Visão geral

A estratégia é um sistema de negociação integrado que combina vários indicadores técnicos, principalmente para capturar oportunidades de negociação através da monitorização dinâmica da dinâmica do mercado e mudanças de tendência. A estratégia integra vários indicadores, como o sistema de equilíbrio (EMA), o indicador de força relativa (RSI), o indicador de dispersão de convergência da média móvel (MACD) e a faixa de Bryn Byn (BB), e introduz um mecanismo de parada de perda dinâmico baseado na amplitude de onda real (ATR), que permite a análise e o controle de risco de várias dimensões do mercado.

Princípio da estratégia

A estratégia utiliza mecanismos de confirmação de sinais em vários níveis, incluindo:

- Julgamento de tendências: usa um cruzamento de EMAs de 7 e 14 ciclos para determinar a direção da tendência do mercado

- Análise de dinâmica: O indicador RSI monitora o estado de sobrecompra e sobrevenda do mercado, definindo um limiar dinâmico de 30⁄70

- Confirmação da força da tendência: introdução do indicador ADX para determinar a força da tendência, confirmando a existência de uma forte tendência quando o ADX é > 25

- Julgamento de bandas de flutuação: a aplicação de um binary para definir bandas de flutuação de preços, combinando o preço com o toque de um binary para gerar um sinal de negociação

- Verificação de volume de transação: Filtragem linear de volume de transação dinâmica para garantir que as transações ocorram com a atividade suficiente do mercado

- Controle de risco: estratégia de stop loss dinâmica baseada no ATR, com um intervalo de stop loss de 1,5 vezes o ATR

Vantagens estratégicas

- Verificação de sinais multidimensional para reduzir sinais falsos

- Mecanismos de Stop Losses Dinâmicos Aumentam a Capacidade de Adaptação ao Risco da Estratégia

- Combinação de análise de volume e intensidade de tendência para aumentar a confiabilidade das transações

- Parâmetros do indicador são ajustáveis, com boa adaptabilidade

- Mecanismos completos de entrada e saída, lógica de negociação clara

- Indicadores técnicos padronizados, fáceis de entender e de manter

Risco estratégico

- Vários indicadores podem causar atraso no sinal

- A otimização de parâmetros pode apresentar o risco de overfitting

- O mercado horizontal pode gerar transações frequentes

- Sistemas de sinalização complexos podem aumentar a carga computacional

- Uma amostra maior é necessária para verificar a eficácia da estratégia.

Direção de otimização da estratégia

- Introdução de um mecanismo de adaptação à volatilidade do mercado, ajustamento dinâmico dos parâmetros do indicador

- Aumentar o filtro de tempo para evitar negociações em períodos desfavoráveis

- Otimização da estratégia de suspensão, considerando a suspensão móvel

- Adição de custos de transação e otimização de condições de liquidação

- Introdução de mecanismos de gerenciamento de posições para realização de ajustes dinâmicos de posições

Resumir

A estratégia, através da colaboração de vários indicadores, constrói um sistema de negociação mais completo. Os principais benefícios são o mecanismo de confirmação de sinal multidimensional e o sistema de controle de risco dinâmico, mas também é necessário prestar atenção aos problemas de otimização de parâmetros e adaptabilidade ao mercado.

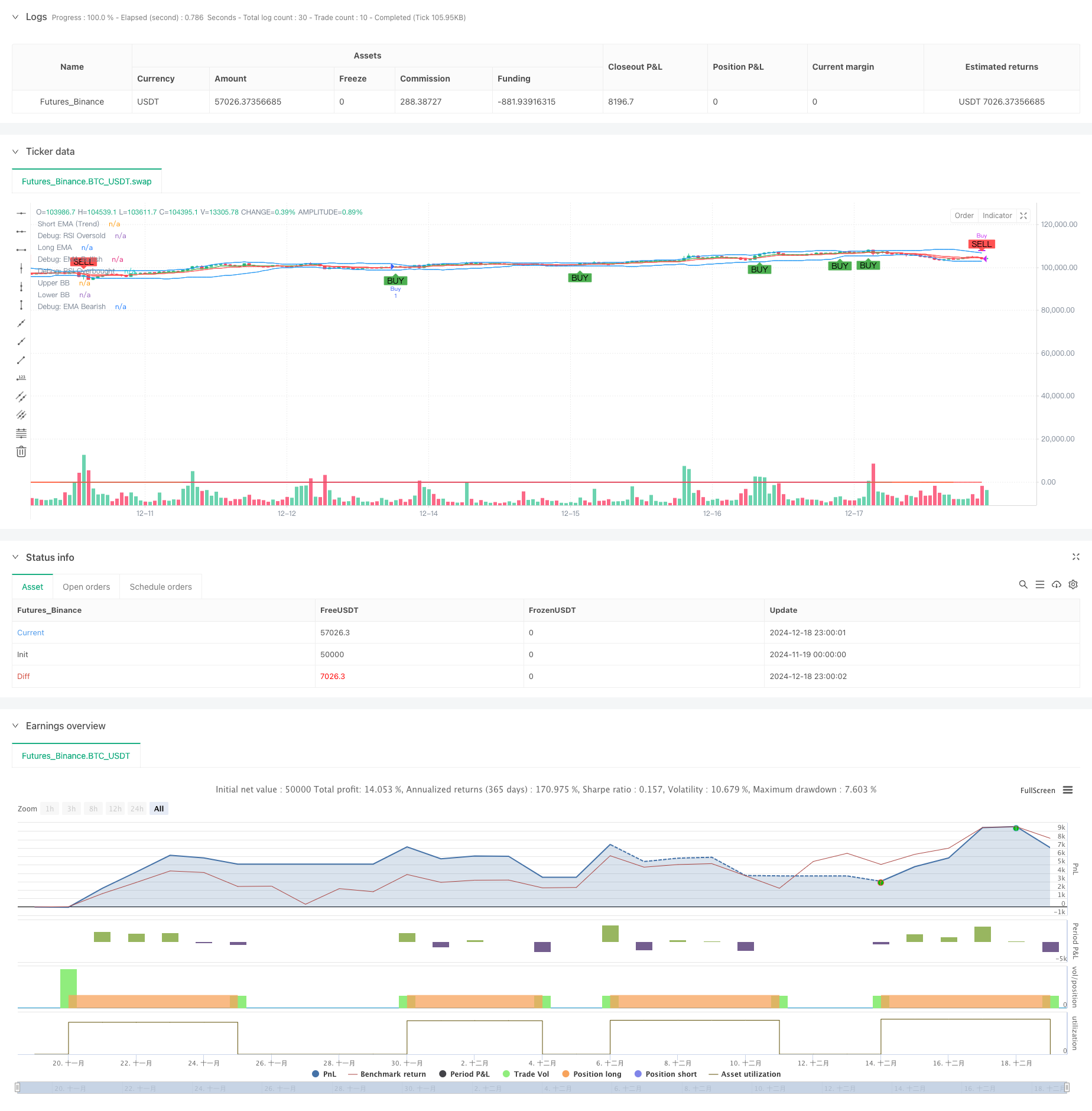

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-19 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XRP/USDT Scalping Strategy", overlay=true)

// Input Parameters

emaShortLength = input.int(7, title="Short EMA Length")

emaLongLength = input.int(14, title="Long EMA Length")

rsiLength = input.int(7, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level") // Adjusted to 70 for broader range

rsiOversold = input.int(30, title="RSI Oversold Level") // Adjusted to 30 for broader range

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalLength = input.int(9, title="MACD Signal Length")

bbLength = input.int(20, title="Bollinger Bands Length")

bbStdDev = input.float(2.0, title="Bollinger Bands Standard Deviation") // Adjusted to 2.0 for better signal detection

// EMA Calculation

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// RSI Calculation

rsi = ta.rsi(close, rsiLength)

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalLength)

macdHistogram = macdLine - signalLine

// Bollinger Bands Calculation

basis = ta.sma(close, bbLength)

deviation = ta.stdev(close, bbLength)

bbUpper = basis + (bbStdDev * (deviation > 1e-5 ? deviation : 1e-5)) // Ensure robust Bollinger Band calculation

bbLower = basis - bbStdDev * deviation

// Volume Condition

volCondition = volume > ta.sma(volume, input.int(20, title="Volume SMA Period")) // Dynamic volume filter

// Trend Strength (ADX)

// True Range Calculation

tr = math.max(high - low, math.max(math.abs(high - close[1]), math.abs(low - close[1])))

// Directional Movement

plusDM = high - high[1] > low[1] - low ? math.max(high - high[1], 0) : 0

minusDM = low[1] - low > high - high[1] ? math.max(low[1] - low, 0) : 0

// Smooth Moving Averages

atr_custom = ta.rma(tr, 14)

plusDI = 100 * ta.rma(plusDM, 14) / atr_custom // Correct reference to atr_custom

minusDI = 100 * ta.rma(minusDM, 14) / atr_custom // Correct reference to atr_custom

// ADX Calculation

adx = plusDI + minusDI > 0 ? 100 * ta.rma(math.abs(plusDI - minusDI) / (plusDI + minusDI), 14) : na // Simplified ternary logic for ADX calculation // Prevent division by zero // Prevent division by zero // Final ADX

strongTrend = adx > 25

// Conditions for Buy Signal

emaBullish = emaShort > emaLong

rsiOversoldCondition = rsi < rsiOversold

macdBullishCrossover = ta.crossover(macdLine, signalLine)

priceAtLowerBB = close <= bbLower

buySignal = emaBullish and (rsiOversoldCondition or macdBullishCrossover or priceAtLowerBB) // Relaxed conditions by removing volCondition and strongTrend

// Conditions for Sell Signal

emaBearish = emaShort < emaLong

rsiOverboughtCondition = rsi > rsiOverbought

macdBearishCrossover = ta.crossunder(macdLine, signalLine)

priceAtUpperBB = close >= bbUpper

sellSignal = emaBearish and (rsiOverboughtCondition or macdBearishCrossover or priceAtUpperBB) // Relaxed conditions by removing volCondition and strongTrend

// Plot EMA Lines

trendColor = emaShort > emaLong ? color.green : color.red

plot(emaShort, color=trendColor, title="Short EMA (Trend)") // Simplified color logic

plot(emaLong, color=color.red, title="Long EMA")

// Plot Bollinger Bands

plot(bbUpper, color=color.blue, title="Upper BB")

plot(bbLower, color=color.blue, title="Lower BB")

// Plot Buy and Sell Signals

plot(emaBullish ? 1 : na, color=color.green, linewidth=1, title="Debug: EMA Bullish")

plot(emaBearish ? 1 : na, color=color.red, linewidth=1, title="Debug: EMA Bearish")

plot(rsiOversoldCondition ? 1 : na, color=color.orange, linewidth=1, title="Debug: RSI Oversold")

plot(rsiOverboughtCondition ? 1 : na, color=color.purple, linewidth=1, title="Debug: RSI Overbought")

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL", size=size.small) // Dynamic size for signals

// Strategy Execution with ATR-based Stop Loss and Take Profit

// Reuse atr_custom from earlier calculation

stopLoss = low - (input.float(1.5, title="Stop Loss Multiplier") * atr_custom) // Consider dynamic adjustment based on market conditions // Adjustable stop-loss multiplier

takeProfit = close + (2 * atr_custom)

if (buySignal)

strategy.entry("Buy", strategy.long, stop=stopLoss) // Removed limit to simplify trade execution

if (sellSignal)

strategy.close("Buy")