A estratégia de Zhao é focada no dinheiro inteligente do mercado de fim de semana.

Sabia que o mercado de criptomoedas escondeu o seu porão enquanto os grandes capitais de Wall Street estavam de férias no fim de semana? Esta estratégia é como um guarda-costas noturno, que sai quando os investidores institucionais estão “fora do escritório”.

O foco!A estratégia é de negociar somente aos sábados, especialmente no horário de 0 a 8 horas UTC no domingo. Porquê? Porque é um momento em que a mobilidade é relativamente baixa e a eficácia da análise técnica é mais alta, assim como é mais fácil ouvir sons pequenos em bibliotecas silenciosas.

A fusão de múltiplos indicadores: não lutar sozinho

A estratégia é como montar uma aliança de vingadores:

- RSI ((8 ciclos)O que é que o governo está a fazer?

- MACD(8,17,9)Confirmação da dinâmica

- Cinturão de BrinIdentificar áreas de preços extremos

- CVD desviaçãoO que é o dinheiro inteligente: descobrindo o verdadeiro propósito

Guia para evitar poçosA confirmação de um único indicador é como assistir a um filme sozinho, facilmente enganado pela trama. A confirmação de vários indicadores é como assistir a um filme com amigos, onde você pode ouvir diferentes pontos de vista!

A gestão inteligente de dinheiro: 500 dólares para brincar

A parte mais interessante é que o sistema foi projetado para pequenos investidores:

- O mínimo é de 120 dólares por folha.Não te dará um “haha”

- Até 4 posições simultâneas“Não ponha os ovos em uma cesta, disperse os riscos”

- 5-20 vezes a alavancagem dinâmicaO que é o mercado de ações?

Como se fosse um carro, você pode ir rápido na estrada, mas devagar na estrada. O sistema ajusta o tamanho da posição de acordo com as características de risco de diferentes moedas.

️ Controle de Risco: Preocupar-se mais do que você

Mecanismo de proteção tripla:

- Perda máxima de 5% por dia“Você perdeu muito hoje?

- Perda de fim-de-semana até 15%“Afinal, o fim de semana tem um limite”

- Quatro paradas consecutivas de perdasPrevenção de transações emocionais

Sistema de travagem de emergênciaSe a perda for superior a 30%, todas as transações serão interrompidas imediatamente. É como o sistema ABS de um carro, que pode salvar vidas em momentos críticos!

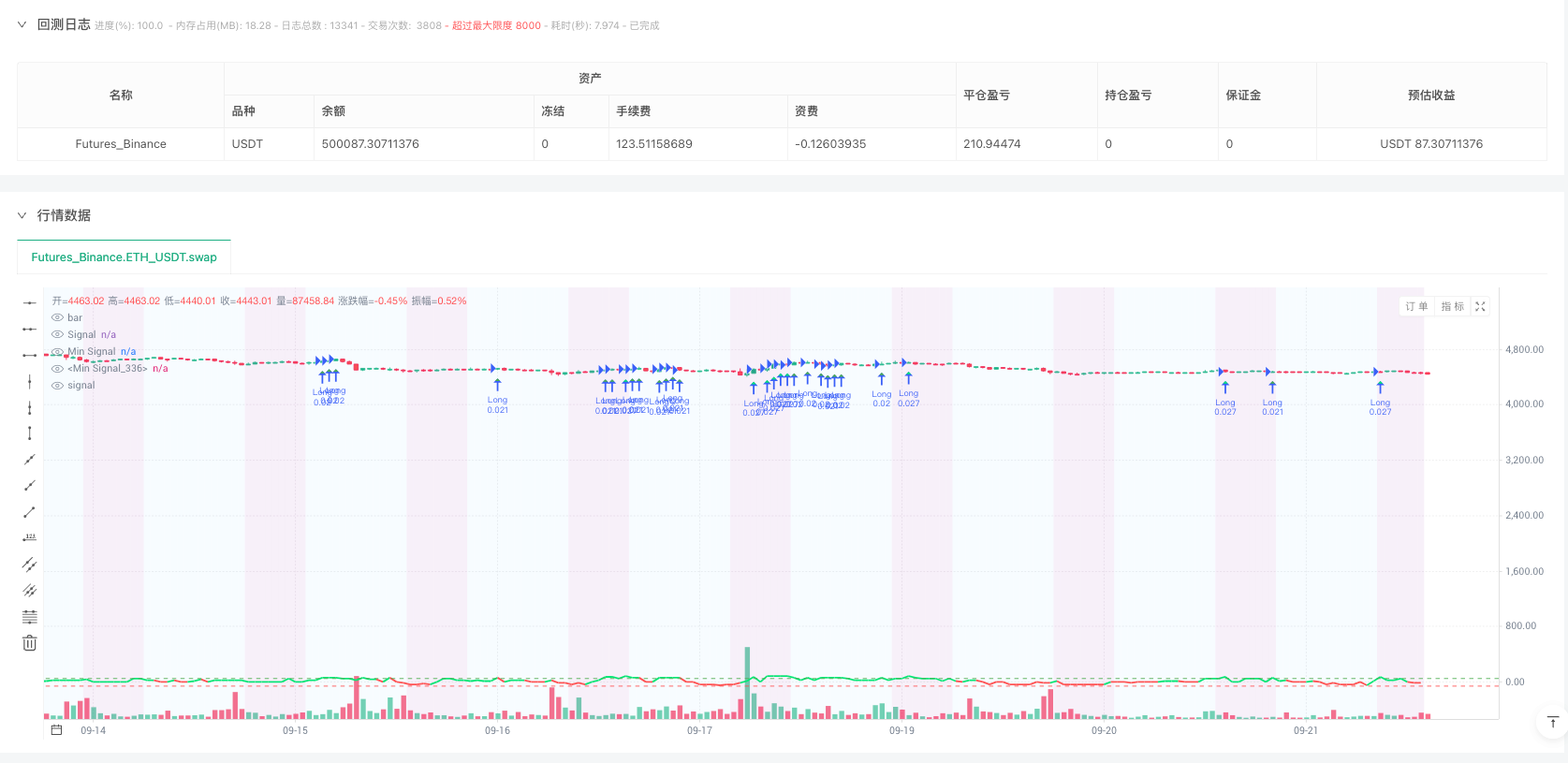

/*backtest

start: 2024-09-24 00:00:00

end: 2025-09-22 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":500000}]

*/

//@version=6

strategy("Weekend Hunter Ultimate v6.2 [PRODUCTION READY]",

overlay=true,

pyramiding=0,

calc_bars_count=5000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=10,

commission_type=strategy.commission.percent,

commission_value=0.075,

slippage=3,

initial_capital=500)

// ========================================

// WEEKEND-ONLY CONFIGURATION

// ========================================

enable_weekend_only = input.bool(true, "WEEKEND TRADING ONLY", tooltip="Saturday-Sunday when institutions are offline")

weekend_start_day = input.string("Saturday", "Weekend Start", options=["Friday", "Saturday"])

weekend_end_day = input.string("Sunday", "Weekend End", options=["Sunday", "Monday"])

// Optimal Weekend Windows (Research-Based)

optimal_saturday_start = input.int(0, "Saturday Start Hour (UTC)", minval=0, maxval=23)

optimal_sunday_end = input.int(23, "Sunday End Hour (UTC)", minval=0, maxval=23)

prime_sunday_window = input.bool(true, "Enable Prime Sunday Window (0-8 UTC)")

// Weekend Detection Logic

is_saturday = dayofweek == dayofweek.saturday

is_sunday = dayofweek == dayofweek.sunday

is_weekend = is_saturday or is_sunday

current_hour = hour(time)

// Prime Weekend Window

in_prime_window = is_sunday and current_hour >= 0 and current_hour <= 8

in_weekend_hours = (is_saturday and current_hour >= optimal_saturday_start) or

(is_sunday and current_hour <= optimal_sunday_end)

weekend_trading_active = enable_weekend_only ? (is_weekend and in_weekend_hours) : true

// ========================================

// POSITION & CAPITAL MANAGEMENT

// ========================================

var float daily_pnl = 0.0

var float weekend_pnl = 0.0

var int last_day = 0

var int consecutive_losses = 0

// Maximum concurrent positions with $500

max_concurrent_positions = 4

current_positions = strategy.opentrades

// Smart Capital Management

available_capital = strategy.equity - (strategy.position_size * close)

min_capital_per_trade = 120.0

safety_buffer = 50.0

can_afford_position = available_capital > (min_capital_per_trade + safety_buffer)

position_available = current_positions < max_concurrent_positions

// ========================================

// AGGRESSIVE 65% WIN RATE CONFIGURATION

// ========================================

historical_win_rate = input.float(65.0, "Target Win Rate %", minval=60.0, maxval=70.0) / 100

avg_win_percent = input.float(5.5, "Average Win %", minval=4.0, maxval=7.0) / 100

avg_loss_percent = input.float(1.8, "Average Loss %", minval=1.5, maxval=2.5) / 100

// Loss Limits

max_daily_loss = input.float(5.0, "Max Daily Loss %", minval=3.0, maxval=8.0)

max_weekend_loss = input.float(15.0, "Max Weekend Loss %", minval=10.0, maxval=20.0)

max_consecutive_losses_allowed = 4

// ========================================

// DYNAMIC LEVERAGE SYSTEM 5-20x

// ========================================

min_leverage = input.float(5.0, "Minimum Leverage", minval=5.0, maxval=10.0)

max_leverage = input.float(20.0, "Maximum Leverage", minval=15.0, maxval=25.0)

// EXACT COIN-SPECIFIC RISK PROFILES

symbol_risk_profile = syminfo.ticker == "BTCUSDT" ? 0.9 :

syminfo.ticker == "ETHUSDT" ? 0.85 :

syminfo.ticker == "LINKUSDT" ? 0.75 :

syminfo.ticker == "XRPUSDT" ? 0.75 :

syminfo.ticker == "DOGEUSDT" ? 0.6 :

syminfo.ticker == "SOLUSDT" ? 0.7 :

syminfo.ticker == "AVAXUSDT" ? 0.7 :

syminfo.ticker == "1000PEPEUSDT" ? 0.5 :

syminfo.ticker == "TONUSDT" ? 0.65 :

syminfo.ticker == "POLUSDT" ? 0.7 : 0.5

// ========================================

// PROFIT PROTECTION SYSTEM

// ========================================

use_trailing = input.bool(true, "Enable Smart Trailing", tooltip="Protects profits when approaching target")

trailing_activation_percent = input.float(2.5, "Trailing Activation %", minval=2.0, maxval=3.5)

trailing_distance_percent = input.float(1.5, "Trail Distance %", minval=1.0, maxval=2.0)

// ========================================

// MULTI-TIMEFRAME CONFLUENCE

// ========================================

// 4H Trend Bias

htf_4h_close = request.security(syminfo.tickerid, "240", close, lookahead=barmerge.lookahead_off)

htf_4h_ema50 = request.security(syminfo.tickerid, "240", ta.ema(close, 50), lookahead=barmerge.lookahead_off)

// 1H Momentum Confirmation - Fixed MACD

[htf_1h_macd, htf_1h_signal, htf_1h_hist] = request.security(syminfo.tickerid, "60", ta.macd(close, 12, 26, 9), lookahead=barmerge.lookahead_off)

htf_1h_rsi = request.security(syminfo.tickerid, "60", ta.rsi(close, 14), lookahead=barmerge.lookahead_off)

// Trend Alignment Scoring

htf_4h_trend = htf_4h_close > htf_4h_ema50 ? 1 : -1

htf_1h_momentum = htf_1h_macd > htf_1h_signal ? 1 : -1

current_trend = close > ta.ema(close, 20) ? 1 : -1

trend_alignment = (htf_4h_trend + htf_1h_momentum + current_trend) / 3.0

// ========================================

// VOLATILITY & MARKET REGIME

// ========================================

atr_period = 14

atr_value = ta.atr(atr_period)

atr_percentage = (atr_value / close) * 100

volatility_regime = atr_percentage < 2.0 ? "Low" : atr_percentage < 5.0 ? "Medium" : "High"

// Weekend Liquidity Adjustment

volume_sma = ta.sma(volume, 20)

current_liquidity_ratio = volume / volume_sma

weekend_liquidity_adjustment = is_weekend ? math.min(current_liquidity_ratio * 0.8, 1.0) : 1.0

// ========================================

// CVD DIVERGENCE DETECTION

// ========================================

var float cvd = 0.0

bull_volume = close > open ? volume : 0

bear_volume = close < open ? volume : 0

volume_delta = bull_volume - bear_volume

cvd := cvd + volume_delta

// Divergence Detection

price_higher = close > close[10]

cvd_lower = cvd < cvd[10]

bearish_divergence = price_higher and cvd_lower

price_lower = close < close[10]

cvd_higher = cvd > cvd[10]

bullish_divergence = price_lower and cvd_higher

// ========================================

// SIGNAL GENERATION SYSTEM

// ========================================

// Primary Indicators

rsi = ta.rsi(close, 8)

// Fixed MACD unpacking

[macd_line, signal_line, histogram] = ta.macd(close, 8, 17, 9)

// Fixed Bollinger Bands unpacking

[bb_upper, bb_middle, bb_lower] = ta.bb(close, 20, 2.5)

// Volume Confirmation

volume_surge = volume > (volume_sma * 1.5)

min_volume_threshold = ta.sma(volume, 100) * 0.1

valid_volume = volume > min_volume_threshold

volume_confirmation = volume_surge and current_liquidity_ratio > 0.7 and valid_volume

// Signal Strength Calculation

var float signal_strength = 0.0

// Trend Component (40% weight)

trend_score = trend_alignment * 40

// Momentum Component (30% weight)

momentum_bullish = rsi < 30 and rsi > rsi[1]

momentum_bearish = rsi > 70 and rsi < rsi[1]

momentum_score = momentum_bullish ? 30 : momentum_bearish ? -30 : 0

// Volume Component (20% weight)

volume_score = volume_confirmation ? 20 : 0

volume_score := volume_score + (bullish_divergence ? 10 : bearish_divergence ? -10 : 0)

// Weekend Component (10% weight) - Fixed type

weekend_score = is_weekend ? 10.0 : 0.0

if in_prime_window

weekend_score := weekend_score * 1.5

signal_strength := trend_score + momentum_score + volume_score + weekend_score

// Weekend Signal Boost

if is_weekend

signal_strength := signal_strength * 1.2

if in_prime_window

signal_strength := signal_strength * 1.3

// ========================================

// DYNAMIC LEVERAGE CALCULATION

// ========================================

// Safety Score Components

volatility_safety = volatility_regime == "Low" ? 1.0 : volatility_regime == "Medium" ? 0.7 : 0.4

signal_confidence = math.abs(signal_strength) / 100

overall_safety = (volatility_safety + signal_confidence) / 2 * symbol_risk_profile

// Calculate Dynamic Leverage

leverage_range = max_leverage - min_leverage

dynamic_leverage = min_leverage + (leverage_range * overall_safety)

final_leverage = math.round(math.max(min_leverage, math.min(max_leverage, dynamic_leverage)), 1)

// ========================================

// POSITION SIZING WITH CAPITAL CHECK

// ========================================

// Signal Thresholds

min_signal_strength = input.float(55.0, "Minimum Signal Strength", minval=45.0, maxval=65.0)

high_confidence_threshold = input.float(75.0, "High Confidence Threshold", minval=70.0, maxval=85.0)

high_confidence = math.abs(signal_strength) > high_confidence_threshold

position_multiplier = high_confidence ? 1.3 : 1.0

// Calculate Position Size

base_position_usd = 120.0

desired_position_usd = base_position_usd * position_multiplier

// Pair-specific adjustment

pair_multiplier = syminfo.ticker == "1000PEPEUSDT" ? 0.5 : syminfo.ticker == "BTCUSDT" ? 1.0 : syminfo.ticker == "ETHUSDT" ? 1.0 : 0.8

final_position_usd = desired_position_usd * pair_multiplier

contracts = can_afford_position ? final_position_usd / close : 0

// ========================================

// ENTRY CONDITIONS WITH ALL SAFETY CHECKS

// ========================================

// Signal Conditions

strong_bullish_signal = signal_strength > min_signal_strength and trend_alignment > 0

strong_bearish_signal = signal_strength < -min_signal_strength and trend_alignment < 0

// Flash Crash Protection (8%)

flash_crash_detected = math.abs((close - close[4]) / close[4]) > 0.08

// Loss Tracking

if dayofmonth != last_day

daily_pnl := 0.0

if dayofweek == dayofweek.monday

weekend_pnl := 0.0

last_day := dayofmonth

daily_loss_pct = (daily_pnl / strategy.equity) * 100

weekend_loss_pct = (weekend_pnl / strategy.equity) * 100

loss_limits_active = daily_loss_pct <= -max_daily_loss or weekend_loss_pct <= -max_weekend_loss or consecutive_losses >= max_consecutive_losses_allowed

// Emergency Stop at -30% Account Level

account_emergency_stop = strategy.equity < (strategy.initial_capital * 0.7)

// Final Entry Conditions (fixed line continuation)

can_enter_long = strong_bullish_signal and weekend_trading_active and not loss_limits_active and position_available and can_afford_position and strategy.position_size == 0 and not flash_crash_detected and not account_emergency_stop

can_enter_short = strong_bearish_signal and weekend_trading_active and not loss_limits_active and position_available and can_afford_position and strategy.position_size == 0 and not flash_crash_detected and not account_emergency_stop

// ========================================

// DYNAMIC STOP LOSS & TAKE PROFIT

// ========================================

// ATR-Based with Leverage Adjustment

base_atr_mult_sl = input.float(1.5, "Base ATR Multiplier SL", minval=1.0, maxval=2.0)

base_atr_mult_tp = input.float(4.5, "Base ATR Multiplier TP", minval=3.5, maxval=6.0)

leverage_adjustment = 1.0 + (final_leverage - 5) / 50

atr_mult_sl = base_atr_mult_sl / leverage_adjustment

atr_mult_tp = base_atr_mult_tp * (1.0 + signal_confidence * 0.2)

stop_distance = atr_value * atr_mult_sl

tp_distance = atr_value * atr_mult_tp

long_stop = close - stop_distance

long_tp = close + tp_distance

short_stop = close + stop_distance

short_tp = close - tp_distance

// ========================================

// STRATEGY EXECUTION WITH ALERTS

// ========================================

// Long Entry with alert

if can_enter_long

alert_message = '{"action":"open_long","ticker":"' + syminfo.ticker + '","price":"' + str.tostring(close) + '","leverage":"' + str.tostring(final_leverage) + '","stop_loss":"' + str.tostring(long_stop) + '","take_profit":"' + str.tostring(long_tp) + '"}'

strategy.entry("Long", strategy.long, qty=contracts, comment="L " + str.tostring(final_leverage, "#.#") + "x S:" + str.tostring(signal_strength, "#"))

alert(alert_message, alert.freq_once_per_bar)

if use_trailing

strategy.exit("Long Exit", "Long", stop=long_stop, limit=long_tp, trail_points=close * trailing_activation_percent / 100, trail_offset=close * trailing_distance_percent / 100)

else

strategy.exit("Long Exit", "Long", stop=long_stop, limit=long_tp)

// Short Entry with alert

if can_enter_short

alert_message = '{"action":"open_short","ticker":"' + syminfo.ticker + '","price":"' + str.tostring(close) + '","leverage":"' + str.tostring(final_leverage) + '","stop_loss":"' + str.tostring(short_stop) + '","take_profit":"' + str.tostring(short_tp) + '"}'

strategy.entry("Short", strategy.short, qty=contracts, comment="S " + str.tostring(final_leverage, "#.#") + "x S:" + str.tostring(signal_strength, "#"))

alert(alert_message, alert.freq_once_per_bar)

if use_trailing

strategy.exit("Short Exit", "Short", stop=short_stop, limit=short_tp, trail_points=close * trailing_activation_percent / 100, trail_offset=close * trailing_distance_percent / 100)

else

strategy.exit("Short Exit", "Short", stop=short_stop, limit=short_tp)

// Emergency Exits with alert

if strategy.position_size != 0

entry_price = strategy.position_avg_price

current_profit_pct = strategy.position_size > 0 ? ((close - entry_price) / entry_price * 100) : ((entry_price - close) / entry_price * 100)

// Liquidation Protection

liq_distance = 100 / final_leverage * 0.8

approaching_liquidation = math.abs(current_profit_pct) > liq_distance

if approaching_liquidation or flash_crash_detected or account_emergency_stop

alert('{"action":"close_all","ticker":"' + syminfo.ticker + '"}', alert.freq_once_per_bar)

strategy.close_all(comment="EMERGENCY")

// Weekend End Exit

if dayofweek == dayofweek.monday and hour == 0 and strategy.position_size != 0

alert('{"action":"close_all","ticker":"' + syminfo.ticker + '"}', alert.freq_once_per_bar)

strategy.close_all(comment="Weekend End")

// Weekend Background

bgcolor(is_weekend ? color.new(color.blue, 95) : na, title="Weekend")

bgcolor(in_prime_window ? color.new(color.purple, 90) : na, title="Prime")

// Signal Strength

plot(signal_strength, "Signal", signal_strength > 0 ? color.lime : color.red, 2)

hline(min_signal_strength, "Min Signal", color.green, hline.style_dashed)

hline(-min_signal_strength, "Min Signal", color.red, hline.style_dashed)

// Entry Signals

plotshape(can_enter_long, "Long", shape.triangleup, location.belowbar, high_confidence ? color.lime : color.green, size=size.small)

plotshape(can_enter_short, "Short", shape.triangledown, location.abovebar, high_confidence ? color.red : color.maroon, size=size.small)

// Warnings

bgcolor(loss_limits_active ? color.new(color.red, 80) : na, title="Loss Limit")

bgcolor(account_emergency_stop ? color.new(color.purple, 80) : na, title="Emergency")