Обзор

Стратегия является системой торговли, которая отслеживает тенденции, основанные на множестве средних и динамических индикаторов. Стратегия использует в основном динамические отношения 20-дневных, 50-дневных, 150-дневных и 200-дневных простых скользящих средних (SMA), комбинируя перепады и RSI, чтобы улавливать сильные восходящие тенденции на уровне дневной линии и своевременно выравнивать, когда тенденция ослабевает.

Стратегический принцип

Основная логика стратегии включает в себя следующие ключевые элементы:

- Система средних линий: с использованием средних линий 20/50/150/200 дней для построения системы определения тенденций, требующая много средних линий, представляющих собой многоглавый ряд.

- Подтверждение динамики: использование индикатора RSI и его движущейся средней для определения динамики цен, требующей RSI больше 55 или RSI SMA больше 50 и RSI вверх.

- Проверка количества сделок: подтверждение эффективности сигналов купли-продажи путем сравнения 20-дневного среднего количества сделок с недавними.

- Проверка сохранности тренда: проверка 50-дневного среднего тренда, находящегося в восходящем тренде в течение не менее 25 дней из последних 40 торговых дней.

- Подтверждение местоположения: цена должна быть стабильной выше 150-дневной средней линии в течение не менее 20 торговых дней.

Условия покупки:

- За последние 10 дней было более 4 солнечных дней и по крайней мере 1 день с перебоями

- RSI соответствует динамическим условиям

- Однородная система представляет собой многоголовый ряд и продолжает расти

- Цены стабильно работают над 150-дневной средней линией

Условия продажи включают:

- Цены упали ниже 150-дневной средней

- Последовательное снижение выбросов

- 50-дневная средняя снизилась до 150-дневной

- Недавнее преобладание женского пола и увеличение количества сделок

Стратегические преимущества

- Круговая проверка по нескольким техническим показателям снижает ошибочность

- Тенденционная устойчивость требует строгого фильтрации краткосрочных колебаний

- Комбинированный анализ трафика для повышения надежности сигнала

- Ясные условия для остановки убытков, эффективный контроль риска

- Подходит для уловить среднесрочные и долгосрочные тенденции, снижая частоту торгов

- Логика стратегии ясна, проста для понимания и реализации.

Стратегический риск

- Среднелинейная система является отсталой и может пропустить начальный этап тренда.

- Строгие условия для входа могут привести к упущению некоторых торговых возможностей

- На нестабильных рынках могут возникать частые ложные сигналы

- Определенная задержка в распознавании реверсии

- Для вывода требуется большая сумма.

Предложения по контролю рисков:

- Установка разумного стоп-позиции

- Управление финансами должно быть умеренным

- Рассмотреть возможность увеличения показателей подтверждения тенденции

- Параметры, адаптируемые к рыночным условиям

Направление оптимизации стратегии

- Добавление параметров адаптации

- Среднелинейный цикл, скорректированный в соответствии с динамикой рыночных колебаний

- Оптимизировать настройки RSI Threshold

- Совершенствование механизма погашения убытков

- Увеличение убытков отслеживания

- Настройка времени остановки

- Введение анализа рыночной среды

- Повышение показателя интенсивности тренда

- Учитывайте показатели волатильности

- Оптимизация масштаба сделок

- Дизайн динамического управления позициями

- Настройка на мощность сигнала

Подвести итог

Это строго разработанная стратегия отслеживания тенденций, которая позволяет эффективно улавливать сильные тенденционные возможности с помощью совместного использования нескольких технических показателей. Основные преимущества стратегии заключаются в ее полном механизме подтверждения сигналов и строгой системе контроля риска. Несмотря на определенную отсталость, благодаря разумной оптимизации параметров и управлению рисками стратегия может поддерживать стабильную производительность в долгосрочной деятельности.

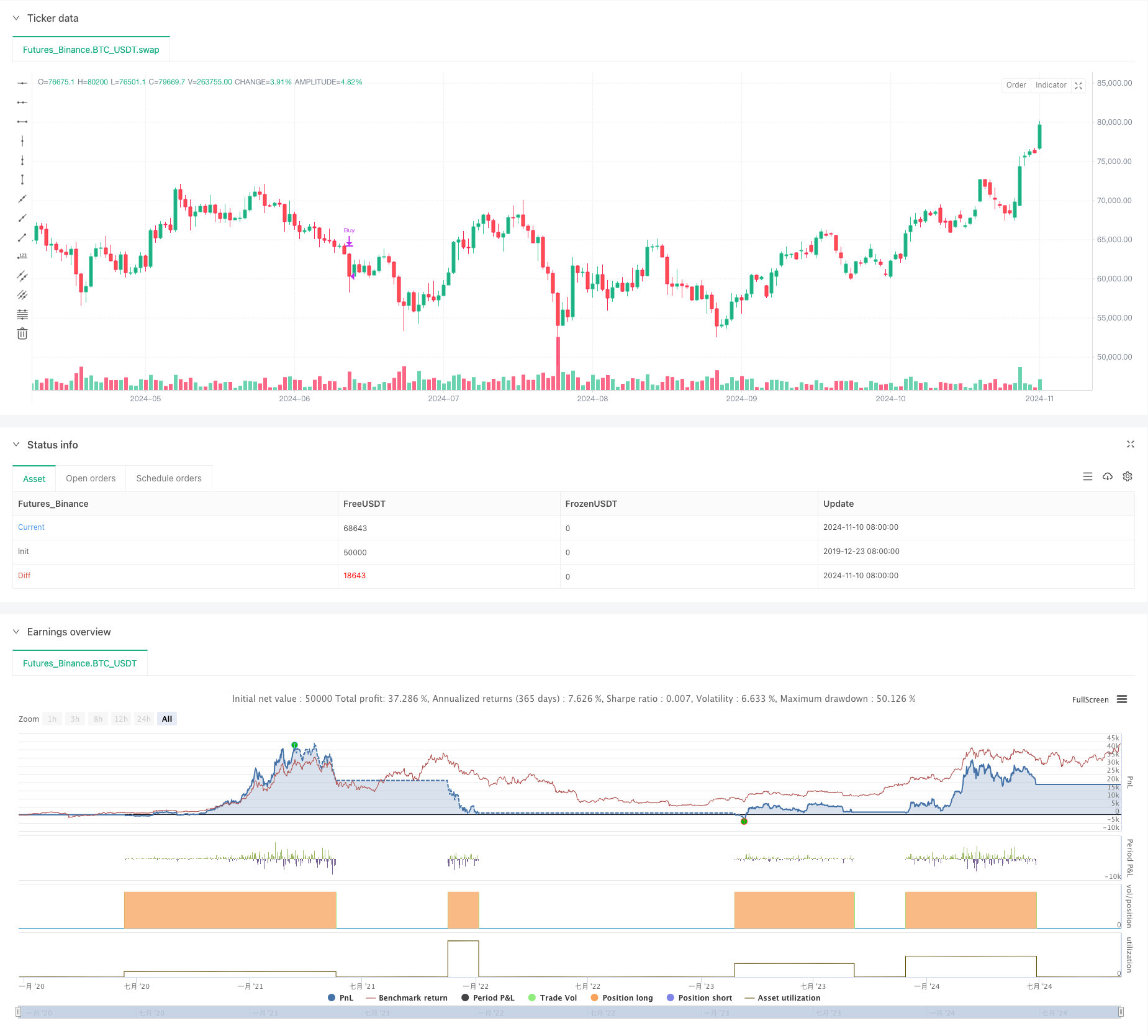

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Micho's 150 (1D Time Frame Only)", overlay=true)

// Define the length for the SMAs and RSI

sma20Length = 20

sma50Length = 50

sma150Length = 150

sma200Length = 200

volumeMaLength = 20

rsiLength = 14

rsiSmaLength = 14

smaCheckLength = 40 // Check the last month of trading days (~20 days)

requiredRisingDays = 25 // Require SMA to rise in at least 16 of the past 20 days

sma150AboveSma200CheckDays = 1 // Require SMA150 > SMA200 for the last 10 days

// Calculate the SMAs for price

sma20 = ta.sma(close, sma20Length)

sma50 = ta.sma(close, sma50Length)

sma150 = ta.sma(close, sma150Length)

sma200 = ta.sma(close, sma200Length)

// Calculate the 20-period moving average of volume

volumeMA20 = ta.sma(volume, volumeMaLength)

// Calculate the 14-period RSI

rsi = ta.rsi(close, rsiLength)

// Calculate the 14-period SMA of RSI

rsiSMA = ta.sma(rsi, rsiSmaLength)

// Check if most of the last 5 days are buyer days (close > open)

buyerDays = 0

for i = 0 to 9

if close[i] > open[i]

buyerDays := buyerDays + 1

// Check if at least 1 day has volume higher than the 20-period volume MA

highVolumeDays = 0

for i = 0 to 9

if close[i] > open[i] and volume[i] > volumeMA20

highVolumeDays := highVolumeDays + 1

// Define the new RSI condition

rsiCondition = (rsi >= 55) or (rsiSMA > 50 and rsi > rsi[1])

// Check if the 50-day SMA has been rising on at least 16 of the last 20 trading days

risingDays = 0

for i = 1 to smaCheckLength

if sma50[i] > sma50[i + 1]

risingDays := risingDays + 1

// Check if the SMA has risen on at least 16 of the last 20 days

sma50Rising = risingDays >= requiredRisingDays

// Check if the price has been above the SMA150 for the last 20 trading days

priceAboveSma150 = true

for i = 1 to smaCheckLength

if close[i] < sma150[i]

priceAboveSma150 := false

// Check if the SMA150 has been above the SMA200 for the last 10 days

sma150AboveSma200 = true

for i = 1 to sma150AboveSma200CheckDays

if sma150[i] < sma200[i]

sma150AboveSma200 := false

// Define the conditions for the 150-day and 200-day SMAs being rising

sma150Rising = sma150 > sma150[1]

sma200Rising = sma200 > sma200[1]

// Check if most of the last 5 days are seller days (close < open)

sellerDays = 0

for i = 0 to 9

if close[i] < open[i]

sellerDays := sellerDays + 1

// Check if at least 1 day has seller volume higher than the 20-period volume MA

highSellerVolumeDays = 0

for i = 0 to 9

if close[i] < open[i] and volume[i] > volumeMA20

highSellerVolumeDays := highSellerVolumeDays + 1

// Check in the last N days the price below 150

priceBelowSma150 = true

for i = 0 to 0

if close[i] > sma150[i]

priceBelowSma150 := false

// Restrict the strategy to 1D time frame

if timeframe.isdaily

// Buy condition:

// - Most of the last 5 days are buyer days (buyerDays > 2)

// - At least 1 of those days has high buyer volume (highVolumeDays >= 1)

// - RSI SMA (14-period) between 45 and 50 with RSI >= 55, or RSI SMA > 50 and RSI rising

// - 50-day SMA > 150-day SMA and 150-day SMA > 200-day SMA

// - 50-day SMA has been rising on at least 16 of the last 20 trading days

// - The price hasn't been below the 150-day SMA in the last 20 days

// - 150-day SMA has been above the 200-day SMA for the last 10 days

// - 150-day and 200-day SMAs are rising

buyCondition = (close > sma150 and buyerDays > 4 and highVolumeDays >= 1 and rsiCondition and sma50 > sma150 and sma50Rising and sma150Rising and sma200Rising and priceAboveSma150)

// Sell condition:

// - Price crossing below SMA 150

// - Seller volume (current volume > volume MA 20)

// - 150-day SMA crosses below 200-day SMA

// - Most of the last 5 days are seller days (sellerDays > 2) and at least 1 day of higher seller volume (highSellerVolumeDays >= 1)

sellCondition = (priceBelowSma150 and (sma50 < sma150 or (sellerDays >5 and highSellerVolumeDays >= 5)))

// Execute buy when all conditions are met

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Execute sell when all conditions are met

if (sellCondition)

strategy.close("Buy")