Стратегия разворота тренда с комбинацией нескольких индикаторов

Обзор

Это стратегия, использующая комбинацию из нескольких индикаторов для определения точек обратной тенденции цены. Основная идея заключается в том, что один индикатор трудно идентифицировать точку обратной тенденции, поэтому выбирайте несколько индикаторов с аналогичными функциями для комбинации. Когда несколько индикаторов посылают синхронный сигнал, мы можем относительно определить высокую вероятность того, что тенденция изменится, и поэтому проводить торговые операции.

Стратегический принцип

Стратегия использует в комбинации пять различных индикаторов, которые имеют функции определения ценовых тенденций:

- Coral Trend Indicator: использует комбинацию скользких скользящих средних индексов с тремя или более высокими ступенями для определения тенденции цен

- SSL Channel: определение ценовых каналов и тенденций в сочетании с подвижными средними

- Heikin Ashi RSI: тенденции, используемые для определения комбинации индекса обменного курса и среднесуточной линии

- MACD DEMA: двойная скользящая средняя и MACD объединяют тенденции

- WaveTrend Oscillator: оценивает тенденции по ценовым каналам

Торговая логика стратегии заключается в том, что из вышеуказанных пяти индикаторов можно произвольно выбрать один или несколько индикаторов для комбинации. Когда выбранные несколько индикаторов одновременно посылают сигналы покупки / продажи, мы открываем позиции на соответствующем бар.

Например, если мы выбираем 2 индикатора: Coral Trend и SSL Channel. Тогда мы делаем больше только тогда, когда они оба посылают одновременно сигналы о покупке; только тогда, когда они оба посылают одновременно сигналы о продаже, мы делаем ничего.

Это позволяет значительно повысить надежность торговых сигналов, избегая ошибочного использования одного индикатора.

Стратегические преимущества

- Используйте комбинацию индикаторов, чтобы определить высокую вероятность обратного тренда и повысить вероятность выигрыша.

- Каждый показатель использует различные методы вычислений, чтобы сделать сигнал более полным и точным.

- Комбинирование от 1 до 5 показателей может быть выбрано по своему усмотрению. Комбинирование гибкое

- Подробные параметры для каждого показателя, оптимизированные для разных рынков

- Предоставление параметров окна обратной связи, позволяющих настроить чувствительность идентификации точки покупки и продажи

Стратегические риски и решения

Риск введения в заблуждение одним показателем

- Решение: комбинированная проверка с использованием нескольких показателей

Неправильная настройка параметров может привести к слишком чувствительной или слишком вялой

- Решение: параметры оптимизации для повторного тестирования в зависимости от различных циклов и сортов

Промежуточная задержка

- Решение: настройка подходящего окна просмотра

Направление оптимизации стратегии

- Тестирование большего количества типов трендовых индикаторов, расширение пула индикаторов, обогащение портфеля

- Добавление алгоритмов машинного обучения для автоматического определения оптимального пакета показателей

- Добавление параметров для адаптации модуля оптимизации, чтобы параметры могли динамически корректироваться

- Обратный тренд в идентификации в сочетании с эмоциональными и фундаментальными показателями

- Разработка модели управления количественными рисками для контроля риска сделок

Подвести итог

Эта стратегия в целом реализует более надежную стратегию обратного трейдинга. Ее концепция, использующая проверенную комбинацию нескольких показателей, имеет сильную универсальность и очень хорошую масштабируемость. Если ее дальнейше оптимизировать, совместить с технологиями, такими как машинное обучение и динамическая оптимизация параметров, эффект может быть дополнительно повышен, и это заслуживает более глубокого исследования и применения.

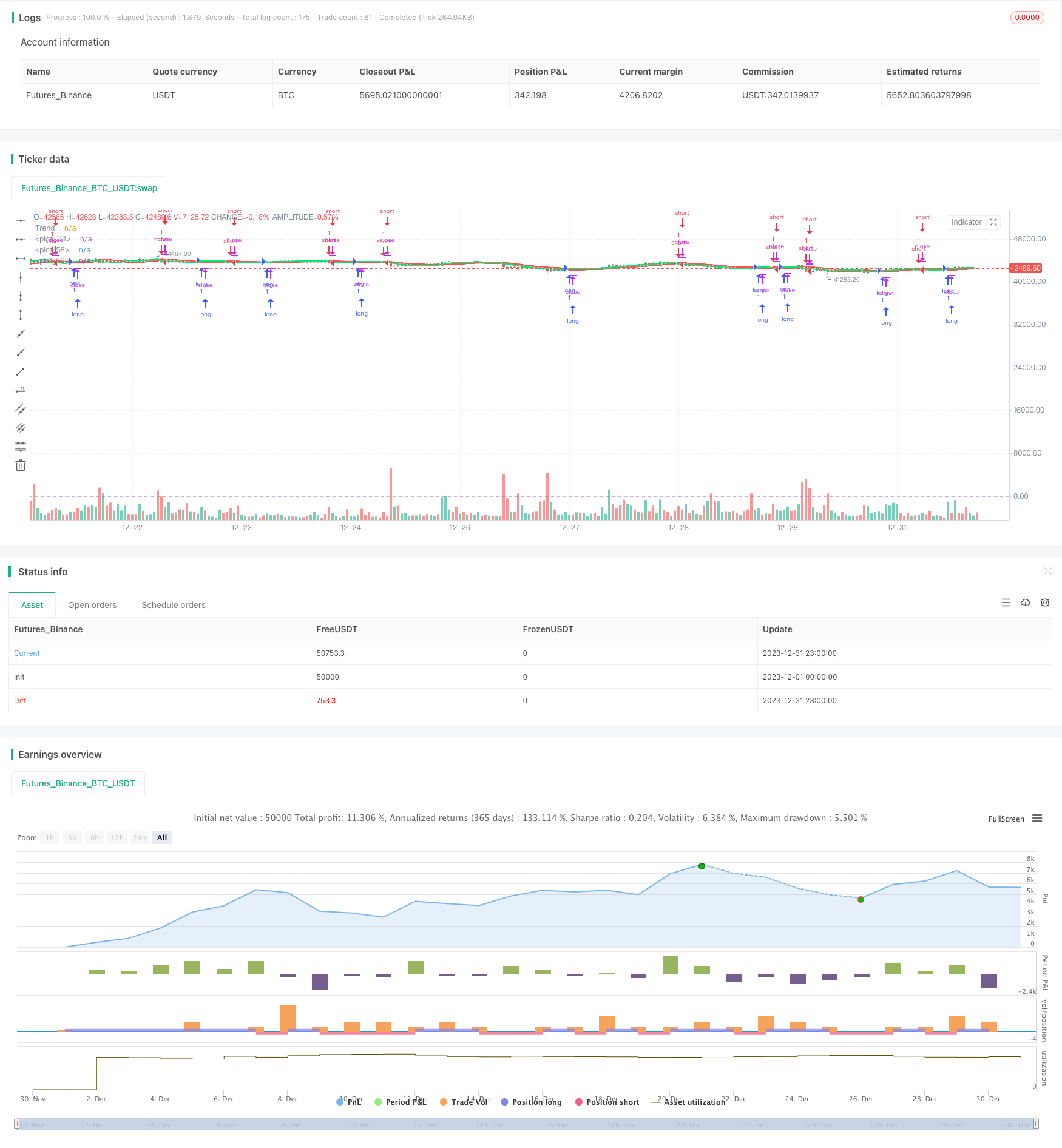

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//@author=iori86

//Any trade decisions you make are entirely your own responsibility//

strategy('GT 5.1 Strategy', 'GT 5.1 Strategy •', true, default_qty_type=strategy.cash)

string GROUP_6="STRATEGY OPTIONS"

dec1 = input(true,"HARSI", group=GROUP_6)

harsi_back = input.int(6, 'Lookback HARSI', group=GROUP_6, minval=1, maxval=32)

dec2 = input(true,"SSL", group=GROUP_6)

ssl_back = input.int(1, 'Lookback SSL', group=GROUP_6, minval=0, maxval=4)

dec3 = input(true,"CORAL", group=GROUP_6)

coral_back = input.int(4, 'Lookback CORAL', group=GROUP_6, minval=1, maxval=10)

dec4 = input(false,"MACD DEMA", group=GROUP_6)

macd_back =input.int(0, 'Lookback MACD DEMA', group=GROUP_6, minval=0, maxval=10)

dec5 = input(false,"WAVE TREND", group=GROUP_6)

wave_back=input.int(0, 'Lookback WAVE', group=GROUP_6, minval=0, maxval=10)

//================================================================HARSI============================================================================//

string GROUP_1 = 'Config » HARSI'

i_lenHARSI = input.int(14, 'Length', group=GROUP_1, minval=1)

i_smoothing = input.int(7, 'Open Smoothing', group=GROUP_1, minval=1, maxval=100)

f_zrsi(_source, _length) => ta.rsi(_source, _length) - 50

f_zstoch(_source, _length, _smooth, _scale) =>

float _zstoch = ta.stoch(_source, _source, _source, _length) - 50

float _smoothed = ta.sma(_zstoch, _smooth)

float _scaled = (_smoothed / 100 )* _scale

f_rsi(_source, _length, _mode) =>

float _zrsi = f_zrsi(_source, _length)

var float _smoothed = na

_smoothed := na(_smoothed[1]) ? _zrsi : (_smoothed[1] + _zrsi) / 2

_mode ? _smoothed : _zrsi

f_rsiHeikinAshi(_length) =>

float _closeRSI = f_zrsi(close, _length)

float _openRSI = nz(_closeRSI[1], _closeRSI)

float _highRSI_raw = f_zrsi(high, _length)

float _lowRSI_raw = f_zrsi(low, _length)

float _highRSI = math.max(_highRSI_raw, _lowRSI_raw)

float _lowRSI = math.min(_highRSI_raw, _lowRSI_raw)

float _close = (_openRSI + _highRSI + _lowRSI + _closeRSI) / 4

var float _open = na

_open := na(_open[i_smoothing]) ? (_openRSI + _closeRSI) / 2 : ((_open[1] * i_smoothing) + _close[1]) / (i_smoothing + 1)

float _high = math.max(_highRSI, math.max(_open, _close))

float _low = math.min(_lowRSI, math.min(_open, _close))

[_open, _high, _low, _close]

[O, H, L, C] = f_rsiHeikinAshi(i_lenHARSI)

//=======================================================================SSL=======================================================================//

string GROUP_2 = 'Config » SSL Channel'

int len = input.int(10, 'Period', group=GROUP_2)

float smaHigh = ta.sma(high, len)

float smaLow = ta.sma(low, len)

float Hlv = na

Hlv := close > smaHigh ? 1 : close < smaLow ? -1 : Hlv[1]

float sslDown = Hlv < 0 ? smaHigh : smaLow

float sslUp = Hlv < 0 ? smaLow : smaHigh

plot(sslDown, linewidth=2, color=color.new(color.red, 0))

plot(sslUp, linewidth=2, color=color.new(color.lime, 0))

//=======================================================================CORAL=======================================================================//

string GROUP_3 = 'Config » Coral Trend Candles'

src = close

sm = input.float(9, 'Smoothing Period', group=GROUP_3, minval=1)

cd = input.float(0.4, 'Constant D', group=GROUP_3, minval=0.1)

float di = (sm) / 2.0 + 1.0

float c1 = 2 / (di + 1.0)

float c2 = 1 - c1

float c3 = 3.0 * (cd * cd + cd * cd * cd)

float c4 = -3.0 * (2.0 * cd * cd + cd + cd * cd * cd)

float c5 = 3.0 * cd + 1.0 + cd * cd * cd + 3.0 * cd * cd

var float i1 = na

var float i2 = na

var float i3 = na

var float i4 = na

var float i5 = na

var float i6 = na

i1 := c1 * src + c2 * nz(i1[1])

i2 := c1 * i1 + c2 * nz(i2[1])

i3 := c1 * i2 + c2 * nz(i3[1])

i4 := c1 * i3 + c2 * nz(i4[1])

i5 := c1 * i4 + c2 * nz(i5[1])

i6 := c1 * i5 + c2 * nz(i6[1])

var float bfr = na

bfr := -cd * cd * cd * i6 + c3 * i5 + c4 * i4 + c5 * i3

color bfrC = bfr > nz(bfr[1]) ? color.green : bfr < nz(bfr[1]) ? color.red : color.blue

plot(bfr, title='Trend', linewidth=3, style=plot.style_circles, color=bfrC)

//=======================================================================MACD DEMA=======================================================================//

string GROUP_4 = 'Config » MACD DEMA'

sma = input(12,title='DEMA Short', group=GROUP_4)

lma = input(26,title='DEMA Long', group=GROUP_4)

tsp = input(9,title='Signal', group=GROUP_4)

//dolignes = input(true,title="Lines", group=GROUP_4)

MMEslowa = ta.ema(close,lma)

MMEslowb = ta.ema(MMEslowa,lma)

DEMAslow = ((2 * MMEslowa) - MMEslowb )

MMEfasta = ta.ema(close,sma)

MMEfastb = ta.ema(MMEfasta,sma)

DEMAfast = ((2 * MMEfasta) - MMEfastb)

LigneMACDZeroLag = (DEMAfast - DEMAslow)

MMEsignala = ta.ema(LigneMACDZeroLag, tsp)

MMEsignalb = ta.ema(MMEsignala, tsp)

Lignesignal = ((2 * MMEsignala) - MMEsignalb )

MACDZeroLag = (LigneMACDZeroLag - Lignesignal)

swap1 = MACDZeroLag>0?color.green:color.red

//plot(MACDZeroLag,'Histo',color=swap1,histbase=0)

//p1 = plot(dolignes?LigneMACDZeroLag:na,"LigneMACD",color.blue)

//p2 = plot(dolignes?Lignesignal:na,"Signal",color.red)

//fill(p1, p2, color.blue)

hline(0)

//=======================================================================WAVE TREND=======================================================================//

string GROUP_5 = 'Config » WAVE TREND'

n1 = input(10, "Channel Length", group=GROUP_5)

n2 = input(21, "Average Length", group=GROUP_5)

//obLevel1 = input(60, "Over Bought Level 1", group=GROUP_5)

//obLevel2 = input(53, "Over Bought Level 2", group=GROUP_5)

//osLevel1 = input(-60, "Over Sold Level 1", group=GROUP_5)

//osLevel2 = input(-53, "Over Sold Level 2", group=GROUP_5)

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1,4)

//plot(0,"a" ,color.gray)

//plot(obLevel1,"a", color.red)

//plot(osLevel1,"a", color.green)

//plot(obLevel2,"a", color.red)

//plot(osLevel2,"a", color.green)

//plot(wt1,"a", color.green)

//plot(wt2,"a", color.red)

//plot(wt1-wt2,"a",color.blue, 1)

//=======================================================================CONDITIONS=======================================================================//

bool checker_1 = false // HARSI BUY

bool checker_11 = false // HARSI lookback BUY

bool checker_2 = false // HARSI SELL

bool checker_21 = false // HARSI lookback SELL

bool checker_3 = false // SSL AL

bool checker_31 = false // SSL lookback 0 dan büyükse al

bool checker_4 = false // SSL SAT

bool checker_41 = false // SSL lookback 0 dan büyükse sat

bool checker_5 = false // CORAL AL

bool checker_51 = false // CORAL lookback 1 den büyükse al

bool checker_6 = false // CORAL SAT

bool checker_61 = false // CORAL lookback 1 den büyükse sat

bool checker_7 = false // MACD AL

bool checker_71 = false // MACD lookback 0 dan büyükse al

bool checker_8 = false // MACD SAT

bool checker_81 = false // MACD lookback 0 dan büyükse sat

bool checker_9 = false // WAVE AL

bool checker_91 = false // WAVE lookback 0 dan büyükse al

bool checker_10 = false // WAVE SAT

bool checker_101 = false // WAVE lookback 0 dan büyükse sat

//=======================================================================HARSI=======================================================================//

if harsi_back==1

if ( C > O and C[1] < O[1] and C > C[1])

checker_1 := true

//HARSI SELL

if (C < O and C[1] > O[1] )

checker_2 := true

// HARSI BUY

if harsi_back>1

int say_1=0

while harsi_back>say_1 and checker_11 == false

if ( C[say_1] > O[say_1] and C[say_1+1] < O[say_1+1] and C[say_1] > C[say_1+1])

checker_11 := true

say_1:=say_1+1

int say_2=0

while harsi_back>say_2 and checker_21 == false

if (C[say_2] < O[say_2] and C[say_2+1] > O[say_2+1])

checker_21 := true

say_2:=say_2+1

//=======================================================================SSL=======================================================================//

if ssl_back==0

if (ta.crossover(sslUp, sslDown))

checker_3 := true

if (ta.crossover(sslDown, sslUp))

checker_4 := true

if ssl_back>0

int say_3=0

while ssl_back>=say_3 and checker_31==false

if (sslUp[say_3]>sslDown[say_3] and sslUp[say_3+1]<sslDown[say_3+1] )

checker_31 := true

say_3:=say_3+1

int say_4=0

while ssl_back>=say_4 and checker_41==false

if (sslUp[say_4]<sslDown[say_4] and sslUp[say_4+1]>sslDown[say_4+1])

checker_41 := true

say_4:=say_4+1

//======================================================================CORAL=======================================================================//

if coral_back==1

if(bfrC == color.green and bfrC[1] == color.red)

checker_5 := true

if(bfrC == color.red and bfrC[1] == color.green)

checker_6 := true

if coral_back>1

int say_5=0

while coral_back>say_5 and checker_51 == false

if(bfrC[say_5] == color.green and bfrC[say_5+1] == color.red)

checker_51 := true

say_5 := say_5+1

int say_6=0

while coral_back>say_6 and checker_61 == false

if(bfrC[say_6] == color.red and bfrC[say_6+1] == color.green)

checker_61 := true

say_6 := say_6+1

//=======================================================================MACD=======================================================================//

if macd_back==0

if ta.crossover(LigneMACDZeroLag,Lignesignal)

checker_7 := true

if ta.crossover(Lignesignal,LigneMACDZeroLag)

checker_8 := true

if macd_back>0

int say_7=0

while macd_back>=say_7 and checker_71==false

if ta.crossover(LigneMACDZeroLag[say_7],Lignesignal[say_7])

checker_71 := true

say_7:=say_7+1

int say_8=0

while macd_back>=say_8 and checker_81==false

if ta.crossover(Lignesignal[say_8],LigneMACDZeroLag[say_8])

checker_81 := true

say_8:=say_8+1

//=======================================================================WAVE TREND=======================================================================//

if wave_back ==0

if ta.crossover(wt1,wt2)

checker_9 := true

if ta.crossover(wt2,wt1)

checker_10 :=true

if wave_back>0

int say_9 =0

while wave_back>=say_9 and checker_91==false

if (ta.crossover(wt1[say_9],wt2[say_9]))

checker_91 := true

say_9:=say_9+1

int say_10=0

while wave_back>=say_10 and checker_101==false

if (ta.crossover(wt2[say_10],wt1[say_10]))

checker_101 := true

say_10:=say_10+1

//=======================================================================BUY=======================================================================//

var buy = false

var sell = true

//=======================================================================TEK SEÇENEK=======================================================================//

if buy == false and sell==true

//dec1

if dec1 == true and dec2==false and dec3== false and dec4==false and dec5==false

if checker_1 or checker_11

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2

if dec2 == true and dec1==false and dec3== false and dec4==false and dec5==false

if checker_3 or checker_31

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up,textcolor= color.white, size=size.small, text="SSL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec3

if dec3 == true and dec2==false and dec1== false and dec4==false and dec5==false

if checker_5 or checker_51

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up,textcolor= color.white, size=size.small, text="CORAL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec4

if dec4 == true and dec2==false and dec3== false and dec1==false and dec5==false

if checker_7 or checker_71

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec5

if dec5 == true and dec1==false and dec2== false and dec3==false and dec4==false

if checker_9 or checker_91

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================2 SEÇENEK=======================================================================//

//dec1-dec2

if dec1 == true and dec2==true and dec3== false and dec4== false and dec5== false

if (checker_1== true or checker_11==true) and (checker_3 == true or checker_31 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec3

if dec1 == true and dec2==false and dec3== true and dec4== false and dec5== false

if (checker_1 == true or checker_11==true) and (checker_5 == true or checker_51 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec4

if dec1 == true and dec2==false and dec3== false and dec4== true and dec5== false

if (checker_1 == true or checker_11==true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec5

if dec1 == true and dec2==false and dec3== false and dec4== false and dec5== true

if (checker_1 == true or checker_11==true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2 dec3

if dec1 == false and dec2==true and dec3== true and dec4== false and dec5== false

if (checker_3 == true or checker_31==true) and (checker_5 == true or checker_51 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n CORAL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2 dec4

if dec1 == false and dec2==true and dec3== false and dec4== true and dec5== false

if (checker_3 == true or checker_31==true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2 dec5

if dec1 == false and dec2==true and dec3== false and dec4== false and dec5== true

if (checker_3 == true or checker_31==true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec3 dec4

if dec1 == false and dec2==false and dec3== true and dec4== true and dec5== false

if (checker_5 == true or checker_51==true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="CORAL\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec3 dec5

if dec1 == false and dec2==false and dec3== true and dec4== false and dec5== true

if (checker_5 == true or checker_51==true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="CORAL\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec4 dec5

if dec1 == false and dec2==false and dec3== false and dec4== true and dec5== true

if (checker_7 == true or checker_71==true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="MACD\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================3 SEÇENEK=======================================================================//

// dec 1 dec2 dec3

if dec1 == true and dec2==true and dec3 == true and dec4 ==false and dec5== false

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n CORAL")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec2 dec4

if dec1 == true and dec2==true and dec3 == false and dec4 ==true and dec5== false

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n MACD ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec2 dec5

if dec1 == true and dec2==true and dec3 == false and dec4 ==false and dec5== true

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n WAVE ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec3 dec4

if dec1 == true and dec2==false and dec3 == true and dec4 ==true and dec5== false

if (checker_1 == true or checker_11==true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL\n\n MACD ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec3 dec5

if dec1 == true and dec2==false and dec3 == true and dec4 ==false and dec5== true

if (checker_1 == true or checker_11==true) and (checker_5 == true or checker_51 == true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL\n\n WAVE ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec1 dec4 dec5

if dec1 == true and dec2==false and dec3 == false and dec4 ==true and dec5== true

if (checker_1 == true or checker_11==true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n MACD\n\n WAVE ")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec2 dec3 dec4

if dec1 == false and dec2==true and dec3 == true and dec4==true and dec5== false

if (checker_3 == true or checker_31==true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n CORAL\n\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec2 dec3 dec5

if dec1 == false and dec2==true and dec3== true and dec4== false and dec5== true

if (checker_3 == true or checker_31==true) and (checker_5 == true or checker_51 == true) and (checker_9 == true or checker_91==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n CORAL\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec2 dec4 dec5

if dec1 == false and dec2==true and dec3== false and dec4== true and dec5== true

if (checker_3 == true or checker_31==true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n MACD\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

// dec3 dec4 dec5

if dec1 == false and dec2==false and dec3 == true and dec4 ==true and dec5== true

if (checker_5 == true or checker_51==true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91 == true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="CORAL\n MACD\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================4 SEÇENEK=======================================================================//

//dec1 dec2 dec3 dec4

if dec1 == true and dec2==true and dec3 == true and dec4==true and dec5== false

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 ==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL\n\n CORAL\n\n\n MACD")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec3 dec4 dec5

if dec1 == true and dec2==false and dec3 == true and dec4==true and dec5== true

if (checker_1 == true or checker_11==true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91 ==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n CORAL\n\n MACD\n\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec2 dec4 dec5

if dec1 == true and dec2==true and dec3 == false and dec4==true and dec5== true

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_7 == true or checker_71 == true) and (checker_9 == true or checker_91 ==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n MACD\n\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec1 dec2 dec3 dec5

if dec1 == true and dec2==true and dec3 == true and dec4==false and dec5== true

if (checker_1 == true or checker_11==true) and (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true) and (checker_9 == true or checker_91 ==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="HARSI\n SSL\n\n CORAL\n\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//dec2 dec3 dec4 dec5

if dec1 == false and dec2==true and dec3 == true and dec4==true and dec5== true

if (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 ==true) and (checker_9 == true or checker_91==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SSL\n CORAL\n\n MACD\n\n\n WAVE")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================5 SEÇENEK=======================================================================//

//dec1 dec2 dec3 dec4 dec5

if dec1 == true and dec2==true and dec3 == true and dec4==true and dec5== true

if (checker_1 == true or checker_11) and (checker_3 == true or checker_31 == true) and (checker_5 == true or checker_51 == true) and (checker_7 == true or checker_71 ==true) and (checker_9 == true or checker_91==true)

label.new(bar_index, low-ta.tr, color=color.green,style= label.style_label_up, size=size.small, text="SUPER BUY")

strategy.entry("long", strategy.long)

sell:= false

buy:=true

//=======================================================================SELL=======================================================================//

//=======================================================================TEK SEÇENEK=======================================================================//

if buy == true and sell==false

//dec1

if dec1 == true and dec2==false and dec3== false and dec4==false and dec5==false

if checker_2 or checker_21

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2

if dec2 == true and dec1==false and dec3== false and dec4==false and dec5==false

if checker_4 or checker_41

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec3

if dec3 == true and dec2==false and dec1== false and dec4==false and dec5==false

if checker_6 or checker_61

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="CORAL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec4

if dec4 == true and dec2==false and dec3== false and dec1==false and dec5==false

if checker_8 or checker_81

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec5

if dec5 == true and dec1==false and dec2== false and dec3==false and dec4==false

if checker_10 or checker_101

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//=======================================================================2 SEÇENEK=======================================================================//

//dec1-dec2

if dec1 == true and dec2==true and dec3== false and dec4== false and dec5== false

if (checker_2==true or checker_21==true) and (checker_4 or checker_41 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec3

if dec1 == true and dec2==false and dec3== true and dec4== false and dec5== false

if (checker_2 == true or checker_21==true) and (checker_6 == true or checker_61 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n CORAL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec4

if dec1 == true and dec2==false and dec3== false and dec4== true and dec5== false

if (checker_2 == true or checker_21==true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec5

if dec1 == true and dec2==false and dec3== false and dec4== false and dec5== true

if (checker_2 == true or checker_21==true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2 dec3

if dec1 == false and dec2==true and dec3== true and dec4== false and dec5== false

if (checker_4 == true or checker_41==true) and (checker_6 == true or checker_61 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2 dec4

if dec1 == false and dec2==true and dec3== false and dec4== true and dec5== false

if (checker_4 == true or checker_41==true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2 dec5

if dec1 == false and dec2==true and dec3== false and dec4== false and dec5== true

if (checker_4 == true or checker_41==true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec3 dec4

if dec1 == false and dec2==false and dec3== true and dec4== true and dec5== false

if (checker_6 == true or checker_61==true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="CORAL\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec3 dec5

if dec1 == false and dec2==false and dec3== true and dec4== false and dec5== true

if (checker_6 == true or checker_61==true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="CORAL\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec4 dec5

if dec1 == false and dec2==false and dec3== false and dec4== true and dec5== true

if (checker_8 == true or checker_81==true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="MACD\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//=======================================================================3 SEÇENEK=======================================================================//

// dec1 dec2 dec3

if dec1 == true and dec2==true and dec3 == true and dec4 ==false and dec5== false

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true)

label.new(bar_index, high+ta.tr/2, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n CORAL")

strategy.entry("short", strategy.short)

sell:= true

buy := false

// dec1 dec2 dec4

if dec1 == true and dec2==true and dec3 == false and dec4 ==true and dec5== false

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr/2, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy := false

// dec1 dec2 dec5

if dec1 == true and dec2==true and dec3 == false and dec4 ==false and dec5== true

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr/2, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n MACD ")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec1 dec3 dec4

if dec1 == true and dec2==false and dec3 == true and dec4 ==true and dec5== false

if (checker_2 == true or checker_21==true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n CORAL\n\n MACD ")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec1 dec3 dec5

if dec1 == true and dec2==false and dec3 == true and dec4 ==false and dec5== true

if (checker_2 == true or checker_21==true) and (checker_6 == true or checker_61 == true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n MACD ")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec1 dec4 dec5

if dec1 == true and dec2==false and dec3 == false and dec4 ==true and dec5== true

if (checker_2 == true or checker_21==true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n MACD\n\n WAVE ")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec2 dec3 dec4

if dec1 == false and dec2==true and dec3 == true and dec4==true and dec5== false

if (checker_4 == true or checker_41==true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL\n\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec2 dec3 dec5

if dec1 == false and dec2==true and dec3== true and dec4== false and dec5== true

if (checker_4 == true or checker_41==true) and (checker_6 == true or checker_61 == true) and (checker_10 == true or checker_101==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec2 dec4 dec5

if dec1 == false and dec2==true and dec3== false and dec4== true and dec5== true

if (checker_4 == true or checker_41==true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

// dec3 dec4 dec5

if dec1 == false and dec2==false and dec3 == true and dec4 ==true and dec5== true

if (checker_6 == true or checker_61==true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101 == true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="CORAL\n MACD\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//=======================================================================4 SEÇENEK=======================================================================//

//dec1 dec2 dec3 dec4

if dec1 == true and dec2==true and dec3 == true and dec4==true and dec5== false

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 ==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n CORAL\n\n\n MACD")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec3 dec4 dec5

if dec1 == true and dec2==false and dec3 == true and dec4==true and dec5== true

if (checker_2 == true or checker_21==true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101 ==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n CORAL\n\n MACD\n\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec2 dec4 dec5

if dec1 == true and dec2==true and dec3 == false and dec4==true and dec5== true

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_8 == true or checker_81 == true) and (checker_10 == true or checker_101 ==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n MACD\n\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec1 dec2 dec3 dec5

if dec1 == true and dec2==true and dec3 == true and dec4==false and dec5== true

if (checker_2 == true or checker_21==true) and (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 ==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="HARSI\n SSL\n\n CORAL\n\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//dec2 dec3 dec4 dec5

if dec1 == false and dec2==true and dec3 == true and dec4==true and dec5== true

if (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 ==true) and (checker_10 == true or checker_101==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SSL\n CORAL\n\n MACD\n\n\n WAVE")

strategy.entry("short", strategy.short)

sell:= true

buy:=false

//=======================================================================5 SEÇENEK=======================================================================//

//dec1 dec2 dec3 dec4 dec5

if dec1 == true and dec2==true and dec3 == true and dec4==true and dec5== true

if (checker_2 == true or checker_21) and (checker_4 == true or checker_41 == true) and (checker_6 == true or checker_61 == true) and (checker_8 == true or checker_81 ==true) and (checker_10 == true or checker_101==true)

label.new(bar_index, high+ta.tr, color=color.red,style= label.style_label_down, size=size.small, text="SUPER SELL")

strategy.entry("short", strategy.short)

sell:= true

buy:=false