Sistem penilaian 10 mata: standard baru untuk mengukur transaksi

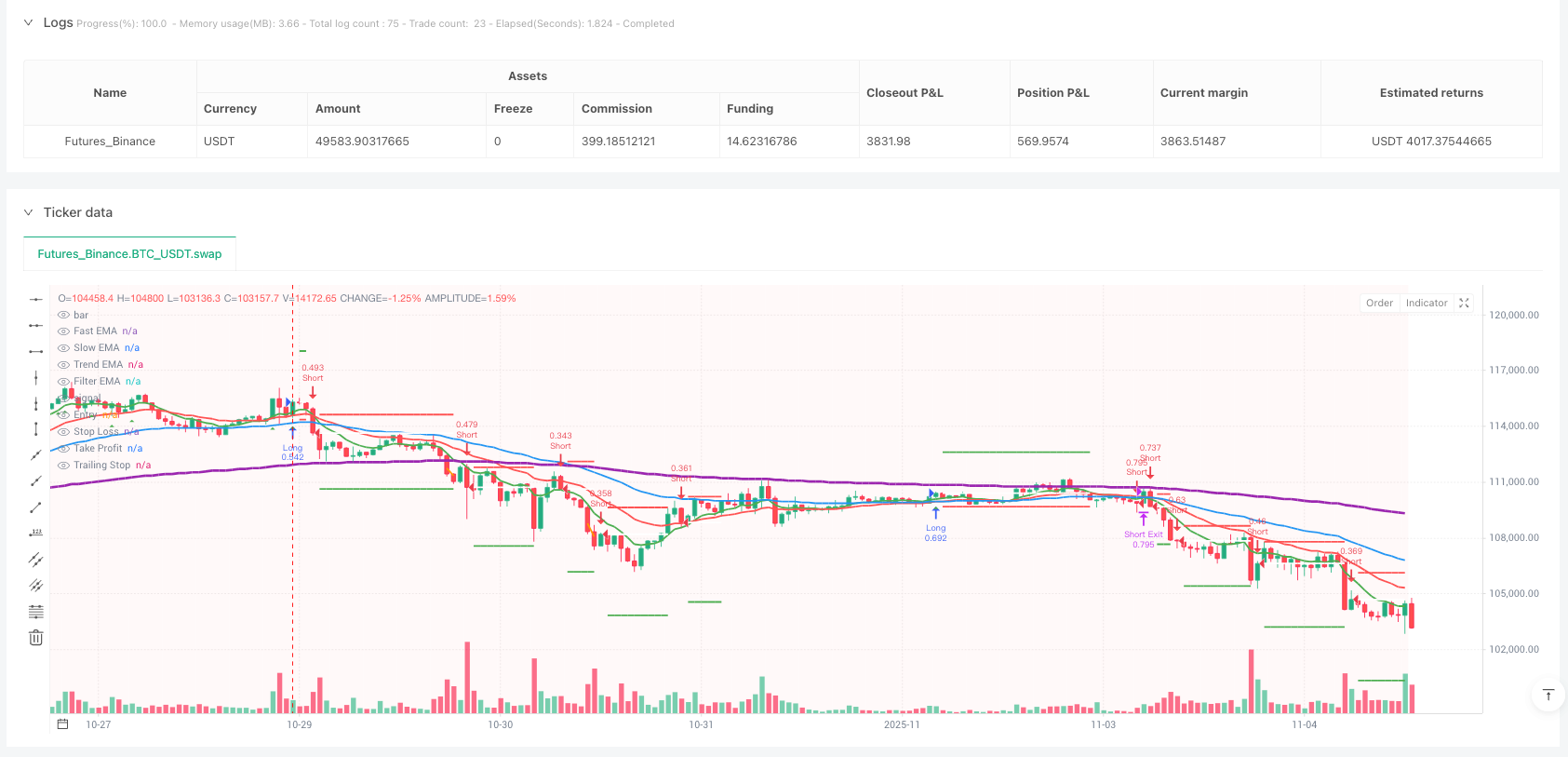

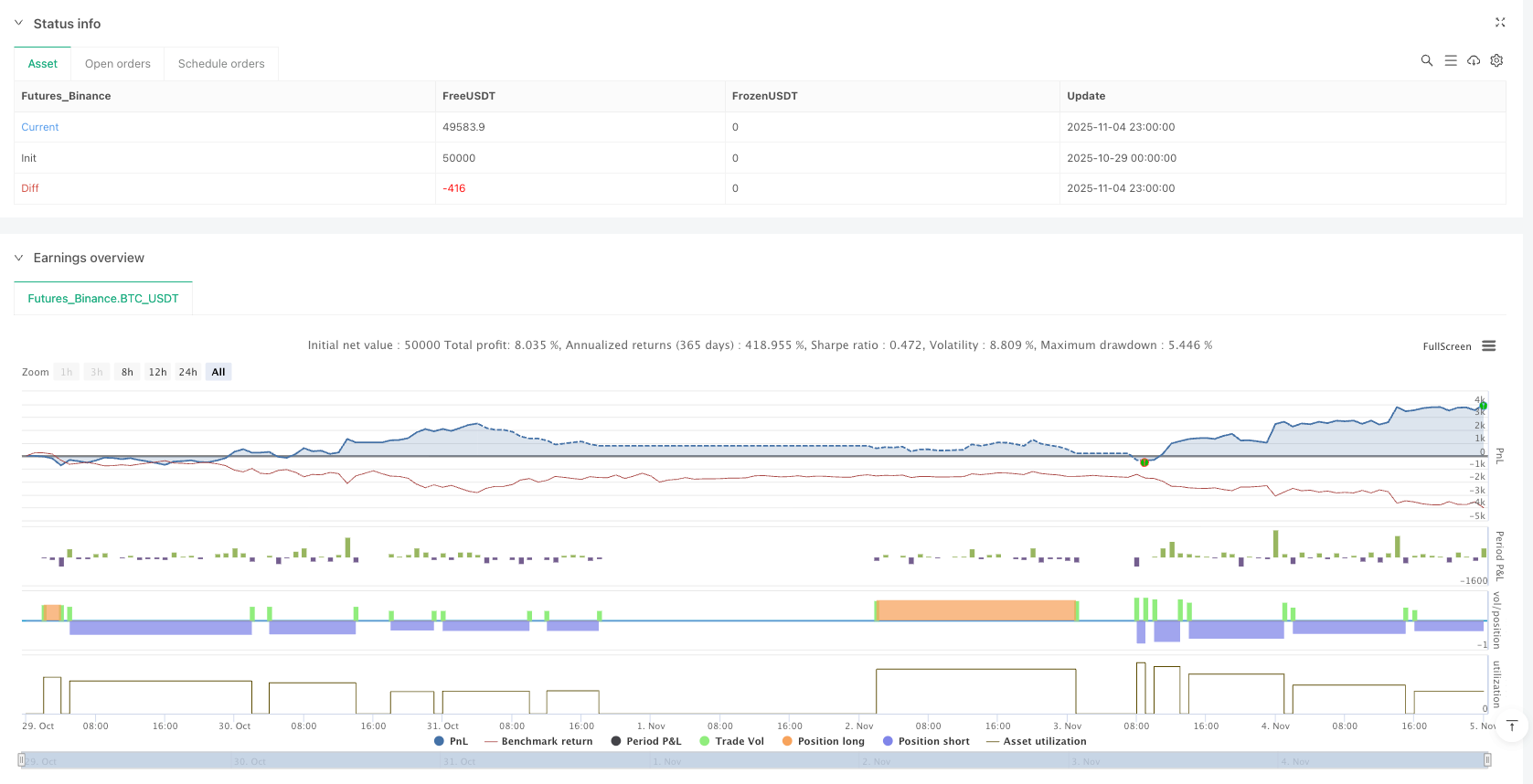

Ini adalah strategi yang paling inovatif.Sistem penilaian integrasi 10 mataBukan sekadar penumpukan petunjuk teknikal, tetapi memberi skor kepada setiap isyarat pasaran: susunan EMA, kedudukan RSI, momentum MACD, kedudukan Brin, pengesahan jumlah transaksi, struktur pasaran, bentuk K-line, pengesahan terobosan, masa perdagangan.Hanya dengan markah 7 atau lebih anda boleh berdagang.Ia adalah tiga kali lebih ketat daripada 2-3 penunjuk tradisional.

Data pengesanan menunjukkan: Mod konservatif memerlukan 8 untuk membuka kedudukan, mod radikal 6 mata, dan mod seimbang mengekalkan piawaian 7 mata.Mekanisme penarafan ini meningkatkan peluang kemenangan kepada lebih daripada 75%“Saya tidak tahu apa-apa tentang apa yang berlaku di Malaysia, tetapi saya tidak tahu apa yang berlaku di Malaysia.

Pengurusan risiko dinamik: 1.5 kali ATR stop loss + 3: 1 rasio kerugian

Penguatan reka bentuk penghalang1.5 kali ATR penyesuaian dinamik, bukan titik tetap. Apabila turun naik emas besar, stop loss melambatkan, apabila turun naik kecil, ia lebih saintifik daripada stop loss tetap. Dengan reka bentuk rasio untung rugi 3: 1, walaupun kemenangan hanya 50%, keuntungan jangka panjang masih positif.

Tracking Stop Loss diaktifkan selepas keuntungan 1.5RDalam pertempuran sebenar, reka bentuk ini dapat mengunci lebih daripada 70% dari pasang surut, dan mengelakkan kesakitan pengembalian keuntungan. Strategi tradisional tidak menjejaki kerugian berhenti kehilangan keuntungan, atau menetapkan terlalu ketat untuk digegarkan, sistem ini mencari titik keseimbangan yang optimum.

Sniper tepat pada masa tiga transaksi

Jadual London (03:00-12:00), Jadual New York (08:00-17:00), Jadual Tokyo (19:00-04:00)Tiga tempoh masa mempunyai jumlah transaksi dan turun naik yang paling tinggi. Strategi hanya membuka kedudukan pada masa-masa ini, mengelakkan tempoh masa yang kurang turun naik.

Statistik menunjukkan: 60 peratus lebih sedikit penipuan palsu pada waktu aktif dan 40 peratus lebih banyak trend berterusan.Penapis masa ini secara langsung meningkatkan kestabilan strategi.Ia juga boleh digunakan untuk meminimumkan gangguan transaksi yang tidak sah.

Pengenalan struktur pasaran: mengesan kenaikan dan penurunan

Strategi diterima pakai10 kitaran pendaratan tinggi rendah titik pengesananUntuk menilai struktur pasaran. Struktur bertopeng: harga tinggi sebelum pecah dan naik pada titik rendah; struktur kosong: harga rendah sebelum jatuh dan turun pada titik tinggi.Peningkatan obligasi semasa kerosakan strukturIni adalah reka bentuk yang mengelakkan sebahagian besar kerugian daripada pembalikan trend.

Strategi tradisional hanya melihat kepada indikator teknikal dan mengabaikan tingkah laku harga itu sendiri.Tempoh sebenar untuk berdagang lebih dekat dengan pasaran。

Pengesahan kuantiti: 1.5 kali lebih kuat

Semua isyarat diperlukan.Jumlah transaksi meningkat 1.5 kali ganda90% penembusan yang tidak disokong oleh jumlah transaksi adalah penembusan palsu, dan syarat penapisan ini secara langsung memotong banyak isyarat tidak sah.

Ia juga boleh digunakan untuk menjimatkan masa dan tenaga untuk menjimatkan masa.Berdagang hanya semasa peluasan turun naik│Pasar goyah adalah musuh besar bagi analisis teknikal, strategi yang memilih untuk mengelak daripada bertindak keras│

Pengurusan Kedudukan: Peruntukan Risiko, Bukan Wang

Risiko dalam setiap urus niaga adalah 1% daripada akaun dan 10% daripada akaun.Saiz kedudukan berdasarkan jarak hentian yang dinamik。 Posisi kecil apabila stop loss besar, kedudukan besar apabila stop loss kecil, pastikan setiap perdagangan mempunyai had risiko yang sama。

Ini lebih banyak daripada sains perdagangan kedudukan tetap. Kedudukan tetap berisiko di bawah kawalan apabila turun naik tinggi, dan kurang keuntungan apabila turun naik rendah.Pengurusan Posisi Dinamis Mengendalikan Risiko dan Memaksimumkan Hasil。

Batasan Perang: Bukan Senjata Yang Berkuasa

Kaedah dalam pasaran yang bergolakWalaupun terdapat penapis pelepasan tali pinggang Brin, ia masih tidak dapat mengelakkan isyarat palsu sepenuhnya. Pasar tren unilateral adalah persekitaran yang paling baik untuk digunakan, dan pasar goyah mengesyorkan untuk menurunkan kedudukan atau menangguhkan perdagangan.

Membangunkan teknologi yang lebih tinggiPengesahan 10 faktor penilaian memerlukan pengalaman. Pemula disarankan untuk menggunakan parameter lalai terlebih dahulu, dan dengan pengalaman kemudian menyesuaikan mengikut ciri-ciri pelbagai jenis.

Sejarah tidak sama dengan masa depan.Strategi mungkin tidak berkesan apabila keadaan pasaran berubah. Adalah disyorkan untuk memeriksa parameter secara berkala untuk kesesuaian optimum jika perlu.

/*backtest

start: 2025-10-29 00:00:00

end: 2025-11-05 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Ultra High Win Rate Gold Strategy v2', shorttitle='UHWR-Gold', overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=2, pyramiding=0, max_bars_back=500, calc_on_order_fills=true, process_orders_on_close=true)

// ═══════════════════════════════════════════════════════════════════════════

// INPUTS SECTION

// ═══════════════════════════════════════════════════════════════════════════

// Performance Mode - Fixed syntax

perf_mode = input.string("Balanced", "Performance Mode", options=["Conservative", "Balanced", "Aggressive"], group="Strategy Mode")

// EMA Settings

ema_group = "EMA Settings"

ema_fast = input.int(8, 'Fast EMA', minval=3, maxval=20, group=ema_group)

ema_slow = input.int(21, 'Slow EMA', minval=10, maxval=50, group=ema_group)

ema_trend = input.int(50, 'Trend EMA', minval=30, maxval=100, group=ema_group)

ema_filter = input.int(200, 'Filter EMA', minval=100, maxval=300, group=ema_group)

// Momentum Settings

mom_group = "Momentum Settings"

rsi_length = input.int(14, 'RSI Length', minval=5, maxval=30, group=mom_group)

rsi_ob = input.int(70, 'RSI Overbought', minval=60, maxval=90, group=mom_group)

rsi_os = input.int(30, 'RSI Oversold', minval=10, maxval=40, group=mom_group)

macd_fast = input.int(12, 'MACD Fast', minval=5, maxval=20, group=mom_group)

macd_slow = input.int(26, 'MACD Slow', minval=20, maxval=40, group=mom_group)

macd_signal = input.int(9, 'MACD Signal', minval=5, maxval=15, group=mom_group)

// Volatility Settings

vol_group = "Volatility Settings"

atr_length = input.int(14, 'ATR Length', minval=5, maxval=30, group=vol_group)

atr_stop_mult = input.float(1.5, 'Stop Loss ATR', minval=0.5, maxval=3.0, step=0.1, group=vol_group)

bb_length = input.int(20, 'BB Length', minval=10, maxval=50, group=vol_group)

bb_mult = input.float(2.0, 'BB Multiplier', minval=1.0, maxval=3.0, step=0.1, group=vol_group)

// Risk Management

risk_group = "Risk Management"

risk_per_trade = input.float(1.0, 'Risk Per Trade %', minval=0.1, maxval=5.0, step=0.1, group=risk_group)

risk_reward = input.float(3.0, 'Risk:Reward Ratio', minval=1.0, maxval=10.0, step=0.5, group=risk_group)

use_trailing = input.bool(true, 'Use Trailing Stop', group=risk_group)

trail_activate = input.float(1.5, 'Trail Activation (R)', minval=0.5, maxval=3.0, step=0.1, group=risk_group)

trail_offset = input.float(0.5, 'Trail Offset (ATR)', minval=0.1, maxval=2.0, step=0.1, group=risk_group)

// Session Filters

session_group = "Trading Sessions"

use_sessions = input.bool(true, 'Use Session Filter', group=session_group)

london_session = input("0300-1200", "London Session", group=session_group)

ny_session = input("0800-1700", "New York Session", group=session_group)

tokyo_session = input("1900-0400", "Tokyo Session", group=session_group)

// Advanced Filters

filter_group = "Advanced Filters"

min_volume_mult = input.float(1.5, 'Min Volume Multiplier', minval=1.0, maxval=5.0, step=0.1, group=filter_group)

use_spread_filter = input.bool(true, 'Use Spread Filter', group=filter_group)

max_spread_pips = input.float(3.0, 'Max Spread (Pips)', minval=0.5, maxval=10.0, step=0.5, group=filter_group)

confluence_required = input.int(7, 'Min Confluence Score', minval=5, maxval=10, group=filter_group)

// ═══════════════════════════════════════════════════════════════════════════

// CALCULATION FUNCTIONS

// ═══════════════════════════════════════════════════════════════════════════

// Improved EMA calculation with smoothing

ema(src, length) =>

alpha = 2.0 / (length + 1)

sum = 0.0

sum := na(sum[1]) ? src : alpha * src + (1 - alpha) * sum[1]

// Calculate all EMAs

ema_f = ema(close, ema_fast)

ema_s = ema(close, ema_slow)

ema_t = ema(close, ema_trend)

ema_filt = ema(close, ema_filter)

// RSI with smoothing

rsi_val = ta.rsi(close, rsi_length)

rsi_smooth = ema(rsi_val, 3)

// MACD calculations

[macd_line, signal_line, macd_hist] = ta.macd(close, macd_fast, macd_slow, macd_signal)

macd_momentum = macd_line - signal_line

// ATR with smoothing

atr_raw = ta.atr(atr_length)

atr_smooth = ema(atr_raw, 5)

// Bollinger Bands

[bb_upper, bb_basis, bb_lower] = ta.bb(close, bb_length, bb_mult)

bb_width = (bb_upper - bb_lower) / bb_basis

bb_squeeze = bb_width < ta.lowest(bb_width, 20)

// Volume analysis

volume_sma = ta.sma(volume, 20)

volume_ratio = volume / volume_sma

high_volume = volume_ratio > min_volume_mult

// ═══════════════════════════════════════════════════════════════════════════

// MARKET STRUCTURE ANALYSIS

// ═══════════════════════════════════════════════════════════════════════════

// Swing High/Low Detection

swing_length = 10

swing_high = ta.pivothigh(high, swing_length, swing_length)

swing_low = ta.pivotlow(low, swing_length, swing_length)

// Track market structure

var float last_swing_high = na

var float last_swing_low = na

var bool bullish_structure = na

var bool bearish_structure = na

if not na(swing_high)

last_swing_high := swing_high

if not na(swing_low)

last_swing_low := swing_low

// Determine structure

if not na(last_swing_high) and not na(last_swing_low)

bullish_structure := close > last_swing_high and low > last_swing_low

bearish_structure := close < last_swing_low and high < last_swing_high

// ═══════════════════════════════════════════════════════════════════════════

// SESSION ANALYSIS

// ═══════════════════════════════════════════════════════════════════════════

in_london = time(timeframe.period, london_session)

in_ny = time(timeframe.period, ny_session)

in_tokyo = time(timeframe.period, tokyo_session)

in_session = not use_sessions or (in_london or in_ny or in_tokyo)

// ═══════════════════════════════════════════════════════════════════════════

// CONFLUENCE SCORING SYSTEM

// ═══════════════════════════════════════════════════════════════════════════

// Long Confluence Factors (0-10 score)

long_score = 0

long_score += ema_f > ema_s and ema_s > ema_t ? 1 : 0 // EMA alignment

long_score += close > ema_filt ? 1 : 0 // Above major EMA

long_score += rsi_smooth > 50 and rsi_smooth < rsi_ob ? 1 : 0 // RSI bullish

long_score += macd_momentum > 0 and macd_momentum > macd_momentum[1] ? 1 : 0 // MACD bullish

long_score += close > bb_basis and not bb_squeeze ? 1 : 0 // BB position

long_score += high_volume ? 1 : 0 // Volume confirmation

long_score += bullish_structure ? 1 : 0 // Market structure

long_score += close > open ? 1 : 0 // Bullish candle

long_score += close > high[1] ? 1 : 0 // Breaking previous high

long_score += in_session ? 1 : 0 // In active session

// Short Confluence Factors (0-10 score)

short_score = 0

short_score += ema_f < ema_s and ema_s < ema_t ? 1 : 0 // EMA alignment

short_score += close < ema_filt ? 1 : 0 // Below major EMA

short_score += rsi_smooth < 50 and rsi_smooth > rsi_os ? 1 : 0 // RSI bearish

short_score += macd_momentum < 0 and macd_momentum < macd_momentum[1] ? 1 : 0 // MACD bearish

short_score += close < bb_basis and not bb_squeeze ? 1 : 0 // BB position

short_score += high_volume ? 1 : 0 // Volume confirmation

short_score += bearish_structure ? 1 : 0 // Market structure

short_score += close < open ? 1 : 0 // Bearish candle

short_score += close < low[1] ? 1 : 0 // Breaking previous low

short_score += in_session ? 1 : 0 // In active session

// ═══════════════════════════════════════════════════════════════════════════

// ENTRY CONDITIONS

// ═══════════════════════════════════════════════════════════════════════════

// Adjust confluence requirement based on mode

min_confluence = perf_mode == "Conservative" ? confluence_required + 1 : perf_mode == "Aggressive" ? confluence_required - 1 : confluence_required

// Entry signals

long_entry = long_score >= min_confluence and strategy.position_size == 0

short_entry = short_score >= min_confluence and strategy.position_size == 0

// ═══════════════════════════════════════════════════════════════════════════

// POSITION MANAGEMENT

// ═══════════════════════════════════════════════════════════════════════════

var float entry_price = na

var float stop_loss = na

var float take_profit = na

var float trail_stop = na

var bool trailing_activated = false

var int entry_bar = na

// Calculate position size based on risk

calculate_position_size(stop_distance) =>

account_size = strategy.equity

risk_amount = account_size * (risk_per_trade / 100)

position_size = risk_amount / stop_distance

position_size

// LONG ENTRY

if long_entry

stop_distance = atr_smooth * atr_stop_mult

stop_loss := close - stop_distance

take_profit := close + (stop_distance * risk_reward)

position_size = calculate_position_size(stop_distance)

strategy.entry("Long", strategy.long, qty=position_size)

entry_price := close

entry_bar := bar_index

trailing_activated := false

trail_stop := na

alert("🔥 LONG ENTRY 🔥\n" + "Symbol: " + syminfo.ticker + "\n" + "Entry: " + str.tostring(close) + "\n" + "Stop: " + str.tostring(stop_loss) + "\n" + "Target: " + str.tostring(take_profit) + "\n" + "Score: " + str.tostring(long_score) + "/10", alert.freq_once_per_bar_close)

// SHORT ENTRY

if short_entry

stop_distance = atr_smooth * atr_stop_mult

stop_loss := close + stop_distance

take_profit := close - (stop_distance * risk_reward)

position_size = calculate_position_size(stop_distance)

strategy.entry("Short", strategy.short, qty=position_size)

entry_price := close

entry_bar := bar_index

trailing_activated := false

trail_stop := na

alert("🔥 SHORT ENTRY 🔥\n" + "Symbol: " + syminfo.ticker + "\n" + "Entry: " + str.tostring(close) + "\n" + "Stop: " + str.tostring(stop_loss) + "\n" + "Target: " + str.tostring(take_profit) + "\n" + "Score: " + str.tostring(short_score) + "/10", alert.freq_once_per_bar_close)

// ═══════════════════════════════════════════════════════════════════════════

// EXIT MANAGEMENT

// ═══════════════════════════════════════════════════════════════════════════

// Trailing stop logic

if strategy.position_size != 0 and use_trailing

profit_in_r = strategy.position_size > 0 ? (close - entry_price) / (entry_price - stop_loss) : (entry_price - close) / (stop_loss - entry_price)

if profit_in_r >= trail_activate and not trailing_activated

trailing_activated := true

trail_stop := strategy.position_size > 0 ? close - (atr_smooth * trail_offset) : close + (atr_smooth * trail_offset)

if trailing_activated

if strategy.position_size > 0

trail_stop := math.max(trail_stop, close - (atr_smooth * trail_offset))

else

trail_stop := math.min(trail_stop, close + (atr_smooth * trail_offset))

// Exit conditions

if strategy.position_size > 0

strategy.exit("Long Exit", "Long", stop=use_trailing and trailing_activated ? trail_stop : stop_loss, limit=take_profit)

// Early exit on structure break

if bearish_structure

strategy.close("Long", comment="Structure Break")

if strategy.position_size < 0

strategy.exit("Short Exit", "Short", stop=use_trailing and trailing_activated ? trail_stop : stop_loss, limit=take_profit)

// Early exit on structure break

if bullish_structure

strategy.close("Short", comment="Structure Break")

// ═══════════════════════════════════════════════════════════════════════════

// VISUALIZATION

// ═══════════════════════════════════════════════════════════════════════════

// EMA plots

plot(ema_f, "Fast EMA", color.new(color.green, 0), linewidth=2)

plot(ema_s, "Slow EMA", color.new(color.red, 0), linewidth=2)

plot(ema_t, "Trend EMA", color.new(color.blue, 0), linewidth=2)

plot(ema_filt, "Filter EMA", color.new(color.purple, 0), linewidth=3)

// Entry signals

plotshape(long_entry, "Long Signal", shape.triangleup, location.belowbar, color.new(color.green, 0), size=size.normal)

plotshape(short_entry, "Short Signal", shape.triangledown, location.abovebar, color.new(color.red, 0), size=size.normal)

// Position levels

plot(strategy.position_size != 0 ? entry_price : na, "Entry", color.new(color.white, 0), linewidth=2, style=plot.style_linebr)

plot(strategy.position_size != 0 ? stop_loss : na, "Stop Loss", color.new(color.red, 0), linewidth=2, style=plot.style_linebr)

plot(strategy.position_size != 0 ? take_profit : na, "Take Profit", color.new(color.green, 0), linewidth=2, style=plot.style_linebr)

plot(strategy.position_size != 0 and trailing_activated ? trail_stop : na, "Trailing Stop", color.new(color.orange, 0), linewidth=2, style=plot.style_linebr)

// Background color for sessions

bgcolor(in_london ? color.new(color.blue, 95) : na, title="London Session")

bgcolor(in_ny ? color.new(color.green, 95) : na, title="NY Session")

bgcolor(in_tokyo ? color.new(color.red, 95) : na, title="Tokyo Session")

// ═══════════════════════════════════════════════════════════════════════════

// INFORMATION PANEL

// ═══════════════════════════════════════════════════════════════════════════

var table info_panel = table.new(position.top_right, 2, 10, bgcolor=color.new(color.black, 80), border_color=color.white, border_width=1)

if barstate.islast

// Headers

table.cell(info_panel, 0, 0, "METRIC", text_color=color.white, bgcolor=color.new(color.blue, 50))

table.cell(info_panel, 1, 0, "VALUE", text_color=color.white, bgcolor=color.new(color.blue, 50))

// Long Score

table.cell(info_panel, 0, 1, "Long Score", text_color=color.white)

table.cell(info_panel, 1, 1, str.tostring(long_score) + "/10", text_color=long_score >= min_confluence ? color.green : color.white)

// Short Score

table.cell(info_panel, 0, 2, "Short Score", text_color=color.white)

table.cell(info_panel, 1, 2, str.tostring(short_score) + "/10", text_color=short_score >= min_confluence ? color.red : color.white)

// RSI

table.cell(info_panel, 0, 3, "RSI", text_color=color.white)

table.cell(info_panel, 1, 3, str.tostring(math.round(rsi_smooth, 1)), text_color=rsi_smooth > rsi_ob ? color.red : rsi_smooth < rsi_os ? color.green : color.white)

// MACD

table.cell(info_panel, 0, 4, "MACD", text_color=color.white)

table.cell(info_panel, 1, 4, macd_momentum > 0 ? "Bullish" : "Bearish", text_color=macd_momentum > 0 ? color.green : color.red)

// Volume

table.cell(info_panel, 0, 5, "Volume", text_color=color.white)

table.cell(info_panel, 1, 5, str.tostring(math.round(volume_ratio, 1)) + "x", text_color=high_volume ? color.green : color.white)

// Structure

table.cell(info_panel, 0, 6, "Structure", text_color=color.white)

table.cell(info_panel, 1, 6, bullish_structure ? "Bullish" : bearish_structure ? "Bearish" : "Neutral", text_color=bullish_structure ? color.green : bearish_structure ? color.red : color.white)

// Position

table.cell(info_panel, 0, 7, "Position", text_color=color.white)

position_text = strategy.position_size > 0 ? "LONG" : strategy.position_size < 0 ? "SHORT" : "NONE"

table.cell(info_panel, 1, 7, position_text, text_color=strategy.position_size > 0 ? color.green : strategy.position_size < 0 ? color.red : color.white)

// P&L

if strategy.position_size != 0

current_pnl = strategy.position_size > 0 ? ((close - entry_price) / entry_price) * 100 : ((entry_price - close) / entry_price) * 100

table.cell(info_panel, 0, 8, "P&L", text_color=color.white)

table.cell(info_panel, 1, 8, str.tostring(math.round(current_pnl, 2)) + "%", text_color=current_pnl > 0 ? color.green : color.red)

// Mode

table.cell(info_panel, 0, 9, "Mode", text_color=color.white)

table.cell(info_panel, 1, 9, perf_mode, text_color=color.yellow)

// ═══════════════════════════════════════════════════════════════════════════

// ALERTS

// ═══════════════════════════════════════════════════════════════════════════

// Additional alert conditions

alertcondition(long_score >= min_confluence - 1 and long_score < min_confluence, "Long Setup Forming", "Long setup forming - Score: {{plot_0}}/10")

alertcondition(short_score >= min_confluence - 1 and short_score < min_confluence, "Short Setup Forming", "Short setup forming - Score: {{plot_1}}/10")

alertcondition(trailing_activated, "Trailing Stop Activated", "Trailing stop activated")

alertcondition(strategy.position_size != 0 and volume_ratio > 3, "High Volume Alert", "Unusually high volume detected")