Estratégia de negociação de média móvel tripla

Visão geral

A estratégia é uma estratégia de negociação de seguimento de tendências baseada em três médias móveis. Ela usa três médias móveis de diferentes períodos para tomar decisões de mercado, e é uma estratégia típica de seguimento de tendências.

Princípio da estratégia

A estratégia usa 3 médias móveis: MA1, MA2 e MA3, com um período de média móvel definido pelo usuário, geralmente definido como MA1 < MA2 < MA3, por exemplo, MA1 é de 50 ciclos, MA2 é de 100 ciclos e MA3 é de 200 ciclos.

A estratégia utiliza a MA1 como a principal linha de referência para a tomada de decisões de negociação. Quando o curto ciclo MA1 atravessa o longo ciclo MA2 ou MA3, faça mais; quando o MA1 atravessa o MA2 ou MA3 abaixo, faça um curto.

A estratégia pode optar por negociar apenas o cruzamento de MA1 e MA2, ou negociar apenas o cruzamento de MA1 e MA3, ou negociar os dois cruzados ao mesmo tempo.

Quando o sinal de cruzamento aparece, use o preço de mercado para abrir uma posição. O stop loss é definido como uma porcentagem de close, por exemplo, 30% de stop loss e 15% de stop loss.

Para otimizar a estratégia, pode-se ajustar o parâmetro de ciclo da linha MA, ajustar a porcentagem de stop loss, adicionar outros indicadores de filtragem de sinais, etc.

Análise de vantagens

Usando múltiplos conjuntos de médias móveis para tomar decisões, pode-se filtrar eficazmente as brechas falsas.

Utilizando uma combinação de MA de diferentes períodos, pode-se ajustar dinamicamente a posição na tendência, permitindo o acompanhamento da tendência.

Opção de negociar apenas com a Cruz de Ouro ou com a Cruz da Morte ou com ambas.

O mecanismo de suspensão de prejuízos pode ser eficaz no controle de perdas individuais.

Análise de Riscos

A estratégia de acompanhamento de tendências, que pode ser prejudicada em situações de turbulência.

Se a configuração do ciclo de MA for inadequada, pode haver negociações frequentes, reduzindo a taxa de vitória.

Depois de um fracasso, a perda de tempo pode levar a grandes perdas.

Se o Stop Loss for muito relaxado, a perda individual pode ser muito grande.

Direção de otimização

Optimizar os parâmetros de MA para encontrar a melhor combinação de parâmetros.

Adicionar outros indicadores para a filtragem e otimizar o tempo de entrada. Como MACD, KDJ, etc.

Optimizar o ponto de parada para otimizar a estratégia de ganhos e riscos.

Aumentar o gerenciamento de posições, como a abertura de posições de quantidade fixa ou o gerenciamento de fundos.

Aumentar o ponto de deslizamento da linha de parada e otimizar a estratégia de parada para a ruptura.

Resumir

A estratégia em geral é uma estratégia típica de acompanhamento de tendências, julgada por vários grupos de MA cruzados, pertence a uma estratégia de acompanhamento de tendências relativamente estável. Pode ser melhorada ainda mais por meio de otimização de parâmetros, filtragem de indicadores, gerenciamento de posição, etc. Mas a ideia central é simples e clara, adequada para aprendizagem e prática de iniciantes.

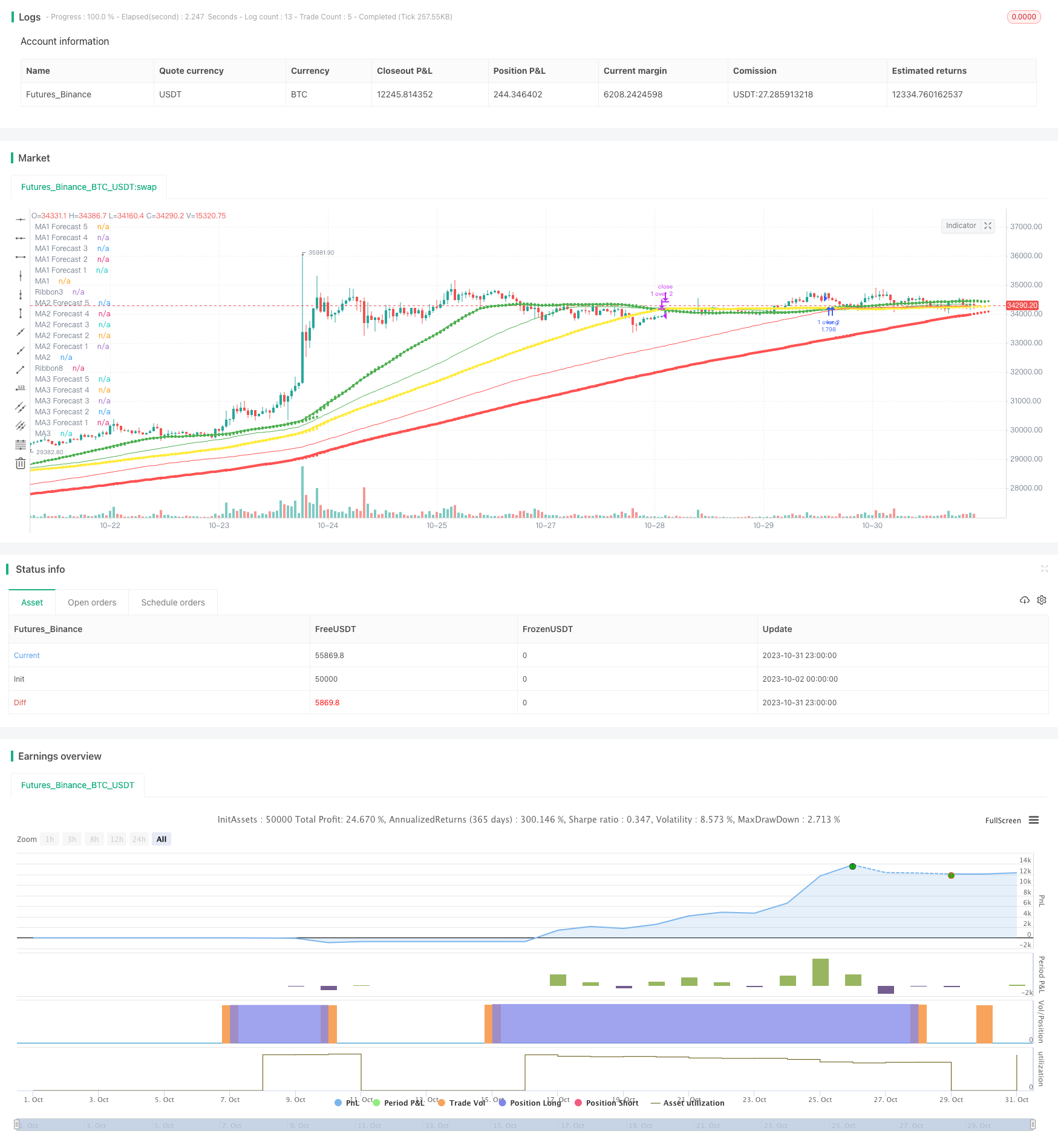

/*backtest

start: 2023-10-02 00:00:00

end: 2023-11-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// Pine Script v4

// @author BigBitsIO

// Script Library: https://www.tradingview.com/u/BigBitsIO/#published-scripts

//

// study(title, shorttitle, overlay, format, precision)

// https://www.tradingview.com/pine-script-reference/#fun_strategy

strategy(shorttitle = "TManyMA Strategy - STA - Stops", title="Triple Many Moving Averages", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// MA#Period is a variable used to store the indicator lookback period. In this case, from the input.

// input - https://www.tradingview.com/pine-script-docs/en/v4/annotations/Script_inputs.html

MA1Period = input(50, title="MA1 Period", minval=1, step=1)

MA1Type = input(title="MA1 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA1Source = input(title="MA1 Source", type=input.source, defval=close)

MA1Resolution = input(title="MA1 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA1Visible = input(title="MA1 Visible", type=input.bool, defval=true) // Will automatically hide crossBovers containing this MA

MA2Period = input(100, title="MA2 Period", minval=1, step=1)

MA2Type = input(title="MA2 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA2Source = input(title="MA2 Source", type=input.source, defval=close)

MA2Resolution = input(title="MA2 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA2Visible = input(title="MA2 Visible", type=input.bool, defval=true) // Will automatically hide crossovers containing this MA

MA3Period = input(200, title="MA3 Period", minval=1, step=1)

MA3Type = input(title="MA3 Type", defval="SMA", options=["RMA", "SMA", "EMA", "WMA", "HMA", "DEMA", "TEMA", "VWMA"])

MA3Source = input(title="MA3 Source", type=input.source, defval=close)

MA3Resolution = input(title="MA3 Resolution", defval="00 Current", options=["00 Current", "01 1m", "02 3m", "03 5m", "04 15m", "05 30m", "06 45m", "07 1h", "08 2h", "09 3h", "10 4h", "11 1D", "12 1W", "13 1M"])

MA3Visible = input(title="MA3 Visible", type=input.bool, defval=true) // Will automatically hide crossovers containing this MA

ShowCrosses = input(title="Show Crosses", type=input.bool, defval=false)

ForecastBias = input(title="Forecast Bias", defval="Neutral", options=["Neutral", "Bullish", "Bearish"])

ForecastBiasPeriod = input(14, title="Forecast Bias Period")

ForecastBiasMagnitude = input(1, title="Forecast Bias Magnitude", minval=0.25, maxval=20, step=0.25)

ShowForecasts = input(title="Show Forecasts", type=input.bool, defval=true)

ShowRibbons = input(title="Show Ribbons", type=input.bool, defval=true)

TradeMA12Crosses = input(title="Trade MA 1-2 Crosses", type=input.bool, defval=true)

TradeMA13Crosses = input(title="Trade MA 1-3 Crosses", type=input.bool, defval=true)

TradeMA23Crosses = input(title="Trade MA 2-3 Crosses", type=input.bool, defval=true)

TakeProfitPercent = input(30, title="Take Profit Percent", minval=0.01, step=0.5)

StopLossPercent = input(15, title="Stop Loss Percent", minval=0.01, step=0.5)

// MA# is a variable used to store the actual moving average value.

// if statements - https://www.tradingview.com/pine-script-reference/#op_if

// MA functions - https://www.tradingview.com/pine-script-reference/ (must search for appropriate MA)

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

ma(MAType, MASource, MAPeriod) =>

if MAType == "SMA"

sma(MASource, MAPeriod)

else

if MAType == "EMA"

ema(MASource, MAPeriod)

else

if MAType == "WMA"

wma(MASource, MAPeriod)

else

if MAType == "RMA"

rma(MASource, MAPeriod)

else

if MAType == "HMA"

wma(2*wma(MASource, MAPeriod/2)-wma(MASource, MAPeriod), round(sqrt(MAPeriod)))

else

if MAType == "DEMA"

e = ema(MASource, MAPeriod)

2 * e - ema(e, MAPeriod)

else

if MAType == "TEMA"

e = ema(MASource, MAPeriod)

3 * (e - ema(e, MAPeriod)) + ema(ema(e, MAPeriod), MAPeriod)

else

if MAType == "VWMA"

vwma(MASource, MAPeriod)

res(MAResolution) =>

if MAResolution == "00 Current"

timeframe.period

else

if MAResolution == "01 1m"

"1"

else

if MAResolution == "02 3m"

"3"

else

if MAResolution == "03 5m"

"5"

else

if MAResolution == "04 15m"

"15"

else

if MAResolution == "05 30m"

"30"

else

if MAResolution == "06 45m"

"45"

else

if MAResolution == "07 1h"

"60"

else

if MAResolution == "08 2h"

"120"

else

if MAResolution == "09 3h"

"180"

else

if MAResolution == "10 4h"

"240"

else

if MAResolution == "11 1D"

"1D"

else

if MAResolution == "12 1W"

"1W"

else

if MAResolution == "13 1M"

"1M"

// https://www.tradingview.com/pine-script-reference/#fun_request.security

MA1 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period))

MA2 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period))

MA3 = request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period))

// Plotting crossover/unders for all combinations of crosses

// Crossovers no longer detected in label code, they need to be re-used for strategy - crosses and visibility must be set

MA12Crossover = MA1Visible and MA2Visible and crossover(MA1, MA2)

MA12Crossunder = MA1Visible and MA2Visible and crossunder(MA1, MA2)

MA13Crossover = MA1Visible and MA3Visible and crossover(MA1, MA3)

MA13Crossunder = MA1Visible and MA3Visible and crossunder(MA1, MA3)

MA23Crossover = MA2Visible and MA3Visible and crossover(MA2, MA3)

MA23Crossunder = MA2Visible and MA3Visible and crossunder(MA2, MA3)

// https://www.tradingview.com/pine-script-reference/v4/#fun_label%7Bdot%7Dnew

if ShowCrosses and MA12Crossunder

lun1 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed under '+tostring(MA2Period)+' '+MA2Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun1, MA1)

if ShowCrosses and MA12Crossover

lup1 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed over '+tostring(MA2Period)+' '+MA2Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup1, MA1)

if ShowCrosses and MA13Crossunder

lun2 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed under '+tostring(MA3Period)+' '+MA3Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun2, MA1)

if ShowCrosses and MA13Crossover

lup2 = label.new(bar_index, na, tostring(MA1Period)+' '+MA1Type+' crossed over '+tostring(MA3Period)+' '+MA3Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup2, MA1)

if ShowCrosses and MA23Crossunder

lun3 = label.new(bar_index, na, tostring(MA2Period)+' '+MA2Type+' crossed under '+tostring(MA3Period)+' '+MA3Type,

color=color.red,

textcolor=color.red,

style=label.style_xcross, size=size.small)

label.set_y(lun3, MA2)

if ShowCrosses and MA23Crossover

lup3 = label.new(bar_index, na, tostring(MA2Period)+' '+MA2Type+' crossed over '+tostring(MA3Period)+' '+MA3Type,

color=color.green,

textcolor=color.green,

style=label.style_xcross, size=size.small)

label.set_y(lup3, MA2)

// plot - This will draw the information on the chart

// plot - https://www.tradingview.com/pine-script-docs/en/v4/annotations/plot_annotation.html

plot(MA1Visible ? MA1 : na, color=color.green, linewidth=2, title="MA1")

plot(MA2Visible ? MA2 : na, color=color.yellow, linewidth=3, title="MA2")

plot(MA3Visible ? MA3 : na, color=color.red, linewidth=4, title="MA3")

// Forecasting - forcasted prices are calculated using our MAType and MASource for the MAPeriod - the last X candles.

// it essentially replaces the oldest X candles, with the selected source * X candles

// Bias - We'll add an "adjustment" for each additional candle being forecasted based on ATR of the previous X candles

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

bias(Bias, BiasPeriod) =>

if Bias == "Neutral"

0

else

if Bias == "Bullish"

(atr(BiasPeriod) * ForecastBiasMagnitude)

else

if Bias == "Bearish"

((atr(BiasPeriod) * ForecastBiasMagnitude) * -1) // multiplying by -1 to make it a negative, bearish bias

// Note - Can not show forecasts on different resolutions at the moment, x-axis is an issue

Bias = bias(ForecastBias, ForecastBiasPeriod) // 14 is default atr period

MA1Forecast1 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 1)) * (MA1Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA1Period

MA1Forecast2 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 2)) * (MA1Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA1Period

MA1Forecast3 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 3)) * (MA1Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA1Period

MA1Forecast4 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 4)) * (MA1Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA1Period

MA1Forecast5 = (request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, MA1Period - 5)) * (MA1Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA1Period

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast1 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 1", offset=1, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast2 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 2", offset=2, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast3 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 3", offset=3, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast4 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 4", offset=4, show_last=1)

plot(MA1Resolution == "00 Current" and ShowForecasts and MA1Visible ? MA1Forecast5 : na, color=color.green, linewidth=1, style=plot.style_circles, title="MA1 Forecast 5", offset=5, show_last=1)

MA2Forecast1 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 1)) * (MA2Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA2Period

MA2Forecast2 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 2)) * (MA2Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA2Period

MA2Forecast3 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 3)) * (MA2Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA2Period

MA2Forecast4 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 4)) * (MA2Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA2Period

MA2Forecast5 = (request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, MA2Period - 5)) * (MA2Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA2Period

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast1 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 1", offset=1, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast2 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 2", offset=2, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast3 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 3", offset=3, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast4 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 4", offset=4, show_last=1)

plot(MA2Resolution == "00 Current" and ShowForecasts and MA2Visible ? MA2Forecast5 : na, color=color.yellow, linewidth=1, style=plot.style_circles, title="MA2 Forecast 5", offset=5, show_last=1)

MA3Forecast1 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 1)) * (MA3Period - 1) + ((MA1Source * 1) + (Bias * 1))) / MA3Period

MA3Forecast2 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 2)) * (MA3Period - 2) + ((MA1Source * 2) + (Bias * 2))) / MA3Period

MA3Forecast3 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 3)) * (MA3Period - 3) + ((MA1Source * 3) + (Bias * 3))) / MA3Period

MA3Forecast4 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 4)) * (MA3Period - 4) + ((MA1Source * 4) + (Bias * 4))) / MA3Period

MA3Forecast5 = (request.security(syminfo.tickerid, res(MA3Resolution), ma(MA3Type, MA3Source, MA3Period - 5)) * (MA3Period - 5) + ((MA1Source * 5) + (Bias * 5))) / MA3Period

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast1 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 1", offset=1, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast2 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 2", offset=2, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast3 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 3", offset=3, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast4 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 4", offset=4, show_last=1)

plot(MA3Resolution == "00 Current" and ShowForecasts and MA3Visible ? MA3Forecast5 : na, color=color.red, linewidth=1, style=plot.style_circles, title="MA3 Forecast 5", offset=5, show_last=1)

// Ribbon related code

// For Ribbons to work - they must use the same MAType, MAResolution and MASource. This is to ensure the ribbons are fair between one to the other.

// Ribbons also will usually look better if MA1Period < MA2Period and MA2Period < MA3Period

// custom functions in pine - https://www.tradingview.com/wiki/Declaring_Functions

// This function is used to calculate the period to be used on a ribbon based on existing MAs

rperiod(P1, P2, Step, Ribbons) =>

((abs(P1 - P2)) / (Ribbons + 1) * Step) + min(P1, P2)

// divide by +1 so that 5 lines can show. Divide by 5 and one line shows up on another MA

// MA1-MA2

Ribbon1 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 1, 5)))

Ribbon2 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 2, 5)))

Ribbon3 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 3, 5)))

Ribbon4 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 4, 5)))

Ribbon5 = request.security(syminfo.tickerid, res(MA1Resolution), ma(MA1Type, MA1Source, rperiod(MA1Period, MA2Period, 5, 5)))

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon1 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon1", transp=90)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon2 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon2", transp=85)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon3 : na, color=color.green, linewidth=1, style=plot.style_line, title="Ribbon3", transp=80)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon4 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon4", transp=75)

plot(ShowRibbons and MA1Type == MA2Type and MA1Resolution == MA2Resolution and MA1Source == MA2Source ? Ribbon5 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon5", transp=70)

// MA2-MA3

Ribbon6 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 1, 5)))

Ribbon7 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 2, 5)))

Ribbon8 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 3, 5)))

Ribbon9 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 4, 5)))

Ribbon10 = request.security(syminfo.tickerid, res(MA2Resolution), ma(MA2Type, MA2Source, rperiod(MA2Period, MA3Period, 5, 5)))

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon6 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon6", transp=70)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon7 : na, color=color.yellow, linewidth=1, style=plot.style_line, title="Ribbon7", transp=75)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon8 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon8", transp=80)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon9 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon9", transp=85)

plot(ShowRibbons and MA2Type == MA3Type and MA2Resolution == MA3Resolution and MA2Source == MA3Source ? Ribbon10 : na, color=color.red, linewidth=1, style=plot.style_line, title="Ribbon10", transp=90)

// Strategy Specific

ProfitTarget = (close * (TakeProfitPercent / 100)) / syminfo.mintick

LossTarget = (close * (StopLossPercent / 100)) / syminfo.mintick

if MA12Crossover and TradeMA12Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("1 over 2", true) // buy by market

strategy.exit("profit or loss", "1 over 2", profit = ProfitTarget, loss = LossTarget)

if MA12Crossunder and TradeMA12Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("1 over 2") // sell by market

if MA13Crossover and TradeMA13Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("1 over 3", true) // buy by market

strategy.exit("profit or loss", "1 over 3", profit = ProfitTarget, loss = LossTarget)

if MA13Crossunder and TradeMA13Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("1 over 3") // sell by market

if MA23Crossover and TradeMA23Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}entry

strategy.entry("2 over 3", true) // buy by market

strategy.exit("profit or loss", "2 over 3", profit = ProfitTarget, loss = LossTarget)

if MA23Crossunder and TradeMA23Crosses

//https://www.tradingview.com/pine-script-reference/#fun_strategy{dot}close

strategy.close("2 over 3") // sell by market