Обзор

Это адаптивная торговая стратегия, основанная на RSI и CCI двойных технических показателях. Стратегия создает целостную торговую систему, контролируя перекрестное состояние RSI и CCI в разных временных периодах, в сочетании с равновесной тенденцией EMA. Стратегия обладает такими характеристиками, как сильная адаптивность и стабильность сигнала, что позволяет эффективно улавливать возможности перепродажи на рынке.

Стратегический принцип

Основная логика стратегии включает в себя следующие аспекты:

- Временная адаптация: параметры RSI и CCI динамически корректируются в зависимости от различных временных периодов (от 1 минуты до 4 часов).

- Подтверждение двойных индикаторов: для фильтрации торговых сигналов используется комбинация RSI (относительно сильный показатель) и CCI (прогрессивный показатель). Торговый сигнал появляется, когда RSI и CCI одновременно отвечают определенным условиям.

- Проверка непрерывности сигнала: для обеспечения стабильности сигнала устанавливается минимальное время пребывания (stayTimeFrames).

- Динамический стоп-стоп: стоп-стоп-стоп-стоп, динамически настроенный на основе уровня RSI и CCI на момент входа.

- Подтверждение тренда: использование 200-циклической EMA в качестве ориентира.

Стратегические преимущества

- Самостоятельная адаптация: стратегии могут автоматически корректировать параметры в зависимости от различных временных циклов.

- Высокая надежность сигнала: значительно повышена надежность сигнала с помощью перекрестного подтверждения двойных технических показателей.

- Усовершенствованный контроль риска: используется динамический механизм остановки и устранения убытков, позволяющий эффективно контролировать риск.

- Правила работы четкие: условия входа и выхода четкие, что позволяет практически работать.

- Хорошо масштабируемая: гибкая структура стратегий, позволяющая добавлять новые условия фильтрации по мере необходимости.

Стратегический риск

- Чувствительность параметров: оптимальные параметры могут различаться в разных рыночных условиях.

- Риск поперечного колебания: во время рыночных колебаний может возникнуть ложный сигнал.

- Влияние скольжения: высокочастотные сделки могут столкнуться со скольжением.

- Задержка сигнала: многократный механизм подтверждения может привести к небольшой задержке времени входа.

- Зависимость от рыночной конъюнктуры: рынок может быть более эффективным в условиях сильного тренда, чем в условиях колебаний.

Направление оптимизации стратегии

- Параметры самостоятельно адаптируются: можно ввести механизм оптимизации параметров самостоятельно адаптируются, в зависимости от динамики состояния рынка.

- Идентификация рыночной среды: добавлен модуль идентификации рыночной среды, использующий различные торговые стратегии в различных рыночных состояниях.

- Приспособность к колебаниям: введение индикатора колебаний, корректировка параметров остановочных потерь в зависимости от величины колебаний.

- Фильтрация сигналов: добавление дополнительных технических параметров и формографического распознавания для фильтрации фальшивых сигналов.

- Управление рисками: совершенствование программы управления капиталом, увеличение времени удержания позиций и контроля позиций.

Подвести итог

Стратегия, объединяя преимущества RSI и CCI, создает прочную торговую систему. Самостоятельные характеристики стратегии и совершенный механизм контроля риска делают ее практически полезной. С постоянной оптимизацией и совершенствованием стратегия может быть лучше в реальной торговле.

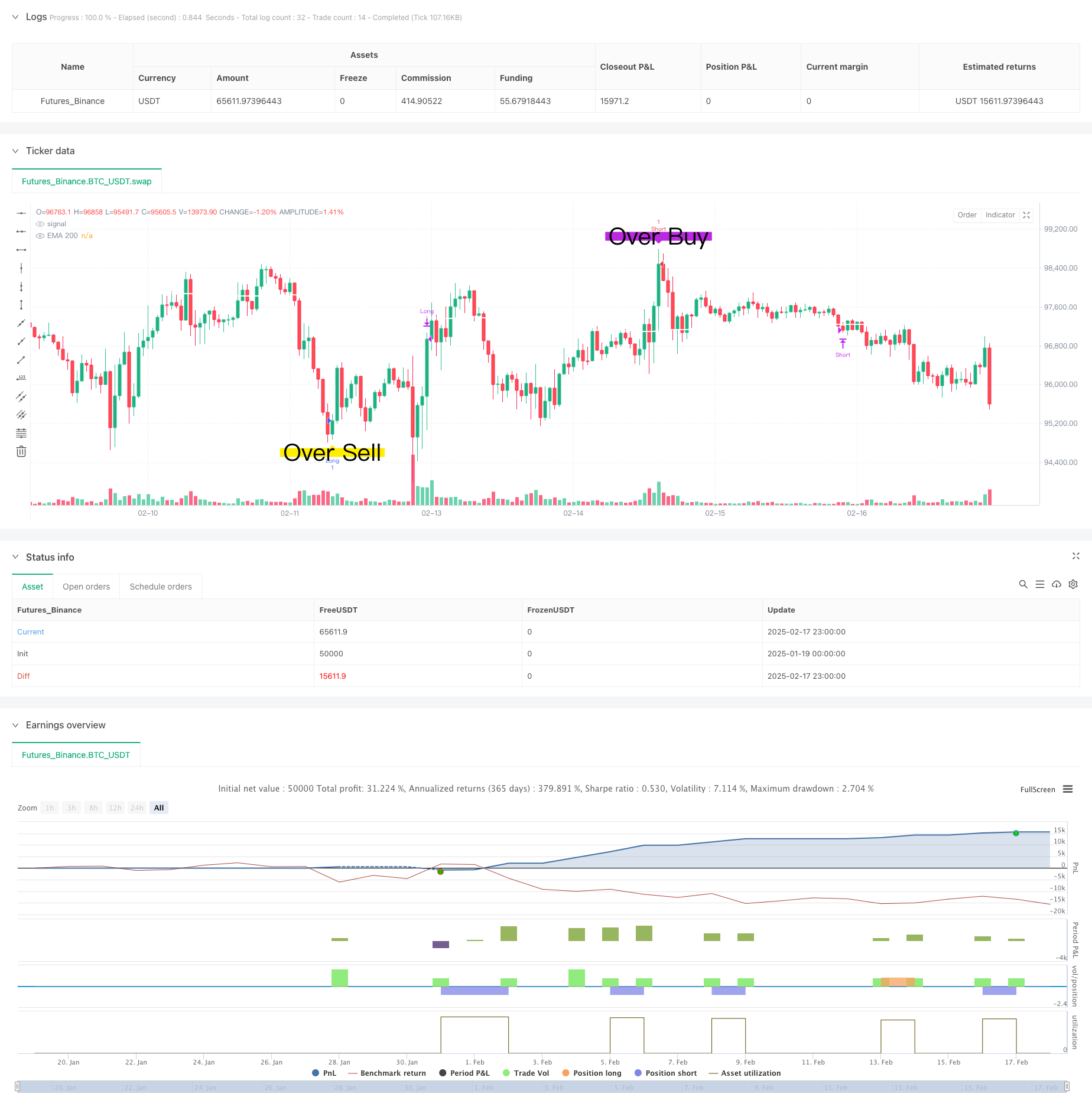

/*backtest

start: 2025-01-19 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("RSI & CCI Strategy with Alerts", overlay=true)

// Detect current chart timeframe

tf = timeframe.period

// Define settings for different timeframes

rsiLength = tf == "1" ? 30 : tf == "5" ? 30 : tf == "15" ? 30 : tf == "30" ? 30 : 30 // Default

cciLength = tf == "1" ? 15 : tf == "5" ? 20 : tf == "15" ? 20 : tf == "30" ? 20 : 20 // Default

cciBuyThreshold = tf == "1" ? -100 : tf == "5" ? -100 : tf == "15" ? -100 : tf == "30" ? -100 : -100

cciSellThreshold = tf == "1" ? 100 : tf == "5" ? 100 : tf == "15" ? 100 : tf == "30" ? 100 : 100 // Default

stayTimeFrames = tf == "1" ? 1 : tf == "5" ? 1 : tf == "15" ? 1 : tf == "30" ? 1 : tf == "240" ? 1 : 2 // Default

stayTimeFramesOver =tf == "1" ? 1 : tf == "5" ? 2 : tf == "15" ? 2 : tf == "30" ? 3 : 2 // Default

// Calculate RSI & CCI

rsi = ta.rsi(close, rsiLength)

rsiOver = ta.rsi(close, 14)

cci = ta.cci(close, cciLength)

// EMA 50

ema200 = ta.ema(close, 200)

plot(ema200, color=color.rgb(255, 255, 255), linewidth=2, title="EMA 200")

// CCI candle threshold tracking

var int cciEntryTimeLong = na

var int cciEntryTimeShort = na

// Store entry time when CCI enters the zone

if (cci < cciBuyThreshold)

if na(cciEntryTimeLong)

cciEntryTimeLong := bar_index

else

cciEntryTimeLong := na

if (cci > cciSellThreshold)

if na(cciEntryTimeShort)

cciEntryTimeShort := bar_index

else

cciEntryTimeShort := na

// Confirming CCI has stayed in the threshold for required bars

cciStayedBelowNeg100 = not na(cciEntryTimeLong) and (bar_index - cciEntryTimeLong >= stayTimeFrames) and rsi >= 53

cciStayedAbove100 = not na(cciEntryTimeShort) and (bar_index - cciEntryTimeShort >= stayTimeFrames) and rsi <= 47

// CCI & RSI candle threshold tracking for Buy Over and Sell Over signals

var int buyOverEntryTime = na

var int sellOverEntryTime = na

// Track entry time when RSI and CCI conditions are met

if (rsiOver <= 31 and cci <= -120)

if na(buyOverEntryTime)

buyOverEntryTime := bar_index

else

buyOverEntryTime := na

if (rsiOver >= 69 and cci >= 120)

if na(sellOverEntryTime)

sellOverEntryTime := bar_index

else

sellOverEntryTime := na

// Confirm that conditions are met for the required stayTimeFrames

buyOverCondition = not na(buyOverEntryTime) and (bar_index - buyOverEntryTime >= stayTimeFramesOver)

sellOverCondition = not na(sellOverEntryTime) and (bar_index - sellOverEntryTime <= stayTimeFramesOver)

//Buy and sell for over bought or sell

conditionOverBuy = buyOverCondition

conditionOverSell = sellOverCondition

// Buy and sell conditions

buyCondition = cciStayedBelowNeg100

sellCondition = cciStayedAbove100

// // Track open positions

var bool isLongOpen = false

var bool isShortOpen = false

// // Strategy logic for backtesting

// if (buyCondition and not isLongOpen)

// strategy.entry("Long", strategy.long)

// isLongOpen := true

// isShortOpen := false

// if (sellCondition and not isShortOpen)

// strategy.entry("Short", strategy.short)

// isShortOpen := true

// isLongOpen := false

// // Close positions based on EMA 50

// if (isLongOpen and exitLongCondition)

// strategy.close("Long")

// isLongOpen := false

// if (isShortOpen and exitShortCondition)

// strategy.close("Short")

// isShortOpen := false

// Track RSI at position entry

var float entryRSILong = na

var float entryRSIShort = na

// Track CCI at position entry

var float entryCCILong = na

var float entryCCIShort = na

if (buyOverCondition and not isLongOpen)

strategy.entry("Long", strategy.long)

entryRSILong := rsi // Store RSI at entry

entryCCILong := cci

isLongOpen := true

isShortOpen := false

if (sellOverCondition and not isShortOpen)

strategy.entry("Short", strategy.short)

entryRSIShort := rsi // Store RSI at entry

entryCCIShort := cci // Stpre CCI at entry

isShortOpen := true

isLongOpen := false

exitLongRSICondition = isLongOpen and not na(entryRSILong) and rsi >= (entryRSILong + 12) or rsi <= (entryRSILong -8)

exitShortRSICondition = isShortOpen and not na(entryRSIShort) and rsi <= (entryRSIShort - 12) or rsi >= (entryRSIShort +8)

exitLongCCICondition = isLongOpen and not na(entryCCILong) and cci <= (entryCCILong -100)

exitShortCCICondition = isShortOpen and not na(entryCCIShort) and cci >= (entryCCIShort +100)

// Close positions based on EMA 50 or RSI change

if (isLongOpen and (exitLongRSICondition) or (exitLongCCICondition))

strategy.close("Long")

isLongOpen := false

entryRSILong := na

entryCCILong := na

isLongOpen := false

if (isShortOpen and (exitShortRSICondition) or (exitShortCCICondition))

strategy.close("Short")

isShortOpen := false

entryRSIShort := na

entryCCIShort := na

isShortOpen := false

// Plot buy and sell signals

plotshape(buyCondition, style=shape.labelup, location=location.belowbar, color=color.green, size=size.large, title="Buy Signal", text="BUY")

plotshape(sellCondition, style=shape.labeldown, location=location.abovebar, color=color.red, size=size.large, title="Sell Signal", text="SELL")

//Plot buy and sell OverBought

plotshape(conditionOverBuy, style=shape.labelup, location=location.belowbar, color=color.rgb(255, 238, 0), size=size.large, title="OverBuy Signal", text="Over Sell")

plotshape(conditionOverSell, style=shape.labeldown, location=location.abovebar, color=color.rgb(186, 40, 223), size=size.large, title="OverSell Signal", text="Over Buy")

// Alerts

alertcondition(buyCondition, title="Buy Alert", message="Buy Signal Triggered")

alertcondition(sellCondition, title="Sell Alert", message="Sell Signal Triggered")