Estratégia de oscilação da banda da seção áurea

Visão geral

A estratégia de divisão de ondas de ouro é uma estratégia quantitativa baseada na teoria da divisão de ouro. A estratégia utiliza principalmente a lei de divisão de ouro para calcular várias faixas de preço, formando bandas de alta e baixa.

Princípio da estratégia

A lógica central do código consiste em calcular o intervalo de divisão de ouro do preço como um ponto-chave. Os principais passos são:

- Calcule a média do EMA de 14 ciclos como eixo central

- As 4 linhas de banda de cima abaixo são calculadas de acordo com o ATR e a fração de ouro

- Um sinal de negociação é gerado quando o preço sobe e quebra a faixa de queda ou desce e quebra a faixa de subida

- Configure um stop loss para acompanhar os movimentos dos preços e os ganhos

Com esta abordagem baseada em breakouts de pontos-chave, é possível capturar com eficiência os turbulências de curto prazo do mercado e negociar com lucro de volta entre os intervalos.

Vantagens estratégicas

A principal vantagem dessa estratégia é que ela utiliza o importante indicador teórico de divisão do ouro para localizar pontos-chave de preços, aumentando assim a probabilidade de lucro. As vantagens concretas são:

- A divisão do ouro é clara e fácil de avaliar

- A faixa de frequência é adequada, não é nem muito pequena nem muito larga

- Opção de múltiplos bandos de frequência para negociações agressivas e conservadoras

- Os sinais de oscilação são evidentes e a estratégia de manobras de linha curta está funcionando.

Risco estratégico

Como a estratégia busca lucros de curto prazo, há alguns riscos a serem considerados:

- Não há lucro em tendências de grandes ciclos

- Risco de perda de liquidez maior em situações de alta volatilidade

- Mais sinais de ruptura, escolha cuidadosa

- Invalidado quando a característica de vibração de banda desaparece

Estes riscos podem ser controlados através de ajustes de parâmetros, seleção de faixas de frequência adequadas e manejo de fundos.

Otimização de Estratégia

A estratégia ainda tem espaço para ser melhorada:

- A combinação de um indicador de tendência com um filtro de uma determinada direção de tendência gera um sinal

- Fechar a estratégia após um período de tempo específico ou antes de um ponto de evento importante

- Ajuste dinâmico da amplitude do stop loss para se adaptar à frequência de flutuação do mercado

- Parâmetros de otimização para escolher EMAs de diferentes períodos como linha média de referência

Resumir

A estratégia de divisão de ondas de ondas de ouro é uma estratégia de linha curta muito prática no geral. Ela usa a teoria da divisão de ouro para definir pontos críticos de preço, e pode obter lucros abundantes quando o preço oscila perto desses pontos.

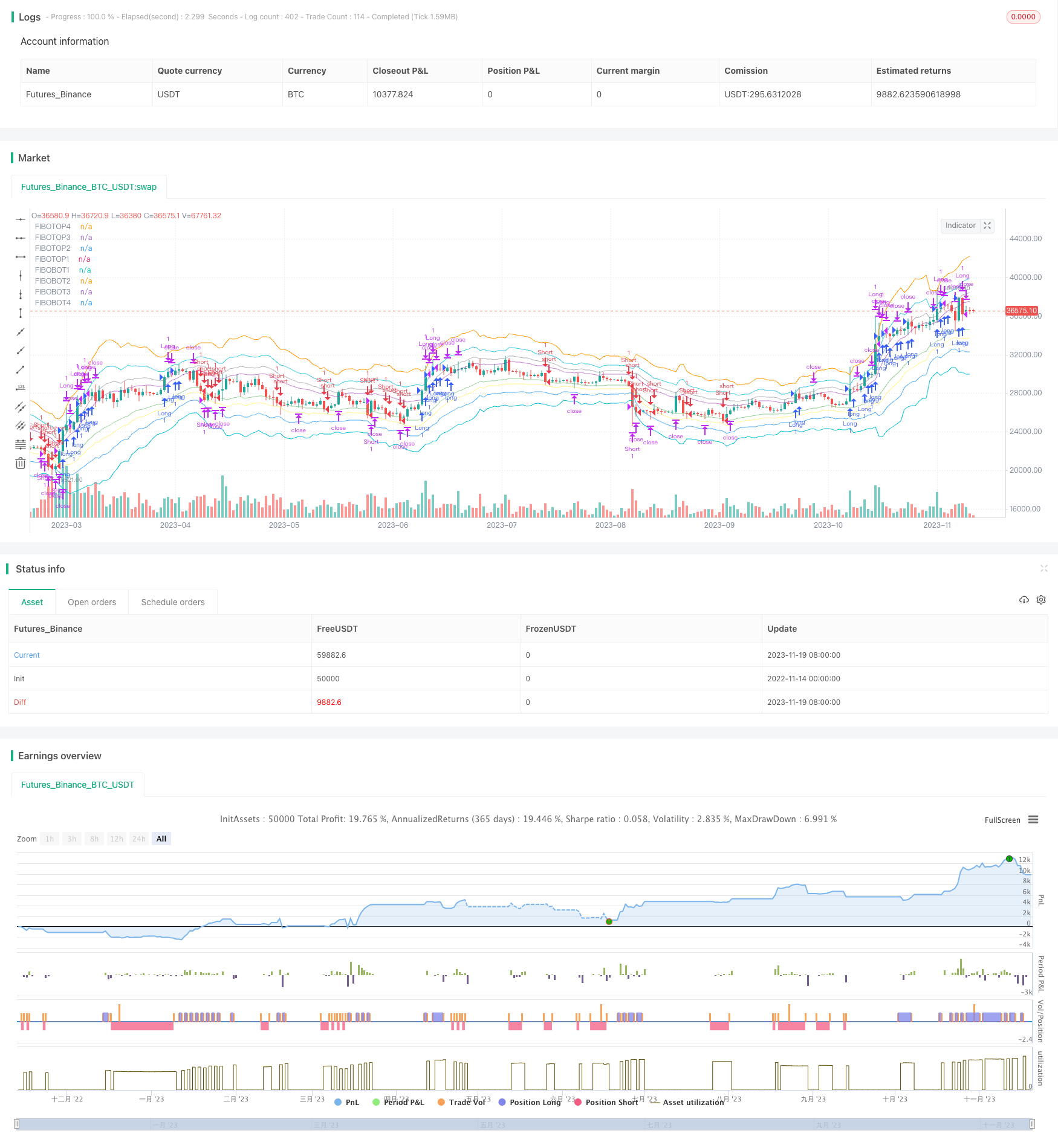

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © drhakankilic

//@version=5

strategy("FIBONACCI BANDS Strategy", shorttitle="FBANDS Strategy", overlay=true)

// === Date === {

//Backtest dates

fromDay = input.int(defval=1, title='From Day',minval=1,maxval=31)

fromMonth = input.int(defval=2, title='From Month',minval=1,maxval=12)

fromYear = input.int(defval=2022, title='From Year')

thruDay = input.int(defval=1, title='Thru Day',minval=1,maxval=31)

thruMonth = input.int(defval=1, title='Thru Month',minval=1,maxval=12)

thruYear = input.int(defval=2112, title='Thru Year')

showDate = true // input(defval=true, title="Show Date Range")

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => // create function "within window of time"

time >= start and time <= finish ? true : false

// }

// === Long or Short ===

tradeDirection = input.string(title="Long veya Short", options=["Long", "Short", "Both"], defval="Both", group="Bot")

// Translate input into trading conditions

longOK = (tradeDirection == "Long") or (tradeDirection == "Both")

shortOK = (tradeDirection == "Short") or (tradeDirection == "Both")

copypaste = input('{{strategy.order.alert_message}}', title='alert message to copy/paste', group="Bot")

// }

// === FIBONACCI BANDS === {

EMAperiod = input.int(14, title='EMAperiod', minval=1, maxval=500, group="Fibonacci")

ATRperiod = input.int(14, title='ATRperiod', minval=1, maxval=500, group="Fibonacci")

EMA = ta.ema(close, EMAperiod)

TR1 = math.max(high - low, math.abs(high - close[1]))

TR = math.max(TR1, math.abs(low - close[1]))

ATR = ta.sma(TR, ATRperiod)

F2 = input(defval=1.618, title='Fibonacci Ratio 2', group="Fibonacci")

F3 = input(defval=2.618, title='Fibonacci Ratio 3', group="Fibonacci")

F4 = input(defval=4.236, title='Fibonacci Ratio 4', group="Fibonacci")

R1 = ATR

R2 = ATR * F2

R3 = ATR * F3

R4 = ATR * F4

FIBOTOP4 = EMA + R4

FIBOTOP3 = EMA + R3

FIBOTOP2 = EMA + R2

FIBOTOP1 = EMA + R1

FIBOBOT1 = EMA - R1

FIBOBOT2 = EMA - R2

FIBOBOT3 = EMA - R3

FIBOBOT4 = EMA - R4

plot(FIBOTOP4[1], title='FIBOTOP4', linewidth=1, color=color.new(color.orange, 0))

plot(FIBOTOP3[1], title='FIBOTOP3', linewidth=1, color=color.new(color.aqua, 20))

plot(FIBOTOP2[1], title='FIBOTOP2', linewidth=1, color=color.new(color.gray, 40))

plot(FIBOTOP1[1], title='FIBOTOP1', linewidth=1, color=color.new(color.purple, 40))

plot(FIBOBOT1[1], title='FIBOBOT1', linewidth=1, color=color.new(color.green, 40))

plot(FIBOBOT2[1], title='FIBOBOT2', linewidth=1, color=color.new(color.yellow, 40))

plot(FIBOBOT3[1], title='FIBOBOT3', linewidth=1, color=color.new(color.blue, 20))

plot(FIBOBOT4[1], title='FIBOBOT4', linewidth=1, color=color.new(color.aqua, 0))

// plot(EMA[1], style=plot.style_cross, title='EMA', color=color.new(color.red, 0))

prefm = input.string(title="Fibo", options=["close>FIBOTOP4(orange)", "close>FIBOTOP3(aqua)","close>FIBOTOP2(gray)","close>FIBOTOP1(purple)", "Disable"] , defval="close>FIBOTOP1(purple)", group="Long")

_prefm = false

if (prefm == "close>FIBOTOP4(orange)" )

_prefm := close>FIBOTOP4[1]

if (prefm == "close>FIBOTOP3(aqua)" )

_prefm := close>FIBOTOP3[1]

if (prefm == "close>FIBOTOP2(gray)" )

_prefm := close>FIBOTOP2[1]

if (prefm == "close>FIBOTOP1(purple)" )

_prefm := close>FIBOTOP2[1]

if (prefm == "Disable" )

_prefm := low<low[1] or low>low[1]

prefmS = input.string(title="Fibo", options=["close<FIBOBOT1(green)", "close<FIBOBOT2(yellow)", "close<FIBOBOT3(blue)", "close<FIBOBOT4(aqua)", "Disable"] , defval="close<FIBOBOT1(green)", group="Short")

_prefmS = false

if (prefmS == "close<FIBOBOT1(green)" )

_prefmS := close<FIBOBOT1[1]

if (prefmS == "close<FIBOBOT2(yellow)" )

_prefmS := close<FIBOBOT2[1]

if (prefmS == "close<FIBOBOT3(blue)" )

_prefmS := close<FIBOBOT3[1]

if (prefmS == "close<FIBOBOT4(aqua)" )

_prefmS := close<FIBOBOT4[1]

if (prefmS == "Disable" )

_prefmS := low<low[1] or low>low[1]

// }

long2= _prefm

short2= _prefmS

//

// === Bot Codes === {

enterlong = input("Long Code", title='Long İlk Alım', group="Long Code")

entershort= input("Short Code", title='Short İlk Alım', group="Short Code")

exitlong = input("Long Exit Code", title='Long Exit', group="Long Code")

exitshort= input("Short Exit Code", title='Short Exit', group="Short Code")

// }

////////////////////////////////////////////////////////////////////////////////////////////TPSL

// Inputs

sl_inp = input.float(4, title='Stop %', step=0.1, group="Long") / 100

tp_inp = input.float(1.5, title='TP %', step=0.1, group="Long") / 100

sl_inp2 = input.float(4, title='Stop %', step=0.1, group="Short") / 100

tp_inp2 = input.float(1.5, title='TP %', step=0.1, group="Short") / 100

longtp = strategy.position_avg_price * (1 + tp_inp)

longstop= strategy.position_avg_price * (1 - sl_inp)

shortstop= strategy.position_avg_price * (1 + sl_inp2)

shorttp = strategy.position_avg_price * (1 - tp_inp2)

////////////////////////////////////////////////////////////////////////////////////////////

if window() and strategy.position_size==0 and longOK

strategy.entry("Long", strategy.long, when= long2, alert_message=enterlong, comment="Long")

if strategy.position_size>0

strategy.exit("Long", stop= longstop, limit=longtp, alert_message=exitlong, comment="TPSL")

////////////////////////////////////////////////////////////////////////////////////////////SHORT

if window() and strategy.position_size==0 and shortOK

strategy.entry("Short", strategy.short, when= short2, alert_message=entershort, comment="Short")

if strategy.position_size<0

strategy.exit("Short", stop= shortstop, limit= shorttp, alert_message=exitshort, comment="TPSL")