Estratégia de negociação de curto prazo baseada em ZigZag com vários padrões

Visão geral

A estratégia baseia-se no indicador ZigZag para identificar as formas de linha K, combinando as linhas de retorno de Fibonacci para definir a janela de entrada, o preço de parada e o preço de parada, para permitir a negociação de linhas curtas. A estratégia suporta várias formas, incluindo 13 formas de tendências alternativas, como Bat, Butterfly e Gartley.

Princípio da estratégia

- Identificação de potenciais pontos de inflexão com o indicador ZigZag

- Calcule os 4 pontos de inversão mais recentes para determinar se eles correspondem a qualquer uma das 13 configurações predefinidas

- Entrar se for uma forma de correspondência e o preço entrar na região de retração de Fibonacci de 0,382

- O Stop Stop é 0.618 Retracement Line, o Stop Loss é -0.618 Retracement Line.

- As formas efetivas incluem as comuns Bat, Butterfly e Gartley, além de algumas formas reversíveis, como Anti-Bat, Anti-Butterfly e outras.

Análise de vantagens

- Estratégias que aproveitam os benefícios do indicador ZigZag para filtrar o ruído do mercado e identificar pontos de mudança de tendência mais claros

- A combinação de múltiplas formas de aumentar as oportunidades de entrada e controlar os riscos

- O retorno de Fibonacci é usado para definir pontos de referência para padronizar a entrada e a parada do Take profit.

Análise de Riscos

- O indicador ZigZag é sensível a parâmetros e precisa ser ajustado para encontrar a melhor combinação de parâmetros

- A correspondência de forma em massa aumenta o risco de curva de adequação, e o efeito em disco pode ser mais fraco do que a ressonância

- Considerando apenas os quatro pontos de viragem mais recentes, não é possível identificar formas mais complexas.

- Não levar em conta o retesto após a ruptura da linha de retirada, o que pode levar a uma parada prematura

Direção de otimização

- Optimizar os parâmetros ZigZag para encontrar a melhor combinação de parâmetros

- Testes de eficácia de formas adicionais, como a confirmação de que o preço de fechamento foi considerado um ponto crítico

- Adicionar mais formas de linha K para expandir as oportunidades de entrada

- Aumentar o mecanismo de retirada e re-teste, reduzindo o risco de parada

Resumir

A estratégia usa o indicador ZigZag e a forma de linha K para julgar o ponto de conversão da tendência, configurando a lógica de entrada e saída padronizada da zona de retirada de Fibonacci, uma estratégia de negociação de linha curta com potencial. A chave é encontrar a melhor combinação de parâmetros e, ao mesmo tempo, ajustar adequadamente o mecanismo de parada de perdas, esperançosamente para obter um melhor efeito em campo.

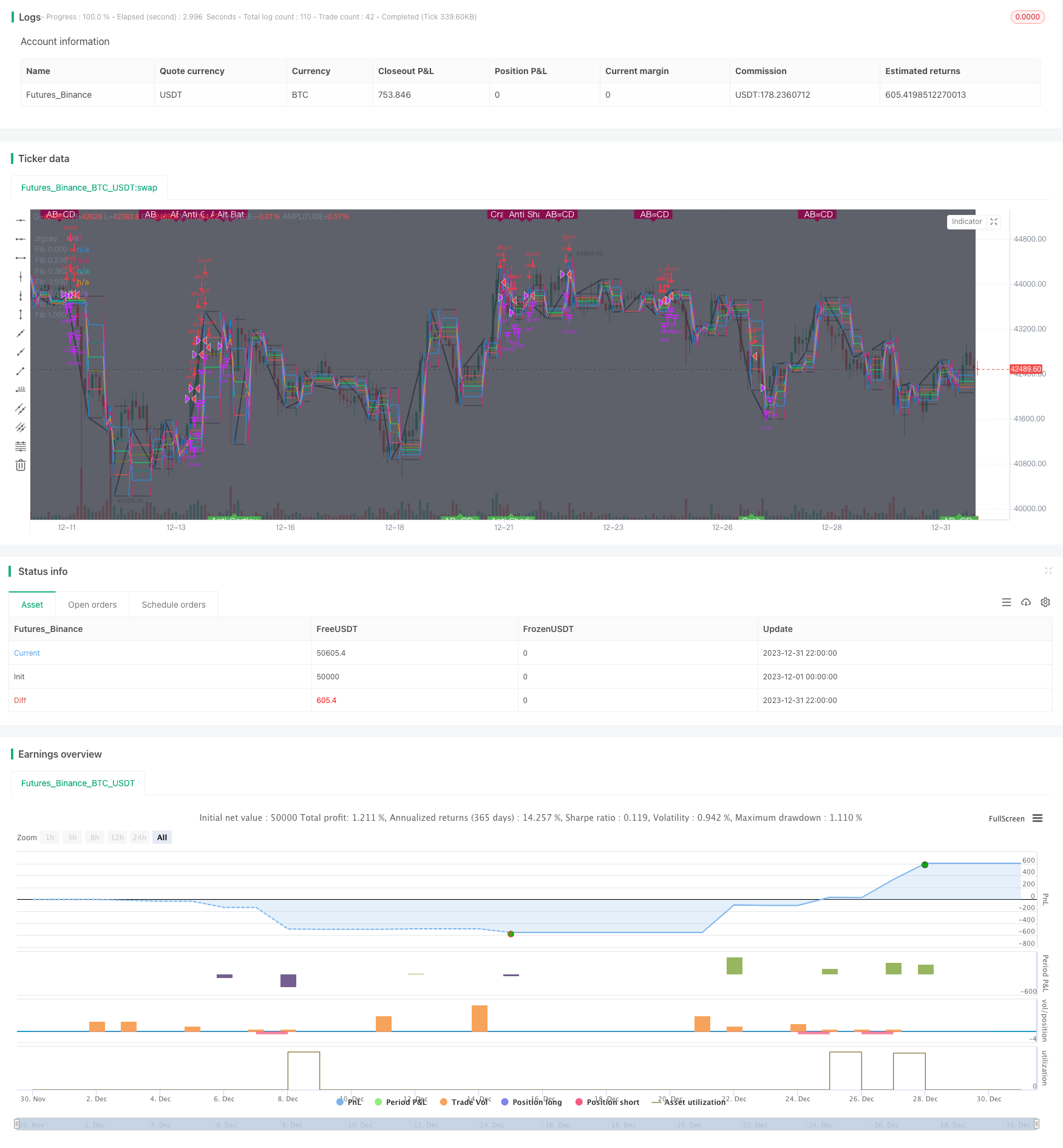

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title='[STRATEGY][RS]ZigZag PA Strategy V4', shorttitle='S', overlay=true)

useHA = input(false, title='Use Heikken Ashi Candles')

useAltTF = input(true, title='Use Alt Timeframe')

tf = input('60', title='Alt Timeframe')

showPatterns = input(true, title='Show Patterns')

showFib0000 = input(title='Display Fibonacci 0.000:', type=bool, defval=true)

showFib0236 = input(title='Display Fibonacci 0.236:', type=bool, defval=true)

showFib0382 = input(title='Display Fibonacci 0.382:', type=bool, defval=true)

showFib0500 = input(title='Display Fibonacci 0.500:', type=bool, defval=true)

showFib0618 = input(title='Display Fibonacci 0.618:', type=bool, defval=true)

showFib0764 = input(title='Display Fibonacci 0.764:', type=bool, defval=true)

showFib1000 = input(title='Display Fibonacci 1.000:', type=bool, defval=true)

zigzag() =>

_isUp = close >= open

_isDown = close <= open

_direction = _isUp[1] and _isDown ? -1 : _isDown[1] and _isUp ? 1 : nz(_direction[1])

_zigzag = _isUp[1] and _isDown and _direction[1] != -1 ? highest(2) : _isDown[1] and _isUp and _direction[1] != 1 ? lowest(2) : na

_ticker = useHA ? heikenashi(syminfo.tickerid) : syminfo.tickerid

sz = useAltTF ? (ta.change(time(tf)) != 0 ? request.security(_ticker, tf, zigzag()) : na) : zigzag()

plot(sz, title='zigzag', color=color.black, linewidth=2)

// ||--- Pattern Recognition:

x = ta.valuewhen(sz, sz, 4)

a = ta.valuewhen(sz, sz, 3)

b = ta.valuewhen(sz, sz, 2)

c = ta.valuewhen(sz, sz, 1)

d = ta.valuewhen(sz, sz, 0)

xab = (abs(b-a)/abs(x-a))

xad = (abs(a-d)/abs(x-a))

abc = (abs(b-c)/abs(a-b))

bcd = (abs(c-d)/abs(b-c))

// ||--> Functions:

isBat(_mode)=>

_xab = xab >= 0.382 and xab <= 0.5

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.618 and bcd <= 2.618

_xad = xad <= 0.618 and xad <= 1.000 // 0.886

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiBat(_mode)=>

_xab = xab >= 0.500 and xab <= 0.886 // 0.618

_abc = abc >= 1.000 and abc <= 2.618 // 1.13 --> 2.618

_bcd = bcd >= 1.618 and bcd <= 2.618 // 2.0 --> 2.618

_xad = xad >= 0.886 and xad <= 1.000 // 1.13

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAltBat(_mode)=>

_xab = xab <= 0.382

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 2.0 and bcd <= 3.618

_xad = xad <= 1.13

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isButterfly(_mode)=>

_xab = xab <= 0.786

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.618 and bcd <= 2.618

_xad = xad >= 1.27 and xad <= 1.618

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiButterfly(_mode)=>

_xab = xab >= 0.236 and xab <= 0.886 // 0.382 - 0.618

_abc = abc >= 1.130 and abc <= 2.618 // 1.130 - 2.618

_bcd = bcd >= 1.000 and bcd <= 1.382 // 1.27

_xad = xad >= 0.500 and xad <= 0.886 // 0.618 - 0.786

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isABCD(_mode)=>

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.13 and bcd <= 2.618

_abc and _bcd and (_mode == 1 ? d < c : d > c)

isGartley(_mode)=>

_xab = xab >= 0.5 and xab <= 0.618 // 0.618

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.13 and bcd <= 2.618

_xad = xad >= 0.75 and xad <= 0.875 // 0.786

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiGartley(_mode)=>

_xab = xab >= 0.500 and xab <= 0.886 // 0.618 -> 0.786

_abc = abc >= 1.000 and abc <= 2.618 // 1.130 -> 2.618

_bcd = bcd >= 1.500 and bcd <= 5.000 // 1.618

_xad = xad >= 1.000 and xad <= 5.000 // 1.272

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isCrab(_mode)=>

_xab = xab >= 0.500 and xab <= 0.875 // 0.886

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 2.000 and bcd <= 5.000 // 3.618

_xad = xad >= 1.382 and xad <= 5.000 // 1.618

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiCrab(_mode)=>

_xab = xab >= 0.250 and xab <= 0.500 // 0.276 -> 0.446

_abc = abc >= 1.130 and abc <= 2.618 // 1.130 -> 2.618

_bcd = bcd >= 1.618 and bcd <= 2.618 // 1.618 -> 2.618

_xad = xad >= 0.500 and xad <= 0.750 // 0.618

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isShark(_mode)=>

_xab = xab >= 0.500 and xab <= 0.875 // 0.5 --> 0.886

_abc = abc >= 1.130 and abc <= 1.618 //

_bcd = bcd >= 1.270 and bcd <= 2.240 //

_xad = xad >= 0.886 and xad <= 1.130 // 0.886 --> 1.13

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isAntiShark(_mode)=>

_xab = xab >= 0.382 and xab <= 0.875 // 0.446 --> 0.618

_abc = abc >= 0.500 and abc <= 1.000 // 0.618 --> 0.886

_bcd = bcd >= 1.250 and bcd <= 2.618 // 1.618 --> 2.618

_xad = xad >= 0.500 and xad <= 1.250 // 1.130 --> 1.130

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

is5o(_mode)=>

_xab = xab >= 1.13 and xab <= 1.618

_abc = abc >= 1.618 and abc <= 2.24

_bcd = bcd >= 0.5 and bcd <= 0.625 // 0.5

_xad = xad >= 0.0 and xad <= 0.236 // negative?

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isWolf(_mode)=>

_xab = xab >= 1.27 and xab <= 1.618

_abc = abc >= 0 and abc <= 5

_bcd = bcd >= 1.27 and bcd <= 1.618

_xad = xad >= 0.0 and xad <= 5

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isHnS(_mode)=>

_xab = xab >= 2.0 and xab <= 10

_abc = abc >= 0.90 and abc <= 1.1

_bcd = bcd >= 0.236 and bcd <= 0.88

_xad = xad >= 0.90 and xad <= 1.1

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isConTria(_mode)=>

_xab = xab >= 0.382 and xab <= 0.618

_abc = abc >= 0.382 and abc <= 0.618

_bcd = bcd >= 0.382 and bcd <= 0.618

_xad = xad >= 0.236 and xad <= 0.764

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

isExpTria(_mode)=>

_xab = xab >= 1.236 and xab <= 1.618

_abc = abc >= 1.000 and abc <= 1.618

_bcd = bcd >= 1.236 and bcd <= 2.000

_xad = xad >= 2.000 and xad <= 2.236

_xab and _abc and _bcd and _xad and (_mode == 1 ? d < c : d > c)

plotshape(not showPatterns ? na : isABCD(-1) and not isABCD(-1)[1], text="\nAB=CD", title='Bear ABCD', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0, offset=-2)

plotshape(not showPatterns ? na : isBat(-1) and not isBat(-1)[1], text="Bat", title='Bear Bat', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0, offset=-2)

plotshape(not showPatterns ? na : isAntiBat(-1) and not isAntiBat(-1)[1], text="Anti Bat", title='Bear Anti Bat', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0, offset=-2)

plotshape(not showPatterns ? na : isAltBat(-1) and not isAltBat(-1)[1], text="Alt Bat", title='Bear Alt Bat', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isButterfly(-1) and not isButterfly(-1)[1], text="Butterfly", title='Bear Butterfly', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isAntiButterfly(-1) and not isAntiButterfly(-1)[1], text="Anti Butterfly", title='Bear Anti Butterfly', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isGartley(-1) and not isGartley(-1)[1], text="Gartley", title='Bear Gartley', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isAntiGartley(-1) and not isAntiGartley(-1)[1], text="Anti Gartley", title='Bear Anti Gartley', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isCrab(-1) and not isCrab(-1)[1], text="Crab", title='Bear Crab', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isAntiCrab(-1) and not isAntiCrab(-1)[1], text="Anti Crab", title='Bear Anti Crab', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isShark(-1) and not isShark(-1)[1], text="Shark", title='Bear Shark', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isAntiShark(-1) and not isAntiShark(-1)[1], text="Anti Shark", title='Bear Anti Shark', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : is5o(-1) and not is5o(-1)[1], text="5-O", title='Bear 5-O', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isWolf(-1) and not isWolf(-1)[1], text="Wolf Wave", title='Bear Wolf Wave', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isHnS(-1) and not isHnS(-1)[1], text="Head and Shoulders", title='Bear Head and Shoulders', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isConTria(-1) and not isConTria(-1)[1], text="Contracting Triangle", title='Bear Contracting triangle', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isExpTria(-1) and not isExpTria(-1)[1], text="Expanding Triangle", title='Bear Expanding Triangle', style=shape.labeldown, color=maroon, textcolor=white, location=location.top, transp=0)

plotshape(not showPatterns ? na : isABCD(1) and not isABCD(1)[1], text="AB=CD\n", title='Bull ABCD', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isBat(1) and not isBat(1)[1], text="Bat", title='Bull Bat', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiBat(1) and not isAntiBat(1)[1], text="Anti Bat", title='Bull Anti Bat', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAltBat(1) and not isAltBat(1)[1], text="Alt Bat", title='Bull Alt Bat', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isButterfly(1) and not isButterfly(1)[1], text="Butterfly", title='Bull Butterfly', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiButterfly(1) and not isAntiButterfly(1)[1], text="Anti Butterfly", title='Bull Anti Butterfly', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isGartley(1) and not isGartley(1)[1], text="Gartley", title='Bull Gartley', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiGartley(1) and not isAntiGartley(1)[1], text="Anti Gartley", title='Bull Anti Gartley', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isCrab(1) and not isCrab(1)[1], text="Crab", title='Bull Crab', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiCrab(1) and not isAntiCrab(1)[1], text="Anti Crab", title='Bull Anti Crab', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isShark(1) and not isShark(1)[1], text="Shark", title='Bull Shark', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isAntiShark(1) and not isAntiShark(1)[1], text="Anti Shark", title='Bull Anti Shark', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : is5o(1) and not is5o(1)[1], text="5-O", title='Bull 5-O', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isWolf(1) and not isWolf(1)[1], text="Wolf Wave", title='Bull Wolf Wave', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isHnS(1) and not isHnS(1)[1], text="Head and Shoulders", title='Bull Head and Shoulders', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isConTria(1) and not isConTria(1)[1], text="Contracting Triangle", title='Bull Contracting Triangle', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

plotshape(not showPatterns ? na : isExpTria(1) and not isExpTria(1)[1], text="Expanding Triangle", title='Bull Expanding Triangle', style=shape.labelup, color=green, textcolor=white, location=location.bottom, transp=0)

//-------------------------------------------------------------------------------------------------------------------------------------------------------------

fib_range = abs(d-c)

fib_0000 = not showFib0000 ? na : d > c ? d-(fib_range*0.000):d+(fib_range*0.000)

fib_0236 = not showFib0236 ? na : d > c ? d-(fib_range*0.236):d+(fib_range*0.236)

fib_0382 = not showFib0382 ? na : d > c ? d-(fib_range*0.382):d+(fib_range*0.382)

fib_0500 = not showFib0500 ? na : d > c ? d-(fib_range*0.500):d+(fib_range*0.500)

fib_0618 = not showFib0618 ? na : d > c ? d-(fib_range*0.618):d+(fib_range*0.618)

fib_0764 = not showFib0764 ? na : d > c ? d-(fib_range*0.764):d+(fib_range*0.764)

fib_1000 = not showFib1000 ? na : d > c ? d-(fib_range*1.000):d+(fib_range*1.000)

plot(title='Fib 0.000', series=fib_0000, color=fib_0000 != fib_0000[1] ? na : black)

plot(title='Fib 0.236', series=fib_0236, color=fib_0236 != fib_0236[1] ? na : red)

plot(title='Fib 0.382', series=fib_0382, color=fib_0382 != fib_0382[1] ? na : olive)

plot(title='Fib 0.500', series=fib_0500, color=fib_0500 != fib_0500[1] ? na : lime)

plot(title='Fib 0.618', series=fib_0618, color=fib_0618 != fib_0618[1] ? na : teal)

plot(title='Fib 0.764', series=fib_0764, color=fib_0764 != fib_0764[1] ? na : blue)

plot(title='Fib 1.000', series=fib_1000, color=fib_1000 != fib_1000[1] ? na : black)

bgcolor(not useAltTF ? na : change(time(tf))!=0?black:na)

f_last_fib(_rate)=>d > c ? d-(fib_range*_rate):d+(fib_range*_rate)

trade_size = input(title='Trade size:', type=float, defval=1.00)

ew_rate = input(title='Fib. Rate to use for Entry Window:', type=float, defval=0.382)

tp_rate = input(title='Fib. Rate to use for TP:', type=float, defval=0.618)

sl_rate = input(title='Fib. Rate to use for SL:', type=float, defval=-0.618)

buy_patterns_00 = isABCD(1) or isBat(1) or isAltBat(1) or isButterfly(1) or isGartley(1) or isCrab(1) or isShark(1) or is5o(1) or isWolf(1) or isHnS(1) or isConTria(1) or isExpTria(1)

buy_patterns_01 = isAntiBat(1) or isAntiButterfly(1) or isAntiGartley(1) or isAntiCrab(1) or isAntiShark(1)

sel_patterns_00 = isABCD(-1) or isBat(-1) or isAltBat(-1) or isButterfly(-1) or isGartley(-1) or isCrab(-1) or isShark(-1) or is5o(-1) or isWolf(-1) or isHnS(-1) or isConTria(-1) or isExpTria(-1)

sel_patterns_01 = isAntiBat(-1) or isAntiButterfly(-1) or isAntiGartley(-1) or isAntiCrab(-1) or isAntiShark(-1)

buy_entry = (buy_patterns_00 or buy_patterns_01) and close <= f_last_fib(ew_rate)

buy_close = high >= f_last_fib(tp_rate) or low <= f_last_fib(sl_rate)

sel_entry = (sel_patterns_00 or sel_patterns_01) and close >= f_last_fib(ew_rate)

sel_close = low <= f_last_fib(tp_rate) or high >= f_last_fib(sl_rate)

strategy.entry('buy', long=strategy.long, qty=trade_size, comment='buy', when=buy_entry)

strategy.close('buy', when=buy_close)

strategy.entry('sell', long=strategy.short, qty=trade_size, comment='sell', when=sel_entry)

strategy.close('sell', when=sel_close)