É a estratégia mais simples de uma FVG?

Não se deixe enganar pelo nome “Estratégia da Avó”.50 ciclo EMA julgar a direção da tendência + brecha de valor justo (FVG) capturar a oportunidade de reversão + 2x o risco de retorno em relação ao lucro de bloqueio◦ O retrospecto mostrou um excelente desempenho em mercados com tendências claras, mas exigindo um rigoroso cumprimento das condições de entrada.

Os principais destaques da estratégia:4K linhas de precisão de entrada de tempo❚C0-C1 formando o FVG, C2 varrendo a mobilidade para o retorno, C3 confirmando o sinal de reversão. ❚Este design é mais preciso do que a estratégia de invasão tradicional, evitando uma grande quantidade de falsas armadilhas de invasão.

Filtros de tendência da EMA: a tendência é a sua melhor amiga

A EMA de 50 ciclos não é uma linha de vida ou morteA estratégia exige que os sinais de cabeçadas múltiplas estejam acima da EMA e os sinais de cabeçadas vazias estejam abaixo da EMA. Este design filtra diretamente 70% das negociações adversas, aumentando significativamente a taxa de vitória.

Mais inteligente, você pode optar por usar o preço de fechamento de qualquer linha K para determinar a tendência do EMA. Por padrão, verifique a linha C0 (a linha K mais antiga) para garantir que todo o formato esteja na direção correta da tendência. Se você quiser ser mais radical, você pode optar pela C3, que permite mais oportunidades de entrada, mas assume um risco maior.

Gestão de Riscos: Objetivos 2R + Mecanismo de Garantia Dinâmico

A configuração de stop loss é extremamente precisa.O stop multiple é definido como o ponto baixo de C1, e o stop zero é definido como o ponto alto de C1. Você pode adicionar um desvio de tick adicional para evitar a eliminação instantânea. O RRR duplo padrão significa um stop de 10 pontos e um lucro de 20 pontos.

A função de backup dinâmico é o ponto alto.O design permite que você mantenha mais tempo em uma tendência, protegendo os lucros já obtidos. Os dados históricos mostram que o retorno máximo foi reduzido em 35% após a ativação do mecanismo de garantia.

Revisão dos requisitos de admissão: perfeita combinação de 4 linhas K

A lógica rígida de configuração multi-head:

- C1 tem que ser a linha que traz a sombra (a armadilha da liquidez)

- Há uma lacuna de FVG entre C0 e C2[2] > Ponto mais alto[0])

- C2 varre C1 baixa e fecha C1 baixa acima ((falsa confirmação de ruptura)

- C3 inverter o FVG e fechar abaixo do preço de abertura de C1 (confirmação de inverter)

Essa lógica é muito mais do que uma simples resistência de suporte quebrando o Gauss.O preconceito é uma oportunidade de retorno após a derrota.。

Espaço para otimizar estratégias: 5 exceções para liberar o potencial

O código fornece cinco interruptores de exceção que permitem que você ajuste sua estratégia de acordo com as características do mercado:

- Desativar o filtro EMAO que é que a China está a fazer para ajudar os países da região?

- Permitir que o C3 fique dentro do FVGO problema é que o número de usuários é muito maior do que o número de usuários.

- Permitir que C3 ultrapasse o preço de abertura de C1O que é que o governo está a fazer?

- Permitir a reversão de fechamento do C2“A liberação da direção do C2 é necessária.

- Filtro de janela de tempoO que é que o governo está a fazer para reduzir a taxa de câmbio e evitar a falta de liquidez?

Dica de combate: quando usar e quando evitar

O melhor cenário de mercadoA estratégia pode ter uma taxa de vitória de mais de 65%, com uma taxa de lucro médio de cerca de 2,5.

Situações que devem ser evitadasMercado de oscilação horizontal: Quando os preços oscilam repetidamente perto da EMA, os sinais de FVG são frequentes, mas de baixa qualidade. É recomendado suspender o uso quando o ATR estiver abaixo da média de 20 ciclos.

Alerta de riscoA retrospectiva histórica não representa o lucro futuro, a estratégia apresenta o risco de perdas contínuas. Recomenda-se o controle do risco individual em 1-2% da conta, a rigorosa aplicação da disciplina de stop loss. A variação de desempenho em diferentes ambientes de mercado é grande e requer monitoramento e ajuste contínuos.

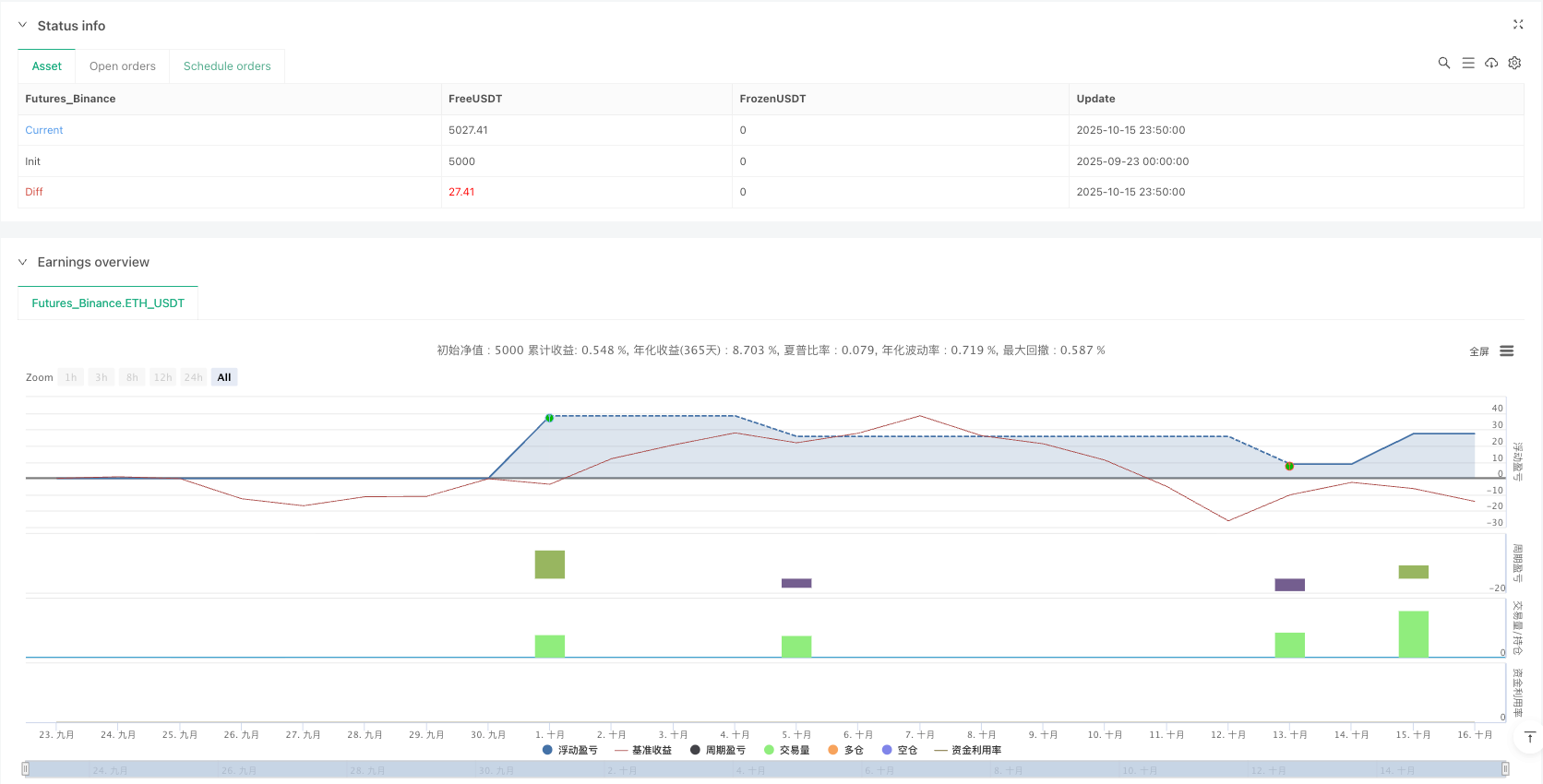

/*backtest

start: 2025-09-23 00:00:00

end: 2025-10-16 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT","balance":5000}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © rdjxyz

//@version=5

strategy("Granny Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// ============================================================================

// INPUTS

// ============================================================================

// Display

showCandleNumbers = input.bool(false, "Show Candle Numbers (0, 1, 2, 3)", group="Display")

// Time Filter

useTimeFilter = input.bool(false, "Use Time Window Filter", group="Time Filter")

timeZone = input.string("America/New_York", "Timezone", options=["America/New_York", "America/Chicago", "America/Los_Angeles", "Europe/London", "Europe/Paris", "Europe/Berlin", "Asia/Tokyo", "Asia/Hong_Kong", "Asia/Shanghai", "Australia/Sydney", "UTC"], group="Time Filter")

sessionTime = input("0930-1600", "Trading Hours (Start-End)", group="Time Filter", tooltip="Set the start and end time for the trading window. Format: HHMM-HHMM")

// EMA

showEMA = input.bool(true, "Show EMA", group="EMA")

emaLength = input.int(50, "EMA Length", minval=1, group="EMA")

// Risk/Reward

stopLossTicks = input.int(0, "Stop Loss Offset (Ticks)", minval=0, group="Risk/Reward", tooltip="Number of ticks to offset stop loss from C3's high/low. 0 = exact high/low, positive = further away")

riskRewardRatio = input.float(2.0, "Risk:Reward Ratio", minval=0.1, step=0.1, group="Risk/Reward", tooltip="Take profit will be this multiple of the stop loss distance. E.g., 2.0 = 2R, 1.5 = 1.5R")

breakEvenAtRR = input.float(0, "Move SL to Break Even at R:R", minval=0, step=0.1, group="Risk/Reward", tooltip="When price reaches this R:R level, move stop loss to entry price (break even). Set to 0 to disable. E.g., 1.0 = break even at 1R, 2.0 = break even at 2R")

// Exceptions

emaBiasCandle = input.string("C0", "Check EMA Bias on Candle", options=["C0", "C1", "C2", "C3"], group="Exceptions", tooltip="Select which candle's close should be checked against the EMA for bias")

disableEMAFilter = input.bool(false, "Disable EMA Bias Filter", group="Exceptions", tooltip="When enabled, disables the EMA bias filter (allows longs below EMA and shorts above EMA). When disabled (default), only look for longs above EMA and shorts below EMA")

allowC3InsideFVG = input.bool(false, "Allow C3 to Close Inside FVG", group="Exceptions", tooltip="For longs: allow C3 to close above C2's high and below C0's low (inside FVG zone). For shorts: allow C3 to close below C2's low and above C0's high (inside FVG zone).")

allowC3OutsideC1Open = input.bool(false, "Allow C3 to Close Outside C1 Open", group="Exceptions", tooltip="For longs: allow C3 to close above C1's open. For shorts: allow C3 to close below C1's open.")

allowC2OppositeDirection = input.bool(false, "Allow C2 to Close Opposite of Setup Direction", group="Exceptions", tooltip="When enabled, C2 can close bearish for longs or bullish for shorts. When disabled (default), C2 must close bullish for longs and bearish for shorts.")

// Debugging

// showDebug = input.bool(false, "Show Debug Markers", group="Debugging")

// ============================================================================

// INDICATORS

// ============================================================================

ema50 = ta.ema(close, emaLength)

// ============================================================================

// TIME WINDOW CHECK

// ============================================================================

// Check if current bar is within the trading window

inTimeWindow = not useTimeFilter or not na(time(timeframe.period, sessionTime, timeZone))

// ============================================================================

// HELPER FUNCTIONS

// ============================================================================

// Check if candle is bullish

isBullish(index) =>

close[index] > open[index]

// Check if candle is bearish

isBearish(index) =>

close[index] < open[index]

// Check if candle has bottom wick

hasBottomWick(index) =>

low[index] < math.min(open[index], close[index])

// Check if candle has top wick

hasTopWick(index) =>

high[index] > math.max(open[index], close[index])

// ============================================================================

// LONG SETUP DETECTION

// ============================================================================

// Detection happens progressively as candles form:

// - C0 and C1 are marked when we're on C2 (can confirm FVG exists)

// - C2 is marked when it forms (current bar meets sweep criteria)

// - C3 is marked when it forms (current bar inverts FVG)

// Check for C2 (current bar): Sweeps C1 low, closes bullish inside C1 range

// When on C2: C0 is at [2], C1 is at [1], C2 is at [0]

// The pattern is: C0 -> C1 (bearish, creates FVG) -> C2 (sweeps and recovers)

// C1 checks (the bar at [1])

c1_is_bearish = close[1] < open[1]

c1_has_wick = low[1] < math.min(open[1], close[1])

// FVG check: gap between C0 and C2 after the bearish move

// The bearish FVG is the gap between C0's low and C2's high (current bar)

fvg_gap_exists = low[2] > high[0]

// C2 checks (current bar at [0])

c2_sweeps_c1_low = low < low[1]

c2_closes_above_c1_low = close > low[1]

c2_closes_below_c0_low = close < low[2]

c2_direction_ok_long = allowC2OppositeDirection or close > open

// EMA bias check for C2 detection (C0, C1, or C2)

ema_check_c2_long = disableEMAFilter or (emaBiasCandle == "C0" ? close[2] > ema50[2] : emaBiasCandle == "C1" ? close[1] > ema50[1] : emaBiasCandle == "C2" ? close > ema50 : true)

isC2Long = c1_is_bearish and c1_has_wick and fvg_gap_exists and c2_sweeps_c1_low and c2_closes_above_c1_low and c2_closes_below_c0_low and c2_direction_ok_long and ema_check_c2_long

// Store that C2 formed (for detecting C3 on the very next bar)

var bool c2LongFormed = false

if isC2Long

c2LongFormed := true

else

c2LongFormed := false // Reset if not C2 - ensures C3 must be the immediate next bar

// Check for C3 (current bar): Inverts FVG and closes below C1 open

// IMPORTANT: C3 must be the bar immediately after C2 (no gaps allowed)

// When on C3: C0 is at [3], C1 is at [2], C2 is at [1]

// "Invert" means price closes back below C1's open (reversing back toward the FVG)

// Must also close above C0's low (staying within the reversal zone)

c2_formed_prev_long = c2LongFormed[1]

c3_c1_open_condition_long = allowC3OutsideC1Open or close < open[2]

c3_range_condition_long = allowC3InsideFVG ? (close > high[1] and close < low[3]) : close > low[3]

isC3Long = c2_formed_prev_long and c3_c1_open_condition_long and c3_range_condition_long

// Debug for C3 conditions

// if showDebug and c2_formed_prev_long

// debugC3 = "C3: "

// debugC3 += c2_formed_prev_long ? "C2✓ " : "C2✗ "

// debugC3 += c3_c1_open_condition_long ? "OPEN✓ " : "OPEN✗ "

// debugC3 += c3_range_condition_long ? "RANGE✓" : "RANGE✗"

// debugC3 += " | C1open:" + str.tostring(open[2]) + " C0low:" + str.tostring(low[3]) + " Close:" + str.tostring(close)

// label.new(bar_index, high, debugC3, color=color.new(color.orange, 70), textcolor=color.white, style=label.style_label_down, size=size.small)

// EMA bias check for C3 (if user selected C3)

ema_check_c3_long = disableEMAFilter or emaBiasCandle != "C3" or close > ema50

// Overall long setup condition

longSetup = isC3Long and ema_check_c3_long

// Candle markers - visible when showCandleNumbers is enabled

// Mark C0 when on C2

plotchar(showCandleNumbers and isC2Long, "C0 Long", "0", location.abovebar, color.white, size=size.tiny, offset=-2)

// Mark C1 when on C2

plotchar(showCandleNumbers and isC2Long, "C1 Long", "1", location.belowbar, color.white, size=size.tiny, offset=-1)

// Mark C2 on current bar

plotchar(showCandleNumbers and isC2Long, "C2 Long", "2", location.belowbar, color.white, size=size.tiny)

// Mark C3 - number (when showCandleNumbers enabled) + emoji on C2 (always)

invalidC3Long = c2_formed_prev_long and not isC3Long

plotchar(showCandleNumbers and (isC3Long or invalidC3Long), "C3 Long", "3", location.belowbar, color.white, size=size.tiny)

plotchar(isC3Long, "Valid Long Setup", "👵🏻", location.belowbar, color.green, size=size.tiny, offset=-1)

plotchar(invalidC3Long, "Invalid Long Setup", "🤡", location.belowbar, color.red, size=size.tiny, offset=-1)

// Variables to store active trade lines for longs

var line longEntryLine = na

var line longSLLine = na

var line longTPLine = na

var label longEntryLabel = na

var label longSLLabel = na

var label longTPLabel = na

// Variables to track break even for longs

var bool longBreakEvenTriggered = false

var float longEntryPrice = na

var float longOneRLevel = na

var float longTPLevel = na

// Draw entry, stop loss, and take profit lines when C3 forms - always visible

if isC3Long

slLevel = low - (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

// Take profit line

slDistance = close - slLevel // Stop loss distance

tpLevel = close + (slDistance * riskRewardRatio) // Take profit level

// ============================================================================

// SHORT SETUP DETECTION

// ============================================================================

// Check for C2 (current bar): Sweeps C1 high, closes bearish inside C1 range

// C1 would be at [1], C0 at [2]

c1_is_bullish = close[1] > open[1]

c1_has_top_wick = high[1] > math.max(open[1], close[1])

// FVG check: gap between C0 and C2 after the bullish move

// The bullish FVG is the gap between C0's high and C2's low (current bar)

fvg_gap_exists_short = high[2] < low[0]

c2_sweeps_c1_high = high > high[1]

c2_closes_below_c1_high = close < high[1]

c2_closes_above_c0_high = close > high[2]

c2_direction_ok_short = allowC2OppositeDirection or close < open

// EMA bias check for C2 detection (C0, C1, or C2)

ema_check_c2_short = disableEMAFilter or (emaBiasCandle == "C0" ? close[2] < ema50[2] : emaBiasCandle == "C1" ? close[1] < ema50[1] : emaBiasCandle == "C2" ? close < ema50 : true)

isC2Short = c1_is_bullish and c1_has_top_wick and fvg_gap_exists_short and c2_sweeps_c1_high and c2_closes_below_c1_high and c2_closes_above_c0_high and c2_direction_ok_short and ema_check_c2_short

// Store that C2 formed (for detecting C3 on the very next bar)

var bool c2ShortFormed = false

if isC2Short

c2ShortFormed := true

else

c2ShortFormed := false // Reset if not C2 - ensures C3 must be the immediate next bar

// Check for C3 (current bar): Inverts FVG and closes above C1 open

// IMPORTANT: C3 must be the bar immediately after C2 (no gaps allowed)

// When on C3: C0 is at [3], C1 is at [2], C2 is at [1]

// "Invert" means price closes back above C1's open (reversing back toward the FVG)

// Must also close below C0's high (staying within the reversal zone)

c2_formed_prev_short = c2ShortFormed[1]

c3_c1_open_condition_short = allowC3OutsideC1Open or close > open[2]

c3_range_condition_short = allowC3InsideFVG ? (close < low[1] and close > high[3]) : close < high[3]

isC3Short = c2_formed_prev_short and c3_c1_open_condition_short and c3_range_condition_short

// EMA bias check for C3 (if user selected C3)

ema_check_c3_short = disableEMAFilter or emaBiasCandle != "C3" or close < ema50

// Overall short setup condition

shortSetup = isC3Short and ema_check_c3_short

// Candle markers - visible when showCandleNumbers is enabled

// Mark C0 when on C2

plotchar(showCandleNumbers and isC2Short, "C0 Short", "0", location.belowbar, color.white, size=size.tiny, offset=-2)

// Mark C1 when on C2

plotchar(showCandleNumbers and isC2Short, "C1 Short", "1", location.abovebar, color.white, size=size.tiny, offset=-1)

// Mark C2 on current bar

plotchar(showCandleNumbers and isC2Short, "C2 Short", "2", location.abovebar, color.white, size=size.tiny)

// Mark C3 - number (when showCandleNumbers enabled) + emoji on C2 (always)

invalidC3Short = c2_formed_prev_short and not isC3Short

plotchar(showCandleNumbers and (isC3Short or invalidC3Short), "C3 Short", "3", location.abovebar, color.white, size=size.tiny)

plotchar(isC3Short, "Valid Short Setup", "👵🏻", location.abovebar, color.green, size=size.tiny, offset=-1)

plotchar(invalidC3Short, "Invalid Short Setup", "🤡", location.abovebar, color.red, size=size.tiny, offset=-1)

// Variables to store active trade lines for shorts

var line shortEntryLine = na

var line shortSLLine = na

var line shortTPLine = na

var label shortEntryLabel = na

var label shortSLLabel = na

var label shortTPLabel = na

// Variables to track break even for shorts

var bool shortBreakEvenTriggered = false

var float shortEntryPrice = na

var float shortOneRLevel = na

var float shortTPLevel = na

// Draw entry, stop loss, and take profit lines when C3 forms - always visible

if isC3Short

slLevelShort = high + (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

// Take profit line

slDistanceShort = slLevelShort - close // Stop loss distance

tpLevelShort = close - (slDistanceShort * riskRewardRatio) // Take profit level

// ============================================================================

// ENTRY & EXIT LOGIC

// ============================================================================

// Long entry

if longSetup and strategy.position_size == 0 and inTimeWindow

slLevel = low - (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

slDistance = close - slLevel // Stop loss distance

tpLevel = close + (slDistance * riskRewardRatio) // Take profit level

strategy.entry("Long", strategy.long)

strategy.exit("Long Exit", "Long", stop=slLevel, limit=tpLevel)

// Initialize break even tracking

if breakEvenAtRR > 0

longBreakEvenTriggered := false

longEntryPrice := close

longOneRLevel := close + (slDistance * breakEvenAtRR) // R:R trigger level

longTPLevel := tpLevel

// Check for break even trigger on long trades

if strategy.position_size > 0 and breakEvenAtRR > 0 and not longBreakEvenTriggered

// Check if price has reached the specified R:R level

if high >= longOneRLevel

// Move stop loss to break even (entry price)

strategy.exit("Long Exit", "Long", stop=longEntryPrice, limit=longTPLevel)

longBreakEvenTriggered := true

// Short entry

if shortSetup and strategy.position_size == 0 and inTimeWindow

slLevelShort = high + (stopLossTicks * syminfo.mintick) // Stop loss level with tick offset

slDistanceShort = slLevelShort - close // Stop loss distance

tpLevelShort = close - (slDistanceShort * riskRewardRatio) // Take profit level

strategy.entry("Short", strategy.short)

strategy.exit("Short Exit", "Short", stop=slLevelShort, limit=tpLevelShort)

// Initialize break even tracking

if breakEvenAtRR > 0

shortBreakEvenTriggered := false

shortEntryPrice := close

shortOneRLevel := close - (slDistanceShort * breakEvenAtRR) // R:R trigger level

shortTPLevel := tpLevelShort

// Check for break even trigger on short trades

if strategy.position_size < 0 and breakEvenAtRR > 0 and not shortBreakEvenTriggered

// Check if price has reached the specified R:R level

if low <= shortOneRLevel

// Move stop loss to break even (entry price)

strategy.exit("Short Exit", "Short", stop=shortEntryPrice, limit=shortTPLevel)

shortBreakEvenTriggered := true

// ============================================================================

// VISUALIZATION

// ============================================================================

// Plot EMA

plot(showEMA ? ema50 : na, "EMA", color=color.white, linewidth=2)

// Background color for bias

bgcolor(close > ema50 ? color.new(color.green, 95) : close < ema50 ? color.new(color.red, 95) : na)