Visão geral

A estratégia é um sistema de negociação inteligente que combina MACD (Moving Average Convergence Spread Index) e LRS (Linear Regression Slope Index). A estratégia otimiza o cálculo do MACD através de uma combinação de vários métodos de média móvel e introduz a análise de regressão linear para aumentar a confiabilidade do sinal de negociação. A estratégia permite ao comerciante a flexibilidade de escolher usar um único indicador ou uma combinação de dois indicadores para gerar sinais de negociação e é equipada com um mecanismo de stop loss para controlar o risco.

Princípio da estratégia

O núcleo da estratégia é capturar a tendência do mercado com MACD e indicadores de retorno linear optimizados. A parte MACD usa uma combinação de quatro métodos de média móvel, SMA, EMA, WMA e TEMA, aumentando a sensibilidade à tendência de preço. A parte de retorno linear determina a direção e a intensidade da tendência calculando a inclinação e a localização da linha de retorno.

Vantagens estratégicas

- Flexibilidade de combinação de indicadores: opção de usar um único indicador ou uma combinação de dois indicadores, dependendo da situação do mercado

- Computação MACD melhorada: maior precisão na identificação de tendências por meio de várias métricas de médias móveis

- Confirmação de tendências objetivas: o uso de regressão linear fornece um julgamento de tendências com suporte matemático e estatístico

- Melhor gestão de risco: mecanismo de stop loss integrado

- Parâmetros ajustáveis: os parâmetros-chave podem ser otimizados de acordo com diferentes características do mercado

Risco estratégico

- Sensibilidade de parâmetros: os parâmetros podem precisar de ajustes frequentes em diferentes cenários de mercado

- Atraso de sinal: há um certo atraso no indicador de média móvel

- Mercado de choque não é válido: pode gerar falsos sinais em mercados de choque horizontal

- Custo de oportunidade da dupla confirmação: a rigorosa dupla confirmação pode perder boas oportunidades de negociação

Direção de otimização da estratégia

- Aumentar a identificação do cenário de mercado: introdução de indicadores de volatilidade para distinguir entre tendências e turbulências

- Ajuste de parâmetros dinâmicos: Parâmetros de MACD e regressão linear ajustados automaticamente de acordo com a situação do mercado

- Optimizar o Stop Loss: introdução de Stop Loss dinâmico, ajustado automaticamente de acordo com a volatilidade do mercado

- Aumentar a análise de volume de transação: a combinação de indicadores de volume de transação para aumentar a credibilidade do sinal

- Introdução de análise de ciclo de tempo: considerar confirmação de múltiplos ciclos de tempo para aumentar a precisão das transações

Resumir

A estratégia cria um sistema de negociação com flexibilidade e confiabilidade, combinando versões melhoradas de indicadores clássicos e métodos estatísticos. Seu design modular permite que os comerciantes ajustem flexivelmente os parâmetros da estratégia e o mecanismo de confirmação de sinais de acordo com diferentes condições de mercado. Com otimização e melhoria contínuas, a estratégia espera manter um desempenho estável em vários cenários de mercado.

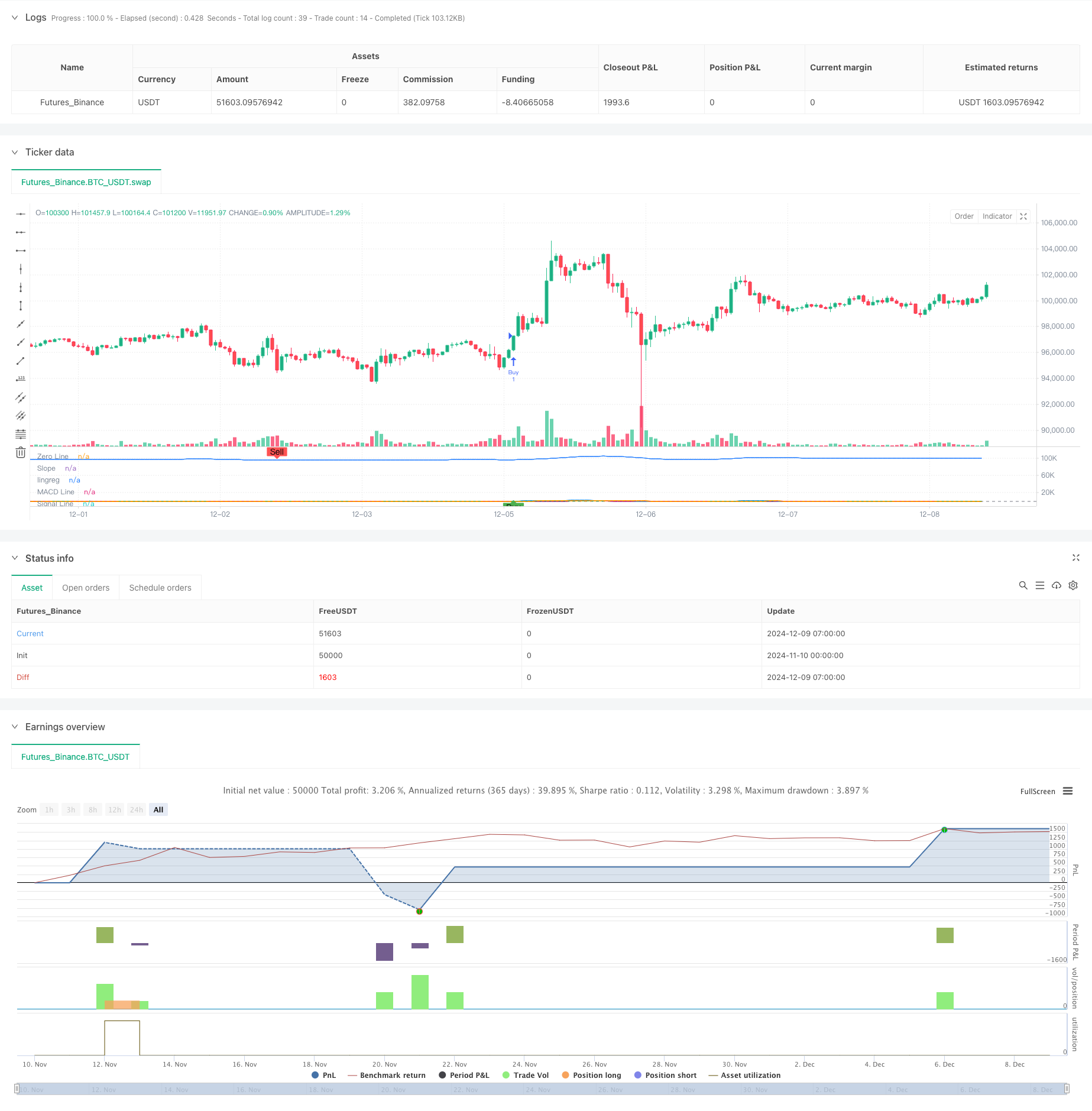

/*backtest

start: 2024-11-10 00:00:00

end: 2024-12-09 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy('SIMPLIFIED MACD & LRS Backtest by NHBProd', overlay=false)

// Function to calculate TEMA (Triple Exponential Moving Average)

tema(src, length) =>

ema1 = ta.ema(src, length)

ema2 = ta.ema(ema1, length)

ema3 = ta.ema(ema2, length)

3 * (ema1 - ema2) + ema3

// MACD Calculation Function

macdfx(src, fast_length, slow_length, signal_length, method) =>

fast_ma = method == 'SMA' ? ta.sma(src, fast_length) :

method == 'EMA' ? ta.ema(src, fast_length) :

method == 'WMA' ? ta.wma(src, fast_length) :

tema(src, fast_length)

slow_ma = method == 'SMA' ? ta.sma(src, slow_length) :

method == 'EMA' ? ta.ema(src, slow_length) :

method == 'WMA' ? ta.wma(src, slow_length) :

tema(src, slow_length)

macd = fast_ma - slow_ma

signal = method == 'SMA' ? ta.sma(macd, signal_length) :

method == 'EMA' ? ta.ema(macd, signal_length) :

method == 'WMA' ? ta.wma(macd, signal_length) :

tema(macd, signal_length)

hist = macd - signal

[macd, signal, hist]

// MACD Inputs

useMACD = input(true, title="Use MACD for Signals")

src = input(close, title="MACD Source")

fastp = input(12, title="MACD Fast Length")

slowp = input(26, title="MACD Slow Length")

signalp = input(9, title="MACD Signal Length")

macdMethod = input.string('EMA', title='MACD Method', options=['EMA', 'SMA', 'WMA', 'TEMA'])

// MACD Calculation

[macd, signal, hist] = macdfx(src, fastp, slowp, signalp, macdMethod)

// Linear Regression Inputs

useLR = input(true, title="Use Linear Regression for Signals")

lrLength = input(24, title="Linear Regression Length")

lrSource = input(close, title="Linear Regression Source")

lrSignalSelector = input.string('Rising Linear', title='Signal Selector', options=['Price Above Linear', 'Rising Linear', 'Both'])

// Linear Regression Calculation

linReg = ta.linreg(lrSource, lrLength, 0)

linRegPrev = ta.linreg(lrSource, lrLength, 1)

slope = linReg - linRegPrev

// Linear Regression Buy Signal

lrBuySignal = lrSignalSelector == 'Price Above Linear' ? (close > linReg) :

lrSignalSelector == 'Rising Linear' ? (slope > 0 and slope > slope[1]) :

lrSignalSelector == 'Both' ? (close > linReg and slope > 0) : false

// MACD Crossover Signals

macdCrossover = ta.crossover(macd, signal)

// Buy Signals based on user choices

macdSignal = useMACD and macdCrossover

lrSignal = useLR and lrBuySignal

// Buy condition: Use AND condition if both are selected, OR condition if only one is selected

buySignal = (useMACD and useLR) ? (macdSignal and lrSignal) : (macdSignal or lrSignal)

// Plot MACD

hline(0, title="Zero Line", color=color.gray)

plot(macd, color=color.blue, title="MACD Line", linewidth=2)

plot(signal, color=color.orange, title="Signal Line", linewidth=2)

plot(hist, color=hist >= 0 ? color.green : color.red, style=plot.style_columns, title="MACD Histogram")

// Plot Linear Regression Line and Slope

plot(slope, color=slope > 0 ? color.purple : color.red, title="Slope", linewidth=2)

plot(linReg,title="lingreg")

// Signal Plot for Visualization

plotshape(buySignal, style=shape.labelup, location=location.bottom, color=color.new(color.green, 0), title="Buy Signal", text="Buy")

// Sell Signals for Exiting Long Positions

macdCrossunder = ta.crossunder(macd, signal) // MACD Crossunder for Sell Signal

lrSellSignal = lrSignalSelector == 'Price Above Linear' ? (close < linReg) :

lrSignalSelector == 'Rising Linear' ? (slope < 0 and slope < slope[1]) :

lrSignalSelector == 'Both' ? (close < linReg and slope < 0) : false

// User Input for Exit Signals: Select indicators to use for exiting trades

useMACDSell = input(true, title="Use MACD for Exit Signals")

useLRSell = input(true, title="Use Linear Regression for Exit Signals")

// Sell condition: Use AND condition if both are selected to trigger a sell at the same time, OR condition if only one is selected

sellSignal = (useMACDSell and useLRSell) ? (macdCrossunder and lrSellSignal) :

(useMACDSell ? macdCrossunder : false) or

(useLRSell ? lrSellSignal : false)

// Plot Sell Signals for Visualization (for exits, not short trades)

plotshape(sellSignal, style=shape.labeldown, location=location.top, color=color.new(color.red, 0), title="Sell Signal", text="Sell")

// Alerts

alertcondition(buySignal, title="Buy Signal", message="Buy signal detected!")

alertcondition(sellSignal, title="Sell Signal", message="Sell signal detected!")

// Take Profit and Stop Loss Inputs

takeProfit = input.float(10.0, title="Take Profit (%)") // Take Profit in percentage

stopLoss = input.float(0.10, title="Stop Loss (%)") // Stop Loss in percentage

// Backtest Date Range

startDate = input(timestamp("2024-01-01 00:00"), title="Start Date")

endDate = input(timestamp("2025-12-12 00:00"), title="End Date")

inBacktestPeriod = true

// Entry Rules (Only Long Entries)

if (buySignal and inBacktestPeriod)

strategy.entry("Buy", strategy.long)

// Exit Rules (Only for Long Positions)

strategy.exit("Exit Buy", from_entry="Buy", limit=close * (1 + takeProfit / 100), stop=close * (1 - stopLoss / 100))

// Exit Long Position Based on Sell Signals

if (sellSignal and inBacktestPeriod)

strategy.close("Buy", comment="Exit Signal")