Visão geral

A estratégia é um sistema de negociação integrado que combina vários indicadores técnicos e a emoção do mercado. O núcleo da estratégia usa sinais cruzados de médias móveis de curto e longo prazo (SMA) em combinação com o indicador MACD para confirmar a direção da tendência.

Princípio da estratégia

A estratégia funciona com base nos seguintes componentes centrais:

- Sistema de média móvel multi-período: determinação de tendências usando SMAs de 10 e 30 períodos

- Indicador MACD: configuração com parâmetros padrão ((12, 26, 9) para confirmação de tendências

- Monitoramento do sentimento do mercado: o indicador RSI para o julgamento de sobrecompra e sobrevenda

- Reconhecimento de forma de gráfico: sistema de reconhecimento automático que inclui formas de topo/base duplo e topo de cabeça e ombro

- Filtragem por tempo: oportunidades de negociação focadas em períodos de tempo específicos

- Identificação de pontos de resistência: uso de 20 ciclos de retrocesso para determinar os principais pontos de resistência

As condições de compra devem ser preenchidas: estar no momento de negociação do alvo, usar o SMA de curto prazo no SMA de longo prazo e o indicador MACD mostrar um sinal de múltiplas cabeças. As condições de venda devem ser cumpridas: o preço atinge o principal nível de resistência e o indicador MACD mostra um sinal de cabeça vazia.

Vantagens estratégicas

- Confirmação de sinal multidimensional: combinação de indicadores técnicos e formato gráfico para aumentar a confiabilidade do sinal de negociação

- Gestão de risco perfeita: Incluindo mecanismos de saída antecipada baseados em RSI

- Integração do sentimento do mercado: julgar o sentimento do mercado com o indicador RSI, evitando a busca excessiva de queda e queda

- Identificação automática de formas: reduzir a distorção de julgamentos subjetivos

- Filtragem de tempo: focalização nos momentos de maior atividade do mercado para melhorar a eficiência das transações

Risco estratégico

- Sensibilidade de parâmetros: configurações de parâmetros de vários indicadores técnicos podem afetar o desempenho da política

- Risco de atraso: a média móvel e o MACD têm um certo atraso

- Precisão de reconhecimento de forma: sistemas de reconhecimento automático podem ter erros de julgamento

- Dependência do cenário do mercado: Falso sinal pode ser frequente em mercados turbulentos

- Limites de tempo: oportunidades que podem ser perdidas em outros períodos de tempo, mas que só podem ser negociadas em determinados períodos de tempo

Direção de otimização da estratégia

- Adaptação de parâmetros: introdução de um mecanismo de ajuste de parâmetros de adaptação, ajustando automaticamente os parâmetros do indicador de acordo com a volatilidade do mercado

- Sistema de peso de sinais: estabelecer um sistema de peso de sinais de indicadores para melhorar a precisão da decisão

- Optimização de Stop Loss: aumentar o mecanismo de Stop Loss dinâmico e aumentar a capacidade de controle de risco

- Reforço de reconhecimento de forma: introdução de algoritmos de aprendizagem de máquina para melhorar a precisão de reconhecimento de forma de gráficos

- Extensão do ciclo de retorno: retorno em diferentes ciclos de mercado para verificar a estabilidade da estratégia

Resumir

Trata-se de uma estratégia de negociação mais abrangente, que combina vários indicadores técnicos e sentimentos de mercado para criar um sistema de negociação relativamente completo. A vantagem da estratégia reside na detecção de sinais multidimensional e no mecanismo de gerenciamento de risco perfeito, mas também há problemas como sensibilidade de parâmetros e precisão de identificação de formas.

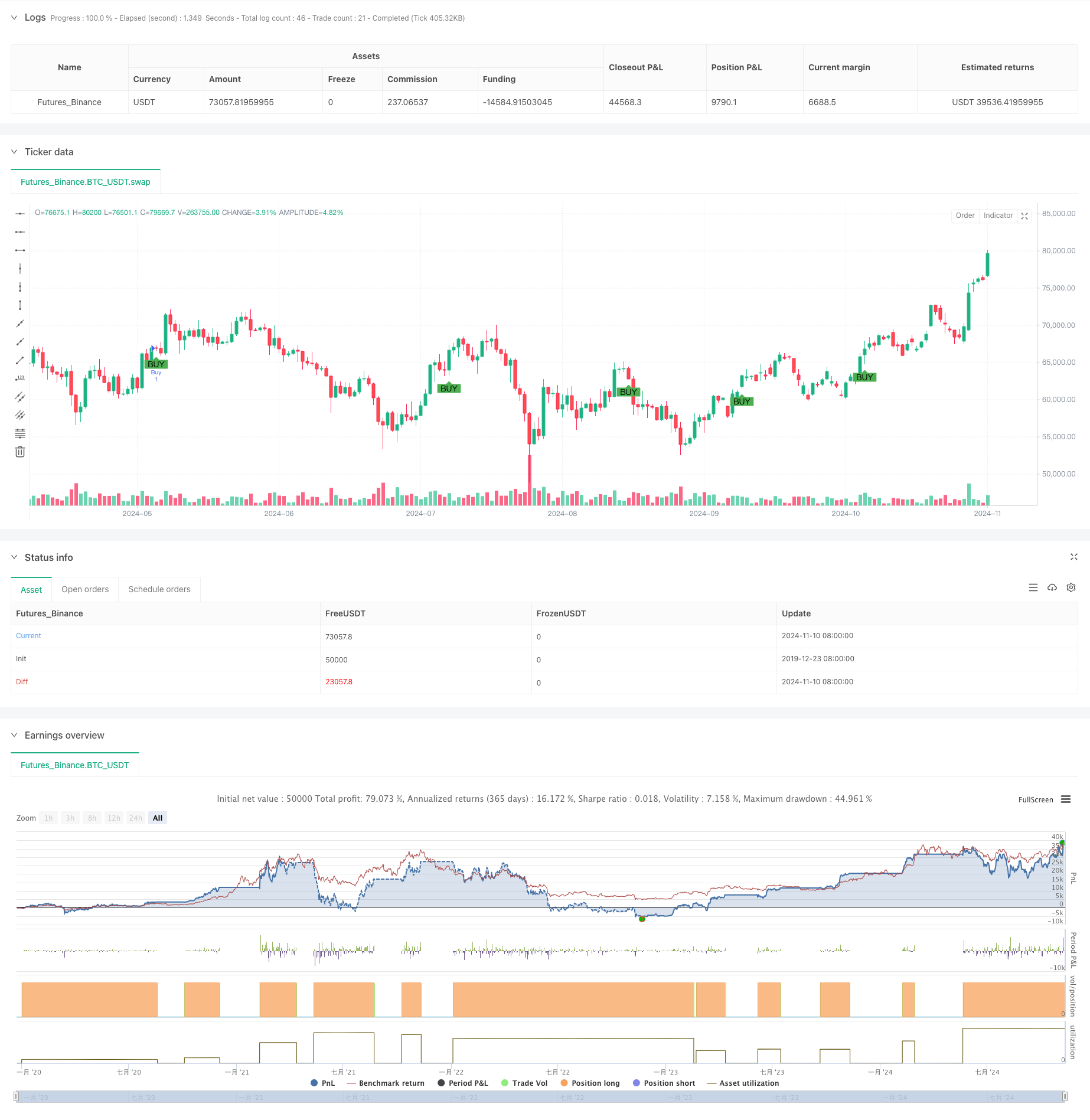

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment + Chart Patterns", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Time filtering: only trade during New York session (12:00 PM - 9:00 PM UTC)

isNewYorkSession = true

// Define buy condition based on SMA, MACD, and New York session

buyCondition = isNewYorkSession and ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance during New York session

sellCondition = isNewYorkSession and close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// ------ Chart Patterns ------ //

// Double Top/Bottom Pattern Detection

doubleTop = ta.highest(close, 50) == close[25] and ta.highest(close, 50) == close[0] // Approximate double top: two peaks

doubleBottom = ta.lowest(close, 50) == close[25] and ta.lowest(close, 50) == close[0] // Approximate double bottom: two troughs

// Head and Shoulders Pattern Detection

shoulder1 = ta.highest(close, 20)[40]

head = ta.highest(close, 20)[20]

shoulder2 = ta.highest(close, 20)[0]

isHeadAndShoulders = shoulder1 < head and shoulder2 < head and shoulder1 == shoulder2

// Pattern-based signals

patternBuyCondition = isNewYorkSession and doubleBottom and rsi < rsiOversold // Buy at double bottom in oversold conditions

patternSellCondition = isNewYorkSession and (doubleTop or isHeadAndShoulders) and rsi > rsiOverbought // Sell at double top or head & shoulders in overbought conditions

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition or patternBuyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance or pattern sell)

if (sellCondition or patternSellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition or patternBuyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition or patternSellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// ------ Alerts for Patterns ------ //

// Add alert for pattern-based buy condition

alertcondition(patternBuyCondition, title="Pattern Buy Signal Activated", message="Double Bottom or Pattern Buy signal activated: Conditions met.")

// Add alert for pattern-based sell condition

alertcondition(patternSellCondition, title="Pattern Sell Signal Activated", message="Double Top or Head & Shoulders detected. Sell signal triggered.")

// Existing alerts for SMA/MACD-based conditions

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")