Estratégia de acompanhamento de tendências dinâmicas

ATR

Data de criação:

2024-06-03 16:57:51

última modificação:

2024-06-03 16:57:51

cópia:

12

Cliques:

716

1

focar em

1664

Seguidores

Visão geral

A estratégia usa o indicador Supertrend para capturar a tendência do mercado. O indicador Supertrend combina preço e volatilidade, indicando uma tendência ascendente quando a linha do indicador é verde e uma tendência descendente quando é vermelha. A estratégia gera um sinal de compra e venda detectando mudanças na cor da linha do indicador, enquanto usa a linha do indicador como um ponto de parada dinâmico.

Princípio da estratégia

- Calcule a trajetória ascendente (up) e descendente (dn) do indicador Supertrend e julgue a direção da tendência atual (trend) de acordo com a relação entre o preço de fechamento e a trajetória ascendente (down).

- Quando a tendência passa de baixa (-1) para alta (-1), gera um sinal de compra (buySignal); quando a tendência passa de alta (-1) para baixa (-1), gera um sinal de venda (sellSignal).

- Ao gerar um sinal de compra, abrir uma posição a mais e definir o ponto de parada para o downtrend ((dn); ao gerar um sinal de venda, abrir uma posição a zero e definir o ponto de parada para o uptrend ((up)).

- A introdução da lógica de stop loss móvel, quando o preço sobe / desce um determinado número de pontos (trailingValue), o stop loss será movido para cima / para baixo, para obter a proteção de stop loss.

- A introdução de uma lógica de parada fixa, que permite que a posição em aberto seja lucrativa quando a tendência muda.

Vantagens estratégicas

- Adaptabilidade: O indicador Supertrend combina preço e volatilidade, adaptando-se a diferentes condições de mercado e variedades de negociação.

- Stop Loss Dinâmico: O uso da linha de indicadores como ponto de stop-loss dinâmico pode controlar o risco de forma eficaz e reduzir os prejuízos.

- Stop loss móvel: A introdução da lógica de stop loss móvel pode proteger os lucros e aumentar a rentabilidade da estratégia enquanto a tendência persiste.

- Sinais claros: Os sinais de compra e venda gerados pela estratégia são claros, fáceis de operar e executar.

- Flexibilidade de parâmetros: os parâmetros da estratégia (como o ciclo ATR, o multiplicador ATR, etc.) podem ser ajustados de acordo com as características do mercado e o estilo de negociação, aumentando a adaptabilidade.

Risco estratégico

- Risco de parâmetros: Diferentes configurações de parâmetros podem causar grandes diferenças no desempenho da estratégia, necessitando de um bom feedback e otimização de parâmetros.

- Risco de mercado de turbulência: Em mercados de turbulência, mudanças frequentes de tendência podem levar a estratégias que produzem mais sinais de negociação, aumentando os custos de negociação e o risco de deslizamento.

- Risco de ruptura de tendência: quando a tendência do mercado muda de repente, a estratégia pode ajustar a posição mais tarde do que o esperado, resultando em maiores perdas.

- Risco de otimização excessiva: a otimização excessiva da estratégia pode levar à curva de ajuste e ao mau desempenho no mercado futuro.

Direção de otimização da estratégia

- A introdução de análises de múltiplos quadros temporais, a confirmação da solidez das tendências e a redução da frequência de transações em mercados turbulentos.

- Em combinação com outros indicadores técnicos ou fatores fundamentais, para melhorar a precisão do julgamento de tendências.

- Otimizar a lógica de stop loss e stop loss, como a introdução de stop loss dinâmico ou o risco-benefício-rácio, para aumentar o lucro-perda da estratégia.

- Teste de robustez dos parâmetros, selecionando um conjunto de parâmetros que podem manter um bom desempenho em diferentes condições de mercado.

- Introdução de regras de gerenciamento de posições e de gestão de fundos para controlar o risco de transações individuais e o risco global.

Resumir

A estratégia de acompanhamento de tendências dinâmicas usa o indicador Supertrend para capturar a tendência do mercado, controlar o risco de perda por meio de stop loss dinâmico e móvel, e bloquear os lucros usando o stop loss fixo. A estratégia é adaptável, o sinal é claro e fácil de operar.

Código-fonte da estratégia

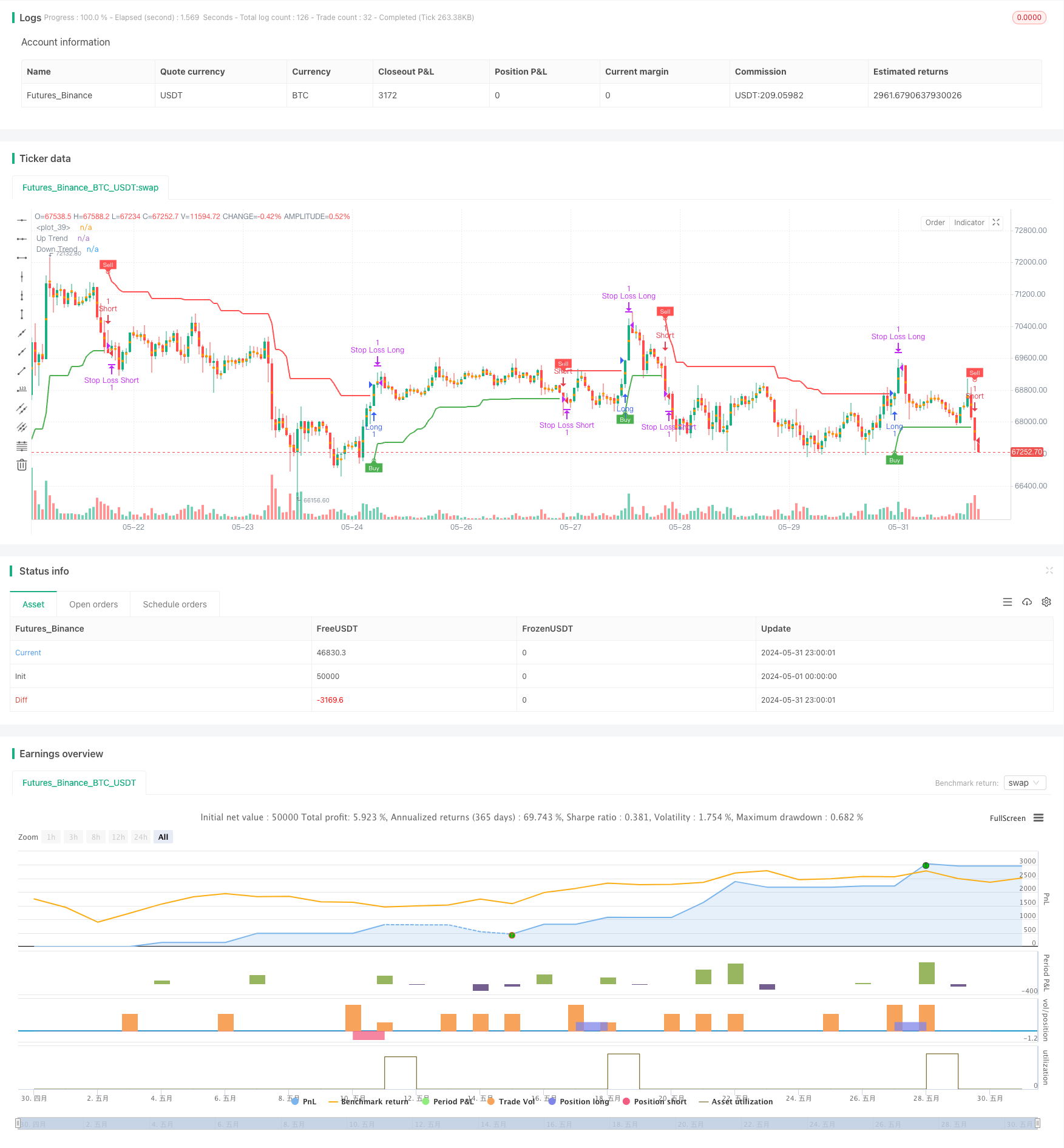

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Supertrend Strategy', overlay=true, format=format.price, precision=2)

Periods = input.int(title='ATR Period', defval=10)

src = input.source(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.0)

changeATR = input.bool(title='Change ATR Calculation Method ?', defval=true)

showsignals = input.bool(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input.bool(title='Highlighter On/Off ?', defval=true)

// ATR calculation

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

// Supertrend calculations

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

// Trend direction

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plotting

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(buySignal and showsignals ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

plotshape(sellSignal and showsignals ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

// Highlighting

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? trend == 1 ? color.green : color.white : color.white

shortFillColor = highlighting ? trend == -1 ? color.red : color.white : color.white

fill(mPlot, upPlot, title='UpTrend Highligter', color=longFillColor, transp=90)

fill(mPlot, dnPlot, title='DownTrend Highligter', color=shortFillColor, transp=90)

// Alerts

alertcondition(buySignal, title='SuperTrend Buy', message='SuperTrend Buy!')

alertcondition(sellSignal, title='SuperTrend Sell', message='SuperTrend Sell!')

changeCond = trend != trend[1]

alertcondition(changeCond, title='SuperTrend Direction Change', message='SuperTrend has changed direction!')

// Pip and trailing stop calculation

pips = 50

pipValue = syminfo.mintick * pips

trailingPips = 10

trailingValue = syminfo.mintick * trailingPips

// Strategy

if (buySignal)

strategy.entry("Long", strategy.long, stop=dn, comment="SuperTrend Buy")

if (sellSignal)

strategy.entry("Short", strategy.short, stop=up, comment="SuperTrend Sell")

// Take profit on trend change

if (changeCond and trend == -1)

strategy.close("Long", comment="SuperTrend Direction Change")

if (changeCond and trend == 1)

strategy.close("Short", comment="SuperTrend Direction Change")

// Initial Stop Loss

longStopLevel = up - pipValue

shortStopLevel = dn + pipValue

// Trailing Stop Loss

var float longTrailStop = na

var float shortTrailStop = na

if (strategy.opentrades > 0)

if (strategy.position_size > 0) // Long position

if (longTrailStop == na or close > strategy.position_avg_price + trailingValue)

longTrailStop := high - trailingValue

strategy.exit("Stop Loss Long", from_entry="Long", stop=longTrailStop)

if (strategy.position_size < 0) // Short position

if (shortTrailStop == na or close < strategy.position_avg_price - trailingValue)

shortTrailStop := low + trailingValue

strategy.exit("Stop Loss Short", from_entry="Short", stop=shortTrailStop)

// Initial Exit

strategy.exit("Initial Stop Loss Long", from_entry="Long", stop=longStopLevel)

strategy.exit("Initial Stop Loss Short", from_entry="Short", stop=shortStopLevel)