Visão geral

Trata-se de uma estratégia de negociação em vários níveis que integra o cálculo do ATR real médio adaptado e a detecção de tendências baseada em momentum. A estratégia é mais notável pelo seu exclusivo mecanismo de ganho de 7 passos, que combina 4 níveis de saída baseados no ATR e 3 níveis de porcentagem fixos.

Princípio da estratégia

O núcleo da estratégia funciona através dos seguintes componentes-chave:

- Calculação de amplitude real aumentada: a volatilidade do mercado é medida levando em consideração os movimentos de preços mais significativos.

- Integração do Fator de Potência: Adaptação do ATR com base em mudanças recentes de preços para torná-lo mais adaptável.

- Cálculo do ATR adaptativo: ajuste do ATR tradicional de acordo com o fator de potência, tornando-o mais sensível durante oscilações.

- Quantificação da intensidade da tendência: Avaliação da intensidade da tendência por meio de algoritmos complexos.

- Mecanismo de ganhos em sete etapas: quatro níveis de saída baseados no ATR e três níveis de porcentagem fixos.

Vantagens estratégicas

- Adaptabilidade: adaptação a diferentes condições de mercado através do cálculo dinâmico do ATR.

- Gestão de riscos perfeita: o mecanismo multi-nível de ganhos oferece controle de riscos sistematizado.

- Alta flexibilidade: pode operar com igual eficiência em mercados multinacionais.

- Parâmetros ajustáveis: oferece vários parâmetros ajustáveis para adaptar-se a diferentes estilos de negociação.

- Execução sistemática: regras claras de entrada e saída para reduzir transações emocionais.

Risco estratégico

- Sensibilidade de parâmetros: A configuração inadequada de parâmetros pode levar a excesso de negociação ou a oportunidades perdidas.

- Dependência de condições de mercado: pode ter um desempenho fraco em mercados de alta volatilidade ou de baixa volatilidade.

- Risco de complexidade: mecanismos de lucro em vários níveis podem aumentar a dificuldade de execução.

- Efeitos de deslizamento: vários beneficiários podem ser significativamente afetados pelo deslizamento.

- Requisitos de gerenciamento de fundos: O capital necessário para executar uma estratégia de lucro em vários níveis.

Direção de otimização da estratégia

- Ajuste de parâmetros dinâmicos: Ajuste automático de parâmetros de acordo com a situação do mercado.

- Filtragem do cenário de mercado: adição de um mecanismo de identificação do cenário de mercado.

- Melhoria da gestão de riscos: introdução de um mecanismo dinâmico de suspensão de perdas.

- Otimização de Execução: Simplificar o mecanismo de lucro para reduzir o impacto do deslizamento.

- Melhoria do quadro de feedback: Adição de mais fatores de transação real.

Resumir

Esta estratégia oferece aos comerciantes um sistema de negociação abrangente, combinando o ATR adaptável e o mecanismo de ganhos em níveis múltiplos. Sua vantagem é a capacidade de se adaptar a diferentes condições de mercado, gerenciando o risco por meio de uma metodologia sistematizada. Embora existam alguns riscos potenciais, a estratégia pode se tornar uma ferramenta de negociação eficaz com otimização e gerenciamento de risco adequados.

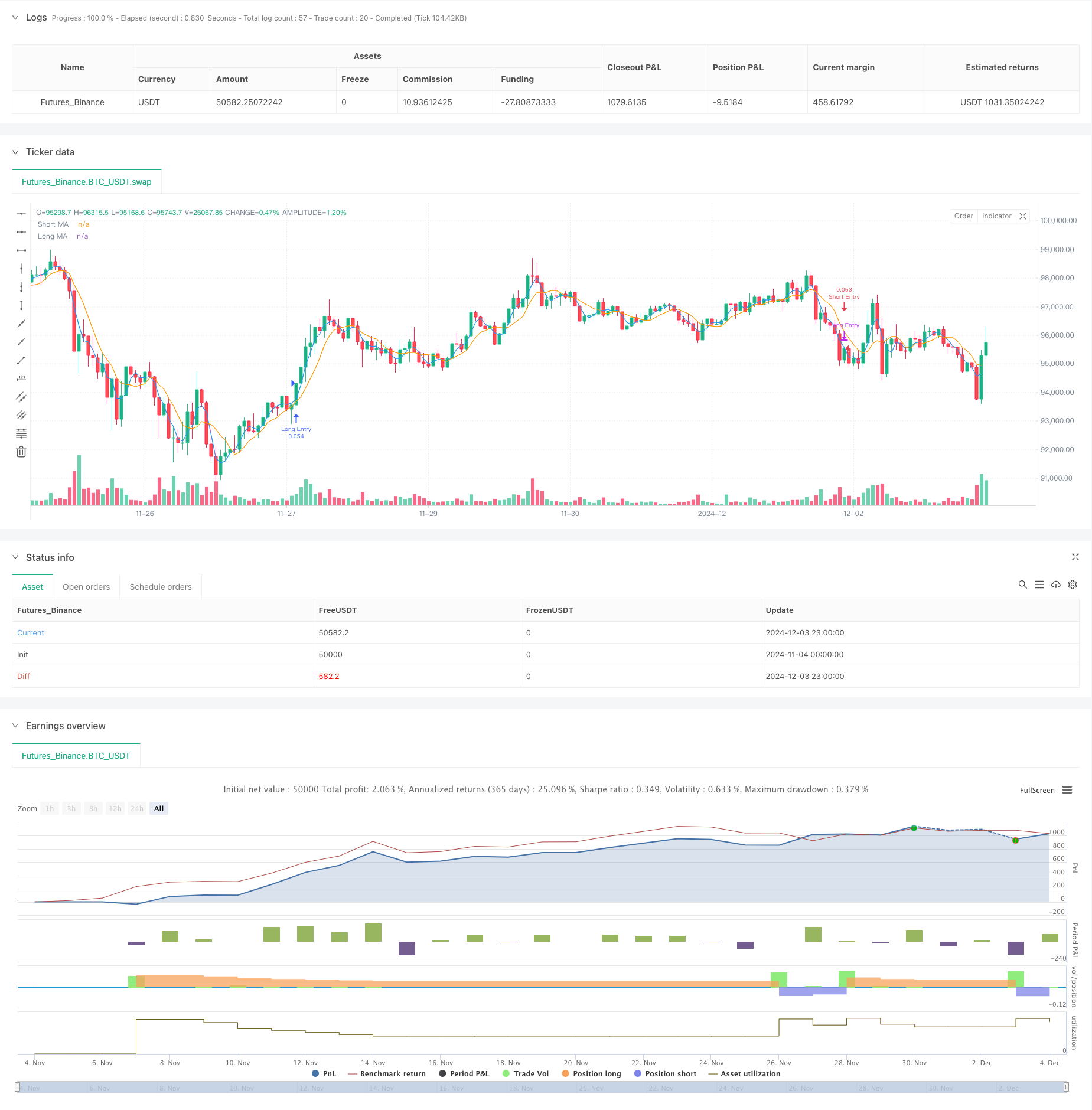

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The SuperATR 7-Step Profit Strategy is a multi-layered trading strategy that combines adaptive ATR and momentum-based trend detection

// with a sophisticated 7-step take-profit mechanism. This approach utilizes four ATR-based exit levels and three fixed percentage levels,

// enabling flexible and dynamic profit-taking in both long and short market positions.

//@version=5

strategy("SuperATR 7-Step Profit - Strategy [presentTrading] ", overlay=true, precision=3, commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1, currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital=10000)

// ————————

// User Inputs

// ————————

short_period = input.int(3, minval=1, title="Short Period")

long_period = input.int(7, minval=1, title="Long Period")

momentum_period = input.int(7, minval=1, title="Momentum Period")

atr_sma_period = input.int(7, minval=1, title="ATR SMA Period for Confirmation")

trend_strength_threshold = input.float(1.618, minval=0.0, title="Trend Strength Threshold", step=0.1)

// ————————

// Take Profit Inputs

// ————————

useMultiStepTP = input.bool(true, title="Enable Multi-Step Take Profit")

// ATR-based Take Profit Inputs

atrLengthTP = input.int(14, minval=1, title="ATR Length for Take Profit")

atrMultiplierTP1 = input.float(2.618, minval=0.1, title="ATR Multiplier for TP Level 1")

atrMultiplierTP2 = input.float(5.0, minval=0.1, title="ATR Multiplier for TP Level 2")

atrMultiplierTP3 = input.float(10.0, minval=0.1, title="ATR Multiplier for TP Level 3")

atrMultiplierTP4 = input.float(13.82, minval=0.1, title="ATR Multiplier for TP Level 4")

// Fixed Percentage Take Profit Inputs

tp_level_percent1 = input.float(3.0, minval=0.1, title="Fixed TP Level 1 (%)")

tp_level_percent2 = input.float(8.0, minval=0.1, title="Fixed TP Level 2 (%)")

tp_level_percent3 = input.float(17.0, minval=0.1, title="Fixed TP Level 3 (%)")

// Take Profit Percentages for Each Level

tp_percent_atr = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each ATR TP Level")

tp_percent_fixed = input.float(10.0, minval=0.1, maxval=100, title="Percentage to Exit at Each Fixed TP Level")

// —————————————

// Helper Functions

// —————————————

// Function to calculate True Range with enhanced volatility detection

calculate_true_range() =>

prev_close = close[1]

tr1 = high - low

tr2 = math.abs(high - prev_close)

tr3 = math.abs(low - prev_close)

true_range = math.max(tr1, tr2, tr3)

true_range

// ———————————————

// Indicator Calculations

// ———————————————

// Calculate True Range

true_range = calculate_true_range()

// Calculate Momentum Factor

momentum = close - close[momentum_period]

stdev_close = ta.stdev(close, momentum_period)

normalized_momentum = stdev_close != 0 ? (momentum / stdev_close) : 0

momentum_factor = math.abs(normalized_momentum)

// Calculate Short and Long ATRs

short_atr = ta.sma(true_range, short_period)

long_atr = ta.sma(true_range, long_period)

// Calculate Adaptive ATR

adaptive_atr = (short_atr * momentum_factor + long_atr) / (1 + momentum_factor)

// Calculate Trend Strength

price_change = close - close[momentum_period]

atr_multiple = adaptive_atr != 0 ? (price_change / adaptive_atr) : 0

trend_strength = ta.sma(atr_multiple, momentum_period)

// Calculate Moving Averages

short_ma = ta.sma(close, short_period)

long_ma = ta.sma(close, long_period)

// Determine Trend Signal

trend_signal = (short_ma > long_ma and trend_strength > trend_strength_threshold) ? 1 :

(short_ma < long_ma and trend_strength < -trend_strength_threshold) ? -1 : 0

// Calculate Adaptive ATR SMA for Confirmation

adaptive_atr_sma = ta.sma(adaptive_atr, atr_sma_period)

// Determine if Trend is Confirmed with Price Action

trend_confirmed = (trend_signal == 1 and close > short_ma and adaptive_atr > adaptive_atr_sma) or (trend_signal == -1 and close < short_ma and adaptive_atr > adaptive_atr_sma)

// —————————————

// Trading Logic

// —————————————

// Entry Conditions

long_entry = trend_confirmed and trend_signal == 1

short_entry = trend_confirmed and trend_signal == -1

// Exit Conditions

long_exit = strategy.position_size > 0 and short_entry

short_exit = strategy.position_size < 0 and long_entry

// Execute Long Trades

if long_entry

strategy.entry("Long Entry", strategy.long)

if long_exit

strategy.close("Long Entry")

// Execute Short Trades

if short_entry

strategy.entry("Short Entry", strategy.short)

if short_exit

strategy.close("Short Entry")

// ————————————————

// Multi-Step Take Profit Logic

// ————————————————

if useMultiStepTP

// Calculate ATR for Take Profit Levels

atrValueTP = ta.atr(atrLengthTP)

// Long Position Take Profit Levels

if strategy.position_size > 0

// ATR-based Take Profit Prices

tp_priceATR1_long = strategy.position_avg_price + atrMultiplierTP1 * atrValueTP

tp_priceATR2_long = strategy.position_avg_price + atrMultiplierTP2 * atrValueTP

tp_priceATR3_long = strategy.position_avg_price + atrMultiplierTP3 * atrValueTP

tp_priceATR4_long = strategy.position_avg_price + atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_long = strategy.position_avg_price * (1 + tp_level_percent1 / 100)

tp_pricePercent2_long = strategy.position_avg_price * (1 + tp_level_percent2 / 100)

tp_pricePercent3_long = strategy.position_avg_price * (1 + tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_long)

strategy.exit("TP ATR 2 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_long)

strategy.exit("TP ATR 3 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_long)

strategy.exit("TP ATR 4 Long", from_entry="Long Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_long)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_long)

strategy.exit("TP Percent 2 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_long)

strategy.exit("TP Percent 3 Long", from_entry="Long Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_long)

// Short Position Take Profit Levels

if strategy.position_size < 0

// ATR-based Take Profit Prices

tp_priceATR1_short = strategy.position_avg_price - atrMultiplierTP1 * atrValueTP

tp_priceATR2_short = strategy.position_avg_price - atrMultiplierTP2 * atrValueTP

tp_priceATR3_short = strategy.position_avg_price - atrMultiplierTP3 * atrValueTP

tp_priceATR4_short = strategy.position_avg_price - atrMultiplierTP4 * atrValueTP

// Fixed Percentage Take Profit Prices

tp_pricePercent1_short = strategy.position_avg_price * (1 - tp_level_percent1 / 100)

tp_pricePercent2_short = strategy.position_avg_price * (1 - tp_level_percent2 / 100)

tp_pricePercent3_short = strategy.position_avg_price * (1 - tp_level_percent3 / 100)

// Set ATR-based Take Profit Exits

strategy.exit("TP ATR 1 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR1_short)

strategy.exit("TP ATR 2 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR2_short)

strategy.exit("TP ATR 3 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR3_short)

strategy.exit("TP ATR 4 Short", from_entry="Short Entry", qty_percent=tp_percent_atr, limit=tp_priceATR4_short)

// Set Fixed Percentage Take Profit Exits

strategy.exit("TP Percent 1 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent1_short)

strategy.exit("TP Percent 2 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent2_short)

strategy.exit("TP Percent 3 Short", from_entry="Short Entry", qty_percent=tp_percent_fixed, limit=tp_pricePercent3_short)

// ——————————

// Plotting

// ——————————

plot(short_ma, color=color.blue, title="Short MA")

plot(long_ma, color=color.orange, title="Long MA")

// Plot Buy and Sell Signals

//plotshape(long_entry, title="Long Entry", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, text="Buy")

//plotshape(short_entry, title="Short Entry", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, text="Sell")

// Optional: Plot Trend Strength for analysis

// Uncomment the lines below to display Trend Strength on a separate chart pane

// plot(trend_strength, title="Trend Strength", color=color.gray)

// hline(trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)

// hline(-trend_strength_threshold, title="Trend Strength Threshold", color=color.gray, linestyle=hline.style_dashed)