Visão geral

A estratégia é um sistema de negociação completo que combina uma série de indicadores técnicos, baseando-se principalmente nos indicadores da nuvem de Ichimoku para tomar decisões comerciais. O sistema determina o momento de entrada através do cruzamento da antena Tenkan com a linha de referência Kijun, enquanto combina o índice relativamente forte RSI e a média móvel MA como condições auxiliares de filtragem. A estratégia usa o componente da nuvem como ponto de parada dinâmico, formando um sistema completo de controle de risco.

Princípio da estratégia

A lógica central da estratégia é baseada nos seguintes elementos-chave:

- O sinal de entrada é gerado pela interseção da antena com a linha de referência, formando um sinal múltiplo e um sinal de vazio.

- A relação entre a posição do preço em relação à nuvem (Kumo) como confirmação de tendência, o preço faz mais acima da nuvem, o preço faz menos abaixo da nuvem

- Relação de localização entre as médias móveis de 50 e 200 dias como condição de filtragem de tendências

- Indicador de RSI em circuito como confirmação de fraqueza do mercado, filtrando falsos sinais

- Utilização de limites superiores e inferiores da nuvem como uma posição de parada dinâmica para a gestão dinâmica do risco

Vantagens estratégicas

- A combinação de múltiplos indicadores técnicos fornece sinais de negociação mais confiáveis e reduz significativamente o impacto de falsos sinais

- O uso de um gráfico de nuvem como um ponto de parada dinâmico, capaz de ajustar automaticamente a posição de parada de acordo com as flutuações do mercado, protegendo os lucros e dando ao preço espaço suficiente para a flutuação

- Filtrando o RSI circular, evita negociações desfavoráveis em áreas de sobrecompra e sobrevenda

- O cruzamento de médias móveis fornece confirmação adicional de tendências e aumenta a taxa de sucesso das negociações

- Sistema completo de controlo de risco, incluindo todas as fases de entrada, detenção e saída

Risco estratégico

- A filtragem de múltiplos indicadores pode fazer com que se percam oportunidades potenciais.

- Sinais de fuga falsos frequentes podem ocorrer em um mercado volátil

- O próprio indicador de gráficos de nuvem tem um certo atraso que pode afetar o tempo de entrada

- No mercado de alta volatilidade, o stop loss dinâmico pode ser demasiado relaxado

- O excesso de condições de filtragem pode reduzir as oportunidades de negociação e afetar o lucro geral da estratégia

Direção de otimização da estratégia

- Introdução de indicadores de taxa de flutuação, ajustando os parâmetros da estratégia de acordo com a flutuação do mercado

- Optimizar a configuração de parâmetros do gráfico da nuvem para melhor adaptá-lo a diferentes ambientes de mercado

- Aumentar a análise do volume de transações e aumentar a confiabilidade dos sinais

- Introdução de um mecanismo de filtragem de tempo para evitar períodos de maior volatilidade

- Desenvolver sistemas de otimização de parâmetros adaptáveis para ajustes dinâmicos de estratégias

Resumir

A estratégia, através da combinação de vários indicadores técnicos, constrói um sistema de negociação completo. A estratégia não se concentra apenas na geração de sinais, mas também inclui um mecanismo de controle de risco completo. A taxa de sucesso da negociação é efetivamente aumentada por meio da configuração de condições de filtragem múltiplas.

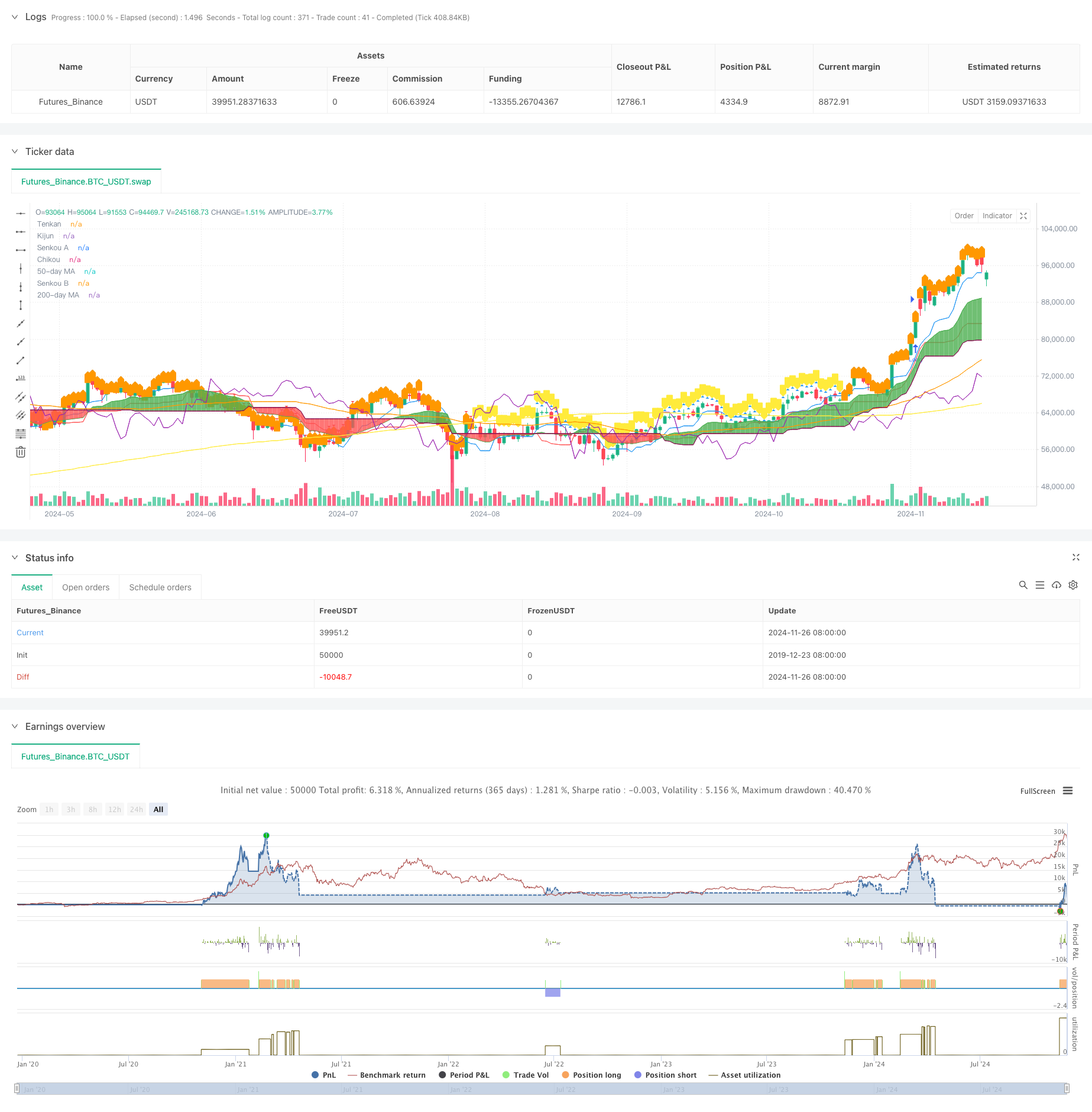

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-27 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Strategy with Optional RSI, MA Filters and Alerts", overlay=true)

// Input for date and time filter

startDate = input(timestamp("2020-01-01 00:00"), title="Start Date")

endDate = input(timestamp("2023-01-01 00:00"), title="End Date")

// Inputs for Ichimoku settings

tenkanPeriod = input.int(9, title="Tenkan Period")

kijunPeriod = input.int(26, title="Kijun Period")

senkouBPeriod = input.int(52, title="Senkou B Period")

// Inputs for Moving Average settings

useMAFilter = input.bool(true, title="Enable Moving Average Filter?")

ma50Period = input.int(50, title="50-day MA Period")

ma200Period = input.int(200, title="200-day MA Period")

// Inputs for RSI settings

useRSIFilter = input.bool(true, title="Enable RSI Filter?")

rsiPeriod = input.int(14, title="RSI Period")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

// Ichimoku Cloud components

tenkan = (ta.highest(high, tenkanPeriod) + ta.lowest(low, tenkanPeriod)) / 2

kijun = (ta.highest(high, kijunPeriod) + ta.lowest(low, kijunPeriod)) / 2

senkouA = ta.sma(tenkan + kijun, 2) / 2

senkouB = (ta.highest(high, senkouBPeriod) + ta.lowest(low, senkouBPeriod)) / 2

chikou = close[26]

// Moving Averages

ma50 = ta.sma(close, ma50Period)

ma200 = ta.sma(close, ma200Period)

// Weekly RSI

rsiSource = request.security(syminfo.tickerid, "W", ta.rsi(close, rsiPeriod))

// Plotting the Ichimoku Cloud components

pTenkan = plot(tenkan, color=color.blue, title="Tenkan")

pKijun = plot(kijun, color=color.red, title="Kijun")

pSenkouA = plot(senkouA, color=color.green, title="Senkou A")

pSenkouB = plot(senkouB, color=color.maroon, title="Senkou B")

plot(chikou, color=color.purple, title="Chikou")

plot(ma50, color=color.orange, title="50-day MA")

plot(ma200, color=color.yellow, title="200-day MA")

// Corrected fill function

fill(pSenkouA, pSenkouB, color=senkouA > senkouB ? color.green : color.red, transp=90)

// Debugging: Output values on the chart to see if conditions are ever met

plotshape(series=(tenkan > kijun), color=color.blue, style=shape.triangleup, title="Tenkan > Kijun")

plotshape(series=(tenkan < kijun), color=color.red, style=shape.triangledown, title="Tenkan < Kijun")

plotshape(series=(ma50 > ma200), color=color.orange, style=shape.labelup, title="MA 50 > MA 200")

plotshape(series=(ma50 < ma200), color=color.yellow, style=shape.labeldown, title="MA 50 < MA 200")

// Define the trailing stop loss using Kumo

var float trailingStopLoss = na

// Check for MA conditions (apply only if enabled)

maConditionLong = not useMAFilter or (useMAFilter and ma50 > ma200)

maConditionShort = not useMAFilter or (useMAFilter and ma50 < ma200)

// Check for Ichimoku Cloud conditions

ichimokuLongCondition = close > math.max(senkouA, senkouB)

ichimokuShortCondition = close < math.min(senkouA, senkouB)

// Check for RSI conditions (apply only if enabled)

rsiConditionLong = not useRSIFilter or (useRSIFilter and rsiSource > rsiOverbought)

rsiConditionShort = not useRSIFilter or (useRSIFilter and rsiSource < rsiOversold)

// Combine conditions for entry

longCondition = maConditionLong and tenkan > kijun and ichimokuLongCondition and rsiConditionLong

shortCondition = maConditionShort and tenkan < kijun and ichimokuShortCondition and rsiConditionShort

// Date and time filter

withinDateRange = true

// Check for Long Condition

if (longCondition and withinDateRange)

strategy.entry("Long", strategy.long)

trailingStopLoss := math.min(senkouA, senkouB)

alert("Buy Signal: Entering Long Position", alert.freq_once_per_bar_close)

// Check for Short Condition

if (shortCondition and withinDateRange)

strategy.entry("Short", strategy.short)

trailingStopLoss := math.max(senkouA, senkouB)

alert("Sell Signal: Entering Short Position", alert.freq_once_per_bar_close)

// Exit conditions

exitLongCondition = close < kijun or tenkan < kijun

exitShortCondition = close > kijun or tenkan > kijun

if (exitLongCondition and strategy.position_size > 0)

strategy.close("Long")

alert("Exit Signal: Closing Long Position", alert.freq_once_per_bar_close)

if (exitShortCondition and strategy.position_size < 0)

strategy.close("Short")

alert("Exit Signal: Closing Short Position", alert.freq_once_per_bar_close)

// Apply trailing stop loss

if (strategy.position_size > 0)

strategy.exit("Trailing Stop Long", stop=trailingStopLoss)

else if (strategy.position_size < 0)

strategy.exit("Trailing Stop Short", stop=trailingStopLoss)