Visão geral

A estratégia é um sistema de negociação baseado no VWAP e no canal de diferenciação padrão, que opera a negociação identificando a forma inversa do preço na fronteira do canal. A estratégia combina a filosofia de negociação do volume e do retorno do valor médio para capturar oportunidades de negociação quando o preço ultrapassa o ponto técnico crítico.

Princípio da estratégia

O núcleo da estratégia é a construção de um canal de ascensão e descensão usando o VWAP como centro de preço, usando a diferença padrão de 20 ciclos. Procure oportunidades de aumento perto da faixa de baixo e de queda perto da faixa de cima.

- Multi-condicionamento: o preço forma uma inversão de tendência de baixa e, em seguida, ultrapassa a alta anterior da linha do Sol

- Condições de fechamento: o preço forma uma forma de queda no traçado superior e, em seguida, quebra o mínimo anterior da linha negativa

- Configuração de parada: fazer mais com o VWAP e o alvo acima do carril, com o alvo abaixo do carril

- Parar de perda: fazer mais para parar de perda no ponto mais baixo do sol retrógrado, fazer ativos para parar de perda no ponto mais alto do sol retrógrado

Vantagens estratégicas

- Combinando os benefícios de acompanhamento de tendências e negociação de reversão, pode capturar a continuação de tendências e aproveitar oportunidades de reversão.

- Usando o VWAP como um indicador central, pode refletir melhor a oferta e demanda reais do mercado

- O método de batch-stop permite obter lucros em preços diferentes

- Parar os prejuízos é razoável e permite controlar os riscos de forma eficaz

- A lógica da estratégia é clara, a configuração de parâmetros é simples, fácil de entender e executar

Risco estratégico

- Pode ser frequente a ação de stop loss em mercados com forte volatilidade

- A fase de classificação horizontal pode gerar muitos falsos sinais

- O VWAP é mais sensível a períodos de tempo

- A largura de canal padrão pode não ser adequada para todas as circunstâncias do mercado

- Pode ter perdido algumas oportunidades importantes para a tendência

Direção de otimização da estratégia

- Introdução de filtros de transmissão para melhorar a qualidade do sinal

- Aumentar os indicadores de confirmação de tendências, como o sistema de médias móveis

- Ajuste dinâmico do ciclo de desvio padrão para adaptar-se a diferentes condições de mercado

- Otimização da taxa de interrupção do lote para aumentar a receita geral

- Adicione filtro de tempo para evitar negociações em momentos adversos

- Considere aumentar os indicadores de volatilidade e otimizar a gestão de posições

Resumir

Trata-se de um sistema de negociação completo que combina VWAP, canal de diferenciação padrão e forma de preço. A estratégia é executada procurando sinais de reversão nos preços-chave e gerenciando o risco com paradas em lotes e paradas razoáveis. Embora existam algumas limitações, a estabilidade e a lucratividade da estratégia podem ser melhoradas com a orientação de otimização sugerida.

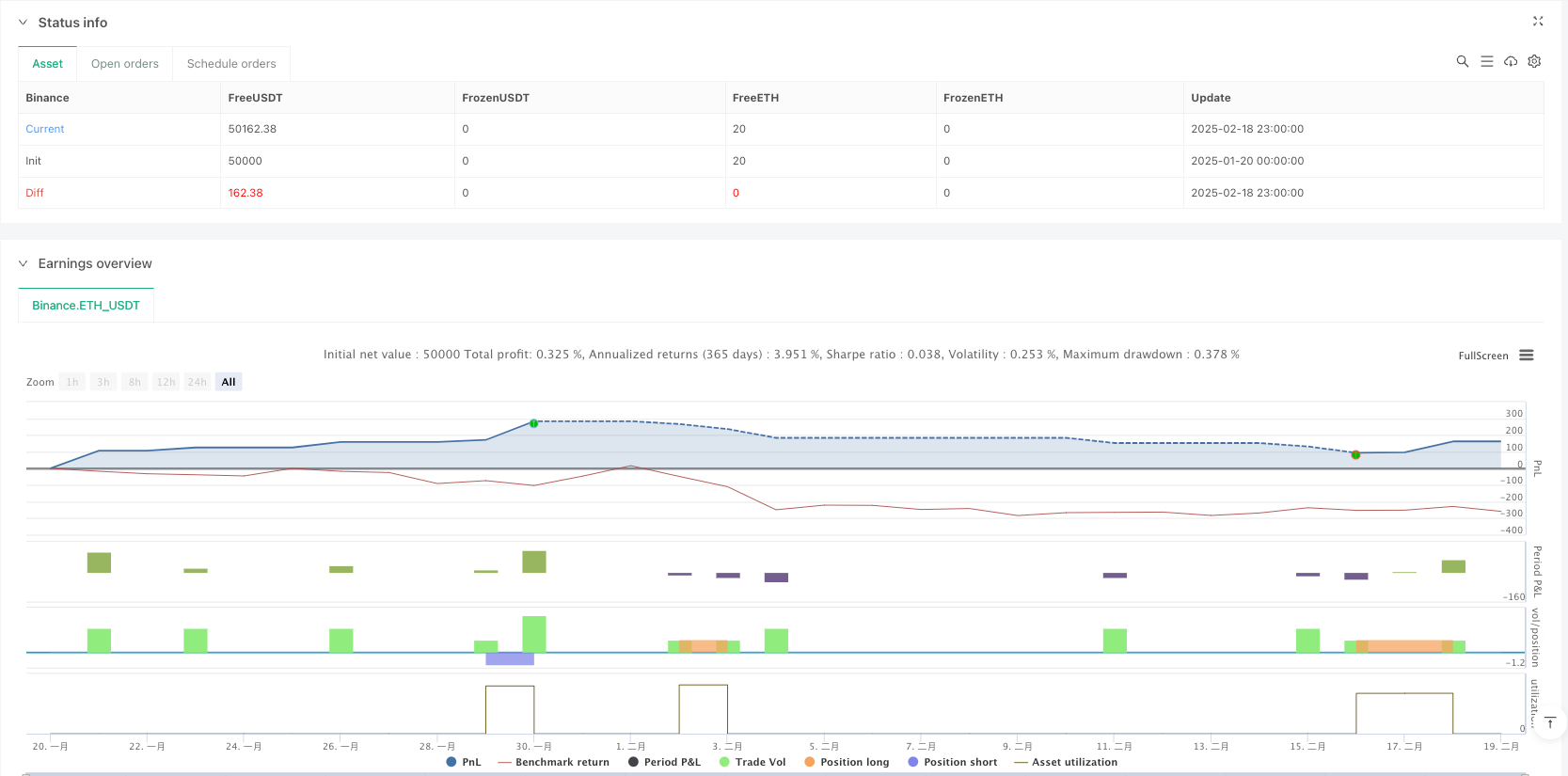

/*backtest

start: 2025-01-20 00:00:00

end: 2025-02-19 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("VRS Strategy", overlay=true)

// Calculate VWAP

vwapValue = ta.vwap(close)

// Calculate standard deviation for the bands

stdDev = ta.stdev(close, 20) // 20-period standard deviation for bands

upperBand = vwapValue + stdDev

lowerBand = vwapValue - stdDev

// Plot VWAP and its bands

plot(vwapValue, color=color.blue, title="VWAP", linewidth=2)

plot(upperBand, color=color.new(color.green, 0), title="Upper Band", linewidth=2)

plot(lowerBand, color=color.new(color.red, 0), title="Lower Band", linewidth=2)

// Signal Conditions

var float previousGreenCandleHigh = na

var float previousGreenCandleLow = na

var float previousRedCandleLow = na

// Detect bearish candle close below lower band

bearishCloseBelowLower = close[1] < lowerBand and close[1] < open[1]

// Detect bullish reversal candle after a bearish close below lower band

bullishCandle = close > open and low < lowerBand // Ensure it's near the lower band

candleReversalCondition = bearishCloseBelowLower and bullishCandle

if (candleReversalCondition)

previousGreenCandleHigh := high[1] // Capture the high of the previous green candle

previousGreenCandleLow := low[1] // Capture the low of the previous green candle

previousRedCandleLow := na // Reset previous red candle low

// Buy entry condition: next candle breaks the high of the previous green candle

buyEntryCondition = not na(previousGreenCandleHigh) and close > previousGreenCandleHigh

if (buyEntryCondition)

// Set stop loss below the previous green candle

stopLoss = previousGreenCandleLow

risk = close - stopLoss // Calculate risk for position sizing

// Target Levels

target1 = vwapValue // Target 1 is at VWAP

target2 = upperBand // Target 2 is at the upper band

// Ensure we only enter the trade near the lower band

if (close < lowerBand)

strategy.entry("Buy", strategy.long)

// Set exit conditions based on targets

strategy.exit("Take Profit 1", from_entry="Buy", limit=target1)

strategy.exit("Take Profit 2", from_entry="Buy", limit=target2)

strategy.exit("Stop Loss", from_entry="Buy", stop=stopLoss)

// Sell signal condition: Wait for a bearish candle near the upper band

bearishCandle = close < open and high > upperBand // A bearish candle should be formed near the upper band

sellSignalCondition = bearishCandle

if (sellSignalCondition)

previousRedCandleLow := low[1] // Capture the low of the current bearish candle

// Sell entry condition: next candle breaks the low of the previous bearish candle

sellEntryCondition = not na(previousRedCandleLow) and close < previousRedCandleLow

if (sellEntryCondition)

// Set stop loss above the previous bearish candle

stopLossSell = previousRedCandleLow + (high[1] - previousRedCandleLow) // Set stop loss above the bearish candle

targetSell = lowerBand // Target for sell is at the lower band

// Ensure we only enter the trade near the upper band

if (close > upperBand)

strategy.entry("Sell", strategy.short)

// Set exit conditions for sell

strategy.exit("Take Profit Sell", from_entry="Sell", limit=targetSell)

strategy.exit("Stop Loss Sell", from_entry="Sell", stop=stopLossSell)

// Reset previous values when a trade occurs

if (strategy.position_size > 0)

previousGreenCandleHigh := na

previousGreenCandleLow := na

previousRedCandleLow := na