Visão geral

A estratégia é um sistema de negociação inteligente baseado em múltiplas médias móveis e intensidade de tendência. Ela mede a intensidade da tendência do mercado analisando o grau de desvio entre os preços e as diferentes médias móveis periódicas e, em combinação com o indicador de taxa de flutuação ATR, gerencia a posição e controla o risco.

Princípio da estratégia

A lógica central da estratégia baseia-se nos seguintes aspectos:

- Usando médias móveis de dois períodos diferentes (rápido e lento) para identificar a direção da tendência e os sinais de cruzamento

- A intensidade da tendência é quantificada através do cálculo do desvio do preço em relação à média móvel (contando em pontos)

- Combinação de formas de linhas K (devorador, touro, estrela-fogo, estrela-cruz, etc.) como sinal de confirmação auxiliar

- Calculação dinâmica de objetivos de stop loss e profit com o indicador ATR

- Gerenciamento de pedidos com lucros parciais e rastreamento de perdas

Vantagens estratégicas

- O sistema possui uma forte adaptabilidade, podendo ser ajustado por parâmetros para diferentes ambientes de mercado

- Quantificar a intensidade da tendência através de desvios, evitando transações frequentes quando a tendência é mais fraca

- Melhorar a confiabilidade dos sinais de transação combinando múltiplos indicadores técnicos e confirmação de forma

- A utilização de um método de stop loss dinâmico baseado em ATR para controlar o risco razoavelmente

- Apoio a dois tipos de gestão de fundos: recuperação e posição fixa

- Funções de parada parcial de lucro e rastreamento de perdas, protegendo efetivamente os lucros

Risco estratégico

- Aumentar a filtragem dos indicadores de choque, que podem gerar mais falsos sinais em mercados de choque

- A combinação de múltiplos indicadores pode levar a oportunidades de negociação perdidas

- O excesso de otimização de parâmetros pode levar a um risco de sobreajuste

- Em mercados com pouca liquidez, grandes volumes de transações podem representar riscos de deslizamento

- O que é necessário é um equilíbrio razoável de stop loss para evitar perdas excessivas.

Direção de otimização da estratégia

- Indicadores de volume de transação podem ser adicionados como indicadores auxiliares para a confirmação de tendências

- Considere a introdução de indicadores de volatilidade de mercado para ajustar dinamicamente a frequência de negociação

- Filtragem de sinais com base na consistência de tendências em diferentes períodos de tempo

- Adicionar mais opções de paralisação, como paralisação de tempo

- Desenvolver mecanismos de otimização de parâmetros adaptativos para melhorar a adaptabilidade da estratégia

Resumir

A estratégia constrói um sistema de negociação abrangente através da combinação de médias móveis, quantificação da intensidade da tendência, forma de linha K e gerenciamento de risco dinâmico. Ela mantém a simplicidade da lógica da estratégia e aumenta a confiabilidade das negociações por meio de mecanismos de confirmação múltipla. A alta personalização da estratégia permite que ela se adapte a diferentes estilos de negociação e ambientes de mercado, mas é necessário prestar atenção à otimização de parâmetros e controle de risco.

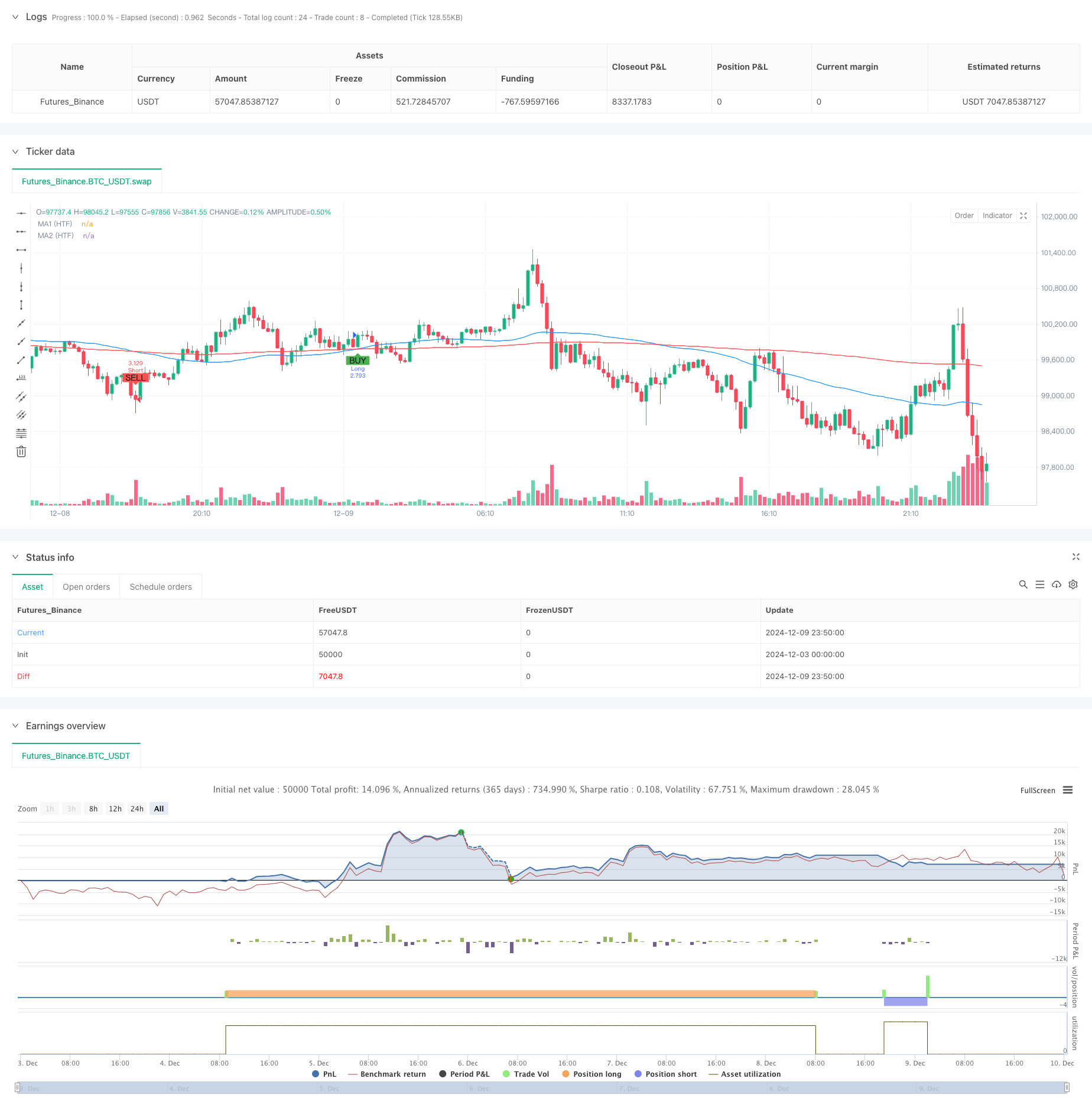

/*backtest

start: 2024-12-03 00:00:00

end: 2024-12-10 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Customizable Strategy with Signal Intensity Based on Pips Above/Below MAs", overlay=true)

// Customizable Inputs

// Account and Risk Management

account_size = input.int(100000, title="Account Size (USD)", minval=1)

compounded_results = input.bool(true, title="Compounded Results")

risk_per_trade = input.float(1.0, title="Risk per Trade (%)", minval=0.1, maxval=100) / 100

// Moving Averages Settings

ma1_length = input.int(50, title="Moving Average 1 Length", minval=1)

ma2_length = input.int(200, title="Moving Average 2 Length", minval=1)

// Higher Time Frame for Moving Averages

ma_htf = input.timeframe("D", title="Higher Time Frame for MA Delay")

// Signal Intensity Range based on pips

signal_intensity_min = input.int(0, title="Signal Intensity Start (Pips)", minval=0, maxval=1000)

signal_intensity_max = input.int(1000, title="Signal Intensity End (Pips)", minval=0, maxval=1000)

// ATR-Based Stop Loss and Take Profit

atr_length = input.int(14, title="ATR Length", minval=1)

atr_multiplier_stop = input.float(1.5, title="Stop Loss Size (ATR Multiplier)", minval=0.1)

atr_multiplier_take_profit = input.float(2.5, title="Take Profit Size (ATR Multiplier)", minval=0.1)

// Trailing Stop and Partial Profit

trailing_stop_rr = input.float(2.0, title="Trailing Stop (R:R)", minval=0)

partial_profit_percentage = input.float(50, title="Take Partial Profit (%)", minval=0, maxval=100)

// Trend Filter Settings

trend_filter_enabled = input.bool(true, title="Trend Filter Enabled")

trend_filter_sensitivity = input.float(50, title="Trend Filter Sensitivity", minval=0, maxval=100)

// Candle Pattern Type for Entry

entry_candle_type = input.string("Any", title="Entry Candle Type", options=["Any", "Engulfing", "Hammer", "Shooting Star", "Doji"])

// Moving Average Entry Conditions

ma_entry_condition = input.string("Both", title="MA Entry", options=["Fast Above Slow", "Fast Below Slow", "Both"])

// Trade Direction (Long, Short, or Both)

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"])

// ATR Calculation

atr_value = ta.atr(atr_length)

// Moving Average Calculations (using Higher Time Frame)

ma1_htf = ta.sma(request.security(syminfo.tickerid, ma_htf, close), ma1_length)

ma2_htf = ta.sma(request.security(syminfo.tickerid, ma_htf, close), ma2_length)

// Candle Pattern Conditions

is_engulfing = close[1] < open[1] and close > open and high > high[1] and low < low[1]

is_hammer = (high - low) > 3 * (close - open) and (close > open) and (low == ta.lowest(low, 5))

is_shooting_star = (high - low) > 3 * (open - close) and (open > close) and (high == ta.highest(high, 5))

is_doji = (close - open) <= ((high - low) * 0.1)

// Apply the selected candle pattern

candle_condition = false

if entry_candle_type == "Any"

candle_condition := true

if entry_candle_type == "Engulfing"

candle_condition := is_engulfing

if entry_candle_type == "Hammer"

candle_condition := is_hammer

if entry_candle_type == "Shooting Star"

candle_condition := is_shooting_star

if entry_candle_type == "Doji"

candle_condition := is_doji

// Moving Average Entry Conditions

ma_cross_above = ta.crossover(ma1_htf, ma2_htf)

ma_cross_below = ta.crossunder(ma1_htf, ma2_htf)

// Calculate pips distance to MAs and normalize it for signal intensity

pip_size = syminfo.mintick * 10 // Assuming Forex; for other asset classes, modify as needed

// Calculate distances in pips between price and MAs

distance_to_ma1_pips = math.abs(close - ma1_htf) / pip_size

distance_to_ma2_pips = math.abs(close - ma2_htf) / pip_size

// Calculate signal intensity based on the pips distance

// Normalize the signal intensity between the user-specified min and max

signal_intensity = math.min(math.max((distance_to_ma1_pips + distance_to_ma2_pips), signal_intensity_min), signal_intensity_max)

// Trend Filter Condition (Optional)

trend_condition = false

if trend_filter_enabled

trend_condition := ta.sma(close, ma2_length) > ta.sma(close, ma2_length + int(trend_filter_sensitivity))

// Entry Conditions Based on MA, Candle Patterns, and Trade Direction

long_condition = (trade_direction == "Long" or trade_direction == "Both") and (ma_entry_condition == "Fast Above Slow" or ma_entry_condition == "Both") and ma_cross_above and candle_condition and (not trend_filter_enabled or trend_condition) and signal_intensity > signal_intensity_min

short_condition = (trade_direction == "Short" or trade_direction == "Both") and (ma_entry_condition == "Fast Below Slow" or ma_entry_condition == "Both") and ma_cross_below and candle_condition and (not trend_filter_enabled or not trend_condition) and signal_intensity > signal_intensity_min

// Position Sizing Based on Risk Per Trade and ATR for Stop Loss

risk_amount = account_size * risk_per_trade

stop_loss_atr = atr_multiplier_stop * atr_value

// Calculate the position size based on the risk amount and ATR stop loss

position_size = risk_amount / stop_loss_atr

// If compounded results are not enabled, adjust position size for non-compounded returns

if not compounded_results

position_size := position_size / account_size * 100000 // Adjust for non-compounded results

// Convert take profit and stop loss from ATR to USD

pip_value = syminfo.mintick * 10 // Assuming Forex; for other asset classes, modify as needed

take_profit_atr = atr_multiplier_take_profit * atr_value

take_profit_usd = (take_profit_atr * pip_value) * position_size

stop_loss_usd = (stop_loss_atr * pip_value) * position_size

// Trailing Stop

trail_stop_level = trailing_stop_rr * stop_loss_atr

// Initialize long_box_id and short_box_id as boxes (not ints)

var box long_box_id = na

var box short_box_id = na

// Track Monthly Profit

var float monthly_profit = 0.0

if (month(timenow) != month(timenow[1])) // New month

monthly_profit := 0

// Long Trade Management

if long_condition

strategy.entry("Long", strategy.long, qty=position_size)

// Partial Profit at 50% position close when 1:1 risk/reward

strategy.exit("Partial Profit", from_entry="Long", limit=strategy.position_avg_price + stop_loss_atr, qty_percent=partial_profit_percentage / 100)

// Full take profit and stop loss with trailing stop

strategy.exit("Take Profit Long", from_entry="Long", limit=strategy.position_avg_price + take_profit_atr, stop=strategy.position_avg_price - stop_loss_atr, trail_offset=trail_stop_level)

// Delete the old box if it exists

if not na(long_box_id)

box.delete(long_box_id)

// Plot Take Profit and Stop Loss for Long Positions

// long_box_id := box.new(left=bar_index - 1, top=strategy.position_avg_price + take_profit_atr, right=bar_index, bottom=strategy.position_avg_price - stop_loss_atr, bgcolor=color.new(color.green, 90), border_width=1, border_color=color.new(color.green, 0))

// Short Trade Management

if short_condition

strategy.entry("Short", strategy.short, qty=position_size)

// Partial Profit at 50% position close when 1:1 risk/reward

strategy.exit("Partial Profit", from_entry="Short", limit=strategy.position_avg_price - stop_loss_atr, qty_percent=partial_profit_percentage / 100)

// Full take profit and stop loss with trailing stop

strategy.exit("Take Profit Short", from_entry="Short", limit=strategy.position_avg_price - take_profit_atr, stop=strategy.position_avg_price + stop_loss_atr, trail_offset=trail_stop_level)

// Delete the old box if it exists

// if not na(short_box_id)

// box.delete(short_box_id)

// Plot Take Profit and Stop Loss for Short Positions

// short_box_id := box.new(left=bar_index - 1, top=strategy.position_avg_price + stop_loss_atr, right=bar_index, bottom=strategy.position_avg_price - take_profit_atr, bgcolor=color.new(color.red, 90), border_width=1, border_color=color.new(color.red, 0))

// Plot MAs and Signals

plot(ma1_htf, color=color.blue, title="MA1 (HTF)")

plot(ma2_htf, color=color.red, title="MA2 (HTF)")

plotshape(series=long_condition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=short_condition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")