Visão geral

A estratégia de média móvel baseada no cruzamento de duas medias é um método de negociação diária simples e eficaz para identificar oportunidades de compra e venda potenciais no mercado, analisando a relação entre duas médias móveis de diferentes períodos. A estratégia usa uma média móvel simples de curto prazo (SMA) e uma média móvel simples de longo prazo, indicando um sinal de alta quando a média curta atravessa a média de longo prazo, indicando uma potencial oportunidade de compra; ao contrário, quando a média curta atravessa a média de longo prazo, indicando um sinal de baixa, indicando uma potencial oportunidade de venda.

Princípio da estratégia

O princípio central da estratégia é usar as características de tendência e atraso de diferentes médias móveis de períodos, para julgar a direção da tendência atual do mercado, comparando a média de curto prazo e a média de longo prazo, para tomar decisões de negociação correspondentes. Quando o mercado está em alta, o preço ultrapassa a média de longo prazo, e a média de curto prazo atravessa a média de longo prazo para formar um garfo de ouro, produzindo um sinal de compra. Quando o mercado está em baixa, o preço cai primeiro a média de longo prazo, e a média de curto prazo atravessa a média de longo prazo para formar um garfo de morte, produzindo um sinal de venda.

Vantagens estratégicas

- Simples e fácil de entender: a estratégia é baseada na clássica teoria das médias móveis, a lógica é clara, fácil de entender e implementar.

- Adaptabilidade: A estratégia pode ser aplicada em vários mercados e diferentes variedades de negociação, sendo capaz de responder de forma flexível a diferentes características do mercado, ajustando a configuração dos parâmetros.

- Captura de tendências: a direção da tendência é determinada pela interseção de duas linhas de equilíbrio, o que ajuda os comerciantes a acompanhar a tendência principal em tempo hábil e aumentar as oportunidades de lucro.

- Controle de risco: A estratégia introduz o conceito de gerenciamento de risco, controlando a abertura de risco de cada transação através do ajuste de posição e gerenciando efetivamente os potenciais prejuízos.

- Reduzir o ruído: aproveitar as características de atraso da linha de equilíbrio para filtrar efetivamente o ruído aleatório do mercado e melhorar a confiabilidade dos sinais de negociação.

Risco estratégico

- Seleção de parâmetros: diferentes configurações de parâmetros podem ter um impacto importante no desempenho da estratégia. A escolha incorreta pode levar à falha ou ao mau desempenho da estratégia.

- Tendências de mercado: A estratégia pode apresentar perdas consecutivas em mercados de turbulência ou pontos de tendência.

- Custo de deslizamento: a frequência de negociação pode gerar custos de deslizamento mais elevados, afetando o lucro geral da estratégia.

- Incidentes de cisnes negros: A estratégia é pouco adaptada a situações extremas, e os eventos de cisnes negros podem trazer grandes perdas para a estratégia.

- Risco de sobre-ajuste: se a otimização de parâmetros for excessivamente dependente de dados históricos, a estratégia pode causar um mau desempenho nas negociações reais.

Direção de otimização da estratégia

- Otimização de parâmetros dinâmicos: ajuste dinâmico dos parâmetros da estratégia de acordo com as mudanças no estado do mercado, aumentando a adaptabilidade.

- Confirmação de tendências: introdução de outros indicadores ou padrões de comportamento de preços após a geração de sinais de negociação para confirmar tendências e aumentar a confiabilidade do sinal.

- Stop Loss Stop: Introdução de um mecanismo razoável de Stop Loss Stop para controlar ainda mais a margem de risco de transações individuais.

- Gerenciamento de posições: métodos para otimizar o ajuste de posições, como a introdução de indicadores de taxa de flutuação e o ajuste dinâmico de posições de acordo com os níveis de flutuação do mercado.

- Avaliação da força de múltiplos pontos: Avaliação da relação contrária entre a força de múltiplos pontos e a força de um ponto, intervenção no início da tendência e melhoria da precisão da captação da tendência.

Resumir

A estratégia de média móvel baseada no cruzamento de duas equilíbrios é um método de negociação diária simples e prático, que determina a direção da tendência do mercado, gerando sinais de negociação, comparando a relação de posição de diferentes equilíbrios periódicos. A lógica da estratégia é clara, é adaptável e pode efetivamente capturar a tendência do mercado, ao mesmo tempo em que introduz medidas de gerenciamento de risco para controlar os perdas potenciais.

Overview

The Moving Average Crossover Strategy based on dual moving averages is a straightforward and effective intraday trading approach designed to identify potential buy and sell opportunities in the market by analyzing the relationship between two moving averages of different periods. This strategy utilizes a short-term simple moving average (SMA) and a long-term simple moving average. When the short-term moving average crosses above the long-term moving average, it indicates a bullish signal, suggesting a potential buying opportunity. Conversely, when the short-term moving average crosses below the long-term moving average, it indicates a bearish signal, suggesting a potential selling opportunity. This crossover method helps traders capture trending moves in the market while minimizing market noise interference.

Strategy Principle

The core principle of this strategy is to utilize the trend characteristics and lag of moving averages with different periods. By comparing the relative position relationship between the short-term moving average and the long-term moving average, it determines the current market trend direction and makes corresponding trading decisions. When an upward trend emerges in the market, the price will first break through the long-term moving average, and the short-term moving average will subsequently cross above the long-term moving average, forming a golden cross and generating a buy signal. When a downward trend emerges in the market, the price will first break below the long-term moving average, and the short-term moving average will subsequently cross below the long-term moving average, forming a death cross and generating a sell signal. In the parameter settings of this strategy, the period of the short-term moving average is set to 9, and the period of the long-term moving average is set to 21. These two parameters can be adjusted based on market characteristics and personal preferences. Additionally, this strategy introduces the concept of money management by setting the initial capital and risk percentage per trade, using position sizing to control the risk exposure of each trade.

Strategy Advantages

- Simplicity: This strategy is based on the classic moving average theory, with clear logic and easy to understand and implement.

- Adaptability: This strategy can be applied to multiple markets and different trading instruments. By adjusting parameter settings, it can flexibly adapt to different market characteristics.

- Trend Capture: By using the dual moving average crossover to determine the trend direction, it helps traders timely follow the mainstream trend and increase profit opportunities.

- Risk Control: This strategy introduces the concept of risk management, using position sizing to control the risk exposure of each trade, effectively managing potential losses.

- Noise Reduction: By utilizing the lag characteristic of moving averages, it effectively filters out random noise in the market, improving the reliability of trading signals.

Strategy Risks

- Parameter Selection: Different parameter settings can have a significant impact on strategy performance. Improper selection may lead to strategy failure or poor performance.

- Market Trend: In ranging markets or trend turning points, this strategy may experience consecutive losses.

- Slippage Costs: Frequent trading may result in higher slippage costs, affecting the overall profitability of the strategy.

- Black Swan Events: This strategy has poor adaptability to extreme market conditions, and black swan events may cause significant losses to the strategy.

- Overfitting Risk: If parameter optimization relies too heavily on historical data, it may lead to poor performance of the strategy in actual trading.

Strategy Optimization Directions

- Dynamic Parameter Optimization: Dynamically adjust strategy parameters based on changes in market conditions to improve adaptability.

- Trend Confirmation: After generating trading signals, introduce other indicators or price behavior patterns to confirm the trend, improving signal reliability.

- Stop-Loss and Take-Profit: Introduce reasonable stop-loss and take-profit mechanisms to further control the risk exposure of each trade.

- Position Management: Optimize the position sizing method, such as introducing volatility indicators to dynamically adjust positions based on market volatility levels.

- Long-Short Strength Assessment: Assess the comparative relationship between bullish and bearish strengths, entering at the early stage of a trend to improve the accuracy of trend capture.

Summary

The Moving Average Crossover Strategy based on dual moving averages is a simple and practical intraday trading method. By comparing the position relationship of moving averages with different periods, it determines the market trend direction and generates trading signals. This strategy has clear logic, strong adaptability, and can effectively capture market trends while introducing risk management measures to control potential losses. However, this strategy also has potential risks such as parameter selection, trend reversal, frequent trading, etc. It needs to be further improved through dynamic optimization, signal confirmation, position management, and other methods to enhance the robustness and profitability of the strategy. In general, as a classic technical analysis indicator, the basic principles and practical application value of moving averages have been widely verified by the market. It is a trading strategy worthy of in-depth research and continuous optimization.

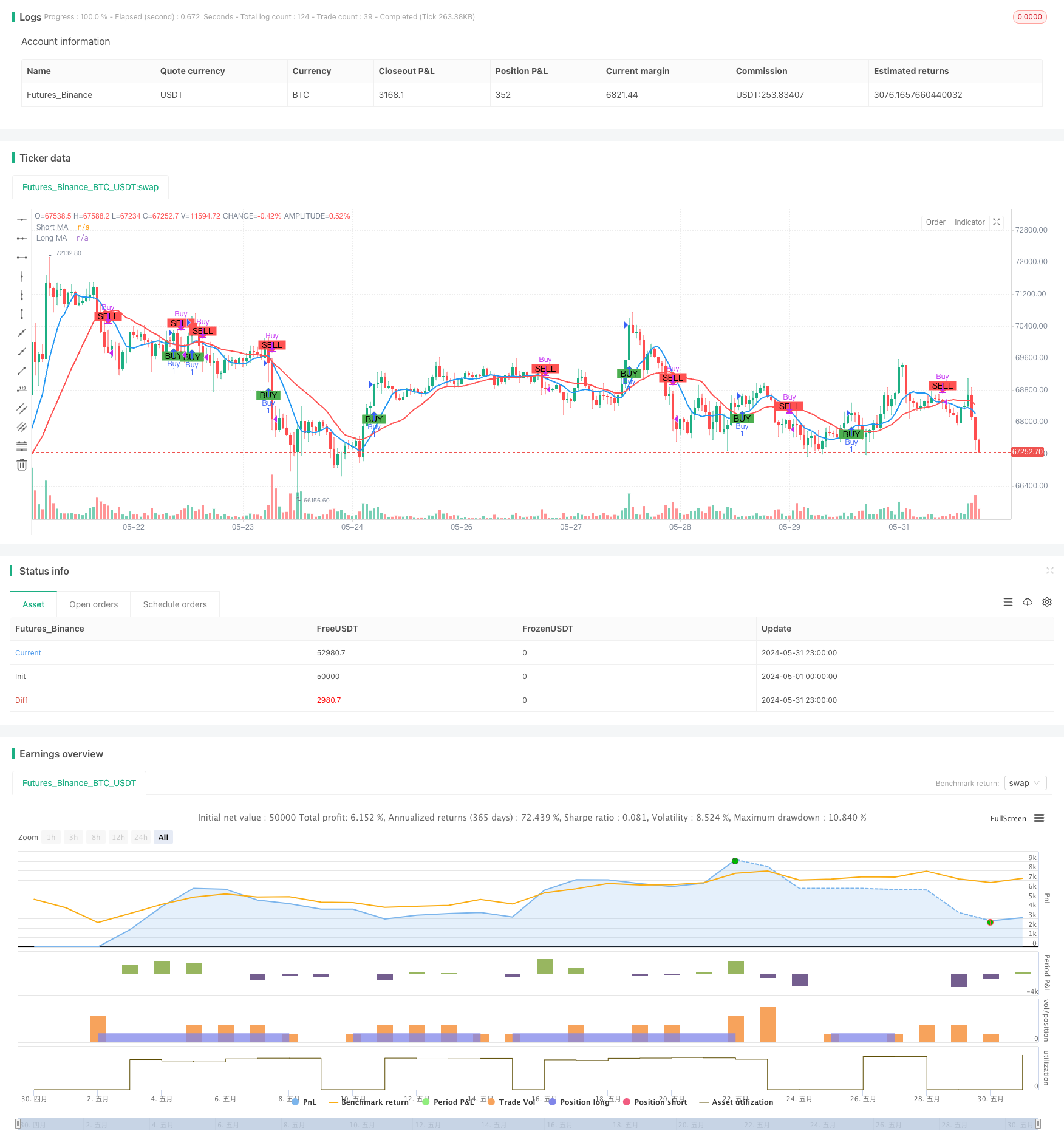

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Average Crossover Strategy", overlay=true)

// Input parameters

shortLength = input.int(9, title="Short Moving Average Length")

longLength = input.int(21, title="Long Moving Average Length")

capital = input.float(100000, title="Initial Capital")

risk_per_trade = input.float(1.0, title="Risk Per Trade (%)")

// Calculate Moving Averages

shortMA = ta.sma(close, shortLength)

longMA = ta.sma(close, longLength)

// Plot Moving Averages

plot(shortMA, title="Short MA", color=color.blue, linewidth=2)

plot(longMA, title="Long MA", color=color.red, linewidth=2)

// Generate Buy/Sell signals

longCondition = ta.crossover(shortMA, longMA)

shortCondition = ta.crossunder(shortMA, longMA)

// Plot Buy/Sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Risk management: calculate position size

risk_amount = capital * (risk_per_trade / 100)

position_size = risk_amount / close

// Execute Buy/Sell orders with position size

if (longCondition)

strategy.entry("Buy", strategy.long, qty=1, comment="Buy")

if (shortCondition)

strategy.close("Buy", comment="Sell")

// Display the initial capital and risk per trade on the chart

var label initialLabel = na

if (na(initialLabel))

initialLabel := label.new(x=bar_index, y=high, text="Initial Capital: " + str.tostring(capital) + "\nRisk Per Trade: " + str.tostring(risk_per_trade) + "%", style=label.style_label_down, color=color.white, textcolor=color.black)

else

label.set_xy(initialLabel, x=bar_index, y=high)