Visão geral

A estratégia é um sistema de negociação de acompanhamento de tendências baseado em múltiplos indicadores de média e de dinâmica. A estratégia utiliza principalmente a relação dinâmica das médias móveis simples de 20, 50, 150 e 200 dias (SMA), combinando a intermitência e o indicador RSI, para capturar uma forte tendência ascendente no nível da linha diária e para equilibrar a tendência em tempo hábil. A estratégia é usada em combinação com vários indicadores técnicos, filtrando efetivamente os falsos sinais e aumentando a precisão da negociação.

Princípio da estratégia

A lógica central da estratégia inclui as seguintes partes-chave:

- Sistema de linha média: Use a linha média de 20/50/150/200 dias para construir um sistema de julgamento de tendências, exigindo que a linha média multivariada apresente uma ordenação multivariada.

- Confirmação de momentum: O uso do indicador RSI e sua média móvel para determinar o movimento de preços requer que o RSI seja maior que 55 ou o RSI SMA seja maior que 50 e o RSI seja superior.

- Verificação de volume de transação: Comparando a linha média de volume de transação dos 20 dias com o volume de transações recentes, confirme a eficácia do sinal de compra e venda.

- Verificação da continuidade da tendência: verifique se a linha média de 50 dias manteve uma tendência ascendente por pelo menos 25 dos últimos 40 dias de negociação.

- Confirmação de posição: Preços precisam permanecer estáveis acima da linha média de 150 dias por pelo menos 20 dias de negociação.

As condições de compra são:

- Mais de 4 dias de sol nos últimos 10 dias e pelo menos um dia de sol

- O RSI atendeu a condição de momentum

- Sistema linear medido com arranjos múltiplos e ascendente

- Preço estável acima da média de 150 dias

As condições de venda incluem:

- Preços abaixo da média de 150 dias

- A diminuição contínua de emissões

- A média diária de 50 dias despencou da média diária de 150 dias.

- Recentemente, o sexo feminino dominou e aumentou o volume de transações

Vantagens estratégicas

- Verificação cruzada de múltiplos indicadores tecnológicos para reduzir a taxa de erro

- A sustentabilidade da tendência é exigida rigorosamente e pode filtrar oscilações de curto prazo.

- Combinação de análise de tráfego para melhorar a confiabilidade do sinal

- Condições claras de suspensão de danos, controle eficaz de riscos

- Atividade de captação de tendências de médio e longo prazo, reduzindo a frequência de negociação

- A lógica da estratégia é clara, fácil de entender e implementar

Risco estratégico

- O sistema de linha média é atrasado e pode perder o início da tendência

- As condições de entrada rígidas podem fazer com que você perca algumas oportunidades de negociação.

- Sinais falsos frequentes podem ocorrer em mercados voláteis

- Há um certo atraso na identificação da inversão

- O que é necessário para suportar uma retirada de capital em grande escala?

Sugestões de controle de risco:

- Estabelecer uma posição de parada razoável

- A gestão de fundos deve ser moderada

- Considere aumentar os indicadores de confirmação de tendências

- Parâmetros ajustados ao contexto de mercado

Direção de otimização da estratégia

- Adição de parâmetros de adaptação

- Ajuste do ciclo de linha média com base na dinâmica da taxa de flutuação do mercado

- Optimizar a definição do limiar RSI

- Melhorar o mecanismo de suspensão

- Aumentar a perda de rastreamento

- Configuração do tempo de parada

- Introdução à análise do cenário de mercado

- Indicadores de intensidade de tendência aumentados

- Considerando os indicadores de volatilidade

- Optimizar o tamanho das transações

- Projeto de gestão de posições dinâmicas

- Ajuste de acordo com a intensidade do sinal

Resumir

É uma estratégia de rastreamento de tendências rigorosamente projetada, capaz de capturar efetivamente oportunidades de tendências fortes através do uso combinado de múltiplos indicadores técnicos. A principal vantagem da estratégia reside no seu mecanismo completo de confirmação de sinais e no rigoroso sistema de controle de risco. Embora haja algum atraso, a estratégia consegue manter um desempenho estável em longo prazo com a otimização de parâmetros e o gerenciamento de riscos razoáveis.

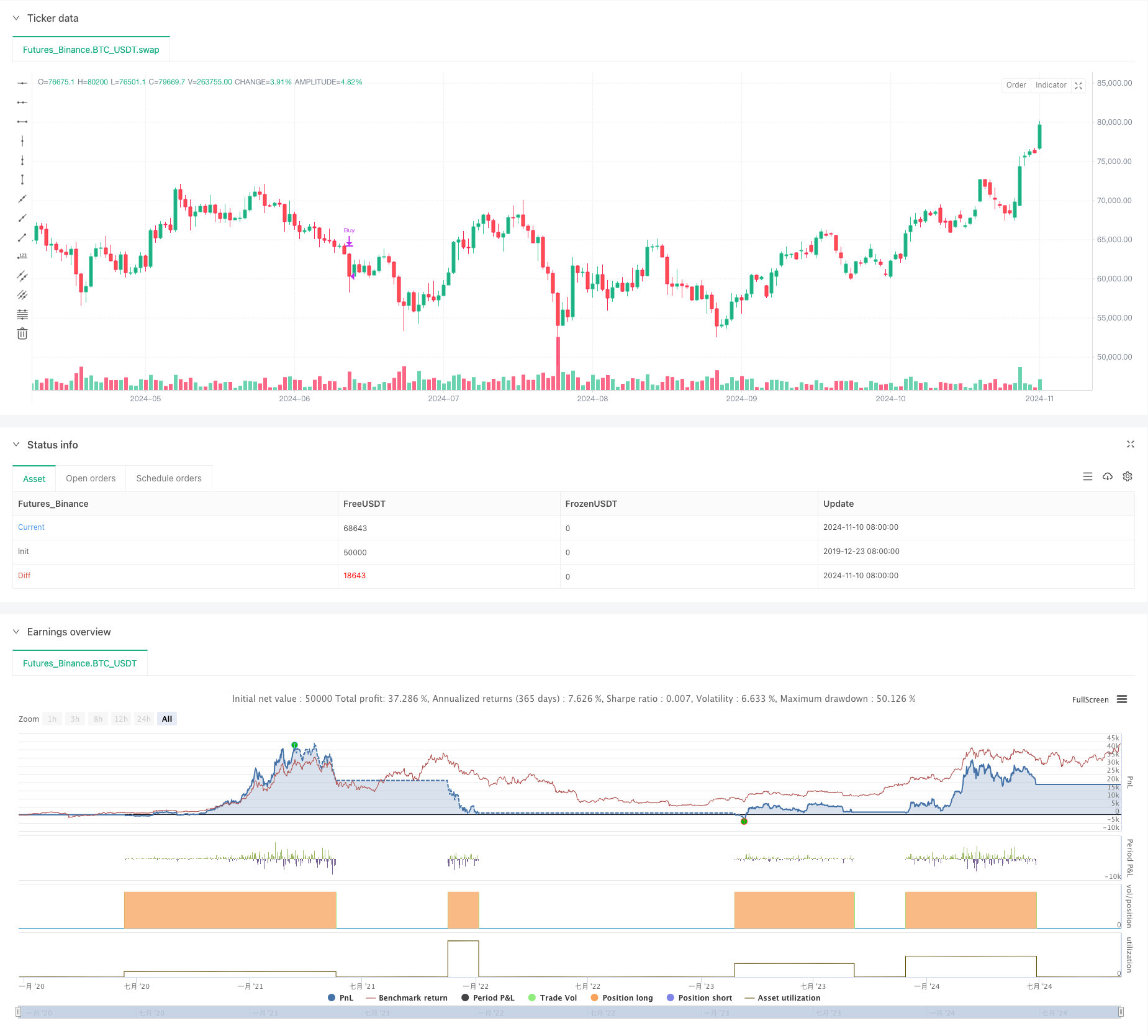

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Micho's 150 (1D Time Frame Only)", overlay=true)

// Define the length for the SMAs and RSI

sma20Length = 20

sma50Length = 50

sma150Length = 150

sma200Length = 200

volumeMaLength = 20

rsiLength = 14

rsiSmaLength = 14

smaCheckLength = 40 // Check the last month of trading days (~20 days)

requiredRisingDays = 25 // Require SMA to rise in at least 16 of the past 20 days

sma150AboveSma200CheckDays = 1 // Require SMA150 > SMA200 for the last 10 days

// Calculate the SMAs for price

sma20 = ta.sma(close, sma20Length)

sma50 = ta.sma(close, sma50Length)

sma150 = ta.sma(close, sma150Length)

sma200 = ta.sma(close, sma200Length)

// Calculate the 20-period moving average of volume

volumeMA20 = ta.sma(volume, volumeMaLength)

// Calculate the 14-period RSI

rsi = ta.rsi(close, rsiLength)

// Calculate the 14-period SMA of RSI

rsiSMA = ta.sma(rsi, rsiSmaLength)

// Check if most of the last 5 days are buyer days (close > open)

buyerDays = 0

for i = 0 to 9

if close[i] > open[i]

buyerDays := buyerDays + 1

// Check if at least 1 day has volume higher than the 20-period volume MA

highVolumeDays = 0

for i = 0 to 9

if close[i] > open[i] and volume[i] > volumeMA20

highVolumeDays := highVolumeDays + 1

// Define the new RSI condition

rsiCondition = (rsi >= 55) or (rsiSMA > 50 and rsi > rsi[1])

// Check if the 50-day SMA has been rising on at least 16 of the last 20 trading days

risingDays = 0

for i = 1 to smaCheckLength

if sma50[i] > sma50[i + 1]

risingDays := risingDays + 1

// Check if the SMA has risen on at least 16 of the last 20 days

sma50Rising = risingDays >= requiredRisingDays

// Check if the price has been above the SMA150 for the last 20 trading days

priceAboveSma150 = true

for i = 1 to smaCheckLength

if close[i] < sma150[i]

priceAboveSma150 := false

// Check if the SMA150 has been above the SMA200 for the last 10 days

sma150AboveSma200 = true

for i = 1 to sma150AboveSma200CheckDays

if sma150[i] < sma200[i]

sma150AboveSma200 := false

// Define the conditions for the 150-day and 200-day SMAs being rising

sma150Rising = sma150 > sma150[1]

sma200Rising = sma200 > sma200[1]

// Check if most of the last 5 days are seller days (close < open)

sellerDays = 0

for i = 0 to 9

if close[i] < open[i]

sellerDays := sellerDays + 1

// Check if at least 1 day has seller volume higher than the 20-period volume MA

highSellerVolumeDays = 0

for i = 0 to 9

if close[i] < open[i] and volume[i] > volumeMA20

highSellerVolumeDays := highSellerVolumeDays + 1

// Check in the last N days the price below 150

priceBelowSma150 = true

for i = 0 to 0

if close[i] > sma150[i]

priceBelowSma150 := false

// Restrict the strategy to 1D time frame

if timeframe.isdaily

// Buy condition:

// - Most of the last 5 days are buyer days (buyerDays > 2)

// - At least 1 of those days has high buyer volume (highVolumeDays >= 1)

// - RSI SMA (14-period) between 45 and 50 with RSI >= 55, or RSI SMA > 50 and RSI rising

// - 50-day SMA > 150-day SMA and 150-day SMA > 200-day SMA

// - 50-day SMA has been rising on at least 16 of the last 20 trading days

// - The price hasn't been below the 150-day SMA in the last 20 days

// - 150-day SMA has been above the 200-day SMA for the last 10 days

// - 150-day and 200-day SMAs are rising

buyCondition = (close > sma150 and buyerDays > 4 and highVolumeDays >= 1 and rsiCondition and sma50 > sma150 and sma50Rising and sma150Rising and sma200Rising and priceAboveSma150)

// Sell condition:

// - Price crossing below SMA 150

// - Seller volume (current volume > volume MA 20)

// - 150-day SMA crosses below 200-day SMA

// - Most of the last 5 days are seller days (sellerDays > 2) and at least 1 day of higher seller volume (highSellerVolumeDays >= 1)

sellCondition = (priceBelowSma150 and (sma50 < sma150 or (sellerDays >5 and highSellerVolumeDays >= 5)))

// Execute buy when all conditions are met

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Execute sell when all conditions are met

if (sellCondition)

strategy.close("Buy")