Двухдорожечный осциллятор RSI, длинная и короткая двухсторонняя торговая стратегия

Обзор

Двусторонняя стратегия торговли, использующая индикатор RSI для двусторонней торговли. Эта стратегия использует принцип сверхпокупа и сверхпродажи индикатора RSI, в сочетании с двусторонней установкой и равномерным торговым сигналом, чтобы обеспечить эффективное открытие и закрытие позиций в двух направлениях.

Стратегический принцип

Эта стратегия основана на принципе перекупа и перепродажи RSI. Сначала стратегия рассчитывает значение RSI в качестве vrsi, а также двусторонние верхние и нижние траектории sn и ln.

Стратегия также обнаруживает перепады в K-линии, в дальнейшем генерируя сигналы многодевизации. В частности, когда K-линия прорывается вверх-вниз, она генерирует сигналы многодевизации longLocic, а когда K-линия прорывается вверх-вниз, она генерирует сигналы короткой логики shortLogic. Кроме того, стратегия предоставляет переключатель параметров, который позволяет делать только многодевизации, только пустодевизации или переворачивать сигналы.

После создания множества сигналов об обратном положении, стратегия будет статистически измерять количество сигналов, контролируя количество открытых позиций. Через параметры можно установить различные правила набора позиций. Условия открытого положения включают в себя такие способы, как остановка, остановка потери, перемещение остановки потери и т. Д. Можно установить различные стоп-стоп-потери.

В целом, стратегия включает в себя использование различных технологических средств, таких как RSI, среднелинейный пересечение, статистический налог, стоп-стоп, для автоматической торговли длинными и короткими двунаправлениями.

Стратегические преимущества

- Используйте RSI, чтобы создать позиции на фоне RSI, чтобы создать позиции на фоне RSI.

- Двойная орбитальная настройка предотвращает ошибочный сигнал. Верхняя линия предотвращает преждевременное выравнивание многоголовых позиций, а нижняя линия предотвращает преждевременное выравнивание пустых позиций.

- Фильтрация ложного прорыва. Сигналы создаются только после прорыва цены, чтобы избежать ложных сигналов.

- Количество статистических сигналов, количество закладки, контроль риска.

- Настраиваемый процент стоп-стоп, контролируемый риск прибыли.

- Мобильные стопы отслеживают стопы и закрепляют прибыль.

- Можно делать только больше, делать только пусто или переворачивать сигналы, чтобы адаптироваться к различным рыночным условиям.

- Автоматизация торговых систем, снижение затрат на эксплуатацию.

Стратегический риск

- RSI рискует обернуться и потерпеть неудачу.

- Существует риск, что фиксированная точка остановки приостановки может быть подстроена. Неправильная настройка остановки может привести к преждевременной остановке или остановке.

- Опираясь на технические показатели, существует риск оптимизации параметров. Неправильная настройка параметров показателей может повлиять на эффективность стратегии.

- При одновременном возникновении нескольких состояний существует риск пропускания билетов.

- Автоматические торговые системы рискуют совершить ошибку.

В связи с вышеуказанными рисками можно оптимизировать параметры настройки, скорректировать стратегию остановки, увеличить фильтрацию ликвидности, оптимизировать логику генерирования сигналов, увеличить мониторинг ошибок.

Направление оптимизации стратегии

- Оптимизация параметров RSI для тестирования параметров различных циклов.

- Тестируйте различные параметры стоп-стоп-убытков.

- Повышение объема сделок или снижение доходности, чтобы избежать недостаточной ликвидности.

- Оптимизация логики генерирования сигнала, улучшение метода пересечения равномерных линий.

- Добавление многократных периодов отслеживания для проверки стабильности.

- Попробуйте включить другие показатели, чтобы оптимизировать эффективность сигнала.

- Присоединиться к стратегии управления позициями.

- Дополнительный мониторинг за ошибками.

- Оптимизация алгоритмов автоматического отслеживания убытков.

- Рассмотреть возможность включения стратегий повышения уровня машинного обучения.

Подвести итог

Стратегия RSI позволяет автоматизировать торговлю двусторонними методами, используя различные методы, такие как RSI, статистические принципы открытия и остановки позиций. Стратегия имеет высокую настраиваемость, и пользователи могут настраивать параметры в соответствии с потребностями и приспосабливаться к различным рыночным условиям.

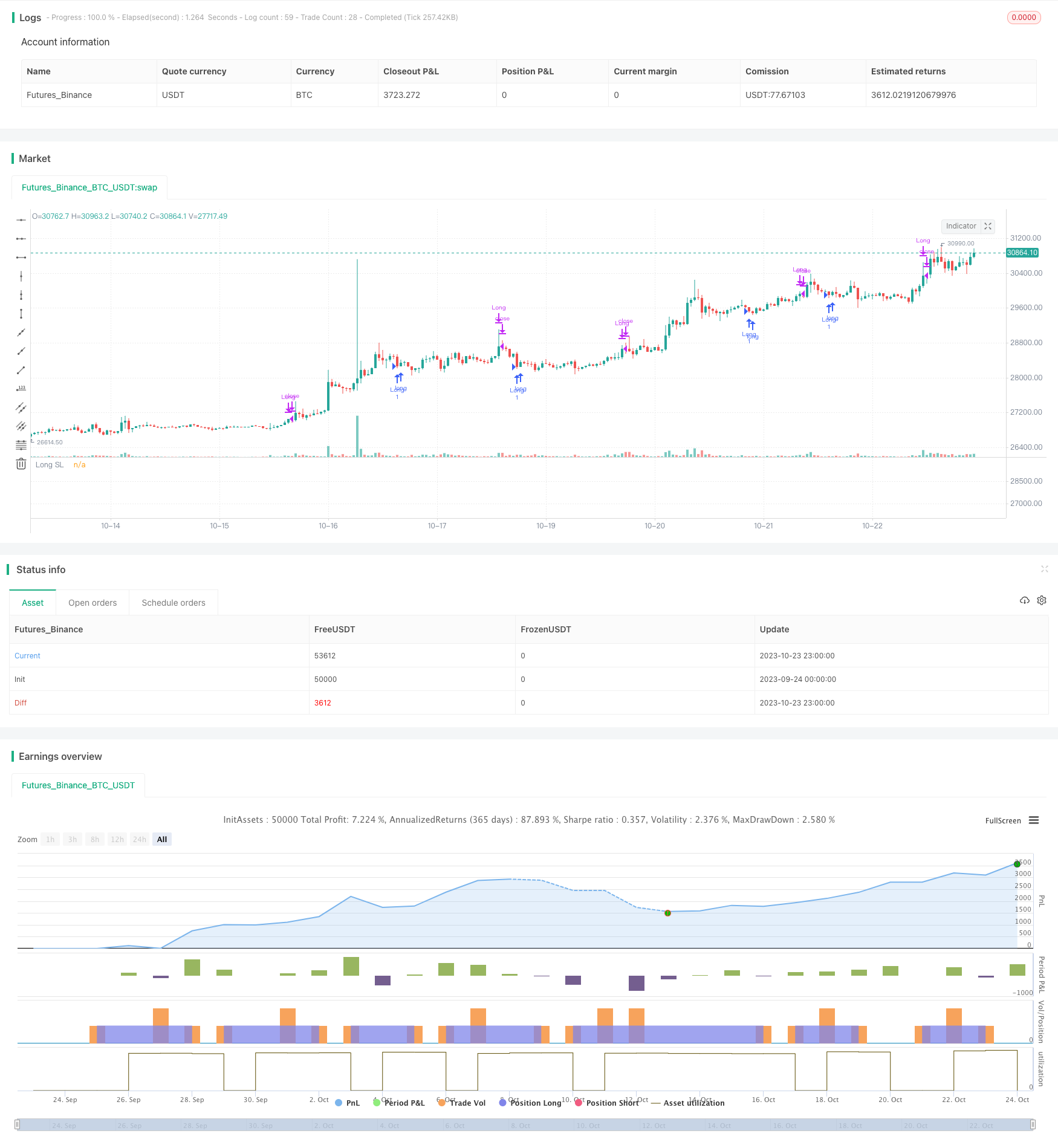

/*backtest

start: 2023-09-24 00:00:00

end: 2023-10-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// Learn more about Autoview and how you can automate strategies like this one here: https://autoview.with.pink/

// strategy("Autoview Build-a-bot - 5m chart", "Strategy", overlay=true, pyramiding=2000, default_qty_value=10000)

// study("Autoview Build-a-bot", "Alerts")

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made *//

testStartYear = input(1, "Backtest Start Year")

testStartMonth = input(11, "Backtest Start Month")

testStartDay = input(10, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(77777777, "Backtest Stop Year")

testStopMonth = input(11, "Backtest Stop Month")

testStopDay = input(15, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

/////////////////////////////////////

//* Put your strategy logic below *//

/////////////////////////////////////

RSIlength = input(1,title="RSI Period Length")

price = close

vrsi = (rsi(price, RSIlength))

src = close

len = input(2, minval=1, title="Length")

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsin = input(12)

sn = 100 - rsin

ln = 0 + rsin

// Put your long and short rules here

longLocic = crossunder(rsi, ln)

shortLogic = crossover(rsi, sn)

//////////////////////////

//* Strategy Component *//

//////////////////////////

isLong = input(true, "Longs Only")

isShort = input(false, "Shorts Only")

isFlip = input(false, "Flip the Opens")

long = longLocic

short = shortLogic

if isFlip

long := shortLogic

short := longLocic

else

long := longLocic

short := shortLogic

if isLong

long := long

short := na

if isShort

long := na

short := short

////////////////////////////////

//======[ Signal Count ]======//

////////////////////////////////

sectionLongs = 0

sectionLongs := nz(sectionLongs[1])

sectionShorts = 0

sectionShorts := nz(sectionShorts[1])

if long

sectionLongs := sectionLongs + 1

sectionShorts := 0

if short

sectionLongs := 0

sectionShorts := sectionShorts + 1

//////////////////////////////

//======[ Pyramiding ]======//

//////////////////////////////

pyrl = input(2, "Pyramiding less than") // If your count is less than this number

pyre = input(1, "Pyramiding equal to") // If your count is equal to this number

pyrg = input(1000000, "Pyramiding greater than") // If your count is greater than this number

longCondition = long and sectionLongs <= pyrl or long and sectionLongs >= pyrg or long and sectionLongs == pyre ? 1 : 0 and vrsi < 20

shortCondition = short and sectionShorts <= pyrl or short and sectionShorts >= pyrg or short and sectionShorts == pyre ? 1 : 0

////////////////////////////////

//======[ Entry Prices ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

////////////////////////////////////

//======[ Open Order Count ]======//

////////////////////////////////////

sectionLongConditions = 0

sectionLongConditions := nz(sectionLongConditions[1])

sectionShortConditions = 0

sectionShortConditions := nz(sectionShortConditions[1])

if longCondition

sectionLongConditions := sectionLongConditions + 1

sectionShortConditions := 0

if shortCondition

sectionLongConditions := 0

sectionShortConditions := sectionShortConditions + 1

///////////////////////////////////////////////

//======[ Position Check (long/short) ]======//

///////////////////////////////////////////////

last_longCondition = na

last_shortCondition = na

last_longCondition := longCondition ? time : nz(last_longCondition[1])

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1])

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

/////////////////////////////////////

//======[ Position Averages ]======//

/////////////////////////////////////

totalLongs = 0.0

totalLongs := nz(totalLongs[1])

totalShorts = 0.0

totalShorts := nz(totalShorts[1])

averageLongs = 0.0

averageLongs := nz(averageLongs[1])

averageShorts = 0.0

averageShorts := nz(averageShorts[1])

if longCondition

totalLongs := totalLongs + last_open_longCondition

totalShorts := 0.0

if shortCondition

totalLongs := 0.0

totalShorts := totalShorts + last_open_shortCondition

averageLongs := totalLongs / sectionLongConditions

averageShorts := totalShorts / sectionShortConditions

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

isTS = input(false, "Trailing Stop")

tsi = input(100, "Activate Trailing Stop Price (%). Divided by 100 (1 = 0.01%)") / 100

ts = input(100, "Trailing Stop (%). Divided by 100 (1 = 0.01%)") / 100

last_high = na

last_low = na

last_high_short = na

last_low_short = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high > nz(last_high[1])) ? high : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

last_low_short := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low < nz(last_low[1])) ? low : nz(last_low[1])

long_ts = isTS and not na(last_high) and low <= last_high - last_high / 100 * ts and longCondition == 0 and last_high >= averageLongs + averageLongs / 100 * tsi

short_ts = isTS and not na(last_low) and high >= last_low + last_low / 100 * ts and shortCondition == 0 and last_low <= averageShorts - averageShorts/ 100 * tsi

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(125, "Take Profit (%). Divided by 100 (1 = 0.01%)") / 100

long_tp = isTP and close > averageLongs + averageLongs / 100 * tp and not longCondition

short_tp = isTP and close < averageShorts - averageShorts / 100 * tp and not shortCondition

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(true, "Stop Loss")

sl = input(140, "Stop Loss (%). Divided by 100 (1 = 0.01%)") / 100

long_sl = isSL and close < averageLongs - averageLongs / 100 * sl and longCondition == 0

short_sl = isSL and close > averageShorts + averageShorts / 100 * sl and shortCondition == 0

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

longClose = long_tp or long_sl or long_ts ? 1 : 0

shortClose = short_tp or short_sl or short_ts ? 1: 0

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? purple : long_sl ? maroon : long_ts ? blue : longCloseCol[1]

shortCloseCol := short_tp ? purple : short_sl ? maroon : short_ts ? blue : shortCloseCol[1]

tpColor = isTP and in_longCondition ? purple : isTP and in_shortCondition ? purple : white

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : white

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

plot(isTS and in_longCondition ? averageLongs + averageLongs / 100 * tsi : na, "Long Trailing Activate", blue, style=3, linewidth=2)

plot(isTS and in_longCondition and last_high >= averageLongs + averageLongs / 100 * tsi ? last_high - last_high / 100 * ts : na, "Long Trailing", fuchsia, style=2, linewidth=3)

plot(isTS and in_shortCondition ? averageShorts - averageShorts/ 100 * tsi : na, "Short Trailing Activate", blue, style=3, linewidth=2)

plot(isTS and in_shortCondition and last_low <= averageShorts - averageShorts/ 100 * tsi ? last_low + last_low / 100 * ts : na, "Short Trailing", fuchsia, style=2, linewidth=3)

plot(isTP and in_longCondition and last_high < averageLongs + averageLongs / 100 * tp ? averageLongs + averageLongs / 100 * tp : na, "Long TP", tpColor, style=3, linewidth=2)

plot(isTP and in_shortCondition and last_low > averageShorts - averageShorts / 100 * tp ? averageShorts - averageShorts / 100 * tp : na, "Short TP", tpColor, style=3, linewidth=2)

plot(isSL and in_longCondition and last_low_short > averageLongs - averageLongs / 100 * sl ? averageLongs - averageLongs / 100 * sl : na, "Long SL", slColor, style=3, linewidth=2)

plot(isSL and in_shortCondition and last_high_short < averageShorts + averageShorts / 100 * sl ? averageShorts + averageShorts / 100 * sl : na, "Short SL", slColor, style=3, linewidth=2)

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

// plot(longCondition, "Long", green)

// plot(shortCondition, "Short", red)

// plot(longClose, "Long Close", longCloseCol)

// plot(shortClose, "Short Close", shortCloseCol)

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or not in_longCondition

averageLongs := 0

totalLongs := 0.0

sectionLongs := 0

sectionLongConditions := 0

if shortClose or not in_shortCondition

averageShorts := 0

totalShorts := 0.0

sectionShorts := 0

sectionShortConditions := 0

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod()

strategy.entry("Long", 1, when=longCondition)

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Long", when=longClose)

strategy.close("Short", when=shortClose)