLoss = na

var float target1 = na

var float target2 = na

var float trailStop = na

var bool target1Hit = false

var bool trailActive = false

// Daily Reset

if newDay

todayTrades := 0

consecutiveLosses := 0

todayPnL := 0.0

// Track P&L

if strategy.closedtrades > 0 and strategy.closedtrades != strategy.closedtrades[1]

lastPnL = strategy.closedtrades.profit(strategy.closedtrades - 1)

todayPnL += lastPnL

if lastPnL < 0

consecutiveLosses += 1

else

consecutiveLosses := 0

// Risk Limits

lossLimit = strategy.initial_capital * (dailyLossLimit / 100)

profitTarget = strategy.initial_capital * (dailyProfitTarget / 100)

hitDailyTarget = todayPnL >= profitTarget

hitLossLimit = math.abs(todayPnL) >= lossLimit

canTrade = todayTrades < maxTradesPerDay and

consecutiveLosses < maxConsecutiveLosses and

not hitDailyTarget and

not hitLossLimit and

tradingTime and

not skipInitialBars and

strategy.position_size == 0

// ═══════════════════════════════════════════════════════════

// 🎯 LONG ENTRY CONDITIONS

// ═══════════════════════════════════════════════════════════

// Bullish Trend

longTrend = kernelSlope > 0 and close > kernel

longVWAP = close > vwapValue and vwapSlope > 0

longCVD = useCVD ? cvd > cvdMA and ta.rising(cvd, 2) : true

longRSI = useRSI ? rsi > rsiOversold and rsi < rsiOverbought : true

longVolume = highVolume or volumeIncreasing

longCandle = close > open and bodyPercent >= candleBodyPercent and

candleRange >= minCandlePoints and close >= (high - (candleRange * 0.25))

longSignal = longTrend and longVWAP and longCVD and longRSI and longVolume and longCandle and canTrade and

(tradingDirection == "Long Only" or tradingDirection == "Both")

// ═══════════════════════════════════════════════════════════

// 🎯 SHORT ENTRY CONDITIONS

// ═══════════════════════════════════════════════════════════

// Bearish Trend

shortTrend = kernelSlope < 0 and close < kernel

shortVWAP = close < vwapValue and vwapSlope < 0

shortCVD = useCVD ? cvd < cvdMA and ta.falling(cvd, 2) : true

shortRSI = useRSI ? rsi < rsiOverbought and rsi > rsiOversold : true

shortVolume = highVolume or volumeIncreasing

shortCandle = close < open and bodyPercent >= candleBodyPercent and

candleRange >= minCandlePoints and close <= (low + (candleRange * 0.25))

shortSignal = shortTrend and shortVWAP and shortCVD and shortRSI and shortVolume and shortCandle and canTrade and

(tradingDirection == "Short Only" or tradingDirection == "Both")

// ═══════════════════════════════════════════════════════════

// 💰 POSITION SIZING

// ═══════════════════════════════════════════════════════════

calcPositionSize(stopDistance) =>

riskAmount = strategy.initial_capital * (riskPercent / 100)

contracts = math.floor(riskAmount / stopDistance)

math.min(contracts, maxContracts)

// ═══════════════════════════════════════════════════════════

// 📥 LONG ENTRY

// ═══════════════════════════════════════════════════════════

if longSignal

entryPrice := close

entryBar := bar_index

// Calculate Stop Loss

if stopLossType == "ATR"

stopLoss := close - (atr * atrMultiplier)

else if stopLossType == "Swing"

stopLoss := math.min(swingLow, close - (atr * atrMultiplier))

else

stopLoss := close - fixedStopLoss

risk = entryPrice - stopLoss

target1 := entryPrice + (risk * rrTarget1)

target2 := entryPrice + (risk * rrTarget2)

qty = calcPositionSize(risk)

trailStop := stopLoss

target1Hit := false

trailActive := false

todayTrades += 1

strategy.entry("LONG", strategy.long, qty=qty, comment="Long-" + str.tostring(todayTrades))

// ═══════════════════════════════════════════════════════════

// 📥 SHORT ENTRY

// ═══════════════════════════════════════════════════════════

if shortSignal

entryPrice := close

entryBar := bar_index

// Calculate Stop Loss

if stopLossType == "ATR"

stopLoss := close + (atr * atrMultiplier)

else if stopLossType == "Swing"

stopLoss := math.max(swingHigh, close + (atr * atrMultiplier))

else

stopLoss := close + fixedStopLoss

risk = stopLoss - entryPrice

target1 := entryPrice - (risk * rrTarget1)

target2 := entryPrice - (risk * rrTarget2)

qty = calcPositionSize(risk)

trailStop := stopLoss

target1Hit := false

trailActive := false

todayTrades += 1

strategy.entry("SHORT", strategy.short, qty=qty, comment="Short-" + str.tostring(todayTrades))

// ═══════════════════════════════════════════════════════════

// 🏃 TRAILING STOP (LONG)

// ═══════════════════════════════════════════════════════════

if strategy.position_size > 0 and useTrailing

unrealizedProfit = close - entryPrice

risk = entryPrice - stopLoss

if unrealizedProfit >= (risk * trailActivationRR) and not trailActive

trailActive := true

trailStop := close - (risk * trailStopRR)

if trailActive

newTrailStop = close - (risk * trailStopRR)

if newTrailStop > trailStop

trailStop := newTrailStop

// ═══════════════════════════════════════════════════════════

// 🏃 TRAILING STOP (SHORT)

// ═══════════════════════════════════════════════════════════

if strategy.position_size < 0 and useTrailing

unrealizedProfit = entryPrice - close

risk = stopLoss - entryPrice

if unrealizedProfit >= (risk * trailActivationRR) and not trailActive

trailActive := true

trailStop := close + (risk * trailStopRR)

if trailActive

newTrailStop = close + (risk * trailStopRR)

if newTrailStop < trailStop

trailStop := newTrailStop

// ═══════════════════════════════════════════════════════════

// 📤 LONG EXIT

// ═══════════════════════════════════════════════════════════

if strategy.position_size > 0

activeSL = trailActive and useTrailing ? trailStop : stopLoss

// Stop Loss

if low <= activeSL

strategy.close("LONG", comment="Long-SL")

// Target 1

else if high >= target1 and not target1Hit

exitQty = math.floor(strategy.position_size * (partialExitPercent / 100))

strategy.close("LONG", qty=exitQty, comment="Long-T1")

target1Hit := true

stopLoss := entryPrice

// Target 2

else if high >= target2

strategy.close("LONG", comment="Long-T2")

// Force Exit

else if forceExitTime

strategy.close("LONG", comment="Long-EOD")

// ═══════════════════════════════════════════════════════════

// 📤 SHORT EXIT

// ═══════════════════════════════════════════════════════════

if strategy.position_size < 0

activeSL = trailActive and useTrailing ? trailStop : stopLoss

// Stop Loss

if high >= activeSL

strategy.close("SHORT", comment="Short-SL")

// Target 1

else if low <= target1 and not target1Hit

exitQty = math.floor(math.abs(strategy.position_size) * (partialExitPercent / 100))

strategy.close("SHORT", qty=exitQty, comment="Short-T1")

target1Hit := true

stopLoss := entryPrice

// Target 2

else if low <= target2

strategy.close("SHORT", comment="Short-T2")

// Force Exit

else if forceExitTime

strategy.close("SHORT", comment="Short-EOD")

// ═══════════════════════════════════════════════════════════

// ⚠️ REVERSAL EXIT

// ═══════════════════════════════════════════════════════════

longReversal = strategy.position_size > 0 and (close < kernel and kernelSlope < 0 or close < vwapValue)

shortReversal = strategy.position_size < 0 and (close > kernel and kernelSlope > 0 or close > vwapValue)

if longReversal and target1Hit

strategy.close("LONG", comment="Long-Rev")

if shortReversal and target1Hit

strategy.close("SHORT", comment="Short-Rev")

// ═══════════════════════════════════════════════════════════

// 🎨 VISUALIZATION

// ═══════════════════════════════════════════════════════════

// Indicators

plot(kernel, "Kernel", color=color.new(color.purple, 0), linewidth=2)

plot(vwapValue, "VWAP", color=color.new(color.orange, 0), linewidth=2)

kernelUpper = kernel + atr

kernelLower = kernel - atr

plot(kernelUpper, "K Upper", color=color.new(color.purple, 70), linewidth=1, style=plot.style_circles)

plot(kernelLower, "K Lower", color=color.new(color.purple, 70), linewidth=1, style=plot.style_circles)

// Signals

plotshape(longSignal, "LONG", shape.triangleup, location.belowbar,

color=color.new(color.lime, 0), size=size.normal, text="LONG")

plotshape(shortSignal, "SHORT", shape.triangledown, location.abovebar,

color=color.new(color.red, 0), size=size.normal, text="SHORT")

// Position Levels

posColor = strategy.position_size > 0 ? color.blue : strategy.position_size < 0 ? color.orange : na

plot(strategy.position_size != 0 ? entryPrice : na, "Entry",

color=color.new(posColor, 0), style=plot.style_linebr, linewidth=2)

slColor = strategy.position_size > 0 ? color.red : color.fuchsia

plot(strategy.position_size != 0 ? stopLoss : na, "SL",

color=color.new(slColor, 0), style=plot.style_linebr, linewidth=2)

t1Color = strategy.position_size > 0 ? color.green : color.aqua

plot(strategy.position_size != 0 ? target1 : na, "T1",

color=color.new(t1Color, 0), style=plot.style_linebr, linewidth=1)

plot(strategy.position_size != 0 ? target2 : na, "T2",

color=color.new(t1Color, 0), style=plot.style_linebr, linewidth=2)

plot(strategy.position_size != 0 and trailActive ? trailStop : na, "Trail",

color=color.new(color.yellow, 0), style=plot.style_linebr, linewidth=2)

// Volume

barcolor(highVolume ? color.new(color.blue, 70) : na)

// Background

bgcolor(tradingTime ? color.new(color.green, 98) : color.new(color.gray, 95))

bgcolor(strategy.position_size > 0 ? color.new(color.blue, 97) :

strategy.position_size < 0 ? color.new(color.orange, 97) : na)

bgcolor(hitDailyTarget ? color.new(color.green, 92) : hitLossLimit ? color.new(color.red, 92) : na)

// ═══════════════════════════════════════════════════════════

// 📊 STATS TABLE

// ═══════════════════════════════════════════════════════════

var table stats = table.new(position.top_right, 2, 11, border_width=1)

if barstate.islast

// Header

table.cell(stats, 0, 0, "📊 LONG & SHORT", bgcolor=color.blue, text_color=color.white, text_size=size.small)

table.cell(stats, 1, 0, "STRATEGY", bgcolor=color.blue, text_color=color.white, text_size=size.small)

// Trades

table.cell(stats, 0, 1, "Trades", text_size=size.small)

table.cell(stats, 1, 1, str.tostring(todayTrades) + "/" + str.tostring(maxTradesPerDay),

bgcolor=todayTrades >= maxTradesPerDay ? color.red : color.green, text_color=color.white, text_size=size.small)

// Losses

table.cell(stats, 0, 2, "Losses", text_size=size.small)

table.cell(stats, 1, 2, str.tostring(consecutiveLosses),

bgcolor=consecutiveLosses >= maxConsecutiveLosses ? color.red : color.green,

text_color=color.white, text_size=size.small)

// P&L

pnlPct = (todayPnL / strategy.initial_capital) * 100

table.cell(stats, 0, 3, "P&L", text_size=size.small)

table.cell(stats, 1, 3, str.tostring(todayPnL, "#,###") + "\n" + str.tostring(pnlPct, "#.##") + "%",

bgcolor=todayPnL > 0 ? color.green : todayPnL < 0 ? color.red : color.gray,

text_color=color.white, text_size=size.small)

// Position

table.cell(stats, 0, 4, "Position", text_size=size.small)

posText = strategy.position_size > 0 ? "LONG\n" + str.tostring(strategy.position_size) :

strategy.position_size < 0 ? "SHORT\n" + str.tostring(math.abs(strategy.position_size)) : "FLAT"

posBg = strategy.position_size > 0 ? color.blue : strategy.position_size < 0 ? color.orange : color.gray

table.cell(stats, 1, 4, posText, bgcolor=posBg, text_color=color.white, text_size=size.small)

if strategy.position_size != 0

// Entry

table.cell(stats, 0, 5, "Entry", text_size=size.small)

table.cell(stats, 1, 5, str.tostring(entryPrice, "#.##"), text_size=size.small)

// Live P&L

livePnL = strategy.position_size > 0 ? (close - entryPrice) * strategy.position_size :

(entryPrice - close) * math.abs(strategy.position_size)

livePct = strategy.position_size > 0 ? ((close - entryPrice) / entryPrice) * 100 :

((entryPrice - close) / entryPrice) * 100

table.cell(stats, 0, 6, "Live P&L", text_size=size.small)

table.cell(stats, 1, 6, str.tostring(livePnL, "#,###") + "\n" + str.tostring(livePct, "#.##") + "%",

bgcolor=livePnL > 0 ? color.green : color.red, text_color=color.white, text_size=size.small)

// Bars

bars = bar_index - entryBar

table.cell(stats, 0, 7, "Bars", text_size=size.small)

table.cell(stats, 1, 7, str.tostring(bars), text_size=size.small)

// Stop

table.cell(stats, 0, 8, "Stop", text_size=size.small)

table.cell(stats, 1, 8, str.tostring(trailActive ? trailStop : stopLoss, "#.##") +

(trailActive ? " 🟡" : ""), text_size=size.small)

// T1

table.cell(stats, 0, 9, "T1", text_size=size.small)

table.cell(stats, 1, 9, str.tostring(target1, "#.##") + (target1Hit ? " ✓" : ""), text_size=size.small)

// T2

table.cell(stats, 0, 10, "T2", text_size=size.small)

table.cell(stats, 1, 10, str.tostring(target2, "#.##"), text_size=size.small)

// ═══════════════════════════════════════════════════════════

// 🔔 ALERTS

// ═══════════════════════════════════════════════════════════

alertcondition(longSignal, "🟢 LONG SIGNAL", "LONG Entry Signal")

alertcondition(shortSignal, "🔴 SHORT SIGNAL", "SHORT Entry Signal")

alertcondition(longReversal or shortReversal, "⚠️ REVERSAL", "Reversal Detected")