Estratégia de tendência progressiva BB KC

Visão geral

Esta estratégia usa um conjunto de sinais de Brin e Kate para identificar tendências de mercado. A Brin é uma ferramenta de análise técnica que define canais de acordo com a amplitude de flutuação dos preços. A Kate é um indicador técnico que combina a volatilidade dos preços com a tendência para determinar se há apoio ou pressão.

Princípio da estratégia

- O meio-carril, o trem superior e o trem inferior de Brin, com 20 ciclos, são calculados com uma largura de banda de 2 vezes a diferença padrão.

- O meio-carril, o carril superior e o carril inferior do Kate de 20 ciclos são calculados e a largura de banda é determinada por 2,2 vezes o alcance real das oscilações.

- Faça mais quando Kate estiver na faixa de Brin na faixa de Brin e o volume de transação for maior do que a média de 10 ciclos.

- Quando o Kate atravessa a faixa de Brin abaixo da linha e o volume de transações é maior do que a média de 10 ciclos, faça um vazio.

- Se 20 linhas K não se retirarem após a abertura da posição, o stop loss forçado é retirado.

- Depois de fazer mais, configure um stop loss de 1,5% e um stop loss de -1,5% depois de fazer curto; depois de fazer mais, configure um stop loss de 2% e um stop loss de -2% depois de fazer curto.

A estratégia baseia-se principalmente na faixa de Bryn para determinar o alcance e a intensidade das oscilações. Usando a verificação auxiliada por Kate, a combinação de dois indicadores com diferentes parâmetros, mas de natureza semelhante, pode aumentar a precisão do sinal. A introdução de volumes de transação também pode reduzir efetivamente os sinais inválidos.

Análise de vantagens

- A combinação dos dois indicadores, o Brin Belt e o Kate Line, aumentou a precisão dos sinais de negociação.

- A combinação de indicadores de volume de transação pode efetivamente reduzir os sinais de invalidez de frequentes colisões no mercado.

- Estabelecer um mecanismo de stop loss e rastreamento de stop loss para controlar o risco de forma eficaz.

- A paragem forçada após o sinal de invalidez é definida para parar a paragem rapidamente.

Análise de Riscos

- As faixas de Bryn e as linhas de Kate são indicadores baseados em médias móveis e combinados com cálculos de volatilidade, que são suscetíveis a erros de sinalização em situações de turbulência.

- O mecanismo de não-retorno de lucro, em que o bloqueio repetido pode levar a perdas excessivas.

- Os sinais de reversão são mais comuns, e é fácil perder oportunidades de tendência após ajustar os parâmetros. A amplitude de stop loss pode ser relaxada de forma apropriada ou os sinais de filtragem de indicadores auxiliares, como MACD, podem ser adicionados para reduzir o risco de sinais errados.

Direção de otimização

- Pode-se testar o impacto de diferentes parâmetros na taxa de retorno da estratégia, como o comprimento da linha média ajustada, o múltiplo da diferença padrão e outros parâmetros.

- Pode-se adicionar outros indicadores de julgamento para determinar o sinal, como o KDJ indicador ou MACD indicador auxiliar.

- Os parâmetros podem ser otimizados automaticamente por meio de métodos de aprendizado de máquina.

Resumir

Esta estratégia utiliza um conjunto de indicadores de Brin e Kate para identificar tendências de mercado e é complementada por indicadores de volume de transação para verificar sinais. A estratégia pode ser ainda mais fortalecida por meio de otimização de parâmetros, adição de outros indicadores técnicos, etc. A estratégia pode ser adaptada a uma situação de mercado mais ampla.

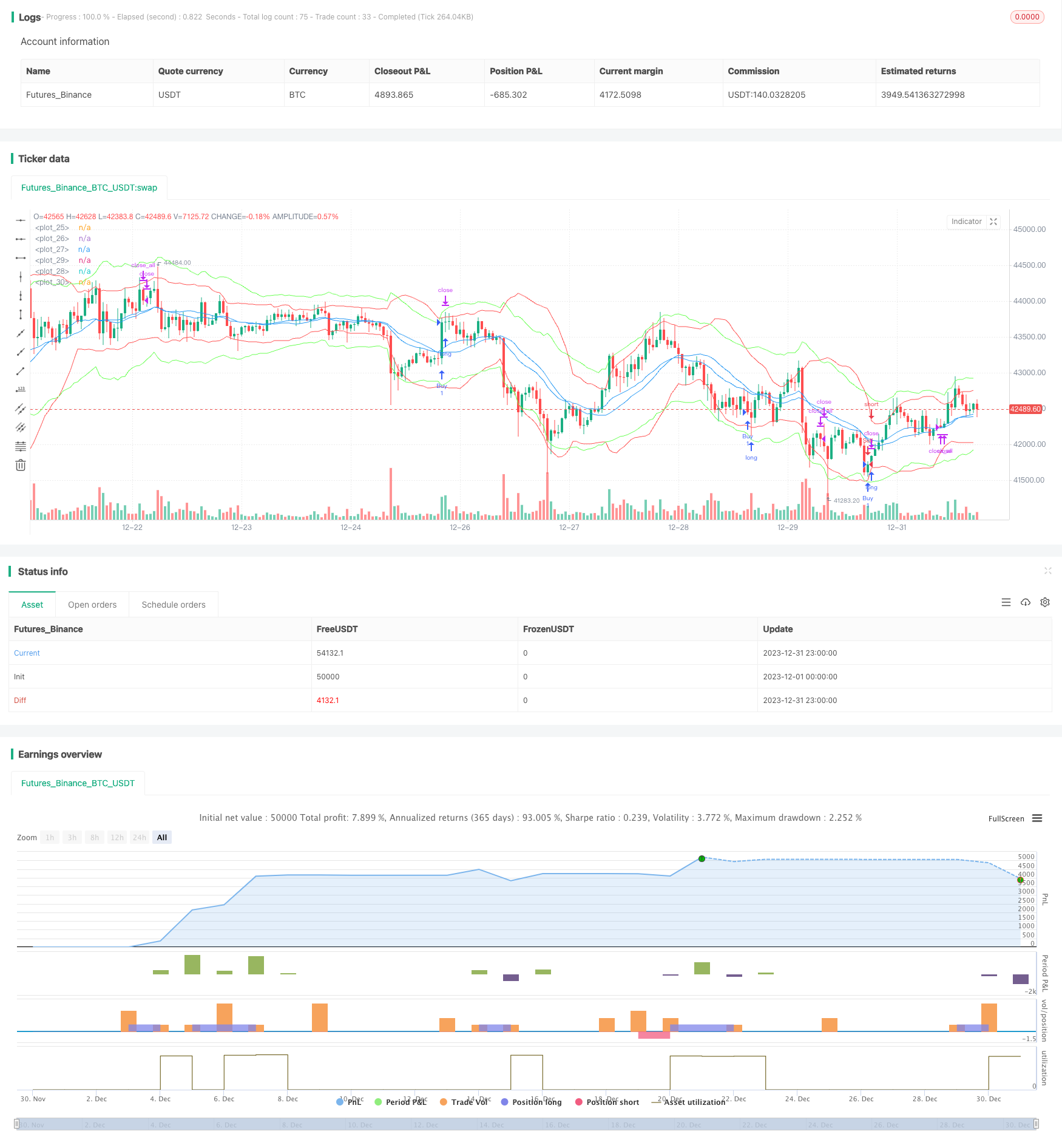

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © jensenvilhelm

//@version=5

strategy("BB and KC Strategy", overlay=true)

// Define the input parameters for the strategy, these can be changed by the user to adjust the strategy

kcLength = input.int(20, "KC Length", minval=1) // Length for Keltner Channel calculation

kcStdDev = input.float(2.2, "KC StdDev") // Standard Deviation for Keltner Channel calculation

bbLength = input.int(20, "BB Length", minval=1) // Length for Bollinger Bands calculation

bbStdDev = input.float(2, "BB StdDev") // Standard Deviation for Bollinger Bands calculation

volumeLength = input.int(10, "Volume MA Length", minval=1) // Length for moving average of volume calculation

stopLossPercent = input.float(1.5, "Stop Loss (%)") // Percent of price for Stop loss

trailStopPercent = input.float(2, "Trail Stop (%)") // Percent of price for Trailing Stop

barsInTrade = input.int(20, "Bars in trade before exit", minval = 1) // Minimum number of bars in trade before considering exit

// Calculate Bollinger Bands and Keltner Channel

[bb_middle, bb_upper, bb_lower] = ta.bb(close, bbLength, bbStdDev) // Bollinger Bands calculation

[kc_middle, kc_upper, kc_lower] = ta.kc(close, kcLength, kcStdDev) // Keltner Channel calculation

// Calculate moving average of volume

vol_ma = ta.sma(volume, volumeLength) // Moving average of volume calculation

// Plotting Bollinger Bands and Keltner Channels on the chart

plot(bb_upper, color=color.red) // Bollinger Bands upper line

plot(bb_middle, color=color.blue) // Bollinger Bands middle line

plot(bb_lower, color=color.red) // Bollinger Bands lower line

plot(kc_upper, color=color.rgb(105, 255, 82)) // Keltner Channel upper line

plot(kc_middle, color=color.blue) // Keltner Channel middle line

plot(kc_lower, color=color.rgb(105, 255, 82)) // Keltner Channel lower line

// Define entry conditions: long position if upper KC line crosses above upper BB line and volume is above MA of volume

// and short position if lower KC line crosses below lower BB line and volume is above MA of volume

longCond = ta.crossover(kc_upper, bb_upper) and volume > vol_ma // Entry condition for long position

shortCond = ta.crossunder(kc_lower, bb_lower) and volume > vol_ma // Entry condition for short position

// Define variables to store entry price and bar counter at entry point

var float entry_price = na // variable to store entry price

var int bar_counter = na // variable to store bar counter at entry point

// Check entry conditions and if met, open long or short position

if (longCond)

strategy.entry("Buy", strategy.long) // Open long position

entry_price := close // Store entry price

bar_counter := 1 // Start bar counter

if (shortCond)

strategy.entry("Sell", strategy.short) // Open short position

entry_price := close // Store entry price

bar_counter := 1 // Start bar counter

// If in a position and bar counter is not na, increment bar counter

if (strategy.position_size != 0 and na(bar_counter) == false)

bar_counter := bar_counter + 1 // Increment bar counter

// Define exit conditions: close position if been in trade for more than specified bars

// or if price drops by more than specified percent for long or rises by more than specified percent for short

if (bar_counter > barsInTrade) // Only consider exit after minimum bars in trade

if (bar_counter >= barsInTrade)

strategy.close_all() // Close all positions

// Stop loss and trailing stop

if (strategy.position_size > 0)

strategy.exit("Sell", "Buy", stop=entry_price * (1 - stopLossPercent/100), trail_points=entry_price * trailStopPercent/100) // Set stop loss and trailing stop for long position

else if (strategy.position_size < 0)

strategy.exit("Buy", "Sell", stop=entry_price * (1 + stopLossPercent/100), trail_points=entry_price * trailStopPercent/100) // Set stop loss and trailing stop for short position