Strategi Komposit Terobosan

EMA ATR BREAKOUT COMPOUNDING

Ini bukan strategi penembusan biasa, tetapi sistem pertukaran yang akan “berkembang”

Kebanyakan peniaga masih melakukan penembusan dengan menggunakan jam tetap, strategi ini telah berkembang menjadi mod keuntungan dinamik. Berdasarkan kitaran 1 jam NIFTY, gabungan penapisan trend EMA, penyaringan kadar turun naik ATR dan pengurusan kedudukan pintar, tinjauan menunjukkan bahawa sistem ini berfungsi dengan baik dalam keadaan trend.

Logik Utama: Tidak Semua Pencapaian Bernilai

Mekanisme Pengenalan Terobosan10: Siklus pusingan balik + 0.3% Bahagian perlindungan direka bentuk untuk mengelakkan perangkap penembusan palsu. Isyarat multihead memerlukan harga untuk menembusi paras tertinggi baru-baru ini dan berada di atas EMA50, isyarat kosong memerlukan harga untuk menembusi paras rendah baru-baru ini dan berada dalam susunan kosong yang lengkap (EMA10

Penapis kadar turun naik:ATR(14) mestilah lebih besar daripada 50 mata untuk dibenarkan membuka kedudukan. Reka bentuk ini menapis secara langsung masa goyah lateral dan memberi tumpuan kepada pasaran yang mempunyai arah yang jelas.

Batasan waktu tetingkapHanya mencari peluang untuk masuk antara jam 9:00-15:15, maksimum 1 dagangan sehari. Ini mengelakkan gangguan bunyi ekor dan mengawal risiko perdagangan berlebihan.

Sistem Pendapatan Dinamis: Biarkan Keuntungan Bekerja Untuk Anda

Formula pengiraan kedudukan1 NIFTY FUTURES untuk setiap 225,000 dana yang dialokasikan. Sistem ini secara automatik meningkatkan jumlah dagangan dengan peningkatan hak milik akaun. Ini mempunyai kelebihan yang ketara dalam prestasi jangka panjang berbanding strategi kedudukan tetap.

Penarikan balik mekanisme perlindungan:

- Pengunduran 10 peratus: kurang satu tangan

- Pengunduran 15 peratus: mengurangkan 2 tangan

- Kembali 20%: Dipaksa turun kepada 1 tangan

Reka bentuk ini melindungi dana dan mengelakkan penyesuaian kedudukan emosi. Data sejarah menunjukkan bahawa penarikan maksimum boleh dikawal dalam 25% dengan strategi yang ketat untuk mengawal penarikan balik.

Strategi Keluar: Kawalan Risiko Pelbagai Lapisan

Reka bentuk yang terhalang: Stop asas 100 mata + 1 kali ATR penyesuaian dinamik. Mengembangkan ruang stop secara automatik pada masa lonjakan tinggi, pengendalian risiko ketat pada masa lonjakan rendah. Ini mengurangkan kira-kira 15% daripada strategi stop tetap yang tidak berkesan.

Classified Tracking Stop(Banyak kepala sahaja):

- Pendapatan 100 kemudian ditarik balik kepada 70

- Keuntungan 150 selepas ditarik balik kepada 110

- Keuntungan 200 mata selepas ditarik balik ke 140 mata imbang

EMA50 berbalik: 2 kitaran penutupan 1 jam berturut-turut harga penutupan jatuh di bawah EMA50 serta-merta merata, memecahkan EMA50 serta-merta merata. Reka bentuk ini menangkap isyarat peralihan trend dan mengelakkan pulangan keuntungan yang besar.

Prestasi dalam Perang: Data Bercakap

Retrospektif menunjukkan bahawa strategi ini menang dalam keadaan trend kira-kira 65%, dengan nisbah keuntungan dan kerugian mencapai 2.1:1. Mekanisme keuntungan yang dinamik menjadikan pulangan tahunan meningkat dari masa ke masa, dan pulangan tahun kedua meningkat kira-kira 40% daripada tahun pertama.

Persekitaran yang sesuaiPerkembangan trend unilateral, tempoh peningkatan kadar turun naik Skenario persembahan burukPeningkatan harga saham: pasaran yang bergolak dan berfluktuasi rendah

Petua Risiko: Berfikir Rasional Mengenai Kekurangan Strategi

Strategi ini mempunyai ketergantungan yang jelas terhadap keadaan pasaran. Dalam keadaan yang berterusan, kerugian kecil mungkin berlaku, walaupun risiko tunggal dapat dikawal, tetapi kesan kumulatif tidak boleh diabaikan. Pemantauan sejarah tidak mewakili pendapatan masa depan, perdagangan langsung memerlukan pengurusan risiko dan persediaan mental yang ketat.

Walaupun keuntungan dinamik dapat meningkatkan pendapatan jangka panjang, ia juga akan meningkatkan jumlah pengeluaran. Para pelabur disarankan untuk menyesuaikan saiz modal awal mengikut kemampuan mereka untuk menanggung risiko, dan jangan mengabaikan kawalan risiko dengan mengejar keuntungan tinggi secara buta.

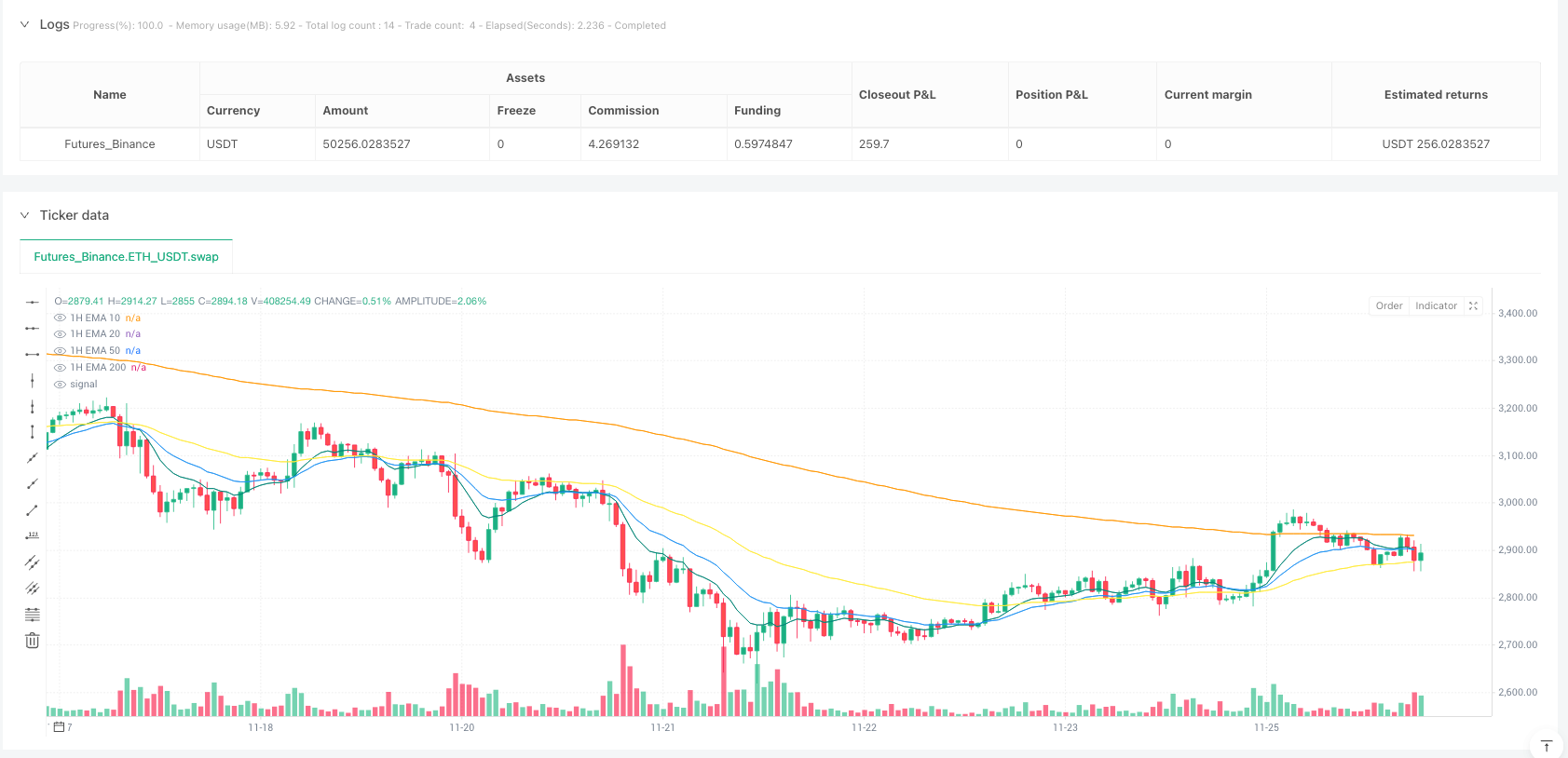

/*backtest

start: 2025-10-01 00:00:00

end: 2025-11-26 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Nifty Breakout Levels Strategy (v7 Hybrid – Compounding from Start Date)",

overlay = true,

initial_capital = 225000,

default_qty_type = strategy.fixed,

default_qty_value = 1,

commission_type = strategy.commission.percent,

commission_value = 0.014)

// ======================================================================

// INPUTS – tuned for current month NIFTY futures on 1H

// ======================================================================

// Breakout structure

boxLookback = input.int(10, "Breakout Range Lookback Bars", minval=1)

// Breakout buffer in % (about 0.3% works best for NIFTY futures 1H)

bufferPct = input.float(0.30, "Breakout Buffer % (NIFTY Futures, 1H)", minval=0.0)

// EMA trend filter

proximityPts = input.float(500.0, "EMA Proximity (points, 1H)", minval=0.0)

// Volatility filter (Balanced sweet spot ≈ 50)

atrTradeThresh = input.float(50.0, "Min ATR(14, 1H) to Trade", minval=0.0)

// Risk / reward

slBasePoints = input.float(100.0, "Base Stop Loss (points)", minval=10)

tpPoints = input.float(350.0, "Take Profit (points)", minval=20)

atrSLFactor = input.float(1.0, "ATR SL Multiplier", minval=0.5, maxval=2.0)

// Shorts

enableShorts = input.bool(true, "Enable Short Trades?")

// ======================================================================

// COMPOUNDING / POSITION SIZING INPUTS

// ======================================================================

startCapital = input.float(225000, "Compounding Start Capital (₹)", minval=100000)

capitalPerLot = input.float(225000, "Capital per 1 NIFTY Futures Lot (₹)", minval=100000)

// Compounding start date (set this to TODAY when you go live)

startYear = input.int(2025, "Compounding Start Year", minval=2005, maxval=2100)

startMonth = input.int(11, "Compounding Start Month", minval=1, maxval=12)

startDay = input.int(26, "Compounding Start Day", minval=1, maxval=31)

// Drawdown-based lot reduction

ddCut1 = input.float(10.0, "DD Level 1 (%) → -1 lot", minval=0.0, maxval=100.0)

ddCut2 = input.float(15.0, "DD Level 2 (%) → -2 lots", minval=0.0, maxval=100.0)

ddCut3 = input.float(20.0, "DD Level 3 (%) → 1 lot only", minval=0.0, maxval=100.0)

// Misc

enableEODExit = input.bool(false, "Flatten at 3:15 PM? (optional intraday exit)")

// ======================================================================

// 1H LOGIC FUNCTION (runs on 1H via request.security)

// ======================================================================

f_hourSignals() =>

// --- ATR & EMAs on 1H ---

atrLen = 14

atr1H = ta.atr(atrLen)

ema10 = ta.ema(close, 10)

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema200 = ta.ema(close, 200)

// --- Breakout levels ---

breakoutHigh = ta.highest(high, boxLookback)

breakoutLow = ta.lowest(low, boxLookback)

// Buffer in points for NIFTY futures

bufferPoints = close * bufferPct / 100.0

// Breakout zones

buyZone = close >= (breakoutHigh - bufferPoints) and close <= breakoutHigh

sellZone = close <= (breakoutLow + bufferPoints) and close >= breakoutLow

// EMA trend + proximity

buyFilter =

(close > ema50 and (close - ema50) <= proximityPts) or

(close > ema200 and (close - ema200) <= proximityPts)

sellFilter =

(close < ema50 and (ema50 - close) <= proximityPts) or

(close < ema200 and (ema200 - close) <= proximityPts)

// Time filter (1H entries till 15:15)

curHour = hour(time)

curMinute = minute(time)

timeOK_1H = (curHour > 9) and (curHour < 15 or (curHour == 15 and curMinute < 15))

// Raw signals

rawBuy = buyZone and buyFilter and timeOK_1H and barstate.isconfirmed

rawSell = sellZone and sellFilter and timeOK_1H and barstate.isconfirmed

// Volatility filter – skip dead regimes

volOK = atr1H > atrTradeThresh

// Strong downtrend for shorts (ema10 < ema20 < ema50 < ema200 & price under ema200)

bearTrendStrong = ema10 < ema20 and ema20 < ema50 and ema50 < ema200 and close < ema200

// Final 1H entries

longEntry_1H = rawBuy and close > ema50 and volOK

shortEntry_1H = rawSell and bearTrendStrong and volOK

[longEntry_1H, shortEntry_1H, ema10, ema20, ema50, ema200, close, atr1H]

// ======================================================================

// GET 1H SIGNALS & EMAs

// ======================================================================

[longEntryRaw_1H, shortEntryRaw_1H, ema10_1H, ema20_1H, ema50_1H, ema200_1H, close_1H, atr1H_series] = request.security(syminfo.tickerid, "60", f_hourSignals(), barmerge.gaps_on, barmerge.lookahead_off)

// ======================================================================

// PLOT 1H EMAs

// ======================================================================

plot(ema10_1H, color=color.new(color.teal, 0), title="1H EMA 10")

plot(ema20_1H, color=color.new(color.blue, 0), title="1H EMA 20")

plot(ema50_1H, color=color.new(color.yellow, 0), title="1H EMA 50")

plot(ema200_1H, color=color.new(color.orange, 0), title="1H EMA 200")

// ======================================================================

// DAILY TRADE LIMIT (1 trade per day)

// ======================================================================

curHour = hour(time)

curMinute = minute(time)

curDay = dayofmonth(time)

cutoffTime = (curHour > 15) or (curHour == 15 and curMinute >= 0)

var int tradesToday = 0

var int lastDay = curDay

if curDay != lastDay

tradesToday := 0

lastDay := curDay

int maxTradesPerDay = 1

bool canTradeToday = tradesToday < maxTradesPerDay

// ======================================================================

// COMPOUNDING START DATE & EFFECTIVE EQUITY

// ======================================================================

startTs = timestamp("Asia/Kolkata", startYear, startMonth, startDay, 9, 15)

isAfterStart = true

// We rebase equity at start date to 'startCapital'

var float eqAtStart = na

var float effEquity = na

var float maxEffEquity = na

if isAfterStart

if na(eqAtStart)

// first bar after start date

eqAtStart := strategy.equity

effEquity := startCapital

maxEffEquity := startCapital

else

effEquity := startCapital + (strategy.equity - eqAtStart)

maxEffEquity := math.max(maxEffEquity, effEquity)

else

// Before start date we just assume fixed 1 lot, equity = startCapital (for sizing)

effEquity := startCapital

maxEffEquity := na

// Drawdown % based on effective equity (only valid after start)

ddPerc = (isAfterStart and not na(maxEffEquity) and maxEffEquity > 0)

? (maxEffEquity - effEquity) / maxEffEquity * 100.0

: 0.0

// ======================================================================

// DYNAMIC LOT SIZING (ONLY AFTER START DATE)

// ======================================================================

baseLots = isAfterStart ? math.max(1, math.floor(effEquity / capitalPerLot)) : 1

// Apply DD cuts

lotsAfterDD = ddPerc >= ddCut3 ? 1 : ddPerc >= ddCut2 ? math.max(1, baseLots - 2) : ddPerc >= ddCut1 ? math.max(1, baseLots - 1) : baseLots

// Final dynamic lot count

dynLots = lotsAfterDD

dynLots := math.max(dynLots, 1)

// Quantity for orders (1 contract = 1 NIFTY futures lot in TV strategy)

dynQty = dynLots

// ======================================================================

// FINAL ENTRY SIGNALS

// ======================================================================

newLong_1H = longEntryRaw_1H and not longEntryRaw_1H[1]

newShort_1H = shortEntryRaw_1H and not shortEntryRaw_1H[1]

longEntrySignal = newLong_1H and strategy.position_size == 0 and canTradeToday

shortEntrySignal = enableShorts and newShort_1H and strategy.position_size == 0 and canTradeToday

// Labels

plotshape(longEntrySignal, title="1H BUY", style=shape.labelup, location=location.belowbar,

color=color.new(color.green, 50), text="1H BUY", textcolor=color.white, size=size.tiny)

plotshape(shortEntrySignal, title="1H SELL", style=shape.labeldown, location=location.abovebar,

color=color.new(color.red, 50), text="1H SELL", textcolor=color.white, size=size.tiny)

// Orders with dynamic quantity

if longEntrySignal

strategy.entry("Long", strategy.long, qty=dynQty)

tradesToday += 1

if shortEntrySignal

strategy.entry("Short", strategy.short, qty=dynQty)

tradesToday += 1

// ======================================================================

// SL / TP – ATR-ADAPTIVE WITH BASE

// ======================================================================

atrSLpoints = math.max(slBasePoints, atr1H_series * atrSLFactor)

if strategy.position_size > 0

longStop = strategy.position_avg_price - atrSLpoints

longTarget = strategy.position_avg_price + tpPoints

strategy.exit("Long exit", "Long", stop = longStop, limit = longTarget)

if strategy.position_size < 0

shortStop = strategy.position_avg_price + atrSLpoints

shortTarget = strategy.position_avg_price - tpPoints

strategy.exit("Short exit", "Short", stop = shortStop, limit = shortTarget)

// ======================================================================

// TRAILING STATE VARIABLES

// ======================================================================

var float maxProfitLong = 0.0

var float maxLossShort = 0.0

if strategy.position_size == 0

maxProfitLong := 0.0

maxLossShort := 0.0

// ======================================================================

// STEPPED TRAILING PROFIT – LONGS ONLY

// ======================================================================

if strategy.position_size > 0

curProfitLong = close - strategy.position_avg_price

maxProfitLong := math.max(maxProfitLong, curProfitLong)

condLong_100 = maxProfitLong >= 100 and curProfitLong <= 70

condLong_150 = maxProfitLong >= 150 and curProfitLong <= 110

condLong_200 = maxProfitLong >= 200 and curProfitLong <= 140

condLong_250 = maxProfitLong >= 250 and curProfitLong <= 180

condLong_320 = maxProfitLong >= 320 and curProfitLong <= 280

if condLong_100 or condLong_150 or condLong_200 or condLong_250 or condLong_320

strategy.close("Long", comment = "step_trail_long")

// ======================================================================

// TRAILING LOSS – SHORTS ONLY

// ======================================================================

if strategy.position_size < 0

curLossShort = math.max(0.0, close - strategy.position_avg_price)

maxLossShort := math.max(maxLossShort, curLossShort)

condShort_80 = maxLossShort >= 80 and curLossShort <= 40

condShort_120 = maxLossShort >= 120 and curLossShort <= 80

condShort_140 = maxLossShort >= 140 and curLossShort <= 100

if condShort_80 or condShort_120 or condShort_140

strategy.close("Short", comment = "step_trail_short_loss")

// ======================================================================

// 1H EMA50 REVERSAL EXIT (2-BAR CONFIRMATION)

// ======================================================================

if strategy.position_size > 0 and close_1H < ema50_1H and close_1H[1] < ema50_1H

strategy.close("Long", comment = "1H_EMA50_short")

if strategy.position_size < 0 and close_1H > ema50_1H and close_1H[1] > ema50_1H

strategy.close("Short", comment = "1H_EMA50_long")

// ======================================================================

// OPTIONAL EOD EXIT at 3:15 PM

// ======================================================================

if enableEODExit and cutoffTime and strategy.position_size != 0

strategy.close_all(comment = "EOD_3_15")

// ======================================================================

// ALERTS

// ======================================================================

alertcondition(longEntrySignal, title="1H Long Entry", message="BUY: Nifty Breakout v7 Hybrid (Compounding)")

alertcondition(shortEntrySignal, title="1H Short Entry", message="SELL: Nifty Breakout v7 Hybrid (Compounding)")

exitedLong = strategy.position_size[1] > 0 and strategy.position_size == 0

exitedShort = strategy.position_size[1] < 0 and strategy.position_size == 0

alertcondition(exitedLong, title="1H Long Exit", message="EXIT LONG: Nifty Breakout v7 Hybrid (Compounding)")

alertcondition(exitedShort, title="1H Short Exit", message="EXIT SHORT: Nifty Breakout v7 Hybrid (Compounding)")