Стратегия технического индикатора «Полосы Боллинджера», основанная на разложении временного ряда и взвешивании объема

Обзор

Эта стратегия объединяет в себе четыре технических показателя: временная последовательность, средневзвешенная стоимость сделки, брин-полоса и дельта (OBV-PVT) для многомерного определения ценовых тенденций, перекупа и перепродажи.

Стратегический принцип

- Используйте временную последовательность для удаления шума и периодичности в ценах, чтобы более точно оценить тенденции;

- На основе этой трендовой линии рассчитывается новая цена, взвешенная на объемы сделок;

- Для определения перепродажи используется индикатор BBB%B, который определяет процентную ширину полосы Бринга в цене закрытия;

- вычислить пропорциональную ширину ленты Бурин для переменного дельта OBV-PVT в качестве критерия отклонения от величины;

- Торговые сигналы генерируются в зависимости от многополосного пересечения индикатора количественной стоимости и свертывания и снятия индикатора Бринского пояса.

Анализ преимуществ

- В результате, по мнению экспертов, в результате использования различных критериев, включая цены, объемы продаж и статистические характеристики, стратегия стала более эффективной.

- В сочетании с BB%B и Delta (OBV-PVT) можно лучше оценить краткосрочные перекупки и перепродажи;

- В то же время, в некоторых торговых точках кристаллический сигнал фильтрует шум.

Анализ рисков

- Параметры слишком сложны и трудно подстраиваются;

- Потеря может быть увеличена в результате кратковременных толчков.

- Отклонение от нормы цены не может полностью отфильтровывать ложные сигналы.

Можно оптимизировать стратегию путем корректировки среднелинейных циклов, ширины буринских полос и рисково-убыточного соотношения, снижая частоту торговли и одновременно увеличивая убыточный коэффициент по одной сделке.

Подвести итог

Эта стратегия использует различные аналитические инструменты, такие как разбивка временной последовательности, индикатор Бринбинтовых полос, индикатор OBV, чтобы эффективно улавливать основные тенденции рынка путем идентификации краткосрочных последствий, путем органического сочетания количественных отношений, статистических характеристик и определения тенденций. В то же время существует определенный риск, который требует корректировки параметров для достижения оптимального состояния.

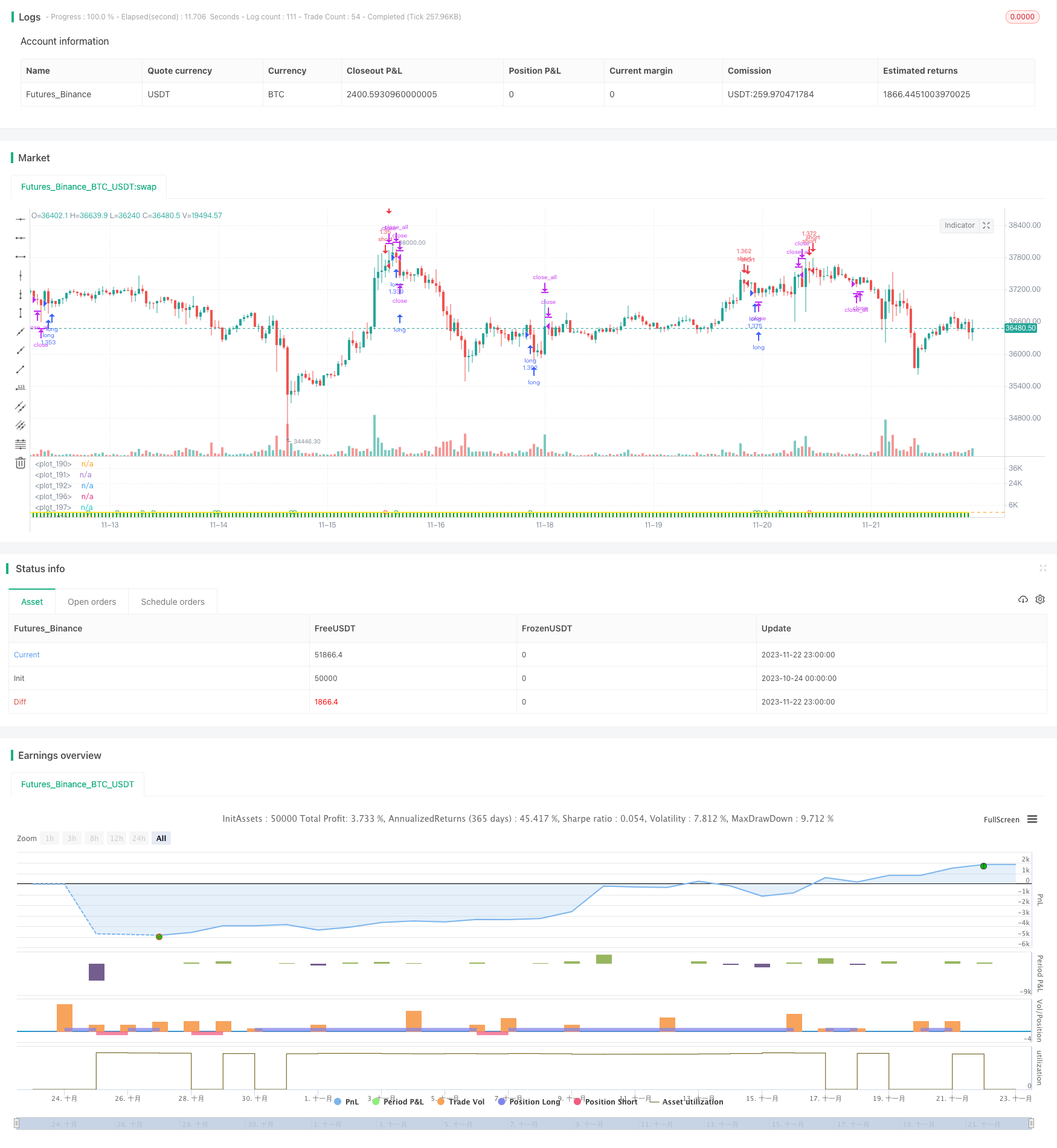

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © oakwhiz and tathal

//@version=4

strategy("BBPBΔ(OBV-PVT)BB", default_qty_type=strategy.percent_of_equity, default_qty_value=100)

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2010, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100)

// Normalize Function

normalize(_src, _min, _max) =>

// Normalizes series with unknown min/max using historical min/max.

// _src : series to rescale.

// _min, _min: min/max values of rescaled series.

var _historicMin = 10e10

var _historicMax = -10e10

_historicMin := min(nz(_src, _historicMin), _historicMin)

_historicMax := max(nz(_src, _historicMax), _historicMax)

_min + (_max - _min) * (_src - _historicMin) / max(_historicMax - _historicMin, 10e-10)

// STEP 2:

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

// Stop loss & Take Profit Section

sl_inp = input(2.0, title='Stop Loss %')/100

tp_inp = input(4.0, title='Take Profit %')/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

icreturn = false

innercandle = if (high < high[1]) and (low > low[1])

icreturn := true

src = close

float change_src = change(src)

float i_obv = cum(change_src > 0 ? volume : change_src < 0 ? -volume : 0*volume)

float i_pvt = pvt

float result = change(i_obv - i_pvt)

float nresult = ema(normalize(result, -1, 1), 20)

length = input(20, minval=1)

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ema(nresult, length)

dev = mult * stdev(nresult, length)

upper = basis + dev

lower = basis - dev

bbr = (nresult - lower)/(upper - lower)

////////////////INPUTS///////////////////

lambda = input(defval = 1000, type = input.float, title = "Smoothing Factor (Lambda)", minval = 1)

leng = input(defval = 100, type = input.integer, title = "Filter Length", minval = 1)

srcc = close

///////////Construct Arrays///////////////

a = array.new_float(leng, 0.0)

b = array.new_float(leng, 0.0)

c = array.new_float(leng, 0.0)

d = array.new_float(leng, 0.0)

e = array.new_float(leng, 0.0)

f = array.new_float(leng, 0.0)

/////////Initialize the Values///////////

//for more details visit:

// https://asmquantmacro.com/2015/06/25/hodrick-prescott-filter-in-excel/

ll1 = leng-1

ll2 = leng-2

for i = 0 to ll1

array.set(a,i, lambda*(-4))

array.set(b,i, src[i])

array.set(c,i, lambda*(-4))

array.set(d,i, lambda*6 + 1)

array.set(e,i, lambda)

array.set(f,i, lambda)

array.set(d, 0, lambda + 1.0)

array.set(d, ll1, lambda + 1.0)

array.set(d, 1, lambda * 5.0 + 1.0)

array.set(d, ll2, lambda * 5.0 + 1.0)

array.set(c, 0 , lambda * (-2.0))

array.set(c, ll2, lambda * (-2.0))

array.set(a, 0 , lambda * (-2.0))

array.set(a, ll2, lambda * (-2.0))

//////////////Solve the optimization issue/////////////////////

float r = array.get(a, 0)

float s = array.get(a, 1)

float t = array.get(e, 0)

float xmult = 0.0

for i = 1 to ll2

xmult := r / array.get(d, i-1)

array.set(d, i, array.get(d, i) - xmult * array.get(c, i-1))

array.set(c, i, array.get(c, i) - xmult * array.get(f, i-1))

array.set(b, i, array.get(b, i) - xmult * array.get(b, i-1))

xmult := t / array.get(d, i-1)

r := s - xmult*array.get(c, i-1)

array.set(d, i+1, array.get(d, i+1) - xmult * array.get(f, i-1))

array.set(b, i+1, array.get(b, i+1) - xmult * array.get(b, i-1))

s := array.get(a, i+1)

t := array.get(e, i)

xmult := r / array.get(d, ll2)

array.set(d, ll1, array.get(d, ll1) - xmult * array.get(c, ll2))

x = array.new_float(leng, 0)

array.set(x, ll1, (array.get(b, ll1) - xmult * array.get(b, ll2)) / array.get(d, ll1))

array.set(x, ll2, (array.get(b, ll2) - array.get(c, ll2) * array.get(x, ll1)) / array.get(d, ll2))

for j = 0 to leng-3

i = leng-3 - j

array.set(x, i, (array.get(b,i) - array.get(f,i)*array.get(x,i+2) - array.get(c,i)*array.get(x,i+1)) / array.get(d, i))

//////////////Construct the output///////////////////

o5 = array.get(x,0)

////////////////////Plottingd///////////////////////

TimeFrame = input('1', type=input.resolution)

start = security(syminfo.tickerid, TimeFrame, time)

//------------------------------------------------

newSession = iff(change(start), 1, 0)

//------------------------------------------------

vwapsum = 0.0

vwapsum := iff(newSession, o5*volume, vwapsum[1]+o5*volume)

volumesum = 0.0

volumesum := iff(newSession, volume, volumesum[1]+volume)

v2sum = 0.0

v2sum := iff(newSession, volume*o5*o5, v2sum[1]+volume*o5*o5)

myvwap = vwapsum/volumesum

dev2 = sqrt(max(v2sum/volumesum - myvwap*myvwap, 0))

Coloring=close>myvwap?color.green:color.red

av=myvwap

showBcol = input(false, type=input.bool, title="Show barcolors")

showPrevVWAP = input(false, type=input.bool, title="Show previous VWAP close")

prevwap = 0.0

prevwap := iff(newSession, myvwap[1], prevwap[1])

nprevwap= normalize(prevwap, 0, 1)

l1= input(20, minval=1)

src2 = close

mult1 = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis1 = sma(src2, l1)

dev1 = mult1 * stdev(src2, l1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

bbr1 = (src - lower1)/(upper1 - lower1)

az = plot(bbr, "Δ(OBV-PVT)", color.rgb(0,153,0,0), style=plot.style_columns)

bz = plot(bbr1, "BB%B", color.rgb(0,125,125,50), style=plot.style_columns)

fill(az, bz, color=color.white)

deltabbr = bbr1 - bbr

oneline = hline(1)

twoline = hline(1.2)

zline = hline(0)

xx = input(.3)

yy = input(.7)

zz = input(-1)

xxx = hline(xx)

yyy = hline(yy)

zzz = hline(zz)

fill(oneline, twoline, color=color.red, title="Sell Zone")

fill(yyy, oneline, color=color.orange, title="Slightly Overbought")

fill(yyy, zline, color=color.white, title="DO NOTHING ZONE")

fill(zzz, zline, color=color.green, title="GO LONG ZONE")

l20 = crossover(deltabbr, 0)

l30 = crossunder(deltabbr, 0)

l40 = crossover(o5, 0)

l50 = crossunder(o5, 0)

z1 = bbr1 >= 1

z2 = bbr1 < 1 and bbr1 >= .7

z3 = bbr1 < .7 and bbr1 >= .3

z4 = bbr1 < .3 and bbr1 >= 0

z5 = bbr1 < 0

a1 = bbr >= 1

a2 = bbr < 1 and bbr >= .7

a4 = bbr < .3 and bbr >= 0

a5 = bbr < 0

b4 = deltabbr < .3 and deltabbr >= 0

b5 = deltabbr < 0

c4 = o5 < .3 and o5 >= 0

c5 = o5 < 0

b1 = deltabbr >= 1

b2 = deltabbr < 1 and o5 >= .7

c1 = o5 >= 1

c2 = o5 < 1 and o5 >= .7

///

n = input(16,"Period")

H = highest(hl2,n)

L = lowest(hl2,n)

hi = H[1]

lo = L[1]

up = high>hi

dn = low<lo

lowerbbh = lowest(10)[1]

bbh = (low == open ? open < lowerbbh ? open < close ? close > ((high[1] - low[1]) / 2) + low[1] :na : na : na)

plot(normalize(av,-1,1), linewidth=2, title="Trendline", color=color.yellow)

long5 = close < av and av[0] > av[1]

sell5 = close > av

cancel = false

if open >= high[1]

cancel = true

long = (long5 or z5 or a5) and (icreturn or bbh or up)

sell = ((z1 or a1) or (l40 and l20)) and (icreturn or dn) and (c1 or b1)

short = ((z1 or z2 or a1 or sell5) and (l40 or l20)) and icreturn

buy= (z5 or z4 or a5 or long5) and (icreturn or dn)

plotshape(long and not sell ? -0.5 : na, title="Long", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(short and not sell? 1 : na, title="Short", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

if (inDateRange)

strategy.entry("long", true, when = long )

if (inDateRange) and (strategy.position_size > 0)

strategy.close_all(when = sell or cancel)

if (inDateRange)

strategy.entry("short", false, when = short )

if (inDateRange) and (strategy.position_size < 0)

strategy.close_all(when = buy)