Техническая количественная торговая стратегия с несколькими индикаторами

Обзор

Стратегия использует множество технических показателей, включая параллельную линию, переходную систему, экспорт мнения, простые скользящие средние, индексные скользящие средние и текущие средние, чтобы идентифицировать потенциальные точки покупки и продажи на графике.

Стратегический принцип

Основные показатели

- Система параллельной линии: для определения остановочных и потенциальных точек входа

- Стратегия экспортного мнения: для определения направления тенденций

- Простая скользящая средняя с нулевым отставанием: предоставление скользящей средней с низким отставанием

- Индексные скользящие средние: отслеживание тенденций и колебаний цен

- Гладкая средняя линия: создание более гладкой средней линии

Торговые сигналы

- Когда парализовая линия поворачивает систему вверх и цена превышает 99-ю скользящую среднюю индекса, делать больше; когда она показывает тенденцию к снижению и цена ниже 99-й скользящей средней индекса, делать меньше

- Сигналы в сочетании с стратегией экспорта общественного мнения подтверждают дальнейшее направление тенденции

- Гладкая равномерная линия сочетается с сигналом параллельной линии, чтобы избежать ложного прорыва

Управление рисками

- Настройка стоп-лома и стоп-стоп

- Рассмотреть возможность переоформления условий покупки и гибкости в изменении позиций

Анализ преимуществ

Наибольшее преимущество этой стратегии заключается в том, что портфель индикаторов является всеобъемлющим, что позволяет эффективно идентифицировать направление тенденции. Система параллельных линий определяет потенциальные переломы; ОПИОННАЯ ЭКСПОРТНАЯ СТРАТЕГИЯ ОДНОЛОЖЕНИЯ ОДНОЛОЖЕНИЯ ПРИМЕРНЫХ ТРЕНДОВ; ПОДВИЖНАЯ СТРАТЕГИЯ ПРИМЕРНЫХ ФИЛТЕРОВ.

Кроме того, в стратегию включены механизмы остановки и остановки для управления рисками. Гладкая равновесие также используется для предотвращения помех от кратковременного шума. Все это делает стратегию очень стабильной.

Анализ рисков

Из-за зависимости от большого количества показателей, когда эти показатели посылают сигналы конфликта, эта стратегия сталкивается с определенными трудностями. Кроме того, неправильная настройка параметров может негативно повлиять на торговлю.

Кроме того, технические сделки сами по себе несут определенные риски, которые не позволяют полностью избежать убытков.

Направление оптимизации

- Тестирование и оптимизация параметров показателя для поиска оптимального сочетания

- Включение алгоритмов машинного обучения, использующих модели обучения большим объемам данных, для дальнейшего повышения точности сигналов

- Динамическая коррекция позиций и линий стоп-ложа в сочетании с эмоциональными показателями, информацией о новостях и другими факторами, определяющими состояние рынка

- Оптимизация логики перенаправления условий покупки, чтобы сделать обнаружение сигналов более гибким и последовательным

Подвести итог

Стратегия объединяет несколько технических показателей, чтобы идентифицировать торговые сигналы через комбинацию показателей. Преимущество заключается в высокой точности и стабильности сигнала. В то же время, меры по контролю риска находятся на месте. В целом, это набор торговых программ, которые стоит рассмотреть.

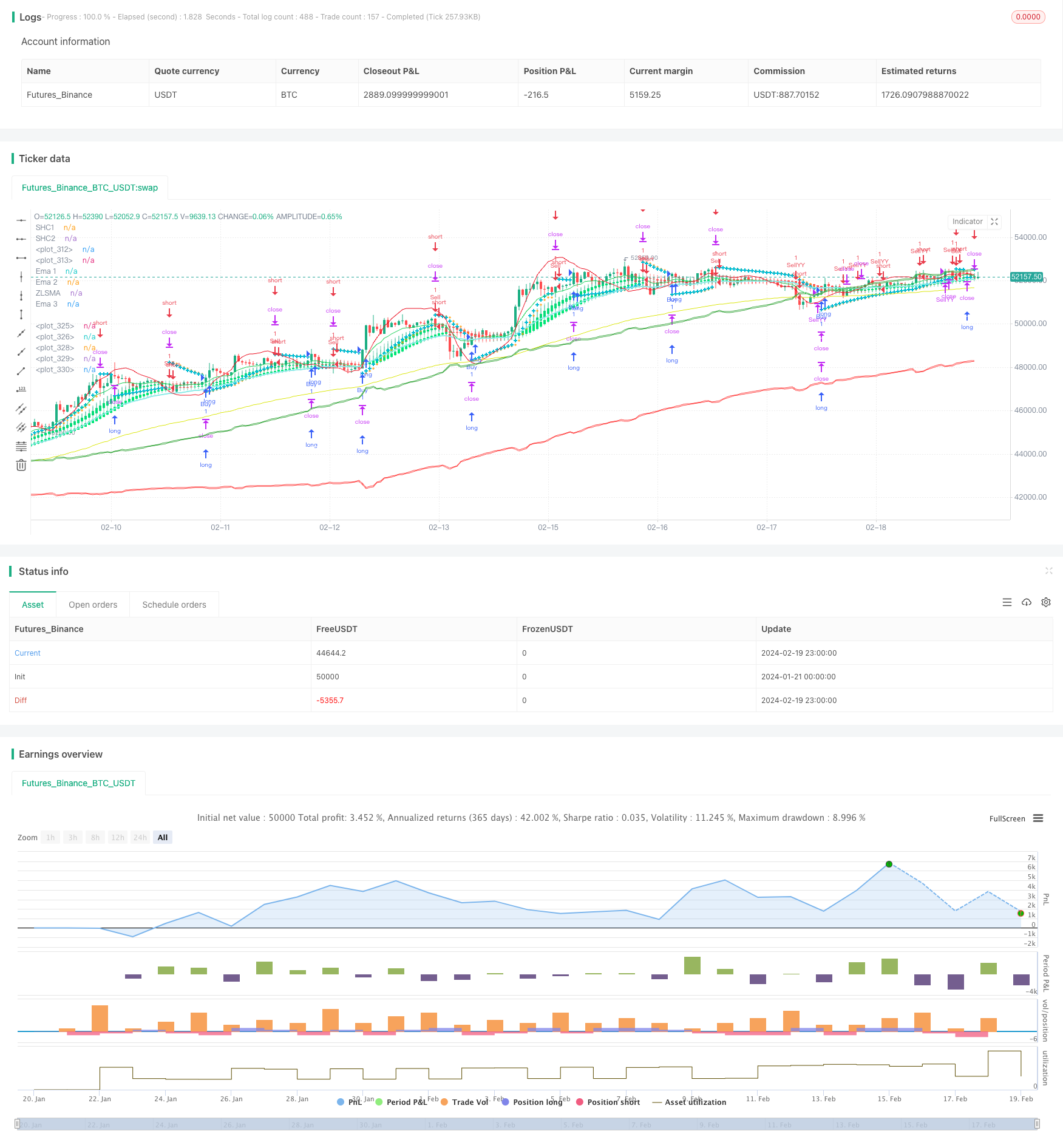

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CE-ZLSMA-EMA-SAR-SHC", overlay=true)

// Parabolic SAR Strategy

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

var bool longSar = false

var bool shortSar = false

//input smoothed HAC 1

len=input.int(title="Length SHC1", defval = 10)

o=ta.ema(open,len)

c=ta.ema(close,len)

h=ta.ema(high,len)

l=ta.ema(low,len)

haclose = (o+h+l+c)/4

var haopen = 0.0

if na(haopen[1])

haopen := (o + c) / 2

else

haopen := (haopen[1] + haclose[1]) / 2

hahigh = math.max (h, math.max(haopen,haclose))

halow = math.min (l, math.min(haopen,haclose))

len2=input(10)

o2=ta.ema(haopen, len2)

c2=ta.ema(haclose, len2)

h2=ta.ema(hahigh, len2)

l2=ta.ema(halow, len2)

col=o2>c2 ? color.red : color.lime

bool shc1Green = o2 > c2

bool shc1Lime = o2 < c2

//input smoothed HAC 1

lenSHC2=input.int(title="Length SHC2 ", defval = 20)

oShc2=ta.ema(open,lenSHC2)

cShc2=ta.ema(close,lenSHC2)

hShc2=ta.ema(high,lenSHC2)

lShc2=ta.ema(low,lenSHC2)

hacloseShc2 = (oShc2+hShc2+lShc2+cShc2)/4

var haopenShc2 = 0.0

if na(haopenShc2[1])

haopenShc2 := (oShc2 + cShc2) / 2

else

haopenShc2 := (haopenShc2[1] + hacloseShc2[1]) / 2

hahighShc2 = math.max (hShc2, math.max(haopenShc2,hacloseShc2))

halowShc2 = math.min (lShc2, math.min(haopenShc2,hacloseShc2))

len2Shc2=input(10)

o2Shc2=ta.ema(haopenShc2, len2Shc2)

c2Shc2=ta.ema(hacloseShc2, len2Shc2)

h2Shc2=ta.ema(hahighShc2, len2Shc2)

l2Shc2=ta.ema(halowShc2, len2Shc2)

colShc2=o2Shc2>c2Shc2 ? color.red : color.lime

bool shc2Green = o2Shc2 > c2Shc2

bool shc2Lime = o2Shc2 < c2Shc2

//end smooth

bool shcGree = shc1Green and shc2Green

bool shcLime = shc1Lime and shc2Lime

//zlsma

lengthZlsma = input.int(title="Length", defval=32)

offset = input.int(title="Offset", defval=0)

src = input(close, title="Source")

lsma = ta.linreg(src, lengthZlsma, offset)

lsma2 = ta.linreg(lsma, lengthZlsma, offset)

eq= lsma-lsma2

zlsma = lsma+eq

// ema 10

len4 = input.int(10, minval=1, title="Length")

src4 = input.source(close, title="Source")

out4 = ta.ema(src4, len4)

//End of format

// ema 34

len5 = input.int(34, minval=1, title="Length")

src5 = input.source(close, title="Source")

out5 = ta.ema(src5, len5)

//end ema 34

// ema 99

len6 = input.int(99, minval=1, title="Length")

src6 = input.source(close, title="Source")

out6 = ta.ema(src6, len6)

// end ema 99

//kiem tra dieu kien gia dong cua lon hon ema99 thi moi me lenh long

bool onEma99 = close > out6

bool downEma99 = open < out6

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := math.max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := math.min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := math.min(AF + increment, maximum)

else

if low < EP

EP := low

AF := math.min(AF + increment, maximum)

if uptrend

SAR := math.min(SAR, low[1])

if bar_index > 1

SAR := math.min(SAR, low[2])

else

SAR := math.max(SAR, high[1])

if bar_index > 1

SAR := math.max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

if barstate.isconfirmed

if uptrend

// log.info("true")

strategy.entry("ParSE", strategy.short, stop=nextBarSAR, comment="ParSE")

strategy.cancel("ParLE")

shortSar := false

longSar := true

else

// log.info("false")

strategy.entry("ParLE", strategy.long, stop=nextBarSAR, comment="ParLE")

strategy.cancel("ParSE")

longSar := false

shortSar := true

// Chandelier Exit Strategy

length = input.int(title="ATR Period", defval=1)

mult = input.float(title="ATR Multiplier", step=0.1, defval=1.1)

showLabels = input.bool(title="Show Buy/Sell Labels ?", defval=true)

useClose = input.bool(title="Use Close Price for Extremums ?", defval=true)

highlightState = input.bool(title="Highlight State ?", defval=true)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var bool longOpened = false

var bool shortOpended = false

// Entry and exit logic

if (dir == 1)

if longSar

if not longOpened

strategy.close("Sell", disable_alert = true)

strategy.order("Buy", strategy.long)

longOpened := true

shortOpended := false

if (dir == -1)

if shortSar

if not shortOpended

strategy.close("Buy", disable_alert = true)

strategy.order("Sell", strategy.short)

shortOpended := true

longOpened := false

//strategy YY

// ~~~~~~~~~~~ INPUTS ~~~~~~~~~~~ //

lenYY = input.int(80, "Trend Length:", tooltip="How far back should we span this indicator?\nThis length effects all lengths of the indicator")

purchaseSrc = input.source(close, "Purchase Source (Long and Short):", tooltip="What source needs to exit the purchase zone for a purchase to happen?")

exitSrc = input.source(close, "Exit Source (Long and Short):", tooltip="What source needs to hit a exit condition to stop the trade (Take profit, Stop Loss or hitting the other sides Purchase Zone)?")

useTakeProfit = input.bool(true, "Use Take Profit", tooltip="Should we take profit IF we cross the basis line and then cross it AGAIN?")

useStopLoss = input.bool(true, "Use Stop Loss", tooltip="Stop loss will ensure you don't lose too much if its a bad call")

stopLossMult = input.float(0.1, "Stoploss Multiplier %:", tooltip="How far from the purchase lines should the stop loss be")

resetCondition = input.string("Entry", "Reset Purchase Availability After:", options=["Entry", "Stop Loss", "None"],

tooltip="If we reset after a condition is hit, this means we can purchase again when the purchase condition is met. \n" +

"Otherwise, we will only purchase after an opposite signal has appeared.\n" +

"Entry: means when the close enters the purchase zone (buy or sell).\n" +

"Stop Loss: means when the close hits the stop loss location (even when were out of a trade)\n" +

"This allows us to get more trades and also if our stop loss initally was hit but it WAS a good time to purchase, we don't lose that chance.")

// ~~~~~~~~~~~ VARIABLES ~~~~~~~~~~~ //

var bool longStart = na

var bool longAvailable = na

var bool longTakeProfitAvailable = na

var bool longStopLoss = na

var bool shortStart = na

var bool shortAvailable = na

var bool shortTakeProfitAvailable = na

var bool shortStopLoss = na

resetAfterStopLoss = resetCondition == "Stop Loss"

resetAfterEntry = resetCondition == "Entry"

// ~~~~~~~~~~~ CALCULATIONS ~~~~~~~~~~~ //

// Mid Line

midHigh = ta.vwma(ta.highest(high, lenYY), lenYY)

midLow = ta.vwma(ta.lowest(low, lenYY), lenYY)

mid = math.avg(midHigh, midLow)

midSmoothed = ta.ema(mid, lenYY)

//Volume Filtered

avgVol = ta.vwma(volume, lenYY)

volDiff = volume / avgVol

midVolSmoothed = ta.vwma(midSmoothed * volDiff, 3)

//RSI Filtered

midDifference = ta.sma(midHigh - midLow, lenYY)

midRSI = ta.rsi(midVolSmoothed, lenYY) * 0.01

midAdd = midRSI * midDifference

//Calculate Zones

purchaseZoneHigh = midSmoothed + midAdd

purchaseZoneLow = midSmoothed - midAdd

purchaseZoneBasis = math.avg(purchaseZoneHigh, purchaseZoneLow)

//Create Stop Loss Locations

stopLossHigh = purchaseZoneHigh * (1 + (stopLossMult * 0.01))

stopLossLow = purchaseZoneLow * (1 - (stopLossMult * 0.01))

// ~~~~~~~~~~~ PURCHASE CALCULATIONS ~~~~~~~~~~~ //

//Long

longEntry = ta.crossunder(purchaseSrc, purchaseZoneLow)

longStart := ta.crossover(purchaseSrc, purchaseZoneLow) and longAvailable

longAvailable := ta.crossunder(purchaseSrc, purchaseZoneHigh) or (resetAfterStopLoss and longStopLoss) or (resetAfterEntry and longEntry) ? true : longStart ? false : longAvailable[1]

longEnd = ta.crossover(exitSrc, purchaseZoneHigh)

longStopLoss := ta.crossunder(exitSrc, stopLossLow)

longTakeProfitAvailable := ta.crossover(exitSrc, purchaseZoneBasis) ? true : longEnd ? false : longTakeProfitAvailable[1]

longTakeProfit = ta.crossunder(exitSrc, purchaseZoneBasis) and longTakeProfitAvailable

//Short

shortEntry = ta.crossover(purchaseSrc, purchaseZoneHigh)

shortStart := ta.crossunder(purchaseSrc, purchaseZoneHigh) and shortAvailable

shortAvailable := ta.crossover(purchaseSrc, purchaseZoneLow) or (resetAfterStopLoss and shortStopLoss) or (resetAfterEntry and shortEntry)? true : shortStart ? false : shortAvailable[1]

shortEnd = ta.crossunder(exitSrc, purchaseZoneLow)

shortStopLoss := ta.crossover(exitSrc, stopLossHigh)

shortTakeProfitAvailable := ta.crossunder(exitSrc, purchaseZoneBasis) ? true : shortEnd ? false : shortTakeProfitAvailable[1]

shortTakeProfit = ta.crossover(exitSrc, purchaseZoneBasis) and shortTakeProfitAvailable

// ~~~~~~~~~~~ STRATEGY ~~~~~~~~~~~ //

var bool openLongYY = false

var bool openShortYY = false

if (longStart)

strategy.order("BuyYY", strategy.long)

strategy.close("SellYY", disable_alert = true)

openLongYY := true

openShortYY := false

else if (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit))

strategy.close("BuyYY", disable_alert = true)

if (shortStart)

strategy.close("BuyYY", disable_alert = true)

strategy.order("SellYY", strategy.short)

openShortYY := true

openLongYY := false

else if (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

strategy.close("SellYY", disable_alert = true)

// ~~~~~~~~~~~ ALERTS ~~~~~~~~~~~ //

// if longStart or (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit)) or shortStart or (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

// alert("{{strategy.order.action}} | {{ticker}} | {{close}}", alert.freq_once_per_bar)

// Plotting

plot(SAR, style=plot.style_cross, linewidth=1, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

plot(zlsma, color=color.rgb(235, 15, 33), linewidth=1, title = "ZLSMA")

plot(out4, color=color.rgb(24, 209, 85), title="Ema 1")

plot(out5, color=color.rgb(139, 234, 231), linewidth = 2, title="Ema 2")

plot(out6, color=color.rgb(219, 230, 18), title="Ema 3")

plotcandle(o2, h2, l2, c2, title="SHC1", color=col)

plotcandle(o2Shc2, hShc2, l2Shc2, c2Shc2, title="SHC2", color=col)

// ~~~~~~~~~~~ PLOTS YY ~~~~~~~~~~~ //

shortLine = plot(purchaseZoneHigh, color=color.green)

shortStopLossLine = plot(stopLossHigh, color=color.green) //color=color.rgb(0, 97, 3)

fill(shortLine, shortStopLossLine, color = color.new(color.green, 90))

plot(purchaseZoneBasis, color=color.white)

longLine = plot(purchaseZoneLow, color=color.red)

longStopLossLine = plot(stopLossLow, color=color.red) //color=color.rgb(105, 0, 0)

fill(longLine, longStopLossLine, color=color.new(color.red, 90))