Visão geral

A estratégia de negociação inteligente de multi-indicadores ponderados é um sistema de negociação quantitativa integrado que gera decisões de negociação por meio da integração de sinais de vários indicadores técnicos e atribui diferentes pesos. A estratégia combina várias ferramentas de análise técnica, como MACD, RSI aleatório, EMA, super tendências e cruzamentos de médias móveis, formando uma estrutura de negociação abrangente. O sistema não apenas suporta mecanismos de stop loss e stop loss dinâmicos em vários níveis, mas também pode ajustar automaticamente os parâmetros de negociação de acordo com as condições do mercado, permitindo que ele mantenha uma alta adaptabilidade em diferentes ambientes de mercado.

Princípio da estratégia

O núcleo da estratégia está em seu sistema de sinais ponderados, que gera sinais de negociação por meio de cinco estratégias diferentes:

Estratégia MACD: Utilize o cruzamento da linha MACD com a linha de sinal para determinar a direção da tendência do mercado. Quando a linha MACD atravessa a linha de sinal, gera um sinal de compra, e quando a linha MACD atravessa o sinal de venda.

Estratégia de RSI aleatória: Combinação de vantagens de RSI e indicadores aleatórios para monitorar o estado de sobrecompra e sobrevenda do mercado. Quando o RSI aleatório é inferior ao limiar de sobrevenda definido, gera um sinal de compra, quando é superior ao limiar de sobrecompra, gera um sinal de venda.

A estratégia da EMA de compra e venda excessivaA EMA é usada para identificar o grau de desvio do preço da média, gerando um sinal de compra quando o RSI está abaixo do limiar de oversold definido e um sinal de venda quando está acima do limiar de oversold.

Estratégia de super tendência: Canais de preços configurados com base em múltiplos ATR, para determinar a direção da negociação através da mudança de tendência. Quando o indicador de tendência super gerou um sinal de compra quando foi corrigido por uma mudança negativa, gerou um sinal de venda quando foi positivo.

Estratégia de Crossover de Média Móvel: Utilize a interseção de duas médias móveis de diferentes períodos para determinar a tendência do mercado. Quando a média curta atravessa a média de longo prazo, gera um sinal de compra, quando a média baixa produz um sinal de venda.

A estratégia é ponderada com base nos sinais de cada estratégia por meio de um sistema de ponderação personalizável, que aciona a negociação somente quando o total ponderado excede o limite definido. Além disso, a estratégia contém um mecanismo de identificação de topo e fundo potencial, que permite ajustar a posição quando o mercado pode se reversar.

Este mecanismo de confirmação de sinais em vários níveis reduz eficazmente os falsos sinais e aumenta a confiabilidade do sistema de negociação, enquanto a configuração de parâmetros flexíveis permite que a estratégia se adapte a diferentes variedades de negociação e períodos de tempo.

Vantagens estratégicas

Sinais de confirmação múltiplaO cálculo de pesos dos sinais gerados por cinco indicadores técnicos independentes reduz a possibilidade de erro de um único indicador e aumenta a qualidade e a confiabilidade dos sinais de negociação.

Sistema de pesos adaptadosCada sub-estratégia pode ter um peso diferente, permitindo que o comerciante ajuste o foco da estratégia de acordo com a sua confiança nos diferentes indicadores e o desempenho histórico, aumentando a flexibilidade da estratégia.

Uma boa gestão de riscosA estratégia inclui um mecanismo de controle de risco em vários níveis, incluindo a função de stop loss, multi-level stop loss e de ajuste dinâmico do ponto de stop loss, garantindo o controle rápido do risco em caso de mudanças adversas no mercado.

Identificação automática de potenciais toposAtravés da análise integrada do RSI, do volume de negócios e do movimento de preços, a estratégia é capaz de identificar os topos e os topos potenciais do mercado e, no momento adequado, fechar posições em partes, bloquear lucros ou reduzir perdas.

Alta personalizaçãoQuase todos os parâmetros podem ser ajustados, incluindo o ciclo de cálculo de cada indicador, o peso, a porcentagem de stop loss, etc., permitindo que o comerciante otimize a estratégia de acordo com o estilo pessoal e as diferentes condições de mercado.

Mecanismo de atraso internoPara evitar a entrada prematura em negociações ou negociações baseadas em sinais de ruído, a estratégia adotou um mecanismo de confirmação de atraso, garantindo que apenas os sinais contínuos desencadeiam negociações, reduzindo o impacto das flutuações de curto prazo.

Função de filtragem de tempoA estratégia permite definir a data de início da negociação, permitindo que o comerciante verifique o desempenho de um determinado período de tempo com base em dados históricos ou evite períodos de volatilidade anormal do mercado conhecido.

Risco estratégico

Risco de otimização excessiva de parâmetrosA solução é testar o retorno em vários períodos de tempo e variedades, usando uma configuração de parâmetros relativamente robusta, evitando a otimização excessiva para dados históricos específicos.

Risco de mudanças nas condições de mercadoA estratégia pode apresentar diferenças de desempenho em mercados de tendência e mercados de turbulência, e mudanças bruscas no estado do mercado podem reduzir a eficácia da estratégia. A solução é introduzir mecanismos de identificação do ambiente de mercado, ajustar os parâmetros ou suspender a negociação em diferentes estados de mercado.

Risco de conflitos de sinaisO uso simultâneo de vários indicadores pode gerar sinais conflitantes, o que pode causar confusão na tomada de decisão. A solução é colocar um peso razoável para cada indicador, enfatizando os indicadores mais confiáveis e garantindo que os limites de sinal sejam razoavelmente ajustados para reduzir a probabilidade de conflitos.

Riscos de má gestão de fundosA solução é controlar rigorosamente a proporção de capital em cada transação, garantindo que o máximo risco em uma única transação esteja dentro do limite aceitável.

Risco de falha técnicaO sistema de negociação automatizado pode enfrentar problemas técnicos, como interrupções de rede e atrasos de dados. A solução é criar mecanismos de intervenção manual, monitorar regularmente o estado de funcionamento do sistema e lidar com situações excepcionais em tempo hábil.

Direção de otimização da estratégia

Adicionar um filtro de ambiente de mercadoDesenvolver um indicador capaz de identificar se o mercado atual é tendencial ou oscilante, ajustar o peso das estratégias secundárias de acordo com a dinâmica do estado do mercado, fortalecer a estratégia de acompanhamento de tendências em mercados de tendência, fortalecer a estratégia de oscilação em mercados de turbulência.

A introdução da optimização de aprendizagem de máquinaA utilização de tecnologia de aprendizagem de máquina para ajustar automaticamente os parâmetros e os pesos dos indicadores permite que a estratégia aprenda e se adapte continuamente aos dados mais recentes do mercado, aumentando a capacidade de adaptação dinâmica da estratégia.

Aumentar o volume de transaçõesA mudança no volume de transações é usada como um sinal de confirmação adicional, que aumenta a credibilidade do sinal apenas quando o volume de transações correspondente ao esperado é suportado.

Otimização de algoritmos de identificação de topo-base potencialO objetivo é: melhorar a lógica de identificação de topo e fundo existente, adicionando mais fatores de confirmação, como forma de preço, confirmação de múltiplos ciclos, etc., para aumentar a precisão da identificação.

Adicionado ao Índice de EmoçãoIntegração de indicadores de sentimento de mercado, como o índice de pânico (VIX) e a taxa de opções de baixa e baixa, ajuste a estratégia de negociação ou suspenda a negociação em situações de extremo sentimento de mercado, evitando a negociação excessiva em períodos de alta volatilidade.

Desenvolvimento de um mecanismo de suspensão dinâmicaAjustar automaticamente o nível de stop loss de acordo com a volatilidade do mercado, alargar o alcance de stop loss em mercados de alta volatilidade e apertar o stop loss em mercados de baixa volatilidade, tornando a gestão de risco mais flexível e eficaz.

Otimização do ciclo de tempoAumentar a capacidade de análise de períodos de tempo múltiplos, exigindo períodos de tempo de níveis mais altos e mais baixos para confirmar sinais simultaneamente, reduzindo falhas e falsos sinais

Resumir

A estratégia de negociação inteligente de multi-indicadores ponderados cria um sistema de negociação abrangente e flexível, integrando várias ferramentas de análise técnica e atribuindo diferentes pesos. A estratégia possui não apenas a confirmação múltipla de sinais, o sistema de pesos de adaptação e o gerenciamento de risco perfeito, mas também inclui mecanismos de identificação de topo a fundo de potenciais automações, o que a torna mais adaptável em ambientes de mercado complexos e variáveis.

Apesar de existirem riscos potenciais, como otimização excessiva de parâmetros, mudanças nas condições de mercado e conflitos de sinais, esses riscos podem ser controlados efetivamente por meio de configuração razoável de parâmetros, identificação do ambiente de mercado e gestão rigorosa de fundos. As direções de otimização futuras incluem o acréscimo de filtros de ambiente de mercado, a introdução de tecnologias de aprendizado de máquina, a análise de volume de transação e a otimização de algoritmos de identificação de topo-fundo potencial. Estas melhorias aumentarão ainda mais a estabilidade e a lucratividade da estratégia.

Para os investidores que buscam uma abordagem de negociação sistematizada, esta estratégia de negociação inteligente de peso multi-indicador oferece uma estrutura digna de consideração, que pode não apenas reduzir a influência dos fatores emocionais nas decisões de negociação, mas também otimizar continuamente o desempenho das negociações de forma orientada por dados. Ao implementar esta estratégia, é recomendável começar com configurações de parâmetros conservadoras, ajustar gradualmente e monitorar de perto o desempenho da estratégia para encontrar a configuração mais adequada para as preferências de risco pessoais e as condições de mercado.

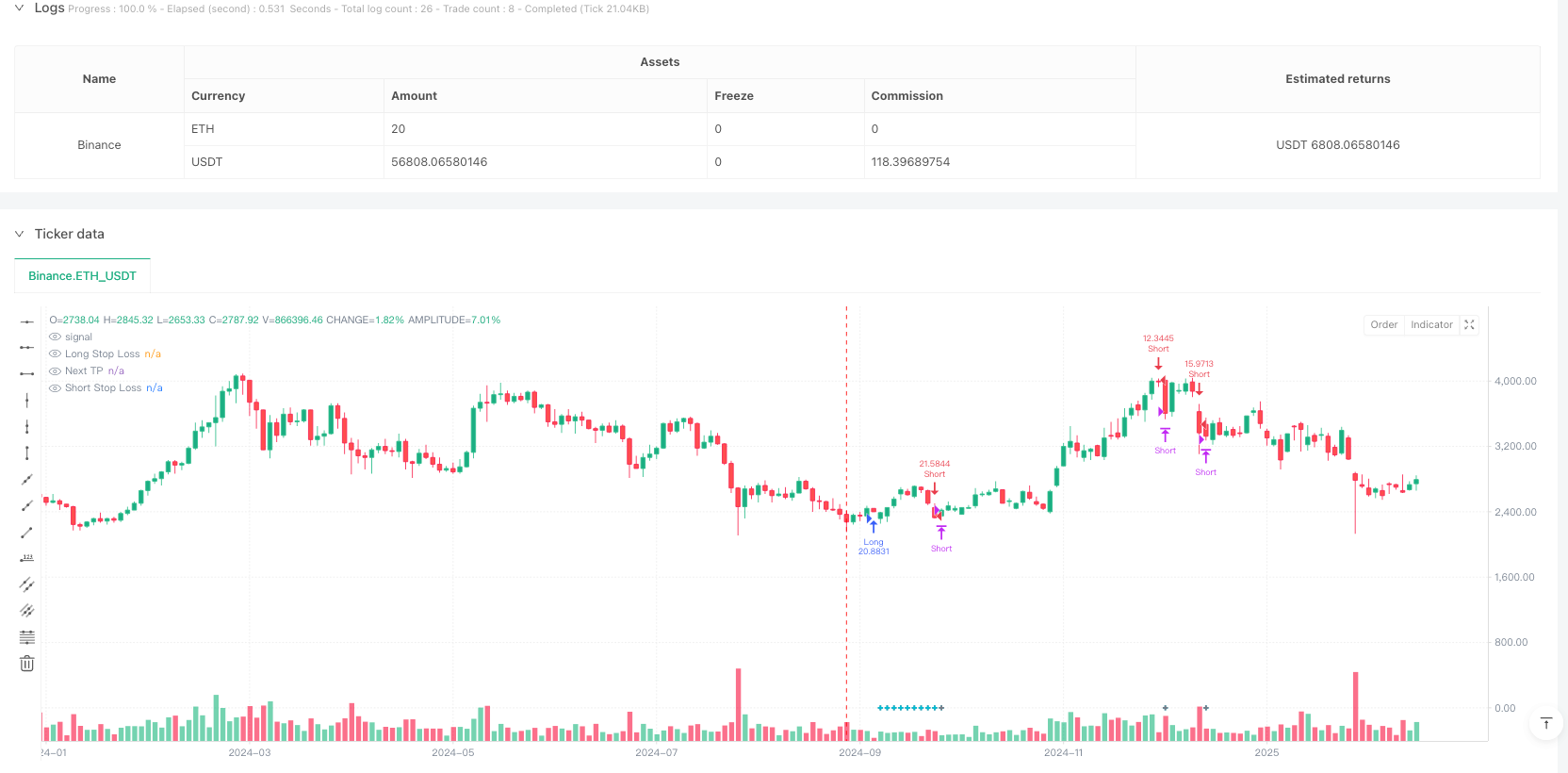

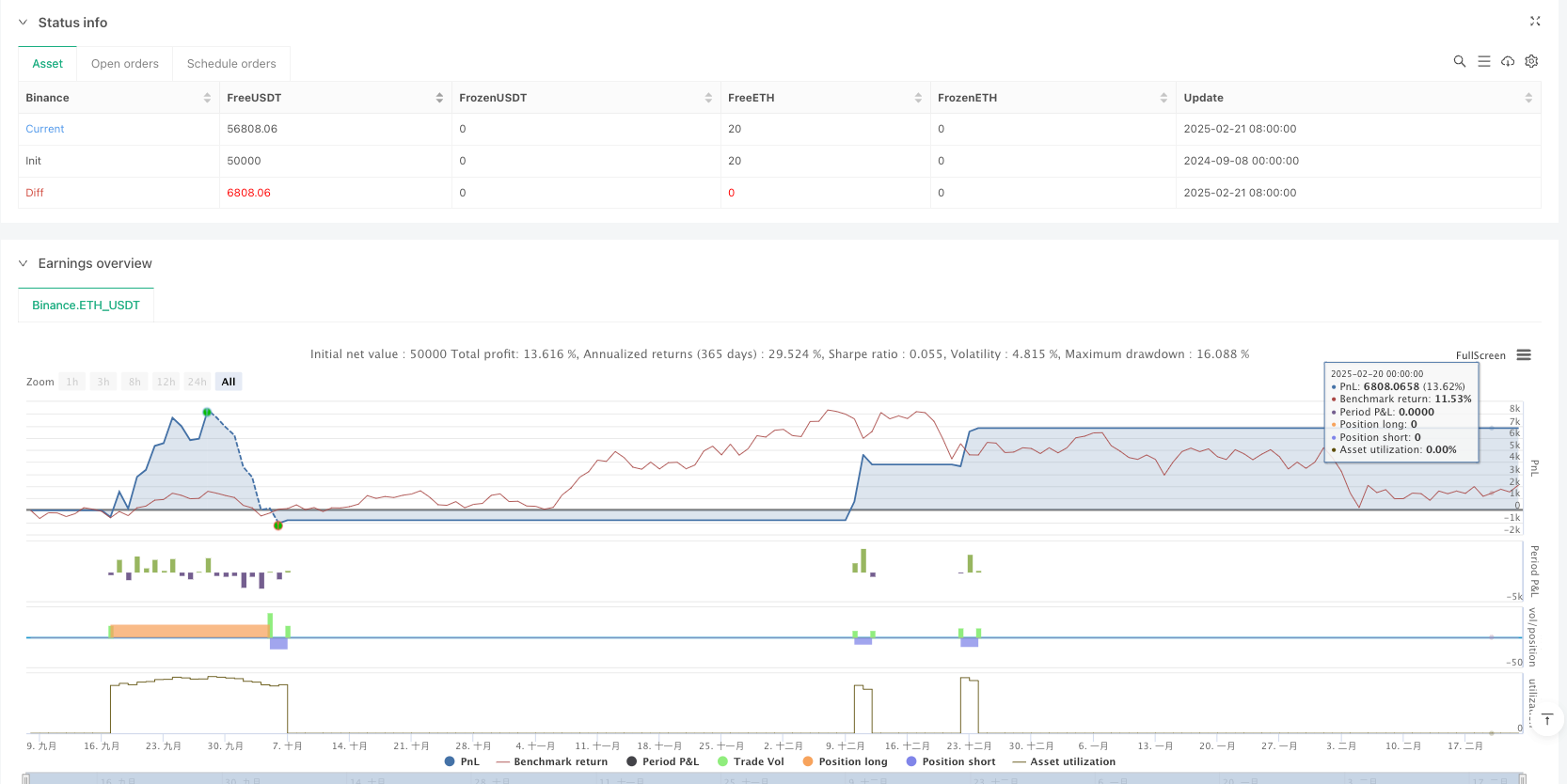

/*backtest

start: 2024-09-08 00:00:00

end: 2025-02-23 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// **********************************************************************************************************************************************************************************************************************************************************************

// Last update: 08/03/2022

// *************************************************************************************************************************************************************************************************************************************************************************

//@version=5

strategy(title='Smart trading', overlay=true, precision=2, commission_value=0.075, commission_type=strategy.commission.percent, initial_capital=1000, currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=100, slippage=1,calc_on_every_tick = false,calc_on_order_fills = true)

// *************************************************************************************************************************************************************************************************************************************************************************

// COMMENTS

// *************************************************************************************************************************************************************************************************************************************************************************

chat_id = input("-1001587924564",'Chat ID Telegram')

procent_stop = input.float(1.0,'Процент стоп')

procent_teik = input.float(4.0,'Процент TP4 ')

// *************************************************************************************************************************************************************************************************************************************************************************

// INPUTS

// *************************************************************************************************************************************************************************************************************************************************************************

// * Type trading

allow_longs = input.bool(true, 'Только лонги', group='Trading type')

allow_shorts = input.bool(true, 'Только шорты', group='Trading type')

// * Datastamp

from_day = input.int(1, 'From Day', minval=1, maxval=31, group='DataStamp')

from_month = input.int(1, 'From Month', minval=1, maxval=12, group='DataStamp')

from_year = input.int(2021, 'From Year', minval=1980, maxval=9999, group='DataStamp')

to_day = input.int(1, 'To Day', minval=1, maxval=31, group='DataStamp')

to_month = input.int(1, 'To Month', minval=1, maxval=12, group='DataStamp')

to_year = input.int(9999, 'To Year', minval=2017, maxval=9999, group='DataStamp')

// * Stop loss

stoploss = input.bool(true, 'Стоп лосс в стратегии', group='Stop loss')

movestoploss = input.string('TP-2', 'Перенос стопа', options=['None', 'Percentage', 'TP-1', 'TP-2', 'TP-3'], group='Stop loss')

movestoploss_entry = input.bool(false, 'Перенос стопа на твх', group='Stop loss')

stoploss_perc = input.float(6.0, 'Стоп лосс в %', minval=0, maxval=100, group='Stop loss') * 0.01

move_stoploss_factor = input.float(20.0, 'Фактор переноса стопа в %', group='Stop loss') * 0.01 + 1

stop_source = input.source(hl2, 'Stop Source', group='Stop loss')

// * Take profits

take_profits = input.bool(true, 'Тейк профит в стратегии', group='Take Profits')

// retrade= input.bool(false, 'Retrade', group='Take Profits')

MAX_TP = input.int(6, 'Кол-во TP', minval=1, maxval=10, group='Take Profits')

long_profit_perc = input.float(6.8, 'Long - TP в % каждый', minval=0.0, maxval=999, step=1, group='Take Profits') * 0.01

long_profit_qty = input.float(15, 'Long - TP в % от твх', minval=0.0, maxval=100, step=1, group='Take Profits')

short_profit_perc = input.float(13, 'Short - TP в % каждый', minval=0.0, maxval=999, step=1, group='Take Profits') * 0.01

short_profit_qty = input.float(10, 'Short - TP в % от твх', minval=0.0, maxval=100, step=1, group='Take Profits')

// * Delays

delay_macd = input.int(1, 'Candles delay MACD', minval=1, group='Delays')

delay_srsi = input.int(2, 'Candles delay RSI', minval=1, group='Delays')

delay_rsi = input.int(2, 'Candles delay EMA', minval=1, group='Delays')

delay_super = input.int(1, 'Candles delay Supertrend', minval=1, group='Delays')

delay_cross = input.int(1, 'Candles delay MA', minval=1, group='Delays')

delay_exit = input.int(7, 'Candles delay exit', minval=1, group='Delays')

// * Inputs Smart strategies

str_0 = input.bool(true, 'Strategy 0: Weighted Strategy', group='Weights')

weight_trigger = input.int(2, 'Smart Signal entry [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str1 = input.int(1, 'Smart Strategy 1 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str2 = input.int(1, 'Smart Strategy 2 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str3 = input.int(1, 'Smart Strategy 3 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str4 = input.int(1, 'Smart Strategy 4 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

weight_str5 = input.int(1, 'Smart Strategy 5 [0, 5]', minval=0, maxval=5, step=1, group='Weights')

// * Inputs strategy 1: MACD

str_1 = input.bool(true, 'Strategy 1: MACD', group='Strategy 1: MACD')

MA1_period_1 = input.int(16, 'MA 1', minval=1, maxval=9999, step=1, group='Strategy 1: MACD')

MA1_type_1 = input.string('EMA', 'MA1 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 1: MACD')

MA1_source_1 = input.source(hl2, 'MA1 Source', group='Strategy 1: MACD')

MA2_period_1 = input.int(36, 'MA 2', minval=1, maxval=9999, step=1, group='Strategy 1: MACD')

MA2_type_1 = input.string('EMA', 'MA2 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 1: MACD')

MA2_source_1 = input.source(high, 'MA2 Source', group='Strategy 1: MACD')

// * Inputs strategy 2: RSI oversold/overbought

str_2 = input.bool(true, 'Strategy 2: RSI', group='Strategy 2: RSI')

long_RSI = input.float(70, 'Exit RSI Long (%)', minval=0.0, step=1, group='Strategy 2: RSI')

short_RSI = input.float(27, 'Exit RSI Short (%)', minval=0.0, step=1, group='Strategy 2: RSI')

length_RSI = input.int(14, 'RSI Length', group='Strategy 2: RSI')

length_stoch = input.int(14, 'RSI Stochastic', group='Strategy 2: RSI')

smoothK = input.int(3, 'Smooth', group='Strategy 2: RSI')

// * Inputs strategy 3: EMA oversold/overbought

str_3 = input.bool(true, 'Strategy 3: RSI', group='Strategy 3: RSI')

long_RSI2 = input.float(77, 'Exit EMA Long', minval=0.0, step=1, group='Strategy 3: RSI')

short_RSI2 = input.float(30, 'Exit EMA Short', minval=0.0, step=1, group='Strategy 3: RSI')

// * Inputs strategy 4: Supertrend

str_4 = input.bool(true, 'Strategy 4: Supertrend', group='Strategy 4: Supertrend')

periods_4 = input.int(2, 'ATR Period', group='Strategy 4: Supertrend')

source_4 = input.source(hl2, 'Source', group='Strategy 4: Supertrend')

multiplier = input.float(2.4, 'ATR Multiplier', step=0.1, group='Strategy 4: Supertrend')

change_ATR = input.bool(true, 'Change ATR Calculation Method ?', group='Strategy 4: Supertrend')

// * Inputs strategy 5: MA

str_5 = input.bool(true, 'Strategy 5: MA', group='Strategy 5: MA')

MA1_period_5 = input.int(46, 'MA 1', minval=1, maxval=9999, step=1, group='Strategy 5: MA')

MA1_type_5 = input.string('EMA', 'MA1 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 5: MA')

MA1_source_5 = input.source(close, 'MA1 Source', group='Strategy 5: MA')

MA2_period_5 = input.int(82, 'MA 2', minval=1, maxval=9999, step=1, group='Strategy 5: MA')

MA2_type_5 = input.string('EMA', 'MA2 Type', options=['RMA', 'SMA', 'EMA', 'WMA', 'HMA', 'DEMA', 'TEMA', 'VWMA'], group='Strategy 5: MA')

MA2_source_5 = input.source(close, 'MA2 Source', group='Strategy 5: MA')

// * Inputs Potential TOP/BOTTOM

str_6 = input.bool(false, 'Потенциальные ордера long/short', group='Potential TOP/BOTTOM')

top_qty = input.float(30, 'Лонг закрыть (%) из оставшейся позиции', minval=0.0, maxval=100, step=1, group='Potential TOP/BOTTOM')

bottom_qty = input.float(30, 'Шорт закрыть (%) из оставшейся позиции', minval=0.0, maxval=100, step=1, group='Potential TOP/BOTTOM')

source_6_top = input.source(close, 'TP-TOP на предыдущий', group='Potential TOP/BOTTOM')

source_6_bottom = input.source(close, 'TP-BOTTOM на предыдущий', group='Potential TOP/BOTTOM')

long_trail_perc = input.float(150, 'Объем Long (%)', minval=0.0, step=1, group='Potential TOP/BOTTOM') * 0.01

short_trail_perc = input.float(150, 'Объем Short (%)', minval=0.0, step=1, group='Potential TOP/BOTTOM') * 0.01

// * Flags

FLAG_SIGNALS = input.bool(true, 'Show Buy/Sell Signals ?', group='Miscellaneous')

FLAG_SHADOWS = input.bool(true, 'Show shadows satisfied strategies ?', group='Miscellaneous')

// * Alarms

alarm_label_long = input.string('Buy', 'Label open long', group='Basic alarm system')

alarm_label_short = input.string('Sell', 'Label open short', group='Basic alarm system')

alarm_label_close_long = input.string('Close long', 'Label close long', group='Basic alarm system')

alarm_label_close_short = input.string('Close short', 'Label close short', group='Basic alarm system')

alarm_label_TP_long = input.string('TP long', 'Label Take Profit long', group='Basic alarm system')

alarm_label_TP_short = input.string('TP short', 'Label Take Profit short', group='Basic alarm system')

alarm_label_SL = input.string('SL', 'Label Stop-Loss', group='Basic alarm system')

// *************************************************************************************************************************************************************************************************************************************************************************

// ABBREVIATIONS

// *************************************************************************************************************************************************************************************************************************************************************************

// TP: Take profits

// SL: Stop-Loss

// *************************************************************************************************************************************************************************************************************************************************************************

// GLOBAL VARIABLES

// *************************************************************************************************************************************************************************************************************************************************************************

start = timestamp(from_year, from_month, from_day, 00, 00) // backtest start window

end = timestamp(to_year, to_month, to_day, 23, 59)// backtest finish window

var FLAG_FIRST = false

var price_stop_long = 0.

var price_stop_short = 0.

var profit_qty = 0. // Quantity to close per TP from open position

var profit_perc = 0. // Percentage to take profits since open position or last TP

var nextTP = 0. // Next target to take profits

var since_entry = 0 // Number of bars since open last postion

var since_close = 0 // Number of bars since close or TP/STOP last position

// * Compute profit quantity and profit percentage

if strategy.position_size > 0

profit_qty := long_profit_qty

profit_perc := long_profit_perc

else if strategy.position_size < 0

profit_qty := short_profit_qty

profit_perc := short_profit_perc

else

nextTP := 0. // Next Take Profit target (out of market)

// *************************************************************************************************************************************************************************************************************************************************************************

// FUNCTIONS

// *************************************************************************************************************************************************************************************************************************************************************************

// * MA type

// *************************************************************************************************************************************************************************************************************************************************************************

ma(MAType, MASource, MAPeriod) =>

if MAType == 'SMA'

ta.sma(MASource, MAPeriod)

else if MAType == 'EMA'

ta.ema(MASource, MAPeriod)

else if MAType == 'WMA'

ta.wma(MASource, MAPeriod)

else if MAType == 'RMA'

ta.rma(MASource, MAPeriod)

else if MAType == 'HMA'

ta.wma(2 * ta.wma(MASource, MAPeriod / 2) - ta.wma(MASource, MAPeriod), math.round(math.sqrt(MAPeriod)))

else if MAType == 'DEMA'

e = ta.ema(MASource, MAPeriod)

2 * e - ta.ema(e, MAPeriod)

else if MAType == 'TEMA'

e = ta.ema(MASource, MAPeriod)

3 * (e - ta.ema(e, MAPeriod)) + ta.ema(ta.ema(e, MAPeriod), MAPeriod)

else if MAType == 'VWMA'

ta.vwma(MASource, MAPeriod)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Number strategies

// *************************************************************************************************************************************************************************************************************************************************************************

n_strategies() =>

var result = 0.

if str_1

result := 1.

if str_2

result += 1.

if str_3

result += 1.

if str_4

result += 1.

if str_5

result += 1.

// *************************************************************************************************************************************************************************************************************************************************************************

// * Price take profit

// *************************************************************************************************************************************************************************************************************************************************************************

price_takeProfit(percentage, N) =>

if strategy.position_size > 0

strategy.position_avg_price * (1 + N * percentage)

else

strategy.position_avg_price * (1 - N * percentage)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Weigthed values

// *************************************************************************************************************************************************************************************************************************************************************************

weight_values(signal) =>

if signal

weight = 1.0

else

weight = 0.

// *************************************************************************************************************************************************************************************************************************************************************************

// * Weigthed total

// *************************************************************************************************************************************************************************************************************************************************************************

weight_total(signal1, signal2, signal3, signal4, signal5) =>

weight_str1 * weight_values(signal1) + weight_str2 * weight_values(signal2) + weight_str3 * weight_values(signal3) + weight_str4 * weight_values(signal4) + weight_str5 * weight_values(signal5)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Set alert TP message

// *************************************************************************************************************************************************************************************************************************************************************************

set_alarm_label_TP() =>

if strategy.position_size > 0

alarm_label_TP_long

else if strategy.position_size < 0

alarm_label_TP_short

// *************************************************************************************************************************************************************************************************************************************************************************

// * Color

// *************************************************************************************************************************************************************************************************************************************************************************

colors(type, value=0) =>

switch str.lower(type)

'buy'=> color.new(color.aqua, value)

'sell' => color.new(color.gray, value)

'TP' => color.new(color.aqua, value)

'SL' => color.new(color.gray, value)

'signal' => color.new(color.orange, value)

'profit' => color.new(color.teal, value)

'loss' => color.new(color.red, value)

'info' => color.new(color.white, value)

'highlights' => color.new(color.orange, value)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Bar since last entry

// *************************************************************************************************************************************************************************************************************************************************************************

bars_since_entry() =>

bar_index - strategy.opentrades.entry_bar_index(0)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Bar since close or TP/STOP

// *************************************************************************************************************************************************************************************************************************************************************************

bars_since_close() =>

ta.barssince(ta.change(strategy.closedtrades))

// *************************************************************************************************************************************************************************************************************************************************************************

// ADDITIONAL GLOBAL VARIABLES

// *************************************************************************************************************************************************************************************************************************************************************************

// * Compute time since last entry and last close/TP position

since_entry := bars_since_entry()

since_close := bars_since_close()

if strategy.opentrades == 0

since_entry := delay_exit

if strategy.closedtrades == 0

since_close := delay_exit

// *************************************************************************************************************************************************************************************************************************************************************************

// STRATEGIES

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 1: MACD

// *************************************************************************************************************************************************************************************************************************************************************************

MA1 = ma(MA1_type_1, MA1_source_1, MA1_period_1)

MA2 = ma(MA2_type_1, MA2_source_1, MA2_period_1)

MACD = MA1 - MA2

signal = ma('SMA', MACD, 9)

trend= MACD - signal

long = MACD > signal

short = MACD < signal

proportion = math.abs(MACD / signal)

// * Conditions

long_signal1 = long and long[delay_macd - 1] and not long[delay_macd]

short_signal1 = short and short[delay_macd - 1] and not short[delay_macd]

close_long1 = short and not long[delay_macd]

close_short1 = long and not short[delay_macd]

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 2: STOCH RSI

// *************************************************************************************************************************************************************************************************************************************************************************

rsi = ta.rsi(close, length_RSI)

srsi = ta.stoch(rsi, rsi, rsi, length_stoch)

k = ma('SMA', srsi, smoothK)

isRsiOB = k >= long_RSI

isRsiOS = k <= short_RSI

// * Conditions

long_signal2 = isRsiOS[delay_srsi] and not isRsiOB and since_entry >= delay_exit and since_close >= delay_exit

short_signal2 = isRsiOB[delay_srsi] and not isRsiOS and since_entry >= delay_exit and since_close >= delay_exit

close_long2 = short_signal2

close_short2 = long_signal2

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 3: RSI

// *************************************************************************************************************************************************************************************************************************************************************************

isRsiOB2 = rsi >= long_RSI2

isRsiOS2 = rsi <= short_RSI2

// * Conditions

long_signal3 = isRsiOS2[delay_rsi] and not isRsiOB2 and since_entry >= delay_exit and since_close >= delay_exit

short_signal3 = isRsiOB2[delay_rsi] and not isRsiOS2 and since_entry >= delay_exit and since_close >= delay_exit

close_long3 = short_signal3

close_short3 = long_signal3

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 4: SUPERTREND

// *************************************************************************************************************************************************************************************************************************************************************************

atr2 = ma('SMA', ta.tr, periods_4)

atr = change_ATR ? ta.atr(periods_4) : atr2

up = source_4 - multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = source_4 + multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend := 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// * Conditions

long4 = trend == 1

short4 = trend == -1

long_signal4 = trend == 1 and trend[delay_super - 1] == 1 and trend[delay_super] == -1

short_signal4 = trend == -1 and trend[delay_super - 1] == -1 and trend[delay_super] == 1

changeCond = trend != trend[1]

close_long4 = short_signal4

close_short4 = short_signal4

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 5: MA CROSS

// *************************************************************************************************************************************************************************************************************************************************************************

MA12 = ma(MA1_type_5, MA1_source_5, MA1_period_5)

MA22 = ma(MA2_type_5, MA2_source_5, MA2_period_5)

long5 = MA12 > MA22

short5 = MA12 < MA22

// * Conditions

long_signal5 = long5 and long5[delay_cross - 1] and not long5[delay_cross]

short_signal5 = short5 and short5[delay_cross - 1] and not short5[delay_cross]

close_long5 = short5 and not long5[delay_cross]

close_short5 = long5 and not short5[delay_cross]

// *************************************************************************************************************************************************************************************************************************************************************************

// * STRATEGY 6: POTENTIAL TOP/BOTTOM

// *************************************************************************************************************************************************************************************************************************************************************************

// * Combination RSI, Stoch RSI, MACD, volume, and weighted-strategy to detect potential TOP/BOTTOMS areas

volumeRSI_condition = volume[2] > volume[3] and volume[2] > volume[4] and volume[2] > volume[5]

condition_OB1 = isRsiOB2 and (isRsiOB or volume < ma('SMA', volume, 20) / 2) and volumeRSI_condition

condition_OS1 = isRsiOS2 and (isRsiOS or volume < ma('SMA', volume, 20) / 2) and volumeRSI_condition

condition_OB2 = volume[2] / volume[1] > (1.0 + long_trail_perc) and isRsiOB and volumeRSI_condition

condition_OS2 = volume[2] / volume[1] > (1.0 + short_trail_perc) and isRsiOS and volumeRSI_condition

condition_OB3 = weight_total(MACD < signal, isRsiOB, isRsiOB2, short4, short5) >= weight_trigger

condition_OS3 = weight_total(MACD > signal, isRsiOS, isRsiOS2, long4, long5) >= weight_trigger

condition_OB = (condition_OB1 or condition_OB2)

condition_OS = (condition_OS1 or condition_OS2)

condition_OB_several = condition_OB[1] and condition_OB[2] or condition_OB[1] and condition_OB[3] or condition_OB[1] and condition_OB[4] or condition_OB[1] and condition_OB[5] or condition_OB[1] and condition_OB[6] or condition_OB[1] and condition_OB[7]

condition_OS_several = condition_OS[1] and condition_OS[2] or condition_OS[1] and condition_OS[3] or condition_OS[1] and condition_OS[4] or condition_OS[1] and condition_OS[5] or condition_OS[1] and condition_OS[6] or condition_OS[1] and condition_OS[7]

// *************************************************************************************************************************************************************************************************************************************************************************

// STRATEGY ENTRIES AND EXITS

// *************************************************************************************************************************************************************************************************************************************************************************

long_SL = close - ((close / 100) * procent_stop)

long_OP = close

long_TP_1 = close + ((close / 100) * (procent_teik * 1.1))

long_TP_2 = close + ((close / 100) * (procent_teik * 1.8))

long_TP_3 = close + ((close / 100) * (procent_teik * 2.8))

long_TP_4 = close + ((close / 100) * (procent_teik * 4.5))

short_SL = close + ((close / 100) * procent_stop)

short_OP = close

short_TP_1 = close - ((close / 100) * (procent_teik * 1.1))

short_TP_2 = close - ((close / 100) * (procent_teik * 1.8))

short_TP_3 = close - ((close / 100) * (procent_teik * 2.8))

short_TP_4 = close - ((close / 100) * (procent_teik * 4.5))

if time >= start and time <= end

// ***************************************************************************************************************************************************************************

// * Set Entries

// ***************************************************************************************************************************************************************************

if str_0

if not str_1

weight_str1 := 0

if not str_2

weight_str2 := 0

if not str_3

weight_str3 := 0

if not str_4

weight_str4 := 0

if not str_5

weight_str5 := 0

if allow_shorts == true

w_total = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

if w_total >= weight_trigger

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

strategy.entry('Short', strategy.short)

if allow_longs == true

w_total = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

if w_total >= weight_trigger

strategy.entry('Long', strategy.long)

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

else

if allow_shorts == true

if str_1

strategy.entry('Short', strategy.short, when=short_signal1)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_2

strategy.entry('Short', strategy.short, when=short_signal2)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_3

strategy.entry('Short', strategy.short, when=short_signal3)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_4

strategy.entry('Short', strategy.short, when=short_signal4)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_5

strategy.entry('Short', strategy.short, when=short_signal5)

// alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + str.tostring(math.round_to_mintick(close)) + '"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('SHORT') + ' ' + str.tostring(math.round_to_mintick(short_TP_1)) + ' ' + str.tostring(math.round_to_mintick(short_TP_2)) + ' ' + str.tostring(math.round_to_mintick(short_TP_3)) + ' ' + str.tostring(math.round_to_mintick(short_TP_4)) + ' ' + str.tostring(math.round_to_mintick(short_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if allow_longs == true

if str_1

strategy.entry('Long', strategy.long, when=long_signal1)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_2

strategy.entry('Long', strategy.long, when=long_signal2)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_3

strategy.entry('Long', strategy.long, when=long_signal3)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_4

strategy.entry('Long', strategy.long, when=long_signal4)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

if str_5

strategy.entry('Long', strategy.long, when=long_signal5)

// alert('{"chat_id":"'+ chat_id +'","text":"#' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' min'+ '\n' + str.tostring('LONG') + '\n' +'Вход на 1-3% от депозита \n' + 'TP 1: ' + str.tostring(math.round_to_mintick(long_TP_1)) + '\n' + 'TP 2: ' + str.tostring(math.round_to_mintick(long_TP_2)) + '\n' + 'TP 3: ' + str.tostring(math.round_to_mintick(long_TP_3)) + '\n' + 'TP 4: ' + str.tostring(math.round_to_mintick(long_TP_4)) + '\n' + '?? STOP: ' + str.tostring(math.round_to_mintick(long_SL)) +'"}')

alert('{"chat_id":"'+ chat_id +'","text":"' + syminfo.ticker + ' ' + str.tostring(timeframe.period) + ' ' + str.tostring('LONG') + ' ' + str.tostring(math.round_to_mintick(long_TP_1)) + ' ' + str.tostring(math.round_to_mintick(long_TP_2)) + ' ' + str.tostring(math.round_to_mintick(long_TP_3)) + ' ' + str.tostring(math.round_to_mintick(long_TP_4)) + ' ' + str.tostring(math.round_to_mintick(long_SL)) + ' ' + str.tostring(math.round_to_mintick(close)) + '"}')

// ***************************************************************************************************************************************************************************

// * Set Take Profits

// ***************************************************************************************************************************************************************************

if strategy.position_size != 0 and take_profits and since_entry == 0

for i = 1 to MAX_TP

id = 'TP ' + str.tostring(i)

strategy.exit(id=id, limit=price_takeProfit(profit_perc, i), qty_percent=profit_qty, comment=id)

// ***************************************************************************************************************************************************************************

// * Set Stop loss

// ***************************************************************************************************************************************************************************

if strategy.position_size > 0

if since_close == 0

if high > price_takeProfit(profit_perc, 6) and MAX_TP >= 6

n = 6

nextTP := na

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 5) and MAX_TP >= 5

n = 5

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 4) and MAX_TP >= 4

n = 4

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_long := price_takeProfit(profit_perc, n-3)

else if high > price_takeProfit(profit_perc, 3) and MAX_TP >= 3

n = 3

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_long := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if high > price_takeProfit(profit_perc, 2) and MAX_TP >= 2

n = 2

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_long := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if high > price_takeProfit(profit_perc, 1) and MAX_TP >= 1

n = 1

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_long := strategy.position_avg_price * (1 + n*profit_perc - stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_long := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_long := strategy.position_avg_price

if since_entry == 0

n = 0

nextTP := price_takeProfit(profit_perc, n + 1)

price_stop_long := strategy.position_avg_price * (1 - stoploss_perc)

if strategy.position_size < 0

if since_close == 0

if low < price_takeProfit(profit_perc, 6) and MAX_TP >= 6

n = 6

nextTP := na

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 5) and MAX_TP >= 5

n = 5

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 4) and MAX_TP >= 4

n = 4

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3'

price_stop_short := price_takeProfit(profit_perc, n-3)

else if low < price_takeProfit(profit_perc, 3) and MAX_TP >= 3

n = 3

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2'

price_stop_short := price_takeProfit(profit_perc, n-2)

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if low < price_takeProfit(profit_perc, 2) and MAX_TP >= 2

n = 2

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1'

price_stop_short := price_takeProfit(profit_perc, n-1)

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if low < price_takeProfit(profit_perc, 1) and MAX_TP >= 1

n = 1

nextTP := price_takeProfit(profit_perc, n + 1)

if movestoploss == 'Percentage'

price_stop_short := strategy.position_avg_price * (1 - n*profit_perc + stoploss_perc * move_stoploss_factor)

else if movestoploss == 'TP-1' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-2' and movestoploss_entry

price_stop_short := strategy.position_avg_price

else if movestoploss == 'TP-3' and movestoploss_entry

price_stop_short := strategy.position_avg_price

if since_entry == 0

n = 0

nextTP := price_takeProfit(profit_perc, n + 1)

price_stop_short := strategy.position_avg_price * (1 + stoploss_perc)

// ***************************************************************************************************************************************************************************

// * Set Exits

// ***************************************************************************************************************************************************************************

if allow_longs == true and allow_shorts == false

if str_0

w_total = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

strategy.close('Long', when=w_total>=weight_trigger, qty_percent=100, comment='SHORT')

else

if str_1

strategy.close('Long', when=close_long1, qty_percent=100, comment='SHORT')

if str_2

strategy.close('Long', when=close_long2, qty_percent=100, comment='SHORT')

if str_3

strategy.close('Long', when=close_long3, qty_percent=100, comment='SHORT')

if str_4

strategy.close('Long', when=close_long4, qty_percent=100, comment='SHORT')

if str_5

strategy.close('Long', when=close_long5, qty_percent=100, comment='SHORT')

if allow_longs == false and allow_shorts == true

if str_0

w_total = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

strategy.close('Short', when=w_total>=weight_trigger, qty_percent=100, comment='LONG')

else

if str_1

strategy.close('Short', when=close_long1, qty_percent=100, comment='LONG')

if str_2

strategy.close('Short', when=close_long2, qty_percent=100, comment='LONG')

if str_3

strategy.close('Short', when=close_long3, qty_percent=100, comment='LONG')

if str_4

strategy.close('Short', when=close_long4, qty_percent=100, comment='LONG')

if str_5

strategy.close('Short', when=close_long5, qty_percent=100, comment='LONG')

if allow_shorts == true and strategy.position_size < 0 and stoploss and since_entry > 0

strategy.close('Short', when=stop_source >= price_stop_short, qty_percent=100, comment='STOP')

if str_6

if top_qty == 100

strategy.close('Short', when=condition_OS_several, qty_percent=bottom_qty, comment='STOP')

else

strategy.exit('Short', when=condition_OS_several, limit=source_6_bottom[1], qty_percent=bottom_qty, comment='TP-B')

if allow_longs == true and strategy.position_size > 0 and stoploss and since_entry > 0

strategy.close('Long', when=stop_source <= price_stop_long, qty_percent=100, comment='STOP')

if str_6

if top_qty == 100

strategy.close('Long', when=condition_OB_several, qty_percent=top_qty, comment='STOP')

else

strategy.exit('Long', when=condition_OB_several, limit=source_6_top[1], qty_percent=top_qty, comment='TP-T')

// ***********************************************************************************************************************************************************************************************************************************************************************************

// * Data window - debugging

// *************************************************************************************************************************************************************************************************************************************************************************

price_stop = strategy.position_size > 0 ? price_stop_long : price_stop_short

// *************************************************************************************************************************************************************************************************************************************************************************

// * Buy/Sell signals

// *************************************************************************************************************************************************************************************************************************************************************************

w_total_long = weight_total(long_signal1, long_signal2, long_signal3, long_signal4, long_signal5)

w_total_short = weight_total(short_signal1, short_signal2, short_signal3, short_signal4, short_signal5)

// *************************************************************************************************************************************************************************************************************************************************************************

// * Stop loss targets

// *************************************************************************************************************************************************************************************************************************************************************************

plot(series=(strategy.position_size > 0) ? price_stop_long : na, color=color.gray, style=plot.style_cross, linewidth=2, transp=30, title="Long Stop Loss")

plot(series=(strategy.position_size < 0) ? price_stop_short : na, color=color.gray, style=plot.style_cross, linewidth=2, transp=30, title="Short Stop Loss")

// *************************************************************************************************************************************************************************************************************************************************************************

// * TP targets

// *************************************************************************************************************************************************************************************************************************************************************************

plot(strategy.position_size > 0 or strategy.position_size < 0 ? nextTP : na, color=color.aqua, style=plot.style_cross, linewidth=2, transp=30, title="Next TP")

// *************************************************************************************************************************************************************************************************************************************************************************